Key Insights

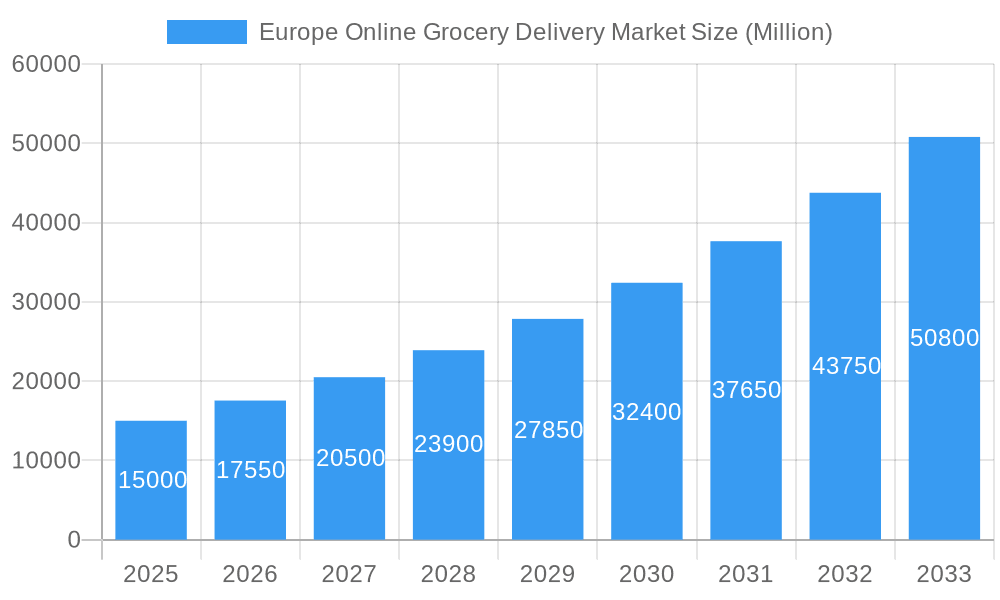

The European online grocery delivery market is projected for significant expansion, driven by evolving consumer preferences for convenience, technological integration, and the widespread adoption of e-commerce. The market is forecasted to achieve a Compound Annual Growth Rate (CAGR) of 22.46%, reaching a valuation of 81.81 billion by 2025. Key growth catalysts include the burgeoning popularity of quick commerce (Q-commerce) models, the increasing demand for health-conscious meal kit services, and the expanded delivery capabilities of major grocery retailers. Germany, the UK, and France are leading markets due to high internet penetration and robust disposable incomes. Challenges such as optimizing last-mile logistics, managing operational expenditures, and addressing consumer concerns regarding product freshness and environmental impact require strategic attention. Product segmentation indicates retail delivery as the primary segment, with Q-commerce and meal kits demonstrating accelerated growth fueled by modern consumer lifestyles.

Europe Online Grocery Delivery Market Market Size (In Billion)

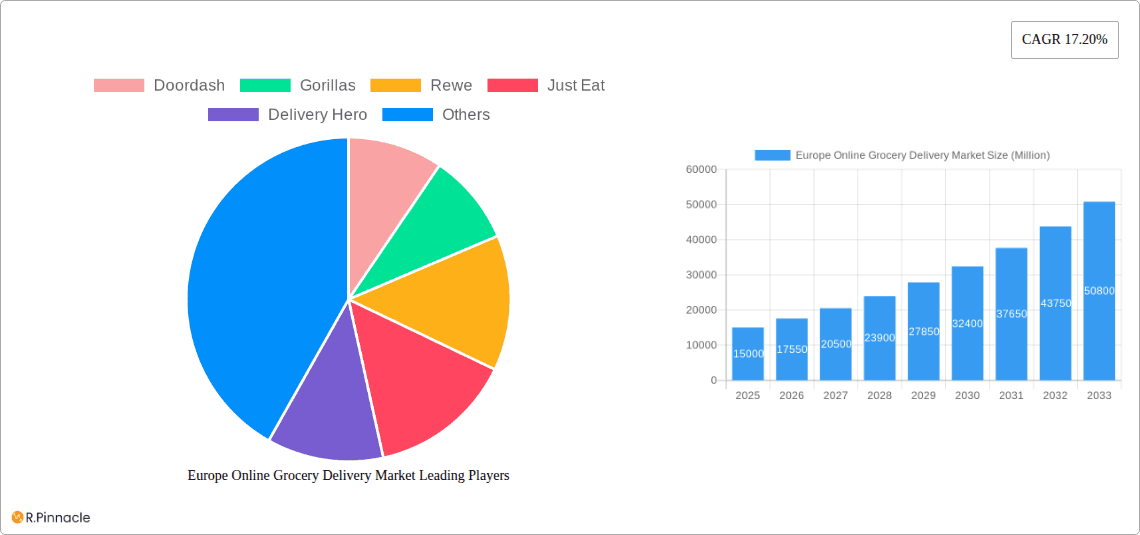

The competitive arena is dynamic, featuring key players like Doordash, Gorillas, Rewe, Just Eat, Delivery Hero, Uber Eats, Flink, Amazon, Zomato, and Getir. Strategic alliances, technological advancements, and geographical expansion are critical for market leadership. Future market trajectory will hinge on companies' ability to innovate in sustainability, operational efficiency, and personalized customer experiences, including AI-driven recommendations. Eastern Europe is expected to witness substantial growth as online grocery penetration rises. The overall outlook for the European online grocery delivery market remains highly positive, supported by sustained consumer demand and continuous sector innovation.

Europe Online Grocery Delivery Market Company Market Share

Europe Online Grocery Delivery Market Analysis: 2019-2033

This detailed report provides comprehensive analysis of the Europe online grocery delivery market, delivering critical insights for industry stakeholders and investors. Examining the period from 2019 to 2033, with a specific focus on 2025, this report details market structure, dynamics, key players, and future projections. Optimized with high-ranking keywords for maximum visibility, this report is an essential resource for understanding market trends and opportunities.

Europe Online Grocery Delivery Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the European online grocery delivery market. We delve into market concentration, examining the market share of key players like Doordash, Gorillas, Rewe, Just Eat, Delivery Hero, Uber Eats, Flink, Amazon com Inc, Zomato, and Getir. We explore the impact of mergers and acquisitions (M&A) activities, analyzing deal values and their influence on market consolidation. The analysis includes:

- Market Concentration: We assess the level of competition and identify dominant players, calculating market share percentages for each major company. For example, we estimate that Amazon holds approximately xx% of the market share in 2025.

- Innovation Drivers: The report explores technological advancements driving market growth, such as improved delivery logistics, AI-powered recommendation engines, and personalized customer experiences.

- Regulatory Frameworks: We analyze the impact of EU regulations on data privacy, food safety, and competition, assessing their influence on market expansion and player strategies.

- Product Substitutes: We identify potential substitutes for online grocery delivery services and evaluate their competitive threat.

- End-User Demographics: We analyze the demographic characteristics of online grocery shoppers, including age, income, location, and lifestyle preferences. This segmentation helps to understand different needs and preferences across the market.

- M&A Activities: The report details significant M&A transactions within the industry during the historical period (2019-2024), quantifying deal values and analyzing their impact on market structure and competitive dynamics. We estimate that the total value of M&A deals during this period reached approximately xx Million.

Europe Online Grocery Delivery Market Dynamics & Trends

This section examines the key factors driving market growth, technological disruptions, evolving consumer preferences, and competitive dynamics. We quantify these factors using metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates. Our analysis incorporates:

- Market Growth Drivers: We explore factors like rising disposable incomes, increasing urbanization, time-constrained lifestyles, and the expanding adoption of e-commerce.

- Technological Disruptions: We assess the impact of technologies such as AI, blockchain, and IoT on delivery efficiency, customer experience, and supply chain optimization.

- Consumer Preferences: The report analyzes shifting consumer preferences, such as demand for personalized recommendations, sustainable packaging, and ethical sourcing of products.

- Competitive Dynamics: We analyze competitive strategies employed by leading players, including pricing strategies, marketing campaigns, and partnerships. We project a CAGR of xx% for the forecast period (2025-2033). Market penetration is estimated to reach xx% by 2033.

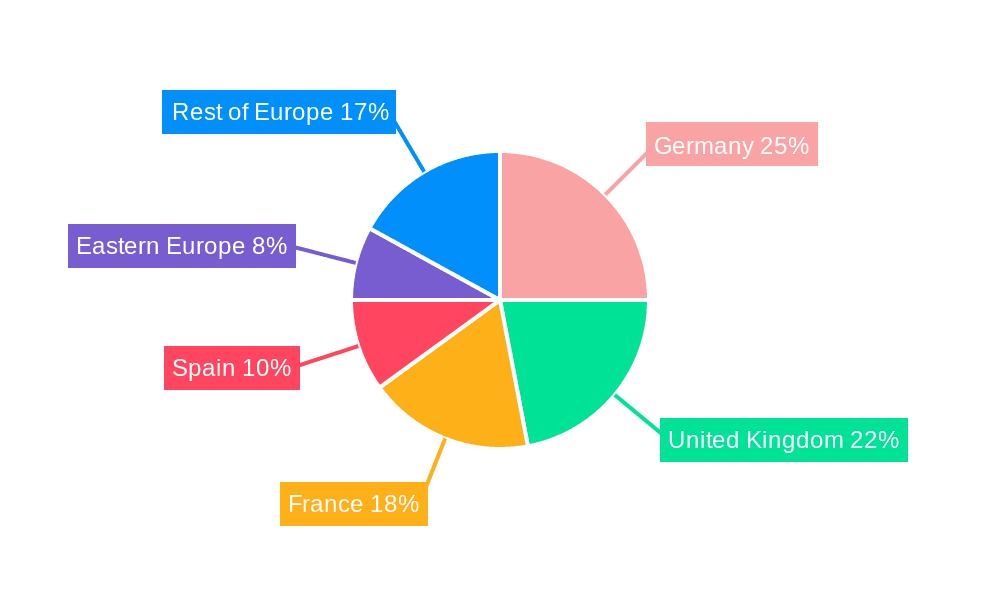

Dominant Regions & Segments in Europe Online Grocery Delivery Market

This section identifies the leading regions and segments within the European online grocery delivery market. The analysis focuses on:

- By Product Type: Retail Delivery, Quick Commerce, Meal Kit Delivery

- By Country: United Kingdom, Germany, France, Spain, Eastern Europe, Rest of Europe

Key Drivers of Regional Dominance:

- United Kingdom: Strong e-commerce infrastructure, high internet penetration, and established logistics networks.

- Germany: Large population, high disposable incomes, and growing adoption of online shopping.

- France: Increasing urbanization, evolving consumer behavior, and investments in logistics infrastructure.

- Spain: Rising internet usage, increasing demand for convenience, and improving logistics capabilities.

The United Kingdom is projected to remain the leading market, driven by high levels of internet penetration and established logistics. Germany is likely to see substantial growth due to its large population and robust economy.

Europe Online Grocery Delivery Market Product Innovations

The market demonstrates consistent product innovation, incorporating technologies like automated warehouses, drone delivery, and personalized shopping recommendations. These advancements enhance delivery speed, efficiency, and customer satisfaction, establishing a competitive advantage and broadening market reach.

Report Scope & Segmentation Analysis

This report segments the market by product type (Retail Delivery, Quick Commerce, Meal Kit Delivery) and by country (United Kingdom, Germany, France, Spain, Eastern Europe, Rest of Europe). Each segment is analyzed, with projections for market size and growth. Competitive dynamics within each segment are also addressed. For instance, the Quick Commerce segment is expected to witness significant growth, driven by increased demand for rapid delivery options.

Key Drivers of Europe Online Grocery Delivery Market Growth

Several factors fuel the growth of the European online grocery delivery market. These include: increasing internet and smartphone penetration, rising disposable incomes, changing lifestyles favoring convenience, and ongoing technological advancements such as improved logistics and AI-powered services. Government support for digital infrastructure further enhances market expansion.

Challenges in the Europe Online Grocery Delivery Market Sector

The sector faces challenges such as intense competition, high operational costs (including labor and logistics), stringent regulations, and potential supply chain disruptions. These hurdles impact profitability and market expansion, requiring innovative solutions and strategic adaptations. The impact of these challenges is estimated to reduce market growth by xx% during the forecast period.

Emerging Opportunities in Europe Online Grocery Delivery Market

Emerging opportunities exist in expanding into less-penetrated regions, particularly in Eastern Europe. The integration of advanced technologies like AI and drone delivery offers further growth potential. Focusing on sustainable practices and catering to specific dietary needs will also enhance market share.

Leading Players in the Europe Online Grocery Delivery Market Market

- Doordash

- Gorillas

- Rewe

- Just Eat

- Delivery Hero

- Uber Eats

- Flink

- Amazon com Inc

- Zomato

- Getir

Key Developments in Europe Online Grocery Delivery Market Industry

- January 2023: Sainsbury's partners with Just Eat for faster grocery delivery, expanding reach and service speed.

- February 2022: Rohlik Group expands Knusper.de into Germany's Rhine-Main region, increasing market presence and product offerings.

Future Outlook for Europe Online Grocery Delivery Market Market

The European online grocery delivery market exhibits substantial growth potential, driven by technological innovation, changing consumer behavior, and expanding market penetration. Strategic partnerships, efficient logistics solutions, and a focus on customer experience will be crucial for success in this dynamic market. We anticipate continued market expansion and consolidation in the coming years.

Europe Online Grocery Delivery Market Segmentation

-

1. Product Type

- 1.1. Retail Delivery

- 1.2. Quick Commerce

- 1.3. Meal Kit Delivery

Europe Online Grocery Delivery Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Online Grocery Delivery Market Regional Market Share

Geographic Coverage of Europe Online Grocery Delivery Market

Europe Online Grocery Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Attractive Offers and Payment Flexibility to Boost the Demand of the Market

- 3.3. Market Restrains

- 3.3.1. High-priced products and additional delivery charges; Inconsistency in product quality

- 3.4. Market Trends

- 3.4.1. Attractive Offers and Payment Flexibility to Boost the Demand of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Online Grocery Delivery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Retail Delivery

- 5.1.2. Quick Commerce

- 5.1.3. Meal Kit Delivery

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Doordash

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gorillas

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rewe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Just Eat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Delivery Hero

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Uber Eats

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Flink

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amazon com Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zomato

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Getir

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Doordash

List of Figures

- Figure 1: Europe Online Grocery Delivery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Online Grocery Delivery Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Online Grocery Delivery Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe Online Grocery Delivery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Online Grocery Delivery Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Europe Online Grocery Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Online Grocery Delivery Market?

The projected CAGR is approximately 22.46%.

2. Which companies are prominent players in the Europe Online Grocery Delivery Market?

Key companies in the market include Doordash, Gorillas, Rewe, Just Eat, Delivery Hero, Uber Eats, Flink, Amazon com Inc, Zomato, Getir.

3. What are the main segments of the Europe Online Grocery Delivery Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 81.81 billion as of 2022.

5. What are some drivers contributing to market growth?

Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Attractive Offers and Payment Flexibility to Boost the Demand of the Market.

6. What are the notable trends driving market growth?

Attractive Offers and Payment Flexibility to Boost the Demand of the Market.

7. Are there any restraints impacting market growth?

High-priced products and additional delivery charges; Inconsistency in product quality.

8. Can you provide examples of recent developments in the market?

January 2023: Sainsbury's, the UK's largest supermarket chain, has partnered with online meal ordering and delivery service Eat Takeaway to provide speedier home delivery for groceries across the country. Customers can order things from Sainsbury's for delivery in under 30 minutes using the Just Eat app. The cooperation will begin with more than 175 stores by the end of February, with a nationwide rollout planned for 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Online Grocery Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Online Grocery Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Online Grocery Delivery Market?

To stay informed about further developments, trends, and reports in the Europe Online Grocery Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence