Key Insights

China's electric vehicle (EV) charging infrastructure market is experiencing substantial expansion, driven by national electrification goals and robust government initiatives. Projected to reach $25.6 billion by 2025, the market is forecast to grow at a CAGR of 48.56% between 2025 and 2033. This growth is propelled by increasing EV adoption, government incentives for charging station deployment, and advancements in charging technology. The market is segmented by charging station type (AC and DC), vehicle type (passenger and commercial), and user application (private and public infrastructure). While AC charging stations currently lead due to lower costs, DC fast-charging stations are rapidly gaining traction, especially in urban areas and along major routes. The passenger vehicle segment holds a dominant share, with the commercial vehicle segment expected to see significant growth as fleet electrification accelerates. Private infrastructure leads, but substantial investment in public charging networks is set to increase their market share. Key players are actively investing in network expansion and innovative charging solutions.

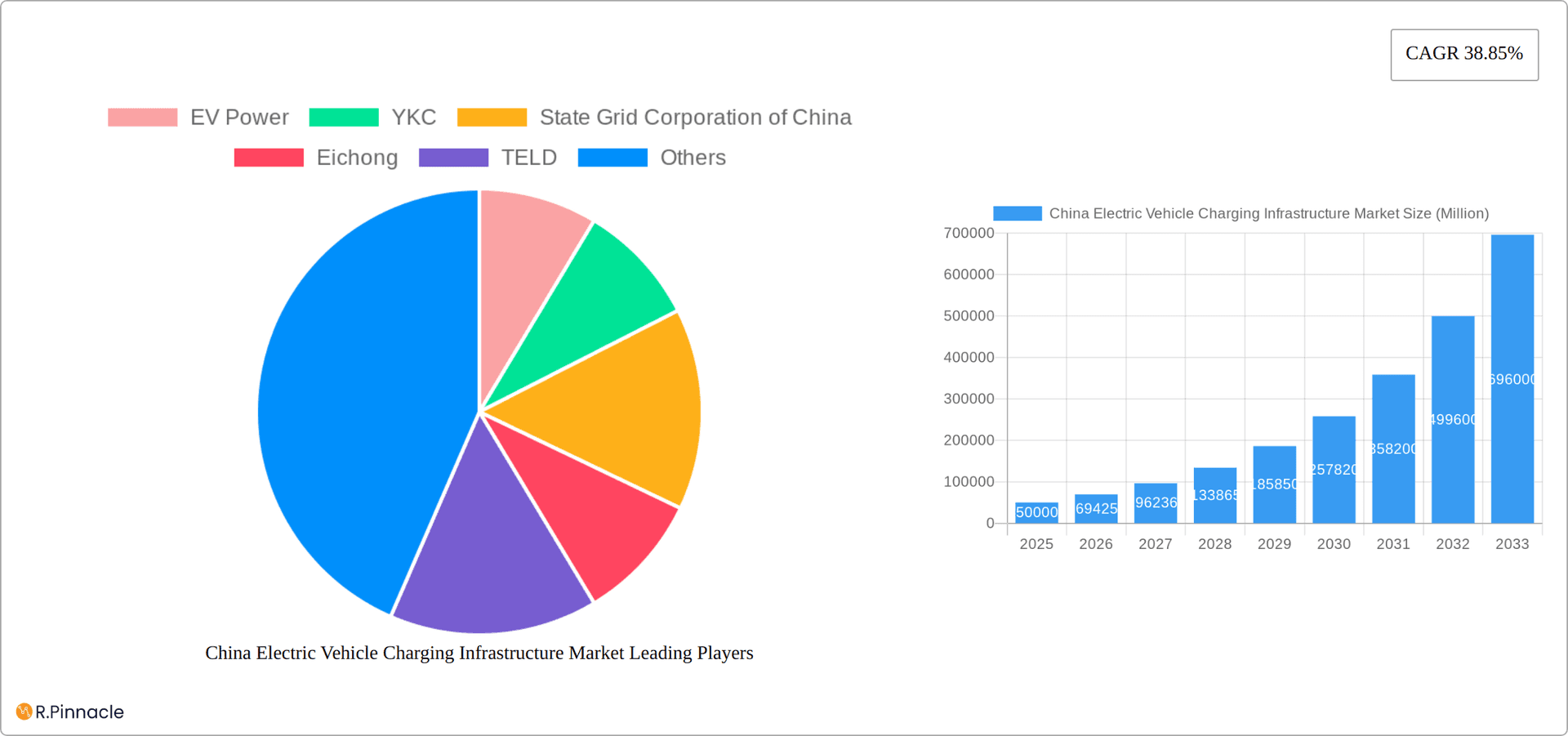

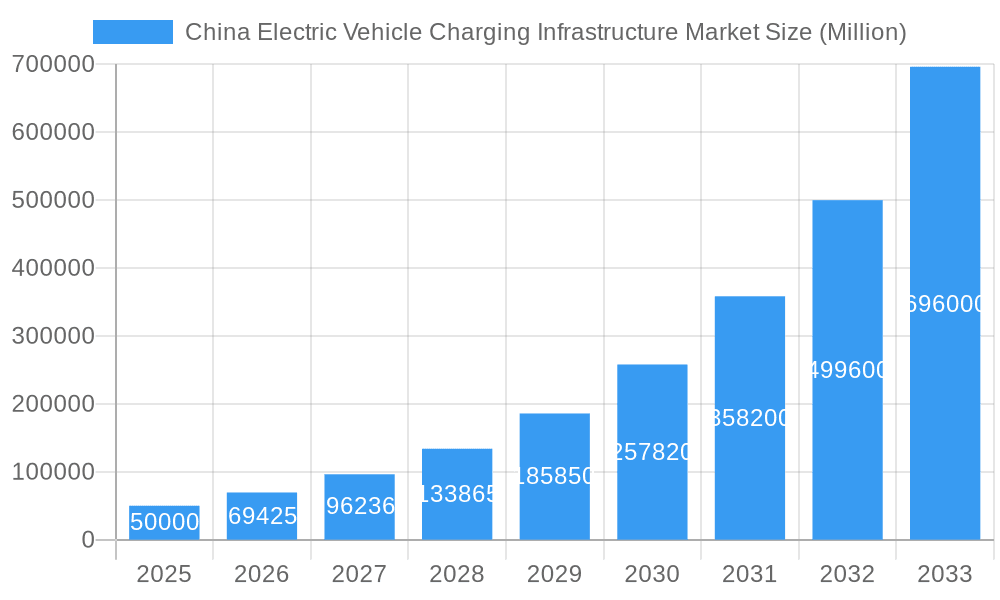

China Electric Vehicle Charging Infrastructure Market Market Size (In Billion)

Government policies are actively supporting the development of a comprehensive charging network through construction subsidies, streamlined permitting, and standardized charging protocols. However, challenges such as uneven distribution, grid limitations, and interoperability issues require attention to sustain market growth and ensure a successful transition to electric mobility. The competitive landscape features both domestic and international companies vying for market share via strategic partnerships, technological innovation, and network expansion. The integration of smart charging, energy storage, and advanced data analytics will be vital for grid stability and user experience.

China Electric Vehicle Charging Infrastructure Market Company Market Share

This report offers an in-depth analysis of the China Electric Vehicle Charging Infrastructure Market, providing critical insights for industry professionals, investors, and decision-makers. With a base year of 2025 and a forecast period of 2025-2033, the report details the market's current status and future trajectory. Key segments including AC and DC charging, passenger and commercial vehicle applications, and private and public infrastructure are thoroughly examined, leveraging extensive data analysis and expert insights for actionable intelligence in this dynamic market.

China Electric Vehicle Charging Infrastructure Market Market Structure & Innovation Trends

The Chinese electric vehicle (EV) charging infrastructure market is dynamic and evolving, presenting a complex interplay of established players and emerging competitors. While key players like State Grid Corporation of China, EV Power, and YKC maintain significant market share, creating a moderately concentrated structure, a large number of smaller companies contribute to intense competition. Market share constantly shifts based on governmental policies, technological breakthroughs, strategic alliances, and the ever-changing landscape of mergers and acquisitions (M&A). Recent significant M&A activity, such as PetroChina's acquisition of Potevio New Energy (valued at [Insert Updated Value] Million), highlights a clear trend towards consolidation, with larger entities seeking to expand their reach and solidify market dominance. This consolidation also influences innovation, pushing for improved efficiency and technological advancements.

- Market Concentration: Moderately concentrated, with a few dominant players and a large number of smaller, fiercely competitive companies.

- Innovation Drivers: Government subsidies and mandates remain crucial drivers, complemented by rapid technological advancements such as faster charging speeds (e.g., advancements in ultra-fast charging), improved battery technologies (enhancing charging efficiency and reducing charging times), and the proliferation of intelligent charging management systems. The increasing adoption of EVs themselves is a key factor fueling innovation.

- Regulatory Frameworks: Stringent and supportive government policies, encompassing mandates for charging infrastructure development across various regions and substantial incentives for EV adoption, are pivotal market drivers. These regulations are regularly updated to reflect technological advancements and market needs.

- Product Substitutes: While gasoline-powered vehicles remain the primary alternative, their market share is rapidly declining. Advancements in alternative energy sources, such as hydrogen fuel cell vehicles, represent a potential long-term competitive threat, though currently limited in market impact.

- End-User Demographics: While initially concentrated among urban and affluent consumers, the end-user base is rapidly expanding to include a wider demographic as EV adoption increases across various income levels and geographic regions.

- M&A Activities: The market is witnessing a wave of consolidation, with strategic acquisitions by larger players aiming to expand their geographic reach, enhance technological capabilities, and improve their market positioning. The PetroChina-Potevio deal exemplifies this trend.

China Electric Vehicle Charging Infrastructure Market Market Dynamics & Trends

The Chinese EV charging infrastructure market is experiencing explosive growth, driven by the government's ambitious electrification plans, rapidly increasing EV sales, and heightened consumer environmental awareness. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected at [Insert Updated CAGR]% (Source: [Insert Source]). This growth is underpinned by substantial government investments in charging infrastructure, decreasing EV prices making them more accessible, and a growing consumer preference for sustainable transportation. Technological advancements, including the development of high-power fast-charging technologies and the implementation of intelligent charging management systems capable of optimizing grid load and energy efficiency, are further accelerating market expansion. While market penetration is strong in major metropolitan areas, significant opportunities remain in less-developed regions requiring focused investment and infrastructure development.

Dominant Regions & Segments in China Electric Vehicle Charging Infrastructure Market

The coastal regions of China, including Beijing, Shanghai, Guangdong, and Jiangsu, currently dominate the EV charging infrastructure market. This dominance is primarily attributed to higher EV adoption rates, well-developed transportation networks, and substantial government investment in charging infrastructure.

Dominant Segments:

- By Charging Station Type: DC fast charging stations are experiencing faster growth than AC charging stations due to their shorter charging times, catering to the increasing demand for convenient charging solutions.

- By Vehicle Type: Passenger vehicles currently constitute the largest segment, but the commercial vehicle segment is expected to witness significant growth in the coming years, driven by increasing fleet electrification.

- By User Application: Public infrastructure is currently dominant, reflecting the government's focus on widespread EV adoption. However, the private infrastructure segment is also expected to grow substantially, driven by increased private EV ownership and the availability of home charging solutions.

Key Drivers of Regional/Segment Dominance:

- Economic Policies: Government subsidies and incentives for EV adoption and charging infrastructure development.

- Infrastructure Development: Existing transportation networks and urban planning facilitating the deployment of charging stations.

- Consumer Preferences: High demand for EVs in major cities and regions with better charging network accessibility.

China Electric Vehicle Charging Infrastructure Market Product Innovations

Significant advancements in charging technology are transforming the EV charging landscape. Faster charging speeds, smart charging management systems, and improved charging station reliability are key product innovations enhancing user experience and addressing range anxiety. The market is seeing increased integration of renewable energy sources into charging infrastructure, aligning with sustainability goals. These innovations are improving market fit by enhancing convenience, reducing charging times, and promoting the adoption of electric vehicles.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the China EV charging infrastructure market across various segments:

By Charging Station Type: The market is segmented into AC and DC charging stations, each analyzed for market size, growth projections, and competitive dynamics. DC fast charging is projected to experience higher growth.

By Vehicle Type: The market is segmented into passenger vehicles and commercial vehicles, providing insights into the specific needs and trends within each segment. Passenger vehicles currently dominate but commercial growth is substantial.

By User Application: The market is segmented into private and public infrastructure, detailing the distinct characteristics and growth potential of each segment. Public infrastructure holds a larger share now, but private is rapidly expanding.

Key Drivers of China Electric Vehicle Charging Infrastructure Market Growth

Several key factors are driving the growth of China's EV charging infrastructure market. These include:

- Government Support: Substantial government investment and supportive policies aimed at promoting EV adoption and infrastructure development.

- Technological Advancements: Innovations in battery technology, charging speed, and smart charging systems are enhancing the appeal and practicality of EVs.

- Rising EV Sales: The increasing sales of electric vehicles are fueling the demand for charging infrastructure.

- Environmental Concerns: Growing awareness of environmental issues is driving consumer preference for electric vehicles.

Challenges in the China Electric Vehicle Charging Infrastructure Market Sector

Despite the significant growth potential, the China EV charging infrastructure market faces several challenges:

- High Initial Investment Costs: The high upfront cost of installing charging infrastructure can be a barrier to entry for smaller players.

- Uneven Geographical Distribution: Charging infrastructure is concentrated in major cities, leaving less developed areas underserved.

- Interoperability Issues: Lack of standardization in charging technologies can hinder seamless charging across different networks.

- Grid Capacity Constraints: The increasing demand for electricity from EV charging could strain the existing power grid in certain areas.

Emerging Opportunities in China Electric Vehicle Charging Infrastructure Market

The burgeoning Chinese EV charging infrastructure market presents numerous lucrative opportunities for businesses and investors:

- Rural Electrification: A considerable untapped market exists in rural areas, presenting opportunities to expand charging infrastructure and facilitate broader EV adoption across the country.

- Integration with Smart Grids: Leveraging smart grid technologies to optimize energy distribution and enhance the efficiency of charging infrastructure is crucial for sustainable growth. This includes implementing advanced charging algorithms and integrating renewable energy sources.

- Vehicle-to-Grid (V2G) Technology: Harnessing the potential of EVs as distributed energy storage resources offers significant benefits, improving grid stability and potentially generating revenue streams for EV owners.

- Charging as a Service (CaaS): Developing flexible and innovative charging business models, such as subscription services, tiered pricing, and convenient payment options, is key to attracting a wider range of customers.

- Specialized Charging Solutions: Developing charging solutions tailored to specific vehicle types, such as heavy-duty trucks and buses, presents niche market opportunities.

Leading Players in the China Electric Vehicle Charging Infrastructure Market Market

- EV Power

- YKC

- State Grid Corporation of China

- Eichong

- TELD

- TGood

- Evking

- Wancheng Wanchong

- Starcharge

- SAIC Motor

- Potevio

- Southern Power Grid

- ShenZhen Carenergy Net

- Hooenergy

- Winland

Key Developments in China Electric Vehicle Charging Infrastructure Market Industry

- [Insert Most Recent Date]: [Insert Description of Recent Key Development]

- September 2023: PetroChina acquired Potevio New Energy Co Ltd., expanding its presence in the EV charging market. This acquisition significantly boosted PetroChina's network and technological capabilities.

- June 2023: The Chinese government announced plans to install 27,000 more EV charging stations along expressways, demonstrating its continued commitment to electrifying transportation.

- November 2022: Audi launched its premium charging network in major Chinese cities, focusing on providing high-quality charging experiences to its EV customers.

Future Outlook for China Electric Vehicle Charging Infrastructure Market Market

The future of the Chinese EV charging infrastructure market is bright, propelled by sustained government support through various policy initiatives, continuous technological innovation leading to improved charging infrastructure and increased affordability of EVs, and the expanding adoption of EVs by consumers. Successful companies will prioritize strategic partnerships, invest heavily in cutting-edge charging technologies, and strategically expand into underserved markets. The market will likely see further consolidation as larger, well-capitalized players continue to acquire smaller firms, streamlining the competitive landscape. A strong emphasis on sustainable and efficient charging solutions, integrating renewable energy sources, and optimized grid management will define the future trajectory of this crucial sector.

China Electric Vehicle Charging Infrastructure Market Segmentation

-

1. Charging Station Type

- 1.1. Alternating Current (AC) Charging Station

- 1.2. Direct Current (DC) Charging Station

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Vehicles

-

3. User Application

- 3.1. Private Infrastructure

- 3.2. Public Infrastructure

China Electric Vehicle Charging Infrastructure Market Segmentation By Geography

- 1. China

China Electric Vehicle Charging Infrastructure Market Regional Market Share

Geographic Coverage of China Electric Vehicle Charging Infrastructure Market

China Electric Vehicle Charging Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 48.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Government Initiatives to Support the Growth of Electric Vehicle Charging Infrastructure

- 3.3. Market Restrains

- 3.3.1. Supply Shortages in Building Electric Vehicle Charging Stations

- 3.4. Market Trends

- 3.4.1. Public Charging Stations are Expected to Gain Prominent Share in the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Electric Vehicle Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Charging Station Type

- 5.1.1. Alternating Current (AC) Charging Station

- 5.1.2. Direct Current (DC) Charging Station

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by User Application

- 5.3.1. Private Infrastructure

- 5.3.2. Public Infrastructure

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Charging Station Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EV Power

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 YKC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 State Grid Corporation of China

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eichong

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TELD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TGood

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Evking

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wancheng Wanchong

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Starcharge

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SAIC Motor

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Potevio

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Southern Power Grid

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 ShenZhen Carenergy Net

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Hooenergy

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Winland

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 EV Power

List of Figures

- Figure 1: China Electric Vehicle Charging Infrastructure Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Electric Vehicle Charging Infrastructure Market Share (%) by Company 2025

List of Tables

- Table 1: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by Charging Station Type 2020 & 2033

- Table 2: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by User Application 2020 & 2033

- Table 4: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by Charging Station Type 2020 & 2033

- Table 6: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by User Application 2020 & 2033

- Table 8: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Electric Vehicle Charging Infrastructure Market?

The projected CAGR is approximately 48.56%.

2. Which companies are prominent players in the China Electric Vehicle Charging Infrastructure Market?

Key companies in the market include EV Power, YKC, State Grid Corporation of China, Eichong, TELD, TGood, Evking, Wancheng Wanchong, Starcharge, SAIC Motor, Potevio, Southern Power Grid, ShenZhen Carenergy Net, Hooenergy, Winland.

3. What are the main segments of the China Electric Vehicle Charging Infrastructure Market?

The market segments include Charging Station Type, Vehicle Type, User Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Favorable Government Initiatives to Support the Growth of Electric Vehicle Charging Infrastructure.

6. What are the notable trends driving market growth?

Public Charging Stations are Expected to Gain Prominent Share in the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Supply Shortages in Building Electric Vehicle Charging Stations.

8. Can you provide examples of recent developments in the market?

September 2023: PetroChina, a leading oil and gas company based out of China, announced its acquisition of an electric vehicle (EV) charging firm, Potevio New Energy Co Ltd. It is to establish its brand presence in the electric vehicle charging market across China. It was estimated that by the end of 2021, Potevio operated 50,000 charging points in more than 50 Chinese cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Electric Vehicle Charging Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Electric Vehicle Charging Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Electric Vehicle Charging Infrastructure Market?

To stay informed about further developments, trends, and reports in the China Electric Vehicle Charging Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence