Key Insights

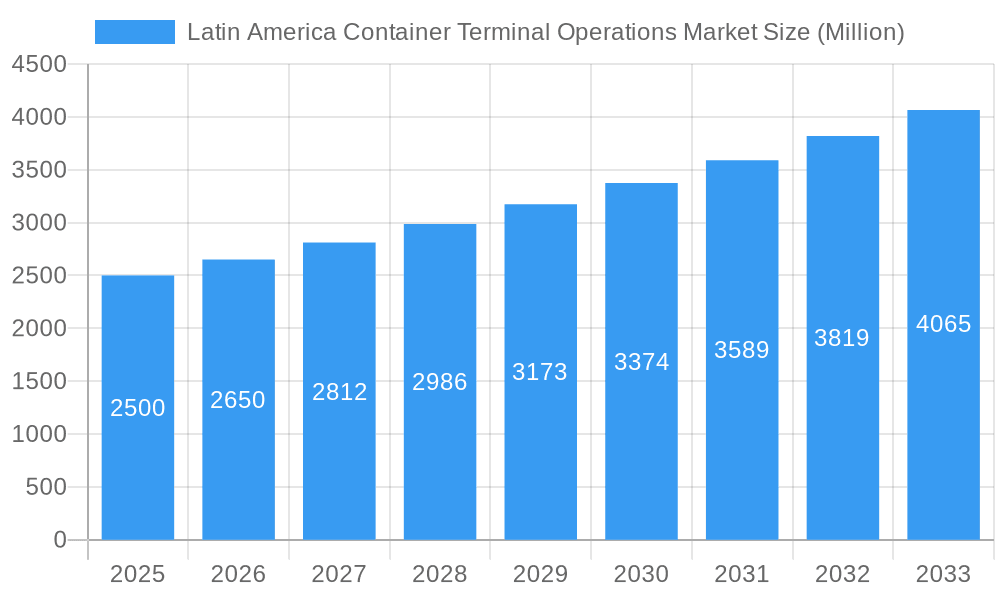

The Latin America Container Terminal Operations market is set for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 4.3%. This growth is anticipated to drive the market size to 5.28 billion by 2025. Key drivers include increasing international trade, especially with Asia, necessitating advanced port infrastructure and services throughout Latin America. Brazil, Mexico, and Peru are at the forefront of this growth, utilizing their strategic locations and modern port facilities to attract higher cargo volumes. The surge in e-commerce also significantly influences the market, demanding more efficient handling of smaller shipments and pushing terminal operators towards greater technological integration. Furthermore, the diversification of cargo types, with a notable rise in dry cargo alongside continued demand for crude oil and liquid cargo, contributes to the market's overall expansion. The market is segmented by service offerings (stevedoring, cargo handling & transportation, and others) and by cargo type (crude oil, dry cargo, and other liquid cargo). Leading companies such as APM Terminals Callao, EMAP, and Santos Brasil are actively influencing market trends through capacity enhancements, technological advancements, and strategic alliances. However, challenges such as underdeveloped infrastructure in certain areas and the need for standardized regulatory frameworks may impact streamlined operations.

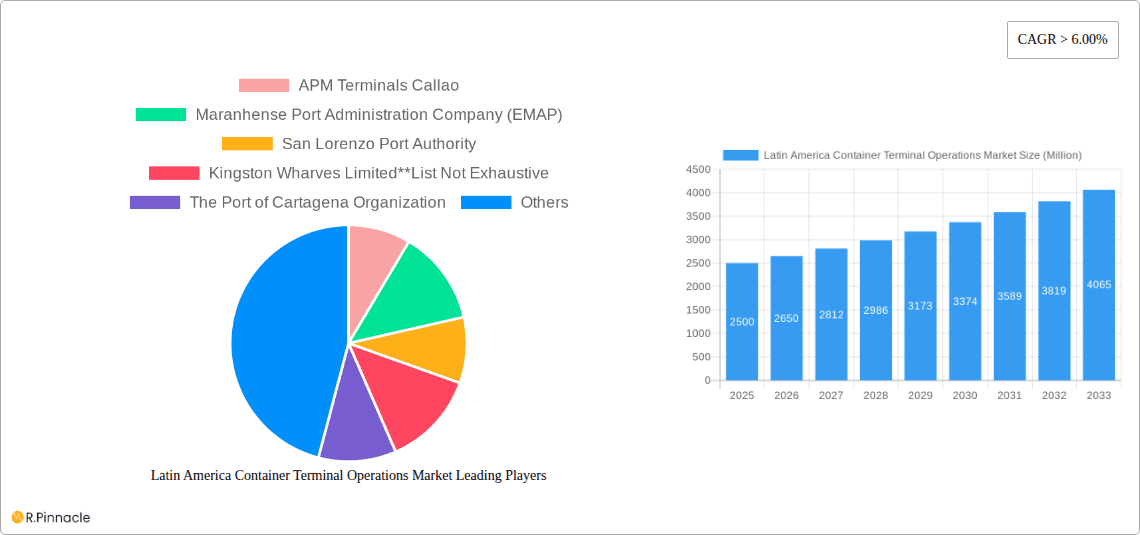

Latin America Container Terminal Operations Market Market Size (In Billion)

Despite these hurdles, the long-term market outlook remains highly favorable, supported by continuous investment in port infrastructure modernization, government policies aimed at trade facilitation, and the escalating demand for efficient logistics solutions within Latin America. Industry players are actively adopting automation, refining logistics processes, and strengthening collaborations to boost operational efficiency and service quality. Intensified competition from global entities seeking to increase their regional footprint is expected to further stimulate innovation and elevate service standards for clients. The market's inherent resilience and robust growth trajectory present a compelling opportunity for both established operators and new entrants.

Latin America Container Terminal Operations Market Company Market Share

Latin America Container Terminal Operations Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America Container Terminal Operations Market, offering actionable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period and base year 2025. We analyze market dynamics, key players, emerging trends, and future growth potential, providing a detailed understanding of this dynamic sector. The report leverages extensive primary and secondary research to deliver accurate and insightful data.

Latin America Container Terminal Operations Market Structure & Innovation Trends

The Latin American container terminal operations market exhibits a moderately concentrated structure, with key players such as APM Terminals Callao, Maranhense Port Administration Company (EMAP), and Santos Brasil Participacoes S/A holding significant market share. However, the market is also characterized by a diverse range of smaller operators and significant regional variations in concentration. Innovation is driven by the need for increased efficiency, technological advancements (such as automation and AI), and pressure to reduce environmental impact. Regulatory frameworks, while varying across countries, are generally focused on improving port infrastructure and streamlining operations. Product substitutes are limited, primarily involving alternative transportation modes (e.g., rail or road) for certain cargo types. End-user demographics encompass diverse importers and exporters across various industries. Significant M&A activity, illustrated by the USD 1 Billion acquisition of SAAM Ports S.A. by Hapag-Lloyd in October 2022, indicates a trend towards consolidation and expansion within the market.

- Market Concentration: Moderate, with regional variations.

- Innovation Drivers: Efficiency gains, technology adoption (automation, AI), environmental concerns.

- Regulatory Frameworks: Vary across countries, focusing on infrastructure and operational efficiency.

- M&A Activity: Significant, with deals exceeding USD 1 Billion (e.g., Hapag-Lloyd's acquisition of SAAM Ports).

- Market Share: Dominant players hold xx% collectively, with remaining share dispersed among smaller operators.

Latin America Container Terminal Operations Market Dynamics & Trends

The Latin America Container Terminal Operations Market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including increasing trade volumes driven by economic growth in several Latin American countries, expanding infrastructure development initiatives aiming to improve port capacities and connectivity, and the adoption of advanced technologies like automated container handling systems leading to enhanced efficiency and productivity. However, challenges persist such as fluctuating commodity prices impacting cargo volumes, infrastructure limitations in certain regions restricting operational capacity, and intense competition among various terminal operators shaping market dynamics. The market penetration of automated systems is estimated at xx% in 2025, projected to increase to xx% by 2033, reflecting a growing trend towards automation in the industry. Consumer preferences are shifting towards faster, more reliable, and environmentally friendly shipping solutions.

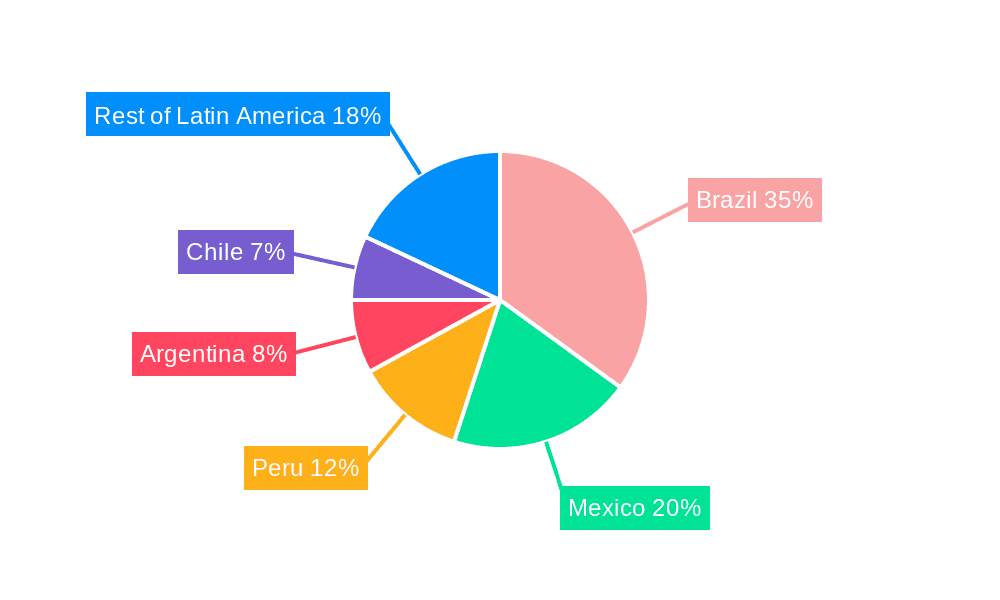

Dominant Regions & Segments in Latin America Container Terminal Operations Market

The Brazilian and Chilean markets currently lead the Latin America Container Terminal Operations Market, fueled by robust economic activity, extensive port infrastructure, and significant trade volumes. Within the services segment, Stevedoring and Cargo Handling & Transportation dominate, accounting for xx% and xx% of the market, respectively. Dry cargo represents the largest cargo type segment, driven by significant agricultural exports from countries like Brazil and Argentina.

Key Drivers:

- Brazil: Strong economic activity, substantial port infrastructure, high cargo volumes.

- Chile: Major trading hub, well-developed infrastructure, strategic geographic location.

- Stevedoring & Cargo Handling: High demand driven by core port operations.

- Dry Cargo: Dominance due to significant agricultural exports.

Dominance Analysis: Brazil's dominance stems from its vast agricultural production and industrial output, requiring extensive port operations. Chile’s strategic geographic location and well-developed infrastructure contribute to its leading position as a major trade hub. The dominance of Stevedoring and Cargo Handling services reflects their fundamental role in port operations, while Dry Cargo’s dominance is attributable to the importance of agricultural and raw material exports within the region.

Latin America Container Terminal Operations Market Product Innovations

Recent product innovations focus on enhancing efficiency and sustainability. This includes automated container handling systems, improved logistics software for better tracking and inventory management, and the adoption of eco-friendly equipment to reduce carbon emissions. These innovations are designed to improve operational efficiency, reduce costs, and meet evolving customer demands for sustainable solutions. The market fit is strong, driven by the need for increased efficiency and a growing focus on environmental sustainability.

Report Scope & Segmentation Analysis

This report segments the Latin America Container Terminal Operations Market by Service (Stevedoring, Cargo Handling & Transportation, Others) and by Cargo Type (Crude Oil, Dry Cargo, Other Liquid Cargo). Each segment exhibits varying growth trajectories and competitive dynamics. The Stevedoring segment is anticipated to grow at a CAGR of xx%, driven by increasing container throughput. The Cargo Handling & Transportation segment shows a projected CAGR of xx%, reflecting improvements in supply chain efficiency. The Dry Cargo segment is projected to experience substantial growth owing to increased agricultural exports. Crude Oil and Other Liquid Cargo segments will show xx% and xx% CAGR respectively. Competitive dynamics vary based on market size, technological capabilities, and strategic partnerships.

Key Drivers of Latin America Container Terminal Operations Market Growth

Several key factors fuel the growth of the Latin America Container Terminal Operations Market. These include increasing global trade, particularly with Asia and North America, significant investments in port infrastructure modernization, and the adoption of advanced technologies to enhance operational efficiency and reduce costs. Furthermore, government initiatives promoting economic development and infrastructure investment across various Latin American countries are creating a conducive environment for market expansion. The rising demand for faster and more reliable shipping services also contributes significantly to market growth.

Challenges in the Latin America Container Terminal Operations Market Sector

The Latin America Container Terminal Operations Market faces several challenges, including fluctuating commodity prices impacting cargo volumes, infrastructure limitations in certain regions restricting operational capacity, bureaucratic hurdles and regulatory complexities delaying project approvals, port congestion leading to delays and increased costs, and fierce competition among numerous operators leading to pressure on pricing. These factors can hinder market growth and profitability.

Emerging Opportunities in Latin America Container Terminal Operations Market

Emerging opportunities include the expansion of e-commerce, increasing demand for specialized cargo handling services, the growing adoption of digital technologies for improved supply chain management and the development of sustainable port operations reducing environmental impact. The growth of intermodal transportation networks connecting ports with inland logistics hubs also presents significant opportunities.

Leading Players in the Latin America Container Terminal Operations Market Market

- APM Terminals Callao

- Maranhense Port Administration Company (EMAP)

- San Lorenzo Port Authority

- Kingston Wharves Limited

- The Port of Cartagena Organization

- Brasil Terminal Portuário S A

- Santos Brasil Participacoes S/A

- Santos Port Authority

- Hutchinson Ports PPC

- DP World

Key Developments in Latin America Container Terminal Operations Market Industry

- October 2022: Hapag-Lloyd AG acquired 100% of SAAM Ports S.A. for approximately USD 1 billion, significantly impacting market consolidation.

- November 2022: CLI acquired control of a grain terminal in Santos port for USD 263.43 million, signaling further consolidation in the grain handling sector.

Future Outlook for Latin America Container Terminal Operations Market Market

The future outlook for the Latin America Container Terminal Operations Market remains positive, driven by sustained economic growth in key regions, continuous investments in port infrastructure, and the ongoing adoption of innovative technologies. Strategic partnerships and collaborations among terminal operators and other supply chain stakeholders will be crucial for success. The focus on sustainability and digitalization will shape future market dynamics, presenting numerous opportunities for growth and innovation.

Latin America Container Terminal Operations Market Segmentation

-

1. Service

- 1.1. Stevedoring

- 1.2. Cargo Handling & Transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Crude Oil

- 2.2. Dry Cargo

- 2.3. Other Liquid Cargo

Latin America Container Terminal Operations Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Container Terminal Operations Market Regional Market Share

Geographic Coverage of Latin America Container Terminal Operations Market

Latin America Container Terminal Operations Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. International Trade Growth; Trade Agreements cresting impact on customs procedures and creating opportunities for customs brokers

- 3.3. Market Restrains

- 3.3.1. Corruption and Informal Practices; Compliance and Documentation

- 3.4. Market Trends

- 3.4.1. Rise in Container Seaborne Trade

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Stevedoring

- 5.1.2. Cargo Handling & Transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Crude Oil

- 5.2.2. Dry Cargo

- 5.2.3. Other Liquid Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 APM Terminals Callao

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maranhense Port Administration Company (EMAP)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 San Lorenzo Port Authority

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kingston Wharves Limited**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Port of Cartagena Organization

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brasil Terminal Portuário S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Santos Brasil Participacoes S/A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Santos Port Authority

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hutchinson Ports PPC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DP World

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 APM Terminals Callao

List of Figures

- Figure 1: Latin America Container Terminal Operations Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Container Terminal Operations Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Container Terminal Operations Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Latin America Container Terminal Operations Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 3: Latin America Container Terminal Operations Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Latin America Container Terminal Operations Market Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Latin America Container Terminal Operations Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 6: Latin America Container Terminal Operations Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Container Terminal Operations Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Latin America Container Terminal Operations Market?

Key companies in the market include APM Terminals Callao, Maranhense Port Administration Company (EMAP), San Lorenzo Port Authority, Kingston Wharves Limited**List Not Exhaustive, The Port of Cartagena Organization, Brasil Terminal Portuário S A, Santos Brasil Participacoes S/A, Santos Port Authority, Hutchinson Ports PPC, DP World.

3. What are the main segments of the Latin America Container Terminal Operations Market?

The market segments include Service, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.28 billion as of 2022.

5. What are some drivers contributing to market growth?

International Trade Growth; Trade Agreements cresting impact on customs procedures and creating opportunities for customs brokers.

6. What are the notable trends driving market growth?

Rise in Container Seaborne Trade.

7. Are there any restraints impacting market growth?

Corruption and Informal Practices; Compliance and Documentation.

8. Can you provide examples of recent developments in the market?

October 2022: Hapag-Lloyd AG and SM SAAM S.A. have signed a binding agreement whereby Hapag-Lloyd acquired 100% of the shares of SAAM Ports S.A., and SAAM Logistics S.A. will therefore receive the company's entire terminal business and related logistics services. The contracting parties have agreed on a price of approximately USD 1 billion, including real estate assets related to the logistics business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Container Terminal Operations Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Container Terminal Operations Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Container Terminal Operations Market?

To stay informed about further developments, trends, and reports in the Latin America Container Terminal Operations Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence