Key Insights

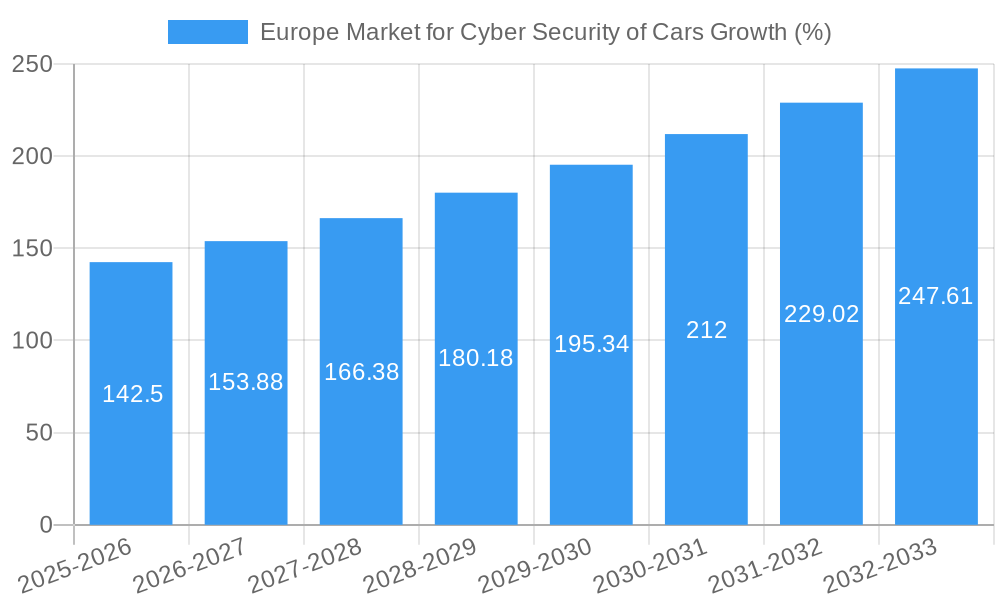

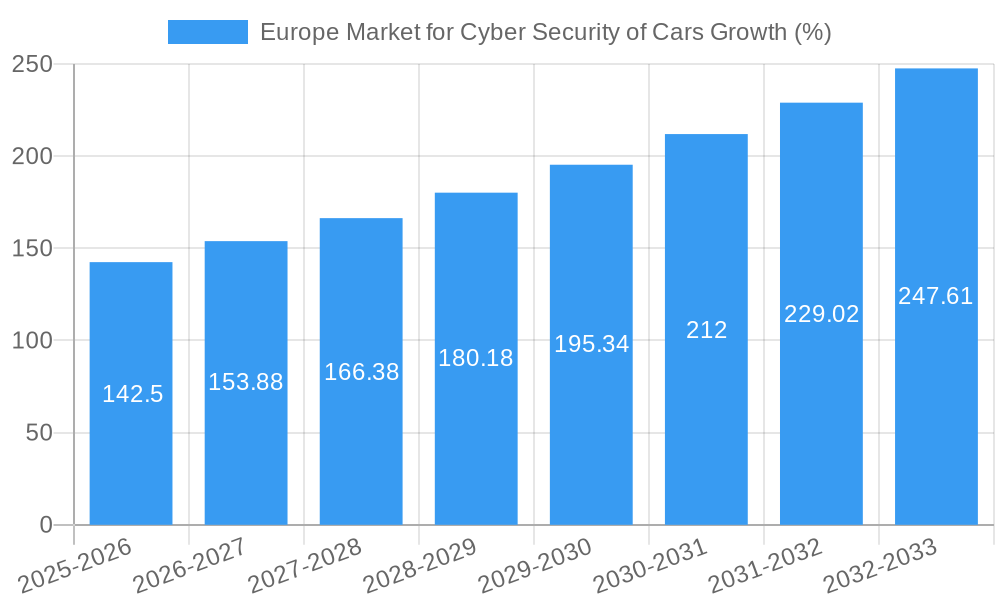

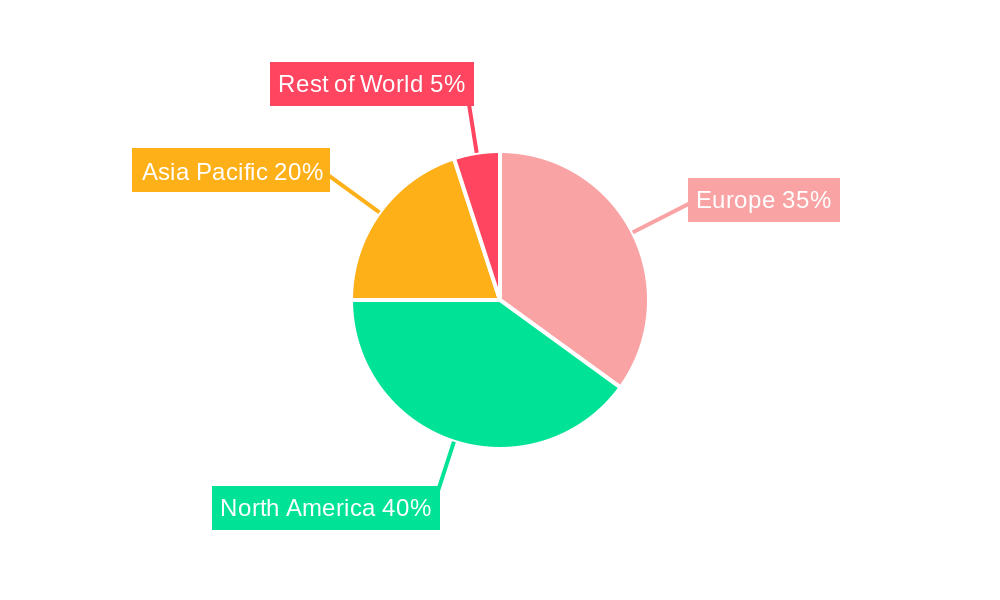

The European market for automotive cybersecurity is experiencing robust growth, driven by increasing vehicle connectivity, the proliferation of sophisticated cyberattacks targeting connected cars, and stringent regulatory mandates focused on data protection and vehicle safety. The market, currently estimated at €XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 9.5% and a starting point within the 2019-2024 historical period), is projected to reach €YY million by 2033, demonstrating a significant expansion opportunity. Key growth drivers include the escalating adoption of advanced driver-assistance systems (ADAS), autonomous driving technologies, and the increasing integration of over-the-air (OTA) updates. These technologies, while enhancing driving experience and efficiency, introduce new vulnerabilities that require advanced cybersecurity solutions. The market is segmented by solution type (software, hardware, services), equipment type (network, application, cloud security), and geography, with Germany, the UK, France, and Italy representing major markets within Europe. The competitive landscape is diverse, encompassing established automotive players, cybersecurity specialists, and technology giants, all vying for market share through innovation and strategic partnerships.

The market's growth trajectory is influenced by several factors. While the increasing demand for secure connected vehicles fuels expansion, challenges remain, including the high cost of implementation, the complexity of integrating cybersecurity solutions into existing vehicle architectures, and the ongoing evolution of cyber threats. To counter these restraints, industry players are focusing on developing cost-effective, scalable, and easily integrable cybersecurity solutions. Furthermore, ongoing collaboration between automotive manufacturers, cybersecurity firms, and regulatory bodies is crucial for establishing industry-wide security standards and promoting the adoption of best practices to protect vehicle systems against increasingly sophisticated cyberattacks. The continued development and deployment of advanced security technologies, including AI-powered threat detection and response systems, will be pivotal in shaping the future of automotive cybersecurity in Europe.

This comprehensive report provides an in-depth analysis of the burgeoning Europe market for automotive cybersecurity, offering invaluable insights for industry professionals, investors, and strategists. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth trajectories. The report leverages extensive primary and secondary research to deliver actionable intelligence, empowering informed decision-making.

Europe Market for Cyber Security of Cars Market Structure & Innovation Trends

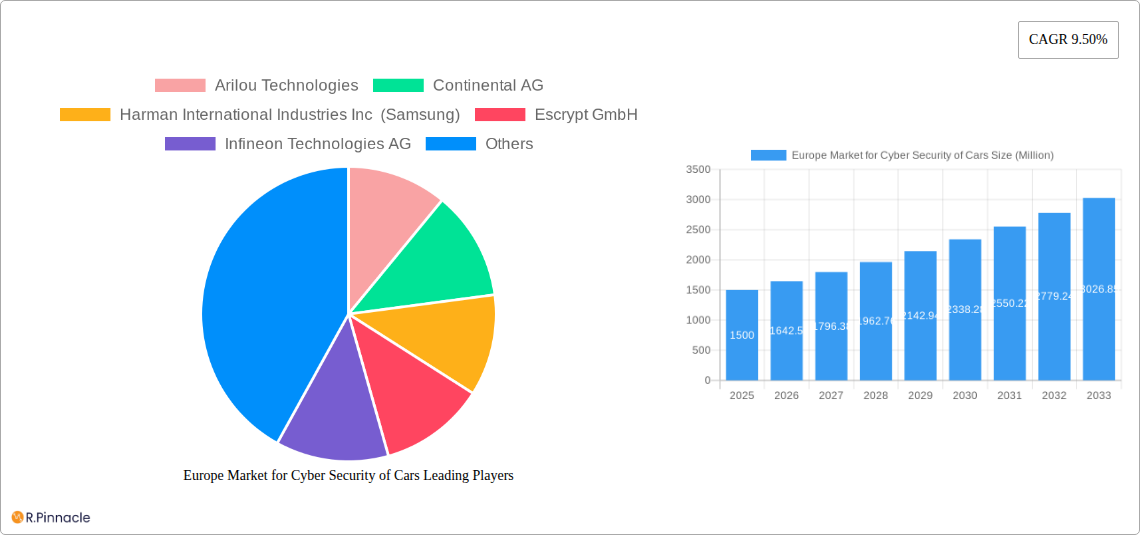

This section analyzes the market's competitive landscape, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. The European automotive cybersecurity market is characterized by a moderately concentrated structure, with a few major players holding significant market share. However, the market is also witnessing increased participation from smaller, specialized firms focusing on niche solutions.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Innovation Drivers: The increasing sophistication of vehicle systems, the rise of connected car technologies, and stringent regulatory requirements are driving innovation. Focus areas include AI-powered threat detection, blockchain-based security solutions, and advanced encryption techniques.

- Regulatory Frameworks: EU regulations like the General Data Protection Regulation (GDPR) and evolving automotive safety standards are significantly influencing the market landscape, mandating robust cybersecurity measures.

- Product Substitutes: While specific substitutes are limited, alternative approaches to security, such as improved software development practices and hardware design, impact the market indirectly.

- End-User Demographics: The primary end-users are automotive manufacturers, Tier-1 suppliers, and fleet operators. The demand is largely driven by the need to protect sensitive vehicle data and ensure operational safety.

- M&A Activities: The past five years have witnessed several mergers and acquisitions, with deal values totaling approximately €xx Million. These activities reflect the strategic importance of cybersecurity in the automotive sector. Examples include [mention specific M&A deals and their values if available, otherwise state "Specific deals and values are detailed within the full report."].

Europe Market for Cyber Security of Cars Market Dynamics & Trends

This section details the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The European automotive cybersecurity market is experiencing robust growth, driven by increasing vehicle connectivity, rising cyber threats, and the growing adoption of autonomous driving technologies.

The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by technological advancements, such as AI and machine learning, which are enhancing the capabilities of cybersecurity solutions. The market penetration rate for advanced automotive cybersecurity solutions is expected to reach xx% by 2033, driven by stricter regulations and the escalating awareness of security risks. Furthermore, consumer preference for connected and autonomous features fuels demand for robust security systems. Competitive dynamics are characterized by intense rivalry, innovation, and strategic partnerships. Major players are investing significantly in research and development, expanding their product portfolios, and forging collaborations to secure a strong market position.

Dominant Regions & Segments in Europe Market for Cyber Security of Cars

This section identifies the leading regions and segments within the European automotive cybersecurity market. Germany, the United Kingdom, and France represent the most significant national markets, driven by strong automotive industries and advanced technological infrastructure.

By Country:

- United Kingdom: Strong regulatory environment and a significant presence of automotive manufacturers contribute to high demand.

- Germany: A prominent hub for automotive innovation and advanced technology fuels strong market growth.

- France: Growing adoption of connected car technologies is driving demand.

- Italy: Increasing investment in automotive R&D is positively impacting the market.

- Rest of Europe: Market growth is propelled by increasing vehicle connectivity and regulatory compliance efforts.

By Solution Type:

- Software-based: This segment dominates, driven by the flexibility and scalability of software solutions.

- Hardware-based: Essential for foundational security, this segment holds a considerable share.

- Professional Services: Demand for expert consultation and implementation services is growing rapidly.

- Integration Services: Growing market demand for seamless integration of cybersecurity solutions.

- Other Solution Types: This segment comprises niche offerings that address specific cybersecurity needs.

By Equipment Type:

- Network Security: A critical segment, driven by the increasing interconnectedness of vehicles.

- Application Security: Focus on protecting vehicle applications from threats.

- Cloud Security: Growing importance with the proliferation of cloud-based services in the automotive sector.

- Other Security Types: This segment includes various other security solutions catering to specific vulnerabilities.

Europe Market for Cyber Security of Cars Product Innovations

The automotive cybersecurity market is witnessing continuous product innovation, driven by the need for advanced threat detection and response mechanisms. New product developments incorporate AI-powered threat analysis, enhanced encryption algorithms, and improved over-the-air (OTA) update capabilities. This focus on preventative measures and real-time response systems strengthens the market's resilience against sophisticated cyberattacks. The integration of cybersecurity functionalities into vehicle architectures, from ECUs to cloud platforms, is becoming increasingly streamlined. This improves efficiency while enhancing overall security posture.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the European automotive cybersecurity market based on solution type, equipment type, and country. Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. For example, the software-based segment is projected to grow at a CAGR of xx% during the forecast period, driven by the increasing adoption of sophisticated software security measures. The market size for this segment is estimated at xx Million in 2025.

Detailed breakdowns of market size and growth projections for each segment and country are presented within the full report.

Key Drivers of Europe Market for Cyber Security of Cars Growth

Several factors fuel the growth of the European automotive cybersecurity market. These include:

- Increasing Vehicle Connectivity: The rise of connected cars exponentially increases the attack surface, driving demand for robust security measures.

- Stringent Regulatory Compliance: EU regulations mandate stringent cybersecurity standards for vehicles, boosting market growth.

- Growing Adoption of Autonomous Driving: Autonomous vehicles rely heavily on connected systems, creating a significant need for robust cybersecurity.

Challenges in the Europe Market for Cyber Security of Cars Sector

The market also faces several challenges, including:

- High Development Costs: Developing advanced cybersecurity solutions requires significant investment in research and development.

- Complex Integration: Integrating cybersecurity solutions into existing vehicle architectures can be technically challenging.

- Shortage of Skilled Professionals: A scarcity of skilled cybersecurity professionals hinders effective implementation and management.

Emerging Opportunities in Europe Market for Cyber Security of Cars

The market presents several promising opportunities:

- Expansion into Emerging Technologies: Opportunities exist in integrating new technologies such as blockchain and AI for enhanced security.

- Growth in Connected Services: The rising demand for connected car services offers lucrative opportunities for cybersecurity providers.

- Focus on Data Privacy: Stronger data privacy regulations present an opportunity to offer specialized data protection solutions.

Leading Players in the Europe Market for Cyber Security of Cars Market

- Arilou Technologies

- Continental AG

- Harman International Industries Inc (Samsung)

- Escrypt GmbH

- Infineon Technologies AG

- Visteon Corporation

- Secunet AG

- Delphi Automotive PLC

- IBM Corporation

- NXP Semiconductors NV

- Argus Cybersecurity

- Cisco Systems Inc

- Honeywell International Inc

Key Developments in Europe Market for Cyber Security of Cars Industry

- January 2020: HARMAN launched the HARMAN Ignite Marketplace, offering cloud-based applications and services with built-in OTA functionality for enhanced security and efficient service updates. This development significantly impacts the market by providing automakers with a robust and secure platform for managing connected car ecosystems.

Future Outlook for Europe Market for Cyber Security of Cars Market

The future of the European automotive cybersecurity market is extremely promising. Continued growth is expected, driven by increasing vehicle connectivity, the expansion of autonomous driving technologies, and the strengthening of regulatory frameworks. Strategic opportunities lie in the development of innovative solutions addressing emerging cybersecurity challenges, fostering collaborations across the automotive ecosystem, and capitalizing on the expanding market for connected services. The market's future is bright, promising significant growth and transformation in the years to come.

Europe Market for Cyber Security of Cars Segmentation

-

1. Solution Type

- 1.1. Software-based

- 1.2. Hardware-based

- 1.3. Professional Service

- 1.4. Integration

- 1.5. Other Types of Solution

-

2. Equipment Type

- 2.1. Network Security

- 2.2. Application Security

- 2.3. Cloud Security

- 2.4. Other Types of Security

Europe Market for Cyber Security of Cars Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Market for Cyber Security of Cars REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Security Threats as More Technologies Get Integrated Into Cars; Government Regulations

- 3.3. Market Restrains

- 3.3.1. Unavailability for skilled workforce

- 3.4. Market Trends

- 3.4.1. Cloud Security Expected to Witness Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Software-based

- 5.1.2. Hardware-based

- 5.1.3. Professional Service

- 5.1.4. Integration

- 5.1.5. Other Types of Solution

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Network Security

- 5.2.2. Application Security

- 5.2.3. Cloud Security

- 5.2.4. Other Types of Security

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Germany Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Arilou Technologies

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Continental AG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Harman International Industries Inc (Samsung)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Escrypt GmbH

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Infineon Technologies AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Visteon Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Secunet AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Delphi Automotive PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 IBM Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 NXP Semiconductors NV

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Argus Cybersecurity

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Cisco Systems Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Honeywell International Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Arilou Technologies

List of Figures

- Figure 1: Europe Market for Cyber Security of Cars Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Market for Cyber Security of Cars Share (%) by Company 2024

List of Tables

- Table 1: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 3: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 4: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 14: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 15: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Market for Cyber Security of Cars?

The projected CAGR is approximately 9.50%.

2. Which companies are prominent players in the Europe Market for Cyber Security of Cars?

Key companies in the market include Arilou Technologies, Continental AG, Harman International Industries Inc (Samsung), Escrypt GmbH, Infineon Technologies AG, Visteon Corporation, Secunet AG, Delphi Automotive PLC, IBM Corporation, NXP Semiconductors NV, Argus Cybersecurity, Cisco Systems Inc, Honeywell International Inc.

3. What are the main segments of the Europe Market for Cyber Security of Cars?

The market segments include Solution Type, Equipment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Security Threats as More Technologies Get Integrated Into Cars; Government Regulations.

6. What are the notable trends driving market growth?

Cloud Security Expected to Witness Significant Market Share.

7. Are there any restraints impacting market growth?

Unavailability for skilled workforce.

8. Can you provide examples of recent developments in the market?

January 2020 - HARMAN launched the HARMAN Ignite Marketplace, an extensive network of cloud-based applications and services available on the HARMAN Ignite Cloud Platform. The HARMAN Ignite platform provides a built-in Over-the-Air (OTA) functionality, which helps manage potential risks like network problems, file tampering, and cybersecurity attacks, due to which automakers are equipped with a secure and efficient way to deliver and frequently update a robust service ecosystem while still mitigating risk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Market for Cyber Security of Cars," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Market for Cyber Security of Cars report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Market for Cyber Security of Cars?

To stay informed about further developments, trends, and reports in the Europe Market for Cyber Security of Cars, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence