Key Insights

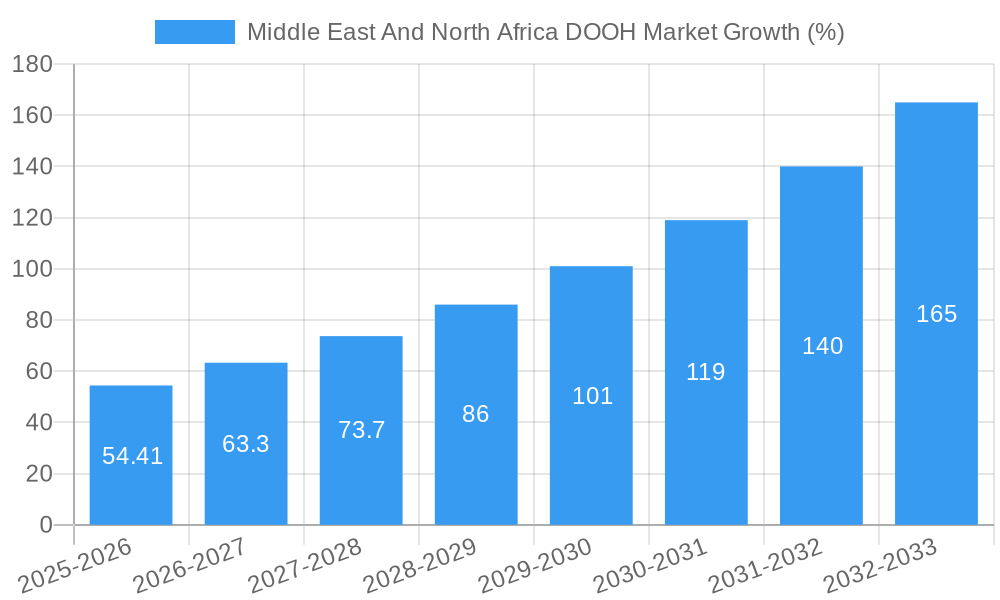

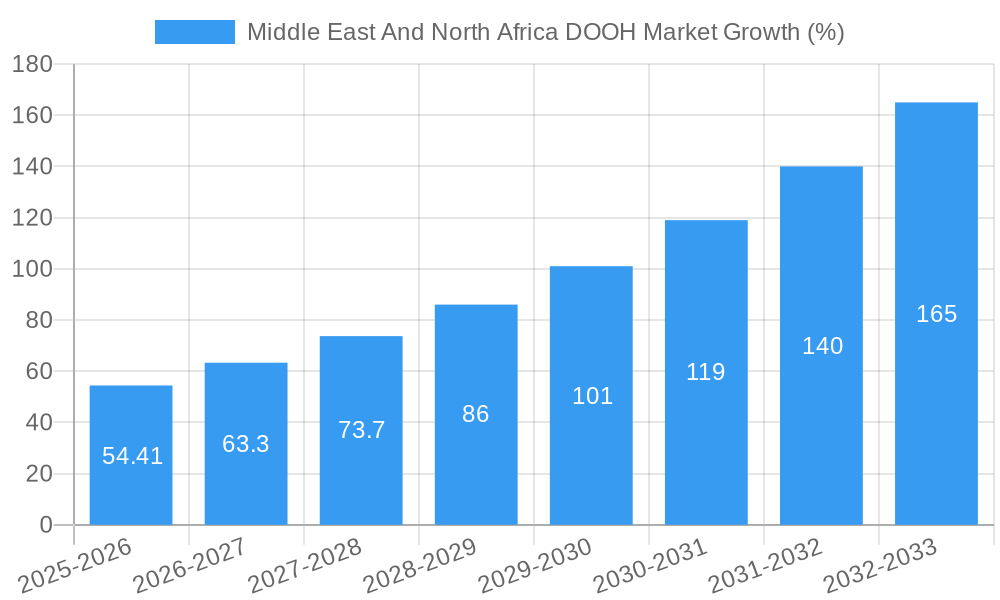

The Middle East and North Africa (MENA) Digital Out-of-Home (DOOH) advertising market exhibits robust growth potential, projected to reach \$335.59 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 16.41% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, rapid urbanization across the region is leading to increased foot traffic in high-density areas, making DOOH a highly effective advertising medium. Secondly, the burgeoning tourism sector and large-scale infrastructure development projects further contribute to high ad viewership. Finally, technological advancements like programmatic DOOH buying and data-driven targeting are enhancing campaign efficiency and return on investment (ROI), attracting increased advertiser participation. The market is segmented by end-user (commercial, institutional, infrastructural), country (Saudi Arabia, UAE, Kuwait, Qatar, Morocco, Egypt, and others), location (indoor, outdoor), and application (billboards, transit, street furniture, and others). Major players like JCDecaux Group, Backlite Media, and HyperMedia FZ LLC are actively shaping the competitive landscape through strategic partnerships and innovative ad formats.

Significant growth is anticipated in countries like Saudi Arabia and the UAE, driven by strong economic growth and investments in smart city initiatives. The increasing adoption of digital billboards and interactive DOOH displays, especially in high-traffic areas like shopping malls and transportation hubs, is a prominent trend. While challenges such as regulatory hurdles and the need for robust infrastructure in certain regions exist, the overall market outlook remains highly optimistic. The increasing sophistication of DOOH technology, coupled with its effectiveness in reaching diverse target audiences across MENA, ensures its continued dominance within the broader outdoor advertising landscape. The forecast period demonstrates sustained growth, fuelled by the region's dynamic economic environment and ongoing investments in urban development.

Middle East & North Africa DOOH Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the dynamic Middle East & North Africa (MENA) Digital Out-of-Home (DOOH) advertising market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's structure, growth drivers, challenges, and future potential. The MENA DOOH market is projected to reach xx Million by 2033, presenting significant opportunities for growth and innovation.

Middle East And North Africa DOOH Market Market Structure & Innovation Trends

The MENA DOOH market exhibits a moderately concentrated structure, with key players like JCDecaux Group, HyperMedia FZ LLC, and Backlite Media holding significant market share. However, the market is also characterized by a growing number of smaller, specialized players, fostering competition and innovation. Market share data for 2025 shows JCDecaux holding approximately 20%, HyperMedia at 15%, and Backlite Media at 12%, with the remaining share distributed among other companies. Innovation is driven by technological advancements such as programmatic advertising, data analytics, and interactive displays. Regulatory frameworks vary across countries, impacting market expansion. Product substitutes include traditional OOH advertising and digital media, while mergers and acquisitions (M&A) activity is expected to consolidate the market further. Recent M&A deal values are estimated at xx Million annually, primarily driven by acquisitions of smaller agencies by larger players. End-user demographics are diverse, covering commercial, institutional, and infrastructural segments, contributing to varying adoption rates of DOOH across the region.

- Market Concentration: Moderately concentrated, with key players holding significant shares.

- Innovation Drivers: Programmatic advertising, data analytics, interactive displays.

- Regulatory Frameworks: Vary across countries, impacting market growth.

- M&A Activity: Significant, with annual deal values estimated at xx Million.

Middle East And North Africa DOOH Market Market Dynamics & Trends

The MENA DOOH market is experiencing robust growth, driven by factors such as increasing urbanization, rising disposable incomes, and the growing adoption of digital technologies. Technological disruptions, particularly the rise of programmatic advertising and data-driven targeting, are transforming the industry, enabling more efficient and effective campaigns. Consumer preferences are shifting towards engaging and interactive advertising experiences, creating demand for innovative DOOH formats. Competitive dynamics are characterized by both consolidation and diversification, with established players expanding their networks while new entrants focus on niche segments. The market is predicted to exhibit a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration increasing from xx% in 2025 to xx% by 2033.

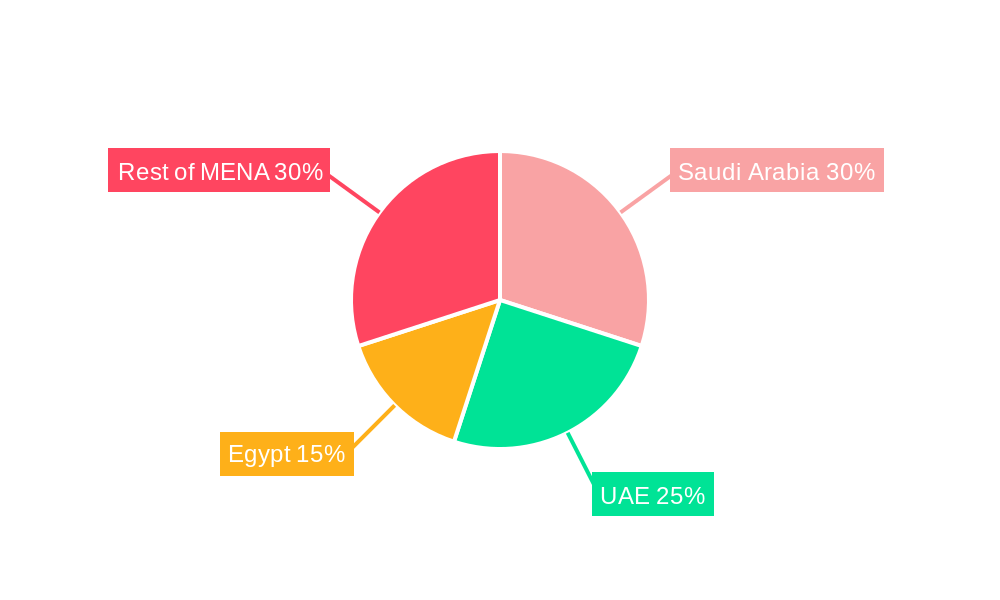

Dominant Regions & Segments in Middle East And North Africa DOOH Market

The United Arab Emirates (UAE) currently holds the dominant position in the MENA DOOH market, followed by Saudi Arabia. This dominance is driven by several factors:

- UAE: Strong economic growth, advanced infrastructure, and a high concentration of commercial activities.

- Saudi Arabia: Large population, significant government investment in infrastructure projects, and a growing advertising market.

By End-User: The commercial segment dominates, driven by high advertising spending from retail, hospitality, and entertainment sectors.

- Commercial: Highest advertising spending, driving market growth.

- Institutional: Steady growth due to government initiatives and public awareness campaigns.

- Infrastructural: Growing adoption at transportation hubs and public spaces.

By Location: Outdoor DOOH advertising significantly outweighs indoor, reflecting the region's climate and lifestyle.

By Application: Billboards represent the largest segment, but transit and street furniture are experiencing rapid growth.

Middle East And North Africa DOOH Market Product Innovations

Recent innovations in the MENA DOOH market include the adoption of programmatic buying platforms, enabling more efficient ad buying and targeted campaigns. Interactive DOOH screens, offering engaging user experiences, are also gaining traction. These innovations enhance ad effectiveness and improve ROI for advertisers, strengthening the appeal of DOOH within the overall media mix. Technological advancements in content management systems allow for dynamic content updates, personalized messaging, and real-time data integration. This adaptability enhances the overall effectiveness of DOOH campaigns by aligning with current trends and consumer behavior.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the MENA DOOH market across various segments:

- By End-User: Commercial, Institutional, Infrastructural (Growth projections vary based on each sector's economic outlook and advertising trends.)

- By Country: Saudi Arabia, UAE, Kuwait, Qatar, Morocco, Egypt, Rest of MENA (Market size varies significantly across countries, reflecting differences in economic development and advertising spending.)

- By Location: Indoor, Outdoor (Outdoor advertising maintains larger market share due to high visibility and consumer exposure.)

- By Application: Billboard, Transit, Street Furniture, Other (The Billboard segment leads, but other applications are expected to grow rapidly.)

Each segment offers unique growth opportunities and competitive dynamics, requiring tailored strategies for success.

Key Drivers of Middle East And North Africa DOOH Market Growth

Several factors drive the MENA DOOH market's growth:

- Technological Advancements: Programmatic buying, data analytics, and interactive displays are enhancing campaign effectiveness.

- Economic Growth: Rising disposable incomes and increased consumer spending fuel advertising expenditure.

- Government Initiatives: Investment in infrastructure development creates more opportunities for DOOH deployments.

Challenges in the Middle East And North Africa DOOH Market Sector

Challenges include:

- Regulatory Hurdles: Varying regulations across countries can complicate market entry and expansion.

- Supply Chain Issues: Dependence on international suppliers for hardware and technology can create vulnerabilities.

- Competitive Pressures: Intense competition among existing players and emergence of new entrants create pressure on pricing and profitability.

Emerging Opportunities in Middle East And North Africa DOOH Market

Emerging opportunities include:

- Expansion into New Markets: Untapped potential in smaller cities and rural areas.

- Adoption of New Technologies: Integration of AR/VR and other immersive technologies.

- Data-Driven Targeting: Leveraging data analytics to improve campaign performance.

Leading Players in the Middle East And North Africa DOOH Market Market

- Backlite Media

- HyperMedia FZ LLC

- JCDecaux Group

- EyeMedia

- Lemma Technologies Ltd

- Dooha Media (Madaeen Al Doha Group)

- Abu Dhabi Media

- ELAN Group

Key Developments in Middle East And North Africa DOOH Market Industry

- January 2023: Phi Advertising partnered with Lemma Technologies, enabling programmatic purchasing of Phi's digital billboard inventory. This significantly expands Phi's reach and programmatic capabilities.

- February 2023: Location Media Xchange (LMX) and Pyxis partnered to launch a new retail DOOH network in the UAE, leveraging advanced content management technology. This collaboration enhances the retail DOOH landscape within the UAE, potentially setting a benchmark for future developments.

Future Outlook for Middle East And North Africa DOOH Market Market

The MENA DOOH market is poised for sustained growth, driven by continued technological innovation, economic expansion, and increasing advertiser adoption. Strategic opportunities lie in leveraging data-driven insights, expanding into new markets, and investing in innovative DOOH formats. The market’s future potential is significant, promising high returns for those who adapt to the changing market dynamics and harness technological advancements.

Middle East And North Africa DOOH Market Segmentation

-

1. Location

- 1.1. Indoor

- 1.2. Outdoor

-

2. Application

- 2.1. Billboard

- 2.2. Transit

- 2.3. Street Furniture

- 2.4. Other Applications

-

3. End-User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Infrastructural

Middle East And North Africa DOOH Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And North Africa DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising; Increase in Public Transit Infrastructure; Adoption of Global Cues such as Programmatic Advertising

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations in the Middle East Have Been a Challenge for Vendors; Traditional Forms of Advertising Continue to Dominate in a Few Countries

- 3.4. Market Trends

- 3.4.1. Transit to be Fastest Growing Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And North Africa DOOH Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Indoor

- 5.1.2. Outdoor

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billboard

- 5.2.2. Transit

- 5.2.3. Street Furniture

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Infrastructural

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. South Africa Middle East And North Africa DOOH Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East And North Africa DOOH Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East And North Africa DOOH Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East And North Africa DOOH Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East And North Africa DOOH Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East And North Africa DOOH Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Backlite Media

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 HyperMedia FZ LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 JCDecaux Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 EyeMedia

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Lemma Technologies Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Dooha Media (Madaeen Al Doha Group)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Abu Dhabi Media

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ELAN Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Backlite Media

List of Figures

- Figure 1: Middle East And North Africa DOOH Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East And North Africa DOOH Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East And North Africa DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East And North Africa DOOH Market Revenue Million Forecast, by Location 2019 & 2032

- Table 3: Middle East And North Africa DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Middle East And North Africa DOOH Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Middle East And North Africa DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East And North Africa DOOH Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East And North Africa DOOH Market Revenue Million Forecast, by Location 2019 & 2032

- Table 14: Middle East And North Africa DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Middle East And North Africa DOOH Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Middle East And North Africa DOOH Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Saudi Arabia Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Israel Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Qatar Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Kuwait Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Oman Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bahrain Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Jordan Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Lebanon Middle East And North Africa DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And North Africa DOOH Market?

The projected CAGR is approximately 16.41%.

2. Which companies are prominent players in the Middle East And North Africa DOOH Market?

Key companies in the market include Backlite Media, HyperMedia FZ LLC, JCDecaux Group, EyeMedia, Lemma Technologies Ltd, Dooha Media (Madaeen Al Doha Group), Abu Dhabi Media, ELAN Group.

3. What are the main segments of the Middle East And North Africa DOOH Market?

The market segments include Location, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 335.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising; Increase in Public Transit Infrastructure; Adoption of Global Cues such as Programmatic Advertising.

6. What are the notable trends driving market growth?

Transit to be Fastest Growing Application.

7. Are there any restraints impacting market growth?

Stringent Regulations in the Middle East Have Been a Challenge for Vendors; Traditional Forms of Advertising Continue to Dominate in a Few Countries.

8. Can you provide examples of recent developments in the market?

February 2023: Location Media Xchange (LMX), the supply-side arm of Moving Walls Group, announced a partnership with Pyxis that is expected to result in an innovative new retail DOOH screen network outfitted with best-in-class content management technology. The agreement combines the strengths of all three companies to provide a comprehensive content delivery platform for the massive DOOH network, which will soon be available on hundreds of sites across the United Arab Emirates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And North Africa DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And North Africa DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And North Africa DOOH Market?

To stay informed about further developments, trends, and reports in the Middle East And North Africa DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence