Key Insights

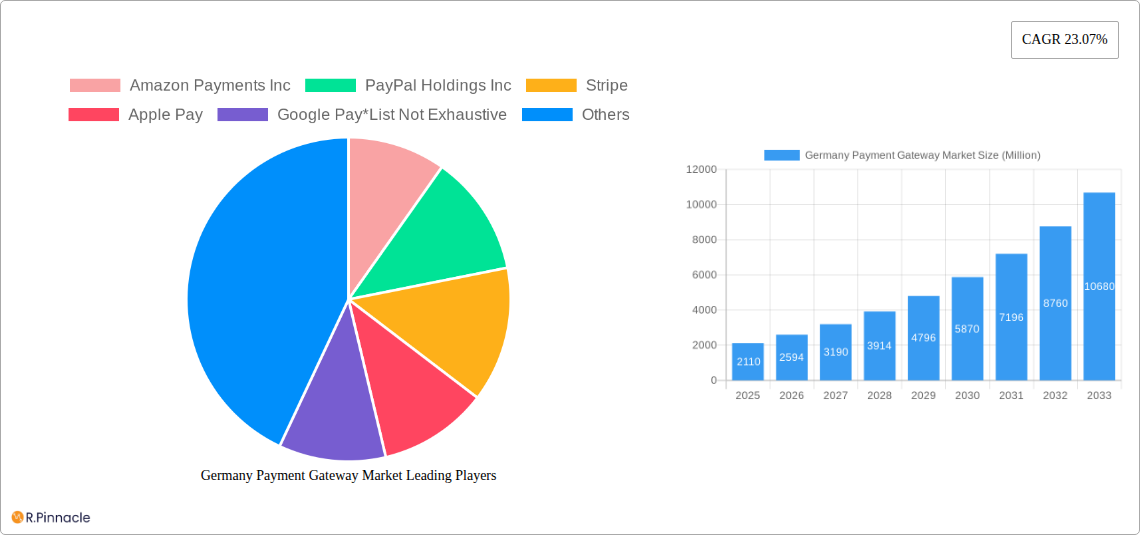

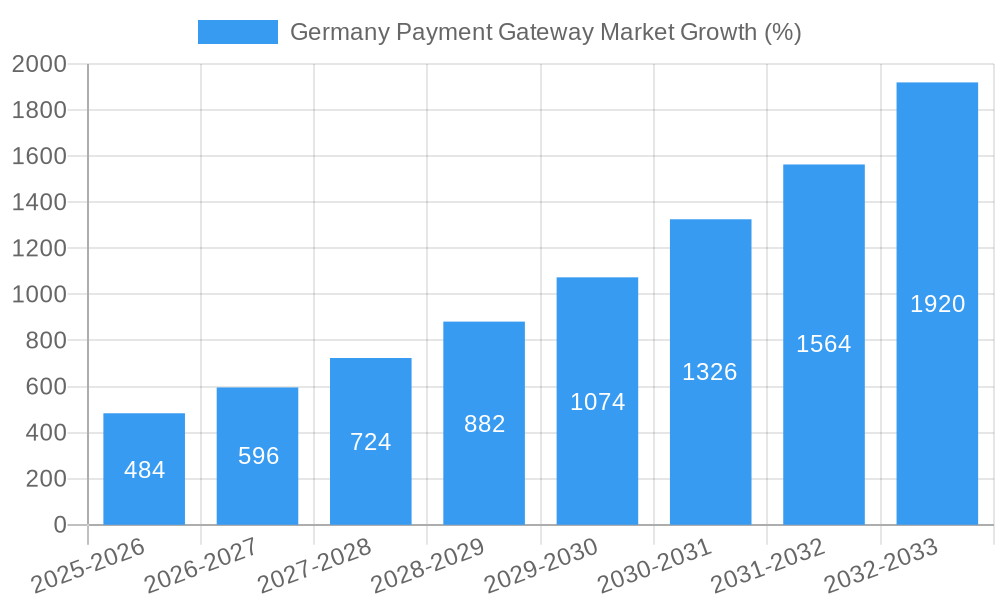

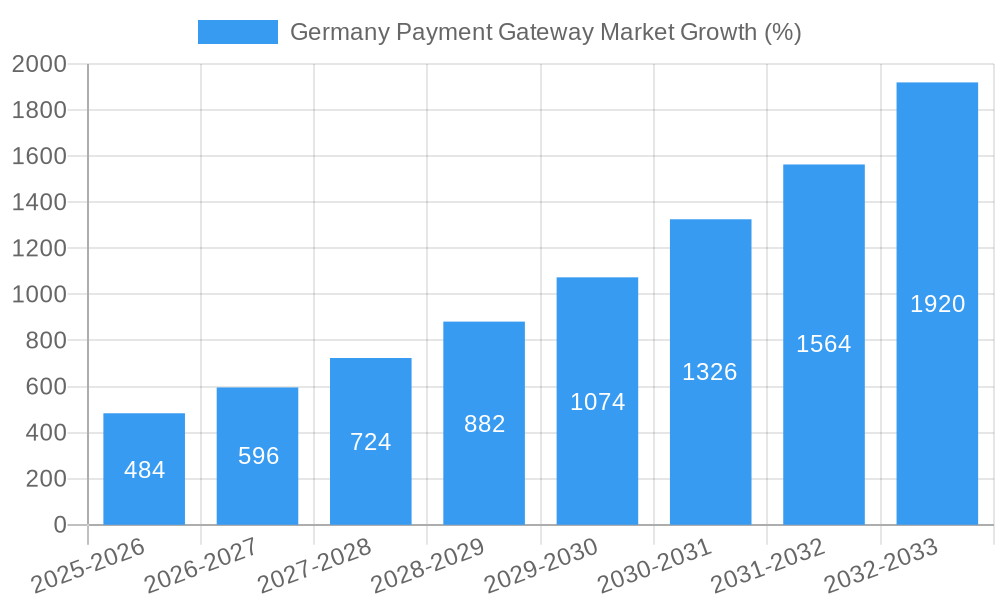

The German payment gateway market, currently valued at €2.11 billion (2025), is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 23.07% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of e-commerce and online transactions within Germany fuels demand for secure and efficient payment processing solutions. Furthermore, the rising popularity of mobile payments and digital wallets, coupled with a growing preference for contactless payment methods, significantly contributes to market growth. Government initiatives promoting digitalization and the increasing penetration of smartphones among the German population also play a crucial role. The market is segmented by payment type (credit/debit cards, mobile wallets, bank transfers, etc.), transaction value, and business type (e-commerce, retail, etc.). Competition is intense, with major players like Amazon Payments, PayPal, Stripe, Apple Pay, and Google Pay vying for market share. However, smaller, specialized providers also exist, focusing on niche segments or offering unique value propositions such as tailored security features or integration with specific ERP systems. Challenges include maintaining data security in the face of increasing cyber threats and adapting to evolving regulatory landscapes surrounding data privacy and consumer protection.

The forecast period (2025-2033) anticipates a continuation of this strong growth trajectory. The market's future success will depend on players' ability to innovate, offering seamless user experiences, robust security measures, and competitive pricing. The integration of advanced technologies like Artificial Intelligence (AI) and machine learning for fraud detection and personalized payment options will be crucial for maintaining a competitive edge. Furthermore, adapting to the evolving needs of consumers, including personalized payment experiences and diverse payment methods, will be paramount to capturing market share and driving future growth within this dynamic and expansive sector.

Germany Payment Gateway Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany Payment Gateway Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth prospects. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Germany Payment Gateway Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the German payment gateway market. We delve into market concentration, examining the market share of leading players such as Amazon Payments Inc, PayPal Holdings Inc, Stripe, Apple Pay, and Google Pay, among others. The report also explores the impact of mergers and acquisitions (M&A) activities, providing insights into deal values and their influence on market dynamics. The analysis includes an assessment of the regulatory framework governing the sector, examining its impact on innovation and market entry. We further investigate the influence of technological advancements, consumer preferences, and the availability of substitute products on the market's overall structure.

- Market Concentration: The German payment gateway market exhibits a [High/Medium/Low – Choose one based on data] level of concentration, with the top 5 players holding an estimated xx% market share in 2025.

- Innovation Drivers: Key drivers include advancements in mobile payment technologies, increasing adoption of e-commerce, and the growing demand for secure and seamless payment solutions.

- Regulatory Framework: The analysis considers the impact of PSD2 and other relevant regulations on market participants.

- M&A Activity: The report identifies significant M&A deals in the historical period (2019-2024), analyzing their impact on market share and competitive dynamics. Total M&A deal value during this period is estimated at xx Million.

- Product Substitutes: The impact of alternative payment methods, such as bank transfers and cash, is evaluated.

- End-User Demographics: The report analyzes the demographics of users of payment gateways in Germany, considering factors like age, location, and income level.

Germany Payment Gateway Market Dynamics & Trends

This section provides a detailed analysis of the key factors driving market growth, including technological advancements, evolving consumer preferences, and competitive pressures. We examine the market’s CAGR and penetration rate, along with an in-depth analysis of market growth drivers and technological disruptions. The report explores consumer behavior shifts and the impact of these on the adoption of different payment gateway solutions. The competitive landscape, including strategies employed by key players, is thoroughly analyzed.

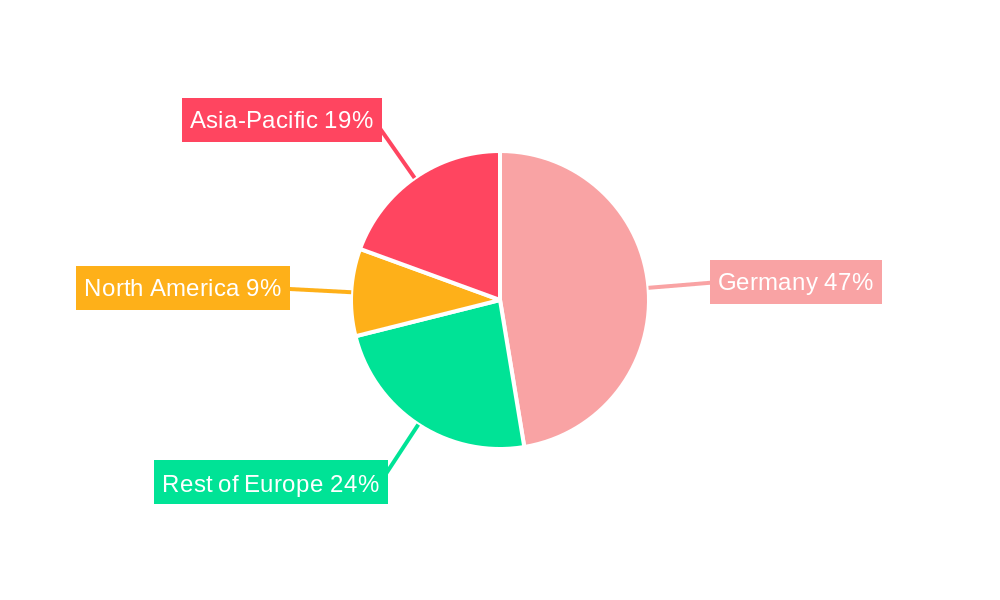

Dominant Regions & Segments in Germany Payment Gateway Market

This section identifies the leading regions and segments within the German payment gateway market. We utilize detailed analysis to pinpoint areas of strong performance, outlining their key drivers and factors contributing to their dominance.

- Leading Region/Segment: [Identify the leading region/segment based on data, e.g., Urban areas show the highest market penetration due to higher internet and smartphone penetration].

- Key Drivers:

- Economic Policies: [Describe relevant economic policies and their effects, e.g., government initiatives supporting digitalization].

- Infrastructure: [Discuss the role of infrastructure such as reliable internet connectivity and robust banking systems].

- Consumer Behavior: [Analyze consumer preferences and adoption rates in the dominant segment].

Germany Payment Gateway Market Product Innovations

This section summarizes recent product developments and their impact on the market. It highlights technological trends and the successful market integration of new products, emphasizing competitive advantages derived from innovative features.

Report Scope & Segmentation Analysis

This section details the market segmentation used in the report and provides growth projections, market sizes, and competitive dynamics for each segment. The report segments the market by [mention segments, e.g., payment type (credit card, debit card, mobile wallets), business size (SMB, enterprise), industry vertical (e-commerce, retail, etc.)]. Each segment's growth trajectory, market size in 2025 and projected sizes, and competitive landscape are analyzed individually.

Key Drivers of Germany Payment Gateway Market Growth

This section identifies and analyzes the key factors driving market growth. These include technological advancements (e.g., the rise of mobile payments and digital wallets), economic factors (e.g., increasing e-commerce adoption and rising disposable incomes), and regulatory changes (e.g., the implementation of PSD2).

Challenges in the Germany Payment Gateway Market Sector

This section discusses the challenges faced by the German payment gateway market, including regulatory hurdles, security concerns, and competition from alternative payment methods. The quantitative impact of these challenges is assessed wherever possible.

Emerging Opportunities in Germany Payment Gateway Market

This section highlights emerging opportunities in the German payment gateway market, such as the growth of mobile payments, the increasing adoption of open banking, and the expansion into new market segments (e.g., the gig economy).

Leading Players in the Germany Payment Gateway Market Market

- Amazon Payments Inc

- PayPal Holdings Inc

- Stripe

- Apple Pay

- Google Pay

- *List Not Exhaustive

Key Developments in Germany Payment Gateway Market Industry

- July 2024: Launch of Wero, a digital payment wallet by the European Payments Initiative (EPI), facilitating instant account-to-account transfers in Germany. This is expected to significantly impact P2P transactions and increase competition in the market.

- January 2024: Partnership between Global Payments Inc. and Commerzbank to offer tailored digital payment solutions for SMEs in Germany. This will likely boost the adoption of digital payment solutions among smaller businesses.

Future Outlook for Germany Payment Gateway Market Market

The future of the German payment gateway market looks promising, driven by continued growth in e-commerce, increasing smartphone penetration, and ongoing technological innovations. Strategic opportunities exist for players who can adapt to evolving consumer preferences, leverage open banking capabilities, and offer secure and innovative payment solutions. The market is projected to experience substantial growth in the coming years, presenting significant potential for established players and new entrants alike.

Germany Payment Gateway Market Segmentation

-

1. Type

- 1.1. Hosted

- 1.2. Non-Hosted

-

2. Enterprise

- 2.1. Small and Medium Enterprise (SME)

- 2.2. Large Enterprise

-

3. End-User

- 3.1. Travel

- 3.2. Retail

- 3.3. BFSI

- 3.4. Media and Entertainment

- 3.5. Other End-users

Germany Payment Gateway Market Segmentation By Geography

- 1. Germany

Germany Payment Gateway Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail

- 3.3. Market Restrains

- 3.3.1. Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Payment Gateways in Retail to drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Payment Gateway Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hosted

- 5.1.2. Non-Hosted

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Small and Medium Enterprise (SME)

- 5.2.2. Large Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Travel

- 5.3.2. Retail

- 5.3.3. BFSI

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amazon Payments Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PayPal Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stripe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Apple Pay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Google Pay*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Amazon Payments Inc

List of Figures

- Figure 1: Germany Payment Gateway Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Payment Gateway Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Payment Gateway Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Payment Gateway Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Germany Payment Gateway Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Germany Payment Gateway Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Germany Payment Gateway Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 6: Germany Payment Gateway Market Volume Billion Forecast, by Enterprise 2019 & 2032

- Table 7: Germany Payment Gateway Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Germany Payment Gateway Market Volume Billion Forecast, by End-User 2019 & 2032

- Table 9: Germany Payment Gateway Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Germany Payment Gateway Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Germany Payment Gateway Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Germany Payment Gateway Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Germany Payment Gateway Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 14: Germany Payment Gateway Market Volume Billion Forecast, by Enterprise 2019 & 2032

- Table 15: Germany Payment Gateway Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Germany Payment Gateway Market Volume Billion Forecast, by End-User 2019 & 2032

- Table 17: Germany Payment Gateway Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Germany Payment Gateway Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Payment Gateway Market?

The projected CAGR is approximately 23.07%.

2. Which companies are prominent players in the Germany Payment Gateway Market?

Key companies in the market include Amazon Payments Inc, PayPal Holdings Inc, Stripe, Apple Pay, Google Pay*List Not Exhaustive.

3. What are the main segments of the Germany Payment Gateway Market?

The market segments include Type, Enterprise, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail.

6. What are the notable trends driving market growth?

Growing Adoption of Payment Gateways in Retail to drive the Market.

7. Are there any restraints impacting market growth?

Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail.

8. Can you provide examples of recent developments in the market?

July 2024: In a significant move, the European Payments Initiative (EPI) has unveiled Wero, an advanced digital payment wallet, in Germany. This initiative, a collaboration with founding members DSGV and DZ BANK, is set to be bolstered by Deutsche Bank's entry later this year. German users can now execute instant, account-to-account money transfers directly through their banking apps. Wero's debut feature focuses on person-to-person (P2P) transactions, allowing users to send and receive money in just 10 seconds. Transfers can be initiated using a phone number, email address, or an app-generated QR code, all without the need for intermediary accounts. Beyond its launch in Germany, Wero is gearing up for cross-border payments, eyeing Belgium and France as its initial targets, followed by expansions into the Netherlands and Luxembourg.January 2024: Global Payments Inc., renowned for its payment technology and software solutions, has teamed up with Commerzbank. Commerzbank stands out as Germany's premier bank for small and medium-sized enterprises and is a trusted ally for corporate clients, as well as private and small-business customers. Together, they aim to roll out digital payment solutions tailored for small and medium-sized businesses throughout Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Payment Gateway Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Payment Gateway Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Payment Gateway Market?

To stay informed about further developments, trends, and reports in the Germany Payment Gateway Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence