Key Insights

The European Cross-Border Road Freight Transport Market, projected to reach $282.7 billion by 2025, is poised for robust expansion with a Compound Annual Growth Rate (CAGR) of 6%. This growth is underpinned by escalating demand for efficient and cost-effective logistics solutions within the EU's single market, amplified by the rapid expansion of e-commerce and the imperative for expedited delivery services. Strong industrial and manufacturing output from key economies like Germany, France, and the UK further fuels the need for sophisticated cross-border supply chains. Growth in sectors such as manufacturing and construction also contributes significantly to market dynamics. Strategic positioning of transportation hubs and well-established logistics networks across Europe facilitate this expansion. However, potential headwinds include volatile fuel prices, persistent driver shortages, and evolving regulatory landscapes.

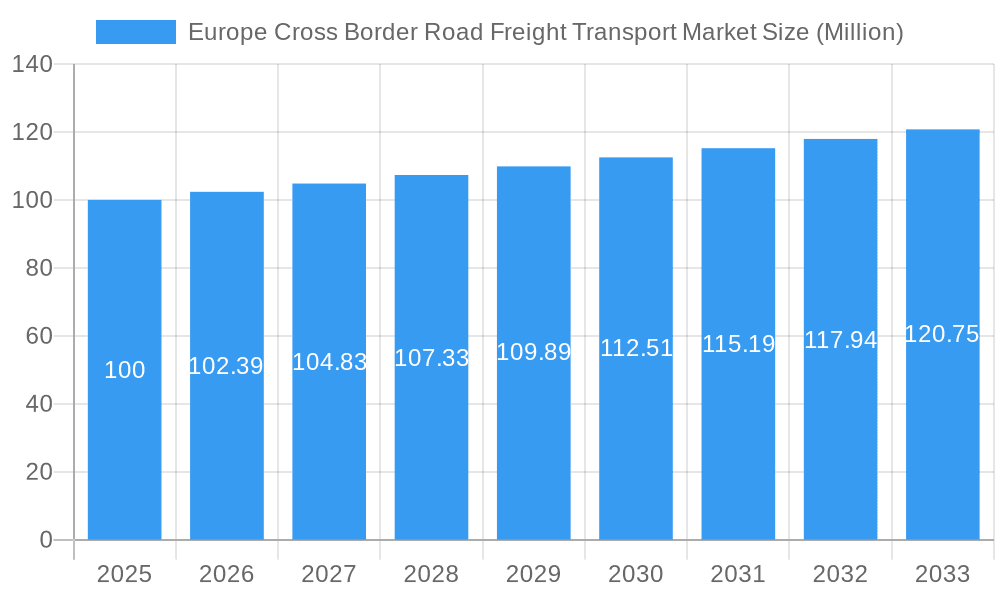

Europe Cross Border Road Freight Transport Market Market Size (In Billion)

The outlook for the forecast period (2025-2033) remains highly positive. Ongoing investments in infrastructure modernization and technological advancements, including advanced Transportation Management Systems (TMS) and digital freight forwarding platforms, are expected to effectively mitigate existing challenges. While Germany, France, and the UK are anticipated to retain their market leadership owing to their economic prowess and robust logistics infrastructure, regions like the Nordics present significant growth opportunities driven by increasing e-commerce penetration and economic development. Industry consolidation, exemplified by major players such as DHL, DB Schenker, and DSV, is actively enhancing operational efficiencies and reshaping the competitive environment.

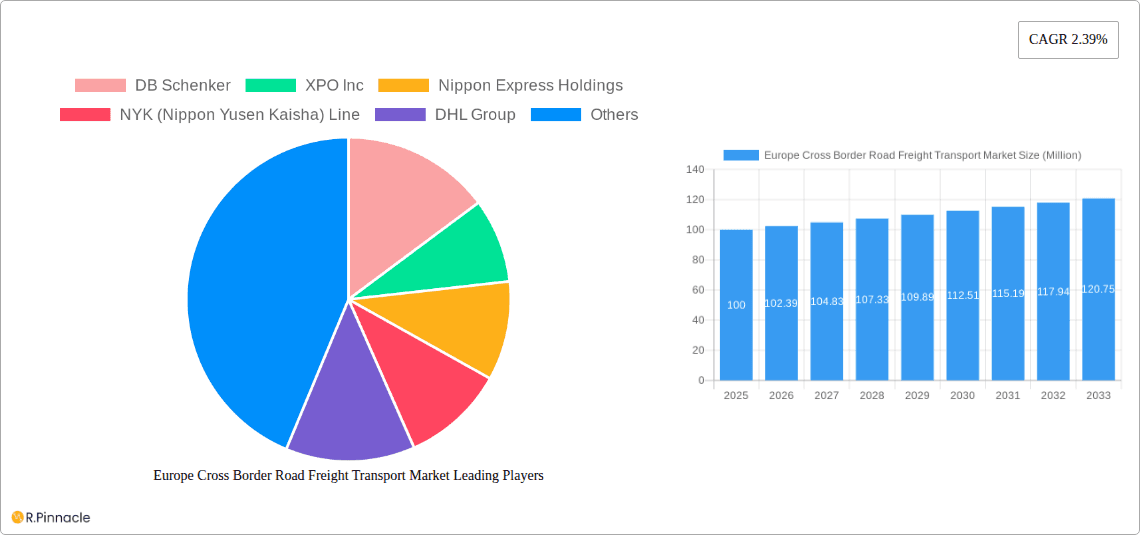

Europe Cross Border Road Freight Transport Market Company Market Share

This report delivers a comprehensive analysis of the Europe Cross-Border Road Freight Transport Market, providing critical insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a primary focus on the 2025 base year, this study meticulously examines market drivers, key participants, and future growth trajectories. The analysis encompasses the historical period 2019-2033, with the base year set at 2025 and the forecast period extending from 2025 to 2033.

Europe Cross Border Road Freight Transport Market Structure & Innovation Trends

The European cross-border road freight transport market is characterized by a moderately concentrated structure, with several major players holding significant market share. Companies such as DB Schenker, DHL Group, DSV A/S, and XPO Inc. dominate the landscape, collectively accounting for an estimated xx% of the total market in 2025. However, smaller, regional players also contribute significantly to the overall market volume.

Market concentration is influenced by several factors, including economies of scale, technological advancements, and regulatory frameworks. Innovation is driven by the need for increased efficiency, sustainability, and improved supply chain visibility. This includes the adoption of advanced technologies like telematics, GPS tracking, and route optimization software.

Regulatory frameworks, such as those related to emissions standards and driver regulations, play a crucial role in shaping market dynamics. These regulations are increasingly focused on reducing environmental impact and enhancing road safety. Product substitutes, such as rail and maritime transport, exert competitive pressure, although road transport remains dominant due to its flexibility and speed.

Mergers and acquisitions (M&A) activities are frequent in this sector, with deal values reaching xx Million in 2024. These activities often involve larger players acquiring smaller companies to expand their geographic reach, enhance service offerings, or integrate new technologies.

Europe Cross Border Road Freight Transport Market Market Dynamics & Trends

The European cross-border road freight transport market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including increasing e-commerce penetration, the expansion of cross-border trade within the EU, and the growth of manufacturing and industrial sectors.

Technological disruptions, such as the adoption of autonomous vehicles and the Internet of Things (IoT), are transforming the industry, creating both opportunities and challenges. Consumer preferences are shifting towards greater transparency, faster delivery times, and environmentally friendly solutions. These preferences are pushing companies to invest in sustainable logistics solutions and improve supply chain visibility.

Competitive dynamics are intense, with companies vying for market share through pricing strategies, service differentiation, and technological innovation. The market is witnessing increased consolidation, with larger players acquiring smaller companies to gain a competitive edge. Market penetration of advanced logistics technologies is expected to reach xx% by 2033, driven by the need for enhanced efficiency and optimized delivery operations.

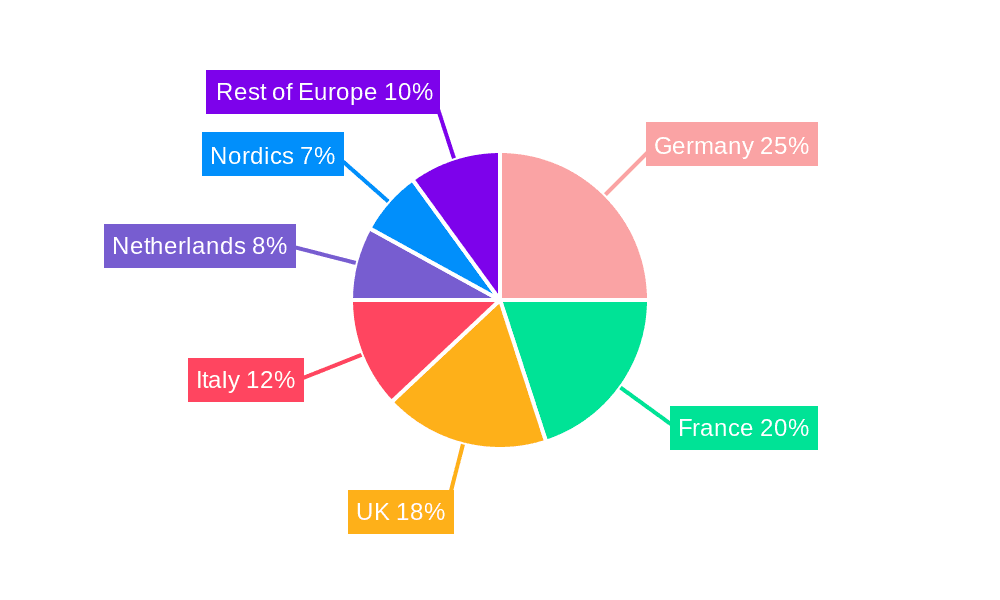

Dominant Regions & Segments in Europe Cross Border Road Freight Transport Market

Dominant Regions:

- Western Europe: Germany, France, and the United Kingdom consistently represent the largest markets due to their well-developed infrastructure, strong economies, and high levels of cross-border trade. The Nordics also exhibit significant growth potential.

- Key Drivers: Robust industrial sectors, established logistics networks, and favorable regulatory environments.

Dominant Segments (End-User Industry):

- Manufacturing: This sector generates significant freight volume due to the need to transport raw materials, intermediate goods, and finished products. Its substantial contribution is further fueled by the robust automotive sector across Europe.

- Wholesale and Retail Trade: The growth of e-commerce fuels a considerable demand for efficient and timely delivery of goods to consumers and retailers. This contributes significantly to overall freight volumes.

- Construction: Large-scale infrastructure projects and construction activities create a significant need for materials transport, driving demand in this segment.

Detailed Dominance Analysis: Germany's strong manufacturing base and strategic location within Europe solidify its position as a leading market. France's large internal market and extensive road infrastructure also contribute to its high market share. The UK, despite Brexit, maintains a significant role in cross-border transport due to its established logistics infrastructure and access to global markets. The Nordics, characterized by significant cross-border trade and robust industrial activity, are experiencing rapid growth. Italy's high concentration of manufacturing and the Netherlands’ role as a major logistics hub also provide sizable contributions.

Europe Cross Border Road Freight Transport Market Product Innovations

Recent product innovations focus on enhancing efficiency, sustainability, and safety. The adoption of electric vehicles, such as the Volta Zero, is gaining momentum, driven by environmental concerns and regulatory pressures. Real-time tracking systems and advanced route optimization software are improving supply chain visibility and reducing delivery times. These innovations provide competitive advantages to companies that embrace them, enhancing their efficiency, sustainability profile, and customer service.

Report Scope & Segmentation Analysis

This report segments the European cross-border road freight transport market by end-user industry (Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; Others) and by country (France, Germany, Italy, Netherlands, Nordics, Russia, Spain, United Kingdom, Rest of Europe). Each segment is analyzed based on its market size, growth rate, and competitive landscape. Growth projections vary by segment and region, reflecting differences in economic conditions, infrastructure development, and regulatory environments.

Key Drivers of Europe Cross Border Road Freight Transport Market Growth

The market's growth is driven by several factors: the expansion of e-commerce, increasing cross-border trade within the EU, the growth of manufacturing and industrial sectors, and improving infrastructure. Technological advancements, such as autonomous vehicles and IoT devices, further enhance efficiency and drive growth. Favorable economic conditions and supportive government policies also contribute to market expansion.

Challenges in the Europe Cross Border Road Freight Transport Market Sector

The industry faces challenges such as fluctuating fuel prices, driver shortages, and increasingly stringent environmental regulations. Supply chain disruptions caused by geopolitical events or natural disasters also negatively impact operations. Intense competition among established players creates pressure on pricing and profit margins. These challenges necessitate strategic adaptation and investment in innovation to maintain profitability and competitiveness.

Emerging Opportunities in Europe Cross Border Road Freight Transport Market

Emerging opportunities include the adoption of sustainable logistics solutions (electric vehicles, alternative fuels), the integration of advanced technologies (AI, big data analytics), and the expansion into new, high-growth markets. The increasing demand for faster and more reliable deliveries, coupled with the need for greater supply chain transparency, presents opportunities for companies that can provide innovative solutions. The growth of e-commerce and last-mile delivery services also offers significant potential.

Leading Players in the Europe Cross Border Road Freight Transport Market Market

- DB Schenker

- XPO Inc

- Nippon Express Holdings

- NYK (Nippon Yusen Kaisha) Line

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Dachser

- Rhenus Group

- C H Robinson

Key Developments in Europe Cross Border Road Freight Transport Market Industry

- September 2023: DB Schenker conducted a test in Norway with Volta Trucks' Volta Zero electric vehicle, following a 2021 partnership and pre-order of nearly 1,500 vehicles – the largest medium-duty electric truck order in Europe. This signals a major shift toward sustainable transport solutions within the industry.

- September 2023: DB Schenker acquired a new 2.3-acre site in Manchester, enhancing its operational capabilities and consolidation efforts across multiple transport modes. This expansion signifies the company's commitment to growth and optimized logistics.

- August 2023: DB Schenker purchased 53 Renault Trucks E-Tech D electric trucks for its French operations, further underscoring the industry's move toward electric fleets and sustainable practices. This investment indicates a commitment to reducing emissions and enhancing efficiency in urban deliveries.

Future Outlook for Europe Cross Border Road Freight Transport Market Market

The European cross-border road freight transport market is poised for continued growth, driven by long-term trends in e-commerce, industrial expansion, and technological innovation. Companies that invest in sustainable practices, adopt advanced technologies, and focus on providing efficient and reliable services will be best positioned to succeed. Strategic partnerships, mergers, and acquisitions will likely reshape the market landscape, fostering consolidation and creating opportunities for larger players. The shift towards automation and digitization will continue to redefine the industry, offering both opportunities and challenges for established and emerging players alike.

Europe Cross Border Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

Europe Cross Border Road Freight Transport Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Cross Border Road Freight Transport Market Regional Market Share

Geographic Coverage of Europe Cross Border Road Freight Transport Market

Europe Cross Border Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Rules and Regulations4.; Higher Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Cross Border Road Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 XPO Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nippon Express Holdings

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NYK (Nippon Yusen Kaisha) Line

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dachser

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rhenus Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 C H Robinson

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Europe Cross Border Road Freight Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Cross Border Road Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Cross Border Road Freight Transport Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Europe Cross Border Road Freight Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Cross Border Road Freight Transport Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 4: Europe Cross Border Road Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Cross Border Road Freight Transport Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Cross Border Road Freight Transport Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Cross Border Road Freight Transport Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Cross Border Road Freight Transport Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Cross Border Road Freight Transport Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Cross Border Road Freight Transport Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Cross Border Road Freight Transport Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Cross Border Road Freight Transport Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Cross Border Road Freight Transport Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Cross Border Road Freight Transport Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Cross Border Road Freight Transport Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Cross Border Road Freight Transport Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Europe Cross Border Road Freight Transport Market?

Key companies in the market include DB Schenker, XPO Inc, Nippon Express Holdings, NYK (Nippon Yusen Kaisha) Line, DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Dachser, Rhenus Group, C H Robinson.

3. What are the main segments of the Europe Cross Border Road Freight Transport Market?

The market segments include End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 282.7 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Stringent Rules and Regulations4.; Higher Costs.

8. Can you provide examples of recent developments in the market?

September 2023: DB Schenker in Norway conducted a test with the electrically powered and highly innovative Volta Zero from Volta Trucks. In 2021, DB Schenker and Volta Trucks announced a partnership. The subsequent pre-order of nearly 1,500 zer-tailpipe emission Volta Zero vehicles was the largest order of medium-duty electric trucks in Europe to date. DB Schenker plans to deploy the all-electric, 16-ton Volta Zero in its European terminals to deliver goods from distribution hubs to urban areas and city centers.September 2023: DB Schenker has purchased a new 2.3-acre site at Trafford Park, Manchester. The new facility will have various features to support DB Schenker's operations and employee needs. It will contain designated zones for consolidating shipments across all transport modes.August 2023: DB Schenker, one of the world’s leading logistics service providers, invests in electric technology and acquires 53 Renault Trucks E-Tech D for its operations in France. Depending on the needs of the branches, these vehicles will ensure urban, suburban or regional trips with an average distance of 150 to 200 kilometers day. Their average reach is about 300 kilometers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Cross Border Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Cross Border Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Cross Border Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the Europe Cross Border Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence