Key Insights

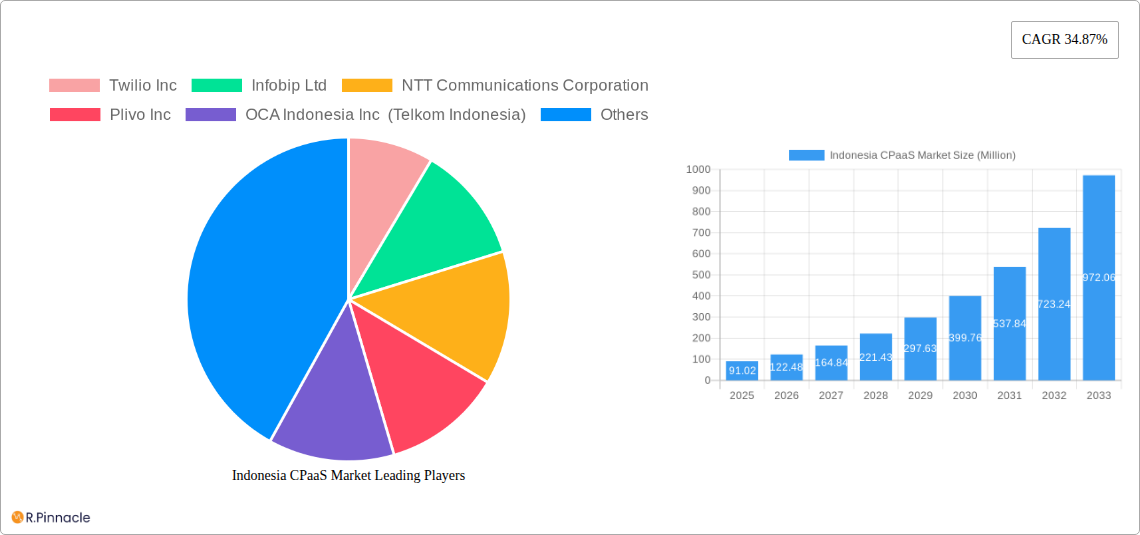

The Indonesia CPaaS (Communications Platform as a Service) market is experiencing robust growth, projected to reach a market size of $91.02 million in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 34.87% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of digital transformation initiatives across various Indonesian industries, particularly in e-commerce, finance, and healthcare, is creating a surge in demand for efficient and scalable communication solutions. Furthermore, the rising penetration of smartphones and mobile internet access within the Indonesian population provides a fertile ground for CPaaS solutions to flourish. Government initiatives promoting digitalization and the growing preference for omnichannel customer engagement strategies are also contributing to the market's upward trajectory. Competition among established players like Twilio, Infobip, and regional providers such as Qiscus and Mekari Qontak fosters innovation and drives prices down, making CPaaS accessible to a wider range of businesses. However, challenges remain, including concerns about data security and privacy, as well as the need for robust digital infrastructure in certain parts of the country.

Despite these challenges, the Indonesia CPaaS market is poised for significant expansion. The projected CAGR suggests a substantial increase in market value over the forecast period (2025-2033). This growth will be driven by continued investments in digital infrastructure, increasing business adoption of cloud-based solutions, and the expanding use of advanced communication features like chatbots and AI-powered messaging. The market segmentation will likely see increasing adoption of CPaaS across various industry verticals as businesses strive for seamless customer interactions and improved operational efficiencies. The presence of both international and domestic players indicates a healthy competitive landscape, likely pushing innovation and creating a wider range of services and pricing options for Indonesian businesses.

This comprehensive report provides an in-depth analysis of the Indonesia CPaaS market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future growth potential. The report leverages extensive data and analysis to provide actionable intelligence for navigating this rapidly evolving market.

Indonesia CPaaS Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the Indonesian CPaaS market. We delve into market concentration, examining the market share held by key players such as Twilio Inc, Infobib Ltd, NTT Communications Corporation, Plivo Inc, OCA Indonesia Inc (Telkom Indonesia), Barantum, 8x8 Inc, Messagebird, Route Mobile Limited, PT Vfirst Komunikasi Indonesia, Qiscus, and Mekari Qontak (PT Mid Solusi Nusantara). The analysis includes an assessment of M&A activities, quantifying deal values where possible (xx Million) and their impact on market consolidation. We also explore the influence of regulatory frameworks, the presence of product substitutes, and the evolving end-user demographics. The section concludes with a detailed examination of innovation drivers, such as technological advancements and government initiatives, shaping the future trajectory of the market. The market share for the top 5 players is estimated at xx%.

Indonesia CPaaS Market Dynamics & Trends

This section provides a comprehensive overview of the market's growth drivers, technological disruptions, evolving consumer preferences, and intense competitive dynamics within the Indonesian CPaaS landscape. We examine the Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) estimated at xx% and project the CAGR for the forecast period (2025-2033) at xx%. Market penetration rates are analyzed across various segments, highlighting the areas with the greatest growth potential. Specific examples of technological disruptions, such as the increasing adoption of RCS and the rise of fraud prevention solutions like 8x8 Omni Shield, are detailed. The analysis considers shifts in consumer preferences towards more sophisticated communication solutions and the impact of these trends on market growth. The competitive landscape is explored, including strategies adopted by major players to maintain their market position.

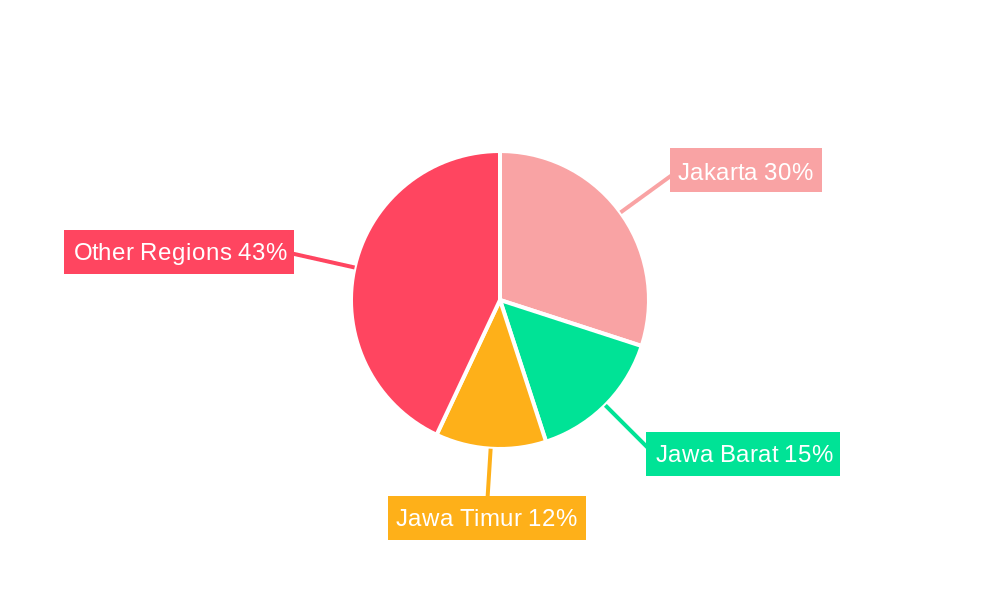

Dominant Regions & Segments in Indonesia CPaaS Market

This section identifies the leading regions and segments within the Indonesian CPaaS market. A detailed dominance analysis is conducted to pinpoint the key factors driving growth in these specific areas.

- Key Drivers for Dominant Regions/Segments:

- Robust economic growth in specific regions.

- Favorable government policies promoting digital adoption.

- Well-developed telecommunications infrastructure.

- High smartphone penetration.

The dominance of a particular region or segment is analyzed in detail, exploring the interplay of economic policies, infrastructure development, and consumer behavior. This analysis incorporates quantitative data to highlight the market share and growth potential of each leading area.

Indonesia CPaaS Market Product Innovations

This section summarizes the latest product developments, applications, and competitive advantages within the Indonesian CPaaS market. Recent technological trends, such as the integration of AI and enhanced security features, are highlighted, emphasizing their impact on market acceptance and competitiveness. The analysis also considers how these innovations address specific market needs and create new opportunities for CPaaS providers. The focus is on the market fit of new products and services, analyzing their ability to meet customer demands and drive market growth.

Report Scope & Segmentation Analysis

This report segments the Indonesia CPaaS market based on various factors, including deployment model (cloud, on-premise), enterprise size (small, medium, large), and industry vertical (BFSI, retail, healthcare, etc.). Each segment's growth projections, market size (in Million), and competitive landscape are analyzed separately. The analysis includes detailed information on the market size and growth potential for each segment. Furthermore, this section explores the competitive dynamics within each segment, identifying key players and their market strategies.

Key Drivers of Indonesia CPaaS Market Growth

Several factors are driving the growth of the Indonesia CPaaS market. These include rapid digital transformation across various industries, increasing adoption of cloud-based communication solutions, the expanding mobile phone user base, and supportive government initiatives promoting digital inclusion. Specific examples, such as the increasing demand for customer engagement tools and the rise of e-commerce, are used to illustrate these drivers. The analysis also highlights the contribution of technological advancements, such as AI and machine learning, in boosting market growth.

Challenges in the Indonesia CPaaS Market Sector

Despite significant growth potential, the Indonesian CPaaS market faces certain challenges. These include regulatory hurdles related to data privacy and security, potential supply chain disruptions impacting service availability, and the presence of intense competition from established players and new entrants. The quantitative impact of these challenges, such as the estimated xx% reduction in market growth due to regulatory uncertainties, is evaluated where possible.

Emerging Opportunities in Indonesia CPaaS Market

Despite challenges, several emerging opportunities exist within the Indonesian CPaaS market. These include the expansion of the market into new sectors like the Internet of Things (IoT), the growing adoption of advanced communication technologies such as RCS, and the increasing demand for customized communication solutions catering to specific industry needs. This section identifies these emerging opportunities and their potential impact on future market growth.

Leading Players in the Indonesia CPaaS Market Market

- Twilio Inc

- Infobip Ltd

- NTT Communications Corporation

- Plivo Inc

- OCA Indonesia Inc (Telkom Indonesia)

- Barantum

- 8x8 Inc

- Messagebird

- Route Mobile Limited

- PT Vfirst Komunikasi Indonesia

- Qiscus

- Mekari Qontak (PT Mid Solusi Nusantara)

Key Developments in Indonesia CPaaS Market Industry

- September 2023: 8x8 Inc. partnered with Coca-Cola Indonesia, integrating its CPaaS solutions into Coca-Cola's "Klik Toko" loyalty program and launched the 8x8 Omni Shield solution for fraud prevention. This showcases the growing demand for secure and integrated communication solutions.

- January 2024: Telkomsel collaborated with Google to introduce RCS-based business messaging, enhancing customer communication and driving digital transformation. This signifies the market's potential for growth and the adoption of advanced communication technologies.

Future Outlook for Indonesia CPaaS Market Market

The future of the Indonesian CPaaS market appears bright, driven by ongoing digitalization across various sectors and the increasing adoption of innovative communication technologies. The market's growth trajectory is projected to remain robust, with significant opportunities for existing and new players. Strategic partnerships, technological innovations, and a focus on meeting evolving customer needs will be critical success factors in this dynamic market. The continued expansion of mobile phone usage and the government's support for digital infrastructure development are expected to further fuel this growth.

Indonesia CPaaS Market Segmentation

-

1. Organization Size

- 1.1. SME

- 1.2. Large-Scale Organization

-

2. End User

- 2.1. IT and Telecom

- 2.2. BFSI

- 2.3. Retail and E-commerce

- 2.4. Healthcare

- 2.5. Other End-user Verticals

Indonesia CPaaS Market Segmentation By Geography

- 1. Indonesia

Indonesia CPaaS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 34.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models; Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations

- 3.2.2 Service

- 3.2.3 and Marketing

- 3.3. Market Restrains

- 3.3.1 Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models; Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations

- 3.3.2 Service

- 3.3.3 and Marketing

- 3.4. Market Trends

- 3.4.1. SME Organization Size Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia CPaaS Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. SME

- 5.1.2. Large-Scale Organization

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecom

- 5.2.2. BFSI

- 5.2.3. Retail and E-commerce

- 5.2.4. Healthcare

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Twilio Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infobip Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NTT Communications Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plivo Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OCA Indonesia Inc (Telkom Indonesia)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Barantum

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 8x8 Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Messagebird

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Route Mobile Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Vfirst Komunikasi Indonesia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Qiscus

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mekari Qontak (PT Mid Solusi Nusantara

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Twilio Inc

List of Figures

- Figure 1: Indonesia CPaaS Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia CPaaS Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia CPaaS Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia CPaaS Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Indonesia CPaaS Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 4: Indonesia CPaaS Market Volume Million Forecast, by Organization Size 2019 & 2032

- Table 5: Indonesia CPaaS Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Indonesia CPaaS Market Volume Million Forecast, by End User 2019 & 2032

- Table 7: Indonesia CPaaS Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia CPaaS Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Indonesia CPaaS Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 10: Indonesia CPaaS Market Volume Million Forecast, by Organization Size 2019 & 2032

- Table 11: Indonesia CPaaS Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: Indonesia CPaaS Market Volume Million Forecast, by End User 2019 & 2032

- Table 13: Indonesia CPaaS Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Indonesia CPaaS Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia CPaaS Market?

The projected CAGR is approximately 34.87%.

2. Which companies are prominent players in the Indonesia CPaaS Market?

Key companies in the market include Twilio Inc, Infobip Ltd, NTT Communications Corporation, Plivo Inc, OCA Indonesia Inc (Telkom Indonesia), Barantum, 8x8 Inc, Messagebird, Route Mobile Limited, PT Vfirst Komunikasi Indonesia, Qiscus, Mekari Qontak (PT Mid Solusi Nusantara.

3. What are the main segments of the Indonesia CPaaS Market?

The market segments include Organization Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models; Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations. Service. and Marketing.

6. What are the notable trends driving market growth?

SME Organization Size Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models; Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations. Service. and Marketing.

8. Can you provide examples of recent developments in the market?

January 2024 - Telkomsel, an Indonesian telecommunications company, collaborated with Google to introduce its Rich Communication Services (RCS)--based business messaging to support digital business transformation by enhancing customer communication experiences and providing more feature-rich short messaging solutions. The RCS services with RBM would be available for Telkomsel customers in Indonesia, which shows the market's future growth potential and would support market growth during the forecast period.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia CPaaS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia CPaaS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia CPaaS Market?

To stay informed about further developments, trends, and reports in the Indonesia CPaaS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence