Key Insights

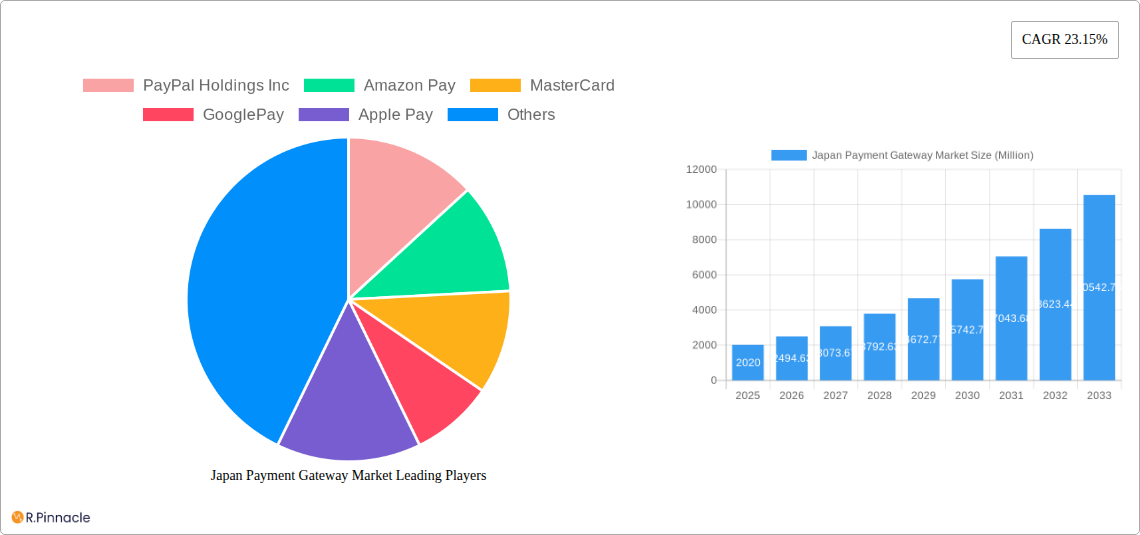

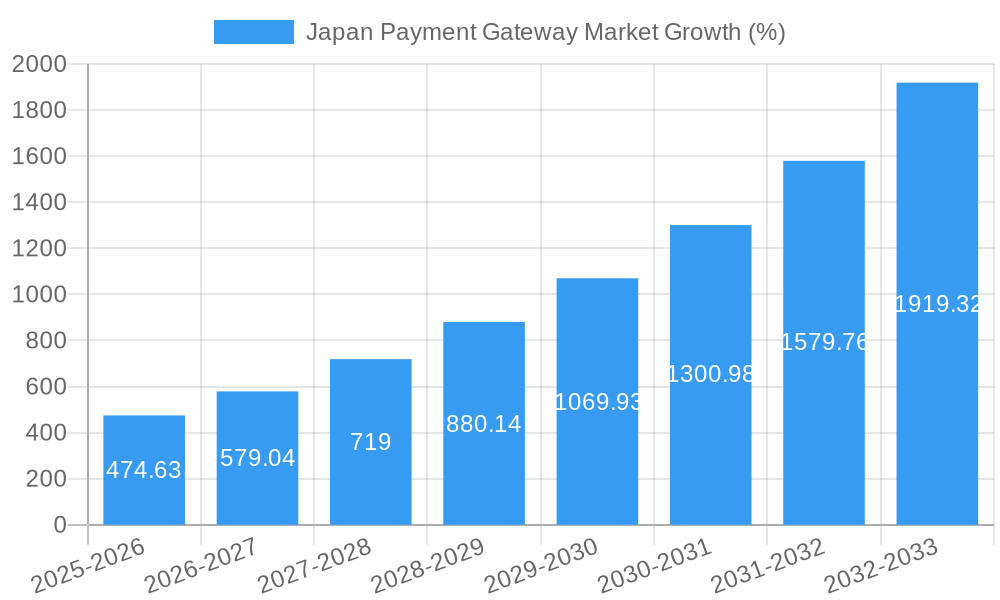

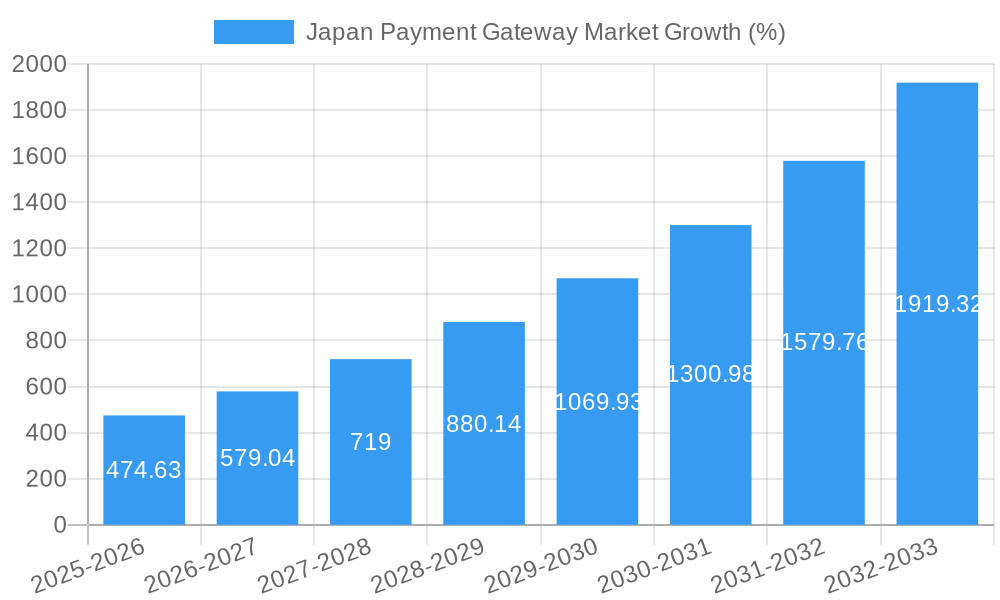

The Japan Payment Gateway Market is experiencing robust growth, projected to reach \$2.02 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 23.15% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of e-commerce and online transactions in Japan, driven by a young and digitally savvy population, is a primary driver. Furthermore, the government's initiatives to promote digitalization and cashless payments are significantly boosting market acceptance. The rise of mobile wallets and contactless payment solutions, coupled with enhanced security features offered by payment gateways, are also contributing to market growth. Competition is fierce, with established players like PayPal, Amazon Pay, and MasterCard vying for market share alongside prominent Japanese companies such as Rakuten Pay and GMO Payment Gateway. The market is segmented by payment type (credit/debit cards, mobile wallets, bank transfers etc.), transaction type (B2B, B2C), and industry vertical (e-commerce, retail, travel etc.). While challenges remain, such as concerns over data security and the need for continued infrastructure development, the overall outlook for the Japan Payment Gateway Market remains extremely positive.

The projected growth trajectory indicates substantial opportunities for both established players and new entrants. Strategic partnerships and collaborations are expected to play a crucial role in market penetration. Companies are likely to focus on developing innovative solutions, such as advanced fraud detection systems and personalized payment experiences, to gain a competitive edge. Furthermore, expansion into niche market segments and leveraging the increasing adoption of fintech solutions will be critical for achieving success in this dynamic market. The continued evolution of payment technologies and regulatory changes will shape the market landscape in the coming years, creating both challenges and opportunities for players operating in this space. This necessitates a strategic approach focused on adaptability and innovation to fully capitalize on the market’s growth potential.

Japan Payment Gateway Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan Payment Gateway Market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth trajectories. The report leverages extensive data analysis to provide actionable intelligence, helping you navigate the complexities of this rapidly evolving market.

Japan Payment Gateway Market Structure & Innovation Trends

This section analyzes the structure of the Japan Payment Gateway market, including market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities.

The market exhibits a moderately concentrated structure, with a few major players holding significant market share. For example, PayPal Holdings Inc, Amazon Pay, and MasterCard command substantial shares, though precise figures are proprietary. However, the market also presents opportunities for smaller, niche players specializing in specific segments.

- Market Concentration: Moderately concentrated, with major players holding xx% market share in 2025 (estimated).

- Innovation Drivers: Increasing e-commerce adoption, government initiatives promoting digital payments, and technological advancements in mobile payment solutions.

- Regulatory Frameworks: The Japanese government's ongoing efforts to regulate and secure digital payment systems influence market dynamics significantly.

- Product Substitutes: Traditional cash and card payments remain prevalent, posing a competitive threat to gateway providers.

- End-User Demographics: A predominantly tech-savvy population fuels market growth, particularly among younger demographics.

- M&A Activities: The report analyzes key mergers and acquisitions, noting a xx Million total deal value in the period 2019-2024 (estimated).

Japan Payment Gateway Market Dynamics & Trends

This section explores the key dynamics and trends shaping the Japan Payment Gateway Market. The market is experiencing robust growth fueled by a confluence of factors.

The rising adoption of e-commerce and mobile payments is a primary driver. Technological innovations, such as the increased use of contactless payments and mobile wallets, are transforming consumer behavior and payment preferences. The competitive landscape is intense, with both established players and new entrants vying for market share. This competitive pressure is driving innovation and improving service offerings. The market's CAGR from 2025 to 2033 is projected to be xx%, driven primarily by growth in e-commerce penetration, reaching xx% market penetration by 2033 (estimated). Consumer preferences are shifting towards secure, convenient, and user-friendly payment solutions, creating new opportunities for gateway providers who can effectively meet these demands.

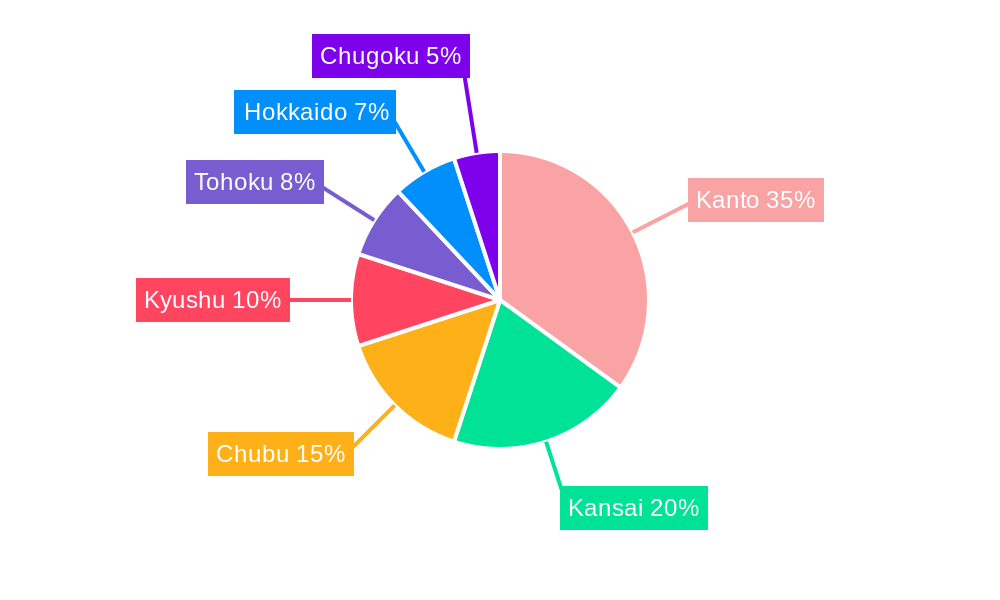

Dominant Regions & Segments in Japan Payment Gateway Market

This section highlights the leading regions and segments within the Japan Payment Gateway Market.

While detailed regional breakdown is proprietary, the major metropolitan areas (Tokyo, Osaka, Nagoya) are likely to show the highest concentration of payment gateway transactions due to higher levels of e-commerce activity and higher population density.

- Key Drivers in Dominant Regions:

- Strong e-commerce infrastructure: Robust internet penetration and high online shopping rates contribute significantly to payment gateway demand.

- Government support for digitalization: Government initiatives to promote cashless payments boost market growth.

- High mobile penetration: Widespread smartphone usage facilitates mobile payment adoption.

The dominance of these regions stems from a combination of factors, including higher internet and smartphone penetration rates, a robust e-commerce ecosystem, and supportive government policies.

Japan Payment Gateway Market Product Innovations

The Japan Payment Gateway market witnesses constant innovation. New payment methods, such as QR code-based payments and biometric authentication, are gaining traction. Providers are focusing on enhancing security features and improving user experience to attract and retain customers. Integration with various e-commerce platforms and loyalty programs is crucial for competitiveness.

Report Scope & Segmentation Analysis

This report segments the Japan Payment Gateway market based on various factors, including payment type (credit/debit cards, mobile wallets, e-wallets etc.), transaction type (online vs. offline), business size (SMEs vs. large enterprises), and industry vertical (retail, travel, etc). Each segment demonstrates varying growth rates, influenced by unique consumer behaviors and industry-specific dynamics. Growth projections for each segment vary, ranging from xx% to xx% CAGR (estimated) over the forecast period. Competitive dynamics within each segment are analyzed, identifying key players and their market positions.

Key Drivers of Japan Payment Gateway Market Growth

Several factors fuel the growth of the Japan Payment Gateway Market. The increasing adoption of e-commerce, a rapidly expanding digital economy, and supportive government initiatives are major contributors. Technological advancements, like the rise of mobile wallets and contactless payment systems, are further accelerating market expansion.

Challenges in the Japan Payment Gateway Market Sector

Despite significant growth potential, the Japan Payment Gateway Market faces challenges. Stringent regulatory compliance requirements can pose obstacles for smaller players. Security concerns regarding data breaches remain a significant factor, impacting consumer trust. The intense competition among established and emerging players also presents challenges. These factors are estimated to cause an xx% reduction in potential growth in 2027 (estimated).

Emerging Opportunities in Japan Payment Gateway Market

Despite existing challenges, considerable opportunities exist. The rising popularity of mobile payments, particularly among younger demographics, presents significant growth prospects. Further expansion into rural areas and the growing adoption of omnichannel payment solutions offer additional avenues for market expansion. Innovation in areas like blockchain technology and AI-powered fraud detection offers promising avenues for growth.

Leading Players in the Japan Payment Gateway Market Market

- PayPal Holdings Inc

- Amazon Pay

- MasterCard

- Google Pay

- Apple Pay

- GMO Payment Gateway

- NETSTARS CO LTD

- Rakuten Group Inc

- Stripe Inc

- List Not Exhaustive

Key Developments in Japan Payment Gateway Market Industry

- March 2024: Hana Bank partnered with GMO Payment Gateway to launch a cross-border payment system, facilitating Korean businesses' expansion into Japan.

- March 2024: Sumitomo Mitsui Card Co. Ltd selected NETSTARS Co. Ltd as the code payment gateway for its "stera" payment terminals.

Future Outlook for Japan Payment Gateway Market Market

The Japan Payment Gateway Market is poised for continued growth, driven by increasing digitalization, supportive government policies, and evolving consumer preferences. Strategic partnerships, technological innovation, and expansion into untapped market segments will be crucial for success in this dynamic market. The projected growth trajectory indicates substantial market expansion over the next decade.

Japan Payment Gateway Market Segmentation

-

1. Type

- 1.1. Hosted

- 1.2. Non-Hosted

-

2. Enterprise

- 2.1. Small and Medium Enterprise (SME)

- 2.2. Large Enterprise

-

3. End-user

- 3.1. Travel

- 3.2. Retail

- 3.3. BFSI

- 3.4. Media and Entertainment

- 3.5. Other End Users

Japan Payment Gateway Market Segmentation By Geography

- 1. Japan

Japan Payment Gateway Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail

- 3.3. Market Restrains

- 3.3.1. Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail

- 3.4. Market Trends

- 3.4.1. Increased E-commerce Sales and High Internet Penetration Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Payment Gateway Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hosted

- 5.1.2. Non-Hosted

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Small and Medium Enterprise (SME)

- 5.2.2. Large Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Travel

- 5.3.2. Retail

- 5.3.3. BFSI

- 5.3.4. Media and Entertainment

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 PayPal Holdings Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amazon Pay

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MasterCard

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GooglePay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Apple Pay

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GMO Payment Gateway

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NETSTARS CO LTD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rakuten Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stripe Inc *List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 PayPal Holdings Inc

List of Figures

- Figure 1: Japan Payment Gateway Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Payment Gateway Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Payment Gateway Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Payment Gateway Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Japan Payment Gateway Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Japan Payment Gateway Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Japan Payment Gateway Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 6: Japan Payment Gateway Market Volume Billion Forecast, by Enterprise 2019 & 2032

- Table 7: Japan Payment Gateway Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 8: Japan Payment Gateway Market Volume Billion Forecast, by End-user 2019 & 2032

- Table 9: Japan Payment Gateway Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Japan Payment Gateway Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Japan Payment Gateway Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Japan Payment Gateway Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Japan Payment Gateway Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 14: Japan Payment Gateway Market Volume Billion Forecast, by Enterprise 2019 & 2032

- Table 15: Japan Payment Gateway Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 16: Japan Payment Gateway Market Volume Billion Forecast, by End-user 2019 & 2032

- Table 17: Japan Payment Gateway Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Japan Payment Gateway Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Payment Gateway Market?

The projected CAGR is approximately 23.15%.

2. Which companies are prominent players in the Japan Payment Gateway Market?

Key companies in the market include PayPal Holdings Inc, Amazon Pay, MasterCard, GooglePay, Apple Pay, GMO Payment Gateway, NETSTARS CO LTD, Rakuten Group Inc, Stripe Inc *List Not Exhaustive.

3. What are the main segments of the Japan Payment Gateway Market?

The market segments include Type, Enterprise, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail.

6. What are the notable trends driving market growth?

Increased E-commerce Sales and High Internet Penetration Rate.

7. Are there any restraints impacting market growth?

Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail.

8. Can you provide examples of recent developments in the market?

March 2024: Hana Bank partnered with GMO Payment Gateway, Japan's payment processing firm, to introduce a cross-border payment and settlement system. This initiative aims to support domestic companies venturing into the Japanese market. The collaboration would offer Korean businesses a comprehensive suite of services, ranging from expert consulting for business startups and franchise launches in Japan to help transfer e-commerce sales made in Japan.March 2024: Sumitomo Mitsui Card Co. Ltd chose NETSTARS Co. Ltd as the code payment gateway for its payment terminals, namely the "stera terminal unit" and "stera terminal mobile." These terminals are utilized by "stera," the payment platform Sumitomo Mitsui Card offers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Payment Gateway Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Payment Gateway Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Payment Gateway Market?

To stay informed about further developments, trends, and reports in the Japan Payment Gateway Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence