Key Insights

The Australian automotive finance market, valued at $183.4 billion in the base year of 2025, is poised for significant expansion. Projections indicate a Compound Annual Growth Rate (CAGR) of 1.4% from 2025 to 2033. This growth is propelled by several key drivers, including increasing vehicle sales driven by population expansion and a favorable economic climate, particularly within the passenger car segment. The burgeoning availability of diverse financing solutions from original equipment manufacturers (OEMs), banks, credit unions, and specialized financial institutions is catering to a broader spectrum of consumer needs. Furthermore, a growing preference for newer vehicle models, complemented by innovative financing structures such as balloon payments and extended loan terms, is stimulating market demand. Nevertheless, potential economic headwinds, interest rate volatility, and stringent regulatory frameworks present challenges to sustained growth. The market is characterized by intense competition among established entities like ANZ Banking Group, Toyota Finance Australia, and National Australia Bank, alongside agile fintech startups and dedicated auto lenders.

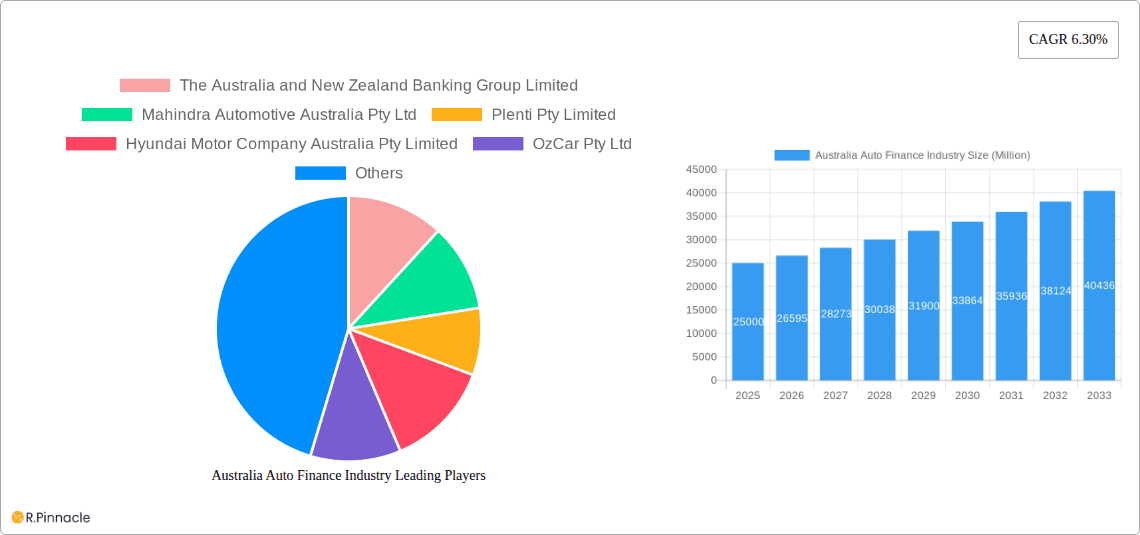

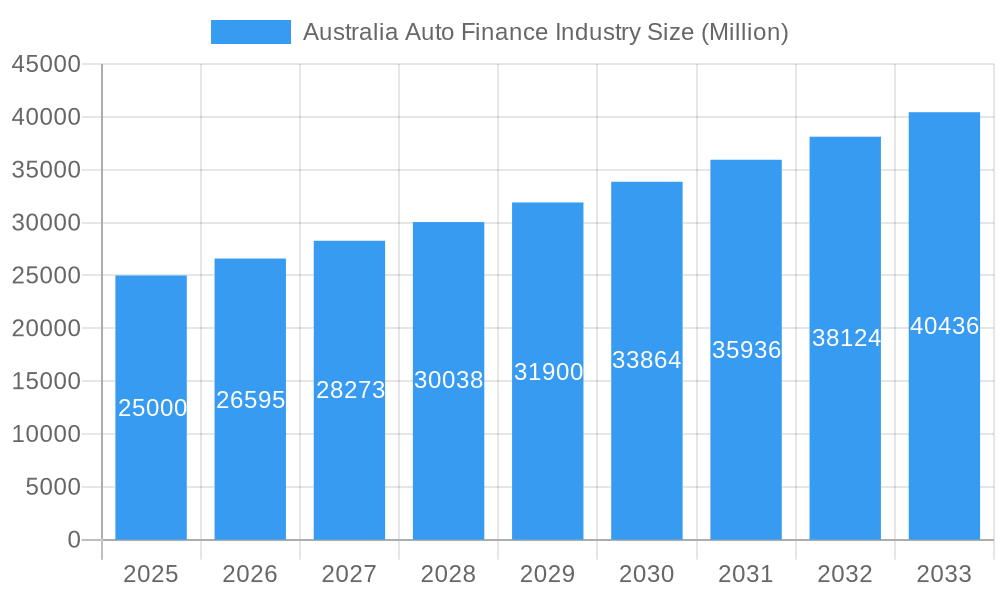

Australia Auto Finance Industry Market Size (In Billion)

Market segmentation reveals distinct trends. The new vehicle segment is anticipated to lead, reflecting consumer inclination towards contemporary vehicles and their associated technological advancements. OEM financing retains a substantial market share, capitalizing on brand equity and established customer relationships. While smaller, the used vehicle segment is expected to demonstrate steady growth, driven by affordability considerations and increasing demand for pre-owned automobiles. Geographic concentration is likely to remain high, with major metropolitan areas accounting for the majority of transactions. Future expansion will depend on navigating economic uncertainties and adapting to evolving consumer preferences, including the adoption of electric vehicles and the integration of fintech solutions. Companies are expected to prioritize enhancing customer experience and streamlining financing processes through digital platforms and advanced data analytics to maintain a competitive edge.

Australia Auto Finance Industry Company Market Share

Australia Auto Finance Industry: 2025-2033 Market Outlook

This comprehensive report offers an in-depth analysis of the Australian automotive finance industry, providing critical insights for industry stakeholders, investors, and strategic planners. Spanning the period from 2025 to 2033, the study utilizes robust data and expert analysis to identify key trends, opportunities, and challenges shaping this dynamic market, with a particular focus on the 2025 base year. The report provides a valuable historical context and a forward-looking perspective on market evolution.

Australia Auto Finance Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences within the Australian auto finance market. We examine market concentration, identifying key players and their market share. The report also explores M&A activity, including deal values and their impact on the industry structure. The analysis encompasses end-user demographics and the influence of substitute products.

Market Concentration: The Australian auto finance market exhibits a moderately concentrated structure, with a few major players holding significant market share. The top five players, including The Australia and New Zealand Banking Group Limited, Toyota Finance Australia Limited, and National Australian Bank, collectively account for an estimated xx% of the market in 2025. Smaller players, such as Plenti Pty Limited and OzCar Pty Ltd, focus on niche segments and innovative financing solutions.

Innovation Drivers: Key innovation drivers include the rise of fintech, advancements in digital lending platforms, and the increasing adoption of data analytics for credit scoring and risk assessment. These innovations are reshaping the customer experience and driving efficiency gains.

Regulatory Framework: The Australian Securities and Investments Commission (ASIC) plays a crucial role in regulating the industry, ensuring fair practices and consumer protection. Recent regulatory changes have focused on responsible lending practices and transparency.

M&A Activity: The period 2019-2024 witnessed a moderate level of M&A activity, with total deal values estimated at approximately $xx Million. These transactions primarily involved smaller players consolidating their market positions or larger companies acquiring fintech startups to enhance their technological capabilities.

Australia Auto Finance Industry Market Dynamics & Trends

This section dives deep into the dynamic forces shaping the Australian auto finance market. We analyze market growth drivers, technological disruptions, evolving consumer preferences, and the intense competitive dynamics. The analysis incorporates key metrics, such as Compound Annual Growth Rate (CAGR) and market penetration, providing a clear picture of the industry’s trajectory. The forecast period from 2025 to 2033 reveals promising opportunities while also highlighting potential headwinds.

The Australian auto finance market experienced robust growth during the historical period (2019-2024), driven by factors such as increasing vehicle sales, favorable economic conditions, and the rising popularity of vehicle finance options. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching an estimated market size of $xx Million by 2033. Key growth drivers include the increasing adoption of digital lending platforms, a growing preference for longer-term financing options, and the penetration of innovative financing products catering to specific consumer needs. Technological disruptions, such as the rise of peer-to-peer lending and embedded finance, are further reshaping the industry. The competitive landscape is characterized by intense rivalry among established banks, captive finance companies, and non-bank lenders. Market penetration rates vary across different segments, with new vehicle finance exhibiting higher penetration compared to used vehicle finance.

Dominant Regions & Segments in Australia Auto Finance Industry

This section identifies the leading regions and segments within the Australian auto finance market. The analysis considers various segmentations, including vehicle type (passenger cars, commercial vehicles), financing source (OEMs, banks, credit unions, financial institutions), and vehicle type (new and used). Key drivers of dominance in each segment are explored, focusing on economic policies, infrastructure development, and consumer preferences.

Leading Region: New South Wales and Victoria consistently dominate the market due to higher population density, robust economic activity, and a strong automotive sector.

Leading Segments:

- Vehicle Type: Passenger cars constitute the largest segment, driven by strong demand from individual consumers.

- Source Type: Banks are the dominant players, leveraging their extensive branch networks and strong brand recognition.

- Vehicle Type: New vehicle finance holds a larger market share compared to used vehicle finance owing to higher transaction values and attractive financing packages from OEMs.

Detailed dominance analysis for each segment includes a discussion of market size, growth projections, and competitive dynamics. The analysis highlights the various factors driving the success of leading segments. For example, the dominance of banks is attributed to their extensive customer base and established credit assessment processes.

Australia Auto Finance Industry Product Innovations

The Australian auto finance market is experiencing significant product innovation, driven by technological advancements and evolving consumer needs. The emergence of digital lending platforms has streamlined the application process, reduced processing times, and enhanced customer experience. Innovative financing products, such as balloon payments, lease-to-own options, and tailored financing solutions for specific vehicle types, cater to a diverse range of customer preferences. These innovations are enhancing competitiveness and fostering greater market penetration.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the Australian auto finance market based on several key parameters. These include vehicle type (new and used), financing source (OEMs, Banks, Credit Unions, Financial Institutions), and vehicle type (Passenger Cars and Commercial Vehicles). Each segment is analyzed in detail, including market size, growth projections, and competitive dynamics. Detailed forecasts are provided for each segment, offering a granular view of the market’s future.

Key Drivers of Australia Auto Finance Industry Growth

Several factors are driving the growth of the Australian auto finance industry. These include:

Economic growth: A healthy economy fuels consumer spending and increases demand for vehicles.

Favorable interest rates: Low interest rates make vehicle financing more affordable.

Technological advancements: Digital lending platforms and innovative financial products enhance accessibility and convenience.

Government incentives: Government policies and incentives aimed at promoting the automotive industry can further boost the market.

Challenges in the Australia Auto Finance Industry Sector

Despite its strong growth prospects, the Australian auto finance industry faces certain challenges:

Economic downturns: Economic recessions can significantly impact consumer spending and reduce demand for vehicle financing.

Regulatory changes: Stringent regulations regarding responsible lending can affect lending practices and profitability.

Competitive intensity: Increased competition from new entrants and established players can put pressure on margins.

Rising delinquency rates: Increases in default rates can negatively impact the profitability and sustainability of the industry.

Emerging Opportunities in Australia Auto Finance Industry

The Australian auto finance industry presents several emerging opportunities:

Growth of the used vehicle market: Rising demand for used vehicles opens new avenues for lenders.

Expansion of digital lending platforms: Leveraging technology to offer seamless and personalized financing experiences.

Adoption of innovative financing products: Offering flexible and tailored finance options to cater to diverse customer preferences.

Focus on sustainability: Offering financing options for electric and hybrid vehicles to cater to environmentally conscious consumers.

Leading Players in the Australia Auto Finance Industry Market

- The Australia and New Zealand Banking Group Limited

- Mahindra Automotive Australia Pty Ltd

- Plenti Pty Limited

- Hyundai Motor Company Australia Pty Limited

- OzCar Pty Ltd

- Toyota Finance Australia Limited

- Kia Australia Pty Ltd

- Mozo Pty Ltd

- National Australian Bank

- Dutton Group

Key Developments in Australia Auto Finance Industry

- January 2023: Launch of a new digital lending platform by a major bank, significantly reducing application processing times.

- June 2022: Acquisition of a fintech startup by a large auto finance company, enhancing its data analytics capabilities.

- November 2021: Introduction of a new government incentive program aimed at promoting the adoption of electric vehicles.

Future Outlook for Australia Auto Finance Industry Market

The Australian auto finance market is poised for continued growth, driven by increasing vehicle sales, technological advancements, and favorable economic conditions. The market is expected to witness further consolidation, with larger players acquiring smaller companies to enhance their market share and expand their product offerings. The focus on digitalization, customer experience, and responsible lending practices will shape the future of the industry. Strategic partnerships and collaborations between automakers and financial institutions will also play a crucial role in shaping the future market landscape.

Australia Auto Finance Industry Segmentation

-

1. Type

- 1.1. New Vehicle

- 1.2. Used Vehicle

-

2. Source Type

- 2.1. OEM

- 2.2. Banks

- 2.3. Credit Unions

- 2.4. Financial Institution

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Australia Auto Finance Industry Segmentation By Geography

- 1. Australia

Australia Auto Finance Industry Regional Market Share

Geographic Coverage of Australia Auto Finance Industry

Australia Auto Finance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Promote Sales of Electric Vehicle

- 3.3. Market Restrains

- 3.3.1. High Initial Investment for Installing Electric Vehicle Charging Infrastructure

- 3.4. Market Trends

- 3.4.1. Used Vehicle to Gain Momentum

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Auto Finance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. New Vehicle

- 5.1.2. Used Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Source Type

- 5.2.1. OEM

- 5.2.2. Banks

- 5.2.3. Credit Unions

- 5.2.4. Financial Institution

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Australia and New Zealand Banking Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mahindra Automotive Australia Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Plenti Pty Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hyundai Motor Company Australia Pty Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OzCar Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toyota Finance Australia Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kia Australia Pty Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mozo Pty Ltd *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 National Australian Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dutton Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Australia and New Zealand Banking Group Limited

List of Figures

- Figure 1: Australia Auto Finance Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Auto Finance Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Auto Finance Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Australia Auto Finance Industry Revenue billion Forecast, by Source Type 2020 & 2033

- Table 3: Australia Auto Finance Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Australia Auto Finance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Australia Auto Finance Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Australia Auto Finance Industry Revenue billion Forecast, by Source Type 2020 & 2033

- Table 7: Australia Auto Finance Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Australia Auto Finance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Auto Finance Industry?

The projected CAGR is approximately 1.4%.

2. Which companies are prominent players in the Australia Auto Finance Industry?

Key companies in the market include The Australia and New Zealand Banking Group Limited, Mahindra Automotive Australia Pty Ltd, Plenti Pty Limited, Hyundai Motor Company Australia Pty Limited, OzCar Pty Ltd, Toyota Finance Australia Limited, Kia Australia Pty Ltd, Mozo Pty Ltd *List Not Exhaustive, National Australian Bank, Dutton Group.

3. What are the main segments of the Australia Auto Finance Industry?

The market segments include Type, Source Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 183.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Promote Sales of Electric Vehicle.

6. What are the notable trends driving market growth?

Used Vehicle to Gain Momentum.

7. Are there any restraints impacting market growth?

High Initial Investment for Installing Electric Vehicle Charging Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Auto Finance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Auto Finance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Auto Finance Industry?

To stay informed about further developments, trends, and reports in the Australia Auto Finance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence