Key Insights

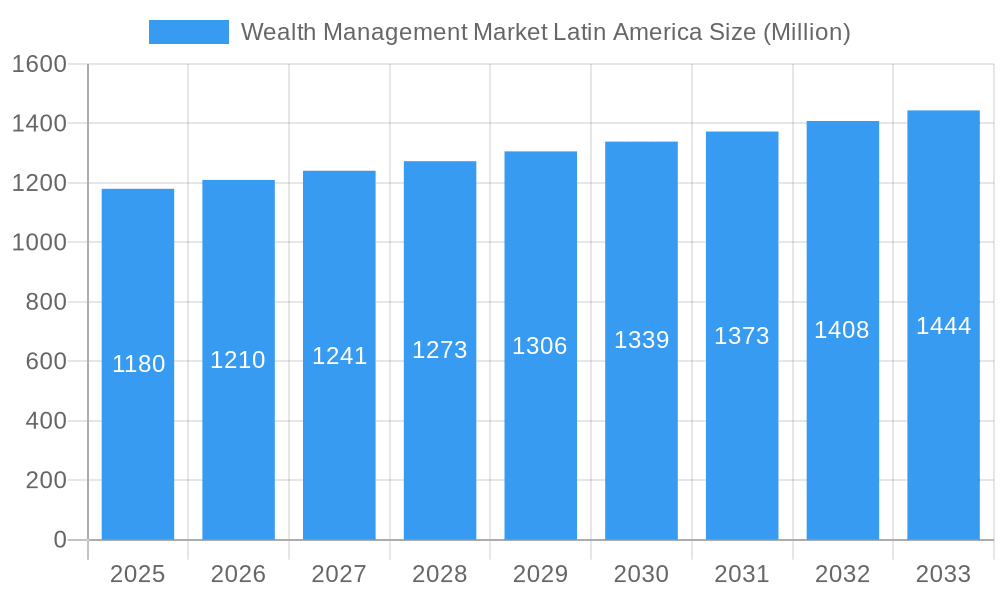

The Latin American wealth management market, currently valued at $1.18 billion in 2025, is projected to experience steady growth, driven by a rising high-net-worth individual (HNWI) population and increasing financial literacy across the region. The compound annual growth rate (CAGR) of 2.34% indicates a consistent, albeit moderate, expansion over the forecast period (2025-2033). This growth is fueled by several key factors. Firstly, a burgeoning middle class in major economies like Brazil and Argentina is creating a larger pool of mass affluent and retail investors seeking sophisticated wealth management services. Secondly, the increasing adoption of digital wealth management platforms is enhancing accessibility and convenience for a wider range of clients, driving market expansion. Finally, family offices and private banks are adapting their strategies to cater to the unique needs of Latin American clients, further fueling market competition and innovation. However, economic volatility in some Latin American countries and regulatory changes represent potential headwinds to growth. Competition among established players like UBS, Morgan Stanley Private Banking, and Credit Suisse, alongside regional firms, will remain intense, creating pressure on pricing and service differentiation.

Wealth Management Market Latin America Market Size (In Billion)

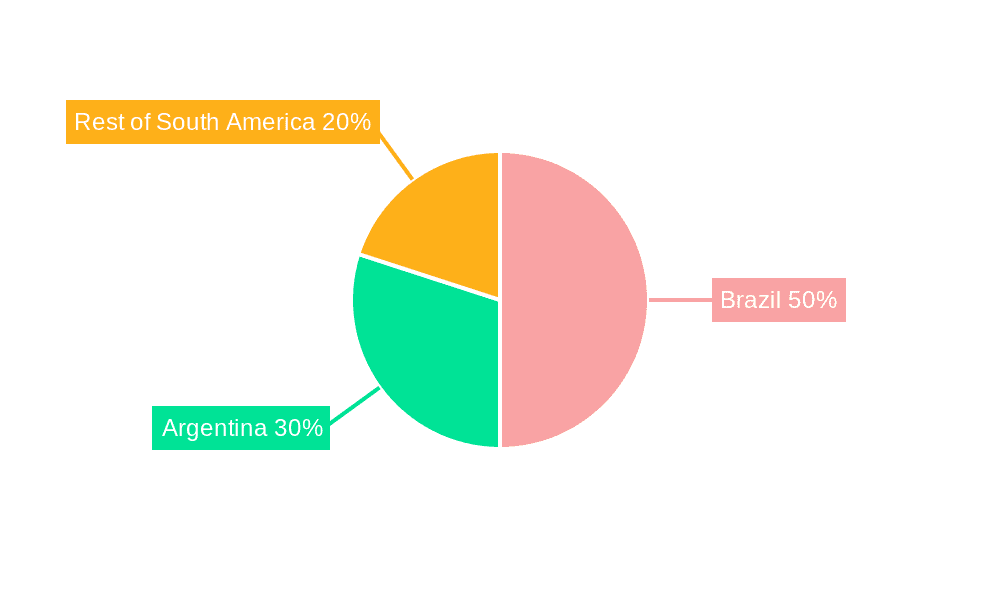

The segmentation of the market reveals interesting dynamics. While HNWIs and Mass Affluent individuals are the major contributors to revenue, the retail/individual segment displays significant growth potential, driven by increased financial inclusion. Private bankers and family offices dominate the wealth management firm type segment, showcasing the premium nature of the services offered. Geographical analysis reveals Brazil and Argentina as the most significant markets within South America, benefiting from established financial infrastructures and a relatively high concentration of wealth. The "Rest of South America" segment presents further opportunities for expansion, particularly as wealth accumulation increases in these nations. The forecast period presents a promising outlook, but success will depend on firms' ability to adapt to evolving client needs and navigate the regional economic landscape.

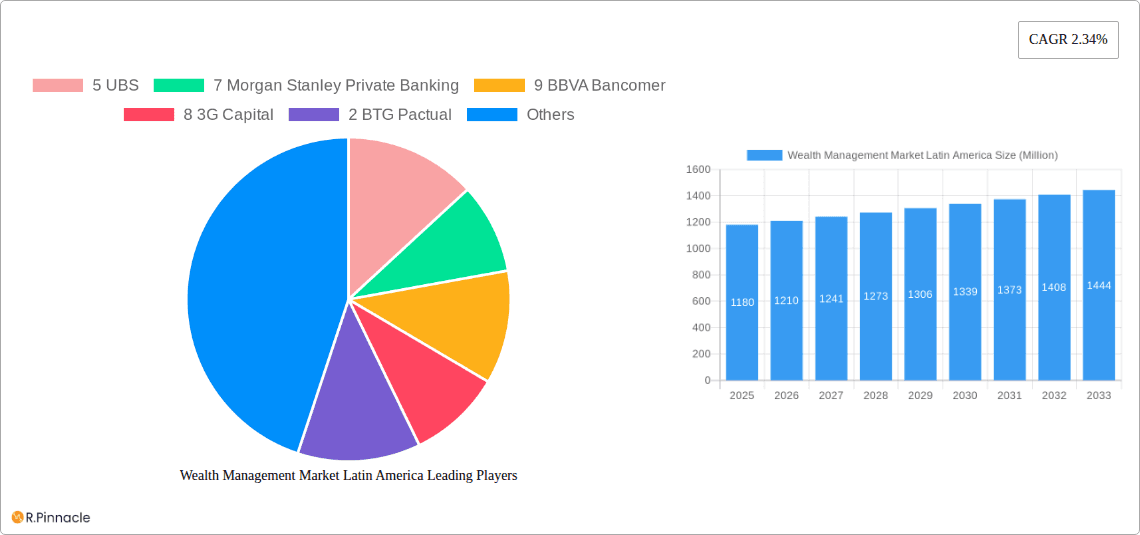

Wealth Management Market Latin America Company Market Share

Wealth Management Market Latin America: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Wealth Management Market in Latin America, offering actionable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future potential. Expect detailed segmentation, analysis of key players, and predictions for significant growth opportunities.

Wealth Management Market Latin America Market Structure & Innovation Trends

This section analyzes the Latin American wealth management market's competitive landscape, highlighting innovation drivers and regulatory influences. We examine market concentration, identifying key players and their market share. The analysis includes an assessment of M&A activity, evaluating deal values and their impact on market structure.

- Market Concentration: The market is moderately concentrated, with key players such as UBS, Morgan Stanley Private Banking, BBVA Bancomer, and Itaú Private Bank holding significant shares. However, a substantial portion is held by a diverse group of "Other Key Private Banks and Family Offices." Precise market share data requires proprietary research; however, we estimate the top 10 players collectively account for approximately xx% of the market in 2025.

- Innovation Drivers: Technological advancements, particularly in digital wealth management platforms and fintech integration, are driving innovation. Regulatory changes aimed at enhancing transparency and consumer protection also significantly influence market evolution.

- Regulatory Frameworks: Varying regulatory landscapes across Latin American nations pose both challenges and opportunities. Navigating diverse compliance requirements is a key factor influencing market participants' strategies.

- Product Substitutes: The increasing availability of alternative investment options presents a challenge to traditional wealth management products. Competition from Robo-advisors and fintech platforms is intensifying.

- End-User Demographics: The expanding high-net-worth individual (HNWI) population in Latin America fuels market growth, particularly in key countries like Brazil and Mexico. The report dives deep into demographic trends and their implications.

- M&A Activities: The report analyzes recent M&A activity, with notable deals including strategic acquisitions by major players to broaden their offerings or geographical reach. The total value of M&A deals within the analyzed period is estimated to be around USD xx Million.

Wealth Management Market Latin America Market Dynamics & Trends

This section delves into the market’s growth trajectory, exploring key drivers, disruptive technologies, evolving consumer preferences, and competitive dynamics. We analyze historical trends (2019-2024) and project future growth (2025-2033), providing a comprehensive picture of the market's evolution. The Compound Annual Growth Rate (CAGR) during the forecast period is estimated to be xx%.

The market is driven by several factors, including rising disposable incomes, a growing HNWI population, and increasing financial literacy. Technological advancements like AI-powered investment solutions are reshaping the industry, demanding adaptation from traditional players. Consumer preferences are shifting towards more personalized and digitally enabled services. Competitive pressures are forcing firms to innovate and offer differentiated services to retain and attract clients. Market penetration in key segments is analyzed, projecting significant growth in online wealth management platforms over the forecast period. Brazil, Mexico and other key economies show divergent market dynamics.

Dominant Regions & Segments in Wealth Management Market Latin America

This section identifies the leading regions, countries, and market segments within the Latin American wealth management market. We analyze the key drivers behind the dominance of specific regions and segments.

- Leading Region: Brazil, with its large and growing economy, consistently demonstrates strong market dominance. Mexico also represents a significant market.

- Dominant Client Type: HNWIs represent a significant segment due to their high investment capacity and demand for sophisticated wealth management services. The Retail/Individuals segment also displays strong growth potential, driven by increasing financial inclusion and the expansion of digital platforms.

- Dominant Wealth Management Firm Type: Private bankers currently hold the largest market share, but family offices are increasingly gaining importance, particularly in managing larger, more complex wealth portfolios.

- Key Drivers:

- Economic Policies: Government initiatives promoting financial inclusion and investment attract participation.

- Infrastructure: Improved digital infrastructure facilitates online wealth management solutions.

- Regulatory Environment: Favorable regulatory frameworks encourage investment.

Wealth Management Market Latin America Product Innovations

Recent years have witnessed significant product innovation, driven by technological advancements and changing consumer preferences. The integration of AI-powered robo-advisors and personalized digital platforms are enhancing client engagement and efficiency. These innovations aim to cater to the demands of tech-savvy clients while maintaining a high level of service personalization. Competition compels innovation, forcing firms to continuously refine and diversify their product offerings.

Report Scope & Segmentation Analysis

This report offers a comprehensive market segmentation analysis, considering both client types and wealth management firm types.

By Client Type:

- HNWIs: This segment displays substantial growth, driven by increasing wealth and demand for sophisticated services.

- Retail/Individuals: This segment demonstrates high potential, fueled by rising financial inclusion and digital adoption.

- Mass Affluent: This segment represents a growing market, providing opportunities for firms offering customized yet accessible solutions.

- Others: This category includes institutional investors and other specialized client groups.

By Wealth Management Firm Type:

- Private Bankers: They hold a substantial market share, offering personalized advice and services.

- Family Offices: Their market share is expected to grow, driven by increasing demand for specialized family wealth management.

- Others: This category includes independent financial advisors, and other entities participating in wealth management.

Key Drivers of Wealth Management Market Latin America Growth

Several factors propel growth within this sector. These include the increasing HNWI population, rising disposable incomes, expanding access to financial services through digital channels, government efforts to promote financial inclusion, and favorable regulatory environments encouraging investment. Technological advancements, such as AI and machine learning, are transforming service delivery and improving efficiency.

Challenges in the Wealth Management Market Latin America Sector

The market faces several challenges. Regulatory complexities across Latin American nations require careful navigation. Competition among established players and the emergence of fintech disruptors increase pressure on margins. Supply chain disruptions, particularly affecting global markets, can impact investment strategies. The threat of economic instability can significantly impact investment sentiment and wealth growth.

Emerging Opportunities in Wealth Management Market Latin America

The market offers significant opportunities, including the expansion of digital wealth management platforms, the growing demand for sustainable and ESG-focused investments, the increasing importance of financial planning and education, and the expansion into underserved market segments. The penetration of fintech technologies presents significant opportunities for both established and new entrants.

Leading Players in the Wealth Management Market Latin America Market

- UBS

- Morgan Stanley Private Banking

- BBVA Bancomer

- 3G Capital

- BTG Pactual

- Citi Wealth Management

- Bradesco

- Itaú Private Bank

- Other Key Private Banks and Family Offices*List Not Exhaustive

- Credit Suisse

Key Developments in Wealth Management Market Latin America Industry

- 2021 (Month Not Specified): BTG Pactual hired Leonardo Brayner, a vice president from Credit Suisse's Bahamas office, strengthening its Miami wealth management operations. This move highlights the competitive talent acquisition within the industry.

- 2021 (Month Not Specified): Credit Suisse made a USD 400 Million cash distribution to investors in its Virtuoso SICAV-SIF funds, following the closure of its Greensill supply chain funds. This event demonstrates the impact of high-profile financial setbacks on investor confidence and market dynamics.

Future Outlook for Wealth Management Market Latin America Market

The Latin American wealth management market presents a positive future outlook, driven by a growing HNWI population, increased adoption of digital technologies, and favorable regulatory reforms. Strategic opportunities exist for firms focusing on customized solutions, sustainable investing, and expansion into new markets within the region. The continued growth of the digital economy will significantly shape the industry's future.

Wealth Management Market Latin America Segmentation

-

1. Client Type

- 1.1. HNWIs

- 1.2. Retail/ Individuals

- 1.3. Mass Affluent

- 1.4. Others

-

2. Wealth Management Firm Type

- 2.1. Private Bankers

- 2.2. Family Offices

- 2.3. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Chile

- 3.3. Peru

- 3.4. Colombia

- 3.5. Rest of Latin America

Wealth Management Market Latin America Segmentation By Geography

- 1. Brazil

- 2. Chile

- 3. Peru

- 4. Colombia

- 5. Rest of Latin America

Wealth Management Market Latin America Regional Market Share

Geographic Coverage of Wealth Management Market Latin America

Wealth Management Market Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Alternative Assets To Boom In Latin America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Wealth Management Market Latin America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. HNWIs

- 5.1.2. Retail/ Individuals

- 5.1.3. Mass Affluent

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Wealth Management Firm Type

- 5.2.1. Private Bankers

- 5.2.2. Family Offices

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Chile

- 5.3.3. Peru

- 5.3.4. Colombia

- 5.3.5. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Chile

- 5.4.3. Peru

- 5.4.4. Colombia

- 5.4.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Brazil Wealth Management Market Latin America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. HNWIs

- 6.1.2. Retail/ Individuals

- 6.1.3. Mass Affluent

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Wealth Management Firm Type

- 6.2.1. Private Bankers

- 6.2.2. Family Offices

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Chile

- 6.3.3. Peru

- 6.3.4. Colombia

- 6.3.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. Chile Wealth Management Market Latin America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. HNWIs

- 7.1.2. Retail/ Individuals

- 7.1.3. Mass Affluent

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Wealth Management Firm Type

- 7.2.1. Private Bankers

- 7.2.2. Family Offices

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Chile

- 7.3.3. Peru

- 7.3.4. Colombia

- 7.3.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. Peru Wealth Management Market Latin America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. HNWIs

- 8.1.2. Retail/ Individuals

- 8.1.3. Mass Affluent

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Wealth Management Firm Type

- 8.2.1. Private Bankers

- 8.2.2. Family Offices

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Chile

- 8.3.3. Peru

- 8.3.4. Colombia

- 8.3.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. Colombia Wealth Management Market Latin America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. HNWIs

- 9.1.2. Retail/ Individuals

- 9.1.3. Mass Affluent

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Wealth Management Firm Type

- 9.2.1. Private Bankers

- 9.2.2. Family Offices

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Chile

- 9.3.3. Peru

- 9.3.4. Colombia

- 9.3.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Rest of Latin America Wealth Management Market Latin America Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. HNWIs

- 10.1.2. Retail/ Individuals

- 10.1.3. Mass Affluent

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Wealth Management Firm Type

- 10.2.1. Private Bankers

- 10.2.2. Family Offices

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Chile

- 10.3.3. Peru

- 10.3.4. Colombia

- 10.3.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 5 UBS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 7 Morgan Stanley Private Banking

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 9 BBVA Bancomer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 8 3G Capital

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 2 BTG Pactual

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 6 Citi Wealth Management

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 4 Bradesco

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 3 Itau Private Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 10 Other Key Private Banks and Family Offices*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 1 Credit Suisse

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 5 UBS

List of Figures

- Figure 1: Wealth Management Market Latin America Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Wealth Management Market Latin America Share (%) by Company 2025

List of Tables

- Table 1: Wealth Management Market Latin America Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: Wealth Management Market Latin America Revenue Million Forecast, by Wealth Management Firm Type 2020 & 2033

- Table 3: Wealth Management Market Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Wealth Management Market Latin America Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Wealth Management Market Latin America Revenue Million Forecast, by Client Type 2020 & 2033

- Table 6: Wealth Management Market Latin America Revenue Million Forecast, by Wealth Management Firm Type 2020 & 2033

- Table 7: Wealth Management Market Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Wealth Management Market Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Wealth Management Market Latin America Revenue Million Forecast, by Client Type 2020 & 2033

- Table 10: Wealth Management Market Latin America Revenue Million Forecast, by Wealth Management Firm Type 2020 & 2033

- Table 11: Wealth Management Market Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Wealth Management Market Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Wealth Management Market Latin America Revenue Million Forecast, by Client Type 2020 & 2033

- Table 14: Wealth Management Market Latin America Revenue Million Forecast, by Wealth Management Firm Type 2020 & 2033

- Table 15: Wealth Management Market Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Wealth Management Market Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Wealth Management Market Latin America Revenue Million Forecast, by Client Type 2020 & 2033

- Table 18: Wealth Management Market Latin America Revenue Million Forecast, by Wealth Management Firm Type 2020 & 2033

- Table 19: Wealth Management Market Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Wealth Management Market Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Wealth Management Market Latin America Revenue Million Forecast, by Client Type 2020 & 2033

- Table 22: Wealth Management Market Latin America Revenue Million Forecast, by Wealth Management Firm Type 2020 & 2033

- Table 23: Wealth Management Market Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Wealth Management Market Latin America Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wealth Management Market Latin America?

The projected CAGR is approximately 2.34%.

2. Which companies are prominent players in the Wealth Management Market Latin America?

Key companies in the market include 5 UBS, 7 Morgan Stanley Private Banking, 9 BBVA Bancomer, 8 3G Capital, 2 BTG Pactual, 6 Citi Wealth Management, 4 Bradesco, 3 Itau Private Bank, 10 Other Key Private Banks and Family Offices*List Not Exhaustive, 1 Credit Suisse.

3. What are the main segments of the Wealth Management Market Latin America?

The market segments include Client Type, Wealth Management Firm Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Alternative Assets To Boom In Latin America.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

In 2021, BTG Pactual hired a private banker from the Swiss private bank Credit Suisse for its Miami wealth management business. Leonardo Brayner joined the Brazilian group after having spent 11 years at Credit Suisse's offices in The Bahamas, where he most recently served as a vice president of wealth management on its client service desk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wealth Management Market Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wealth Management Market Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wealth Management Market Latin America?

To stay informed about further developments, trends, and reports in the Wealth Management Market Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence