Key Insights

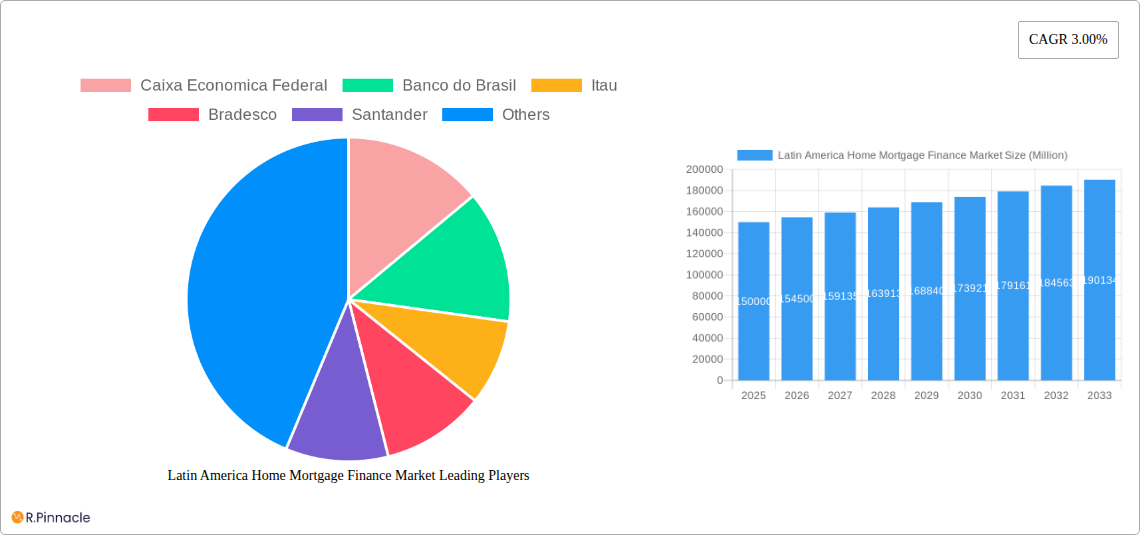

The Latin American home mortgage finance market, while exhibiting a moderate Compound Annual Growth Rate (CAGR) of 3.00%, presents a significant opportunity for investors and stakeholders. The market's size in 2025 is estimated to be $XX million (replace XX with a reasonable estimate based on available data and industry benchmarks; if no data is available a realistic assumption should be stated instead of a placeholder). Growth is driven by several factors, including increasing urbanization, rising disposable incomes in key markets, and government initiatives aimed at expanding homeownership. Trends such as the increasing adoption of digital lending platforms and fintech solutions are further accelerating market expansion, enhancing accessibility and efficiency in the mortgage process. However, challenges remain. Economic volatility in certain regions, fluctuating interest rates, and stringent lending criteria in some countries act as restraints on market growth. The segmentation of the market likely includes various loan types (e.g., fixed-rate, adjustable-rate), loan sizes, and target customer demographics (e.g., first-time homebuyers, high-net-worth individuals). Key players like Caixa Economica Federal, Banco do Brasil, Itaú, Bradesco, Santander, and others are vying for market share, employing diverse strategies to cater to the evolving needs of borrowers. The forecast period of 2025-2033 suggests considerable growth potential, particularly as digitalization and financial inclusion initiatives gain momentum.

The competitive landscape is fiercely competitive, with large established banks holding significant market share. However, the emergence of fintech companies and alternative lenders is disrupting the traditional model. These disruptors often offer faster processing times and more flexible lending options, attracting a wider range of borrowers. Regional variations in market dynamics are anticipated, with countries experiencing stronger economic growth likely demonstrating faster expansion in the mortgage market. Careful analysis of regional regulatory environments and economic indicators is essential for informed decision-making within this sector. Future growth will heavily rely on sustained economic stability, effective risk management strategies by lenders, and the continuous adaptation to technological advancements that shape the financial landscape.

Latin America Home Mortgage Finance Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Latin America home mortgage finance market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period 2019-2033, with a focus on 2025, this report unveils market trends, competitive landscapes, and future growth opportunities. The report leverages rigorous data analysis and expert insights to provide a clear understanding of this dynamic market.

Latin America Home Mortgage Finance Market Structure & Innovation Trends

This section analyzes the market structure, highlighting concentration levels, key innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities within the Latin American home mortgage finance sector. The analysis spans the period from 2019 to 2024, providing a historical context for understanding current market dynamics.

Market Concentration: The market exhibits a moderately concentrated structure, with major players like Caixa Economica Federal, Banco do Brasil, Itaú, Bradesco, Santander, BBVA Bancomex, Citibanamex, Scotia Bank, Banco de Chile, and Davivienda holding significant market share. Precise figures are provided within the report, along with a detailed assessment of their respective strengths and competitive positions. The market share for each of these banks is xx% and varies between years.

Innovation Drivers: Fintech disruption is a primary innovation driver, with emerging players like Toperty (Colombia) and Saturn5 (Mexico) introducing innovative mortgage solutions. Regulatory changes aimed at promoting financial inclusion also drive innovation.

Regulatory Frameworks: Varying regulatory frameworks across Latin American countries significantly impact market dynamics. The report thoroughly examines these differences and their implications for market access and competition.

Product Substitutes: The report explores alternative financing options such as informal lending and government-backed programs and assesses their impact on the formal mortgage market.

End-User Demographics: The report examines the evolving demographics of homebuyers in Latin America, including income levels, age groups, and geographic distribution. This analysis identifies key customer segments and growth opportunities.

M&A Activities: The report details major M&A activities within the sector, including deal values (xx Million) and their strategic implications for market consolidation and competitive landscape shifts during the historical period. Further projections on future M&A activity are included in the forecast.

Latin America Home Mortgage Finance Market Dynamics & Trends

This section delves into the key dynamics and trends shaping the Latin American home mortgage finance market. It covers market growth drivers, technological disruptions, evolving consumer preferences, and the competitive landscape.

The market exhibits a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors like increasing urbanization, rising disposable incomes, and government initiatives to support homeownership. Market penetration varies significantly across countries due to differences in economic conditions and regulatory frameworks. Technological disruptions, particularly the rise of fintech, are reshaping the industry by introducing new products and services, improving efficiency, and creating more accessible financing options. Changing consumer preferences, including a growing preference for digital channels and personalized financial solutions, further influence market dynamics. Intense competition among established banks and emerging fintech companies necessitates dynamic strategies for success.

Dominant Regions & Segments in Latin America Home Mortgage Finance Market

This section identifies the leading regions, countries, and segments within the Latin American home mortgage finance market.

Brazil: Brazil dominates the market, driven by its large population, robust economy (relative to other countries in the region), and established financial infrastructure. Key growth drivers include government policies supporting affordable housing and increasing urbanization. The section offers a detailed analysis of Brazil's market dynamics, including market size, growth rate, and major players.

Mexico: Mexico represents another significant market, propelled by similar factors to Brazil. The report compares and contrasts the Mexican and Brazilian markets, highlighting regional differences.

Other Key Markets: The report provides detailed analysis of other significant markets across Latin America (e.g., Colombia, Chile, Peru), identifying their specific growth drivers and challenges.

Key Drivers:

- Economic Growth: Economic growth in key Latin American markets strongly correlates with mortgage demand.

- Government Policies: Government initiatives to promote homeownership play a vital role.

- Infrastructure Development: Infrastructure projects in urban areas stimulate housing development.

- Urbanization: The ongoing trend of urbanization fuels demand for housing.

Latin America Home Mortgage Finance Market Product Innovations

Recent product innovations focus on enhancing accessibility, affordability, and customer experience. Fintech companies are spearheading the development of digital mortgage platforms, enabling faster processing times and streamlined applications. New mortgage products tailored to specific customer segments, such as first-time homebuyers, are gaining traction. Furthermore, innovative financing options, including rent-to-own models, are emerging to address the needs of a wider customer base. These innovations are driving greater competition and market disruption, forcing established players to adapt and innovate.

Report Scope & Segmentation Analysis

This report segments the Latin American home mortgage finance market based on various criteria, including loan type (e.g., conventional, government-backed), loan amount, borrower type (e.g., individual, corporate), and geographic location. Detailed growth projections, market sizes (in Millions), and competitive landscapes are provided for each segment. The analysis provides granular insights into the performance of different market segments, enabling targeted strategies and informed decision-making.

Key Drivers of Latin America Home Mortgage Finance Market Growth

Several factors propel growth in the Latin American home mortgage finance market. Government initiatives designed to increase homeownership rates are stimulating demand. The continued urbanization trend, coupled with a growing middle class, presents significant growth opportunities. Furthermore, improvements in the financial infrastructure and the adoption of digital technologies are enhancing the efficiency and reach of mortgage providers.

Challenges in the Latin America Home Mortgage Finance Market Sector

The sector faces challenges such as high interest rates, economic volatility, regulatory hurdles, and infrastructure gaps in certain regions. These factors can hinder access to mortgage finance, particularly for lower-income households. Additionally, high default rates, as observed in the recent experience of Banco Bradesco, pose a significant risk to lenders. Addressing these challenges is critical for sustainable growth in the sector.

Emerging Opportunities in Latin America Home Mortgage Finance Market

Emerging opportunities stem from the growing adoption of technology, increasing financial inclusion efforts, and the expansion of the middle class. Fintech innovation presents potential to revolutionize the market through more efficient and inclusive mortgage solutions. Addressing the needs of underserved populations also presents a significant growth opportunity. Further expansion into less-penetrated markets holds potential for considerable growth.

Leading Players in the Latin America Home Mortgage Finance Market Market

- Caixa Economica Federal

- Banco do Brasil

- Itaú

- Bradesco

- Santander

- BBVA Bancomex

- Citibanamex

- Scotia Bank

- Banco de Chile

- Davivienda

Key Developments in Latin America Home Mortgage Finance Market Industry

- August 2022: Two new mortgage fintech startups emerged: Toperty (Colombia) and Saturn5 (Mexico).

- August 2022: Banco Bradesco SA reported an increase in default rates, with the 90-day nonperforming loan ratio rising to 3.5% from 2.5% in Q1 2022.

Future Outlook for Latin America Home Mortgage Finance Market Market

The Latin American home mortgage finance market is poised for significant growth in the coming years. Continued urbanization and economic growth will fuel demand, while technological innovations will enhance efficiency and accessibility. Strategic partnerships between traditional lenders and fintech companies will shape the future competitive landscape. The market will likely witness further consolidation, with larger players acquiring smaller firms to expand their reach and product offerings. The report offers specific projections for market size and growth over the forecast period (2025-2033).

Latin America Home Mortgage Finance Market Segmentation

-

1. Type

- 1.1. Fixed - Rate Mortgage

- 1.2. Adjustable- Rate Mortgage

-

2. Tenure

- 2.1. Upto 5 years

- 2.2. 6-10 years

- 2.3. 11-24 years

- 2.4. 25-30 years

-

3. Geography

- 3.1. Brazil

- 3.2. Chile

- 3.3. Peru

- 3.4. Colombia

- 3.5. Rest of Latin America

Latin America Home Mortgage Finance Market Segmentation By Geography

- 1. Brazil

- 2. Chile

- 3. Peru

- 4. Colombia

- 5. Rest of Latin America

Latin America Home Mortgage Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Economic Growth and GDP per capita

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Latin America Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed - Rate Mortgage

- 5.1.2. Adjustable- Rate Mortgage

- 5.2. Market Analysis, Insights and Forecast - by Tenure

- 5.2.1. Upto 5 years

- 5.2.2. 6-10 years

- 5.2.3. 11-24 years

- 5.2.4. 25-30 years

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Chile

- 5.3.3. Peru

- 5.3.4. Colombia

- 5.3.5. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Chile

- 5.4.3. Peru

- 5.4.4. Colombia

- 5.4.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed - Rate Mortgage

- 6.1.2. Adjustable- Rate Mortgage

- 6.2. Market Analysis, Insights and Forecast - by Tenure

- 6.2.1. Upto 5 years

- 6.2.2. 6-10 years

- 6.2.3. 11-24 years

- 6.2.4. 25-30 years

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Chile

- 6.3.3. Peru

- 6.3.4. Colombia

- 6.3.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Chile Latin America Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed - Rate Mortgage

- 7.1.2. Adjustable- Rate Mortgage

- 7.2. Market Analysis, Insights and Forecast - by Tenure

- 7.2.1. Upto 5 years

- 7.2.2. 6-10 years

- 7.2.3. 11-24 years

- 7.2.4. 25-30 years

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Chile

- 7.3.3. Peru

- 7.3.4. Colombia

- 7.3.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Peru Latin America Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed - Rate Mortgage

- 8.1.2. Adjustable- Rate Mortgage

- 8.2. Market Analysis, Insights and Forecast - by Tenure

- 8.2.1. Upto 5 years

- 8.2.2. 6-10 years

- 8.2.3. 11-24 years

- 8.2.4. 25-30 years

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Chile

- 8.3.3. Peru

- 8.3.4. Colombia

- 8.3.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Colombia Latin America Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed - Rate Mortgage

- 9.1.2. Adjustable- Rate Mortgage

- 9.2. Market Analysis, Insights and Forecast - by Tenure

- 9.2.1. Upto 5 years

- 9.2.2. 6-10 years

- 9.2.3. 11-24 years

- 9.2.4. 25-30 years

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Chile

- 9.3.3. Peru

- 9.3.4. Colombia

- 9.3.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Latin America Latin America Home Mortgage Finance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fixed - Rate Mortgage

- 10.1.2. Adjustable- Rate Mortgage

- 10.2. Market Analysis, Insights and Forecast - by Tenure

- 10.2.1. Upto 5 years

- 10.2.2. 6-10 years

- 10.2.3. 11-24 years

- 10.2.4. 25-30 years

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Chile

- 10.3.3. Peru

- 10.3.4. Colombia

- 10.3.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Caixa Economica Federal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Banco do Brasil

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Itau

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bradesco

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Santander

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BBVA Bancome

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CITI Banamex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Scotia Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Banco de Chile

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Davivienda**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Caixa Economica Federal

List of Figures

- Figure 1: Global Latin America Home Mortgage Finance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Brazil Latin America Home Mortgage Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 3: Brazil Latin America Home Mortgage Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 4: Brazil Latin America Home Mortgage Finance Market Revenue (Million), by Tenure 2024 & 2032

- Figure 5: Brazil Latin America Home Mortgage Finance Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 6: Brazil Latin America Home Mortgage Finance Market Revenue (Million), by Geography 2024 & 2032

- Figure 7: Brazil Latin America Home Mortgage Finance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 8: Brazil Latin America Home Mortgage Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Brazil Latin America Home Mortgage Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Chile Latin America Home Mortgage Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 11: Chile Latin America Home Mortgage Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: Chile Latin America Home Mortgage Finance Market Revenue (Million), by Tenure 2024 & 2032

- Figure 13: Chile Latin America Home Mortgage Finance Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 14: Chile Latin America Home Mortgage Finance Market Revenue (Million), by Geography 2024 & 2032

- Figure 15: Chile Latin America Home Mortgage Finance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 16: Chile Latin America Home Mortgage Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Chile Latin America Home Mortgage Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Peru Latin America Home Mortgage Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Peru Latin America Home Mortgage Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Peru Latin America Home Mortgage Finance Market Revenue (Million), by Tenure 2024 & 2032

- Figure 21: Peru Latin America Home Mortgage Finance Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 22: Peru Latin America Home Mortgage Finance Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: Peru Latin America Home Mortgage Finance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Peru Latin America Home Mortgage Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Peru Latin America Home Mortgage Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Colombia Latin America Home Mortgage Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Colombia Latin America Home Mortgage Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Colombia Latin America Home Mortgage Finance Market Revenue (Million), by Tenure 2024 & 2032

- Figure 29: Colombia Latin America Home Mortgage Finance Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 30: Colombia Latin America Home Mortgage Finance Market Revenue (Million), by Geography 2024 & 2032

- Figure 31: Colombia Latin America Home Mortgage Finance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 32: Colombia Latin America Home Mortgage Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Colombia Latin America Home Mortgage Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of Latin America Latin America Home Mortgage Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Rest of Latin America Latin America Home Mortgage Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Rest of Latin America Latin America Home Mortgage Finance Market Revenue (Million), by Tenure 2024 & 2032

- Figure 37: Rest of Latin America Latin America Home Mortgage Finance Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 38: Rest of Latin America Latin America Home Mortgage Finance Market Revenue (Million), by Geography 2024 & 2032

- Figure 39: Rest of Latin America Latin America Home Mortgage Finance Market Revenue Share (%), by Geography 2024 & 2032

- Figure 40: Rest of Latin America Latin America Home Mortgage Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of Latin America Latin America Home Mortgage Finance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 4: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 8: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 12: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 16: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 20: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 24: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Global Latin America Home Mortgage Finance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Home Mortgage Finance Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Latin America Home Mortgage Finance Market?

Key companies in the market include Caixa Economica Federal, Banco do Brasil, Itau, Bradesco, Santander, BBVA Bancome, CITI Banamex, Scotia Bank, Banco de Chile, Davivienda**List Not Exhaustive.

3. What are the main segments of the Latin America Home Mortgage Finance Market?

The market segments include Type, Tenure, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Economic Growth and GDP per capita.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In August 2022, Two new mortgage fintech start-ups emerged in Latin America: Toperty launched in Colombia and Saturn5 is about to launch in Mexico. Toperty offers to purchase a customer's new house outright and provides a payment schedule that allows the customer to purchase the house while renting it from the business. Saturn5 wants to give its clients the skills and resources they need to buy a house on their own.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Home Mortgage Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Home Mortgage Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Home Mortgage Finance Market?

To stay informed about further developments, trends, and reports in the Latin America Home Mortgage Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence