Key Insights

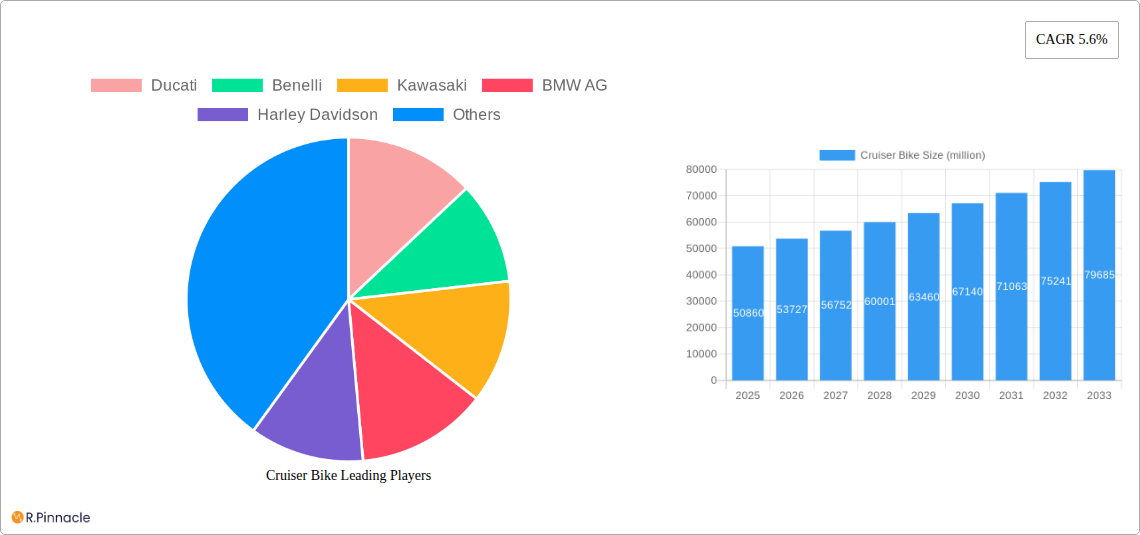

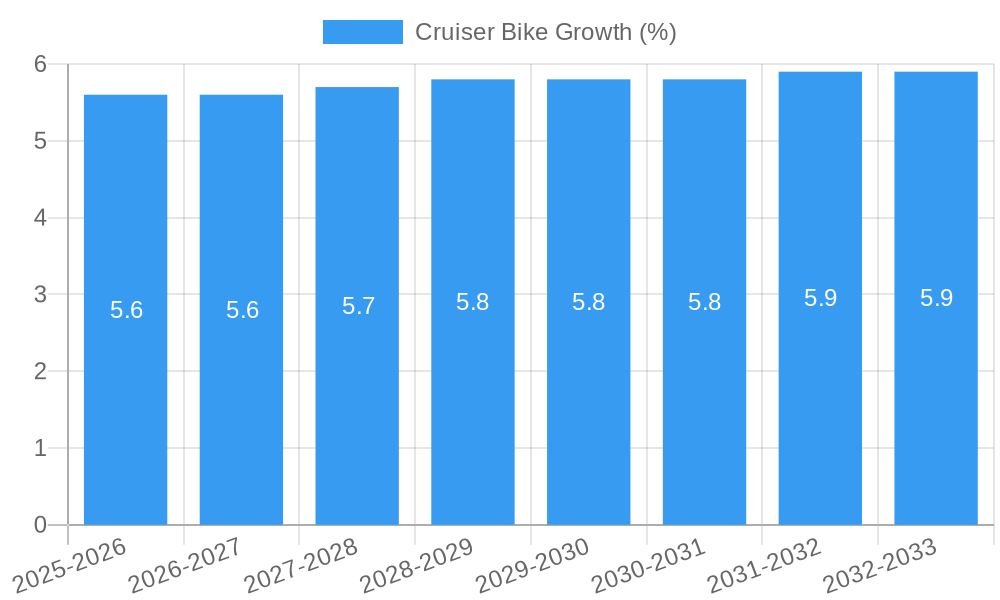

The global cruiser bike market is poised for significant expansion, currently valued at approximately USD 50,860 million. This robust market is projected to witness a compound annual growth rate (CAGR) of 5.6% from the historical period of 2019-2024, extending through the forecast period of 2025-2033. This steady upward trajectory is primarily fueled by evolving consumer preferences for leisure riding and a growing appreciation for the iconic design and powerful performance characteristic of cruiser motorcycles. The increasing disposable incomes in emerging economies, coupled with a burgeoning youth demographic attracted to the lifestyle associated with cruiser bikes, are also acting as substantial market drivers. Furthermore, advancements in technology, leading to enhanced fuel efficiency and improved rider comfort, are making these bikes more appealing to a broader audience. The market is segmented by application, with 'Racing' and 'Amateurish' activities contributing to demand, and by engine type, encompassing 'Less Than 500cc', '501cc to 1000cc', and 'More Than 1000cc' displacements, catering to diverse rider needs and experience levels.

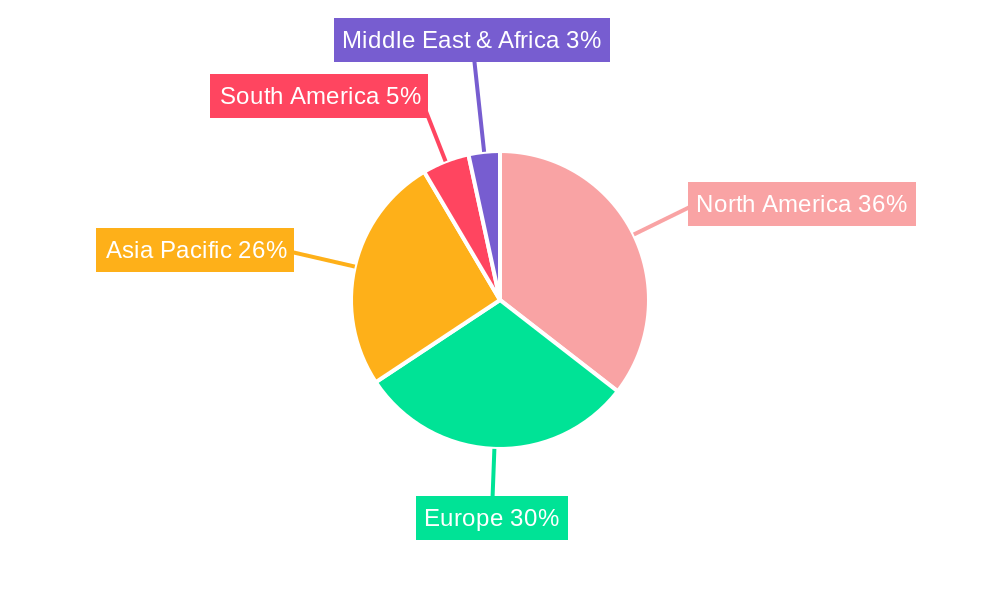

The competitive landscape is dominated by established global players such as Ducati, Kawasaki, BMW AG, Harley Davidson, and Honda Motor Company, alongside other significant brands like Benelli, Piaggio, and Triumph Motorcycle. These companies are actively engaged in product innovation, introducing new models with advanced features and catering to specific market niches to maintain and expand their market share. The market is also experiencing a shift in regional dynamics, with Asia Pacific, particularly China and India, emerging as high-growth regions due to rapid urbanization and a burgeoning middle class with increasing purchasing power. North America and Europe continue to be strong markets, driven by a mature enthusiast base and a strong culture of motorcycle ownership. While the market demonstrates strong growth potential, factors such as increasing raw material costs and stringent emission regulations could present moderate challenges, necessitating strategic adaptation by manufacturers to sustain this growth momentum and ensure continued market vitality.

Cruiser Bike Market Structure & Innovation Trends

The global cruiser bike market exhibits a moderately consolidated structure, with key players like Harley Davidson, Honda Motor Company, and BMW AG holding substantial market share. Innovation is primarily driven by advancements in engine technology, emphasis on rider comfort and ergonomics, and the integration of smart features. Regulatory frameworks, particularly those concerning emissions and safety standards, play a significant role in shaping product development and market entry for companies such as Ducati, Benelli, Kawasaki, Piaggio, and Triumph Motorcycle. While product substitutes exist in other two-wheeler segments, the distinct aesthetic and riding experience of cruiser bikes maintain their unique market position. End-user demographics are gradually broadening, attracting a wider age range and income bracket, influenced by evolving lifestyle trends and a desire for recreational freedom. Mergers and acquisition (M&A) activities, while not as prevalent as in other automotive sectors, have seen strategic partnerships and smaller acquisitions aimed at expanding product portfolios or technological capabilities, with estimated deal values in the hundreds of millions. The market share of top players is estimated to be over 70% collectively.

Cruiser Bike Market Dynamics & Trends

The cruiser bike market is poised for robust growth, driven by increasing disposable incomes and a growing appreciation for leisure and recreational activities worldwide. A projected Compound Annual Growth Rate (CAGR) of approximately 5% is expected throughout the forecast period of 2025–2033. Technological disruptions are a key trend, with manufacturers increasingly incorporating advanced materials for lighter yet stronger frames, improved suspension systems for enhanced ride quality, and sophisticated electronic rider aids for safety and performance. The demand for electric cruiser bikes is also on an upward trajectory, catering to environmentally conscious consumers and urban mobility needs. Consumer preferences are evolving, with a rising interest in customizable options, vintage-inspired designs, and bikes that offer a blend of classic styling with modern performance. This is particularly evident in the premium segments, where brands like Indian and Victory are leveraging their heritage to appeal to a discerning customer base. Competitive dynamics are characterized by intense product differentiation, with companies like Ducati and BMW AG focusing on performance-oriented cruisers, while Harley Davidson and Benelli emphasize their iconic branding and rider communities. Market penetration of cruiser bikes is expected to reach over 40% in developed economies by 2030. The integration of connected technologies, offering features like GPS navigation, music integration, and diagnostic alerts, is becoming a significant differentiator. Furthermore, the growing popularity of motorcycle touring and adventure riding is indirectly fueling the demand for comfortable and capable cruiser bikes.

Dominant Regions & Segments in Cruiser Bike

The North American region, particularly the United States, stands out as the dominant market for cruiser bikes. This dominance is underpinned by a deeply ingrained motorcycle culture, a favorable economic environment, and a robust infrastructure that supports motorcycle touring and recreational riding. Countries within this region exhibit strong economic policies that encourage discretionary spending on leisure vehicles, and the presence of iconic brands like Harley Davidson and Indian further solidifies its leadership.

Within the application segment, Amateurish use represents the largest market share, driven by recreational riders seeking leisure and personal mobility. The Racing segment, while niche, contributes to brand visibility and technological advancement for performance-oriented cruiser models.

Analyzing by engine type, the 501cc to 1000 cc segment commands a significant portion of the market. This range offers a balance of power, performance, and manageable handling, appealing to a broad spectrum of riders. The More Than 1000cc segment caters to enthusiasts who prioritize raw power, touring capabilities, and the iconic presence associated with larger displacement engines. The Less Than 500cc segment, while smaller, is experiencing growth due to its accessibility, lower cost of ownership, and appeal to newer riders or those seeking urban agility.

Key drivers for dominance in these regions and segments include:

- Established Motorcycle Culture: A long-standing tradition of motorcycle ownership and appreciation.

- Economic Prosperity: High disposable incomes and a willingness to invest in recreational assets.

- Supportive Infrastructure: Extensive road networks conducive to touring and leisure riding.

- Brand Loyalty and Heritage: Strong emotional connections with established cruiser brands.

- Availability of Financing: Accessible credit options facilitate purchases.

- Favorable Regulatory Environment: Less stringent regulations compared to some other regions.

Cruiser Bike Product Innovations

Product innovations in the cruiser bike market are increasingly focused on enhancing rider experience and sustainability. Manufacturers are leveraging advanced lightweight materials like aluminum alloys and carbon fiber to improve performance and fuel efficiency. Electrification is a significant trend, with companies developing electric powertrains that offer instant torque and a quieter ride, appealing to a new generation of environmentally conscious riders. Smart technology integration, including advanced infotainment systems, GPS navigation, and connectivity features, is becoming standard, offering a more convenient and connected riding experience. Competitive advantages are being gained through the development of customizable platforms, allowing riders to personalize their bikes extensively, and through the introduction of advanced safety features such as ABS and traction control systems.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global cruiser bike market. The market is segmented by application and engine type.

The Application segments include Racing, which focuses on high-performance cruiser models designed for competitive events, and Amateurish, encompassing recreational and lifestyle-oriented cruiser bikes.

The Type segments are categorized by engine capacity: Less Than 500cc, offering accessible and agile cruiser options; 501cc to 1000 cc, representing the versatile middleweight segment; and More Than 1000cc, catering to riders seeking ultimate power and touring prowess. Each segment is analyzed for its current market size, projected growth rates, and key competitive dynamics, with projections for the forecast period of 2025–2033.

Key Drivers of Cruiser Bike Growth

Several key factors are propelling the growth of the cruiser bike market. Technological advancements, particularly in engine efficiency and the development of electric powertrains, are attracting a wider audience. Economic growth in emerging markets is increasing disposable incomes, making cruiser bikes more accessible for leisure purchases. Furthermore, a growing cultural emphasis on freedom, individuality, and outdoor recreation fuels demand for these iconic two-wheelers. Regulatory support for eco-friendly technologies and a rising trend in motorcycle tourism are also significant growth accelerators.

Challenges in the Cruiser Bike Sector

Despite the positive growth trajectory, the cruiser bike sector faces several challenges. Stringent emission regulations in various regions can increase manufacturing costs and R&D expenses for internal combustion engine models. Supply chain disruptions, as witnessed in recent years, can impact production volumes and lead times. Intense competition from other two-wheeler segments, particularly electric scooters and adventure bikes, poses a threat. Furthermore, the perception of cruiser bikes as less practical for daily commuting in congested urban environments can limit their appeal in certain markets. The cost of premium models can also be a barrier for some consumers.

Emerging Opportunities in Cruiser Bike

Emerging opportunities in the cruiser bike market are abundant. The significant rise in electric cruiser bike development presents a substantial avenue for growth, aligning with global sustainability trends. Expansion into untapped emerging markets in Asia and South America offers considerable potential. The growing popularity of motorcycle-based travel and adventure tourism is creating demand for comfortable, long-distance capable cruiser models. Furthermore, innovations in connected technologies and personalized customization options are opening doors for unique product offerings and enhanced customer engagement.

Leading Players in the Cruiser Bike Market

- Harley Davidson

- Honda Motor Company

- BMW AG

- Kawasaki

- Ducati

- Benelli

- Indian

- Triumph Motorcycle

- Piaggio

- Victory

Key Developments in Cruiser Bike Industry

- 2023/10: Launch of new electric cruiser models by several manufacturers, focusing on extended range and performance.

- 2024/03: Increased investment in R&D for advanced battery technology to improve electric cruiser capabilities.

- 2024/09: Strategic partnerships formed to enhance the development of connected rider technologies for cruiser bikes.

- 2025/01: Introduction of new emission-compliant engines by key players to meet evolving regulatory standards.

- 2025/07: Expansion of customization options and aftermarket accessories to cater to individual rider preferences.

Future Outlook for Cruiser Bike Market

- 2023/10: Launch of new electric cruiser models by several manufacturers, focusing on extended range and performance.

- 2024/03: Increased investment in R&D for advanced battery technology to improve electric cruiser capabilities.

- 2024/09: Strategic partnerships formed to enhance the development of connected rider technologies for cruiser bikes.

- 2025/01: Introduction of new emission-compliant engines by key players to meet evolving regulatory standards.

- 2025/07: Expansion of customization options and aftermarket accessories to cater to individual rider preferences.

Future Outlook for Cruiser Bike Market

The future outlook for the cruiser bike market is exceptionally positive, driven by a confluence of technological innovation, evolving consumer lifestyles, and expanding global markets. The continued development and adoption of electric cruiser technology will be a significant growth accelerator, appealing to a new generation of riders and addressing environmental concerns. Furthermore, the increasing demand for experiential travel and recreational activities will sustain the appeal of traditional cruiser bikes. Strategic investments in emerging markets and a focus on delivering personalized riding experiences through advanced connectivity and customization will further solidify the market's growth trajectory, promising substantial opportunities for market leaders and innovative new entrants.

Cruiser Bike Segmentation

-

1. Application

- 1.1. Racing

- 1.2. Amateurish

-

2. Type

- 2.1. Less Than 500cc

- 2.2. 501cc to 1000 cc

- 2.3. More Than 1000cc

Cruiser Bike Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cruiser Bike REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cruiser Bike Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Racing

- 5.1.2. Amateurish

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Less Than 500cc

- 5.2.2. 501cc to 1000 cc

- 5.2.3. More Than 1000cc

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cruiser Bike Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Racing

- 6.1.2. Amateurish

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Less Than 500cc

- 6.2.2. 501cc to 1000 cc

- 6.2.3. More Than 1000cc

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cruiser Bike Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Racing

- 7.1.2. Amateurish

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Less Than 500cc

- 7.2.2. 501cc to 1000 cc

- 7.2.3. More Than 1000cc

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cruiser Bike Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Racing

- 8.1.2. Amateurish

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Less Than 500cc

- 8.2.2. 501cc to 1000 cc

- 8.2.3. More Than 1000cc

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cruiser Bike Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Racing

- 9.1.2. Amateurish

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Less Than 500cc

- 9.2.2. 501cc to 1000 cc

- 9.2.3. More Than 1000cc

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cruiser Bike Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Racing

- 10.1.2. Amateurish

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Less Than 500cc

- 10.2.2. 501cc to 1000 cc

- 10.2.3. More Than 1000cc

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ducati

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Benelli

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kawasaki

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BMW AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Harley Davidson

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Victory

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Indian

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Piaggio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Triumph Motorcycle

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Honda Motor Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ducati

List of Figures

- Figure 1: Global Cruiser Bike Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Cruiser Bike Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Cruiser Bike Revenue (million), by Application 2024 & 2032

- Figure 4: North America Cruiser Bike Volume (K), by Application 2024 & 2032

- Figure 5: North America Cruiser Bike Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Cruiser Bike Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Cruiser Bike Revenue (million), by Type 2024 & 2032

- Figure 8: North America Cruiser Bike Volume (K), by Type 2024 & 2032

- Figure 9: North America Cruiser Bike Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Cruiser Bike Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Cruiser Bike Revenue (million), by Country 2024 & 2032

- Figure 12: North America Cruiser Bike Volume (K), by Country 2024 & 2032

- Figure 13: North America Cruiser Bike Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Cruiser Bike Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Cruiser Bike Revenue (million), by Application 2024 & 2032

- Figure 16: South America Cruiser Bike Volume (K), by Application 2024 & 2032

- Figure 17: South America Cruiser Bike Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Cruiser Bike Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Cruiser Bike Revenue (million), by Type 2024 & 2032

- Figure 20: South America Cruiser Bike Volume (K), by Type 2024 & 2032

- Figure 21: South America Cruiser Bike Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Cruiser Bike Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Cruiser Bike Revenue (million), by Country 2024 & 2032

- Figure 24: South America Cruiser Bike Volume (K), by Country 2024 & 2032

- Figure 25: South America Cruiser Bike Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Cruiser Bike Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Cruiser Bike Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Cruiser Bike Volume (K), by Application 2024 & 2032

- Figure 29: Europe Cruiser Bike Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Cruiser Bike Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Cruiser Bike Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Cruiser Bike Volume (K), by Type 2024 & 2032

- Figure 33: Europe Cruiser Bike Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Cruiser Bike Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Cruiser Bike Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Cruiser Bike Volume (K), by Country 2024 & 2032

- Figure 37: Europe Cruiser Bike Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Cruiser Bike Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Cruiser Bike Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Cruiser Bike Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Cruiser Bike Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Cruiser Bike Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Cruiser Bike Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Cruiser Bike Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Cruiser Bike Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Cruiser Bike Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Cruiser Bike Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Cruiser Bike Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Cruiser Bike Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Cruiser Bike Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Cruiser Bike Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Cruiser Bike Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Cruiser Bike Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Cruiser Bike Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Cruiser Bike Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Cruiser Bike Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Cruiser Bike Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Cruiser Bike Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Cruiser Bike Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Cruiser Bike Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Cruiser Bike Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Cruiser Bike Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cruiser Bike Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cruiser Bike Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Cruiser Bike Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Cruiser Bike Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Cruiser Bike Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Cruiser Bike Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Cruiser Bike Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Cruiser Bike Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Cruiser Bike Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Cruiser Bike Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Cruiser Bike Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Cruiser Bike Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Cruiser Bike Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Cruiser Bike Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Cruiser Bike Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Cruiser Bike Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Cruiser Bike Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Cruiser Bike Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Cruiser Bike Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Cruiser Bike Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Cruiser Bike Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Cruiser Bike Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Cruiser Bike Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Cruiser Bike Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Cruiser Bike Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Cruiser Bike Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Cruiser Bike Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Cruiser Bike Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Cruiser Bike Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Cruiser Bike Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Cruiser Bike Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Cruiser Bike Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Cruiser Bike Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Cruiser Bike Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Cruiser Bike Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Cruiser Bike Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Cruiser Bike Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Cruiser Bike Volume K Forecast, by Country 2019 & 2032

- Table 81: China Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Cruiser Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Cruiser Bike Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cruiser Bike?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Cruiser Bike?

Key companies in the market include Ducati, Benelli, Kawasaki, BMW AG, Harley Davidson, Victory, Indian, Piaggio, Triumph Motorcycle, Honda Motor Company.

3. What are the main segments of the Cruiser Bike?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 50860 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cruiser Bike," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cruiser Bike report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cruiser Bike?

To stay informed about further developments, trends, and reports in the Cruiser Bike, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence