Key Insights

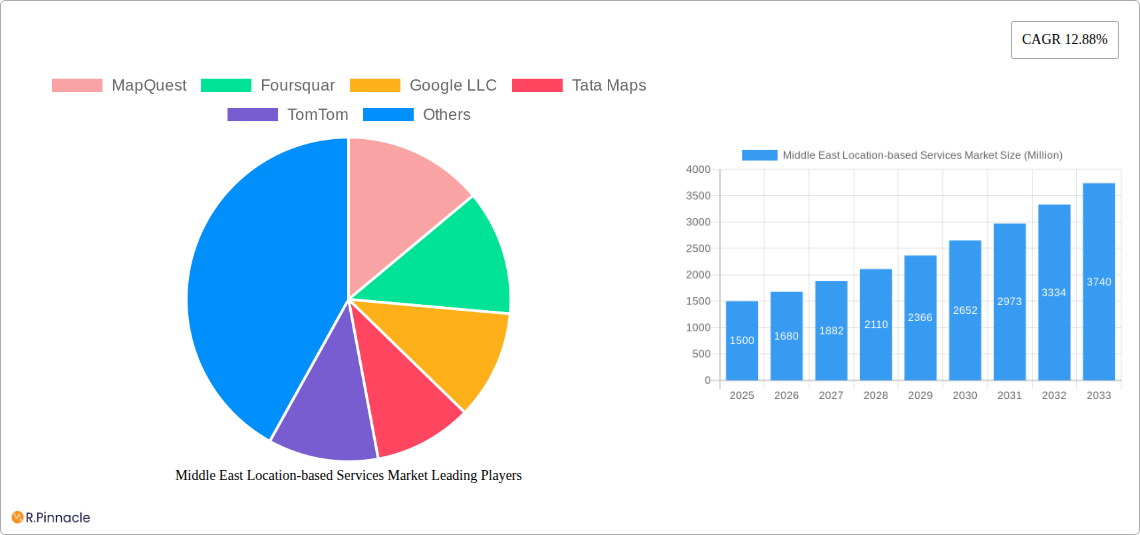

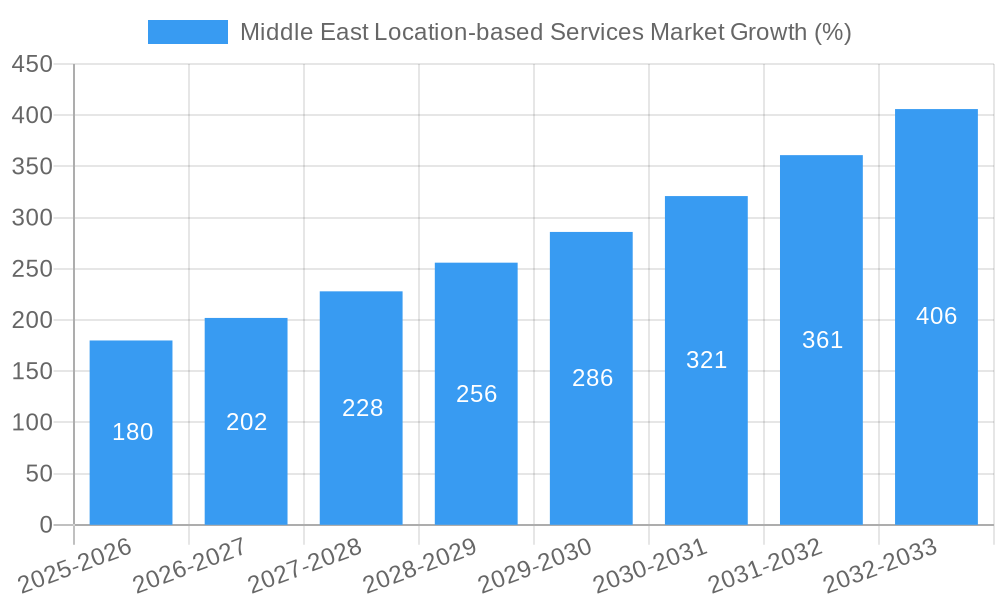

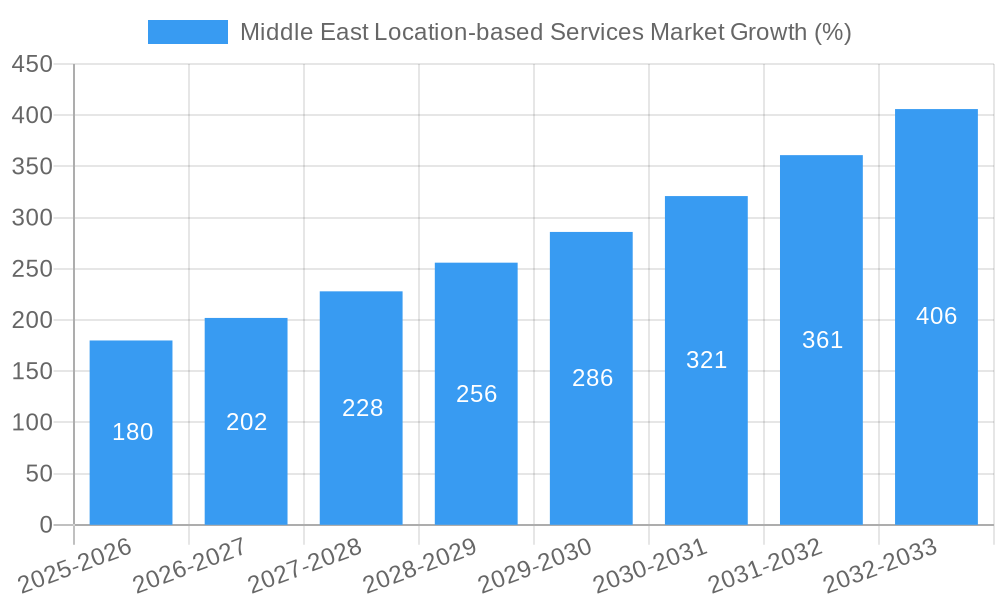

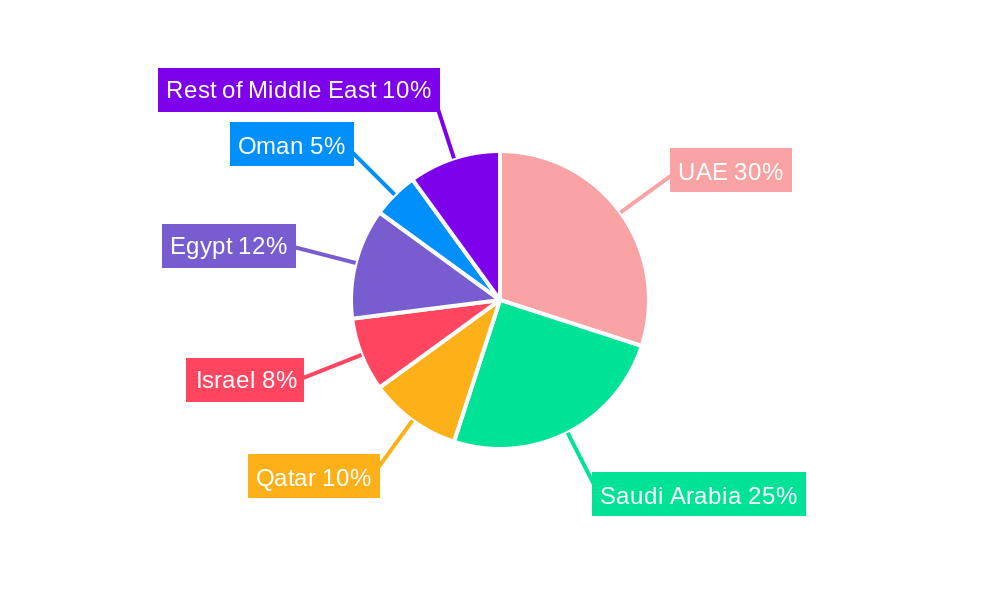

The Middle East Location-Based Services (LBS) market is experiencing robust growth, driven by increasing smartphone penetration, expanding digital infrastructure, and the region's rapid urbanization. A CAGR of 12.88% from 2019-2033 indicates significant potential, with the market expected to reach substantial value by 2033. Key drivers include the burgeoning adoption of LBS across various sectors—from transportation and logistics leveraging real-time tracking and optimized routes to the flourishing e-commerce sector utilizing location-based advertising and delivery services. Furthermore, the growth of smart cities initiatives is fueling demand for advanced LBS solutions in areas like urban planning, public safety, and traffic management. While data privacy concerns and the need for robust cybersecurity measures present some restraints, the overall market trajectory remains positive. The market is segmented by component (hardware, software, services), location (indoor, outdoor), application (mapping & navigation, business intelligence, location-based advertising, social networking, others), and end-user (transportation & logistics, IT & telecom, healthcare, government, BFSI, hospitality, manufacturing, others). The UAE, Saudi Arabia, and Qatar are leading contributors to regional growth, reflecting their advanced technological infrastructure and proactive government support for digital transformation. The continued investment in 5G infrastructure and the rising adoption of IoT devices will further propel market expansion in the coming years.

The significant market potential is further amplified by the increasing adoption of LBS in emerging sectors such as healthcare, where location tracking aids in emergency response and patient monitoring. The growth of the tourism and hospitality industries also contributes significantly, as LBS enhances tourist experiences and improves operational efficiency. Competition among established players like Google LLC, TomTom, and regional companies like Careem and Tata Maps, coupled with the emergence of innovative startups, fosters a dynamic and competitive landscape. Ongoing advancements in AI and machine learning are expected to further enhance the capabilities of LBS, leading to more sophisticated applications and improved user experiences. This combination of technological progress, supportive government policies, and high consumer demand ensures the continued expansion of the Middle East LBS market throughout the forecast period.

Middle East Location-based Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East Location-based Services (LBS) market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's trajectory, identifying key growth drivers, challenges, and emerging opportunities. The market is segmented by component (hardware, software, services), location (indoor, outdoor), application (mapping & navigation, business intelligence & analytics, location-based advertising, social networking & entertainment, other applications), and end-user (transportation & logistics, IT & telecom, healthcare, government, BFSI, hospitality, manufacturing, other end-users). Key players analyzed include MapQuest, Foursquare, Google LLC, Tata Maps, TomTom, Careem, Waze, ALE International, Ericsson, and HERE Technologies. The report projects a market value exceeding xx Million by 2033.

Middle East Location-based Services Market Structure & Innovation Trends

The Middle East LBS market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Google LLC, for instance, commands a substantial portion due to its widespread adoption of Google Maps and related services. However, regional players like Careem are also making significant inroads, particularly in the transportation and logistics sector. The market is characterized by continuous innovation, driven by advancements in technologies like 5G, IoT, and AI. These technologies enhance the accuracy, speed, and functionality of LBS, opening avenues for new applications. Regulatory frameworks, while evolving, generally support the growth of LBS, although data privacy concerns are increasingly being addressed. The market witnesses considerable M&A activity, with deal values reaching xx Million in recent years, reflecting the strategic importance of LBS in various sectors. Product substitutes, like traditional navigation methods, pose minimal threat due to LBS's superior accuracy and convenience. End-user demographics show a strong preference for LBS across age groups and socioeconomic strata, especially in urban areas.

- Market Concentration: Moderately concentrated, with Google LLC and regional players holding significant shares.

- Innovation Drivers: 5G, IoT, AI advancements.

- Regulatory Framework: Supportive, with growing emphasis on data privacy.

- M&A Activity: Significant, with deal values reaching xx Million annually.

- End-user Demographics: High adoption across various demographics, particularly in urban centers.

Middle East Location-based Services Market Dynamics & Trends

The Middle East LBS market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including rising smartphone penetration, increasing urbanization, expanding digital infrastructure, and the burgeoning e-commerce sector. Technological disruptions, such as the adoption of advanced mapping technologies and real-time location tracking systems, are significantly enhancing the capabilities of LBS. Consumer preferences are shifting towards more personalized and integrated LBS solutions. Competitive dynamics are marked by both intense competition among global players and the emergence of niche players specializing in specific LBS applications. Market penetration is expected to exceed xx% by 2033, indicating substantial growth potential.

Dominant Regions & Segments in Middle East Location-based Services Market

The UAE and Saudi Arabia are currently the dominant regions in the Middle East LBS market, fueled by strong economic growth, advanced digital infrastructure, and high smartphone penetration. Within the segment breakdown:

By Component: Software currently holds the largest market share, driven by increasing demand for advanced mapping and analytics solutions.

By Location: Outdoor LBS dominates, primarily due to the widespread use of navigation apps and location-based services in transportation.

By Application: Mapping and navigation currently lead, followed closely by business intelligence and analytics. Location-based advertising is showing significant growth potential.

By End-User: The transportation and logistics sector constitutes a major end-user segment, followed by IT & Telecom and the government sector. Growth in this segment is driven by factors such as the expanding transportation network and increasing demand for optimized logistics solutions.

Key Drivers in Dominant Regions:

- Strong economic growth.

- Advanced digital infrastructure.

- High smartphone penetration rates.

- Government initiatives promoting digital transformation.

Middle East Location-based Services Market Product Innovations

Recent product innovations focus on enhancing accuracy, personalization, and integration with other technologies. This includes the incorporation of AI for improved route optimization, the use of AR/VR for enhanced user experience, and integration with smart city initiatives for real-time data analysis. The market sees a growing emphasis on developing location-based services that cater to specific industry needs. The integration of location data with various applications is driving innovation and competition in this dynamic market.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Middle East LBS market across various segments:

- By Component: Hardware, Software, Services (each segment includes market size projections and competitive analysis).

- By Location: Indoor, Outdoor (each includes growth projections and market dynamics).

- By Application: Mapping & Navigation, Business Intelligence & Analytics, Location-based Advertising, Social Networking & Entertainment, Other Applications (each with market size and competitive landscape analysis).

- By End-User: Transportation & Logistics, IT & Telecom, Healthcare, Government, BFSI, Hospitality, Manufacturing, Other End-Users (each includes growth projections, market size, and competitive landscape).

Key Drivers of Middle East Location-based Services Market Growth

The Middle East LBS market's growth is primarily driven by:

- Technological Advancements: 5G, IoT, AI, and advanced mapping technologies are enhancing LBS accuracy and functionality.

- Economic Growth: Rising disposable incomes and increased urbanization are fueling demand for LBS.

- Government Initiatives: Investments in digital infrastructure and smart city projects are supporting LBS adoption.

Challenges in the Middle East Location-based Services Market Sector

The market faces challenges such as:

- Data Privacy Concerns: Growing awareness of data privacy issues requires robust security measures and transparent data handling practices.

- Infrastructure Limitations: Uneven digital infrastructure across the region can hinder LBS deployment.

- Competition: Intense competition from established global players and regional startups requires continuous innovation and differentiation.

Emerging Opportunities in Middle East Location-based Services Market

Significant opportunities exist in:

- Expansion into niche markets: Specialized LBS applications for industries like healthcare and agriculture offer high growth potential.

- Integration with emerging technologies: Combining LBS with AI, VR/AR, and blockchain can create innovative solutions.

- Focus on personalization: Customized LBS offerings based on user preferences and needs can drive market growth.

Leading Players in the Middle East Location-based Services Market Market

- MapQuest

- Foursquare

- Google LLC

- Tata Maps

- TomTom

- Careem

- Waze

- ALE International

- Ericsson

- HERE Technologies

Key Developments in Middle East Location-based Services Market Industry

- February 2023: Aramex launched delivery drones equipped with multi-directional sensors, boosting demand for location-based services in logistics.

- October 2022: Dubai Municipality partnered with Ordnance Survey to leverage geospatial expertise for improved infrastructure and services, driving location data intelligence adoption.

Future Outlook for Middle East Location-based Services Market Market

The Middle East LBS market is poised for significant growth, driven by continued technological advancements, increasing urbanization, and supportive government policies. Strategic opportunities lie in expanding into untapped markets, developing innovative applications, and focusing on personalized LBS solutions. The market's future hinges on addressing data privacy concerns and ensuring robust digital infrastructure across the region. The integration of LBS with emerging technologies and the expansion into new sectors like smart agriculture and healthcare will be critical for sustained growth.

Middle East Location-based Services Market Segmentation

-

1. Component

- 1.1. Hadware

- 1.2. Software

- 1.3. Services

-

2. Location

- 2.1. Indoor

- 2.2. Outdoor

-

3. Application

- 3.1. Mapping and Navigation

- 3.2. Business Intelligence and Analytics

- 3.3. Location-based Advertising

- 3.4. Social Networking and Entertainment

- 3.5. Other Applications

-

4. End-User

- 4.1. Transportation and Logistics

- 4.2. IT and Telecom

- 4.3. Healthcare

- 4.4. Government

- 4.5. BFSI

- 4.6. Hospitality

- 4.7. Manufacturing

- 4.8. Other End-Users

Middle East Location-based Services Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Location-based Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.88% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased adoption of smart phones

- 3.2.2 social media and location-based app adoption; Growing Demand for Geo-based Marketing

- 3.3. Market Restrains

- 3.3.1. High cost of installation and maintenance; Trade-offs between privacy/security and regulatory constraints

- 3.4. Market Trends

- 3.4.1 Increased adoption of smart phones

- 3.4.2 social media and location-based app is expected to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hadware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Indoor

- 5.2.2. Outdoor

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Mapping and Navigation

- 5.3.2. Business Intelligence and Analytics

- 5.3.3. Location-based Advertising

- 5.3.4. Social Networking and Entertainment

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Transportation and Logistics

- 5.4.2. IT and Telecom

- 5.4.3. Healthcare

- 5.4.4. Government

- 5.4.5. BFSI

- 5.4.6. Hospitality

- 5.4.7. Manufacturing

- 5.4.8. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. United Arab Emirates Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 MapQuest

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Foursquar

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Google LLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Tata Maps

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 TomTom

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Careem

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Waze

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 ALE International

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ericsson

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 HERE Technologies

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 MapQuest

List of Figures

- Figure 1: Middle East Location-based Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Location-based Services Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Location-based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Location-based Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Middle East Location-based Services Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Middle East Location-based Services Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 5: Middle East Location-based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 6: Middle East Location-based Services Market Volume K Unit Forecast, by Location 2019 & 2032

- Table 7: Middle East Location-based Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Middle East Location-based Services Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: Middle East Location-based Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Middle East Location-based Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 11: Middle East Location-based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Middle East Location-based Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Middle East Location-based Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Middle East Location-based Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United Arab Emirates Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Arab Emirates Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Saudi Arabia Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Saudi Arabia Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Qatar Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Qatar Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Israel Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Israel Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Egypt Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Egypt Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Oman Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Oman Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Middle East Location-based Services Market Revenue Million Forecast, by Component 2019 & 2032

- Table 30: Middle East Location-based Services Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 31: Middle East Location-based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 32: Middle East Location-based Services Market Volume K Unit Forecast, by Location 2019 & 2032

- Table 33: Middle East Location-based Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Middle East Location-based Services Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 35: Middle East Location-based Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 36: Middle East Location-based Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 37: Middle East Location-based Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Middle East Location-based Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Saudi Arabia Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Saudi Arabia Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: United Arab Emirates Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Arab Emirates Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Israel Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Qatar Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Qatar Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Kuwait Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Kuwait Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Oman Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Oman Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Bahrain Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Bahrain Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Jordan Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Jordan Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Lebanon Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Lebanon Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Location-based Services Market?

The projected CAGR is approximately 12.88%.

2. Which companies are prominent players in the Middle East Location-based Services Market?

Key companies in the market include MapQuest, Foursquar, Google LLC, Tata Maps, TomTom, Careem, Waze, ALE International, Ericsson, HERE Technologies.

3. What are the main segments of the Middle East Location-based Services Market?

The market segments include Component, Location, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased adoption of smart phones. social media and location-based app adoption; Growing Demand for Geo-based Marketing.

6. What are the notable trends driving market growth?

Increased adoption of smart phones. social media and location-based app is expected to drive the market.

7. Are there any restraints impacting market growth?

High cost of installation and maintenance; Trade-offs between privacy/security and regulatory constraints.

8. Can you provide examples of recent developments in the market?

February 2023: Aramex, logistics and transportation solutions provider, announced the launch of delivery drones equipped with multi-directional sensors capable of operating multiple and continuous long-range flights in different environments. Such trends are expected to drive the demand for location-based services in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Location-based Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Location-based Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Location-based Services Market?

To stay informed about further developments, trends, and reports in the Middle East Location-based Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence