Key Insights

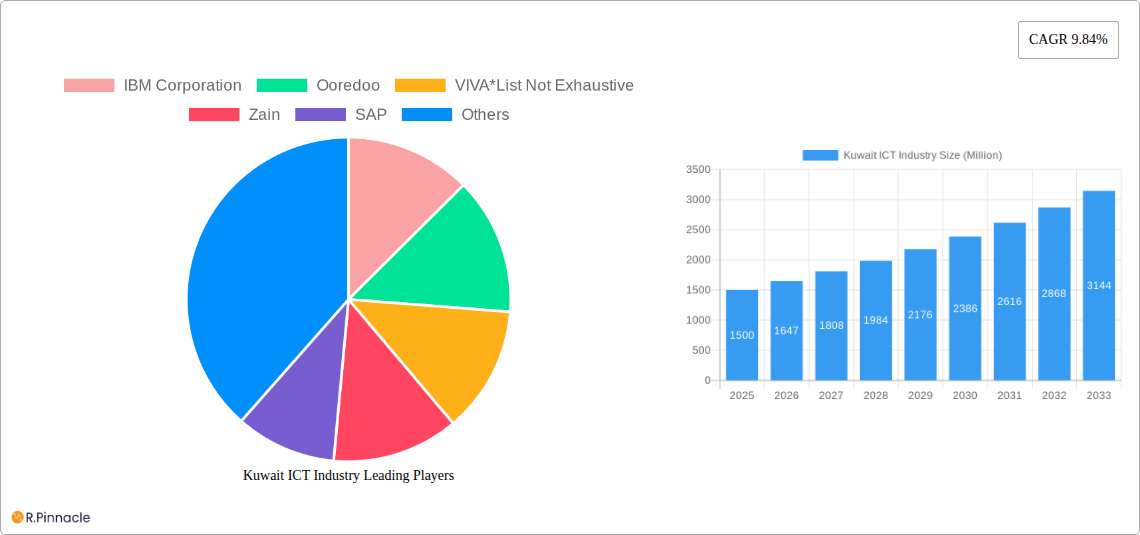

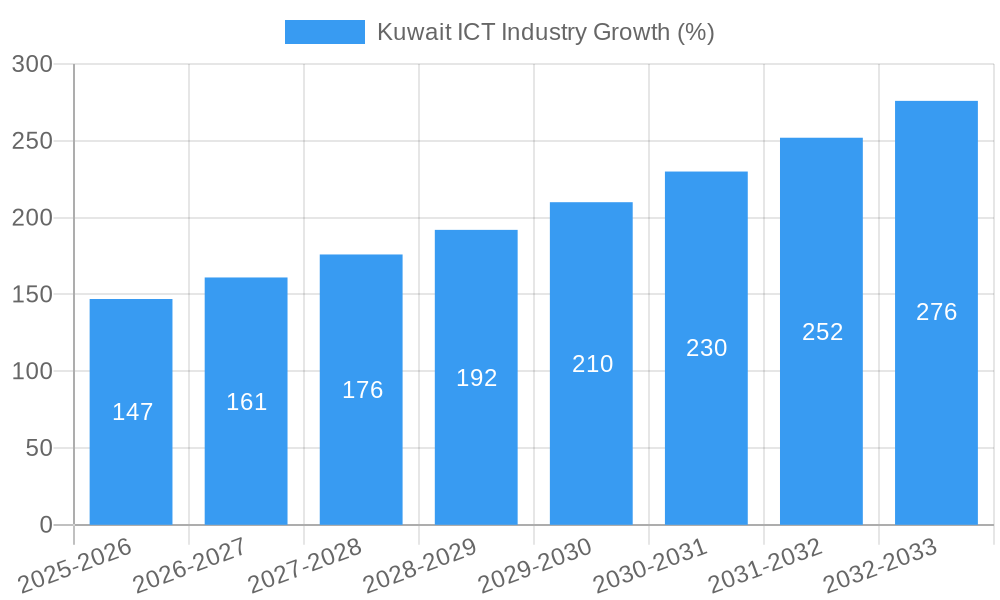

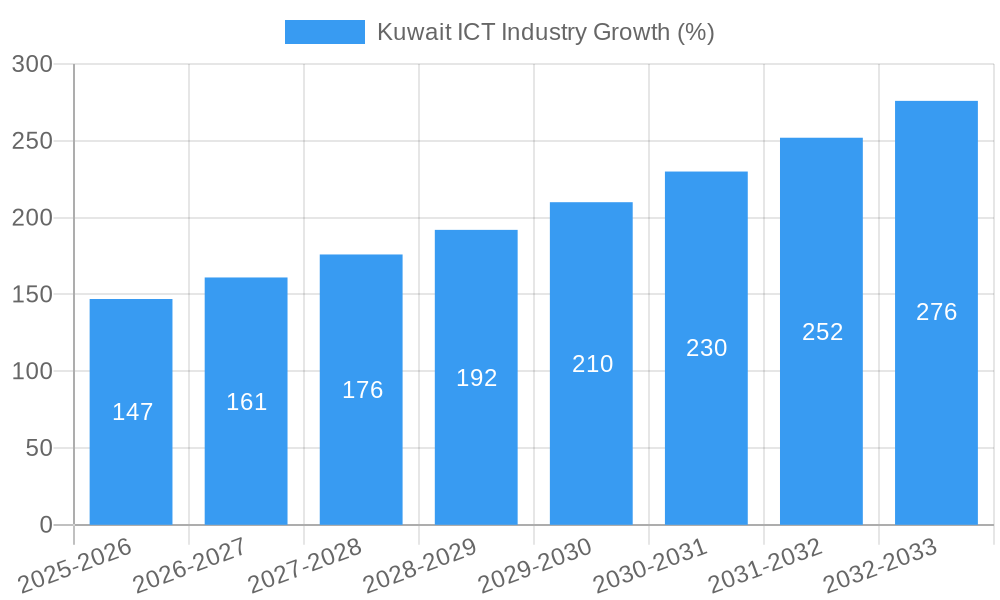

The Kuwaiti ICT market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.84% from 2025 to 2033. This expansion is driven by several key factors. Increased government investment in digital infrastructure, particularly in 5G networks and cloud computing, is laying a strong foundation for technological advancement. The burgeoning adoption of digital technologies across various sectors, including oil and gas, finance, and healthcare, fuels demand for ICT solutions. Furthermore, the Kuwaiti government's ongoing initiatives to promote digital transformation and e-governance are creating lucrative opportunities for ICT companies. The increasing demand for sophisticated data analytics solutions to improve operational efficiency and decision-making across industries also contributes significantly to market growth. While data privacy concerns and the need for robust cybersecurity measures present some challenges, the overall market outlook remains positive.

Growth within the Kuwaiti ICT sector is segmented across various components, including hardware, software and services, communication and connectivity, and specialized technologies such as big data analytics and cloud computing. The oil, gas, and utilities sector represents a substantial end-user segment, reflecting the nation's economic reliance on this sector's robust digitalization needs. Transportation and logistics, healthcare, and financial services also contribute significantly to the market's size and growth. Leading players like IBM, Ooredoo, Zain, SAP, and Cisco are actively participating in this dynamic market, offering a wide range of solutions to meet the evolving demands of Kuwaiti businesses and consumers. The sustained growth is likely to attract further investment and innovation within the Kuwaiti ICT landscape in the coming years.

Kuwait ICT Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Kuwait ICT industry, offering valuable insights for industry professionals, investors, and strategists. With a focus on market dynamics, key players, and future trends, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033. The report utilizes a detailed segmentation analysis, encompassing various components, end-user industries, and technologies, providing a granular understanding of the market landscape. The total market size is predicted to reach xx Million by 2033.

Kuwait ICT Industry Market Structure & Innovation Trends

The Kuwaiti ICT market exhibits a moderately concentrated structure, with a few large players like Zain, Ooredoo, and VIVA holding significant market share. However, the presence of numerous smaller players and a growing number of startups indicates a dynamic competitive environment. Innovation is driven primarily by government initiatives promoting digital transformation, rising mobile penetration, and increasing adoption of cloud computing and big data analytics. The regulatory framework, while generally supportive, faces occasional challenges in keeping pace with technological advancements. Product substitutes, particularly in the communication and connectivity sector, are a significant competitive factor. The end-user demographic is largely concentrated in urban areas, with a high level of smartphone and internet penetration among the younger generation.

Mergers and acquisitions (M&A) have played a notable role in shaping the market landscape. Recent deals include:

- April 2022: Kalaam Telecom's acquisition of Zajil International Telecom, valued at xx Million, consolidates its position as a leading ISP.

- April 2022: Kamco Invest's acquisition of E-Portal Holding K.S.C.C., valued at xx Million, demonstrates the ongoing expansion of ICT solutions beyond traditional telecommunication services.

The total M&A deal value in the Kuwaiti ICT sector during the historical period (2019-2024) is estimated to be xx Million. Market share data for key players is detailed within the full report.

Kuwait ICT Industry Market Dynamics & Trends

The Kuwait ICT market exhibits strong growth potential, driven by several key factors. Government initiatives aimed at fostering digitalization and technological innovation, coupled with increasing government and private sector investments, contribute significantly to market expansion. Technological disruptions, such as the transition to 5G and the proliferation of cloud-based services, are reshaping the market landscape. Consumer preferences are shifting towards greater mobility, data security, and personalized digital experiences. The competitive dynamics are characterized by increasing consolidation, technological advancements, and the emergence of new business models. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, with market penetration of key technologies, like cloud computing, expected to reach xx% by 2033.

Dominant Regions & Segments in Kuwait ICT Industry

The Kuwait City metropolitan area represents the most dominant region within the Kuwait ICT industry, driven by higher population density, concentrated infrastructure investments, and the presence of major ICT companies.

By Component: The software and services segment is expected to dominate, fueled by growing demand for digital transformation solutions and cloud-based services.

- Key Drivers: Government initiatives, private sector investments, growing adoption of digital solutions.

By End-User Industry: The Oil, Gas, and Utilities sector remains a dominant end-user, due to its significant investment in digital technologies for efficiency and safety enhancements. However, the Financial Services and Transportation & Logistics sectors are also exhibiting strong growth.

- Key Drivers: Demand for improved operational efficiency, enhanced security, digital transformation initiatives.

By Technology: Cloud Computing and Big Data Analytics are experiencing rapid adoption, driven by their potential to improve decision-making and operational efficiencies across multiple industries.

- Key Drivers: Increasing availability of affordable cloud solutions, growing demand for data-driven insights, and government support for digital transformation initiatives.

Kuwait ICT Industry Product Innovations

The Kuwait ICT industry is witnessing significant product innovation, driven by technological advancements and evolving market needs. New products and services focus on enhancing operational efficiencies, improving data security, and providing personalized customer experiences. Key innovations include cloud-based solutions, advanced cybersecurity technologies, and 5G-enabled mobile services. The market fit for these innovations is high, owing to the government's push for digital transformation and the increasing digital literacy amongst the population.

Report Scope & Segmentation Analysis

This report segments the Kuwait ICT market comprehensively.

By Component: Hardware, Devices, Software and Services, Communication and Connectivity. Growth projections vary significantly across these segments.

By End-User Industry: Oil, Gas and Utilities; Transportation and Logistics; Healthcare; Financial Services; Manufacturing and Construction; Other End-User Industries (Environment, Media & Entertainment). Each sector exhibits unique growth drivers and challenges.

By Technology: Big Data Analytics; Mobility; Cloud Computing; Storage; Business Process Outsourcing; Other Technologies. Technological advancements drive market dynamism.

Key Drivers of Kuwait ICT Industry Growth

Several factors fuel the growth of the Kuwait ICT industry: Government initiatives promoting digital transformation, increasing private sector investments in technology, rising mobile penetration, and growing adoption of cloud computing and big data analytics are key drivers. The country’s strategic location and investment in robust infrastructure also contribute to its attractiveness as a regional ICT hub.

Challenges in the Kuwait ICT Industry Sector

The Kuwait ICT sector faces challenges including regulatory hurdles, skill gaps in the workforce, and competition from regional players. Supply chain disruptions and the need for enhanced cybersecurity infrastructure also pose significant obstacles. These challenges may impact the projected growth rate by an estimated xx% if not addressed effectively.

Emerging Opportunities in Kuwait ICT Industry

Emerging opportunities include the expansion of 5G networks, growth in cloud computing adoption, increased focus on cybersecurity, and development of smart city initiatives. The growing demand for digital solutions in various sectors presents significant growth potential for innovative ICT companies.

Leading Players in the Kuwait ICT Industry Market

- IBM Corporation

- Ooredoo

- VIVA

- Zain

- SAP

- Amadeus IT Group

- Cisco Systems

- Huawei Technologies

- Oracle

- HP Middle East

Key Developments in Kuwait ICT Industry Industry

- December 2022: Huawei launches the Huawei Cloud Startup Program in Kuwait, fostering growth of local startups.

- March 2022: ZainTech partners with Huawei to accelerate the 5G transition in Kuwait.

- April 2022: Kalaam Telecom acquires Zajil International Telecom, expanding its market reach.

- April 2022: Kamco Invest acquires E-Portal Holding K.S.C.C., strengthening its position in the ICT market.

Future Outlook for Kuwait ICT Industry Market

The Kuwait ICT market is poised for robust growth in the coming years. Government support for digital transformation, increasing private sector investments, and the adoption of advanced technologies will drive significant market expansion. The focus on developing a robust digital infrastructure and fostering innovation will create new opportunities for businesses and contribute to the country’s overall economic development.

Kuwait ICT Industry Segmentation

-

1. Technology

- 1.1. Big Data Analytics

- 1.2. Mobility

- 1.3. Cloud Computing

- 1.4. Storage

- 1.5. Business Process Outsourcing

- 1.6. Other Technologies

-

2. Component

- 2.1. Hardware

- 2.2. Devices

- 2.3. Software and Services

- 2.4. Communication and Connectivity

-

3. End-User Industry

- 3.1. Oil, Gas and Utilities

- 3.2. Transportation and Logistics

- 3.3. Healthcare

- 3.4. Financial Services

- 3.5. Manufacturing and Construction

- 3.6. Other En

Kuwait ICT Industry Segmentation By Geography

- 1. Kuwait

Kuwait ICT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government policies and PPP initiatives such as National Development Plan called New Kuwait; Early adoption of 5G network; Increasing penetration of technology giants

- 3.3. Market Restrains

- 3.3.1 ; Alternative Protocols

- 3.3.2 such as Bluetooth

- 3.3.3 Wi-Fi

- 3.3.4 and Z-Wave

- 3.3.5 Among Others

- 3.4. Market Trends

- 3.4.1. Early Adoption of 5G Network Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait ICT Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Big Data Analytics

- 5.1.2. Mobility

- 5.1.3. Cloud Computing

- 5.1.4. Storage

- 5.1.5. Business Process Outsourcing

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Hardware

- 5.2.2. Devices

- 5.2.3. Software and Services

- 5.2.4. Communication and Connectivity

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Oil, Gas and Utilities

- 5.3.2. Transportation and Logistics

- 5.3.3. Healthcare

- 5.3.4. Financial Services

- 5.3.5. Manufacturing and Construction

- 5.3.6. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ooredoo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 VIVA*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zain

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SAP

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amadeus IT Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cisco Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HP Middle East

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Kuwait ICT Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait ICT Industry Share (%) by Company 2024

List of Tables

- Table 1: Kuwait ICT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait ICT Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Kuwait ICT Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Kuwait ICT Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Kuwait ICT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Kuwait ICT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Kuwait ICT Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 8: Kuwait ICT Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 9: Kuwait ICT Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 10: Kuwait ICT Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait ICT Industry?

The projected CAGR is approximately 9.84%.

2. Which companies are prominent players in the Kuwait ICT Industry?

Key companies in the market include IBM Corporation, Ooredoo, VIVA*List Not Exhaustive, Zain, SAP, Amadeus IT Group, Cisco Systems, Huawei Technologies, Oracle, HP Middle East.

3. What are the main segments of the Kuwait ICT Industry?

The market segments include Technology, Component, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government policies and PPP initiatives such as National Development Plan called New Kuwait; Early adoption of 5G network; Increasing penetration of technology giants.

6. What are the notable trends driving market growth?

Early Adoption of 5G Network Drives the Market Growth.

7. Are there any restraints impacting market growth?

; Alternative Protocols. such as Bluetooth. Wi-Fi. and Z-Wave. Among Others.

8. Can you provide examples of recent developments in the market?

December 2022: Huawei is launching the Huawei Cloud Startup Program in Kuwait in collaboration with local partners. The initiative helps Kuwaiti startups grow their businesses by utilizing Huawei technology. The initiative was developed with local partners such as the Central Agency for Information Technology, Rasameel Investment Company, Kuwait Youth Assembly, and eWTP Arabia Capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait ICT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait ICT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait ICT Industry?

To stay informed about further developments, trends, and reports in the Kuwait ICT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence