Key Insights

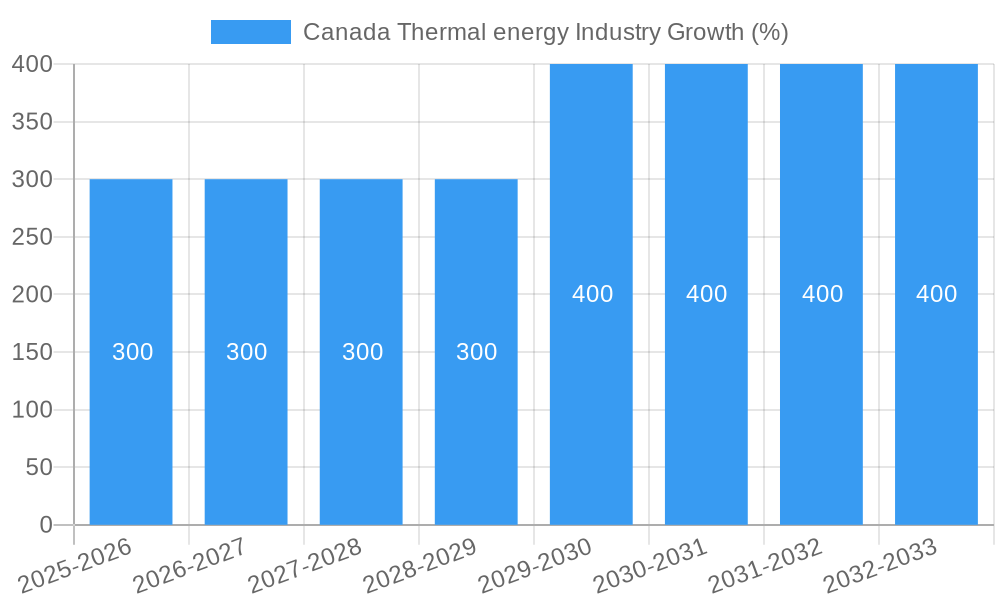

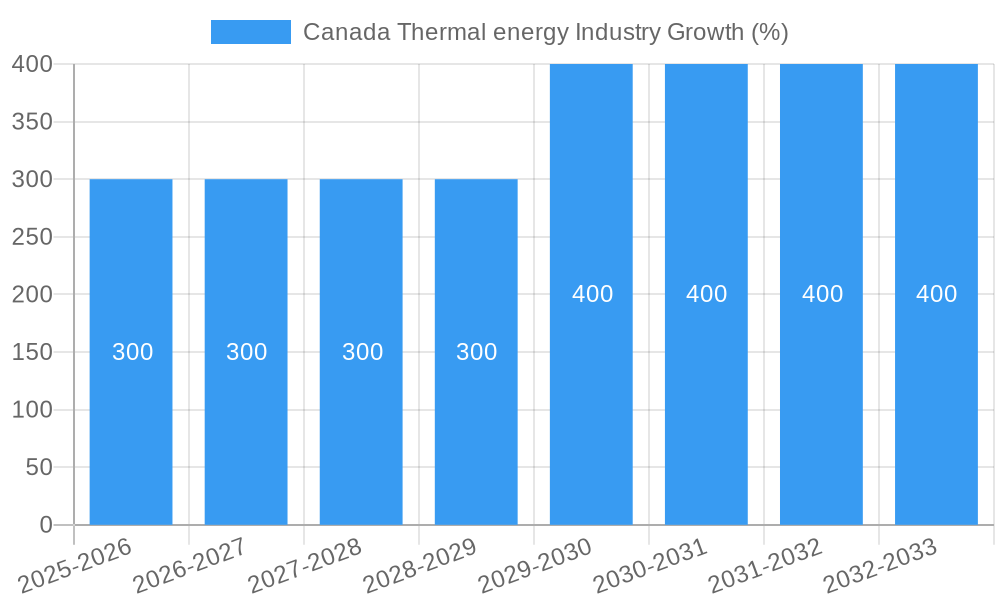

The Canadian thermal energy market, encompassing sources like oil, natural gas, nuclear, and coal, is a substantial sector exhibiting steady growth. While precise market size figures for 2025 are unavailable, a logical estimation, considering a CAGR exceeding 1.00% and a historical period from 2019-2024, would place the 2025 market value in the range of $25-30 billion (in millions, to match the implied scale). This growth is primarily driven by consistent energy demand from industrial and commercial sectors across Canada’s diverse regions – Eastern, Western, and Central Canada. Key trends impacting the market include an increasing focus on energy efficiency improvements within existing thermal plants, alongside ongoing investment in modernizing infrastructure to reduce environmental impact. However, the sector faces significant restraints, including the transition towards renewable energy sources, tightening environmental regulations, and fluctuating fossil fuel prices. This necessitates adaptation and strategic diversification for thermal energy companies operating within the Canadian landscape. While fossil fuels (oil, natural gas, and coal) will likely continue to play a role, albeit a diminishing one, nuclear energy remains a significant contributor to the country's energy mix and enjoys a stable position due to its baseload capacity and relatively low carbon emissions compared to other thermal sources.

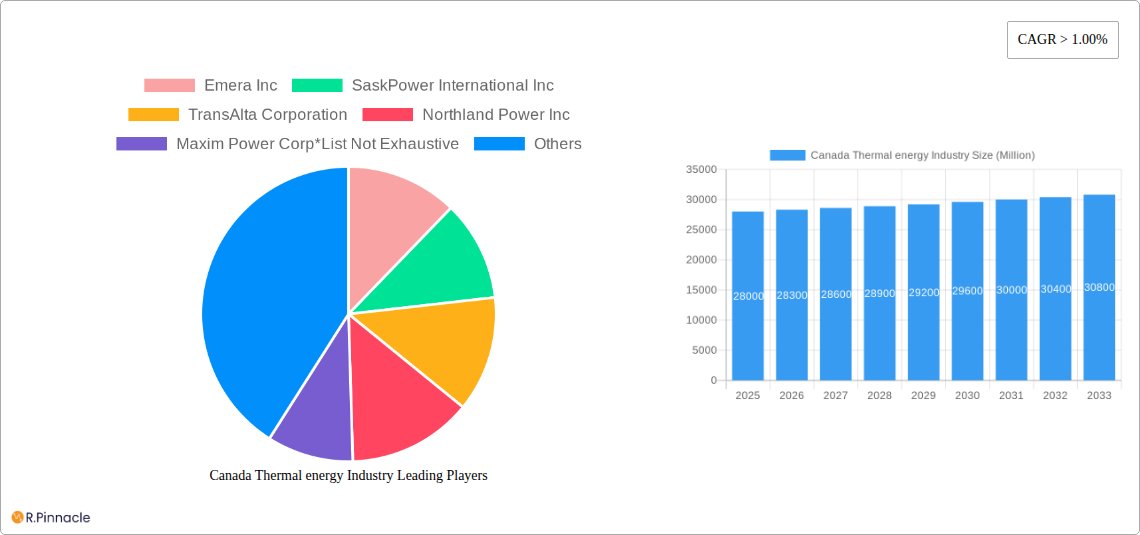

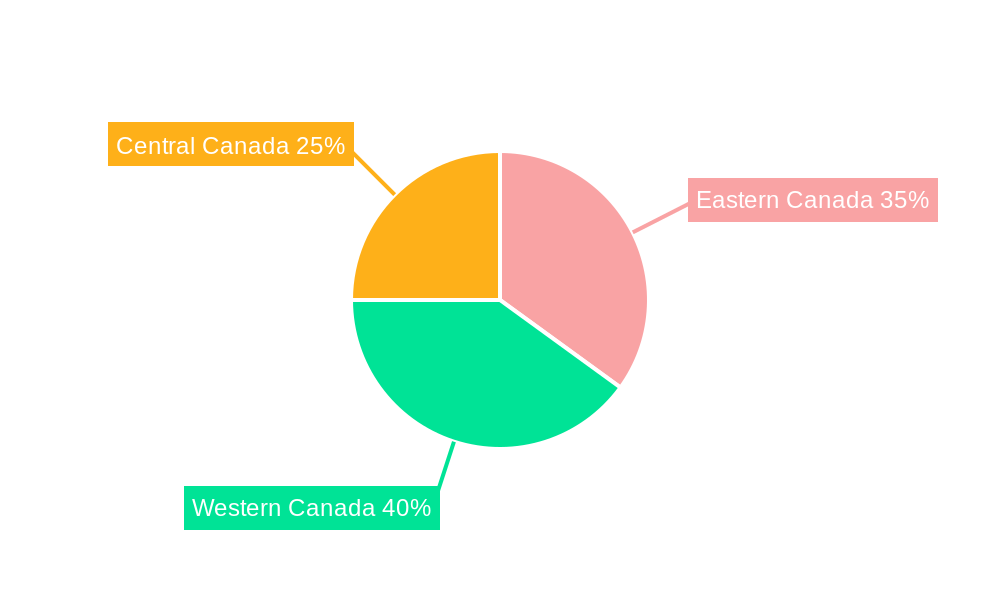

The competitive landscape is shaped by major players like Emera Inc, SaskPower International Inc, TransAlta Corporation, Northland Power Inc, Maxim Power Corp, Ontario Power Generation Inc, and Atco Power Ltd. These companies are actively responding to market pressures by investing in carbon capture and storage technologies and exploring opportunities within combined heat and power systems. The regional breakdown of the market reflects varying energy needs and resource availability across Canada. Western Canada, with its oil sands and natural gas reserves, may show a comparatively higher reliance on fossil fuel-based thermal energy, while Eastern and Central Canada may exhibit more balanced portfolios incorporating nuclear and other energy sources. The forecast period (2025-2033) suggests continued market expansion, albeit at a rate that is likely to moderate due to factors mentioned above. The consistent yet evolving nature of the Canadian thermal energy market demands strategic long-term planning from industry players to navigate the complexities of a shifting energy landscape.

Canada Thermal Energy Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Canadian thermal energy industry, covering market structure, dynamics, key players, and future outlook. The study period spans 2019-2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals, investors, and policymakers seeking actionable insights into this dynamic sector.

Canada Thermal Energy Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Canadian thermal energy market, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activity. The report examines the market share of key players, including Emera Inc, SaskPower International Inc, TransAlta Corporation, Northland Power Inc, Maxim Power Corp, Ontario Power Generation Inc, and Atco Power Ltd (list not exhaustive). We analyze the impact of mergers and acquisitions (M&A), with estimated deal values of xx Million for the period 2019-2024, highlighting the strategic implications for market consolidation. The analysis also covers the influence of regulatory frameworks on innovation, the role of substitute products, and end-user demographics driving demand. The impact of technological advancements, particularly in small modular reactors (SMRs), on market structure is also detailed, including their potential to disrupt traditional thermal energy sources.

Canada Thermal Energy Industry Market Dynamics & Trends

This section delves into the key market dynamics shaping the Canadian thermal energy industry. We explore the market growth drivers, including industrialization, population growth, and energy demand from various sectors. The report quantifies market growth using a Compound Annual Growth Rate (CAGR) of xx% projected for the forecast period (2025-2033), alongside an analysis of market penetration rates for different thermal energy sources. The competitive dynamics are scrutinized, examining the strategies employed by leading players, including pricing strategies, technological advancements, and market expansion initiatives. The impact of technological disruptions, particularly the emergence of SMR technology, is assessed, considering their potential to reshape the energy landscape and influence market share.

Dominant Regions & Segments in Canada Thermal Energy Industry

This section identifies the dominant regions and segments within the Canadian thermal energy market. While data for exact regional dominance is unavailable, this section focuses on segment-wise performance based on sources: oil, natural gas, nuclear, and coal. Dominance is analyzed through detailed examination of economic policies influencing each segment, available infrastructure supporting each energy source, and projected growth potential.

- Oil: Key drivers include existing infrastructure and industrial demand. Challenges include environmental concerns and price volatility.

- Natural Gas: Key drivers include relatively low cost and established infrastructure. Challenges include greenhouse gas emissions and dependence on fossil fuels.

- Nuclear: Key drivers include high energy density and low greenhouse gas emissions. Challenges include public perception, waste disposal, and high upfront capital costs.

- Coal: Key drivers include existing infrastructure and established supply chains. Challenges include high greenhouse gas emissions and environmental regulations.

The analysis includes detailed market size projections for each segment, along with competitive dynamics within each source.

Canada Thermal Energy Industry Product Innovations

This section examines recent product innovations in the Canadian thermal energy sector. The report highlights technological advancements, such as the development and deployment of small modular reactors (SMRs), and their potential to improve efficiency, reduce emissions, and create new market opportunities. The analysis also covers the applications of these innovations, assessing their suitability for diverse end-use sectors. The competitive advantages offered by innovative thermal energy solutions are discussed, including cost-effectiveness, environmental sustainability, and operational efficiency.

Report Scope & Segmentation Analysis

This report segments the Canadian thermal energy market based on the source of energy: oil, natural gas, nuclear, and coal. Each segment's market size is projected for the forecast period (2025-2033), along with assessments of their growth potential and competitive landscape. The report also analyzes the factors driving the growth and challenges faced by each segment.

- Oil: [Insert paragraph on oil segment, including market size projection, growth drivers and challenges.]

- Natural Gas: [Insert paragraph on natural gas segment, including market size projection, growth drivers and challenges.]

- Nuclear: [Insert paragraph on nuclear segment, including market size projection, growth drivers and challenges.]

- Coal: [Insert paragraph on coal segment, including market size projection, growth drivers and challenges.]

Key Drivers of Canada Thermal energy Industry Growth

Growth in the Canadian thermal energy industry is driven by several key factors. Increased industrial activity and population growth are major contributors, leading to a rise in energy demand. Furthermore, government policies promoting energy security and diversification are playing a role. Technological innovations, especially in the development of cleaner and more efficient thermal energy technologies, are also significant drivers, along with the growth of small modular reactors (SMRs).

Challenges in the Canada Thermal energy Industry Sector

Several challenges hinder the growth of the Canadian thermal energy industry. Stringent environmental regulations aim to reduce greenhouse gas emissions, posing hurdles for fossil fuel-based thermal energy sources. Supply chain disruptions and fluctuating energy prices also affect market stability. Finally, increasing competition from renewable energy sources presents a significant challenge to the traditional thermal energy sector. The estimated impact of these challenges is projected to be a xx% reduction in growth for the period 2025-2033.

Emerging Opportunities in Canada Thermal energy Industry

The Canadian thermal energy sector presents several emerging opportunities. The growing demand for reliable and affordable energy, especially in remote areas, creates potential for innovative solutions. The development and deployment of SMR technology offers significant growth prospects. Moreover, opportunities exist to improve energy efficiency across diverse industrial sectors, leading to cost savings and environmental benefits.

Leading Players in the Canada Thermal energy Industry Market

- Emera Inc

- SaskPower International Inc

- TransAlta Corporation

- Northland Power Inc

- Maxim Power Corp

- Ontario Power Generation Inc

- Atco Power Ltd

Key Developments in Canada Thermal energy Industry Industry

October 2022: The Canada Infrastructure Bank (CIB) committed USD 721 Million to the development and construction of Canada's first small modular reactor (SMR) with Ontario Power Generation (OPG). This 300 MW project positions Canada as a global SMR technology hub in a market estimated at USD 150 Billion annually by 2040. This development significantly impacts the market by accelerating SMR adoption and attracting further investment.

January 2023: X-energy Canada and Invest Alberta signed a memorandum of understanding to explore the use of Xe-100 SMRs in Canada. This high-temperature gas-cooled reactor offers a clean energy solution for heavy industries, potentially boosting efficiency and reducing emissions in sectors like oil sands operations and petrochemicals. This signifies a major step towards diversifying the energy mix and promoting sustainable industrial practices.

Future Outlook for Canada Thermal energy Industry Market

The future of the Canadian thermal energy industry is intertwined with the adoption of innovative technologies and the transition to a lower-carbon energy system. The growth of SMRs is expected to play a crucial role, alongside improvements in energy efficiency and the integration of renewable energy sources. The market is poised for significant growth, driven by industrial expansion and government policies supporting a diversified energy portfolio. However, navigating challenges related to environmental regulations and supply chain stability will be critical for continued success.

Canada Thermal energy Industry Segmentation

-

1. Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Nuclear

- 1.4. Coal

Canada Thermal energy Industry Segmentation By Geography

- 1. Canada

Canada Thermal energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Renewables Capacity in Thailand4.; Rising Modernization of Existing Transmission and Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Huge Capital Expenditure Required for Carrying out Modernization of Existing Facilities

- 3.4. Market Trends

- 3.4.1. Natural Gas Based Thermal Power to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Thermal energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Nuclear

- 5.1.4. Coal

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Eastern Canada Canada Thermal energy Industry Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Thermal energy Industry Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Thermal energy Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Emera Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 SaskPower International Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 TransAlta Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Northland Power Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Maxim Power Corp*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Ontario Power Generation Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Atco Power Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Emera Inc

List of Figures

- Figure 1: Canada Thermal energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Thermal energy Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Thermal energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Thermal energy Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Canada Thermal energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Canada Thermal energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Eastern Canada Canada Thermal energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Western Canada Canada Thermal energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Central Canada Canada Thermal energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Thermal energy Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 9: Canada Thermal energy Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Thermal energy Industry?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Canada Thermal energy Industry?

Key companies in the market include Emera Inc, SaskPower International Inc, TransAlta Corporation, Northland Power Inc, Maxim Power Corp*List Not Exhaustive, Ontario Power Generation Inc, Atco Power Ltd.

3. What are the main segments of the Canada Thermal energy Industry?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Renewables Capacity in Thailand4.; Rising Modernization of Existing Transmission and Distribution Infrastructure.

6. What are the notable trends driving market growth?

Natural Gas Based Thermal Power to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Huge Capital Expenditure Required for Carrying out Modernization of Existing Facilities.

8. Can you provide examples of recent developments in the market?

January 2023: X-energy Canada and Invest Alberta signed a memorandum of understanding to find ways for the Xe-small modular reactor ("SMR") to be used in Canada without hurting the economy.Xe-100 is a high-temperature gas-cooled reactor. This clean energy solution would support heavy industries, including oil sand operations, petrochemicals, and other industrial processes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Thermal energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Thermal energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Thermal energy Industry?

To stay informed about further developments, trends, and reports in the Canada Thermal energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence