Key Insights

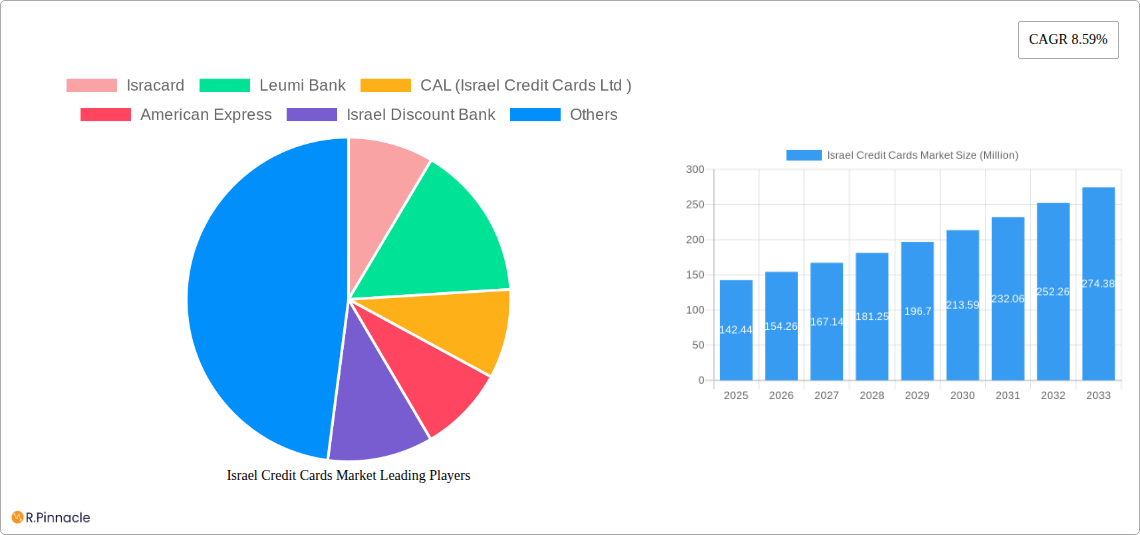

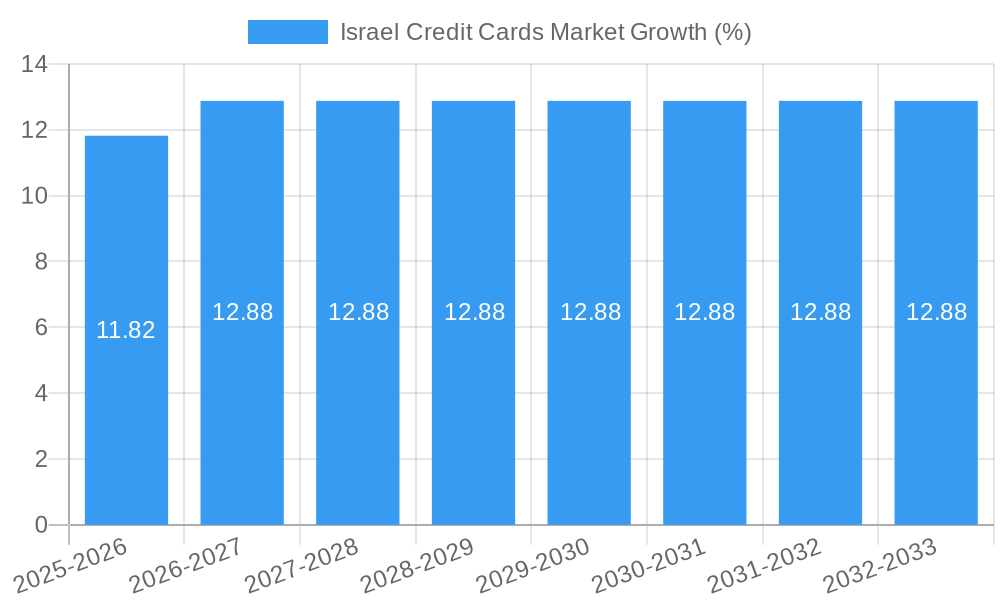

The Israeli credit card market, valued at $142.44 million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8.59% from 2025 to 2033. This growth is fueled by increasing digital adoption, rising consumer spending, and a burgeoning e-commerce sector within Israel. The market's competitive landscape is dominated by major players such as Isracard, Leumi Bank, CAL (Israel Credit Cards Ltd), American Express, Israel Discount Bank, Bank Hapoalim, Mizrahi-Tefahot Bank, and First International Bank of Israel, alongside international players like BNP Paribas Israel. These institutions are continuously innovating to offer enhanced features, rewards programs, and digital payment solutions to cater to evolving consumer preferences. Government initiatives promoting financial inclusion and digital transformation also contribute positively to market expansion. However, factors such as stringent regulatory oversight and potential economic fluctuations could pose challenges to sustained growth. The market segmentation, while not explicitly provided, likely includes categories based on card type (e.g., debit, credit, prepaid), customer demographics (e.g., age, income), and spending patterns. Future growth will depend on the successful navigation of these factors and the continuous adaptation to emerging technologies in the payments space.

The forecast period (2025-2033) anticipates significant growth driven by the increasing penetration of smartphones and online banking. This technological advancement fuels the adoption of contactless payments and mobile wallets, further boosting the market's trajectory. Competition among established players and the emergence of fintech companies will likely intensify, leading to further innovation in credit card offerings and services. The success of individual players will depend on their ability to adapt to changing consumer behavior, effectively manage risk, and provide innovative solutions that align with the evolving regulatory landscape. The market's long-term outlook is positive, contingent upon maintaining economic stability and continued investment in technological infrastructure to support the digital transformation of payments in Israel.

Israel Credit Cards Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Israel credit cards market, covering the period from 2019 to 2033. It delves into market structure, dynamics, key players, and future growth projections, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report leverages a robust data set and expert analysis to deliver actionable intelligence, forecasting a market valued at xx Million by 2033. The base year for this analysis is 2025.

Israel Credit Cards Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Israeli credit card market, exploring market concentration, innovation drivers, regulatory frameworks, and significant M&A activities. The market is characterized by a mix of large established banks and specialized credit card companies.

Market Concentration: The market exhibits moderate concentration, with key players like Isracard, Leumi Bank, and CAL (Israel Credit Cards Ltd.) holding significant market share. Precise market share figures for each player will be detailed in the full report. We project a market concentration ratio (CR4) of xx% for 2025.

Innovation Drivers: The market is driven by innovations in digital payment technologies, including mobile wallets and contactless payments. Furthermore, personalized reward programs and enhanced security features are key drivers of growth.

Regulatory Framework: The Bank of Israel plays a crucial role in regulating the credit card market, influencing aspects such as interest rates and consumer protection. Recent regulatory changes, as detailed in the "Key Developments" section, are impacting market dynamics.

Product Substitutes: The rise of digital payment platforms (e.g., Apple Pay, Google Pay) and alternative payment methods poses a competitive threat to traditional credit cards.

End-User Demographics: The target demographic is diverse, encompassing various age groups and income levels. The report will analyze the credit card usage patterns across different demographic segments.

M&A Activities: Recent years have witnessed several mergers and acquisitions within the Israeli credit card industry, such as the May 2023 agreement between Bank Leumi and CAL. The full report details these activities, including deal values, and their implications for market consolidation.

Israel Credit Cards Market Market Dynamics & Trends

This section examines the market's growth trajectory, exploring key drivers, technological disruptions, consumer preferences, and competitive dynamics. The Israeli credit card market is projected to experience significant growth over the forecast period (2025-2033). Several factors contribute to this growth.

The report will provide a detailed analysis of the Compound Annual Growth Rate (CAGR) and market penetration rates during the study period (2019-2024) and forecast period (2025-2033), segmented by card type (e.g., Visa, Mastercard, Diners Club), user demographics and other relevant categories. Factors influencing growth include increasing consumer spending, expanding e-commerce adoption, and the growing popularity of reward programs. The impact of technological disruptions, including the aforementioned rise of digital payment platforms and Fintech innovations, will be thoroughly assessed. Further, the analysis will incorporate an evaluation of evolving consumer preferences, focusing on the demand for secure and convenient payment solutions. Finally, a deep dive into the competitive landscape will identify prevailing strategies and emerging competitive dynamics.

Dominant Regions & Segments in Israel Credit Cards Market

The Israeli credit card market is relatively geographically concentrated, with the majority of transactions occurring within major urban centers. This section delves into the regional and segment-specific dynamics, identifying the key drivers of dominance in each area. The report will analyze variations in credit card usage and market characteristics across different regions, explaining the reasons for observed variations.

Key Drivers of Regional Dominance:

- Economic Factors: Regional economic activity and disposable income levels significantly influence credit card usage.

- Infrastructure: The availability and accessibility of point-of-sale (POS) systems and ATM networks affect transaction volumes.

- Demographic Trends: Population density and age distribution patterns influence credit card adoption rates.

The full report provides a detailed analysis of market segmentation based on card type, user demographics, and other relevant factors. The leading segment(s) will be identified, with the reasons for their market leadership clearly explained.

Israel Credit Cards Market Product Innovations

Recent years have witnessed significant product innovations in the Israeli credit card market, driven by technological advancements and changing consumer preferences. Key innovations include contactless payment technology, enhanced security features (e.g., biometric authentication), and personalized rewards programs tailored to individual spending patterns. These innovations are designed to enhance the user experience and strengthen the competitive position of credit card issuers within the evolving payments ecosystem. The market's responsiveness to these innovations will be a significant factor in future growth trajectories.

Report Scope & Segmentation Analysis

This report segments the Israeli credit card market based on various parameters, including card type (e.g., Visa, Mastercard, American Express, Diners Club), cardholder demographics (age, income, location), and transaction type (e-commerce vs. in-store). Each segment's market size, growth projections, and competitive landscape will be analyzed thoroughly in the complete report.

Key Drivers of Israel Credit Cards Market Growth

Several factors are driving the growth of the Israeli credit card market, including:

- Rising Disposable Incomes: Increased disposable incomes among Israeli consumers fuel higher spending and credit card usage.

- E-commerce Boom: The expansion of online retail and the increasing preference for online shopping contribute significantly to credit card transactions.

- Government Initiatives: Government policies promoting financial inclusion and digitalization have a positive impact on credit card adoption.

- Technological Advancements: The introduction of contactless payments, mobile wallets, and other innovative technologies enhances credit card convenience and usage.

Challenges in the Israel Credit Cards Market Sector

Despite the positive growth outlook, the Israeli credit card market faces several challenges:

- Regulatory Scrutiny: Stringent regulations and compliance requirements imposed by the Bank of Israel can create operational complexities.

- Competitive Intensity: The presence of numerous banks and credit card providers creates a highly competitive market environment.

- Economic Volatility: Fluctuations in the Israeli economy and currency exchange rates can impact consumer spending and credit card usage.

- Fraud Risk: The increase in online transactions raises concerns regarding fraud and security vulnerabilities.

Emerging Opportunities in Israel Credit Cards Market

Despite challenges, several opportunities are emerging in the Israeli credit card market:

- Fintech Innovation: The integration of Fintech solutions and open banking can lead to new personalized financial products and services.

- Expansion of Digital Payments: The growth of digital payments and mobile wallets presents significant potential for credit card expansion.

- Focus on Niche Markets: Targeting specific demographic segments with tailored products and services can improve market penetration.

- Cross-border Payments: Facilitating cross-border payments and transactions can unlock new growth avenues.

Leading Players in the Israel Credit Cards Market Market

- Isracard

- Leumi Bank

- CAL (Israel Credit Cards Ltd)

- American Express

- Israel Discount Bank

- Bank Hapoalim

- Mizrahi-Tefahot Bank

- First International Bank of Israel

- BNP Paribas Israel

Key Developments in Israel Credit Cards Market Industry

- May 2023: Bank Leumi and CAL (Israel Credit Cards Ltd.) signed a long-term agreement for issuing and operating Visa, MasterCard, and Diners credit cards. This strategic move strengthens CAL's position and expands Bank Leumi's card offerings.

- March 2023: The Bank of Israel mandated more frequent reporting on money movements in and out of Israel, reflecting concerns about shekel volatility amid planned judicial reforms. This could affect credit card transaction monitoring and reporting requirements.

Future Outlook for Israel Credit Cards Market Market

The Israeli credit card market is poised for continued growth, driven by a combination of factors including rising disposable incomes, expanding e-commerce, technological innovations, and the potential for further market consolidation through mergers and acquisitions. The market's evolution will be influenced by the ongoing interplay between regulatory changes and technological advancements, presenting opportunities for both established players and new entrants to the market. This report offers a detailed roadmap for navigating this dynamic environment and capitalizing on emerging opportunities.

Israel Credit Cards Market Segmentation

-

1. Card Type

- 1.1. General Purpose Credit Cards

- 1.2. Specialty & Other Credit Cards

-

2. Application

- 2.1. Food & Groceries

- 2.2. Health & Pharmacy

- 2.3. Restaurants & Bars

- 2.4. Consumer Electronics

- 2.5. Media & Entertainment

- 2.6. Travel & Tourism

- 2.7. Other Applications

-

3. Provider

- 3.1. Visa

- 3.2. MasterCard

- 3.3. Other Providers

Israel Credit Cards Market Segmentation By Geography

- 1. Israel

Israel Credit Cards Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Usage of Credit Card Give the Bonus and Reward Points

- 3.3. Market Restrains

- 3.3.1. Usage of Credit Card Give the Bonus and Reward Points

- 3.4. Market Trends

- 3.4.1. Visa Cards Occupied the Major share in E-Commerce Payments

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Credit Cards Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. General Purpose Credit Cards

- 5.1.2. Specialty & Other Credit Cards

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Groceries

- 5.2.2. Health & Pharmacy

- 5.2.3. Restaurants & Bars

- 5.2.4. Consumer Electronics

- 5.2.5. Media & Entertainment

- 5.2.6. Travel & Tourism

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Provider

- 5.3.1. Visa

- 5.3.2. MasterCard

- 5.3.3. Other Providers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Isracard

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Leumi Bank

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CAL (Israel Credit Cards Ltd )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 American Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Israel Discount Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bank Hapoalim

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mizrahi-Tefahot Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 First International Bank of Israel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BNP Paribas Israel**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Isracard

List of Figures

- Figure 1: Israel Credit Cards Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Israel Credit Cards Market Share (%) by Company 2024

List of Tables

- Table 1: Israel Credit Cards Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Israel Credit Cards Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Israel Credit Cards Market Revenue Million Forecast, by Card Type 2019 & 2032

- Table 4: Israel Credit Cards Market Volume Billion Forecast, by Card Type 2019 & 2032

- Table 5: Israel Credit Cards Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Israel Credit Cards Market Volume Billion Forecast, by Application 2019 & 2032

- Table 7: Israel Credit Cards Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 8: Israel Credit Cards Market Volume Billion Forecast, by Provider 2019 & 2032

- Table 9: Israel Credit Cards Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Israel Credit Cards Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Israel Credit Cards Market Revenue Million Forecast, by Card Type 2019 & 2032

- Table 12: Israel Credit Cards Market Volume Billion Forecast, by Card Type 2019 & 2032

- Table 13: Israel Credit Cards Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Israel Credit Cards Market Volume Billion Forecast, by Application 2019 & 2032

- Table 15: Israel Credit Cards Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 16: Israel Credit Cards Market Volume Billion Forecast, by Provider 2019 & 2032

- Table 17: Israel Credit Cards Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Israel Credit Cards Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Credit Cards Market?

The projected CAGR is approximately 8.59%.

2. Which companies are prominent players in the Israel Credit Cards Market?

Key companies in the market include Isracard, Leumi Bank, CAL (Israel Credit Cards Ltd ), American Express, Israel Discount Bank, Bank Hapoalim, Mizrahi-Tefahot Bank, First International Bank of Israel, BNP Paribas Israel**List Not Exhaustive.

3. What are the main segments of the Israel Credit Cards Market?

The market segments include Card Type, Application, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 142.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Usage of Credit Card Give the Bonus and Reward Points.

6. What are the notable trends driving market growth?

Visa Cards Occupied the Major share in E-Commerce Payments.

7. Are there any restraints impacting market growth?

Usage of Credit Card Give the Bonus and Reward Points.

8. Can you provide examples of recent developments in the market?

May 2023: Bank Leumi and CAL (Israel Credit Cards Ltd.) announced the signing of an agreement for issuing and operating Visa, MasterCard, and Diners credit cards to Leumi customers. The long-term strategic agreement relates to all the commercial terms, operating arrangements, and services that CAL will provide to Leumi and its customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Credit Cards Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Credit Cards Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Credit Cards Market?

To stay informed about further developments, trends, and reports in the Israel Credit Cards Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence