Key Insights

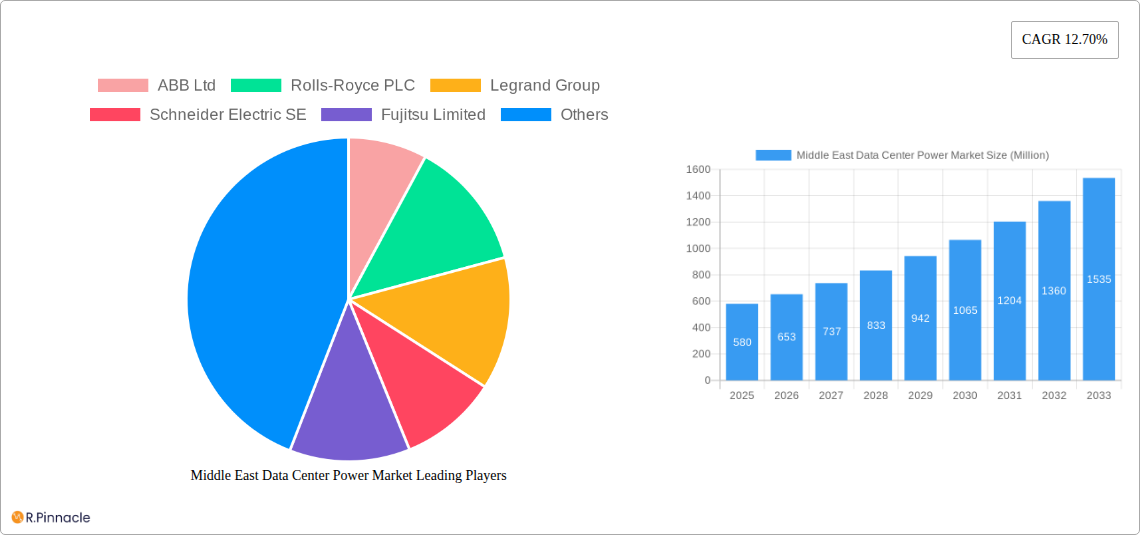

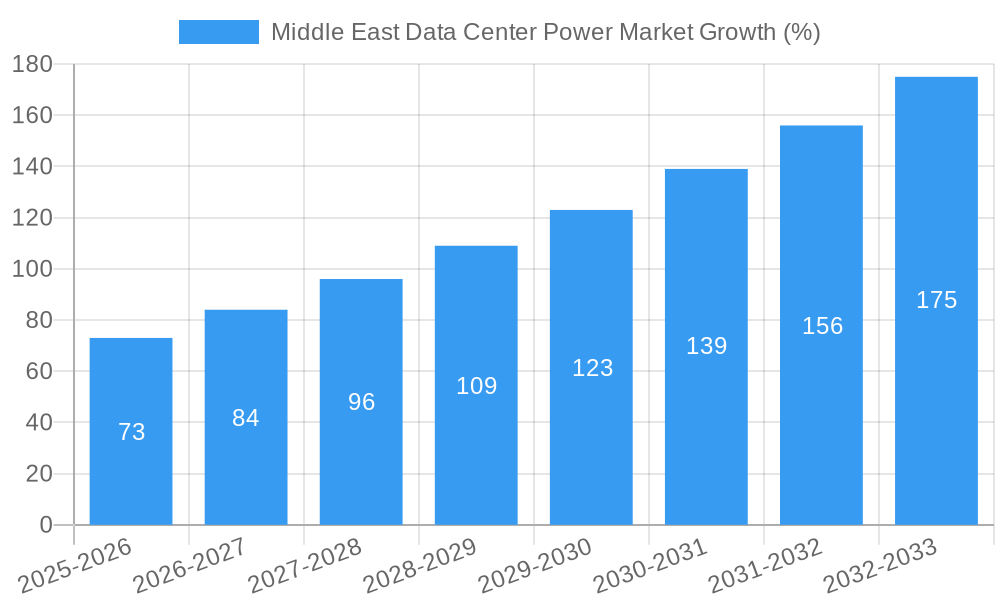

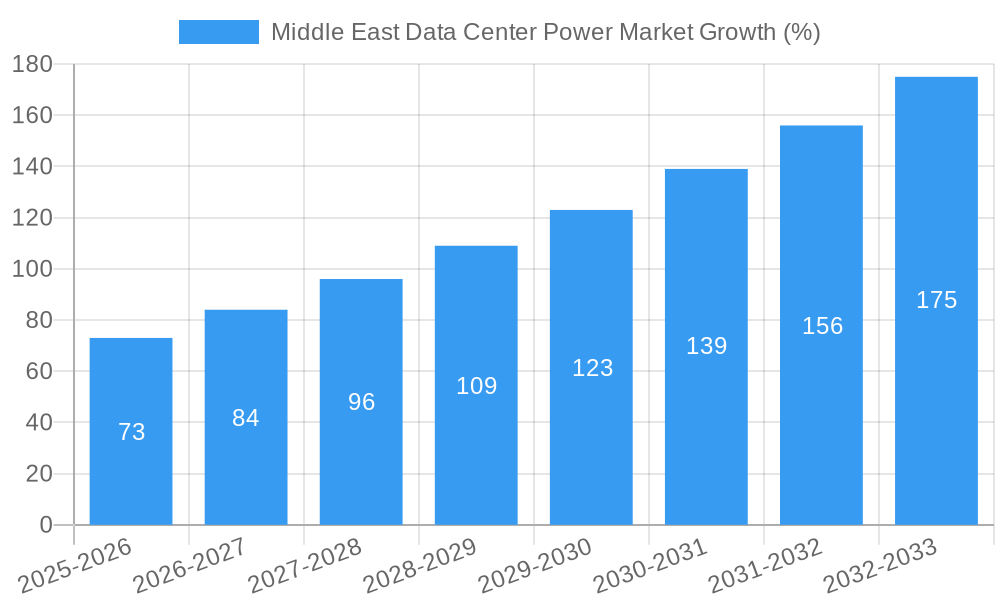

The Middle East data center power market is experiencing robust growth, projected to reach a market size of $0.58 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.70% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the region's burgeoning digital economy, driven by increasing internet penetration and the adoption of cloud computing and big data technologies, necessitates a significant rise in data center infrastructure. Secondly, government initiatives aimed at digital transformation and smart city development across countries like Saudi Arabia, the UAE, and Israel are significantly boosting investment in data center construction and modernization. Thirdly, the increasing demand for reliable and efficient power solutions, especially within critical power infrastructure, is driving the adoption of advanced power distribution solutions like PDUs, switchgear, and uninterruptible power supplies (UPS). Major players like ABB, Schneider Electric, and Vertiv are well-positioned to capitalize on these trends.

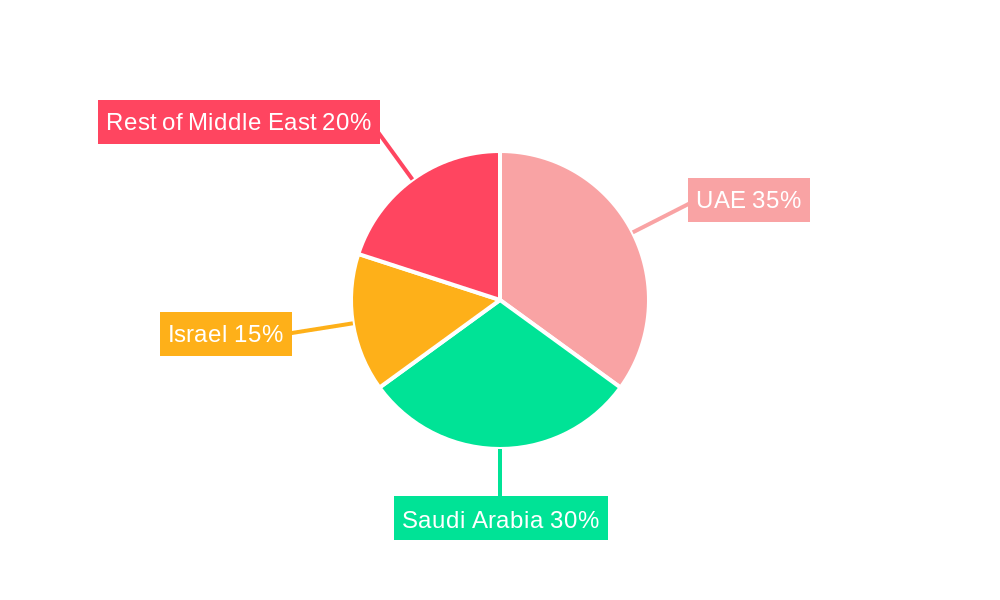

However, market growth is not without its challenges. The high initial investment costs associated with data center power infrastructure can act as a significant restraint, particularly for smaller businesses. Furthermore, regulatory hurdles and the need for skilled workforce to manage and maintain these complex systems represent potential impediments to market expansion. The market segmentation reveals a strong presence across end-user sectors including IT and telecommunications, BFSI (Banking, Financial Services, and Insurance), and the government. Geographically, the UAE and Saudi Arabia are leading the market, followed by Israel. The power infrastructure segment comprising electrical solutions, power distribution solutions, and others is witnessing substantial demand reflecting the critical nature of reliable power supply within these facilities. The service segment plays a crucial role in ensuring ongoing performance and operational efficiency of these data centers.

Middle East Data Center Power Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East data center power market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, key players, technological advancements, and future growth prospects across Saudi Arabia, the United Arab Emirates, and Israel. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

Middle East Data Center Power Market Structure & Innovation Trends

This section analyzes the competitive landscape, identifying key players and their market share. We delve into innovation drivers, regulatory frameworks impacting the market, and the role of mergers and acquisitions (M&A). The market exhibits a moderately concentrated structure with several major players holding significant shares.

- Market Concentration: The top 5 players collectively hold approximately xx% of the market share in 2025. This is expected to slightly decrease to xx% by 2033 due to increased competition from smaller, specialized companies.

- Innovation Drivers: Increasing demand for higher power density, improved energy efficiency, and enhanced security are key drivers of innovation. The adoption of AI and IoT in data centers further accelerates this trend.

- Regulatory Frameworks: Government initiatives promoting digital transformation and data center infrastructure development significantly influence market growth. Stringent regulations around data security and power consumption are also shaping the landscape.

- Product Substitutes: While few direct substitutes exist for critical power solutions, the market faces indirect competition from renewable energy sources and alternative data center cooling technologies.

- End-User Demographics: The IT and telecommunications sector dominates the market, followed by BFSI and government sectors. The other end-user segment (including education, healthcare etc.) shows promising growth potential.

- M&A Activities: Significant M&A activity has been observed in the historical period (2019-2024), with a total deal value of approximately xx Million. Consolidation among power distribution companies is expected to continue, driving further market evolution.

Middle East Data Center Power Market Dynamics & Trends

This section examines market growth drivers, technological disruptions, evolving consumer preferences, and the competitive dynamics at play. We analyze historical data (2019-2024) and project future trends (2025-2033). The market is driven by increasing data consumption, cloud computing adoption, and the rising number of data centers across the region.

The robust growth of the Middle East data center market is fueled by factors such as increased government investments in digital infrastructure, supportive regulatory frameworks, and the growing adoption of cloud computing services. Technological advancements like AI and IoT are creating new opportunities, while the rise of hyperscale data centers is demanding higher power densities and efficient power distribution solutions. Competition is intense, with major players focusing on innovation, cost optimization, and strategic partnerships to secure market share.

Dominant Regions & Segments in Middle East Data Center Power Market

This section identifies the leading regions, countries, and market segments within the Middle East data center power market.

Leading Regions & Countries:

- Saudi Arabia: Dominates the market due to significant investments in digital infrastructure and the government's Vision 2030 initiative, fostering rapid digital transformation.

- United Arab Emirates: Strong growth driven by a thriving tech sector and the establishment of major data centers in key economic zones.

- Israel: Displays robust growth due to its advanced technological capabilities and its position as a regional tech hub.

Dominant Segments:

- End User: The IT and Telecommunication sector leads, followed by BFSI and government segments. High growth is anticipated in the media and entertainment sector.

- Power Infrastructure: Electrical solutions comprise the largest segment, reflecting the substantial demand for reliable and efficient power infrastructure in data centers.

- Power Distribution Solutions: PDUs, switchgear, and critical power distribution solutions are the most significant segments, driven by the need for efficient and secure power management in increasingly complex data centers.

Key Drivers for Dominant Segments:

- Economic Policies: Government incentives and investments in digital infrastructure.

- Technological Advancements: Adoption of high-density computing equipment.

- Infrastructure Development: Expansion of data center facilities across the region.

Middle East Data Center Power Market Product Innovations

Recent product launches reflect a strong emphasis on intelligent power distribution, enhanced security, and improved energy efficiency. Legrand's introduction of next-generation intelligent rack PDUs and Eaton's G3 Universal Input Rack PDU exemplify this trend. These innovations cater to the increasing complexity and power demands of modern data centers, improving operational efficiency and reducing downtime.

Report Scope & Segmentation Analysis

This report segments the Middle East data center power market based on end-user, country, and power infrastructure/distribution solutions. Each segment includes market size estimations for the historical, base, and forecast periods, and analyzes the competitive dynamics within each segment. Growth projections vary across segments, with IT and telecommunications, Saudi Arabia, and PDUs showing the most significant expansion.

Key Drivers of Middle East Data Center Power Market Growth

The market is driven by rapid digital transformation, government initiatives supporting digital infrastructure development, rising data consumption, and the increasing adoption of cloud computing and IoT technologies. The expansion of hyperscale data centers, along with stringent data security and reliability requirements, further fuels market growth.

Challenges in the Middle East Data Center Power Market Sector

Challenges include the high initial investment costs associated with data center infrastructure, the fluctuating prices of energy resources, and potential supply chain disruptions. Furthermore, ensuring consistent compliance with evolving regulatory frameworks and managing the increasing complexity of power management solutions pose significant hurdles. These challenges can impact project timelines and operational costs, potentially slowing down market growth in certain segments.

Emerging Opportunities in Middle East Data Center Power Market

The growing adoption of renewable energy sources in data centers presents a significant opportunity for companies offering integrated power solutions. Furthermore, the increasing demand for edge computing and the rise of specialized data centers for AI and machine learning applications create further avenues for expansion. Companies that can effectively address the demand for optimized power solutions in these emerging segments stand to gain significant market share.

Leading Players in the Middle East Data Center Power Market Market

- ABB Ltd

- Rolls-Royce PLC

- Legrand Group

- Schneider Electric SE

- Fujitsu Limited

- Caterpillar Inc

- Rittal GmbH & Co KG

- Cisco Systems Inc

- Cummins Inc

- Vertiv Group Corp

- Eaton Corporation

Key Developments in Middle East Data Center Power Market Industry

- June 2023: Legrand introduced its next-generation intelligent rack PDUs (PRO4X and Raritan PX4), enhancing data center power management capabilities.

- May 2023: Eaton launched its G3 Universal Input Rack PDU, offering greater adaptability to diverse power requirements in data centers.

Future Outlook for Middle East Data Center Power Market Market

The Middle East data center power market is poised for sustained growth, driven by ongoing digital transformation, increasing investments in infrastructure, and the adoption of advanced technologies. Strategic partnerships, technological innovation, and a focus on sustainability will be crucial for companies seeking to thrive in this dynamic and expanding market. The market is expected to witness continuous innovation in power distribution solutions, focusing on efficiency, reliability, and integration with other data center technologies.

Middle East Data Center Power Market Segmentation

-

1. Power Infrastructure

-

1.1. Electrical Solution

- 1.1.1. UPS Systems

- 1.1.2. Generators

-

1.1.3. Power Distribution Solutions

- 1.1.3.1. PDU

- 1.1.3.2. Switchgear

- 1.1.3.3. Critical Power Distribution

- 1.1.3.4. Transfer Switches

- 1.1.3.5. Remote Power Panels

- 1.1.3.6. Others

- 1.2. Service

-

1.1. Electrical Solution

-

2. End User

- 2.1. IT and Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media and Entertainment

- 2.5. Other End Users

Middle East Data Center Power Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Data Center Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 5.1.1. Electrical Solution

- 5.1.1.1. UPS Systems

- 5.1.1.2. Generators

- 5.1.1.3. Power Distribution Solutions

- 5.1.1.3.1. PDU

- 5.1.1.3.2. Switchgear

- 5.1.1.3.3. Critical Power Distribution

- 5.1.1.3.4. Transfer Switches

- 5.1.1.3.5. Remote Power Panels

- 5.1.1.3.6. Others

- 5.1.2. Service

- 5.1.1. Electrical Solution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media and Entertainment

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 6. United Arab Emirates Middle East Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ABB Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Rolls-Royce PLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Legrand Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Schneider Electric SE

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fujitsu Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Caterpillar Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Rittal GmbH & Co KG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Cisco Systems Inc *List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Cummins Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Vertiv Group Corp

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Eaton Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 ABB Ltd

List of Figures

- Figure 1: Middle East Data Center Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Data Center Power Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Data Center Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2019 & 2032

- Table 3: Middle East Data Center Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Middle East Data Center Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East Data Center Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United Arab Emirates Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Saudi Arabia Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Qatar Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Israel Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Egypt Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Oman Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Middle East Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2019 & 2032

- Table 14: Middle East Data Center Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Middle East Data Center Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Saudi Arabia Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Arab Emirates Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Israel Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Qatar Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kuwait Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Oman Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Bahrain Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Jordan Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Lebanon Middle East Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Data Center Power Market?

The projected CAGR is approximately 12.70%.

2. Which companies are prominent players in the Middle East Data Center Power Market?

Key companies in the market include ABB Ltd, Rolls-Royce PLC, Legrand Group, Schneider Electric SE, Fujitsu Limited, Caterpillar Inc, Rittal GmbH & Co KG, Cisco Systems Inc *List Not Exhaustive, Cummins Inc, Vertiv Group Corp, Eaton Corporation.

3. What are the main segments of the Middle East Data Center Power Market?

The market segments include Power Infrastructure, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

June 2023 - Legrand introduced the industry’s next generation of intelligent rack power distribution units (PDUs). The server technology PRO4X and Raritan PX4 rack PDUs are poised to redefine power management in data centers with exceptional visibility, cutting-edge hardware, and enhanced security.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Data Center Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Data Center Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Data Center Power Market?

To stay informed about further developments, trends, and reports in the Middle East Data Center Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence