Key Insights

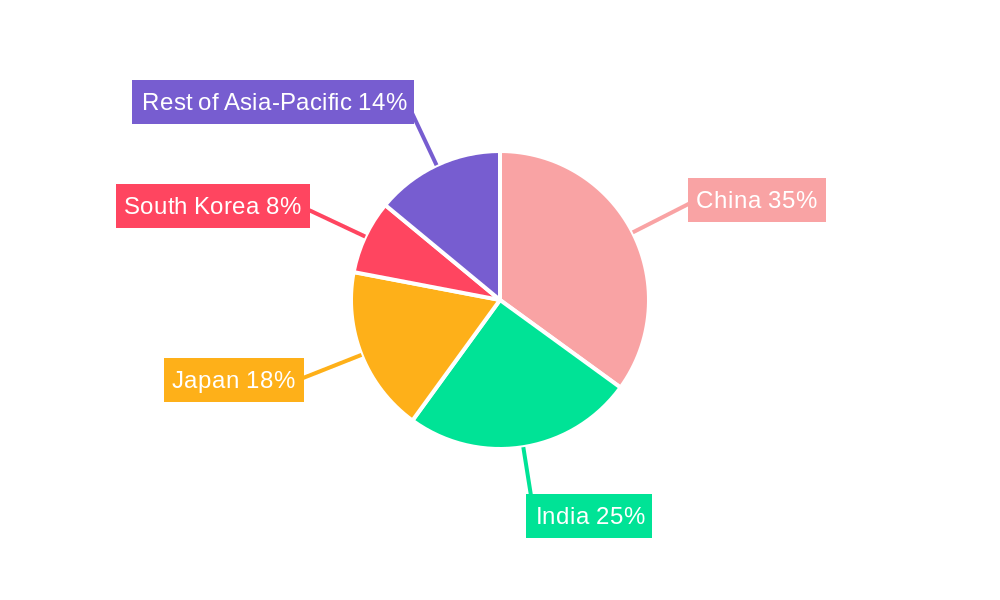

The Asian mobile phone insurance market is experiencing robust growth, fueled by increasing smartphone penetration, rising consumer awareness of device protection, and a surge in e-commerce adoption facilitating easy access to insurance plans. The market's Compound Annual Growth Rate (CAGR) exceeding 5% from 2019-2033 indicates a significant expansion, projected to reach a substantial market value. Key drivers include the escalating cost of smartphone repairs and replacements, the prevalence of accidental damage and theft, and the growing demand for comprehensive data protection and warranty extensions. Market segmentation reveals strong demand across various device types, with mobile phones dominating, followed by tablets and laptops. The corporate segment represents a significant market share due to the need for device protection within employee-owned and company-provided mobile devices. Competitive landscape analysis shows the presence of both established insurance providers like Allianz and Aviva, alongside specialized gadget insurance companies such as Gadget Cover and Apple Care+, and regional players like Warranty Asia, indicating a diversified market structure. The Asia-Pacific region, particularly countries like China, India, and Japan, are crucial markets owing to their massive populations and rising disposable incomes. Future growth will be influenced by technological advancements in insurance offerings, innovative distribution channels, and the increasing adoption of bundled insurance packages.

The market is likely to witness increased competition, further driving innovation and affordability. Expansion into underserved markets within the Asia-Pacific region will present significant opportunities. Growth will also be propelled by the development of customized insurance solutions that cater to specific device features and user needs. However, challenges remain, including consumer awareness gaps, particularly in less developed markets, and the need for effective risk management strategies to maintain profitability. Addressing consumer concerns regarding claim processing and transparency will be crucial for sustainable market expansion. The sustained growth trajectory suggests a promising outlook for companies operating in this sector, demanding strategic planning and competitive positioning to capitalize on market opportunities and overcome potential challenges. The market's future hinges on a combination of technological progress, effective customer engagement, and successful risk management.

Asian Mobile Phone Insurance Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asian mobile phone insurance market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report illuminates market dynamics, key players, and future growth potential. The report leverages extensive data analysis to forecast market trends and provides actionable intelligence to navigate the complexities of this rapidly evolving sector. The total market size is projected to reach xx Million by 2033.

Asian Mobile Phone Insurance Market Structure & Innovation Trends

The Asian mobile phone insurance market exhibits a moderately concentrated structure, with key players like Warranty Asia, Brightstar Corp, Aviva, Allianz Insurance, and Samsung Premium Care holding significant market share. However, the market also features a considerable number of smaller players and niche providers, leading to intense competition. Market share data for 2024 indicates that the top five players collectively account for approximately xx% of the market, with Warranty Asia leading at xx%.

Innovation is driven by several factors, including:

- Technological advancements: The rise of 5G technology, increasing smartphone functionalities, and the integration of IoT devices are fueling demand for comprehensive insurance solutions.

- Regulatory changes: Evolving regulatory frameworks across different Asian countries influence product offerings and market access.

- Product differentiation: Companies are continuously innovating with add-on features and specialized coverage options to attract customers.

- Mergers and Acquisitions (M&A): Consolidation through M&A activities is reshaping the market landscape. Recent deals have involved xx Million in transactions, primarily focused on expanding geographical reach and service offerings. End-user demographics play a crucial role, with a growing young population increasingly adopting smartphones and valuing insurance protection. The increasing adoption of mobile devices in corporate settings is also driving demand for corporate insurance plans.

Asian Mobile Phone Insurance Market Dynamics & Trends

The Asian mobile phone insurance market is experiencing robust growth, driven by several key factors. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a strong CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing smartphone penetration, rising disposable incomes, heightened consumer awareness of insurance benefits, and expanding e-commerce channels facilitating easy access to insurance products.

Technological disruptions, such as the integration of AI and machine learning in claims processing and fraud detection, are streamlining operations and improving customer experience. Changing consumer preferences towards comprehensive coverage and personalized insurance plans are also influencing market dynamics. The competitive landscape is characterized by intense competition, both from established players and new entrants, leading to innovative product offerings and pricing strategies. Market penetration in key Asian countries remains relatively low, indicating significant untapped potential for future growth.

Dominant Regions & Segments in Asian Mobile Phone Insurance Market

The Asian mobile phone insurance market is a dynamic landscape shaped by several key factors. Within the Device Type category, Mobile Devices overwhelmingly dominate, fueled by the explosive growth of smartphone adoption across diverse demographics and socioeconomic strata. This dominance is further amplified by the increasing value of these devices. Analyzing the Coverage Type segment reveals that Physical Damage coverage holds the leading position, reflecting the inherent vulnerability of smartphones to accidental drops, cracks, and water damage. Finally, the End-User category is largely dominated by Individuals, a testament to the widespread personal ownership of smartphones. This is driven by factors such as rising disposable incomes and increased awareness of the benefits of insurance protection.

- Key Drivers for Mobile Devices Dominance: High smartphone penetration rates across Asia, escalating device costs, and a growing understanding among consumers of the financial risks associated with accidental damage.

- Key Drivers for Physical Damage Dominance: The high frequency of accidental damage incidents, encompassing screen cracks, liquid damage, and other physical impairments.

- Key Drivers for Individual End-User Dominance: High rates of personal smartphone ownership, a rise in disposable incomes, and increasing consumer awareness of the financial security provided by insurance.

Significant regional variations exist, with China and India emerging as the leading markets due to their large populations, rapidly expanding smartphone adoption, and favorable economic conditions. The market's growth trajectory is also influenced by factors such as evolving consumer behavior, technological advancements in insurance products, and the regulatory landscape.

Asian Mobile Phone Insurance Market Product Innovations

Recent product innovations focus on enhancing coverage options, improving claims processing efficiency, and offering personalized insurance solutions. Several players are integrating AI-powered features into their applications to streamline claims and customer service. The industry is also witnessing the rise of bundled insurance packages, combining mobile phone insurance with other services like data protection and device theft protection. This enhances convenience for customers and improves the overall value proposition.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the Asian mobile phone insurance market, considering various key parameters:

Coverage Type: The market is segmented into Physical Damage, Electronic Damage, Data Protection, Virus Protection, Theft Protection, and Other Coverage Types. Growth projections vary considerably across these segments, with Physical Damage and Theft Protection exhibiting particularly strong growth potential due to their high demand and associated risks.

Device Type: This segment includes Laptops, Computers, Cameras, Mobile Devices, Tablets, and Other Devices. The Mobile Devices segment holds the dominant position due to the pervasive adoption of smartphones across all demographics.

End-User: This segment encompasses Corporate and Individual users. While the Individual segment currently holds the largest market share, the Corporate segment demonstrates consistent and significant growth, reflecting the increasing importance of mobile devices in the workplace and the need for comprehensive protection.

A detailed examination of each segment reveals unique opportunities and challenges for market players, highlighting the diverse and complex nature of the Asian mobile phone insurance market.

Key Drivers of Asian Mobile Phone Insurance Market Growth

Several key factors are driving the remarkable growth of the Asian mobile phone insurance market:

- Exponential Smartphone Penetration: The unprecedented adoption of smartphones across all demographic groups is the primary catalyst for market expansion.

- Rising Disposable Incomes: Increased disposable incomes in many Asian nations are empowering consumers to invest in insurance coverage as a form of financial risk mitigation.

- Technological Advancements: Innovations such as AI-powered claim processing are streamlining operations, enhancing efficiency, and optimizing the customer experience.

- Supportive Government Policies: Favorable regulatory environments and supportive government initiatives are further fostering market growth and encouraging investment.

- Increased Consumer Awareness: Growing awareness of the potential financial losses associated with mobile device damage or theft is driving demand for insurance solutions.

Challenges in the Asian Mobile Phone Insurance Market Sector

The Asian mobile phone insurance market faces several challenges:

- High competition: The market is highly competitive, with numerous players vying for market share. This leads to pricing pressures and intense competition for customers.

- Fraudulent claims: High incidences of fraudulent claims pose a significant challenge to insurers. This impacts profitability and necessitates robust fraud detection measures.

- Varying regulatory landscapes: Different regulatory frameworks across various Asian countries create complexities for insurers.

Emerging Opportunities in Asian Mobile Phone Insurance Market

Emerging opportunities include:

- Expansion into underserved markets: Many regions within Asia still have low insurance penetration rates, presenting significant untapped potential.

- Development of innovative insurance products: Opportunities exist for creating bespoke insurance products catering to specific customer needs and preferences.

- Leveraging digital technologies: The use of digital technologies, such as AI and big data, offers opportunities to enhance operational efficiency and customer experience.

Leading Players in the Asian Mobile Phone Insurance Market Market

- Warranty Asia

- Brightstar Corp

- Aviva

- Allianz Insurance

- The Digital Insurer

- Samsing Premium Care

- Gadget Cover

- Safeware

- Apple Care+

- Syska Gadget Secure

Key Developments in Asian Mobile Phone Insurance Market Industry

- March 2022: Samsung Electronics launched a self-repair program for Galaxy devices in the Asia Pacific region, impacting the demand for insurance covering physical damage.

- March 2021: AppleCare+ expanded its accidental damage coverage to two incidents per year and reduced deductibles for theft or loss, influencing consumer choices and market competition.

Future Outlook for Asian Mobile Phone Insurance Market Market

The Asian mobile phone insurance market is poised for continued robust growth, driven by increasing smartphone penetration, rising disposable incomes, and technological advancements. The market's future success hinges on players' ability to innovate, adapt to changing consumer preferences, and effectively manage risks such as fraudulent claims. Strategic partnerships and expansion into underserved markets will also play a crucial role in shaping the future of the market.

Asian Mobile Phone Insurance Market Segmentation

-

1. Coverage Type

- 1.1. Physical Damage

- 1.2. Electronic Damage

- 1.3. Data Protection

- 1.4. Virus Protection

- 1.5. Theft Protectiom

- 1.6. Other Coverage Types

-

2. Device Type

- 2.1. Laptops

- 2.2. Computers

- 2.3. Cameras

- 2.4. Mobile Devices

- 2.5. Tablets

- 2.6. Other Devices

-

3. End-User

- 3.1. Corporate

- 3.2. Individual

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. South Korea

- 4.5. Rest of Asia Pacific

Asian Mobile Phone Insurance Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asian Mobile Phone Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Acts as a Restraint to the Market

- 3.4. Market Trends

- 3.4.1. Increase in the Electronics Market in the Asia-Pacific region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 5.1.1. Physical Damage

- 5.1.2. Electronic Damage

- 5.1.3. Data Protection

- 5.1.4. Virus Protection

- 5.1.5. Theft Protectiom

- 5.1.6. Other Coverage Types

- 5.2. Market Analysis, Insights and Forecast - by Device Type

- 5.2.1. Laptops

- 5.2.2. Computers

- 5.2.3. Cameras

- 5.2.4. Mobile Devices

- 5.2.5. Tablets

- 5.2.6. Other Devices

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Corporate

- 5.3.2. Individual

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6. China Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6.1.1. Physical Damage

- 6.1.2. Electronic Damage

- 6.1.3. Data Protection

- 6.1.4. Virus Protection

- 6.1.5. Theft Protectiom

- 6.1.6. Other Coverage Types

- 6.2. Market Analysis, Insights and Forecast - by Device Type

- 6.2.1. Laptops

- 6.2.2. Computers

- 6.2.3. Cameras

- 6.2.4. Mobile Devices

- 6.2.5. Tablets

- 6.2.6. Other Devices

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Corporate

- 6.3.2. Individual

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. South Korea

- 6.4.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Coverage Type

- 7. India Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Coverage Type

- 7.1.1. Physical Damage

- 7.1.2. Electronic Damage

- 7.1.3. Data Protection

- 7.1.4. Virus Protection

- 7.1.5. Theft Protectiom

- 7.1.6. Other Coverage Types

- 7.2. Market Analysis, Insights and Forecast - by Device Type

- 7.2.1. Laptops

- 7.2.2. Computers

- 7.2.3. Cameras

- 7.2.4. Mobile Devices

- 7.2.5. Tablets

- 7.2.6. Other Devices

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Corporate

- 7.3.2. Individual

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. South Korea

- 7.4.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Coverage Type

- 8. Japan Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Coverage Type

- 8.1.1. Physical Damage

- 8.1.2. Electronic Damage

- 8.1.3. Data Protection

- 8.1.4. Virus Protection

- 8.1.5. Theft Protectiom

- 8.1.6. Other Coverage Types

- 8.2. Market Analysis, Insights and Forecast - by Device Type

- 8.2.1. Laptops

- 8.2.2. Computers

- 8.2.3. Cameras

- 8.2.4. Mobile Devices

- 8.2.5. Tablets

- 8.2.6. Other Devices

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Corporate

- 8.3.2. Individual

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. South Korea

- 8.4.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Coverage Type

- 9. South Korea Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Coverage Type

- 9.1.1. Physical Damage

- 9.1.2. Electronic Damage

- 9.1.3. Data Protection

- 9.1.4. Virus Protection

- 9.1.5. Theft Protectiom

- 9.1.6. Other Coverage Types

- 9.2. Market Analysis, Insights and Forecast - by Device Type

- 9.2.1. Laptops

- 9.2.2. Computers

- 9.2.3. Cameras

- 9.2.4. Mobile Devices

- 9.2.5. Tablets

- 9.2.6. Other Devices

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Corporate

- 9.3.2. Individual

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. South Korea

- 9.4.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Coverage Type

- 10. Rest of Asia Pacific Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Coverage Type

- 10.1.1. Physical Damage

- 10.1.2. Electronic Damage

- 10.1.3. Data Protection

- 10.1.4. Virus Protection

- 10.1.5. Theft Protectiom

- 10.1.6. Other Coverage Types

- 10.2. Market Analysis, Insights and Forecast - by Device Type

- 10.2.1. Laptops

- 10.2.2. Computers

- 10.2.3. Cameras

- 10.2.4. Mobile Devices

- 10.2.5. Tablets

- 10.2.6. Other Devices

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Corporate

- 10.3.2. Individual

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. South Korea

- 10.4.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Coverage Type

- 11. China Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 13. India Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Warranty Asia

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Brightstar Corp

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Aviva**List Not Exhaustive

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Allianz Insurance

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 The Digital Insurer

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Samsing Premium Care

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Gadget Cover

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Safeware

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Apple Care+

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Syska Gadget Secure

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Warranty Asia

List of Figures

- Figure 1: Asian Mobile Phone Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asian Mobile Phone Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Coverage Type 2019 & 2032

- Table 3: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 4: Asian Mobile Phone Insurance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Asian Mobile Phone Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan Asian Mobile Phone Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Asian Mobile Phone Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea Asian Mobile Phone Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan Asian Mobile Phone Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia Asian Mobile Phone Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific Asian Mobile Phone Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Coverage Type 2019 & 2032

- Table 16: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 17: Asian Mobile Phone Insurance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 18: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 19: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Coverage Type 2019 & 2032

- Table 21: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 22: Asian Mobile Phone Insurance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 23: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Coverage Type 2019 & 2032

- Table 26: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 27: Asian Mobile Phone Insurance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 28: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Coverage Type 2019 & 2032

- Table 31: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 32: Asian Mobile Phone Insurance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 33: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Coverage Type 2019 & 2032

- Table 36: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 37: Asian Mobile Phone Insurance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 38: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 39: Asian Mobile Phone Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Mobile Phone Insurance Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Asian Mobile Phone Insurance Market?

Key companies in the market include Warranty Asia, Brightstar Corp, Aviva**List Not Exhaustive, Allianz Insurance, The Digital Insurer, Samsing Premium Care, Gadget Cover, Safeware, Apple Care+, Syska Gadget Secure.

3. What are the main segments of the Asian Mobile Phone Insurance Market?

The market segments include Coverage Type, Device Type, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market.

6. What are the notable trends driving market growth?

Increase in the Electronics Market in the Asia-Pacific region.

7. Are there any restraints impacting market growth?

Increasing Cost Acts as a Restraint to the Market.

8. Can you provide examples of recent developments in the market?

On March 2022, Samsung Electronics has announced that Galaxy device owners will be able to take product repair into their own hands for Samsung's most popular models across the globe including Asia Pacific region, the Galaxy S20 and S21 family of products, and the Galaxy Tab S7+ beginning this summer. Samsung consumers would get access to genuine device parts, repair tools, and intuitive, visual, step-by-step repair guides. Samsung is collaborating with iFixit, the leading online repair community, on this program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Mobile Phone Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Mobile Phone Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Mobile Phone Insurance Market?

To stay informed about further developments, trends, and reports in the Asian Mobile Phone Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence