Key Insights

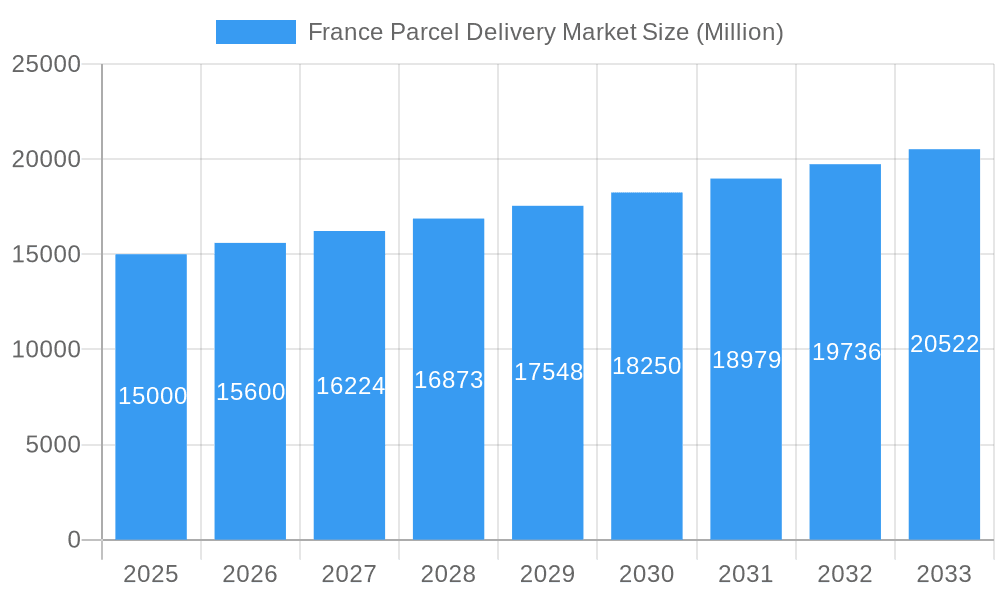

The French parcel delivery market, valued at an estimated 3.35 billion in 2025, is projected for substantial growth at a Compound Annual Growth Rate (CAGR) of 4.12% from 2025 to 2033. This expansion is primarily driven by the robust growth of e-commerce in France, with consumers increasingly preferring online purchases. The burgeoning B2B and B2C e-commerce sectors further amplify the demand for efficient and dependable parcel delivery solutions. The market is segmented by shipment weight (heavy, light, medium), mode of transport (air, road, others), end-user industry (e-commerce, BFSI, healthcare, manufacturing, primary industry, wholesale & retail, others), destination (domestic, international), and delivery speed (express, non-express). The increasing demand for express delivery services significantly contributes to market growth. Key market players, including DHL, FedEx, UPS, and La Poste, alongside regional and specialized carriers, are actively competing for market share.

France Parcel Delivery Market Market Size (In Billion)

Despite significant growth prospects, the market faces challenges such as rising fuel costs, fluctuating transportation regulations impacting operational efficiency, and the growing imperative for sustainable and eco-friendly delivery solutions. Managing consistent service quality and addressing last-mile delivery complexities in urban areas remain ongoing hurdles. To navigate these challenges and leverage opportunities, parcel delivery companies are investing in advanced technologies, including route optimization software, automated sorting systems, and enhanced tracking capabilities. The market's future success depends on adapting to evolving customer expectations, adopting sustainable practices, and effectively managing regulatory environments. The 2025-2033 forecast period offers considerable opportunities for market expansion, fueled by technological innovation and the sustained growth of online retail.

France Parcel Delivery Market Company Market Share

France Parcel Delivery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France parcel delivery market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth potential. The report leverages extensive data analysis to offer actionable intelligence, enabling informed decision-making within this dynamic sector.

France Parcel Delivery Market Market Structure & Innovation Trends

The French parcel delivery market exhibits a moderately concentrated structure, with key players such as La Poste Group, DHL Group, and GEODIS holding significant market share. The exact market share for each player in 2025 is estimated at: La Poste Group (xx%), DHL Group (xx%), GEODIS (xx%), FedEx (xx%), UPS (xx%), and others (xx%). This concentration is influenced by significant capital investments required for infrastructure development and technological advancements. The market is characterized by continuous innovation, driven by the increasing demand for speed, efficiency, and enhanced tracking capabilities. Regulatory frameworks, such as those concerning data privacy and environmental sustainability, play a crucial role in shaping market practices. The market also experiences substitution effects with the rise of alternative delivery models. Mergers and acquisitions (M&A) activity has been relatively high in recent years, with deal values reaching xx Million in 2024, and is predicted to hit xx Million in 2025; further consolidating market share amongst the leading players. This M&A activity is primarily driven by the quest for economies of scale, technological capabilities, and expansion into new market segments. End-user demographics, particularly the rise of e-commerce and the increasing demand for faster delivery times, fuel this consolidation and innovation.

- Market Concentration: Moderately concentrated, dominated by a few major players.

- Innovation Drivers: Demand for speed, efficiency, and enhanced tracking; technological advancements.

- Regulatory Framework: Data privacy, environmental sustainability.

- Product Substitutes: Emerging alternative delivery models.

- M&A Activity: Significant, driven by economies of scale and technological integration. Deal values estimated at xx Million in 2024 and xx Million in 2025.

France Parcel Delivery Market Market Dynamics & Trends

The France parcel delivery market demonstrates robust growth, fueled by the booming e-commerce sector and the increasing preference for online shopping among consumers. The market exhibits a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of automated sorting systems and the increasing use of data analytics for route optimization, are transforming operational efficiency and enhancing customer experiences. Consumer preferences are shifting towards faster and more reliable delivery options, including same-day and next-day deliveries, driving innovation in logistics and supply chain management. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, particularly in the last-mile delivery segment. Market penetration of express delivery services is predicted to reach xx% by 2033, reflecting growing consumer demand for speed and convenience.

Dominant Regions & Segments in France Parcel Delivery Market

The Île-de-France region, encompassing Paris and its surrounding areas, represents the most dominant segment in the France parcel delivery market due to high population density, significant e-commerce activity, and well-established infrastructure. The B2C segment dominates the overall market, driven by the surge in online shopping. Key drivers contributing to the dominance of this segment include:

- Economic Policies: Government support for e-commerce and logistics infrastructure development.

- Infrastructure: Well-developed road and rail networks supporting efficient delivery operations.

In terms of shipment weight, light weight shipments constitute the largest segment, reflecting the dominance of e-commerce deliveries. Air transport is a significant mode of transport, particularly for express deliveries and international shipments. The E-commerce segment drives the highest demand for parcel delivery services, followed by the Wholesale and Retail Trade (Offline) segment. Domestic deliveries significantly outweigh international ones; Express delivery services are also highly sought after.

France Parcel Delivery Market Product Innovations

The France parcel delivery market showcases continuous product innovations, primarily driven by technological advancements. These innovations enhance tracking capabilities, optimize delivery routes, and improve overall efficiency. The integration of artificial intelligence (AI) and machine learning (ML) in route optimization and predictive analytics is becoming increasingly prevalent. Companies are also introducing sustainable delivery solutions such as electric vehicles and eco-friendly packaging options to meet growing environmental concerns. These innovations improve service delivery times and reduce environmental impact.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the France parcel delivery market across various parameters, including:

Model: Business-to-Business (B2B), Business-to-Consumer (B2C), Consumer-to-Consumer (C2C). B2C is projected to maintain the largest market share.

Shipment Weight: Light Weight Shipments, Medium Weight Shipments, Heavy Weight Shipments. Light weight shipments account for the bulk of the market volume.

Mode of Transport: Air, Road, Others. Road remains the dominant mode, while air freight is critical for express international deliveries.

End User Industry: E-commerce, Financial Services (BFSI), Healthcare, Manufacturing, Primary Industry, Wholesale and Retail Trade (Offline), Others. E-commerce is the largest end-user sector.

Destination: Domestic, International. Domestic deliveries comprise the majority of the market.

Speed of Delivery: Express, Non-Express. Express delivery services are experiencing strong growth.

Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed in the complete report.

Key Drivers of France Parcel Delivery Market Growth

Several factors contribute to the growth of the France parcel delivery market, including:

- The rapid expansion of e-commerce, increasing consumer demand for online shopping and home delivery.

- Technological advancements in logistics and supply chain management, including automation, AI, and real-time tracking.

- Supportive government policies promoting the growth of e-commerce and logistics infrastructure.

- Rising disposable incomes and changing consumer preferences.

Challenges in the France Parcel Delivery Market Sector

Despite its robust growth, the France parcel delivery market faces certain challenges:

- Increasing fuel costs and transportation expenses.

- Labor shortages and rising labor costs.

- Stringent regulatory requirements concerning environmental sustainability and data privacy.

- Intense competition among players and the entry of new disruptive players.

Emerging Opportunities in France Parcel Delivery Market

Several opportunities exist within the France parcel delivery market:

- Expansion into underserved regions and rural areas.

- Development of specialized delivery services for niche industries, such as pharmaceuticals and perishable goods.

- Growing demand for sustainable and eco-friendly delivery solutions.

- Integration of advanced technologies such as drones and autonomous vehicles for last-mile delivery.

Leading Players in the France Parcel Delivery Market Market

- Sterne Group

- DHL Group

- GEODIS

- FedEx

- United Parcel Service of America Inc (UPS)

- International Distributions Services (including GLS)

- La Poste Group

- Integer pl Capital Group

- Walden Grou

- Logista

Key Developments in France Parcel Delivery Market Industry

April 2023: GEODIS expanded its direct-to-customer cross-border delivery service by opening two new airport gateway facilities in the US, Italy, and other European nations. This significantly enhances its international reach and capacity.

April 2023: Transports DEVOLUY joined the GEODIS group, strengthening GEODIS's distribution and express services, particularly its 12/24- and 24/48-hour delivery capabilities in Hautes-Alpes.

April 2023: STERNE Time Critical China opened a new office near SHA airport/railway station, offering enhanced NFO/Consol flight/OBC services to Chinese customers. This boosts STERNE's presence and service offerings in the crucial Chinese market.

Future Outlook for France Parcel Delivery Market Market

The France parcel delivery market is poised for sustained growth, driven by continued e-commerce expansion, technological advancements, and increasing consumer demand for speed and convenience. Strategic partnerships, investments in innovative technologies, and a focus on sustainability will be crucial for companies to succeed in this competitive landscape. The market's future is bright, with significant potential for growth and expansion in the coming years.

France Parcel Delivery Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

France Parcel Delivery Market Segmentation By Geography

- 1. France

France Parcel Delivery Market Regional Market Share

Geographic Coverage of France Parcel Delivery Market

France Parcel Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. France

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sterne Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GEODIS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FedEx

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 United Parcel Service of America Inc (UPS)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Distributions Services (including GLS)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 La Poste Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Integer pl Capital Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Walden Grou

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Logista

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sterne Group

List of Figures

- Figure 1: France Parcel Delivery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Parcel Delivery Market Share (%) by Company 2025

List of Tables

- Table 1: France Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: France Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: France Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 4: France Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: France Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: France Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: France Parcel Delivery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: France Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: France Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: France Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 11: France Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: France Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: France Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: France Parcel Delivery Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Parcel Delivery Market?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the France Parcel Delivery Market?

Key companies in the market include Sterne Group, DHL Group, GEODIS, FedEx, United Parcel Service of America Inc (UPS), International Distributions Services (including GLS), La Poste Group, Integer pl Capital Group, Walden Grou, Logista.

3. What are the main segments of the France Parcel Delivery Market?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

April 2023: GEODIS announced it expanded its direct-to-customer cross-border delivery service offering by opening two new airport gateway facilities in the United States, Italy, and other European nations.April 2023: Transports DEVOLUY joined the GEODIS group to provide distribution and express services. This new asset may strengthen its 12/24- and 24/48-hour distribution capacity in the Hautes-Alpes.April 2023: STERNE Time Critical China opened a new office in China near SHA airport/railway station to offer NFO/Consol flight/OBC service to customers in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Parcel Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Parcel Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Parcel Delivery Market?

To stay informed about further developments, trends, and reports in the France Parcel Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence