Key Insights

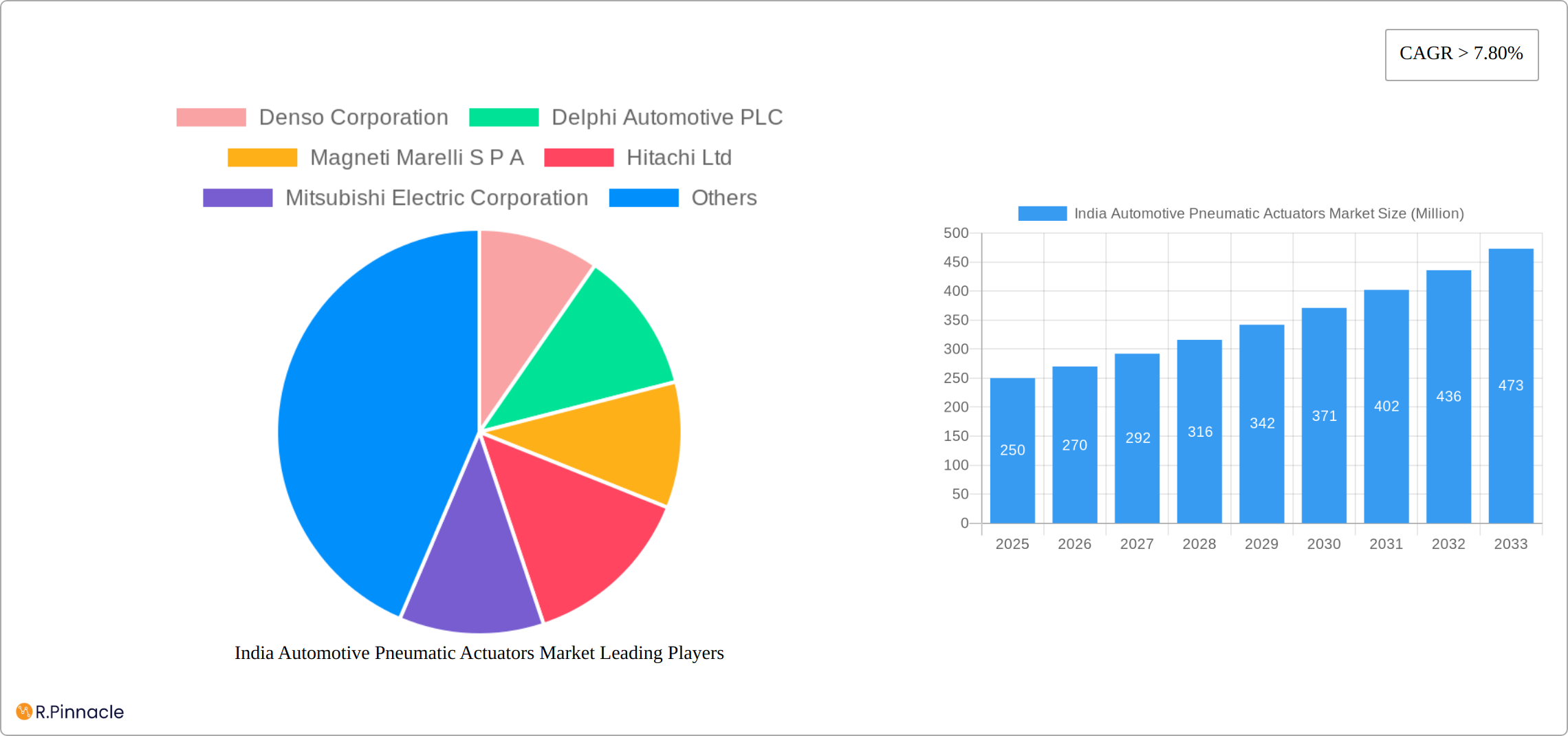

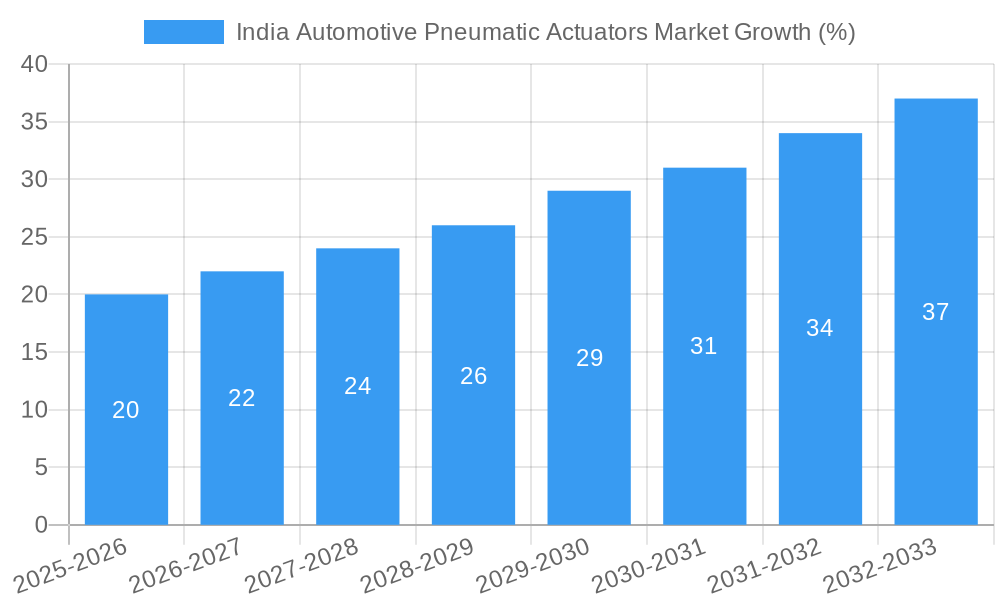

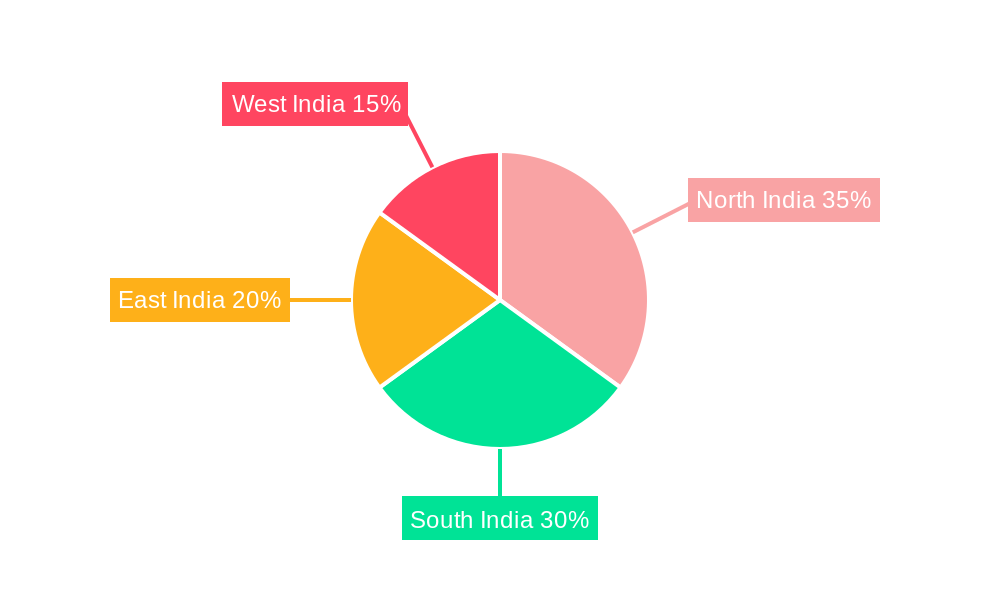

The India Automotive Pneumatic Actuators Market is experiencing robust growth, driven by the expanding automotive industry and increasing demand for fuel-efficient and advanced driver-assistance systems (ADAS). The market's Compound Annual Growth Rate (CAGR) exceeding 7.80% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by factors such as the rising adoption of pneumatic actuators in passenger cars and commercial vehicles, particularly for applications like throttle control, fuel injection, and braking systems. The preference for pneumatic actuators stems from their reliability, cost-effectiveness, and suitability for harsh operating conditions. Segmentation by application type (throttle actuator, fuel injector actuator, brake actuator, and others) and vehicle type (passenger cars and commercial vehicles) reveals a diverse market landscape with opportunities across various segments. The market is further segmented geographically, encompassing North, South, East, and West India, each exhibiting varying growth potentials based on regional automotive manufacturing hubs and infrastructure development.

Looking ahead, the forecast period (2025-2033) promises continued expansion, propelled by government initiatives promoting vehicle electrification and the increasing adoption of advanced safety features. However, challenges remain, including the rising competition from electric and hybrid vehicles, which may reduce the overall demand for pneumatic actuators in the long term. Furthermore, stringent emission norms and the growing preference for electronically controlled systems could pose restraints to market growth. Nevertheless, the continuous development of advanced pneumatic actuators with improved efficiency and performance is expected to mitigate these challenges and sustain market growth in the coming years. Key players like Denso, Delphi, Magneti Marelli, and Bosch are actively contributing to technological advancements and market expansion through strategic partnerships, product innovations, and investments in research and development.

India Automotive Pneumatic Actuators Market Report: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the India Automotive Pneumatic Actuators Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, growth drivers, challenges, and opportunities, ultimately projecting future market potential. The report leverages detailed data and analysis to provide actionable strategies for success within this rapidly evolving market.

India Automotive Pneumatic Actuators Market Structure & Innovation Trends

The India Automotive Pneumatic Actuators market exhibits a moderately concentrated structure, with key players like Denso Corporation, Delphi Automotive PLC, and Bosch vying for market share. While precise market share figures for each company are proprietary, analysis suggests a combined share of approximately 40% amongst these top three players in 2025. The market is driven by continuous innovation in actuator technology, particularly focusing on enhanced efficiency, durability, and integration with advanced driver-assistance systems (ADAS). Stringent emission norms imposed by the Indian government are accelerating the adoption of fuel-efficient actuators. Furthermore, the rising demand for passenger and commercial vehicles in India is a significant market driver. Product substitution is primarily driven by the adoption of electronically controlled actuators, posing a challenge to the pneumatic segment. However, the relatively low cost and robust nature of pneumatic actuators continue to sustain their market relevance. The market has witnessed several M&A activities in recent years, with deal values typically ranging from USD xx Million to USD xx Million. These activities often focus on strategic partnerships and the expansion of product portfolios. End-user demographics are largely influenced by the automotive industry's growth trajectory, with a significant focus on both domestic and international OEMs.

India Automotive Pneumatic Actuators Market Dynamics & Trends

The India Automotive Pneumatic Actuators market is experiencing robust growth, projected to exhibit a CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by the expanding automotive sector, particularly the burgeoning demand for passenger cars and commercial vehicles in India. Increasing urbanization and rising disposable incomes are driving vehicle ownership. Technological disruptions, such as the adoption of advanced materials and manufacturing processes, are leading to improved actuator performance and reduced costs. Consumer preferences are shifting toward vehicles equipped with advanced safety and comfort features, enhancing the demand for sophisticated actuators. Competitive dynamics are shaped by technological advancements, pricing strategies, and the ongoing efforts to meet stringent regulatory requirements. Market penetration of pneumatic actuators remains significant, particularly in the commercial vehicle segment, with estimates exceeding xx% in 2025. However, the transition to electronically controlled systems is expected to gradually reduce this penetration rate in the coming years.

Dominant Regions & Segments in India Automotive Pneumatic Actuators Market

-

Dominant Region: The industrial heartlands of India, especially major automotive manufacturing clusters such as Pune, Chennai, and the National Capital Region (NCR) including Gurgaon and its surrounding areas, are at the forefront of the automotive pneumatic actuators market. These regions benefit from a well-established automotive ecosystem, encompassing sophisticated supply chains, a readily available pool of skilled engineering and manufacturing talent, and substantial capital investments from leading Original Equipment Manufacturers (OEMs). The presence of a strong automotive manufacturing base directly translates to a higher concentration of demand and innovation in pneumatic actuator technologies.

-

Dominant Segments:

- By Application Type: The Throttle Actuator segment continues to command the largest market share, intrinsically linked to precise engine management and performance optimization. Simultaneously, the Brake Actuator segment is experiencing a significant upswing. This growth is propelled by the escalating stringency of vehicle safety regulations and the increasing consumer demand for advanced driver-assistance systems (ADAS) that rely on sophisticated braking mechanisms, including those enhanced by pneumatic actuation. Other applications like clutch actuation and suspension systems are also contributing to market diversification.

- By Vehicle Type: The Passenger Car segment remains the dominant force, mirroring the robust and sustained expansion of India's passenger vehicle market, fueled by rising disposable incomes and evolving mobility preferences. However, the Commercial Vehicle segment is projected for substantial and rapid growth. This surge is attributable to aggressive government investments in infrastructure development, the expansion of the e-commerce sector, and the increasing need for efficient and reliable logistics solutions across the country.

Key Drivers of Market Dominance:

- Supportive Economic Policies & Government Initiatives: Strategic government policies, including "Make in India" and Production Linked Incentive (PLI) schemes, are actively promoting domestic vehicle manufacturing and component production. Furthermore, substantial government impetus for infrastructure development, such as the expansion of national highways and the development of industrial corridors, creates a fertile ground for increased vehicle production and subsequent demand for automotive components.

- Robust Infrastructure Development: Continuous enhancements in India's transportation and logistics infrastructure, including upgraded national highways, improved port connectivity, and the development of multi-modal logistics hubs, are crucial. This facilitates the efficient movement of raw materials, finished vehicles, and aftermarket components, thereby supporting the entire automotive supply chain and driving demand for pneumatic actuators.

- Thriving Automotive Industry Growth: The Indian automotive industry's sustained and vigorous growth trajectory is the paramount driver. The increasing production volumes across all vehicle segments, coupled with a growing export market, directly translates into escalating demand for a wide array of automotive components, including pneumatic actuators.

India Automotive Pneumatic Actuators Market Product Innovations

The landscape of product innovation within the India Automotive Pneumatic Actuators market is characterized by a strong focus on advancing performance and integrating seamlessly with modern vehicle architectures. Key developments include the ongoing pursuit of miniaturization, enabling more compact and lightweight actuator designs that contribute to overall vehicle weight reduction and improved fuel efficiency. Alongside this, manufacturers are relentlessly pursuing enhanced efficiency through improved sealing technologies, reduced internal friction, and optimized airflow dynamics. A significant trend is the deepening integration with sophisticated electronic control systems. This involves the development of smart actuators equipped with integrated sensors, providing real-time data on position, pressure, and temperature, allowing for more precise control and adaptive functionality. The adoption of advanced materials, such as high-strength polymers and specialized alloys, is further enhancing actuator durability, corrosion resistance, and operational lifespan while also contributing to weight savings. These innovations are directly aligned with the automotive industry's imperatives for greater fuel efficiency, reduced emissions, and the implementation of advanced driver-assistance systems (ADAS) and autonomous driving features, where the responsiveness and precision of pneumatic actuators are paramount.

Report Scope & Segmentation Analysis

By Application Type: This report segments the market by application type into Throttle Actuator, Fuel Injector Actuator, Brake Actuator, and Other Application Types. Each segment's growth projections, market sizes, and competitive dynamics are analyzed.

By Vehicle Type: The market is segmented by vehicle type into Passenger Cars and Commercial Vehicles. Each segment's market size, growth drivers, and future outlook are comprehensively analyzed.

Growth projections for both segments are significant, reflecting the overall expansion of the Indian automotive industry. Competitive dynamics are influenced by the presence of both domestic and international players, leading to intense competition across various price points and technological capabilities.

Key Drivers of India Automotive Pneumatic Actuators Market Growth

The burgeoning growth of the India Automotive Pneumatic Actuators market is underpinned by a confluence of powerful economic and technological factors. The foundational driver is the sustained and robust expansion of the Indian automotive industry itself. This is fueled by an ever-increasing domestic demand for both passenger vehicles and commercial vehicles, spurred by a growing middle class, urbanization, and evolving lifestyle aspirations. Complementing this is the significant impetus provided by government initiatives. Policies aimed at bolstering manufacturing, promoting electric vehicle adoption (which indirectly drives innovation in related systems), and crucially, investing heavily in infrastructure development, such as improved road networks and logistics facilities, directly translate into higher vehicle production and demand for critical components. Furthermore, continuous technological advancements in the design, material science, and manufacturing of pneumatic actuators are playing a pivotal role. Innovations leading to lighter, more durable, energy-efficient, and precisely controlled actuators are making them increasingly attractive alternatives and enhancements to existing systems, thereby expanding their application scope and driving market penetration.

Challenges in the India Automotive Pneumatic Actuators Market Sector

The Indian Automotive Pneumatic Actuators market faces several challenges. Stringent emission norms and the increasing preference for electronic actuators pose a threat to the market's traditional pneumatic solutions. Supply chain disruptions and fluctuating raw material prices can impact production costs and profitability. The intense competition from both domestic and international players further challenges market participants. These factors collectively influence market dynamics and growth trajectory.

Emerging Opportunities in India Automotive Pneumatic Actuators Market

Emerging opportunities lie in the development of advanced, fuel-efficient pneumatic actuators tailored to meet evolving emission standards. The growing adoption of ADAS and connected car technologies presents opportunities for integrating pneumatic actuators into sophisticated control systems. Further expansion into niche segments, such as off-highway vehicles, presents additional growth potential.

Leading Players in the India Automotive Pneumatic Actuators Market Market

- Denso Corporation

- Delphi Automotive PLC

- Magneti Marelli S P A

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Continental AG

- Numatics Inc

- CTS Corporation

- Robert Bosch Gmb

- Nucon Industries Pvt Ltd

- ZF Friedrichshafen AG

Key Developments in India Automotive Pneumatic Actuators Market Industry

- September 2023: Nidec Corporation announced an investment of USD 55 Million to enhance its manufacturing facilities in India, expanding its motion and energy business.

- August 2022: ZF Commercial Vehicle Control Systems India expanded its manufacturing capacity, improving productivity through lean engineering.

- July 2022: Vitesco Technologies AG inaugurated a new manufacturing plant in Pune, India, investing USD 34.94 Million and expanding its actuator portfolio.

Future Outlook for India Automotive Pneumatic Actuators Market Market

The future of the India Automotive Pneumatic Actuators market appears promising, driven by the continuous growth of the automotive industry and the increasing demand for advanced vehicle technologies. Strategic investments in research and development, coupled with innovative product offerings, will be crucial for success. The market is expected to witness a steady growth trajectory, driven by both domestic and international market dynamics. Companies adapting to stringent regulations and incorporating sustainability initiatives are likely to gain a competitive edge.

India Automotive Pneumatic Actuators Market Segmentation

-

1. Application Type

- 1.1. Throttle Actuator

- 1.2. Fuel Injector Actuator

- 1.3. Brake Actuator

- 1.4. Other Application Types

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

India Automotive Pneumatic Actuators Market Segmentation By Geography

- 1. India

India Automotive Pneumatic Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in demand for Vehicle Comfort and Safety System

- 3.3. Market Restrains

- 3.3.1. High Raw Material Prices May One of The Factors That Hindering Target Market Growth.

- 3.4. Market Trends

- 3.4.1. Growing Demand for Throttle Actuators

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automotive Pneumatic Actuators Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Throttle Actuator

- 5.1.2. Fuel Injector Actuator

- 5.1.3. Brake Actuator

- 5.1.4. Other Application Types

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North India India Automotive Pneumatic Actuators Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Automotive Pneumatic Actuators Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Automotive Pneumatic Actuators Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Automotive Pneumatic Actuators Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Denso Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Delphi Automotive PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Magneti Marelli S P A

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hitachi Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mitsubishi Electric Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Continental AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Numatics Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 CTS Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Robert Bosch Gmb

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nucon Industries Pvt Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 ZF Friedrichshafen AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Denso Corporation

List of Figures

- Figure 1: India Automotive Pneumatic Actuators Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Automotive Pneumatic Actuators Market Share (%) by Company 2024

List of Tables

- Table 1: India Automotive Pneumatic Actuators Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Automotive Pneumatic Actuators Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 3: India Automotive Pneumatic Actuators Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: India Automotive Pneumatic Actuators Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Automotive Pneumatic Actuators Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Automotive Pneumatic Actuators Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Automotive Pneumatic Actuators Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Automotive Pneumatic Actuators Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Automotive Pneumatic Actuators Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Automotive Pneumatic Actuators Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 11: India Automotive Pneumatic Actuators Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: India Automotive Pneumatic Actuators Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automotive Pneumatic Actuators Market?

The projected CAGR is approximately > 7.80%.

2. Which companies are prominent players in the India Automotive Pneumatic Actuators Market?

Key companies in the market include Denso Corporation, Delphi Automotive PLC, Magneti Marelli S P A, Hitachi Ltd, Mitsubishi Electric Corporation, Continental AG, Numatics Inc, CTS Corporation, Robert Bosch Gmb, Nucon Industries Pvt Ltd, ZF Friedrichshafen AG.

3. What are the main segments of the India Automotive Pneumatic Actuators Market?

The market segments include Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand for Vehicle Comfort and Safety System.

6. What are the notable trends driving market growth?

Growing Demand for Throttle Actuators.

7. Are there any restraints impacting market growth?

High Raw Material Prices May One of The Factors That Hindering Target Market Growth..

8. Can you provide examples of recent developments in the market?

September 2023: Nidec Corporation announced an investment of USD USD 55 million to enhance its manufacturing facilities in India. Through this expansion, the company will expand its motion and energy business across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automotive Pneumatic Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automotive Pneumatic Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automotive Pneumatic Actuators Market?

To stay informed about further developments, trends, and reports in the India Automotive Pneumatic Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence