Key Insights

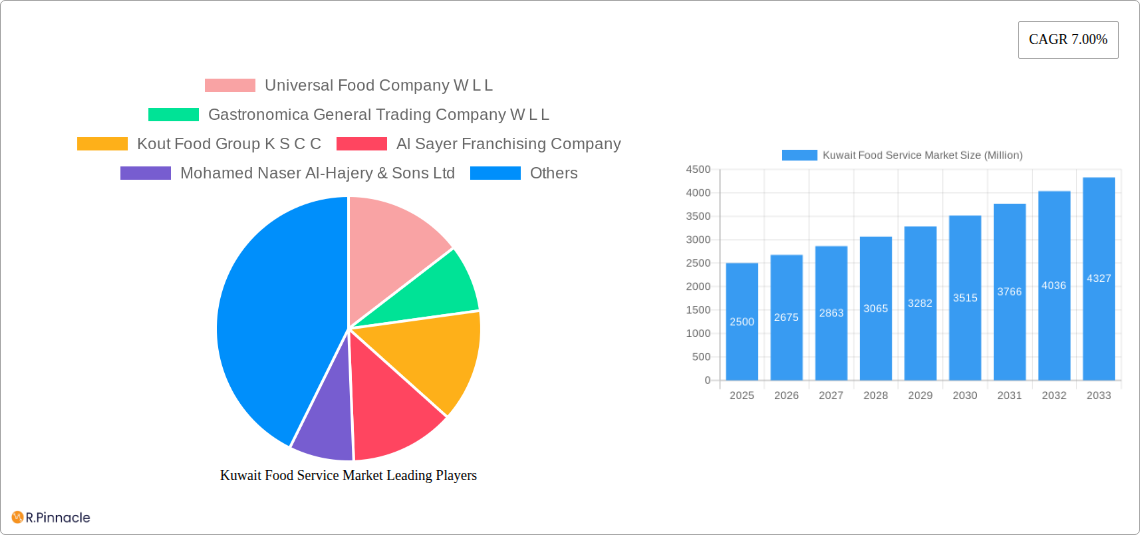

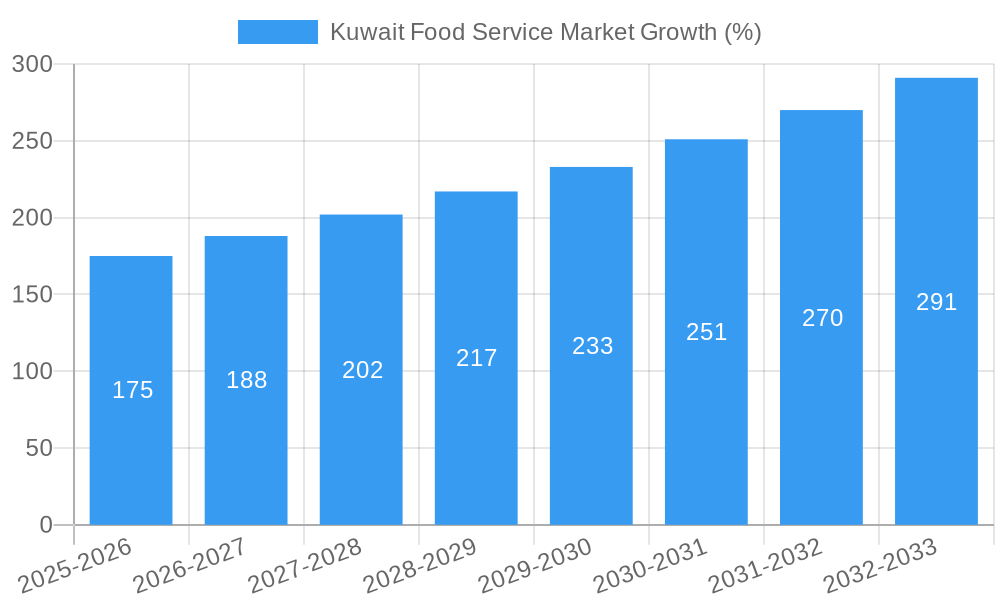

The Kuwait food service market, exhibiting a robust CAGR of 7.00% from 2019 to 2024, is poised for continued growth through 2033. Driven by a young and increasingly affluent population with a preference for diverse culinary experiences and convenience, the market shows strong potential. The increasing number of tourists and expatriates further fuels demand, particularly within the QSR (Quick Service Restaurant) segment. Cafes and bars represent a significant portion of the market, alongside other QSR cuisines reflecting evolving consumer tastes. Growth is being propelled by the expansion of chained outlets offering standardized quality and brand recognition, along with the rise of food delivery services and online ordering platforms. However, challenges remain, including intense competition among established players and the rising costs of raw materials and labor which may impact profit margins. The market segmentation, encompassing varied outlets (chained, independent) and locations (leisure, lodging, retail, standalone, travel, foodservice), presents opportunities for tailored strategies and targeted marketing efforts. The dominance of companies like Americana Restaurants International PLC and M H Alshaya Co WLL highlights the concentration within the sector, though there's scope for smaller, specialized players to thrive by catering to niche preferences.

The market's future trajectory depends on several factors including government regulations concerning food safety and hygiene, economic stability, and the continued expansion of the tourism sector. Location-specific strategies will be vital, with high-traffic areas like shopping malls and tourist destinations offering significant opportunities. Sustainable practices and locally sourced ingredients are also emerging as crucial considerations for attracting environmentally conscious consumers. The overall outlook for the Kuwait food service market remains optimistic, though strategic adaptation to market fluctuations and evolving consumer demands will be critical for long-term success.

Kuwait Food Service Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Kuwait food service market, offering invaluable insights for industry professionals, investors, and strategic planners. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of current market dynamics and future growth trajectories. The report encompasses market sizing (in Millions), segmentation analysis, competitive landscape, and key industry developments, offering actionable intelligence to navigate this dynamic sector.

Kuwait Food Service Market Structure & Innovation Trends

This section analyzes the structure of the Kuwaiti food service market, focusing on market concentration, innovation drivers, and competitive dynamics. We examine the regulatory landscape, the role of product substitutes, and the impact of end-user demographics on market trends. The analysis includes an assessment of mergers and acquisitions (M&A) activity within the sector, providing insights into deal values and their influence on market share. Key players like Americana Restaurants International PLC, M H Alshaya Co WLL, and Kout Food Group K S C C are assessed for their market influence and strategic moves. We estimate that the top five players hold approximately xx% of the market share in 2025, with an estimated xx Million USD in M&A activity between 2019 and 2024.

- Market Concentration: The Kuwaiti food service market exhibits a [Describe concentration level - e.g., moderately concentrated] structure, with a few dominant players and a large number of smaller independent operators.

- Innovation Drivers: Technological advancements such as online ordering platforms, delivery services, and kitchen automation are driving innovation. Changing consumer preferences toward healthier options and diverse cuisines also play a significant role.

- Regulatory Framework: Government regulations regarding food safety, hygiene, and licensing impact market operations. [Mention specific regulations or their impact if known].

- Product Substitutes: The availability of home-cooked meals and grocery delivery services acts as a substitute for food services. The impact is estimated at xx% of the market in 2025.

- End-User Demographics: Kuwait's young and diverse population with varying income levels shapes demand across different food service segments. The rising middle class contributes significantly to market growth.

- M&A Activity: Consolidation through mergers and acquisitions is observed, with larger players expanding their footprint. [Mention specific examples if available, along with deal values].

Kuwait Food Service Market Market Dynamics & Trends

This section delves into the key dynamics shaping the Kuwait food service market. We explore the factors driving market growth, including economic growth, urbanization, and changing lifestyles. Technological disruptions, such as the rise of food delivery apps and online ordering, are examined for their impact on consumer behavior and market competition. Consumer preferences, including trends toward healthier eating and specific cuisines, are analyzed. Competitive dynamics, including pricing strategies, product differentiation, and marketing initiatives, are explored. The estimated Compound Annual Growth Rate (CAGR) for the market during the forecast period (2025-2033) is projected at xx%, with market penetration expected to reach xx% by 2033.

[Insert a detailed paragraph of 600 words exploring the points mentioned above, using specific data and examples where possible. Quantify impacts wherever data permits; otherwise, use informed estimates. ]

Dominant Regions & Segments in Kuwait Food Service Market

This section identifies the dominant regions and segments within the Kuwait food service market. The analysis considers outlet type (chained vs. independent), location (leisure, lodging, retail, standalone, travel), and food service type (cafes & bars, other QSR cuisines). We analyze the key drivers influencing dominance in each segment, encompassing economic policies, infrastructure development, and consumer preferences.

Dominant Segment Analysis: [Choose one segment from each category - Outlet, Location, Foodservice type - and explain why it's dominant in detail. Provide quantitative data whenever available.]

- Key Drivers for Dominant Segment:

- [List key drivers like economic policies, infrastructure, etc., with supporting data or estimations.]

[Repeat this section for other dominant segments, if discernible from available data.]

Kuwait Food Service Market Product Innovations

The Kuwait food service market is witnessing significant product innovations driven by technological advancements and evolving consumer preferences. The integration of technology, such as online ordering systems and mobile payment options, is enhancing customer experience. Healthier menu options and customized offerings are gaining traction, reflecting a growing demand for personalized food experiences. These innovations are aimed at improving efficiency, enhancing customer convenience, and increasing profitability for food service businesses. The adoption rate of new technologies in the food service industry is anticipated to increase significantly during the forecast period.

Report Scope & Segmentation Analysis

This report comprehensively segments the Kuwait food service market across various parameters:

Outlet:

- Chained Outlets: This segment includes established restaurant chains with multiple locations. [Insert Growth Projections, Market Size estimates, and Competitive dynamics if available.]

- Independent Outlets: This comprises independently owned and operated restaurants. [Insert Growth Projections, Market Size estimates, and Competitive dynamics if available.]

Location:

- Leisure: Restaurants located in entertainment and recreational areas. [Insert Growth Projections, Market Size estimates, and Competitive dynamics if available.]

- Lodging: Food service within hotels and other accommodation facilities. [Insert Growth Projections, Market Size estimates, and Competitive dynamics if available.]

- Retail: Food courts and restaurants within shopping malls. [Insert Growth Projections, Market Size estimates, and Competitive dynamics if available.]

- Standalone: Freestanding restaurants. [Insert Growth Projections, Market Size estimates, and Competitive dynamics if available.]

- Travel: Food and beverage services at airports and transportation hubs. [Insert Growth Projections, Market Size estimates, and Competitive dynamics if available.]

Foodservice Type:

- Cafes & Bars: Coffee shops, cafes, and bars. [Insert Growth Projections, Market Size estimates, and Competitive dynamics if available.]

- Other QSR Cuisines: Quick-service restaurants offering various cuisines. [Insert Growth Projections, Market Size estimates, and Competitive dynamics if available.]

Key Drivers of Kuwait Food Service Market Growth

Several factors contribute to the growth of the Kuwait food service market. Economic growth and rising disposable incomes fuel consumer spending on food services. Urbanization and a growing population increase demand for convenient and diverse dining options. Government initiatives promoting tourism and infrastructure development further boost the sector. The influx of international restaurant chains adds variety and competition, stimulating innovation and market expansion.

Challenges in the Kuwait Food Service Market Sector

The Kuwait food service market faces challenges including high operating costs, intense competition, and fluctuating food prices. Regulatory compliance and labor costs also present significant hurdles. Maintaining consistent food quality and addressing consumer expectations for hygiene and safety are crucial concerns for operators. Supply chain disruptions can impact profitability and market stability. The combined effect of these challenges is estimated to impact the market growth by an average of xx% annually.

Emerging Opportunities in Kuwait Food Service Market

Emerging opportunities include the growing demand for healthy and organic food options, increasing popularity of food delivery services, and the potential for expansion into new segments such as cloud kitchens and food tech solutions. Leveraging technology to improve efficiency and customer service presents a significant opportunity for businesses. Catering to evolving consumer preferences for diverse cuisines and personalized experiences will be vital for achieving sustainable growth.

Leading Players in the Kuwait Food Service Market Market

- Universal Food Company W L L

- Gastronomica General Trading Company W L L

- Kout Food Group K S C C

- Al Sayer Franchising Company

- Mohamed Naser Al-Hajery & Sons Ltd

- Americana Restaurants International PLC

- M H Alshaya Co WLL

- LuLu Group International

- Al Maousherji Catering Company

- Alghanim Industries & Yusuf A Alghanim & Sons W L L

- The Sultan Center

- AlAmar Foods Company

Key Developments in Kuwait Food Service Market Industry

- August 2022: Americana Restaurants International PLC secured a franchise agreement with Peet's Coffee, expanding its offerings and market reach in the GCC region. This is expected to significantly impact the coffee shop segment of the market.

- June 2022: Americana Restaurants partnered with Miso Robotics, integrating robotic automation into its operations. This development is expected to improve efficiency and reduce labor costs, leading to increased profitability.

- April 2022: The Sultan Center announced a five-year expansion plan, signifying ambitious growth within the retail food service sector and signifying increased competition within the market.

Future Outlook for Kuwait Food Service Market Market

The Kuwait food service market is poised for continued growth, driven by strong economic fundamentals, evolving consumer preferences, and technological advancements. The increasing adoption of online ordering, delivery services, and innovative food concepts will further shape the market landscape. Strategic partnerships, mergers and acquisitions, and expansion into new geographical areas and product segments will play a critical role in defining the future success of players in this dynamic market. The market is projected to reach xx Million USD by 2033.

Kuwait Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Juice/Smoothie/Desserts Bars

- 1.1.1.2. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Kuwait Food Service Market Segmentation By Geography

- 1. Kuwait

Kuwait Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. An increase in the number of online meal delivery application users and a rise in the number of outlets favour the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Food Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Juice/Smoothie/Desserts Bars

- 5.1.1.1.2. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

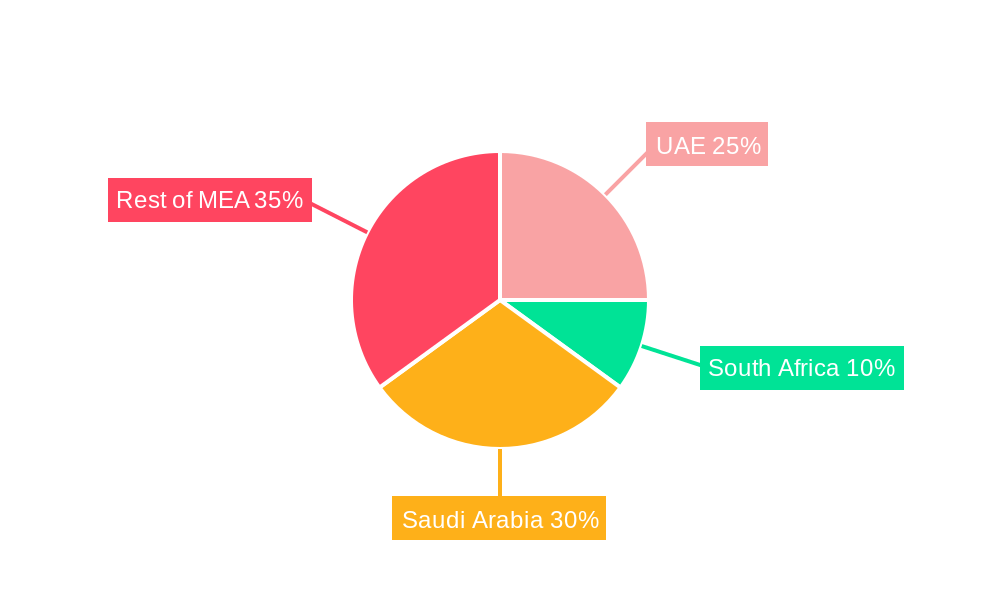

- 6. UAE Kuwait Food Service Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Kuwait Food Service Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Kuwait Food Service Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Kuwait Food Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Universal Food Company W L L

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Gastronomica General Trading Company W L L

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Kout Food Group K S C C

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Al Sayer Franchising Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mohamed Naser Al-Hajery & Sons Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Americana Restaurants International PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 M H Alshaya Co WLL

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 LuLu Group International

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Al Maousherji Catering Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Alghanim Industries & Yusuf A Alghanim & Sons W L L

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 The Sultan Center

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 AlAmar Foods Company

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Universal Food Company W L L

List of Figures

- Figure 1: Kuwait Food Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait Food Service Market Share (%) by Company 2024

List of Tables

- Table 1: Kuwait Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait Food Service Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 3: Kuwait Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 4: Kuwait Food Service Market Volume Thousand Tons Forecast, by Foodservice Type 2019 & 2032

- Table 5: Kuwait Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 6: Kuwait Food Service Market Volume Thousand Tons Forecast, by Outlet 2019 & 2032

- Table 7: Kuwait Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 8: Kuwait Food Service Market Volume Thousand Tons Forecast, by Location 2019 & 2032

- Table 9: Kuwait Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Kuwait Food Service Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 11: Kuwait Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Kuwait Food Service Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 13: UAE Kuwait Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: UAE Kuwait Food Service Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 15: South Africa Kuwait Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Kuwait Food Service Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 17: Saudi Arabia Kuwait Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Saudi Arabia Kuwait Food Service Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 19: Rest of MEA Kuwait Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of MEA Kuwait Food Service Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 21: Kuwait Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 22: Kuwait Food Service Market Volume Thousand Tons Forecast, by Foodservice Type 2019 & 2032

- Table 23: Kuwait Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 24: Kuwait Food Service Market Volume Thousand Tons Forecast, by Outlet 2019 & 2032

- Table 25: Kuwait Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 26: Kuwait Food Service Market Volume Thousand Tons Forecast, by Location 2019 & 2032

- Table 27: Kuwait Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Kuwait Food Service Market Volume Thousand Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Food Service Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Kuwait Food Service Market?

Key companies in the market include Universal Food Company W L L, Gastronomica General Trading Company W L L, Kout Food Group K S C C, Al Sayer Franchising Company, Mohamed Naser Al-Hajery & Sons Ltd, Americana Restaurants International PLC, M H Alshaya Co WLL, LuLu Group International, Al Maousherji Catering Company, Alghanim Industries & Yusuf A Alghanim & Sons W L L, The Sultan Center, AlAmar Foods Company.

3. What are the main segments of the Kuwait Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

An increase in the number of online meal delivery application users and a rise in the number of outlets favour the market growth.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

August 2022: Americana Restaurants International PLC declared that it made a franchise agreement with a United States-based craft coffee company, Peet's Coffee, to enter the GCC market.June 2022: Americana Restaurants, the master franchisee in the MENA region for KFC, Pizza Hut, Hardee's, Krispy Kreme and more, announced that it had entered a partnership with Miso Robotics, a US-based company that has been transforming the restaurant industry through robotics and intelligent automation.April 2022: The Sulthan Center announced its five-year expansion plan spanning multiple countries and store categories. It had 25 properties in Kuwait, Jordan, Oman, and Bahrain, in over 20,000 sq. m. of space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Food Service Market?

To stay informed about further developments, trends, and reports in the Kuwait Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence