Key Insights

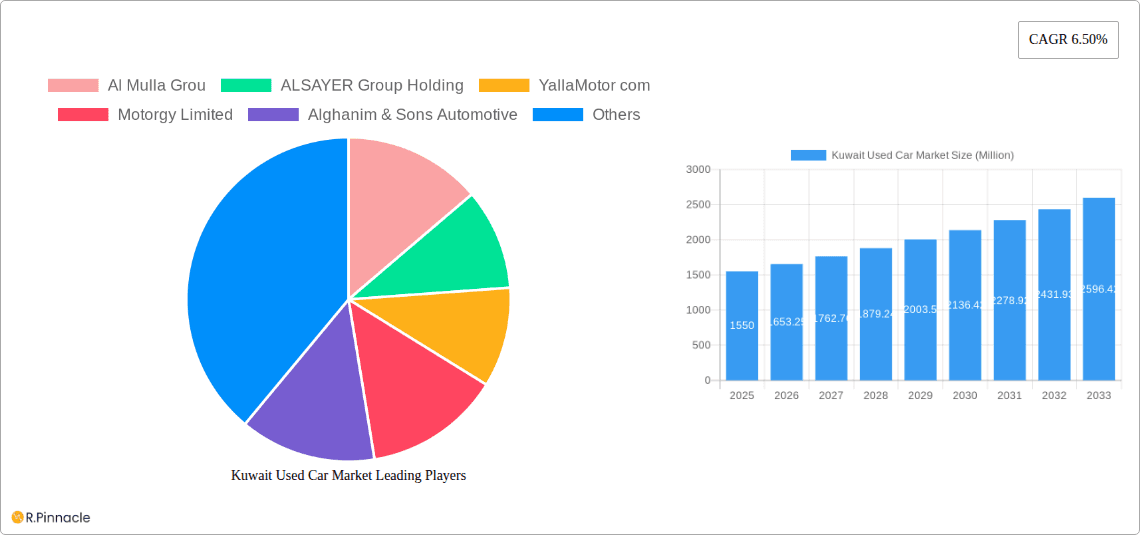

The Kuwait used car market, valued at $1.55 billion in 2025, is projected to experience robust growth, driven by factors such as increasing vehicle ownership, a preference for more affordable transportation options compared to new cars, and a burgeoning online used car marketplace. The market's Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033 indicates a consistently expanding market. Several segments contribute to this growth. The organized vendor segment is expected to see significant gains due to increased consumer trust and better quality assurance. Gasoline-powered vehicles continue to dominate the fuel type segment, although the electric vehicle segment is predicted to witness slow but steady growth, influenced by government initiatives promoting sustainable transportation. SUVs and MUVs remain popular choices among consumers due to their spaciousness and versatility, further driving demand within the vehicle type segment. Key players like Al Mulla Group, ALSAYER Group Holding, and YallaMotor.com are actively shaping the market landscape through their online platforms and established dealership networks. Competition is expected to intensify as new entrants emerge, pushing for innovation and improved services within the used car sector.

Kuwait Used Car Market Market Size (In Billion)

The market's growth is, however, subject to certain restraints. Fluctuations in oil prices can directly impact purchasing power and vehicle demand. Government regulations concerning vehicle age and emissions standards could also influence the market's trajectory. Furthermore, the availability of financing options and consumer confidence levels will play a vital role in driving overall market performance. To successfully navigate these challenges, market players must focus on offering transparent pricing, comprehensive vehicle inspections, and efficient after-sales service to build consumer trust and maintain sustainable growth. The evolving online landscape provides opportunities for growth through optimized digital marketing and improved online platforms to reach a wider audience.

Kuwait Used Car Market Company Market Share

Kuwait Used Car Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Kuwait used car market, covering the period 2019-2033, with a focus on market dynamics, key players, and future growth prospects. The report leverages extensive data analysis to deliver actionable insights for industry professionals, investors, and strategic decision-makers. The total market size is projected to reach xx Million by 2033.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Kuwait Used Car Market Market Structure & Innovation Trends

The Kuwaiti used car market exhibits a diverse structure, encompassing both organized and unorganized vendors. Organized players, including established dealerships like Al Mulla Group, ALSAYER Group Holding, and YallaMotor.com, hold a significant market share, estimated at xx%, driven by their established brand reputation and customer service. Unorganized vendors, comprising individual sellers and smaller dealerships, constitute the remaining xx% of the market, characterized by lower prices and varied vehicle quality.

Market concentration is moderate, with the top five players holding approximately xx% of the market share in 2024. Innovation is driven by online platforms like YallaMotor.com and Dubizzle, offering streamlined vehicle listings and digital payment options. Regulatory frameworks, including vehicle inspection and licensing procedures, influence market operations. Substitute products include public transport and ride-hailing services; however, private car ownership remains prevalent in Kuwait. The end-user demographic is diverse, spanning across various income levels and age groups. M&A activities have been moderate in recent years, with deal values estimated at xx Million in the last five years.

- Market Share: Organized Vendors: xx%, Unorganized Vendors: xx%

- Top 5 Players Market Share: xx%

- M&A Deal Value (2019-2024): xx Million

Kuwait Used Car Market Market Dynamics & Trends

The Kuwait used car market is experiencing dynamic growth, fueled by factors such as a rising population, increasing urbanization, and a preference for personal transportation. The market's Compound Annual Growth Rate (CAGR) is estimated to be xx% during the forecast period (2025-2033). Technological disruptions are evident in the form of online marketplaces, enhancing convenience and transparency for buyers. Consumer preferences are shifting towards fuel-efficient vehicles and SUVs, reflecting changing lifestyle trends. Competitive dynamics are intense, with players emphasizing price competitiveness, customer service, and innovative sales strategies. Market penetration of online platforms is increasing, with xx% of used car transactions now occurring online.

Dominant Regions & Segments in Kuwait Used Car Market

The Kuwait used car market demonstrates strong dominance in the urban regions of Kuwait City and Hawally. The organized vendor segment holds a larger share of the market compared to the unorganized segment, driven by consumer trust in established dealerships and their associated services. Gasoline-powered vehicles remain the dominant fuel type, followed by Diesel, while the Electric and Other Fuel Types segments are still relatively nascent. SUVs and Sedans constitute the largest share of vehicle types, driven by family needs and diverse preferences.

- Key Drivers for Organized Segment Dominance: Brand Reputation, Warranty & After-Sales Services, Finance Options.

- Key Drivers for Gasoline Vehicle Dominance: Affordability, Wide Availability of Fuel Stations, Established Infrastructure.

- Key Drivers for SUV/Sedan Dominance: Family Needs, Diverse Preferences, Wide Availability.

Kuwait Used Car Market Product Innovations

Recent innovations in the Kuwaiti used car market focus on enhancing the customer buying experience through digital platforms and improved services. Online marketplaces offer features like detailed vehicle history reports, virtual inspections, and secure payment gateways. Dealerships are increasingly emphasizing transparent pricing and warranty options. The trend is towards incorporating technology to increase efficiency and build trust in the buying process.

Report Scope & Segmentation Analysis

This report segments the Kuwait used car market across various parameters:

Vendor Type: Organized and Unorganized. The organized segment projects higher growth (xx%) than the unorganized (xx%).

Fuel Type: Gasoline, Diesel, Electric, and Other Fuel Types. Gasoline remains dominant but Electric vehicles (EVs) are expected to gain traction.

Vehicle Type: Hatchback, Sedan, SUVs, and MUVs. SUVs and Sedans will be the leading segments.

Each segment provides detailed analysis of market size, growth projections, and competitive dynamics.

Key Drivers of Kuwait Used Car Market Growth

Several factors drive the growth of the Kuwait used car market:

- Rising Population and Urbanization: Driving the demand for personal transportation.

- Favorable Financing Options: Making car ownership accessible.

- Growing Preference for SUVs: Reflecting changing lifestyle trends.

- Online Marketplaces: Enhancing market transparency and convenience.

Challenges in the Kuwait Used Car Market Sector

The Kuwait used car market faces challenges such as:

- Fluctuating Fuel Prices: Impacting consumer affordability.

- Stringent Vehicle Inspection Regulations: Adding complexity to the process.

- Competition from New Car Market: Influencing demand and prices.

Emerging Opportunities in Kuwait Used Car Market

Emerging opportunities include:

- Growth of the Electric Vehicle Segment: Representing a potential growth area.

- Expansion of Online Marketplaces: Increasing penetration and service diversification.

- Focus on Customer Service & Transparency: Addressing consumer concerns and building trust.

Leading Players in the Kuwait Used Car Market Market

- Al Mulla Group

- ALSAYER Group Holding

- YallaMotor.com

- Motorgy Limited

- Alghanim & Sons Automotive

- AlTayer Motors

- Weelz

- AL BABTAIN GROUP

- Al-Futtaim Group

- Dubizzle Group

Key Developments in Kuwait Used Car Market Industry

- March 2023: Kuwait Finance House launched the "Apply and Win" campaign, boosting auto financing options.

- August 2023: Lynk & Co opened its first showroom, enhancing the car-buying experience.

Future Outlook for Kuwait Used Car Market Market

The Kuwait used car market is poised for continued growth, driven by economic stability, evolving consumer preferences, and technological advancements. Strategic investments in online platforms and customer-centric services will be crucial for success. The expansion of the electric vehicle segment presents significant opportunities for market players.

Kuwait Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicles (SUVs)

- 1.4. Multi-Purpose Vehicles (MUVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types

Kuwait Used Car Market Segmentation By Geography

- 1. Kuwait

Kuwait Used Car Market Regional Market Share

Geographic Coverage of Kuwait Used Car Market

Kuwait Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Online Sales Channel Witnessed Significant Market Growth

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Sport Utility Vehicles are dominating the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicles (SUVs)

- 5.1.4. Multi-Purpose Vehicles (MUVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Al Mulla Grou

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ALSAYER Group Holding

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 YallaMotor com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Motorgy Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alghanim & Sons Automotive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AlTayer Motors

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Weelz

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AL BABTAIN GROUP

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al-Futtaim Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dubizzle Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Al Mulla Grou

List of Figures

- Figure 1: Kuwait Used Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Kuwait Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: Kuwait Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Kuwait Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 3: Kuwait Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: Kuwait Used Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Kuwait Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Kuwait Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 7: Kuwait Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: Kuwait Used Car Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Used Car Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Kuwait Used Car Market?

Key companies in the market include Al Mulla Grou, ALSAYER Group Holding, YallaMotor com, Motorgy Limited, Alghanim & Sons Automotive, AlTayer Motors, Weelz, AL BABTAIN GROUP, Al-Futtaim Group, Dubizzle Group.

3. What are the main segments of the Kuwait Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Online Sales Channel Witnessed Significant Market Growth.

6. What are the notable trends driving market growth?

Sport Utility Vehicles are dominating the market.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

August 2023: Lynk & Co inaugurated the inaugural Lynk & Co Space in the country. This innovative service enhances the car-buying experience, providing Kuwaiti customers with a distinctive opportunity to explore the brand's outstanding vehicle lineup. Lynk & Co. is a joint venture between Geely Auto and Volvo Cars.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Used Car Market?

To stay informed about further developments, trends, and reports in the Kuwait Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence