Key Insights

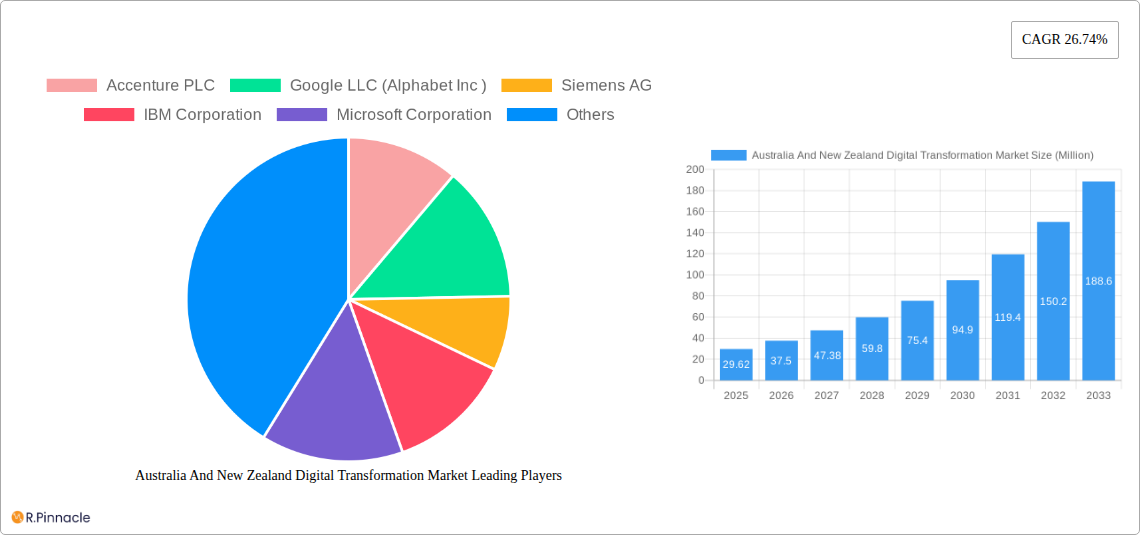

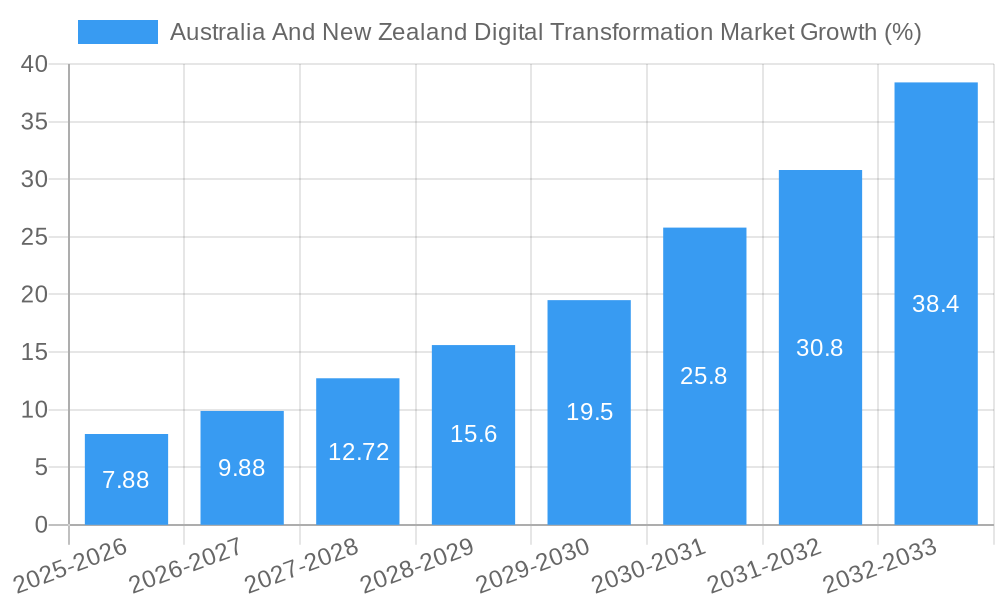

The Australia and New Zealand digital transformation market is experiencing robust growth, projected to reach \$29.62 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 26.74% from 2019-2033. This expansion is driven by several key factors. Firstly, increasing government initiatives promoting digital adoption across various sectors, from healthcare and education to finance and utilities, are significantly stimulating market growth. Secondly, the rising adoption of cloud computing, big data analytics, and artificial intelligence (AI) solutions is fueling demand for digital transformation services. Businesses across the region are increasingly recognizing the need for enhanced operational efficiency, improved customer experiences, and competitive advantage through digital initiatives. Furthermore, the increasing penetration of high-speed internet and mobile technologies provides a robust infrastructure for seamless digital transformation. The market is segmented by industry vertical (e.g., finance, healthcare, retail), technology type (cloud, AI, cybersecurity), and service type (consulting, implementation, support).

Key players like Accenture, Google, IBM, Microsoft, and Salesforce are actively shaping the market landscape through strategic partnerships, investments in innovative technologies, and expansion of their service offerings in the region. However, challenges remain. Data security concerns and the need for skilled professionals to implement and manage complex digital transformation projects pose significant obstacles. Moreover, variations in digital maturity across different industries and the need for substantial investment in infrastructure can slow down the pace of adoption in some segments. Despite these challenges, the long-term outlook remains positive, fueled by sustained government support, technological advancements, and the growing awareness among organizations about the critical role of digital transformation for achieving business objectives in the highly competitive global market. The forecast period of 2025-2033 anticipates continuous expansion driven by these factors and the ongoing digitization of various sectors within Australia and New Zealand.

Australia & New Zealand Digital Transformation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australia and New Zealand digital transformation market, offering invaluable insights for industry professionals, investors, and strategists. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033, using 2025 as the base year. We examine market size, growth drivers, challenges, and opportunities, along with detailed segment analysis and profiles of key players. The estimated market value in 2025 is xx Million.

Australia And New Zealand Digital Transformation Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the Australian and New Zealand digital transformation market. The market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Accenture PLC, Google LLC (Alphabet Inc), Siemens AG, IBM Corporation, Microsoft Corporation, and SAP SE are among the dominant players, although their exact market share values vary by segment and are not publicly available for precise quantification. However, we estimate the combined market share of these leading players to be approximately 50% in 2025.

- Market Concentration: Moderately concentrated, with a few large players holding significant market share.

- Innovation Drivers: Increasing adoption of cloud computing, AI, and IoT; government initiatives promoting digitalization; rising demand for improved operational efficiency and customer experience.

- Regulatory Frameworks: The Australian and New Zealand governments are actively promoting digitalization through various initiatives, impacting market growth and innovation. However, data privacy regulations and cybersecurity concerns present challenges.

- Product Substitutes: The threat of substitution is moderate, as digital transformation solutions are often highly customized and integrated with existing systems. However, open-source alternatives and emerging technologies represent potential challenges.

- End-User Demographics: SMEs and large enterprises across various sectors are driving demand, with SMEs showing increased adoption rates in recent years.

- M&A Activities: The market has witnessed a moderate level of M&A activity in recent years, with deal values ranging from a few Million to several hundred Million. Specific deal values are not publicly available in sufficient detail to calculate exact figures.

Australia And New Zealand Digital Transformation Market Market Dynamics & Trends

The Australia and New Zealand digital transformation market is experiencing robust growth, driven by several factors. The increasing adoption of cloud technologies, AI, and the Internet of Things (IoT) is significantly accelerating digital transformation across industries. Government initiatives aimed at promoting digital adoption and infrastructure development are also playing a key role. Furthermore, consumer demand for improved digital services and experiences is driving organizations to invest heavily in digital transformation projects.

The market is characterized by intense competition, with both established technology providers and emerging players vying for market share. This competition is fostering innovation and driving down prices, making digital transformation solutions more accessible. The Compound Annual Growth Rate (CAGR) for the market during the forecast period (2025-2033) is estimated at xx%. Market penetration is expected to increase significantly across various sectors, particularly within government and finance. Technological disruptions, such as the rise of edge computing and 5G technology, are reshaping the market landscape, creating both opportunities and challenges for businesses. Consumer preferences are shifting towards personalized and seamless digital experiences, putting pressure on organizations to innovate and deliver superior customer service.

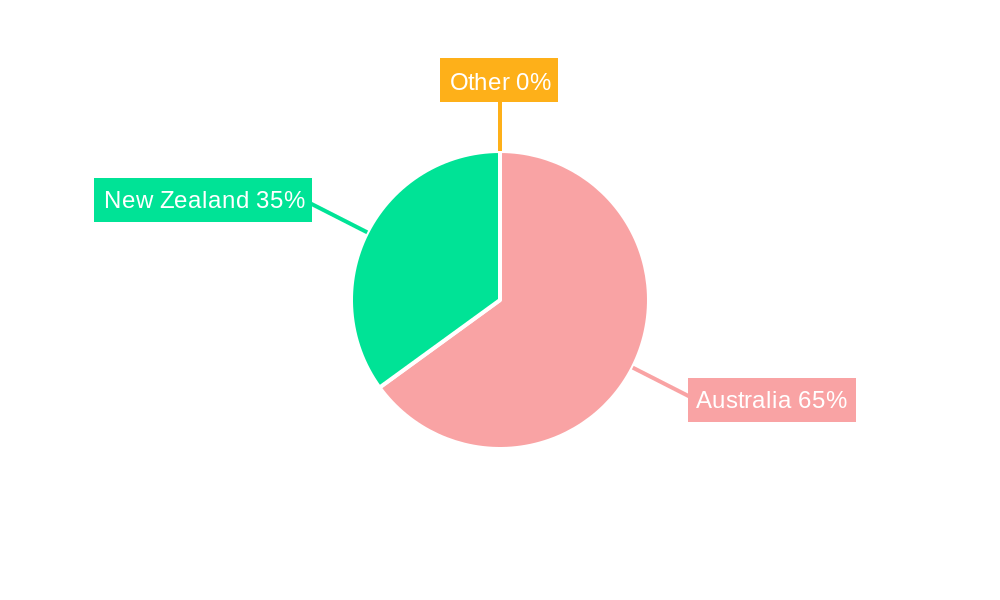

Dominant Regions & Segments in Australia And New Zealand Digital Transformation Market

The Australian market currently dominates the Australia and New Zealand digital transformation market, accounting for a larger share of the overall revenue. This dominance is primarily attributed to its larger economy, more advanced digital infrastructure, and higher levels of technology adoption.

- Key Drivers of Australian Dominance:

- Larger and more developed economy compared to New Zealand.

- More mature digital infrastructure and higher internet penetration rates.

- Higher levels of technology adoption across various sectors.

- Robust government initiatives supporting digital transformation.

- Presence of a larger pool of skilled IT professionals.

New Zealand is also experiencing significant growth in the digital transformation market. While currently smaller than the Australian market, it shows high potential for future growth, driven by increasing investment in digital infrastructure and government initiatives promoting digital innovation.

Australia And New Zealand Digital Transformation Market Product Innovations

Recent product innovations focus on integrating AI, machine learning, and cloud technologies into existing digital transformation solutions. This integration enhances automation, data analysis, and customer experience. New solutions are emerging that emphasize scalability, security, and ease of implementation, addressing key concerns for businesses of all sizes. The market is witnessing a shift towards modular and customizable solutions that allow organizations to tailor their digital transformation strategies to specific needs.

Report Scope & Segmentation Analysis

This report segments the Australia and New Zealand digital transformation market based on several factors: by technology (cloud computing, AI, big data analytics, cybersecurity), by industry (BFSI, healthcare, retail, manufacturing, government), by service type (consulting, implementation, integration), and by organization size (SMEs, large enterprises). Each segment exhibits distinct growth dynamics, market size and competitive landscape. For instance, the cloud computing segment holds a significant market share and is projected to witness robust growth throughout the forecast period, driven by increasing demand for scalability and cost efficiency. The BFSI segment displays high adoption rates due to regulatory requirements and the need for enhanced security.

Key Drivers of Australia And New Zealand Digital Transformation Market Growth

Several factors fuel the growth of the Australia and New Zealand digital transformation market. Firstly, government initiatives promoting digital adoption and investment in infrastructure are crucial. Secondly, increasing adoption of cloud computing, AI, and IoT provides significant operational efficiency and cost savings. Finally, rising consumer expectations for personalized and seamless digital experiences are pushing businesses to invest in digital transformation to improve customer engagement and satisfaction.

Challenges in the Australia And New Zealand Digital Transformation Market Sector

Significant challenges hinder the growth of the digital transformation market. Skill shortages in the IT sector, especially in specialized areas such as AI and cybersecurity, represent a major obstacle. High initial investment costs associated with digital transformation projects can deter some smaller businesses. Cybersecurity threats and data privacy concerns remain a major concern for organizations. The exact quantitative impact of these challenges is difficult to pinpoint precisely, but it can lead to project delays, increased costs, and reduced ROI in some cases.

Emerging Opportunities in Australia And New Zealand Digital Transformation Market

The market presents several emerging opportunities. The increasing adoption of 5G technology promises to transform various sectors, creating new opportunities for businesses to leverage enhanced connectivity and data capabilities. Growth in the Internet of Things (IoT) and edge computing opens doors for innovative solutions in areas such as smart cities, industrial automation, and supply chain optimization. Furthermore, rising demand for personalized and customized digital experiences fuels opportunities for companies to offer innovative solutions for enhanced customer engagement.

Leading Players in the Australia And New Zealand Digital Transformation Market Market

- Accenture PLC

- Google LLC (Alphabet Inc)

- Siemens AG

- IBM Corporation

- Microsoft Corporation

- Cognex Corporation

- Hewlett Packard Enterprise

- SAP SE

- Dell EMC (formerly EMC Corporation)

- Oracle Corporation

- Adobe Inc

- Amazon Web Services Inc

- Apple Inc

- Salesforce com Inc

- Cisco Systems Inc

- *List Not Exhaustive

Key Developments in Australia And New Zealand Digital Transformation Market Industry

- June 2024: Tompkins Robotics announced that Primary Sight, a provider of supply chain technology solutions in Australia, became Tompkins Robotics ANZ. This expansion signifies increasing foreign investment and growth within the Australian supply chain technology sector.

- May 2024: The state government allocated USD 6 Million to the University of Adelaide's Australian Institute for Machine Learning (AIML). This investment strengthens Australia's AI capabilities and fosters growth within the AI sector, potentially leading to increased development and deployment of AI-driven solutions.

Future Outlook for Australia And New Zealand Digital Transformation Market Market

The Australia and New Zealand digital transformation market is poised for continued robust growth. Government support for digital adoption, coupled with increasing adoption of advanced technologies such as AI, IoT, and cloud computing, will drive market expansion. The focus on enhancing cybersecurity and data privacy will also lead to increased investment in relevant solutions. The market's growth trajectory is largely positive, presenting lucrative opportunities for businesses and investors to capitalize on the region's growing digital economy.

Australia And New Zealand Digital Transformation Market Segmentation

-

1. Type

-

1.1. Analytic

- 1.1.1. Current

- 1.1.2. Key Grow

- 1.1.3. Use Case Analysis

- 1.1.4. Market Outlook

- 1.2. Extended Reality (XR)

- 1.3. IoT

- 1.4. Industrial Robotics

- 1.5. Blockchain

- 1.6. Additive Manufacturing/3D Printing

- 1.7. Cybersecurity

- 1.8. Cloud and Edge Computing

-

1.9. Others (digital twin, mobility and connectivity)

- 1.9.1. Market B

-

1.1. Analytic

-

2. End-User Industry

-

2.1. Manufacturing

- 2.1.1. Oil, Gas and Utilities

- 2.1.2. Retail & e-commerce

- 2.1.3. Transportation and Logistics

- 2.1.4. Healthcare

- 2.1.5. BFSI

- 2.1.6. Telecom and IT

- 2.1.7. Government and Public Sector

- 2.1.8. Others (Education, Media &

-

2.1. Manufacturing

Australia And New Zealand Digital Transformation Market Segmentation By Geography

- 1. Australia

Australia And New Zealand Digital Transformation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the adoption of big data analytics and other technologies in Australia And New Zealand; The rapid proliferation of mobile devices and apps

- 3.3. Market Restrains

- 3.3.1. Increase in the adoption of big data analytics and other technologies in Australia And New Zealand; The rapid proliferation of mobile devices and apps

- 3.4. Market Trends

- 3.4.1. The IoT Segment is Expected to Occupy the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia And New Zealand Digital Transformation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analytic

- 5.1.1.1. Current

- 5.1.1.2. Key Grow

- 5.1.1.3. Use Case Analysis

- 5.1.1.4. Market Outlook

- 5.1.2. Extended Reality (XR)

- 5.1.3. IoT

- 5.1.4. Industrial Robotics

- 5.1.5. Blockchain

- 5.1.6. Additive Manufacturing/3D Printing

- 5.1.7. Cybersecurity

- 5.1.8. Cloud and Edge Computing

- 5.1.9. Others (digital twin, mobility and connectivity)

- 5.1.9.1. Market B

- 5.1.1. Analytic

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Manufacturing

- 5.2.1.1. Oil, Gas and Utilities

- 5.2.1.2. Retail & e-commerce

- 5.2.1.3. Transportation and Logistics

- 5.2.1.4. Healthcare

- 5.2.1.5. BFSI

- 5.2.1.6. Telecom and IT

- 5.2.1.7. Government and Public Sector

- 5.2.1.8. Others (Education, Media &

- 5.2.1. Manufacturing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Accenture PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC (Alphabet Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Microsoft Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cognex Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hewlett Packard Enterprise

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAP SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EMC Corporation (Dell EMC)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oracle Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Adobe Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Amazon Web Services Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Apple Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Salesforce com Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Cisco Systems Inc *List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Accenture PLC

List of Figures

- Figure 1: Australia And New Zealand Digital Transformation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia And New Zealand Digital Transformation Market Share (%) by Company 2024

List of Tables

- Table 1: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 7: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 12: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 13: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia And New Zealand Digital Transformation Market?

The projected CAGR is approximately 26.74%.

2. Which companies are prominent players in the Australia And New Zealand Digital Transformation Market?

Key companies in the market include Accenture PLC, Google LLC (Alphabet Inc ), Siemens AG, IBM Corporation, Microsoft Corporation, Cognex Corporation, Hewlett Packard Enterprise, SAP SE, EMC Corporation (Dell EMC), Oracle Corporation, Adobe Inc, Amazon Web Services Inc, Apple Inc, Salesforce com Inc, Cisco Systems Inc *List Not Exhaustive.

3. What are the main segments of the Australia And New Zealand Digital Transformation Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the adoption of big data analytics and other technologies in Australia And New Zealand; The rapid proliferation of mobile devices and apps.

6. What are the notable trends driving market growth?

The IoT Segment is Expected to Occupy the Largest Market Share.

7. Are there any restraints impacting market growth?

Increase in the adoption of big data analytics and other technologies in Australia And New Zealand; The rapid proliferation of mobile devices and apps.

8. Can you provide examples of recent developments in the market?

June 2024: Tompkins Robotics announced that Primary Sight, a provider of supply chain technology solutions in Australia, became Tompkins Robotics ANZ. Bringing Primary Sight into the Tompkins Robotics organization marked a significant milestone as it continued to expand its global footprint and enhance its service offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia And New Zealand Digital Transformation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia And New Zealand Digital Transformation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia And New Zealand Digital Transformation Market?

To stay informed about further developments, trends, and reports in the Australia And New Zealand Digital Transformation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence