Key Insights

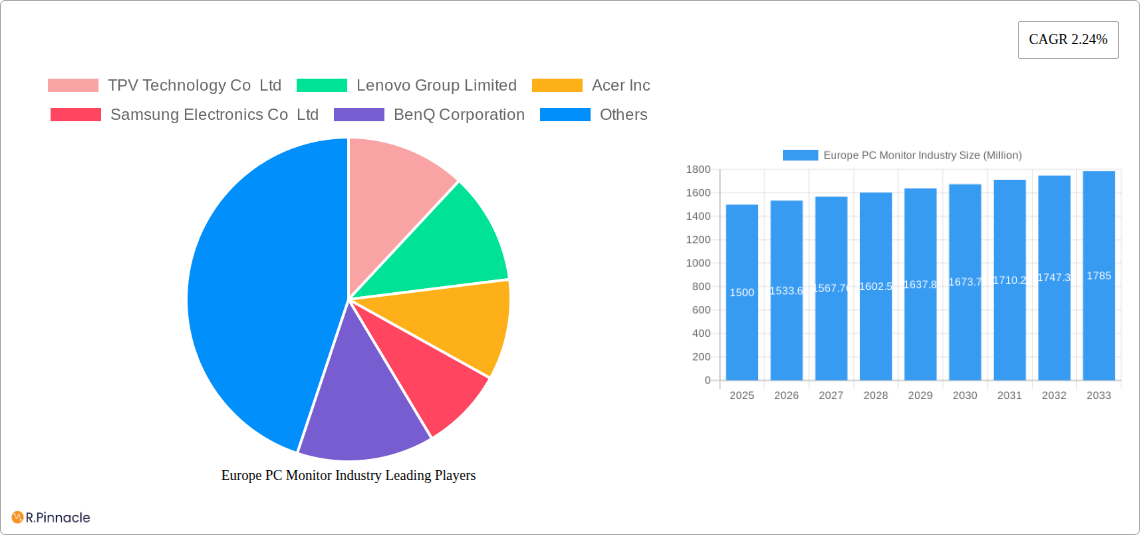

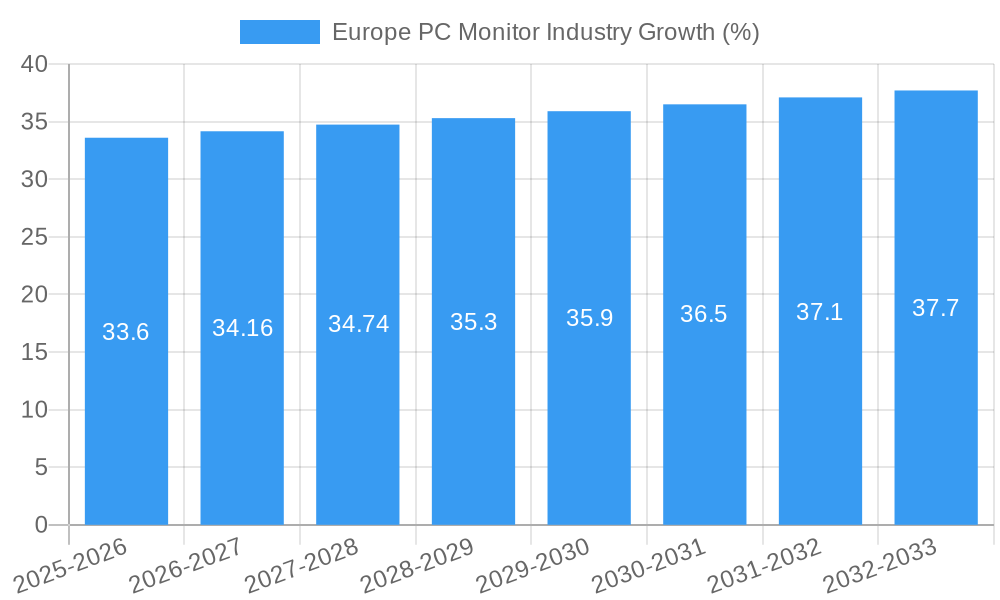

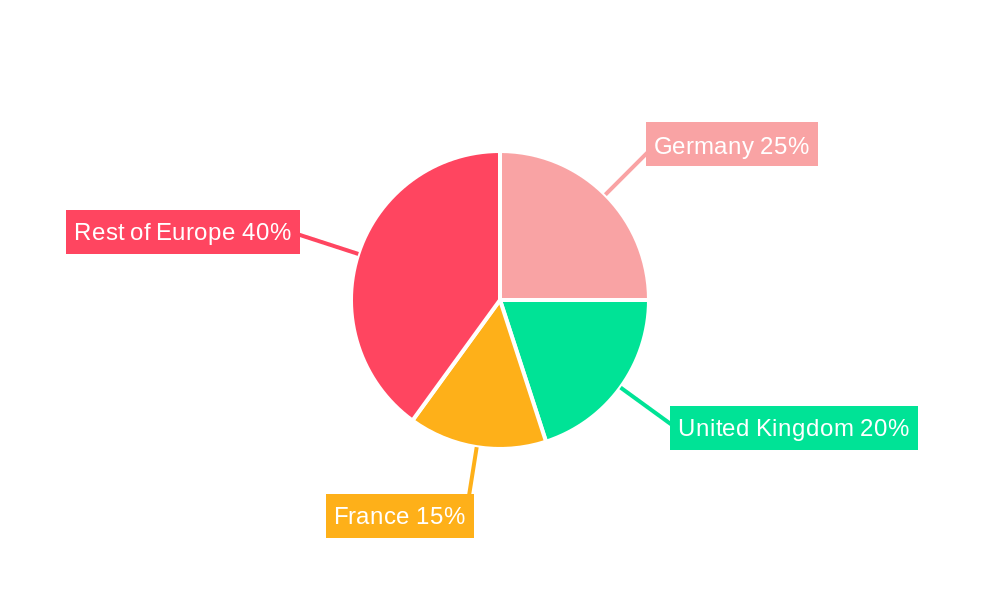

The European PC monitor market, valued at approximately €[Estimate based on XX Million and conversion rate - e.g., €1500 million] in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 2.24% from 2025 to 2033. This growth is driven by several factors. The increasing adoption of hybrid work models necessitates a larger number of monitors in both home and office settings. Furthermore, the rising popularity of gaming, particularly esports, fuels demand for high-resolution, high-refresh-rate monitors, especially among younger demographics. Technological advancements, such as the introduction of QLED and OLED technologies offering superior picture quality and improved color accuracy, also contribute to market expansion. However, economic fluctuations and the maturity of the overall PC market pose potential restraints on growth. The market is segmented by resolution (1366x768, 1920x1080, 1440p, 1536x864, etc.), type (LCD, LED, VA, CRT), application (consumer, commercial, gaming), and country (Germany, UK, France, and other European nations). Germany, the UK, and France represent the largest national markets within Europe.

The competitive landscape is dominated by major players like Samsung, Lenovo, Dell, HP, Acer, and ASUS, each offering a diverse portfolio of monitors to cater to varying needs and budgets. Future growth will likely be driven by the continued adoption of higher resolutions, advanced display technologies, and increased demand from the gaming sector. The market's relatively low CAGR indicates a mature market, but consistent innovation and evolving consumer preferences are expected to maintain steady expansion throughout the forecast period. Analyzing individual segment performance will be crucial for manufacturers seeking to optimize product portfolios and effectively target specific market niches. Focusing on eco-friendly designs and sustainable manufacturing processes will also gain increasing importance in a market increasingly conscious of its environmental impact.

Europe PC Monitor Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe PC monitor market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth trajectories. Expect actionable data, detailed segmentation, and forecasts to help navigate the evolving European PC monitor landscape.

Europe PC Monitor Industry Market Structure & Innovation Trends

The European PC monitor market is moderately concentrated, with key players like TPV Technology, Lenovo, Acer, Samsung, and Dell holding significant market share. The market structure is characterized by intense competition, driven by innovation in display technology, resolution, and features. Regulatory frameworks, including environmental standards (e.g., RoHS compliance), influence manufacturing practices. Product substitutes, like tablets and smartphones, present competitive challenges, impacting market growth. End-user demographics reveal a shift towards higher-resolution displays and specialized monitors for gaming and professional applications. M&A activity in recent years has been moderate, with deal values totaling approximately €XX Million in the historical period (2019-2024), mainly focused on strengthening supply chains and expanding market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately XX% market share in 2024.

- Innovation Drivers: Advancements in display technology (e.g., mini-LED, OLED), increasing demand for high-resolution displays, and the rise of gaming and professional applications.

- M&A Activity (2019-2024): Total deal value approximately €XX Million, primarily focused on vertical integration and geographical expansion.

- Regulatory Framework: Compliance with EU environmental regulations (e.g., RoHS, WEEE) and data privacy regulations (GDPR) are key considerations.

Europe PC Monitor Industry Market Dynamics & Trends

The European PC monitor market experienced a CAGR of XX% during 2019-2024, driven by the increasing adoption of high-resolution displays in both consumer and commercial segments. Technological disruptions, like the introduction of mini-LED and OLED technologies, are reshaping the market. Consumer preferences are shifting towards larger screen sizes, higher refresh rates, and better color accuracy. Competitive dynamics are characterized by price wars, product differentiation through innovative features, and strategic partnerships. Market penetration of high-resolution monitors (above 1920x1080) is steadily increasing, expected to reach XX% by 2033. The forecast period (2025-2033) projects a CAGR of XX%, with substantial growth anticipated in gaming and professional segments.

Dominant Regions & Segments in Europe PC Monitor Industry

Germany, the United Kingdom, and France represent the leading markets within Europe, accounting for approximately XX% of the total market in 2024. The dominance of these regions is attributed to robust IT infrastructure, high per capita income, and significant consumer spending on electronics. Within the segment analysis:

- By Resolution: 1920x1080 remains the dominant resolution, although higher resolutions (1440p, 4K) are gaining traction, especially in the gaming and professional segments.

- By Type: LCD monitors continue to dominate, although LED and mini-LED technologies are experiencing rapid growth. CRT monitors have become a niche market. The QLED market is in an early adoption phase.

- By Application: Consumer and commercial applications account for the largest segment, with gaming experiencing significant growth due to increasing popularity of esports and high-end gaming PCs.

Key Drivers for Dominant Regions:

- Germany: Strong industrial base, high technological adoption rates.

- United Kingdom: Large consumer base, high disposable income.

- France: Expanding digital infrastructure, strong government support for technology adoption.

Europe PC Monitor Industry Product Innovations

Recent product innovations focus on improved display technologies (mini-LED, OLED), higher resolutions (6K), and features designed to enhance user experience (e.g., adaptive sync technologies, HDR support). The market sees a convergence of features catering to gaming and professional use, including curved screens, higher refresh rates, and advanced color management capabilities. These innovations target market segments seeking high-quality visuals and enhanced performance.

Report Scope & Segmentation Analysis

This report segments the European PC monitor market by resolution (1366x768, 1920x1080, 1536x864, 1440x900, 1280x1024, Other Resolutions), type (LCD Monitor, LED Monitor, VA LED Monitor, CRT, Others), application (Consumer, Commercial, Gaming, Other), and country (Germany, UK, France, Rest of Europe). Growth projections indicate a significant increase in market size across all segments, with specific growth rates detailed within the full report. Competitive dynamics are shaped by technological advancements, pricing strategies, and brand recognition.

Key Drivers of Europe PC Monitor Industry Growth

The growth of the European PC monitor market is driven by several factors, including the rising demand for high-resolution displays from both consumers and businesses, the increasing popularity of gaming, and technological advancements like mini-LED, resulting in superior visuals and color accuracy. Furthermore, the growing adoption of remote work and the expanding use of PCs in various industries, including education and healthcare, are propelling market growth.

Challenges in the Europe PC Monitor Industry Sector

Challenges facing the industry include increasing competition from alternative display technologies (like smartphones and tablets), fluctuations in raw material prices, potential supply chain disruptions, and the environmental concerns associated with manufacturing and disposal of electronic waste. These factors contribute to pressure on profit margins and require manufacturers to focus on efficiency and sustainability.

Emerging Opportunities in Europe PC Monitor Industry

Emerging opportunities arise from the increasing demand for high-end gaming monitors, specialized displays for professional applications (e.g., graphic design, video editing), and advancements in foldable and curved monitor designs. The growing importance of sustainability and the introduction of eco-friendly materials and manufacturing processes create opportunities for environmentally conscious brands.

Leading Players in the Europe PC Monitor Industry Market

- TPV Technology Co Ltd

- Lenovo Group Limited

- Acer Inc

- Samsung Electronics Co Ltd

- BenQ Corporation

- ASUSTeK Computer Inc

- HP Development Company L P

- Micro-Star INT'L CO LTD

- Dell Technologies Inc

- ViewSonic Corporation Inc

- LG Electronics

Key Developments in Europe PC Monitor Industry

- May 2023: Dell Inc. launched a 32-inch 6K monitor with IPS Black technology and Zoom certification, showcasing advancements in high-resolution displays and collaboration tools.

- December 2022: Lenovo launched new ThinkVision monitors (P27pz-30 and P32pz-30) featuring 1,152 dimming zones, improving image quality and reducing halo effects.

Future Outlook for Europe PC Monitor Industry Market

The future of the European PC monitor market is promising, driven by technological advancements, rising demand for higher-resolution and specialized displays, and the continued growth of related industries like gaming and remote work. Strategic opportunities exist for manufacturers that can innovate in display technology, offer sustainable products, and cater to niche markets with customized solutions. The market is poised for continued growth, albeit at a potentially slower rate compared to previous periods, due to market saturation in certain segments.

Europe PC Monitor Industry Segmentation

-

1. Resolution

- 1.1. 1366x768

- 1.2. 1920x1080

- 1.3. 1536x864

- 1.4. 1440x900

- 1.5. 1280x720

- 1.6. Other Resolutions

-

2. Type

-

2.1. LCD Monitor

- 2.1.1. In-Plane Switching (IPS)

- 2.1.2. Twisted Nematic (TN)

- 2.1.3. Vertical Alignment (VA)

- 2.2. LED Monitor

- 2.3. CRT

- 2.4. Others (QLED, Plasma, etc.)

-

2.1. LCD Monitor

-

3. Application

- 3.1. Consumer and Commercial

- 3.2. Gaming

- 3.3. Other Applications

Europe PC Monitor Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe PC Monitor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Work From Home Jobs due to Pendamic; Availability of High Speed Internet for Gamming

- 3.3. Market Restrains

- 3.3.1. Affected Supply Chain Distribution Due to Covid-19 Pandemic

- 3.4. Market Trends

- 3.4.1. Gaming Monitors to Witness the Fastest Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resolution

- 5.1.1. 1366x768

- 5.1.2. 1920x1080

- 5.1.3. 1536x864

- 5.1.4. 1440x900

- 5.1.5. 1280x720

- 5.1.6. Other Resolutions

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. LCD Monitor

- 5.2.1.1. In-Plane Switching (IPS)

- 5.2.1.2. Twisted Nematic (TN)

- 5.2.1.3. Vertical Alignment (VA)

- 5.2.2. LED Monitor

- 5.2.3. CRT

- 5.2.4. Others (QLED, Plasma, etc.)

- 5.2.1. LCD Monitor

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Consumer and Commercial

- 5.3.2. Gaming

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Resolution

- 6. Germany Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 TPV Technology Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Lenovo Group Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Acer Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Samsung Electronics Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BenQ Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ASUSTeK Computer Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 HP Development Company L P

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Micro-Star INT'L CO LTD

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Dell Technologies Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 ViewSonic Corporation Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 LG Electronics

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 TPV Technology Co Ltd

List of Figures

- Figure 1: Europe PC Monitor Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe PC Monitor Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe PC Monitor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe PC Monitor Industry Revenue Million Forecast, by Resolution 2019 & 2032

- Table 3: Europe PC Monitor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe PC Monitor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Europe PC Monitor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe PC Monitor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe PC Monitor Industry Revenue Million Forecast, by Resolution 2019 & 2032

- Table 15: Europe PC Monitor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Europe PC Monitor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe PC Monitor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe PC Monitor Industry?

The projected CAGR is approximately 2.24%.

2. Which companies are prominent players in the Europe PC Monitor Industry?

Key companies in the market include TPV Technology Co Ltd, Lenovo Group Limited, Acer Inc, Samsung Electronics Co Ltd, BenQ Corporation, ASUSTeK Computer Inc, HP Development Company L P, Micro-Star INT'L CO LTD, Dell Technologies Inc, ViewSonic Corporation Inc, LG Electronics.

3. What are the main segments of the Europe PC Monitor Industry?

The market segments include Resolution, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Work From Home Jobs due to Pendamic; Availability of High Speed Internet for Gamming.

6. What are the notable trends driving market growth?

Gaming Monitors to Witness the Fastest Market Growth.

7. Are there any restraints impacting market growth?

Affected Supply Chain Distribution Due to Covid-19 Pandemic.

8. Can you provide examples of recent developments in the market?

May 2023: Dell Inc. announced the launch of Dell's 32-inch monitor with a 6K resolution. The company released its new desktop at CES 2023 and claimed it's the first 6K monitor with IPS Black and a Zoom-certified collaboration keyboard.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe PC Monitor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe PC Monitor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe PC Monitor Industry?

To stay informed about further developments, trends, and reports in the Europe PC Monitor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence