Key Insights

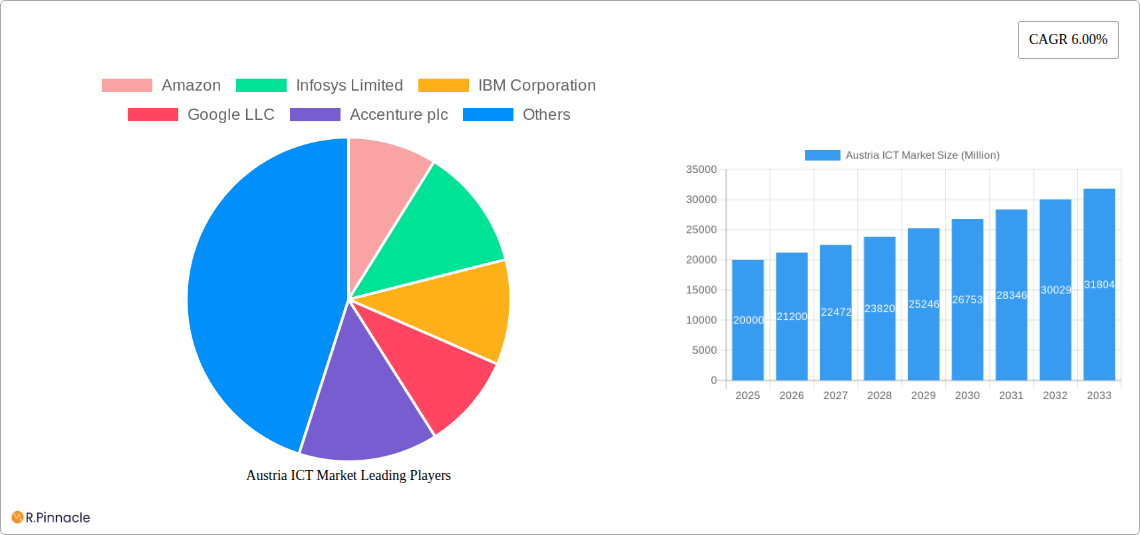

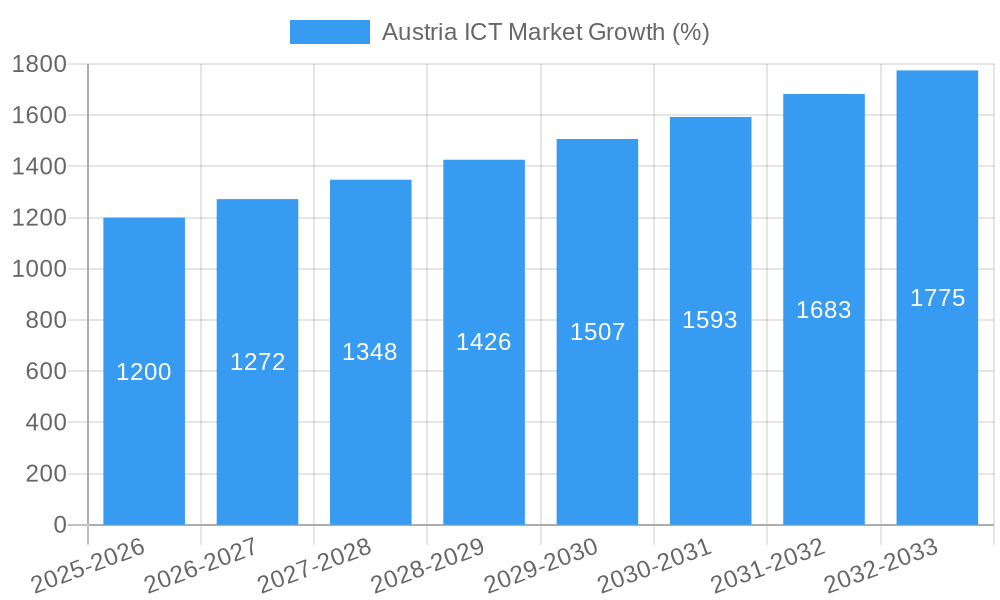

The Austrian ICT market, valued at approximately €20 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6% from 2025 to 2033. This expansion is fueled by several key drivers. Increased digitalization across sectors like BFSI, IT & Telecom, and government is creating significant demand for advanced ICT solutions. The burgeoning e-commerce sector and the growing adoption of cloud computing, big data analytics, and artificial intelligence are further stimulating market growth. Government initiatives promoting digital transformation and investments in digital infrastructure are also contributing to this positive trajectory. While data privacy regulations and cybersecurity concerns pose potential restraints, the overall market outlook remains optimistic.

The market segmentation reveals a diversified landscape. The software segment is projected to experience the highest growth due to increasing demand for software-as-a-service (SaaS) and customized software solutions. Large enterprises are currently the dominant consumer of ICT solutions, but the SME segment is anticipated to witness significant growth, driven by increasing adoption of cloud-based solutions and digital marketing tools. Geographically, Vienna, as the nation's capital and economic hub, is expected to hold the largest market share. Major players like Amazon, IBM, and Infosys are heavily invested in the Austrian market, fueling competition and innovation. However, smaller, specialized firms are also thriving, catering to specific niche needs within the industry. The long-term forecast indicates a continuous expansion of the Austrian ICT market, reflecting Austria's commitment to digital transformation and its integration within the broader European digital economy.

Austria ICT Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Austria ICT market, offering valuable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, dynamics, key players, and future growth potential. The study period (2019-2024) provides a robust historical context, while the forecast period (2025-2033) offers crucial projections for informed decision-making.

Austria ICT Market Structure & Innovation Trends

The Austrian ICT market exhibits a moderately concentrated structure, with key players such as Amazon, Infosys Limited, IBM Corporation, Google LLC, Accenture plc, Hewlett Packard Enterprise, HCL Technologies, Microsoft Corporation, Dell Inc, Cisco Systems, Capgemini, and Oracle holding significant market share. However, a vibrant ecosystem of smaller, specialized firms also contributes to the market's dynamism. Market share data for 2024 indicates that the top five players collectively control approximately XX% of the market, while the remaining share is distributed among numerous smaller players. Innovation is driven by factors such as increasing digitalization across sectors, government initiatives promoting digital transformation, and the burgeoning adoption of cloud computing and 5G technologies. The regulatory framework, while generally supportive of innovation, requires ongoing navigation. Substitutes, primarily in the form of open-source software and alternative cloud providers, exert some competitive pressure. The end-user demographics are diverse, encompassing large enterprises, SMEs, and various industry verticals. M&A activity is significant, with notable deals such as Accenture's acquisition of ARZ in 2022, valued at approximately XX Million, reflecting the consolidation trend within the sector. These activities reshape the competitive landscape and introduce new capabilities.

Austria ICT Market Dynamics & Trends

The Austria ICT market is experiencing robust growth, driven by several key factors. The increasing adoption of cloud services, fueled by technological advancements and the need for scalability and flexibility, is a significant driver. Furthermore, the government's ongoing digitalization initiatives and investments in infrastructure are stimulating demand for ICT solutions across various sectors. The rise of 5G networks promises to accelerate this growth even further, unlocking new possibilities for businesses and consumers alike. Consumer preferences are shifting towards more personalized and seamless digital experiences, demanding innovative and user-friendly ICT products and services. The competitive dynamics are characterized by intense rivalry among established players and the emergence of new disruptive technologies and business models. The Compound Annual Growth Rate (CAGR) for the market is projected to be approximately XX% during the forecast period (2025-2033). Market penetration of key technologies like cloud computing and 5G is expected to reach XX% and XX% respectively by 2033.

Dominant Regions & Segments in Austria ICT Market

While the Austrian ICT market is relatively geographically concentrated, Vienna and other major urban centers are the key growth areas due to higher ICT infrastructure density and concentration of businesses.

By Type: IT Services constitutes the largest segment, driven by increasing demand for digital transformation services and cloud solutions. The Software segment exhibits strong growth due to software-as-a-service (SaaS) adoption and the rise of specialized software solutions. Hardware, although a significant contributor, experiences slower growth compared to software and services. Telecommunication Services sees consistent growth thanks to 5G infrastructure deployment.

By Size of Enterprise: Large enterprises account for a larger share of the market due to their significant investment capacity and demand for sophisticated ICT solutions. However, the SME segment also shows significant growth potential as adoption of cloud-based solutions and digital tools increases.

By Industry Vertical: The BFSI (Banking, Financial Services, and Insurance) sector is a leading adopter of ICT solutions, driven by the need for enhanced security and customer service. The IT and Telecom sector also exhibits high growth due to internal requirements. Other sectors like Retail and E-commerce, Manufacturing, and Government are increasingly adopting ICT to enhance their operations and customer experiences.

Austria ICT Market Product Innovations

Recent product innovations focus on cloud-based solutions, AI-powered analytics tools, and enhanced cybersecurity measures. The market is witnessing increased adoption of 5G technology and edge computing, particularly in the telecommunication and industrial IoT sectors. These innovations offer significant competitive advantages, enabling businesses to improve efficiency, enhance security, and create new revenue streams. The convergence of technologies such as AI, IoT, and cloud is driving the development of intelligent and interconnected systems across numerous industry verticals.

Report Scope & Segmentation Analysis

This report segments the Austria ICT market by Type (Hardware, Software, IT Services, Telecommunication Services), Size of Enterprise (SMEs, Large Enterprises), and Industry Vertical (BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, Energy and Utilities, Other Industry Verticals). Each segment's growth projections, market size (in Millions), and competitive dynamics are analyzed in detail within the full report. For example, the IT Services segment is projected to experience a CAGR of XX% during the forecast period, driven by strong demand for cloud-based services and digital transformation initiatives. The large enterprise segment shows higher growth rates than SMEs driven by higher investment capacity and advanced technological adoption.

Key Drivers of Austria ICT Market Growth

Several factors fuel the growth of the Austria ICT market. Government initiatives to promote digitalization, such as investments in digital infrastructure and the promotion of digital skills, are key drivers. The increasing adoption of cloud computing and 5G technologies across various sectors, coupled with burgeoning demand for cybersecurity solutions, further contributes to market expansion. The strong presence of multinational corporations and a robust startup ecosystem creates a competitive and innovative landscape. Economic growth and rising disposable incomes among consumers further fuel the demand for ICT products and services.

Challenges in the Austria ICT Market Sector

Despite significant growth potential, challenges exist. The availability of skilled ICT professionals remains a constraint, hindering the expansion of certain sectors. Supply chain disruptions, particularly concerning the global semiconductor shortage, can impact the availability of key components. Competition among established players and emerging technologies creates pressure on profit margins and necessitates continuous innovation. Regulatory compliance requirements can add complexity and costs for businesses.

Emerging Opportunities in Austria ICT Market

The Austria ICT market presents several promising opportunities. The growing adoption of AI, IoT, and Big Data analytics across sectors offers scope for innovative solutions. The development of 5G infrastructure and the expansion of smart city initiatives opens new avenues for investment and growth. There is significant scope for expansion within the SME sector, leveraging cloud-based solutions and digital tools to enhance productivity and competitiveness. The increasing focus on cybersecurity opens opportunities for specialized security providers.

Leading Players in the Austria ICT Market Market

- Amazon

- Infosys Limited

- IBM Corporation

- Google LLC

- Accenture plc

- Hewlett Packard Enterprise

- HCL Technologies

- Microsoft Corporation

- Dell Inc

- Cisco Systems

- Capgemini

- Oracle

Key Developments in Austria ICT Market Industry

December 2022: Nokia and A1 Austria successfully verified 3CC CA on a 5G SA experimental network, achieving data speeds approaching 2 Gbps. This development significantly enhances 5G capabilities in Austria.

October 2022: Google announced plans to open new cloud regions in Austria, expanding its cloud services footprint in the country. This expansion will further stimulate cloud adoption in Austria.

June 2022: Accenture acquired ARZ, expanding its cloud-based banking platform-as-a-service offerings and strengthening its position in the Austrian banking sector. This acquisition consolidates market share and improves service offerings.

Future Outlook for Austria ICT Market Market

The Austria ICT market is poised for continued growth, driven by technological advancements, government initiatives, and increasing digital adoption across sectors. The expansion of 5G networks, the increasing adoption of cloud services, and the growing focus on AI and cybersecurity present significant opportunities for growth. Strategic partnerships and investments in innovation will be crucial for players to maintain their competitiveness. The market is expected to continue its upward trajectory in the coming years, fueled by a robust economic climate and a commitment to technological advancement.

Austria ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Austria ICT Market Segmentation By Geography

- 1. Austria

Austria ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consistent Digital Transformation Initiatives; Robust Telecommunication Network

- 3.3. Market Restrains

- 3.3.1. Use of Physical Vault

- 3.4. Market Trends

- 3.4.1. Growing demand for Cloud Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infosys Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Google LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accenture plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hewlett Packard Enterprise

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HCL Technologies*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microsoft Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dell Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cisco Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Capgemini

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Oracle

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Austria ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Austria ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Austria ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Austria ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Austria ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: Austria ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: Austria ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Austria ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Austria ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Austria ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 9: Austria ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 10: Austria ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria ICT Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Austria ICT Market?

Key companies in the market include Amazon, Infosys Limited, IBM Corporation, Google LLC, Accenture plc, Hewlett Packard Enterprise, HCL Technologies*List Not Exhaustive, Microsoft Corporation, Dell Inc, Cisco Systems, Capgemini, Oracle.

3. What are the main segments of the Austria ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consistent Digital Transformation Initiatives; Robust Telecommunication Network.

6. What are the notable trends driving market growth?

Growing demand for Cloud Technology.

7. Are there any restraints impacting market growth?

Use of Physical Vault.

8. Can you provide examples of recent developments in the market?

December 2022: Nokia and A1 Austria announced that they successfully verified 3 Component Carrier Aggregation (3CC CA) on a 5G Standalone (SA) experimental network in Austria, with data speeds approaching 2 Gbps. CA (Carrier Aggregation) enables mobile carriers to achieve faster throughputs and improved coverage by combining multiple spectrum frequencies to better use their spectrum assets. It will allow A1 to provide its subscribers with a better 5G experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria ICT Market?

To stay informed about further developments, trends, and reports in the Austria ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence