Key Insights

The Electric Vehicle (EV) Test Equipment market is experiencing significant expansion, driven by global EV adoption. A projected Compound Annual Growth Rate (CAGR) of 31.42% from 2025 to 2033 underscores this robust growth. Key drivers include stringent emission standards, increasing consumer preference for sustainable transportation, and government initiatives supporting EV infrastructure. Segmentation analysis highlights Battery Test Equipment and EV Charging Infrastructure solutions as leading growth segments, crucial for ensuring EV safety, performance, and durability. The increasing sophistication of EV technologies, such as advanced battery management systems and powertrains, necessitates advanced testing solutions, further propelling market expansion. Geographically, North America and Europe currently lead, supported by mature automotive sectors and favorable policies. However, the Asia-Pacific region, particularly China, is expected to witness rapid growth due to its extensive EV manufacturing capabilities and expanding charging network.

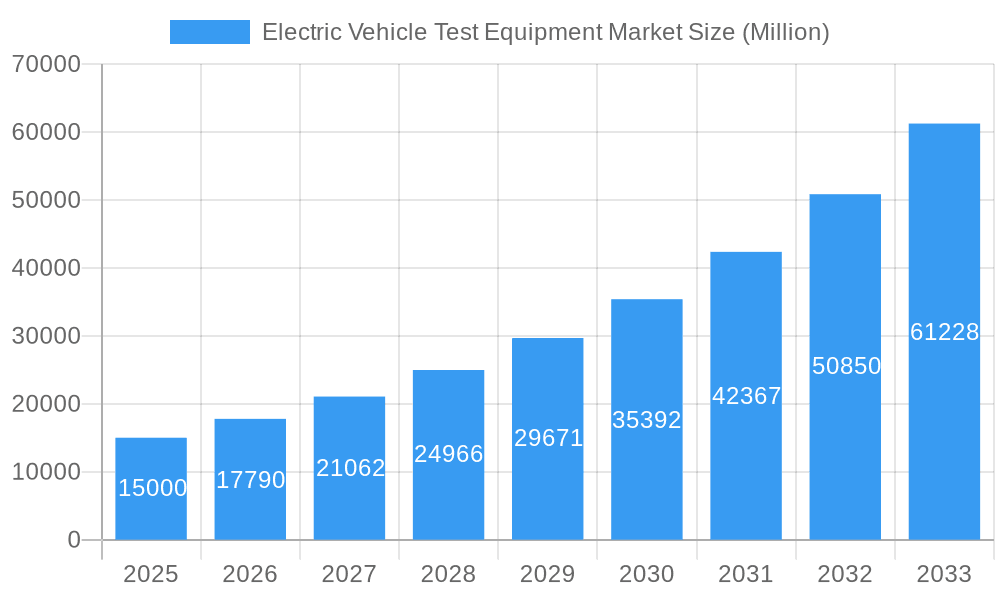

Electric Vehicle Test Equipment Market Market Size (In Million)

The competitive environment features established entities and specialized providers, fostering innovation and increasing the accessibility of advanced testing solutions across the EV ecosystem. The forecast period (2025-2033) anticipates accelerated growth, propelled by rising EV production volumes and the development of next-generation EV technologies. Demand for advanced solutions supporting high-voltage batteries, autonomous driving, and connected car features will increase, requiring continuous innovation in test equipment to address evolving safety, performance, and reliability demands. While high initial investment costs and the need for skilled operators present challenges, the long-term outlook for the EV Test Equipment market remains exceptionally positive, mirroring the overall growth trajectory of the global EV industry.

Electric Vehicle Test Equipment Market Company Market Share

This report offers an in-depth analysis of the Electric Vehicle (EV) Test Equipment market, providing critical insights for industry stakeholders. Covering the period from 2025 to 2033, with a base year of 2025, the report meticulously examines market dynamics, key players, and future trends. The market size is projected to reach 211.72 million by 2033, with a CAGR of 31.42% during the forecast period (2025-2033).

Electric Vehicle Test Equipment Market Structure & Innovation Trends

The Electric Vehicle Test Equipment market exhibits a moderately concentrated structure, with key players like Intertek Group Plc, Horiba Ltd, Maccor Inc, National Instruments Corporation, Dürr Group, TÜV Rheinland, Arbin Instruments, Toyo System Co Ltd, Wonik Pne Co Ltd, Keysight Technologies Inc, Froude Inc, and Dynomerk Controls holding significant market share. However, the presence of several smaller, specialized companies indicates a competitive landscape. Market share data for 2024 indicates that the top 5 players collectively hold approximately xx% of the market.

Innovation Drivers:

- Stringent safety and performance standards for EVs.

- Advancements in battery technology and charging infrastructure.

- Growing demand for autonomous driving features.

- Increased adoption of electric commercial vehicles.

Regulatory Frameworks: Government regulations regarding EV safety and emissions are major drivers, influencing both the demand for and the types of testing equipment needed.

M&A Activities: While precise M&A deal values are not publicly available for all transactions in this sector, several significant acquisitions and partnerships have shaped the market landscape. These activities are generally focused on expanding technological capabilities and geographical reach. The total value of M&A activities in the past five years is estimated at xx Million.

Product Substitutes: While direct substitutes are limited, the competitive landscape includes companies offering integrated solutions encompassing various testing equipment.

End-User Demographics: The primary end users include EV manufacturers, battery manufacturers, charging infrastructure providers, and independent testing laboratories.

Electric Vehicle Test Equipment Market Dynamics & Trends

The EV test equipment market is experiencing robust growth driven by the global surge in EV adoption. The increasing demand for electric vehicles, particularly Battery Electric Vehicles (BEVs), is the primary growth driver. This is fueled by government incentives, environmental concerns, and advancements in battery technology resulting in longer ranges and faster charging times. Technological disruptions, such as the development of solid-state batteries and advanced charging technologies, are creating new opportunities in the market, demanding specialized testing equipment.

Consumer preferences are shifting towards EVs with improved performance, safety, and charging infrastructure availability. This trend drives the demand for comprehensive testing solutions to ensure quality and reliability. Competitive dynamics are characterized by innovation, strategic partnerships, and expansion into new geographical markets. Market penetration of EV testing equipment is steadily increasing, with significant growth anticipated in developing economies. The market is projected to exhibit a CAGR of xx% from 2025 to 2033.

Dominant Regions & Segments in Electric Vehicle Test Equipment Market

Dominant Region: North America and Europe currently command the largest market share in the Electric Vehicle Test Equipment market. This dominance is attributed to their advanced EV infrastructure, stringent environmental regulations driving adoption, and high consumer uptake of electric vehicles. However, the Asia-Pacific region is poised for the most rapid expansion. This accelerated growth is fueled by the burgeoning EV market in key economies like China and India, where significant investments in EV manufacturing and infrastructure are underway.

Dominant Segments:

- By Propulsion Type: Battery Electric Vehicles (BEVs) lead the market. This is directly correlated with their increasing consumer popularity and the critical need for comprehensive and advanced battery testing to ensure safety, performance, and longevity.

- By Equipment Type: Battery testing equipment currently holds the largest market share due to the critical role batteries play in EV performance. This is followed by powertrain testing equipment. The EV charging equipment segment is experiencing substantial growth, driven by the global expansion of charging infrastructure, which necessitates a wide array of specialized testing solutions.

- By Vehicle Type: Passenger cars remain the largest segment, reflecting their widespread adoption. However, the commercial vehicle segment is projected for significant growth. This trend is propelled by the increasing integration of electric trucks, buses, and vans into logistics and public transportation fleets, demanding robust and specialized testing solutions.

Key Drivers by Region/Segment:

- North America: Stringent emission standards, supportive government incentives for EV purchase and manufacturing, and a mature automotive industry with a strong R&D focus are key drivers.

- Europe: Similar to North America, with an unwavering commitment to sustainability goals, aggressive fleet electrification targets, and substantial public and private investment in EV technology.

- Asia-Pacific: Rapid economic development, substantial government backing for EV adoption through subsidies and policy frameworks, and a vast consumer base are propelling the market forward.

Electric Vehicle Test Equipment Market Product Innovations

Recent advancements in the Electric Vehicle Test Equipment market are centered on developing automated, integrated, and intelligent testing solutions. These innovations aim to significantly enhance testing efficiency, accuracy, and repeatability. The integration of sophisticated software and advanced data analytics is crucial, providing deeper insights into EV performance, battery health, and system reliability. Furthermore, new equipment is being specifically designed to accommodate the evolving landscape of battery chemistries, including solid-state batteries, and cutting-edge charging technologies like ultra-fast charging. This focus on innovation allows manufacturers to streamline their testing processes, leading to reduced production costs, accelerated product development cycles, and a stronger competitive advantage in the rapidly evolving EV sector.

Report Scope & Segmentation Analysis

This comprehensive report delves into the Electric Vehicle Test Equipment market, offering detailed segmentation by propulsion type (including Plug-in Hybrid Vehicles, Battery Electric Vehicles, and Fuel Cell Electric Vehicles), equipment type (encompassing Battery Testing, Powertrain Testing, EV Component Testing, EV Charging Equipment Testing, and Other Equipment Types), and vehicle type (covering Passenger Cars and Commercial Vehicles). Each segment's growth trajectory, market valuation, and competitive landscape are meticulously analyzed to provide actionable insights into prevailing market trends and emerging opportunities. The report's granular segmentation enables stakeholders to pinpoint high-growth niches and strategic investment areas within this dynamic industry. The analysis includes projected market values of approximately [Insert XX Million] for each segment in 2025 and detailed growth forecasts extending to 2033.

Key Drivers of Electric Vehicle Test Equipment Market Growth

Several factors drive the growth of the EV test equipment market. Firstly, stringent government regulations and safety standards necessitate rigorous testing, boosting demand. Secondly, the rapid expansion of EV manufacturing globally necessitates more advanced and efficient testing equipment. Finally, continuous innovation in battery technology and charging infrastructure creates new testing requirements and opportunities. The ongoing push for higher EV range, faster charging speeds, and increased safety necessitates ongoing investment in advanced testing equipment to meet these evolving demands.

Challenges in the Electric Vehicle Test Equipment Market Sector

The Electric Vehicle Test Equipment market is navigating several significant hurdles. The relentless pace of technological advancements in EV battery technology and charging infrastructure demands continuous and substantial investment in research and development to keep testing equipment relevant and effective. Supply chain vulnerabilities, particularly concerning specialized electronic components and raw materials, can create bottlenecks in production and delay delivery timelines. Moreover, the highly competitive nature of the market, characterized by the presence of both established global players and agile emerging companies, exerts considerable pressure on pricing and profit margins. Consequently, companies must prioritize delivering cost-effective, highly innovative, and reliable testing solutions to sustain their market share and competitive standing. The cumulative impact of these challenges is estimated to contribute to an approximate [Insert xx]% reduction in overall market growth annually.

Emerging Opportunities in Electric Vehicle Test Equipment Market

Significant opportunities exist for companies offering specialized testing solutions for solid-state batteries, high-power fast charging, and autonomous driving features. Expanding into developing markets with growing EV adoption presents attractive prospects. The development of integrated testing platforms and software solutions that streamline the entire testing process further presents a viable avenue for innovation and market expansion. Finally, the rising demand for electric commercial vehicles also provides opportunities for companies that can supply robust, reliable and efficient testing solutions for this segment.

Leading Players in the Electric Vehicle Test Equipment Market Market

- Intertek Group Plc

- Horiba Ltd

- Maccor Inc

- National Instruments Corporation

- Dürr Group

- TÜV Rheinland

- Arbin Instruments

- Toyo System Co Ltd

- Wonik Pne Co Ltd

- Keysight Technologies Inc

- Froude Inc

- Dynomerk Controls

Key Developments in Electric Vehicle Test Equipment Market Industry

- July 2022: TÜV SÜD Thailand inaugurated a state-of-the-art Battery and Automotive Components Testing Centre. This expansion significantly bolsters testing capacity and accessibility within the crucial Asia-Pacific region, thereby enhancing market competitiveness and supporting local EV development.

- July 2022: National Instruments Japan Corporation established a dedicated Co-engineering Lab. This initiative fosters collaborative research and development in cutting-edge automotive technologies, with a strong emphasis on electrification, underscoring a growing trend towards strategic partnerships and shared innovation.

- April 2022: Tevva's strategic decision to establish a base at HORIBA MIRA Technologies Park highlights the increasing reliance of EV manufacturers on specialized, advanced testing capabilities. This move underscores the critical need for access to comprehensive testing facilities, particularly for the development and validation of electric commercial vehicles.

Future Outlook for Electric Vehicle Test Equipment Market Market

The future of the EV test equipment market is bright, driven by sustained growth in EV adoption and the continuous evolution of EV technologies. The market is poised for expansion, fueled by increasing demand for higher-performance and more sustainable transportation solutions. Strategic partnerships, technological advancements, and expansion into new markets will be key to success. The development of advanced testing solutions that meet the evolving needs of the industry will drive future growth and create lucrative opportunities for key players.

Electric Vehicle Test Equipment Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Propulsion Type

- 2.1. Battery Electric Vehicles (BEVs)

- 2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 2.3. Hybrid Electric Vehicles (HEVs)

- 2.4. Fuel Cell Electric Vehicles (FCEVs)

-

3. Equipment Type

- 3.1. Electric Vehicle (EV) Battery Test Systems

- 3.2. Powertrain Testing

- 3.3. Electric Vehicle (EV) Component

- 3.4. Electric Vehicle (EV) Charging

- 3.5. Others (EV Drivetrain Test)

Electric Vehicle Test Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Vehicle Test Equipment Market Regional Market Share

Geographic Coverage of Electric Vehicle Test Equipment Market

Electric Vehicle Test Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Vehicle Sales to Fuel Market Growth

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Electric Vehicle Adoption Globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Battery Electric Vehicles (BEVs)

- 5.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 5.2.3. Hybrid Electric Vehicles (HEVs)

- 5.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 5.3. Market Analysis, Insights and Forecast - by Equipment Type

- 5.3.1. Electric Vehicle (EV) Battery Test Systems

- 5.3.2. Powertrain Testing

- 5.3.3. Electric Vehicle (EV) Component

- 5.3.4. Electric Vehicle (EV) Charging

- 5.3.5. Others (EV Drivetrain Test)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. Battery Electric Vehicles (BEVs)

- 6.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 6.2.3. Hybrid Electric Vehicles (HEVs)

- 6.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 6.3. Market Analysis, Insights and Forecast - by Equipment Type

- 6.3.1. Electric Vehicle (EV) Battery Test Systems

- 6.3.2. Powertrain Testing

- 6.3.3. Electric Vehicle (EV) Component

- 6.3.4. Electric Vehicle (EV) Charging

- 6.3.5. Others (EV Drivetrain Test)

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. Battery Electric Vehicles (BEVs)

- 7.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 7.2.3. Hybrid Electric Vehicles (HEVs)

- 7.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 7.3. Market Analysis, Insights and Forecast - by Equipment Type

- 7.3.1. Electric Vehicle (EV) Battery Test Systems

- 7.3.2. Powertrain Testing

- 7.3.3. Electric Vehicle (EV) Component

- 7.3.4. Electric Vehicle (EV) Charging

- 7.3.5. Others (EV Drivetrain Test)

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. Battery Electric Vehicles (BEVs)

- 8.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 8.2.3. Hybrid Electric Vehicles (HEVs)

- 8.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 8.3. Market Analysis, Insights and Forecast - by Equipment Type

- 8.3.1. Electric Vehicle (EV) Battery Test Systems

- 8.3.2. Powertrain Testing

- 8.3.3. Electric Vehicle (EV) Component

- 8.3.4. Electric Vehicle (EV) Charging

- 8.3.5. Others (EV Drivetrain Test)

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. Battery Electric Vehicles (BEVs)

- 9.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 9.2.3. Hybrid Electric Vehicles (HEVs)

- 9.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 9.3. Market Analysis, Insights and Forecast - by Equipment Type

- 9.3.1. Electric Vehicle (EV) Battery Test Systems

- 9.3.2. Powertrain Testing

- 9.3.3. Electric Vehicle (EV) Component

- 9.3.4. Electric Vehicle (EV) Charging

- 9.3.5. Others (EV Drivetrain Test)

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Intertek Group Plc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Horiba Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Maccor Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 National Instruments Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Durr Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tuv Rheinland

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Arbin Instruments

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toyo System Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wonik Pne Co Ltd*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Keysight Technologies Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Froude Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Dynomerk Controls

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Intertek Group Plc

List of Figures

- Figure 1: Global Electric Vehicle Test Equipment Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 3: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 5: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 6: North America Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 7: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 8: North America Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 13: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 14: Europe Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 15: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 16: Europe Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 21: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 22: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 23: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 24: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 29: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 30: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 31: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 32: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 3: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 4: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 7: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 8: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 14: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 15: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Spain Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 24: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 25: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: China Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: India Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Japan Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 33: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 34: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 35: South America Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Middle East and Africa Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Vehicle Test Equipment Market?

The projected CAGR is approximately 31.42%.

2. Which companies are prominent players in the Electric Vehicle Test Equipment Market?

Key companies in the market include Intertek Group Plc, Horiba Ltd, Maccor Inc, National Instruments Corporation, Durr Group, Tuv Rheinland, Arbin Instruments, Toyo System Co Ltd, Wonik Pne Co Ltd*List Not Exhaustive, Keysight Technologies Inc, Froude Inc, Dynomerk Controls.

3. What are the main segments of the Electric Vehicle Test Equipment Market?

The market segments include Vehicle Type, Propulsion Type, Equipment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 211.72 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Vehicle Sales to Fuel Market Growth.

6. What are the notable trends driving market growth?

Increased Electric Vehicle Adoption Globally.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: At the Amata City Chonburi Industrial Estate, TÜV SÜD Thailand officially opened its Battery and Automotive Components Testing Centre. This facility will add to TÜV SÜD's existing network of eight battery testing labs located in North America, Germany, and Asia. This integrated facility, which covers over 3,000 square meters, makes it simple to access global and local expertise to meet the quality and safety requirements necessary for e-Mobility to be adopted more quickly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Vehicle Test Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Vehicle Test Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Vehicle Test Equipment Market?

To stay informed about further developments, trends, and reports in the Electric Vehicle Test Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence