Key Insights

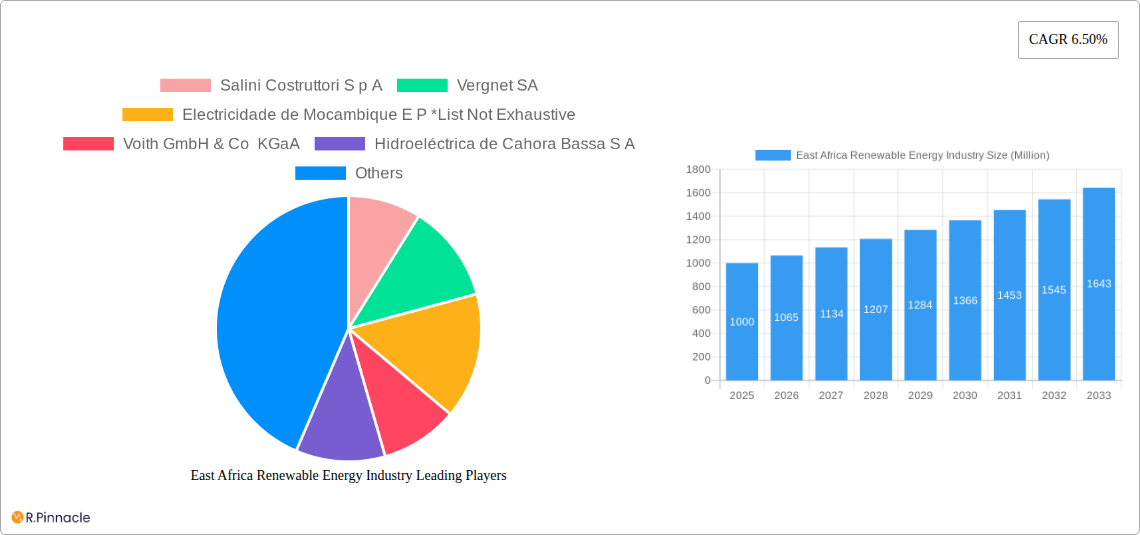

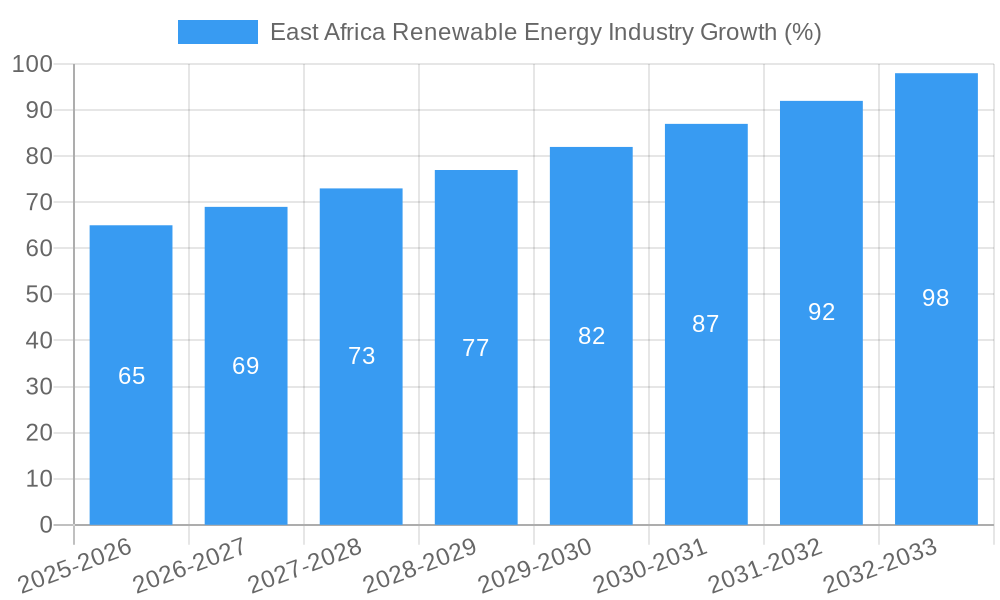

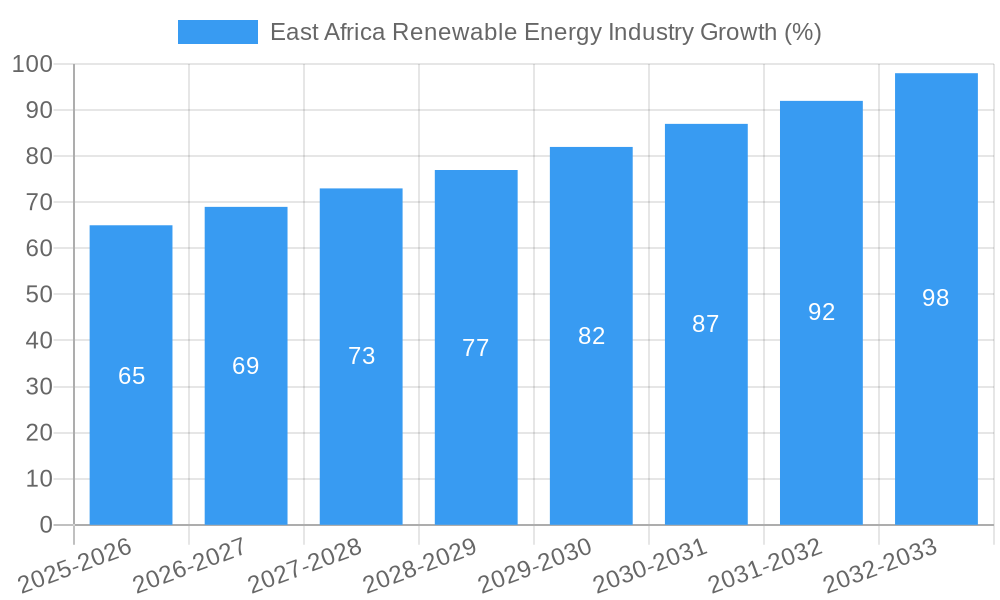

The East African renewable energy market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the region's increasing energy demand, coupled with unreliable grid infrastructure, creates a compelling need for sustainable and decentralized power solutions. Secondly, supportive government policies and initiatives aimed at promoting renewable energy adoption, including feed-in tariffs and tax incentives, are accelerating market development. Thirdly, decreasing technology costs, particularly for solar photovoltaic (PV) systems and wind turbines, are making renewable energy increasingly cost-competitive with traditional fossil fuels. Finally, a growing awareness of climate change and the need for environmental sustainability is driving both public and private investment in renewable energy projects. Key market segments include hydropower, solar, wind, and other emerging technologies like geothermal and biomass. While the hydropower segment currently holds a significant share, the rapid growth in solar and wind energy is expected to reshape the market landscape in the coming years. Challenges remain, including the need for improved grid infrastructure to integrate intermittent renewable energy sources, securing adequate financing for large-scale projects, and addressing regulatory hurdles in certain countries. Despite these obstacles, the long-term outlook for the East African renewable energy market remains positive, driven by strong demand, supportive policies, and technological advancements.

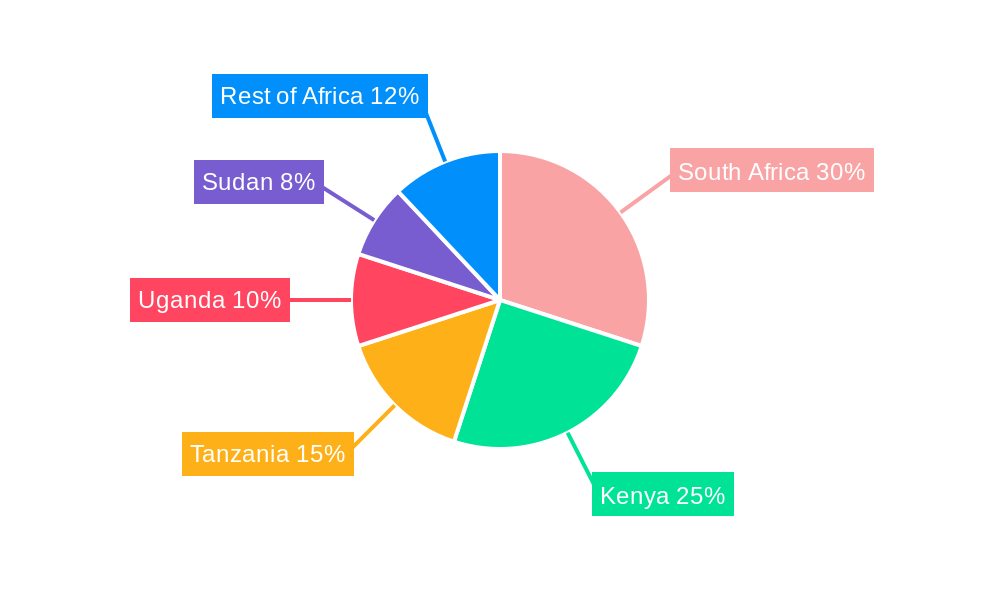

The key players in this burgeoning market include both international companies like Salini Costruttori S.p.A., Vergnet SA, and Voith GmbH & Co. KGaA, alongside regional entities such as Hidroeléctrica de Cahora Bassa S.A. and the Kenya Electricity Generating Company PLC. These companies are actively involved in developing and deploying renewable energy projects across various countries in East Africa, including South Africa, Sudan, Uganda, Tanzania, and Kenya. The diverse range of players reflects both the growing investment interest and the varied technological needs within the region. The competitive landscape is dynamic, with both established players and emerging smaller companies vying for market share. Strategic partnerships and mergers and acquisitions are anticipated to further consolidate the market and accelerate the deployment of renewable energy solutions across East Africa. The continued expansion of the renewable energy sector is critical to achieving sustainable economic growth and improving energy access for the region's growing population.

East Africa Renewable Energy Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the East Africa renewable energy market, covering the period 2019-2033, with a focus on the crucial year 2025. It offers invaluable insights for industry professionals, investors, and policymakers seeking to understand the market's dynamics, opportunities, and challenges. Discover key trends, leading players, and future projections for hydropower, solar, wind, and other renewable energy segments.

East Africa Renewable Energy Industry Market Structure & Innovation Trends

This section analyzes the East African renewable energy market's structure, highlighting key trends and dynamics. The market exhibits a moderately concentrated structure with several major players like Salini Costruttori S p A, Vergnet SA, Voith GmbH & Co KGaA, and Kenya Electricity Generating Company PLC holding significant market share. However, numerous smaller companies and new entrants are also contributing to the market's growth.

- Market Concentration: The market share held by the top 5 players is estimated at xx%.

- Innovation Drivers: Government policies promoting renewable energy, increasing energy demand, and falling technology costs are key innovation drivers.

- Regulatory Frameworks: While regulations vary across East African nations, a general trend towards supportive policies for renewable energy development is observed.

- Product Substitutes: Fossil fuels remain a significant competitor, but their declining cost-competitiveness and environmental concerns are boosting renewable energy adoption.

- End-User Demographics: The end-users are diverse, including residential, commercial, and industrial sectors, with governments playing a crucial role in large-scale projects.

- M&A Activities: The past five years have witnessed xx M&A deals valued at approximately $xx Million, reflecting increasing consolidation and investment in the sector. These deals often involve partnerships between international companies and local entities.

East Africa Renewable Energy Industry Market Dynamics & Trends

This section explores the market's dynamic environment and presents a detailed overview of current and emerging trends. The East African renewable energy market is experiencing robust growth, fueled by several factors. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected to be xx%. Market penetration of renewable energy in the total energy mix is expected to reach xx% by 2033, up from xx% in 2025. Technological advancements, such as improvements in solar panel efficiency and wind turbine designs, are lowering costs and enhancing the competitiveness of renewable energy. Consumer preference is shifting towards cleaner energy sources, driven by environmental awareness and health concerns. Intense competition among various players is stimulating innovation and driving down prices.

Dominant Regions & Segments in East Africa Renewable Energy Industry

This section identifies the dominant regions and segments within the East African renewable energy market. Kenya and Tanzania currently lead in renewable energy capacity, with significant investments in both solar and geothermal projects.

Key Drivers:

- Economic Policies: Government incentives, subsidies, and feed-in tariffs are crucial for attracting investment.

- Infrastructure: Improvements in transmission and distribution networks are essential to support the expansion of renewable energy projects.

- Resource Availability: Abundant solar and hydropower resources provide a natural advantage for several East African countries.

Dominance Analysis:

Hydropower is currently the dominant segment, followed by solar, wind, and other renewable sources like geothermal and biomass. However, the solar segment is expected to witness the highest growth rate over the forecast period. The growth in solar energy is driven by the decreasing cost of solar panels and increasing government initiatives for off-grid electrification.

East Africa Renewable Energy Industry Product Innovations

Recent innovations focus on enhancing efficiency, lowering costs, and improving the reliability of renewable energy technologies. This includes advancements in solar panel technology, development of more efficient wind turbines, and improved energy storage solutions. These innovations are driving market penetration and making renewable energy more competitive with traditional energy sources.

Report Scope & Segmentation Analysis

This report segments the East African renewable energy market by energy type:

- Hydropower: This segment accounts for xx% of the total market in 2025, with a projected market size of $xx Million by 2033. Growth is expected to be driven by ongoing investments in large-scale hydropower projects and the development of smaller, decentralized hydropower plants.

- Solar: This segment is experiencing rapid growth, with a projected market size of $xx Million by 2033, owing to decreasing costs and increased government support for solar power initiatives.

- Wind: This segment has relatively lower market share compared to solar and hydropower, but has the potential for significant growth with further investment in wind farms in suitable locations.

- Others (Geothermal, Biomass): This segment comprises geothermal and biomass, with a combined market share of xx% in 2025 and a projected $xx Million market size by 2033.

Key Drivers of East Africa Renewable Energy Industry Growth

Several factors drive the growth of the East African renewable energy market. These include:

- Government support: Many East African governments have implemented policies to promote renewable energy adoption, such as feed-in tariffs and tax incentives.

- Decreasing technology costs: The cost of renewable energy technologies, such as solar panels and wind turbines, has decreased significantly in recent years, making them more affordable and competitive.

- Increasing energy demand: The rapidly growing population and economy of East Africa are driving up energy demand, creating opportunities for renewable energy sources.

- Environmental concerns: The growing awareness of climate change and its impact is pushing governments and businesses to adopt cleaner energy sources.

Challenges in the East Africa Renewable Energy Industry Sector

Despite its potential, the East African renewable energy sector faces challenges:

- Infrastructure limitations: The lack of adequate transmission and distribution infrastructure hinders the efficient integration of renewable energy into the grid.

- Financing constraints: Securing sufficient funding for large-scale renewable energy projects remains a challenge.

- Regulatory uncertainty: Inconsistent regulatory frameworks across different countries can create uncertainty for investors.

- Technical expertise: A shortage of skilled labor and technical expertise is impacting the sector's growth.

Emerging Opportunities in East Africa Renewable Energy Industry

Despite the challenges, significant opportunities exist for growth within the East African renewable energy sector:

- Mini-grid development: The expansion of mini-grids to provide electricity to remote and underserved communities offers significant opportunities.

- Energy storage solutions: Investments in battery storage technologies are needed to address the intermittency of renewable energy sources.

- Public-private partnerships: Collaboration between governments and private sector players can unlock significant investments.

- Regional energy trade: Opportunities exist for the cross-border trade of renewable energy within East Africa.

Leading Players in the East Africa Renewable Energy Industry Market

- Salini Costruttori S p A

- Vergnet SA

- Electricidade de Mocambique E P

- Voith GmbH & Co KGaA

- Hidroeléctrica de Cahora Bassa S A

- Eleqtra Inc

- REDAVIA GmbH

- Kenya Electricity Generating Company PLC

Key Developments in East Africa Renewable Energy Industry Industry

- August 2022: Masdar signed an agreement with TANESCO to develop a 2 GW renewable energy capacity in Tanzania. This deal, split into two phases of 600 MW and 1400 MW, represents a significant boost for the country's renewable energy sector.

- May 2022: Rwanda signed a deal with Goldsol II to construct a 10 MW solar power plant in the Kayonza District at a cost of USD 30 Million. This project demonstrates the growing interest in solar energy investments in Rwanda.

Future Outlook for East Africa Renewable Energy Market

The East African renewable energy market is poised for substantial growth over the next decade. Continued government support, decreasing technology costs, and increasing energy demand will drive the sector's expansion. Strategic partnerships between international companies and local entities are also crucial for unlocking the sector's full potential. The increasing adoption of distributed generation and energy storage solutions will further enhance the reliability and accessibility of renewable energy across the region.

East Africa Renewable Energy Industry Segmentation

-

1. Type

- 1.1. Hydropower

- 1.2. Solar

- 1.3. Wind

- 1.4. Others

-

2. Geography

- 2.1. Tanzania

- 2.2. Uganda

- 2.3. Kenya

- 2.4. Rest of East Africa

East Africa Renewable Energy Industry Segmentation By Geography

- 1. Tanzania

- 2. Uganda

- 3. Kenya

- 4. Rest of East Africa

East Africa Renewable Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Emphasis on Renewable Energy Integration4.; Significant Hydropower Potential

- 3.3. Market Restrains

- 3.3.1. 4.; Competition From Other Energy Storage Technologies

- 3.4. Market Trends

- 3.4.1. Hydropower Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hydropower

- 5.1.2. Solar

- 5.1.3. Wind

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Tanzania

- 5.2.2. Uganda

- 5.2.3. Kenya

- 5.2.4. Rest of East Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Tanzania

- 5.3.2. Uganda

- 5.3.3. Kenya

- 5.3.4. Rest of East Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Tanzania East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hydropower

- 6.1.2. Solar

- 6.1.3. Wind

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Tanzania

- 6.2.2. Uganda

- 6.2.3. Kenya

- 6.2.4. Rest of East Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Uganda East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hydropower

- 7.1.2. Solar

- 7.1.3. Wind

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Tanzania

- 7.2.2. Uganda

- 7.2.3. Kenya

- 7.2.4. Rest of East Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Kenya East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hydropower

- 8.1.2. Solar

- 8.1.3. Wind

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Tanzania

- 8.2.2. Uganda

- 8.2.3. Kenya

- 8.2.4. Rest of East Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of East Africa East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hydropower

- 9.1.2. Solar

- 9.1.3. Wind

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Tanzania

- 9.2.2. Uganda

- 9.2.3. Kenya

- 9.2.4. Rest of East Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Africa East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sudan East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 12. Uganda East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 14. Kenya East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa East Africa Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Salini Costruttori S p A

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Vergnet SA

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Electricidade de Mocambique E P *List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Voith GmbH & Co KGaA

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Hidroeléctrica de Cahora Bassa S A

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Eleqtra Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 REDAVIA GmbH

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Kenya Electricity Generating Company PLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Salini Costruttori S p A

List of Figures

- Figure 1: East Africa Renewable Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: East Africa Renewable Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: East Africa Renewable Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: East Africa Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Type 2019 & 2032

- Table 5: East Africa Renewable Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 7: East Africa Renewable Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 9: East Africa Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 11: South Africa East Africa Renewable Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa East Africa Renewable Energy Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Sudan East Africa Renewable Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan East Africa Renewable Energy Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Uganda East Africa Renewable Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda East Africa Renewable Energy Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Tanzania East Africa Renewable Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania East Africa Renewable Energy Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Kenya East Africa Renewable Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya East Africa Renewable Energy Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa East Africa Renewable Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa East Africa Renewable Energy Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 23: East Africa Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Type 2019 & 2032

- Table 25: East Africa Renewable Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 27: East Africa Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 29: East Africa Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Type 2019 & 2032

- Table 31: East Africa Renewable Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 33: East Africa Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 35: East Africa Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Type 2019 & 2032

- Table 37: East Africa Renewable Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 39: East Africa Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 41: East Africa Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 42: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Type 2019 & 2032

- Table 43: East Africa Renewable Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 45: East Africa Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: East Africa Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the East Africa Renewable Energy Industry?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the East Africa Renewable Energy Industry?

Key companies in the market include Salini Costruttori S p A, Vergnet SA, Electricidade de Mocambique E P *List Not Exhaustive, Voith GmbH & Co KGaA, Hidroeléctrica de Cahora Bassa S A, Eleqtra Inc, REDAVIA GmbH, Kenya Electricity Generating Company PLC.

3. What are the main segments of the East Africa Renewable Energy Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Emphasis on Renewable Energy Integration4.; Significant Hydropower Potential.

6. What are the notable trends driving market growth?

Hydropower Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Competition From Other Energy Storage Technologies.

8. Can you provide examples of recent developments in the market?

August 2022: Masdar signed an agreement with TANESCO, a Tanzanian company, to develop a 2 GW renewable energy capacity. In this agreement, the project would be set in two phases; in the first phase of the collaboration, the company would generate approximately 600 MW; in the second phase, the total renewable capacity would reach 2,000 MW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "East Africa Renewable Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the East Africa Renewable Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the East Africa Renewable Energy Industry?

To stay informed about further developments, trends, and reports in the East Africa Renewable Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence