Key Insights

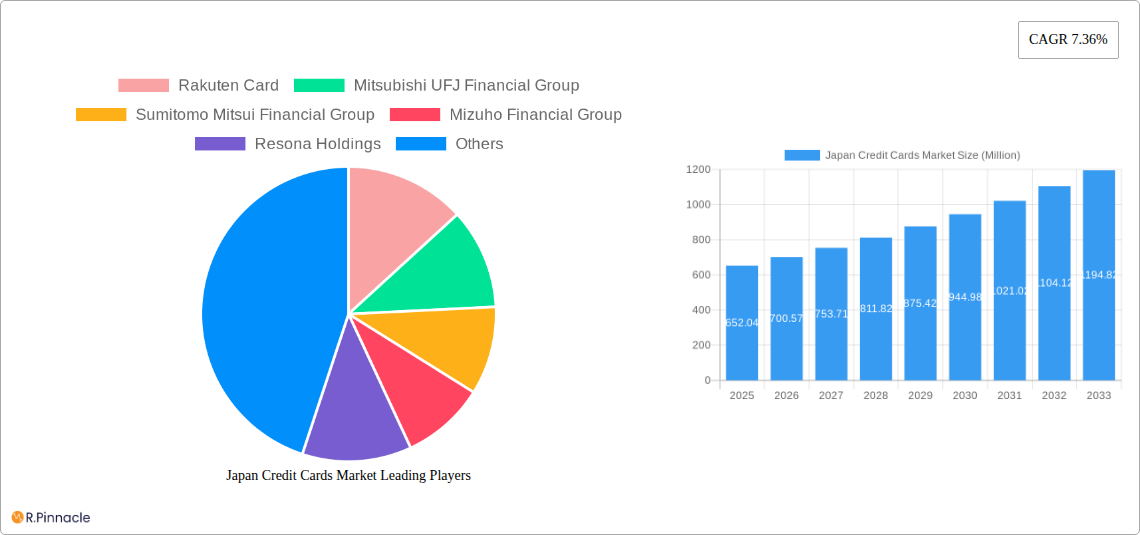

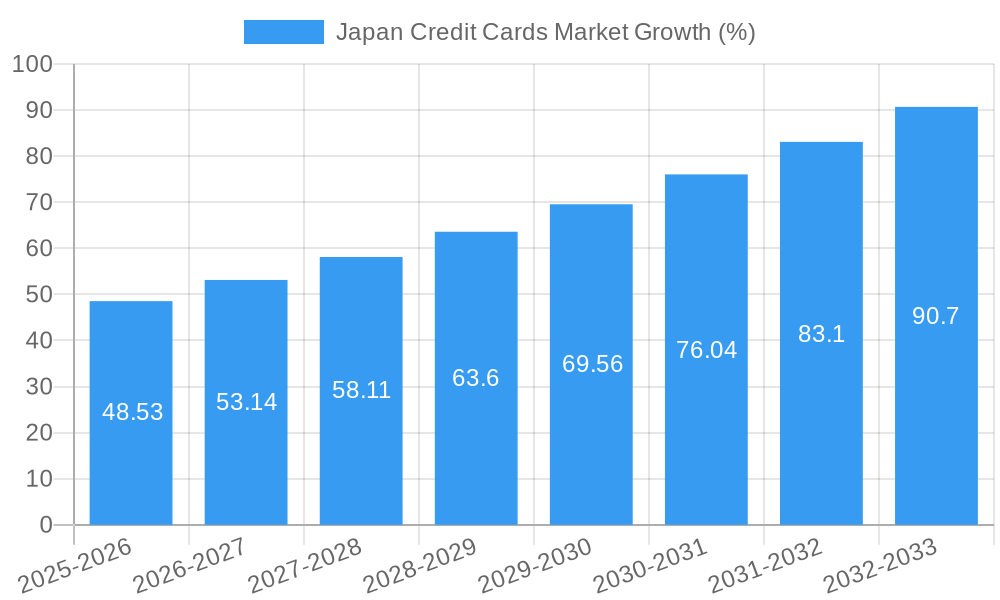

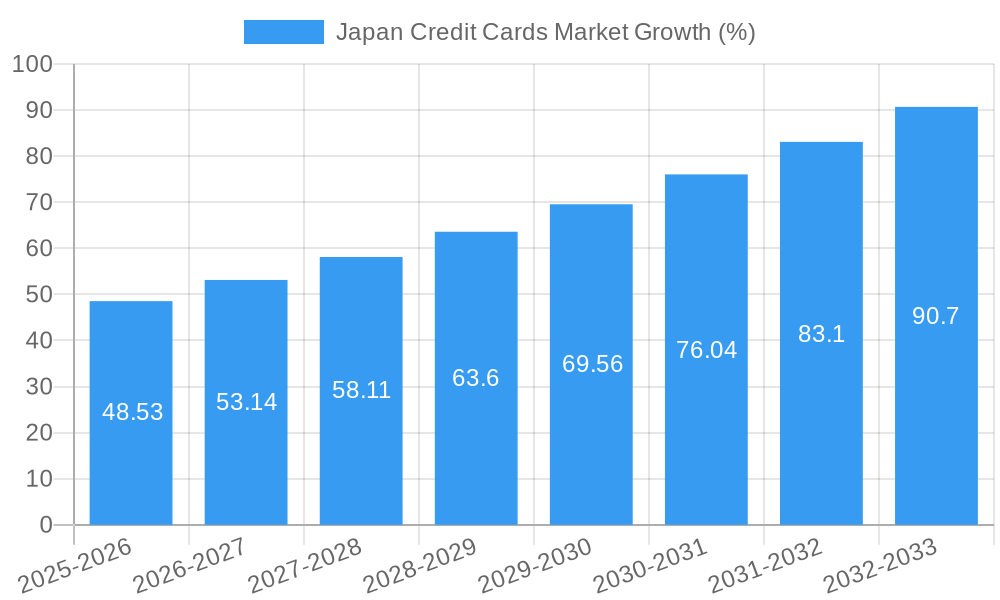

The Japan credit card market, valued at $652.04 million in 2025, is projected to experience robust growth, driven by increasing consumer spending, expanding e-commerce adoption, and the rising popularity of contactless payment solutions. The market's Compound Annual Growth Rate (CAGR) of 7.36% from 2019 to 2024 indicates a consistently upward trajectory. This growth is fueled by a young and increasingly digitally savvy population embracing cashless transactions. Furthermore, government initiatives promoting financial inclusion and digitalization are contributing to market expansion. Key players like Rakuten Card, Mitsubishi UFJ Financial Group, and Sumitomo Mitsui Financial Group are leveraging technological advancements to enhance their offerings, including personalized rewards programs and improved security features. Competition remains fierce, with established banks and specialized credit card companies vying for market share.

Despite the positive outlook, challenges remain. The market faces potential headwinds from fluctuating economic conditions and evolving consumer preferences. Concerns around data privacy and security also need to be addressed to maintain consumer confidence. Furthermore, the penetration of credit cards in rural areas might lag behind urban centers, representing a potential area for future growth. The projected growth trajectory suggests a significant increase in market value by 2033, indicating a lucrative opportunity for both established and emerging players in the Japanese credit card industry. Strategic partnerships, innovative product offerings, and robust security measures will be crucial for success in this dynamic landscape.

Japan Credit Cards Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Japan Credit Cards Market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future potential. We analyze key players, emerging trends, and challenges shaping this dynamic sector. Download now to gain a competitive edge.

Japan Credit Cards Market Market Structure & Innovation Trends

The Japanese credit card market exhibits a moderately concentrated structure, with key players like Rakuten Card, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, Mizuho Financial Group, Resona Holdings, Japan Post Bank, Aozora Bank, Norinchukin Bank, Shizuoka Bank, and JCB (Japan Credit Bureau) holding significant market share (exact figures vary and are detailed within the report). Market share data for 2024 shows that the top 5 players hold approximately xx% of the market, indicating some level of consolidation. Innovation is driven by factors including increasing digitalization, evolving consumer preferences towards contactless payments, and government initiatives promoting financial inclusion. The regulatory framework, while stable, is adapting to the changing technological landscape. The market also faces competition from alternative payment methods, such as mobile wallets and buy-now-pay-later services, impacting market growth, particularly among younger demographics. M&A activity, as evidenced by recent deals (detailed in the Key Developments section), signals a push for consolidation and expansion within the sector. The total value of M&A deals in the historical period (2019-2024) was approximately xx Million USD.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of the market share in 2024.

- Innovation Drivers: Digitalization, contactless payments, government initiatives.

- Regulatory Framework: Stable but adapting to technological advancements.

- Product Substitutes: Mobile wallets, buy-now-pay-later services.

- End-User Demographics: Shifting towards younger, digitally savvy consumers.

- M&A Activity: Consolidation and expansion strategies driving deal values.

Japan Credit Cards Market Market Dynamics & Trends

The Japan Credit Cards Market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: rising disposable incomes, increasing consumer spending, the expanding e-commerce sector, and the government's continuous efforts to promote cashless transactions. Technological disruptions, such as the adoption of advanced security features and mobile payment technologies, further enhance market growth and convenience. Consumer preferences are shifting towards rewards programs, personalized services, and user-friendly interfaces, influencing product innovation and competition. The competitive landscape remains dynamic, with existing players expanding their offerings and new entrants exploring niche markets. Market penetration of credit cards is gradually increasing, particularly in urban areas, yet still lags behind some other developed nations. The report provides detailed analysis on these aspects, including regional variations and specific consumer segments.

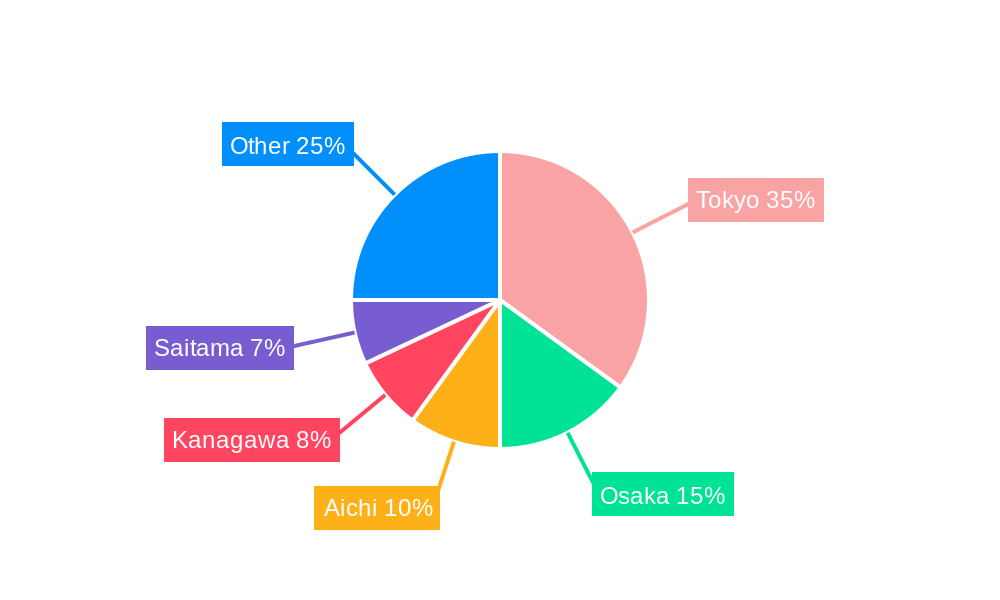

Dominant Regions & Segments in Japan Credit Cards Market

The Kanto region (including Tokyo) currently dominates the Japan Credit Cards Market, driven by high population density, strong economic activity, and advanced infrastructure supporting digital transactions. Key drivers of this dominance include:

- High Population Density: Concentrated consumer base providing a large market.

- Strong Economic Activity: High disposable incomes and consumer spending.

- Advanced Infrastructure: Robust digital infrastructure facilitating seamless transactions.

- High adoption of digital technologies: leading to high credit card usage.

Detailed analysis within the report compares the Kanto region's performance with other regions, providing insights into growth potential and regional variations.

Japan Credit Cards Market Product Innovations

Recent product innovations focus on enhancing security features (e.g., biometric authentication), integrating loyalty programs, and developing user-friendly mobile applications. Contactless payment technologies are rapidly gaining traction, aligning with the global trend towards cashless transactions. The market is also seeing the introduction of specialized credit cards targeting specific demographic segments, offering tailored rewards and benefits. These innovations aim to attract new users and increase market penetration.

Report Scope & Segmentation Analysis

This report segments the Japan Credit Cards Market based on card type (e.g., debit, credit, prepaid), payment network (e.g., Visa, Mastercard, JCB), customer segment (e.g., individual, corporate), and region. Each segment offers distinct growth opportunities and competitive dynamics. Market size and growth projections are provided for each segment, offering a comprehensive overview of the market structure and potential.

Key Drivers of Japan Credit Cards Market Growth

Several key factors contribute to the growth of the Japan Credit Cards Market. These include:

- Rising Disposable Incomes: Increasing purchasing power among consumers fuels spending.

- Expanding E-commerce: Online shopping relies heavily on credit card transactions.

- Government Initiatives: Promotion of cashless transactions supports market expansion.

- Technological Advancements: Innovative features like contactless payments enhance user experience.

Challenges in the Japan Credit Cards Market Sector

The Japan Credit Cards Market faces several challenges including:

- High Competition: Intense rivalry among established players and new entrants.

- Regulatory Hurdles: Compliance with evolving regulations can be costly.

- Concerns about Data Security: Protecting user data is paramount in the digital age.

- Consumer Preference for Cash: A segment of the population still prefers cash transactions.

Emerging Opportunities in Japan Credit Cards Market

Emerging opportunities exist in:

- Expansion into rural areas: Reaching underserved populations with tailored products.

- Development of specialized cards: Targeting niche markets (e.g., eco-conscious consumers).

- Partnerships with Fintech companies: Leveraging technology to enhance services.

- Integration with loyalty programs: Enhancing the value proposition for consumers.

Leading Players in the Japan Credit Cards Market Market

- Rakuten Card

- Mitsubishi UFJ Financial Group

- Sumitomo Mitsui Financial Group

- Mizuho Financial Group

- Resona Holdings

- Japan Post Bank

- Aozora Bank

- Norinchukin Bank

- Shizuoka Bank

- JCB (Japan Credit Bureau)

List Not Exhaustive

Key Developments in Japan Credit Cards Market Industry

- May 2023: Sumitomo Mitsui Banking Corporation announced a USD 10 Million investment in Closed Loop Partners' Circular Plastics Fund, demonstrating a commitment to environmental sustainability.

- May 2023: Mizuho Financial Group, Inc. acquired Greenhill & Co., Inc. for approximately USD 550 Million, expanding its investment banking capabilities and market reach.

Future Outlook for Japan Credit Cards Market Market

The Japan Credit Cards Market is poised for continued growth, driven by sustained economic expansion, technological innovation, and government support for cashless transactions. Strategic partnerships and targeted product development will play a crucial role in shaping the market's future. The increasing adoption of digital technologies and mobile payment solutions presents significant opportunities for market expansion and penetration.

Japan Credit Cards Market Segmentation

-

1. Card Type

- 1.1. General Purpose Credit Cards

- 1.2. Specialty & Other Credit Cards

-

2. Application

- 2.1. Food & Groceries

- 2.2. Health & Pharmacy

- 2.3. Restaurants & Bars

- 2.4. Consumer Electronics

- 2.5. Media & Entertainment

- 2.6. Travel & Tourism

- 2.7. Other Applications

-

3. Provider

- 3.1. Visa

- 3.2. MasterCard

- 3.3. Other Providers

Japan Credit Cards Market Segmentation By Geography

- 1. Japan

Japan Credit Cards Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Usage of Credit Card give the bonus and reward points

- 3.3. Market Restrains

- 3.3.1. Usage of Credit Card give the bonus and reward points

- 3.4. Market Trends

- 3.4.1. Increasing in Number of Credit Card issued

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Credit Cards Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. General Purpose Credit Cards

- 5.1.2. Specialty & Other Credit Cards

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Groceries

- 5.2.2. Health & Pharmacy

- 5.2.3. Restaurants & Bars

- 5.2.4. Consumer Electronics

- 5.2.5. Media & Entertainment

- 5.2.6. Travel & Tourism

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Provider

- 5.3.1. Visa

- 5.3.2. MasterCard

- 5.3.3. Other Providers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Rakuten Card

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi UFJ Financial Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sumitomo Mitsui Financial Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mizuho Financial Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Resona Holdings

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Japan Post Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aozora Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Norinchukin Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shizuoka Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JCB (Japan Credit Bureau)**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rakuten Card

List of Figures

- Figure 1: Japan Credit Cards Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Credit Cards Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Credit Cards Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Credit Cards Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Japan Credit Cards Market Revenue Million Forecast, by Card Type 2019 & 2032

- Table 4: Japan Credit Cards Market Volume Billion Forecast, by Card Type 2019 & 2032

- Table 5: Japan Credit Cards Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Japan Credit Cards Market Volume Billion Forecast, by Application 2019 & 2032

- Table 7: Japan Credit Cards Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 8: Japan Credit Cards Market Volume Billion Forecast, by Provider 2019 & 2032

- Table 9: Japan Credit Cards Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Japan Credit Cards Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Japan Credit Cards Market Revenue Million Forecast, by Card Type 2019 & 2032

- Table 12: Japan Credit Cards Market Volume Billion Forecast, by Card Type 2019 & 2032

- Table 13: Japan Credit Cards Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Japan Credit Cards Market Volume Billion Forecast, by Application 2019 & 2032

- Table 15: Japan Credit Cards Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 16: Japan Credit Cards Market Volume Billion Forecast, by Provider 2019 & 2032

- Table 17: Japan Credit Cards Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Japan Credit Cards Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Credit Cards Market?

The projected CAGR is approximately 7.36%.

2. Which companies are prominent players in the Japan Credit Cards Market?

Key companies in the market include Rakuten Card, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, Mizuho Financial Group, Resona Holdings, Japan Post Bank, Aozora Bank, Norinchukin Bank, Shizuoka Bank, JCB (Japan Credit Bureau)**List Not Exhaustive.

3. What are the main segments of the Japan Credit Cards Market?

The market segments include Card Type, Application, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 652.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Usage of Credit Card give the bonus and reward points.

6. What are the notable trends driving market growth?

Increasing in Number of Credit Card issued.

7. Are there any restraints impacting market growth?

Usage of Credit Card give the bonus and reward points.

8. Can you provide examples of recent developments in the market?

May 2023: Sumitomo Mitsui Banking Corporation announced a USD 10 million investment in U.S.-based Closed Loop Partners' Circular Plastics Fund. The Closed Loop Circular Plastics Fund is managed and operated by Closed Loop Partners, an investment firm dedicated to advancing the circular economy. The fund provides catalytic debt and equity financing into solutions and infrastructure that advance the recovery and recycling of plastics, helping keep more materials in circulation while reducing greenhouse gas emissions and leading a shift to the circular economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Credit Cards Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Credit Cards Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Credit Cards Market?

To stay informed about further developments, trends, and reports in the Japan Credit Cards Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence