Key Insights

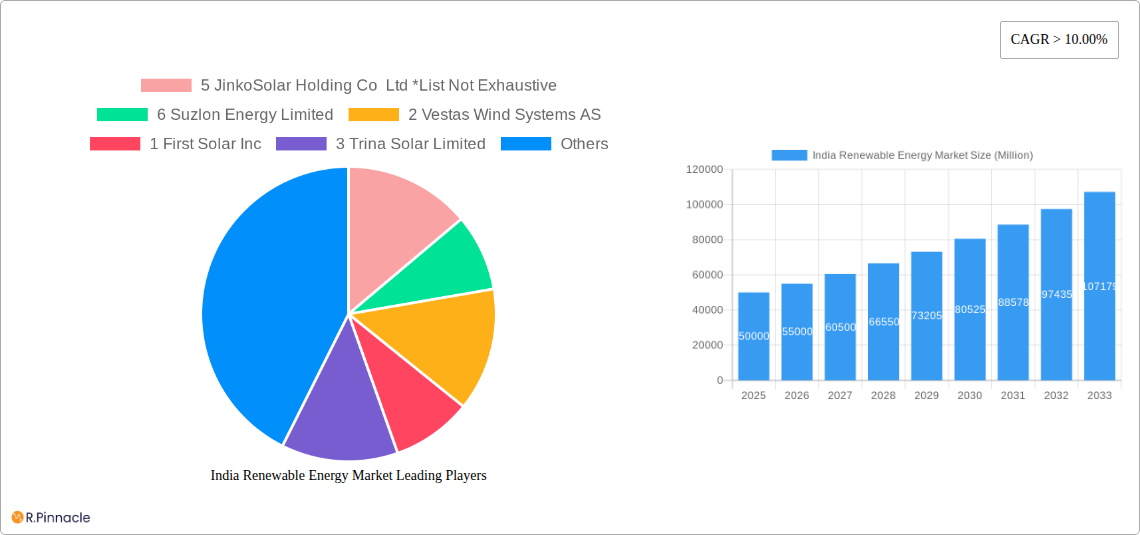

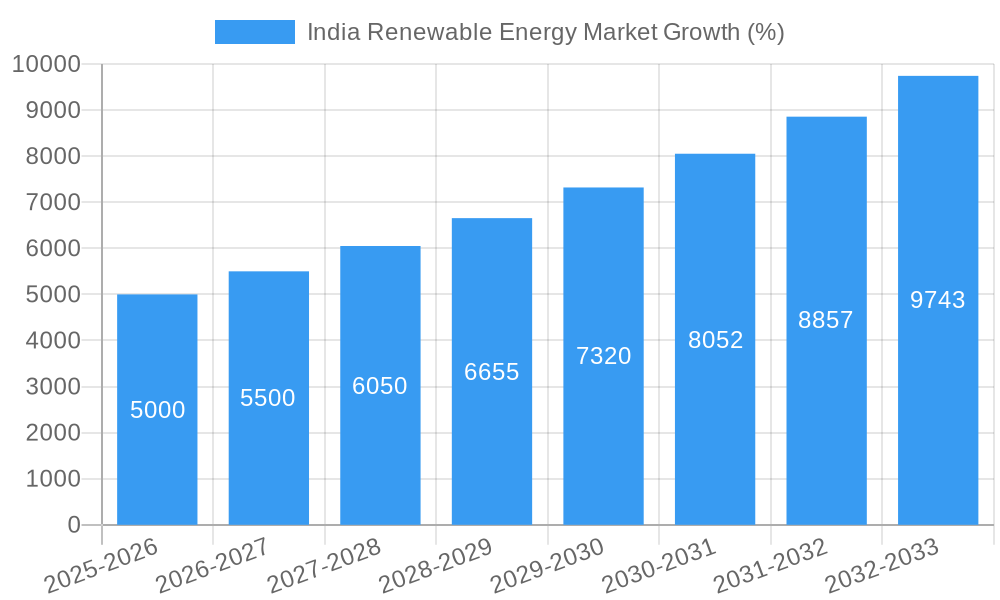

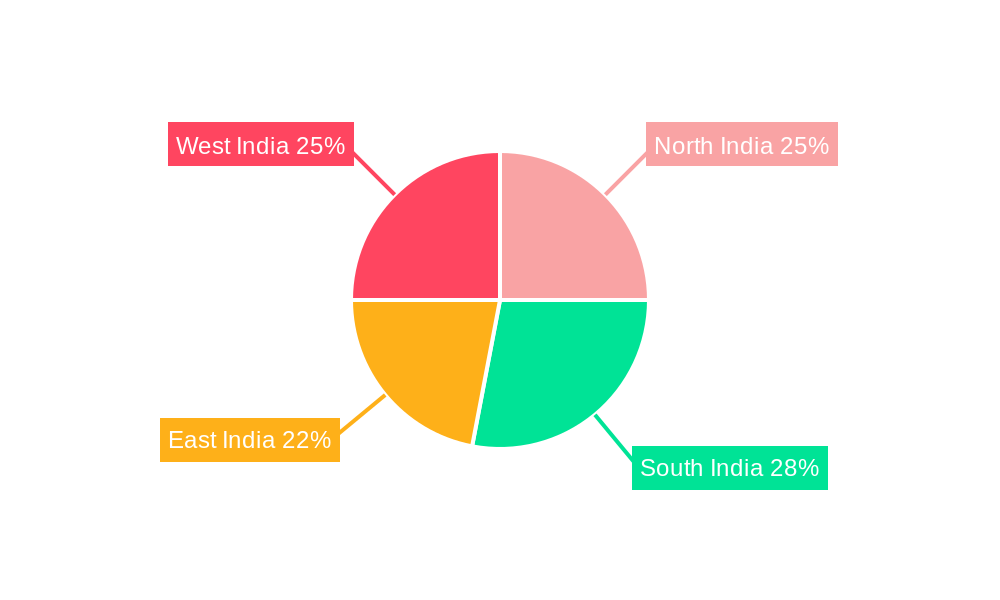

The Indian renewable energy market is experiencing robust growth, driven by the government's ambitious targets for renewable energy capacity addition and a supportive policy environment. The market size, currently estimated at around $XX million (assuming a reasonable figure based on global renewable energy market trends and India's significant potential), is projected to experience a Compound Annual Growth Rate (CAGR) exceeding 10% from 2025 to 2033. This expansion is fueled by several factors, including decreasing costs of solar and wind energy technologies, increasing energy demand, and the need to reduce reliance on fossil fuels. Key market segments include solar, wind, hydro, and bioenergy, with solar and wind power leading the growth trajectory. The presence of both domestic and international players, such as Adani Green Energy, Tata Power, JinkoSolar, and Vestas, fosters competition and technological advancements within the sector. Regional variations exist, with potential for significant development across North, South, East, and West India, depending on resource availability and infrastructure development. However, challenges such as land acquisition, grid integration issues, and financing constraints could potentially restrain market growth.

Despite potential constraints, the long-term outlook for the Indian renewable energy market remains exceptionally positive. The government's commitment to achieving its renewable energy targets, coupled with increasing private sector investment and technological innovation, ensures sustained market expansion. The focus on improving grid infrastructure and streamlining regulatory processes will further unlock the market's considerable potential. Furthermore, the growing awareness of climate change and the need for sustainable energy solutions is driving demand from both consumers and businesses, contributing to the robust growth trajectory predicted for the coming years. The diversification of renewable energy sources, with a focus on a mix of solar, wind, hydro, and bioenergy, will ensure a more resilient and secure energy future for India.

India Renewable Energy Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Renewable Energy Market, offering invaluable insights for industry professionals, investors, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends. The report uses Million (M) for all values.

India Renewable Energy Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Indian renewable energy sector. We examine market concentration, revealing the market share held by key players like Adani Green Energy Limited, Tata Power Company Limited, and Suzlon Energy Limited, amongst others. The report also quantifies Mergers & Acquisitions (M&A) activity within the sector, estimating total deal values in Millions. Innovation drivers such as government policies promoting renewable energy adoption, technological advancements in solar and wind energy, and the growing demand for sustainable energy are discussed. Regulatory frameworks, including feed-in tariffs and licensing procedures, are analyzed for their impact on market growth. Finally, the report considers the influence of substitute products, end-user demographics (residential, commercial, industrial), and the dynamics of domestic versus foreign players.

- Market Concentration: Analysis of market share for leading companies (e.g., Adani Green Energy holds xx% market share in 2025).

- M&A Activity: Total deal value of M&A transactions in the period 2019-2024 estimated at xx Million.

- Innovation Drivers: Technological advancements (e.g., improved solar cell efficiency), policy support (e.g., Production Linked Incentive schemes), and increasing consumer demand for clean energy are key drivers.

- Regulatory Framework: Impact of government policies and regulations on market growth (e.g., impact of carbon credit schemes).

India Renewable Energy Market Dynamics & Trends

This section delves into the key dynamics driving the growth of India's renewable energy market. We analyze market growth drivers, including rising energy demand, government initiatives to promote renewable energy, falling costs of renewable energy technologies, and increasing environmental awareness. Technological disruptions, such as advancements in energy storage and smart grids, are assessed for their impact on market dynamics. Consumer preferences are analyzed, focusing on the growing adoption of renewable energy solutions among residential and commercial consumers. Competitive dynamics, including pricing strategies, technological innovation, and market share gains by leading players, are also examined. The report provides detailed projections of Compound Annual Growth Rate (CAGR) and market penetration for various renewable energy segments.

- Market Size & CAGR: Projected market size in 2033 is estimated at xx Million, with a CAGR of xx% during the forecast period.

- Technological Disruptions: Impact of emerging technologies like battery storage and AI-powered grid management on market growth.

- Consumer Preferences: Shifting consumer preferences towards cleaner energy sources.

- Competitive Dynamics: Analysis of the competitive strategies adopted by various industry players.

Dominant Regions & Segments in India Renewable Energy Market

This section identifies the leading regions and segments within the Indian renewable energy market. The analysis covers major sources: Wind, Solar, Hydro, Bioenergy, and Other Sources. For each segment, key drivers of growth are identified using bullet points, and a detailed dominance analysis is provided using paragraphs. This analysis includes the influence of economic policies, infrastructure development, resource availability, and government incentives on regional and segmental performance.

- Solar: Dominant segment driven by decreasing costs, government support, and abundant solar resources.

- Wind: Significant growth driven by increased wind energy capacity addition and supportive government policies in specific regions.

- Hydro: Market dynamics influenced by factors like dam construction, water availability, and environmental regulations.

- Bioenergy: Growth driven by availability of biomass resources and government initiatives to promote biofuel production.

- Other Sources: Exploration of emerging technologies and their market potential.

India Renewable Energy Market Product Innovations

This section summarizes recent product developments, applications, and competitive advantages within the Indian renewable energy sector. We highlight advancements in solar panel technology, wind turbine design, and energy storage solutions, examining their market fit and competitive implications. Technological trends like the increasing efficiency of solar panels, the development of larger and more efficient wind turbines, and the improving performance and decreasing costs of battery storage systems are discussed in relation to their impact on market dynamics.

Report Scope & Segmentation Analysis

This report segments the Indian renewable energy market by source: Wind, Solar, Hydro, Bioenergy, and Other Sources. Each segment is analyzed in detail, providing growth projections, market size estimates, and an assessment of competitive dynamics. Market size for each segment is projected for 2025 and 2033 in Millions.

- Wind: Market size projections for 2025 and 2033 (in Millions).

- Solar: Market size projections for 2025 and 2033 (in Millions).

- Hydro: Market size projections for 2025 and 2033 (in Millions).

- Bioenergy: Market size projections for 2025 and 2033 (in Millions).

- Other Sources: Market size projections for 2025 and 2033 (in Millions).

Key Drivers of India Renewable Energy Market Growth

The growth of India's renewable energy market is driven by a confluence of factors. Government policies, such as the ambitious renewable energy targets set by the Indian government, provide significant impetus. Decreasing costs of renewable energy technologies, especially solar and wind power, make them increasingly competitive with conventional energy sources. Furthermore, the growing awareness of climate change and the need for sustainable energy solutions is driving demand for renewable energy. The increasing availability of financing and investment in renewable energy projects further supports the sector's growth.

Challenges in the India Renewable Energy Market Sector

Despite significant growth potential, the Indian renewable energy market faces several challenges. Land acquisition for large-scale renewable energy projects can be time-consuming and complex. Intermittency of renewable energy sources and the need for reliable energy storage solutions pose technical hurdles. Grid infrastructure limitations and the need for grid modernization present significant challenges for the integration of renewable energy into the national grid. Furthermore, financing and investment challenges, especially for smaller renewable energy projects, can hinder market growth. Finally, regulatory uncertainties and bureaucratic delays can affect project implementation timelines.

Emerging Opportunities in India Renewable Energy Market

The Indian renewable energy market presents a wealth of emerging opportunities. The growing demand for renewable energy in rural areas creates substantial potential for decentralized renewable energy systems. The increasing adoption of hybrid energy systems, integrating renewable energy sources with energy storage solutions, offers significant opportunities. Technological advancements in areas such as energy storage, smart grids, and AI-powered grid management are expected to unlock new growth avenues. The development of innovative business models, such as Power Purchase Agreements (PPAs) and green financing mechanisms, can support market expansion.

Leading Players in the India Renewable Energy Market

- JinkoSolar Holding Co Ltd

- Suzlon Energy Limited

- Vestas Wind Systems AS

- First Solar Inc

- Trina Solar Limited

- Tata Power Company Limited

- Adani Green Energy Limited

- Domestic Players

- Foreign Players

- NTPC Limited

- Siemens Gamesa Renewable Energy SA

- Azure Power Global Limited

- ReNew Power India

Key Developments in India Renewable Energy Market Industry

- June 2022: Ayana Renewable Power Pvt Ltd (Ayana) announced plans to set up renewable energy projects totaling 2 GW with an investment of USD 1.53 Billion in Karnataka. This significantly boosts investment in the renewable energy sector and demonstrates confidence in the market's growth potential.

- February 2022: Creduce Advanced HCPL JV won the bid for India's largest hydropower carbon credit project with Satluj Jal Vidyut Nigam, generating over 80 Million carbon credits. This highlights the growing importance of carbon credits and the potential for revenue generation from environmental initiatives within the hydropower sector.

Future Outlook for India Renewable Energy Market

The future of the Indian renewable energy market is promising. Continued government support, declining technology costs, and increasing environmental awareness will drive substantial growth. The integration of renewable energy sources with energy storage and smart grid technologies will improve reliability and grid stability. Innovative business models and financing options will facilitate market expansion. The increasing demand for clean energy from both the industrial and residential sectors will further fuel the growth of the renewable energy market in India. The market is poised for significant expansion, presenting substantial opportunities for investors and industry players.

India Renewable Energy Market Segmentation

-

1. Source

- 1.1. Wind

- 1.2. Solar

- 1.3. Hydro

- 1.4. Bioenergy

- 1.5. Other Sources

India Renewable Energy Market Segmentation By Geography

- 1. India

India Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies for Developing Solar Energy4.; Declining Cost of Solar Power Technology

- 3.3. Market Restrains

- 3.3.1. 4.; Unpredictability in the Continuity of Power Supply

- 3.4. Market Trends

- 3.4.1. Solar Segment to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Wind

- 5.1.2. Solar

- 5.1.3. Hydro

- 5.1.4. Bioenergy

- 5.1.5. Other Sources

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North India India Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 5 JinkoSolar Holding Co Ltd *List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 6 Suzlon Energy Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 2 Vestas Wind Systems AS

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 1 First Solar Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 3 Trina Solar Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 2 Tata Power Company Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 1 Adani Green Energy Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Domestic Players

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Foreign Players

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 4 NTPC Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 4 Siemens Gamesa Renewable Energy SA

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 3 Azure Power Global Limited

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 5 ReNew Power India

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 5 JinkoSolar Holding Co Ltd *List Not Exhaustive

List of Figures

- Figure 1: India Renewable Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Renewable Energy Market Share (%) by Company 2024

List of Tables

- Table 1: India Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Renewable Energy Market Volume Megawatt Forecast, by Region 2019 & 2032

- Table 3: India Renewable Energy Market Revenue Million Forecast, by Source 2019 & 2032

- Table 4: India Renewable Energy Market Volume Megawatt Forecast, by Source 2019 & 2032

- Table 5: India Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Renewable Energy Market Volume Megawatt Forecast, by Region 2019 & 2032

- Table 7: India Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: India Renewable Energy Market Volume Megawatt Forecast, by Country 2019 & 2032

- Table 9: North India India Renewable Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North India India Renewable Energy Market Volume (Megawatt) Forecast, by Application 2019 & 2032

- Table 11: South India India Renewable Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South India India Renewable Energy Market Volume (Megawatt) Forecast, by Application 2019 & 2032

- Table 13: East India India Renewable Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: East India India Renewable Energy Market Volume (Megawatt) Forecast, by Application 2019 & 2032

- Table 15: West India India Renewable Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: West India India Renewable Energy Market Volume (Megawatt) Forecast, by Application 2019 & 2032

- Table 17: India Renewable Energy Market Revenue Million Forecast, by Source 2019 & 2032

- Table 18: India Renewable Energy Market Volume Megawatt Forecast, by Source 2019 & 2032

- Table 19: India Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: India Renewable Energy Market Volume Megawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Renewable Energy Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the India Renewable Energy Market?

Key companies in the market include 5 JinkoSolar Holding Co Ltd *List Not Exhaustive, 6 Suzlon Energy Limited, 2 Vestas Wind Systems AS, 1 First Solar Inc, 3 Trina Solar Limited, 2 Tata Power Company Limited, 1 Adani Green Energy Limited, Domestic Players, Foreign Players, 4 NTPC Limited, 4 Siemens Gamesa Renewable Energy SA, 3 Azure Power Global Limited, 5 ReNew Power India.

3. What are the main segments of the India Renewable Energy Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies for Developing Solar Energy4.; Declining Cost of Solar Power Technology.

6. What are the notable trends driving market growth?

Solar Segment to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; Unpredictability in the Continuity of Power Supply.

8. Can you provide examples of recent developments in the market?

June 2022: Ayana Renewable Power Pvt Ltd (Ayana) announced plans to set up renewable energy projects adding up to 2 gigawatts (GWs) with an investment of USD 1.53 billion in Karnataka.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Megawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Renewable Energy Market?

To stay informed about further developments, trends, and reports in the India Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence