Key Insights

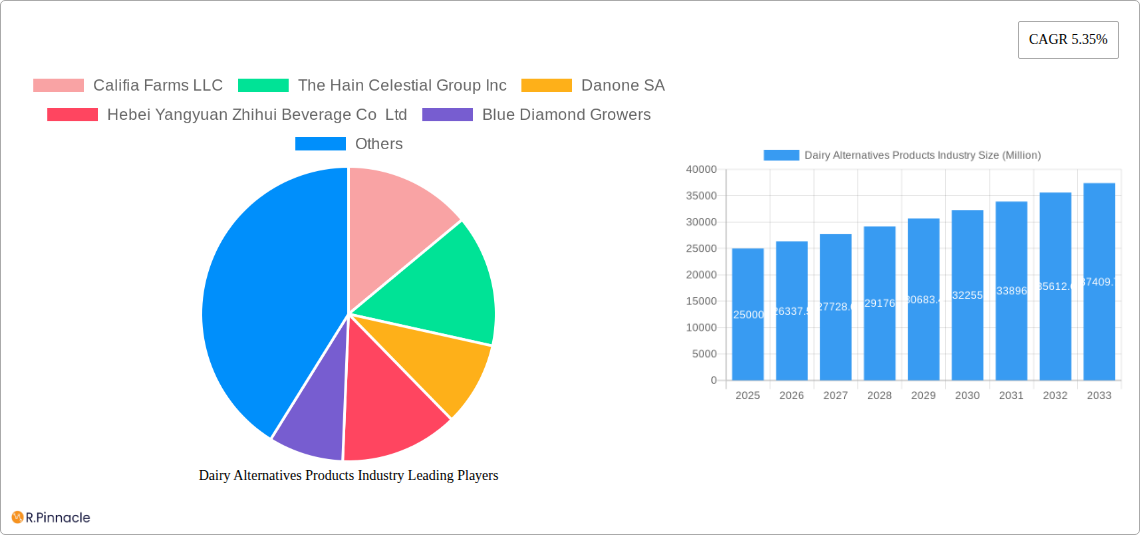

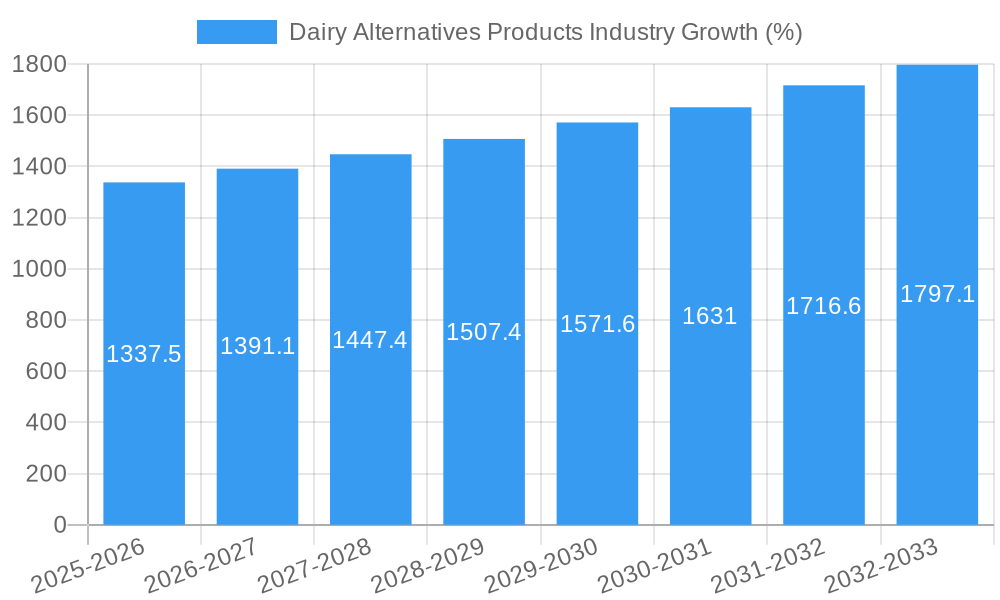

The dairy alternatives market, currently valued at approximately $XX million (estimated based on available CAGR and market trends), is experiencing robust growth, projected at a 5.35% CAGR from 2025 to 2033. This expansion is fueled by several key drivers. Increasing consumer awareness of the health benefits associated with plant-based diets, including reduced saturated fat and cholesterol, is a significant factor. Growing concerns about animal welfare and the environmental impact of dairy farming are also contributing to the shift towards plant-based alternatives. Furthermore, the rise in veganism and vegetarianism, coupled with increasing demand for lactose-free products, is further bolstering market growth. Key product segments within this market include non-dairy milk, non-dairy cheese, non-dairy ice cream, and non-dairy butter, each exhibiting unique growth trajectories based on consumer preferences and product innovation. The distribution channels are diverse, encompassing off-trade retailers, on-trade establishments (restaurants, cafes), and emerging channels like warehouse clubs and gas stations.

Competitive dynamics are shaping the market landscape. Established players like Califia Farms, Danone, and Oatly are aggressively expanding their product portfolios and distribution networks, while smaller, niche players are focusing on innovation and targeted marketing to carve out market share. Despite the substantial growth, the market faces certain restraints. Price sensitivity amongst consumers and the occasional perception of inferior taste or texture compared to traditional dairy products represent challenges. However, ongoing technological advancements in production processes are improving the taste, texture, and nutritional profile of dairy alternatives, addressing these concerns and driving further market penetration. The forecast period of 2025-2033 promises continued expansion, particularly in regions with high awareness of health and sustainability issues.

Dairy Alternatives Products Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Dairy Alternatives Products industry, offering actionable insights for industry professionals and investors. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive data analysis and market research to deliver a clear understanding of current market dynamics and future growth trajectories. The global market size is estimated at xx Million in 2025.

Dairy Alternatives Products Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the dairy alternatives industry. The market is characterized by a moderate level of concentration, with key players including Califia Farms LLC, The Hain Celestial Group Inc, Danone SA, and Oatly Group AB holding significant market share. However, the entry of numerous smaller players and private labels is increasing competition. Innovation is driven by consumer demand for healthier, more sustainable, and ethically sourced products. Regulatory frameworks, varying across regions, play a significant role in shaping product development and market access. The rise of plant-based diets and increasing awareness of environmental sustainability are major factors driving growth. Mergers and acquisitions (M&A) activity is substantial, with deal values reaching xx Million annually in recent years. Examples of significant M&A activity include Vitasoy's planned expansion through acquisition (October 2022).

- Market Concentration: Moderately concentrated, with top players holding approximately xx% market share.

- Innovation Drivers: Consumer demand for health, sustainability, and ethical sourcing.

- Regulatory Frameworks: Varying regulations impacting product development and market access.

- Product Substitutes: Traditional dairy products, other plant-based alternatives.

- End-user Demographics: Primarily health-conscious consumers, vegans, vegetarians, and those with lactose intolerance.

- M&A Activity: Significant activity, with deal values totaling xx Million annually (estimated).

Dairy Alternatives Products Industry Market Dynamics & Trends

The Dairy Alternatives market exhibits a robust growth trajectory fueled by several key factors. The increasing adoption of plant-based diets, driven by health consciousness and environmental concerns, is a primary driver. Technological advancements in product formulation are leading to improved taste, texture, and nutritional profiles of dairy alternatives, further enhancing consumer appeal. The market is witnessing a shift in consumer preferences towards products with clean labels and natural ingredients. Competitive dynamics are intense, with existing players investing heavily in R&D and marketing, and new entrants constantly emerging. The Compound Annual Growth Rate (CAGR) for the forecast period is projected at xx%, with market penetration steadily increasing. Pricing strategies and distribution channels play a crucial role in market share dynamics.

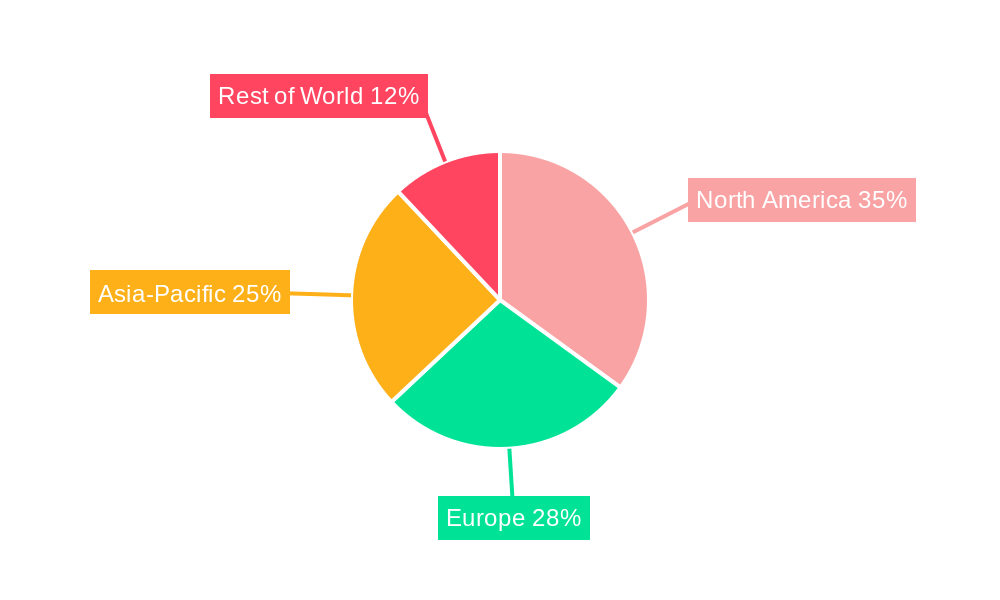

Dominant Regions & Segments in Dairy Alternatives Products Industry

North America and Europe currently dominate the dairy alternatives market, driven by high consumer awareness, robust regulatory frameworks supportive of plant-based food options, and a well-established distribution network. Within the market segments, Non-Dairy Milk holds the largest share, followed by Non-Dairy Cheese and Non-Dairy Ice Cream. The Off-Trade distribution channel commands the majority of market share, owing to the widespread availability in supermarkets and grocery stores.

- Leading Region: North America

- Key Drivers (North America): High consumer awareness of health and sustainability, strong distribution networks, and regulatory support.

- Leading Segment: Non-Dairy Milk

- Key Drivers (Non-Dairy Milk): Wide acceptance as a readily available dairy substitute, competitive pricing, and convenience.

- Dominant Distribution Channel: Off-Trade (supermarkets, grocery stores)

- Key Drivers (Off-Trade): Wide accessibility and established distribution networks.

Dairy Alternatives Products Industry Product Innovations

The dairy alternatives industry is characterized by continuous product innovation, focusing on improved taste, texture, and nutritional value. Companies are leveraging technological advancements to develop products that closely mimic the characteristics of traditional dairy products. This includes innovations in protein sources, emulsifiers, and processing techniques. Market success is dependent on delivering products that meet specific consumer demands for convenience, affordability, and health benefits. Recent product launches like Oatly's new oat yogurt range and Sheese's vegan cheese offerings highlight the industry's focus on expanding product variety and meeting evolving consumer preferences.

Report Scope & Segmentation Analysis

This report segments the dairy alternatives market across various categories and distribution channels.

- Distribution Channel: Off-Trade (supermarkets, grocery stores etc.) and On-Trade (restaurants, cafes etc.). The Off-Trade segment is projected to experience faster growth due to wider accessibility.

- Category: Non-Dairy Milk, Non-Dairy Cheese, Non-Dairy Ice Cream, and Non-Dairy Butter. Non-Dairy Milk currently holds the largest market share, while the others are experiencing strong growth.

Each segment is further analyzed based on its market size, growth rate, and competitive dynamics.

Key Drivers of Dairy Alternatives Products Industry Growth

Several factors fuel the growth of the dairy alternatives industry. Rising health consciousness among consumers is driving demand for plant-based alternatives to traditional dairy. Growing awareness of environmental sustainability and the ethical concerns associated with animal agriculture are also significant contributors. Government regulations and initiatives promoting plant-based foods further contribute to market growth. Finally, continuous product innovation, focusing on improved taste and nutritional profile, enhances consumer appeal.

Challenges in the Dairy Alternatives Products Industry Sector

Despite its significant growth, the dairy alternatives industry faces challenges. Maintaining consistent product quality and addressing issues related to taste and texture remain ongoing concerns. Fluctuations in raw material prices and supply chain disruptions can impact production costs and profitability. Intense competition from established dairy companies and new entrants adds to the pressure. Regulatory hurdles and varying standards across regions also pose difficulties for market expansion. Finally, consumer perception and price sensitivity play a key role.

Emerging Opportunities in Dairy Alternatives Products Industry

Significant opportunities exist for growth in the dairy alternatives sector. Expanding into new geographic markets, particularly in developing countries with growing middle classes, presents substantial potential. Developing innovative products tailored to specific consumer preferences and dietary needs, such as fortified options, presents significant opportunities. Focus on sustainability and ethical sourcing can attract increasingly environmentally conscious consumers. Leveraging technological advancements, such as precision fermentation, can create new product opportunities.

Leading Players in the Dairy Alternatives Products Industry Market

- Califia Farms LLC

- The Hain Celestial Group Inc

- Danone SA

- Hebei Yangyuan Zhihui Beverage Co Ltd

- Blue Diamond Growers

- Oatly Group AB

- Otsuka Holdings Co Ltd

- Vitasoy International Holdings Lt

- VBites Foods Ltd

- Saputo Inc

- Sahmyook Foods

Key Developments in Dairy Alternatives Products Industry Industry

- October 2022: Sheese launched two new vegan cheese products in the United Kingdom, Sheese Italiano and Sheese Mighty Melter, expanding its product portfolio and catering to the growing demand for diverse vegan cheese options.

- October 2022: Vitasoy International Holdings Ltd planned to expand its dairy alternative business by acquiring shares from its joint venture Bega Cheese subsidiary National Food Holdings Ltd., indicating a strategic move to consolidate its market position and increase its production capacity.

- November 2022: Oatly Group AB announced a new range of oat-based yogurt in four flavors (strawberry, blueberry, plain, and Greek style), demonstrating its commitment to innovation and expansion within the growing plant-based yogurt market.

Future Outlook for Dairy Alternatives Products Industry Market

The future of the dairy alternatives industry appears promising, with continued strong growth driven by evolving consumer preferences, technological advancements, and increasing awareness of environmental sustainability. Strategic opportunities include expansion into new markets, development of innovative product formats, and focus on sustainability throughout the supply chain. The market is expected to continue its robust growth trajectory, driven by health consciousness, ethical considerations, and product innovation.

Dairy Alternatives Products Industry Segmentation

-

1. Category

- 1.1. Non-Dairy Butter

- 1.2. Non-Dairy Cheese

- 1.3. Non-Dairy Ice Cream

-

1.4. Non-Dairy Milk

-

1.4.1. By Product Type

- 1.4.1.1. Almond Milk

- 1.4.1.2. Cashew Milk

- 1.4.1.3. Coconut Milk

- 1.4.1.4. Hazelnut Milk

- 1.4.1.5. Hemp Milk

- 1.4.1.6. Oat Milk

- 1.4.1.7. Soy Milk

-

1.4.1. By Product Type

- 1.5. Non-Dairy Yogurt

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Dairy Alternatives Products Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dairy Alternatives Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dairy Alternatives Products Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Non-Dairy Butter

- 5.1.2. Non-Dairy Cheese

- 5.1.3. Non-Dairy Ice Cream

- 5.1.4. Non-Dairy Milk

- 5.1.4.1. By Product Type

- 5.1.4.1.1. Almond Milk

- 5.1.4.1.2. Cashew Milk

- 5.1.4.1.3. Coconut Milk

- 5.1.4.1.4. Hazelnut Milk

- 5.1.4.1.5. Hemp Milk

- 5.1.4.1.6. Oat Milk

- 5.1.4.1.7. Soy Milk

- 5.1.4.1. By Product Type

- 5.1.5. Non-Dairy Yogurt

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. North America Dairy Alternatives Products Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Non-Dairy Butter

- 6.1.2. Non-Dairy Cheese

- 6.1.3. Non-Dairy Ice Cream

- 6.1.4. Non-Dairy Milk

- 6.1.4.1. By Product Type

- 6.1.4.1.1. Almond Milk

- 6.1.4.1.2. Cashew Milk

- 6.1.4.1.3. Coconut Milk

- 6.1.4.1.4. Hazelnut Milk

- 6.1.4.1.5. Hemp Milk

- 6.1.4.1.6. Oat Milk

- 6.1.4.1.7. Soy Milk

- 6.1.4.1. By Product Type

- 6.1.5. Non-Dairy Yogurt

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Off-Trade

- 6.2.1.1. Convenience Stores

- 6.2.1.2. Online Retail

- 6.2.1.3. Specialist Retailers

- 6.2.1.4. Supermarkets and Hypermarkets

- 6.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 6.2.2. On-Trade

- 6.2.1. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. South America Dairy Alternatives Products Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Non-Dairy Butter

- 7.1.2. Non-Dairy Cheese

- 7.1.3. Non-Dairy Ice Cream

- 7.1.4. Non-Dairy Milk

- 7.1.4.1. By Product Type

- 7.1.4.1.1. Almond Milk

- 7.1.4.1.2. Cashew Milk

- 7.1.4.1.3. Coconut Milk

- 7.1.4.1.4. Hazelnut Milk

- 7.1.4.1.5. Hemp Milk

- 7.1.4.1.6. Oat Milk

- 7.1.4.1.7. Soy Milk

- 7.1.4.1. By Product Type

- 7.1.5. Non-Dairy Yogurt

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Off-Trade

- 7.2.1.1. Convenience Stores

- 7.2.1.2. Online Retail

- 7.2.1.3. Specialist Retailers

- 7.2.1.4. Supermarkets and Hypermarkets

- 7.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 7.2.2. On-Trade

- 7.2.1. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Europe Dairy Alternatives Products Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Non-Dairy Butter

- 8.1.2. Non-Dairy Cheese

- 8.1.3. Non-Dairy Ice Cream

- 8.1.4. Non-Dairy Milk

- 8.1.4.1. By Product Type

- 8.1.4.1.1. Almond Milk

- 8.1.4.1.2. Cashew Milk

- 8.1.4.1.3. Coconut Milk

- 8.1.4.1.4. Hazelnut Milk

- 8.1.4.1.5. Hemp Milk

- 8.1.4.1.6. Oat Milk

- 8.1.4.1.7. Soy Milk

- 8.1.4.1. By Product Type

- 8.1.5. Non-Dairy Yogurt

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Off-Trade

- 8.2.1.1. Convenience Stores

- 8.2.1.2. Online Retail

- 8.2.1.3. Specialist Retailers

- 8.2.1.4. Supermarkets and Hypermarkets

- 8.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 8.2.2. On-Trade

- 8.2.1. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. Middle East & Africa Dairy Alternatives Products Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Category

- 9.1.1. Non-Dairy Butter

- 9.1.2. Non-Dairy Cheese

- 9.1.3. Non-Dairy Ice Cream

- 9.1.4. Non-Dairy Milk

- 9.1.4.1. By Product Type

- 9.1.4.1.1. Almond Milk

- 9.1.4.1.2. Cashew Milk

- 9.1.4.1.3. Coconut Milk

- 9.1.4.1.4. Hazelnut Milk

- 9.1.4.1.5. Hemp Milk

- 9.1.4.1.6. Oat Milk

- 9.1.4.1.7. Soy Milk

- 9.1.4.1. By Product Type

- 9.1.5. Non-Dairy Yogurt

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Off-Trade

- 9.2.1.1. Convenience Stores

- 9.2.1.2. Online Retail

- 9.2.1.3. Specialist Retailers

- 9.2.1.4. Supermarkets and Hypermarkets

- 9.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 9.2.2. On-Trade

- 9.2.1. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Category

- 10. Asia Pacific Dairy Alternatives Products Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Category

- 10.1.1. Non-Dairy Butter

- 10.1.2. Non-Dairy Cheese

- 10.1.3. Non-Dairy Ice Cream

- 10.1.4. Non-Dairy Milk

- 10.1.4.1. By Product Type

- 10.1.4.1.1. Almond Milk

- 10.1.4.1.2. Cashew Milk

- 10.1.4.1.3. Coconut Milk

- 10.1.4.1.4. Hazelnut Milk

- 10.1.4.1.5. Hemp Milk

- 10.1.4.1.6. Oat Milk

- 10.1.4.1.7. Soy Milk

- 10.1.4.1. By Product Type

- 10.1.5. Non-Dairy Yogurt

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Off-Trade

- 10.2.1.1. Convenience Stores

- 10.2.1.2. Online Retail

- 10.2.1.3. Specialist Retailers

- 10.2.1.4. Supermarkets and Hypermarkets

- 10.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 10.2.2. On-Trade

- 10.2.1. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Category

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Califia Farms LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Hain Celestial Group Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Danone SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hebei Yangyuan Zhihui Beverage Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Blue Diamond Growers

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Oatly Group AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Otsuka Holdings Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vitasoy International Holdings Lt

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 VBites Foods Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Saputo Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sahmyook Foods

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Califia Farms LLC

List of Figures

- Figure 1: Global Dairy Alternatives Products Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Dairy Alternatives Products Industry Revenue (Million), by Category 2024 & 2032

- Figure 3: North America Dairy Alternatives Products Industry Revenue Share (%), by Category 2024 & 2032

- Figure 4: North America Dairy Alternatives Products Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 5: North America Dairy Alternatives Products Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 6: North America Dairy Alternatives Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Dairy Alternatives Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Dairy Alternatives Products Industry Revenue (Million), by Category 2024 & 2032

- Figure 9: South America Dairy Alternatives Products Industry Revenue Share (%), by Category 2024 & 2032

- Figure 10: South America Dairy Alternatives Products Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 11: South America Dairy Alternatives Products Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 12: South America Dairy Alternatives Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Dairy Alternatives Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Dairy Alternatives Products Industry Revenue (Million), by Category 2024 & 2032

- Figure 15: Europe Dairy Alternatives Products Industry Revenue Share (%), by Category 2024 & 2032

- Figure 16: Europe Dairy Alternatives Products Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: Europe Dairy Alternatives Products Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: Europe Dairy Alternatives Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Dairy Alternatives Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Dairy Alternatives Products Industry Revenue (Million), by Category 2024 & 2032

- Figure 21: Middle East & Africa Dairy Alternatives Products Industry Revenue Share (%), by Category 2024 & 2032

- Figure 22: Middle East & Africa Dairy Alternatives Products Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: Middle East & Africa Dairy Alternatives Products Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: Middle East & Africa Dairy Alternatives Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Dairy Alternatives Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Dairy Alternatives Products Industry Revenue (Million), by Category 2024 & 2032

- Figure 27: Asia Pacific Dairy Alternatives Products Industry Revenue Share (%), by Category 2024 & 2032

- Figure 28: Asia Pacific Dairy Alternatives Products Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Asia Pacific Dairy Alternatives Products Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Asia Pacific Dairy Alternatives Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Dairy Alternatives Products Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 3: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 6: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 12: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 18: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 30: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 31: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 39: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Global Dairy Alternatives Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Dairy Alternatives Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dairy Alternatives Products Industry?

The projected CAGR is approximately 5.35%.

2. Which companies are prominent players in the Dairy Alternatives Products Industry?

Key companies in the market include Califia Farms LLC, The Hain Celestial Group Inc, Danone SA, Hebei Yangyuan Zhihui Beverage Co Ltd, Blue Diamond Growers, Oatly Group AB, Otsuka Holdings Co Ltd, Vitasoy International Holdings Lt, VBites Foods Ltd, Saputo Inc, Sahmyook Foods.

3. What are the main segments of the Dairy Alternatives Products Industry?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

November 2022: Oatly Group AB announced that it would release a new range of oat-based yogurt. The new range comes in four flavors: strawberry, blueberry, plain, and Greek style.October 2022: Sheese launched two new vegan cheese products in the United Kingdom, namely, Sheese Italiano and Sheese Mighty Melter.October 2022: Vitasoy International Holdings Ltd planned to expand its dairy alternative business by acquiring the shares from its joint venture Bega Cheese subsidiary National Food Holdings Ltd.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dairy Alternatives Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dairy Alternatives Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dairy Alternatives Products Industry?

To stay informed about further developments, trends, and reports in the Dairy Alternatives Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence