Key Insights

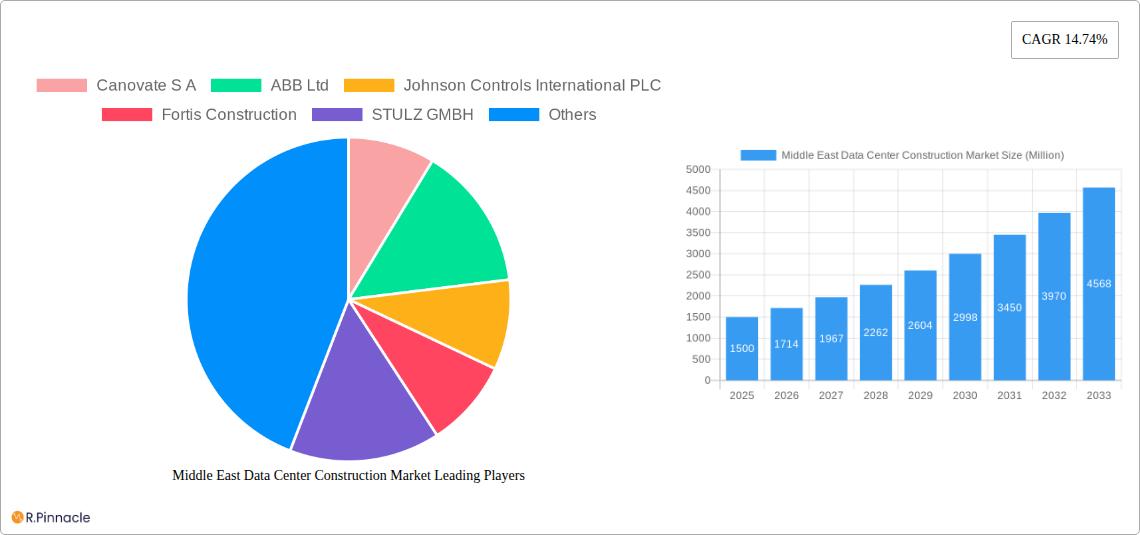

The Middle East data center construction market is experiencing robust growth, driven by increasing digital transformation initiatives across various sectors, including IT & telecommunications, BFSI, and government. A compound annual growth rate (CAGR) of 14.74% from 2019 to 2024 indicates a significant expansion, projected to continue through 2033. This surge is fueled by the region's burgeoning population, rising internet penetration, and the growing adoption of cloud computing and big data analytics. Key trends include a shift towards hyperscale data centers, increasing demand for sustainable and energy-efficient cooling infrastructure (like evaporative cooling), and a focus on robust physical security measures. While the market faces restraints such as high initial investment costs and regulatory complexities, the long-term outlook remains positive due to government initiatives promoting digital economies and significant foreign investment in the region's digital infrastructure. The market segmentation reveals a strong demand across all data center sizes (small to massive) and infrastructure components, highlighting diverse opportunities for various market players. The presence of significant players like Schneider Electric, ABB, and Johnson Controls reflects the market's attractiveness and potential for further consolidation. The UAE, Saudi Arabia, and Qatar are expected to remain leading markets within the Middle East, driven by their robust digital transformation strategies and proactive government support.

The diverse range of end-users, including IT & Telecommunications, BFSI, Government, and Healthcare, underscores the broad applicability of data center infrastructure. The significant investments in cooling, power distribution (PDUs), and security infrastructure are crucial aspects of overall data center development. The inclusion of design and consulting services in the market segmentation highlights the specialized expertise required for successful data center construction projects. The substantial growth projection indicates a promising investment climate, with opportunities spanning across various segments of the value chain. This market evolution, with its focus on sustainable practices and advanced technologies, signifies a substantial contribution to the wider technological and economic development of the Middle East. The ongoing expansion of regional digital infrastructure, fueled by both governmental and private sector investment, is anticipated to significantly propel the market's growth in the coming years.

Middle East Data Center Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East data center construction market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth potential. The report leverages extensive data analysis to provide actionable intelligence for navigating this rapidly evolving landscape.

Middle East Data Center Construction Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Middle East data center construction market. The market is characterized by a mix of global giants and regional players, leading to varying degrees of market concentration. While precise market share figures for individual companies are proprietary data and require further analysis, the following observations can be made:

- Market Concentration: The market exhibits moderate concentration, with a few major international players holding significant shares, alongside numerous regional contractors and specialized service providers. Further research is needed to quantify this accurately.

- Innovation Drivers: The increasing demand for cloud services, the growth of digital economies, and the need for robust digital infrastructure are key drivers of innovation. This leads to advancements in cooling technologies (e.g., evaporative cooling), power infrastructure (e.g., efficient power distribution units), and security systems.

- Regulatory Frameworks: Government initiatives promoting digital transformation and investment in data infrastructure are shaping market growth. Regulatory frameworks vary across the region, impacting project timelines and investment strategies. Specific details are included in the full report.

- Product Substitutes: While direct substitutes for data center construction are limited, indirect competition exists from alternative cloud service models (e.g., edge computing) which could influence data center construction needs.

- End-User Demographics: The report analyzes the end-user landscape across various sectors, including IT & telecommunications, BFSI, government, healthcare, and others, providing insights into their individual demands and contribution to market growth.

- M&A Activities: The market has seen a moderate level of mergers and acquisitions in recent years, with deal values varying significantly. A detailed analysis of notable M&A activities and their impact on market dynamics is presented in the full report.

Middle East Data Center Construction Market Dynamics & Trends

The Middle East data center construction market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, reflecting the region's commitment to digital transformation and the increasing demand for data storage and processing capabilities.

This growth is fueled by several factors including the rapid expansion of the region's digital economy, the rising adoption of cloud computing and big data analytics, government initiatives supporting digital infrastructure development, and increasing investments from both domestic and international players. Technological disruptions, such as the increasing adoption of artificial intelligence (AI) and the Internet of Things (IoT), are further driving the demand for advanced data center infrastructure. Market penetration of advanced technologies, such as liquid cooling and modular data centers, is expected to increase significantly over the forecast period. Competitive dynamics are largely shaped by the interplay between global players bringing specialized expertise and regional contractors leveraging local knowledge and relationships.

Dominant Regions & Segments in Middle East Data Center Construction Market

The Middle East data center construction market is geographically diverse, with significant variations in growth rates and market dynamics across different countries. While the full report details country-specific analysis, some key observations can be offered here:

Leading Regions/Countries: (Specific regions and countries with dominance will be detailed in the full report, including quantifiable metrics.)

- Key Drivers:

- Government policies promoting digital infrastructure.

- Significant investments from both public and private sectors.

- Growing demand for cloud services and digital solutions.

- Strategic location for regional and international connectivity.

Dominant Segments: Analysis within the full report identifies the leading segments across several categories:

- Tier Type: Tier III and Tier IV data centers are likely to dominate due to their higher capacity and redundancy features.

- Data Center Size: Demand for large and mega data centers is anticipated to grow rapidly, driven by the needs of hyperscale cloud providers and large enterprises.

- Infrastructure: Power infrastructure and cooling infrastructure are key segments, with significant investments in advanced technologies to ensure high efficiency and reliability. Detailed analysis of specific infrastructure elements, such as PDUs and evaporative cooling systems, is included.

- End-User: The IT and Telecommunications sector, along with the BFSI sector, are expected to be the largest contributors to market growth.

Middle East Data Center Construction Market Product Innovations

The Middle East data center construction market is witnessing rapid innovation across various infrastructure components. Developments in prefabricated modular data centers, advanced cooling technologies (e.g., liquid cooling, AI-powered cooling management), and energy-efficient power distribution units are gaining traction. These innovations offer significant advantages in terms of speed of deployment, reduced operational costs, and enhanced sustainability. The adoption of these solutions is expected to accelerate over the forecast period, shaping the future landscape of data center construction in the region.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation analysis, covering the following key aspects:

- Tier Type: Tier 1, Tier 2, Tier 3, and Tier 4 data centers. Growth projections and market sizes for each tier are provided. Competitive intensity varies across tiers.

- Data Center Size: Small, Medium, Large, Mega, and Massive data centers. Market sizing and growth projections are detailed for each category.

- Infrastructure: Cooling infrastructure (including evaporative cooling), power infrastructure (including PDUs), racks and cabinets, servers, networking equipment, physical security infrastructure, design and consulting services, and other infrastructure. Each segment's market size and growth potential are analyzed in detail.

- End-User: IT & Telecommunication, BFSI, Government, Healthcare, and Other End-Users. Market size and growth projections by end-user segment are provided.

Key Drivers of Middle East Data Center Construction Market Growth

Several factors are driving the expansion of the Middle East data center construction market:

- Government Support: Significant investments and policies promoting digital transformation.

- Economic Growth: The expanding digital economy fuels demand for data centers.

- Technological Advancements: Innovations in cooling, power, and security solutions.

- Cloud Adoption: The rising adoption of cloud services necessitates increased data center capacity.

Challenges in the Middle East Data Center Construction Market Sector

Despite the substantial growth potential, the market faces several challenges:

- High Initial Investment Costs: The construction of data centers requires significant upfront capital.

- Regulatory Hurdles: Navigating varying regulatory frameworks across the region can be complex.

- Supply Chain Disruptions: Global supply chain issues impact the availability of essential components.

- Competition: Intense competition among numerous companies can exert downward pressure on prices.

Emerging Opportunities in Middle East Data Center Construction Market

The Middle East data center construction market presents numerous opportunities:

- Sustainable Data Centers: Growing demand for environmentally friendly data center designs.

- Edge Computing: Expansion of edge data center deployments to improve latency and performance.

- Hyperscale Data Centers: Significant investments in large-scale data center facilities.

- Specialized Data Centers: Emergence of data centers tailored to specific industry needs (e.g., healthcare, finance).

Leading Players in the Middle East Data Center Construction Market Market

- Canovate S A

- ABB Ltd

- Johnson Controls International PLC

- Fortis Construction

- STULZ GMBH

- Delta Group

- Schneider Electric SE

- Turner Construction Co

- DPR Construction Inc

- Caterpillar Inc

- Airedale International Air Conditioning Ltd

- Cummins Inc

- AECOM Limited

- Legrand

- CyrusOne Inc

- Future Digital data Systems

- Ashi & Bushnag Co Ltd

- EAE Group

- Alfa Laval AB

- Saan Zahav Ltd

Key Developments in Middle East Data Center Construction Market Industry

- October 2022: Launch of M-VAULT 4's fourth data center building in Qatar, expanding cloud services access.

- October 2022: Agreement to build a solar PV plant to power Khazna Data Centers' new facility in Masdar City, promoting sustainable energy use.

Future Outlook for Middle East Data Center Construction Market Market

The future outlook for the Middle East data center construction market is highly positive. Continued growth in digital adoption, government initiatives, and technological advancements will fuel substantial expansion over the forecast period. Strategic partnerships, investments in sustainable infrastructure, and adaptation to emerging technologies will be crucial for success in this dynamic market. The market is expected to experience significant growth driven by the increasing demand for data storage and processing capabilities, as well as government initiatives promoting the adoption of digital technologies.

Middle East Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Basic & Smart - Metered & Switched Solutions

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-Voltage

- 1.1.1.3.2. Medium-Voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Power Distribution Solutions

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-To-Chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-Row and In-Rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Basic & Smart - Metered & Switched Solutions

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-Voltage

- 2.1.3.2. Medium-Voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Other Power Distribution Solutions

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Basic & Smart - Metered & Switched Solutions

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-Voltage

- 3.3.2. Medium-Voltage

- 3.4. Power Panels and Components

- 3.5. Other Power Distribution Solutions

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-To-Chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-Row and In-Rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-To-Chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-Row and In-Rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructure

- 10. General Construction

-

11. Tier Type

- 11.1. Tier 1 and 2

- 11.2. Tier 3

- 11.3. Tier 4

- 12. Tier 1 and 2

- 13. Tier 3

- 14. Tier 4

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

- 21. United Arab Emirates

- 22. Saudi Arabia

- 23. Israel

- 24. Qatar

- 25. Oman

Middle East Data Center Construction Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Renewable Energy Sources; Increase in 5G Deployments Fueling Edge Data Center Investments; Smart City Initiatives Driving Data Center Investments

- 3.3. Market Restrains

- 3.3.1. Security Challenges in Data Centers; Location Constraints on the Development of Data Centers

- 3.4. Market Trends

- 3.4.1. End-User Outlook

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Basic & Smart - Metered & Switched Solutions

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-Voltage

- 5.1.1.1.3.2. Medium-Voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Power Distribution Solutions

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-To-Chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-Row and In-Rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Basic & Smart - Metered & Switched Solutions

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-Voltage

- 5.2.1.3.2. Medium-Voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Other Power Distribution Solutions

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Basic & Smart - Metered & Switched Solutions

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-Voltage

- 5.3.3.2. Medium-Voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Other Power Distribution Solutions

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-To-Chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-Row and In-Rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-To-Chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-Row and In-Rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier 1 and 2

- 5.11.2. Tier 3

- 5.11.3. Tier 4

- 5.12. Market Analysis, Insights and Forecast - by Tier 1 and 2

- 5.13. Market Analysis, Insights and Forecast - by Tier 3

- 5.14. Market Analysis, Insights and Forecast - by Tier 4

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by United Arab Emirates

- 5.22. Market Analysis, Insights and Forecast - by Saudi Arabia

- 5.23. Market Analysis, Insights and Forecast - by Israel

- 5.24. Market Analysis, Insights and Forecast - by Qatar

- 5.25. Market Analysis, Insights and Forecast - by Oman

- 5.26. Market Analysis, Insights and Forecast - by Region

- 5.26.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. United Arab Emirates Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Canovate S A

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Johnson Controls International PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Fortis Construction

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 STULZ GMBH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Delta Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Schneider Electric SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Turner Construction Co

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 DPR Construction Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Caterpillar Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Airedale International Air Conditioning Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Cummins Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 AECOM Limited

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Legrand

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 CyrusOne Inc

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Future Digital data Systems

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Ashi & Bushnag Co Ltd

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 EAE Group

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Alfa Laval AB

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 Saan Zahav Ltd

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.1 Canovate S A

List of Figures

- Figure 1: Middle East Data Center Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Data Center Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 3: Middle East Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 4: Middle East Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 5: Middle East Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 6: Middle East Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 7: Middle East Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 8: Middle East Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 9: Middle East Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 10: Middle East Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 11: Middle East Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 12: Middle East Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 13: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 14: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 15: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 16: Middle East Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Middle East Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 18: Middle East Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 19: Middle East Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 20: Middle East Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 21: Middle East Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 22: Middle East Data Center Construction Market Revenue Million Forecast, by United Arab Emirates 2019 & 2032

- Table 23: Middle East Data Center Construction Market Revenue Million Forecast, by Saudi Arabia 2019 & 2032

- Table 24: Middle East Data Center Construction Market Revenue Million Forecast, by Israel 2019 & 2032

- Table 25: Middle East Data Center Construction Market Revenue Million Forecast, by Qatar 2019 & 2032

- Table 26: Middle East Data Center Construction Market Revenue Million Forecast, by Oman 2019 & 2032

- Table 27: Middle East Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 28: Middle East Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Arab Emirates Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Saudi Arabia Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Qatar Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Israel Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Egypt Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Oman Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of Middle East Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Middle East Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 37: Middle East Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 38: Middle East Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 39: Middle East Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 40: Middle East Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 41: Middle East Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 42: Middle East Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 43: Middle East Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 44: Middle East Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 45: Middle East Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 46: Middle East Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 47: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 48: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 49: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 50: Middle East Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 51: Middle East Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 52: Middle East Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 53: Middle East Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 54: Middle East Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 55: Middle East Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 56: Middle East Data Center Construction Market Revenue Million Forecast, by United Arab Emirates 2019 & 2032

- Table 57: Middle East Data Center Construction Market Revenue Million Forecast, by Saudi Arabia 2019 & 2032

- Table 58: Middle East Data Center Construction Market Revenue Million Forecast, by Israel 2019 & 2032

- Table 59: Middle East Data Center Construction Market Revenue Million Forecast, by Qatar 2019 & 2032

- Table 60: Middle East Data Center Construction Market Revenue Million Forecast, by Oman 2019 & 2032

- Table 61: Middle East Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Saudi Arabia Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: United Arab Emirates Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Israel Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Qatar Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Kuwait Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Oman Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Bahrain Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Jordan Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Lebanon Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Data Center Construction Market?

The projected CAGR is approximately 14.74%.

2. Which companies are prominent players in the Middle East Data Center Construction Market?

Key companies in the market include Canovate S A, ABB Ltd, Johnson Controls International PLC, Fortis Construction, STULZ GMBH, Delta Group, Schneider Electric SE, Turner Construction Co, DPR Construction Inc, Caterpillar Inc, Airedale International Air Conditioning Ltd, Cummins Inc, AECOM Limited, Legrand, CyrusOne Inc, Future Digital data Systems, Ashi & Bushnag Co Ltd, EAE Group, Alfa Laval AB, Saan Zahav Ltd.

3. What are the main segments of the Middle East Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructure, General Construction, Tier Type, Tier 1 and 2, Tier 3, Tier 4, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users, United Arab Emirates, Saudi Arabia, Israel, Qatar, Oman.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Renewable Energy Sources; Increase in 5G Deployments Fueling Edge Data Center Investments; Smart City Initiatives Driving Data Center Investments.

6. What are the notable trends driving market growth?

End-User Outlook.

7. Are there any restraints impacting market growth?

Security Challenges in Data Centers; Location Constraints on the Development of Data Centers.

8. Can you provide examples of recent developments in the market?

October 2022: Mohamed bin Ali bin Mohamed Al-Mannai, Minister of Communications and Information Technology, launched the M-VAULT 4's fourth data center building. Customers in Qatar can access cloud services through the Microsoft Cloud data center region housed in the new data center facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Middle East Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence