Key Insights

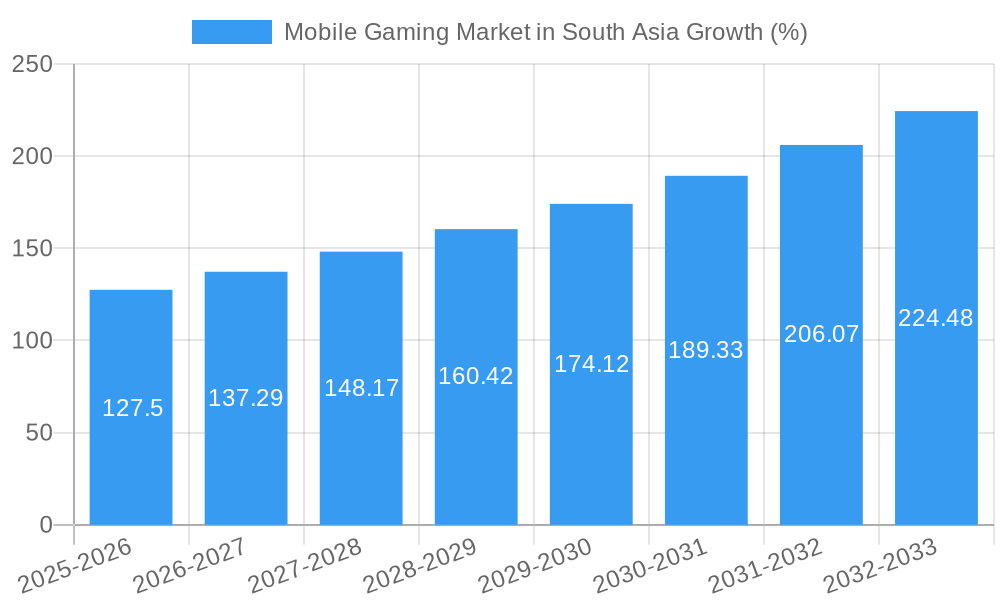

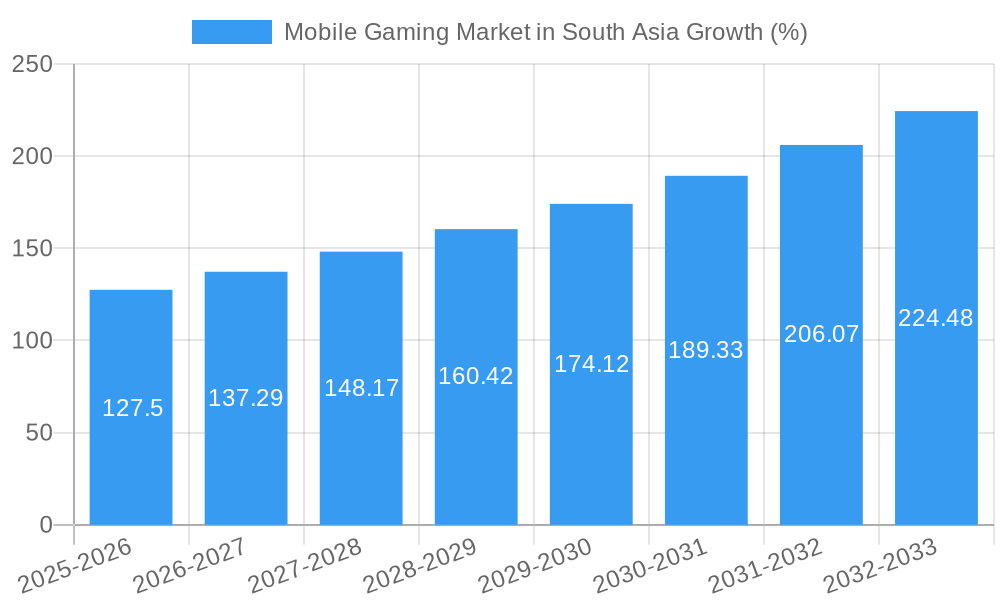

The South Asian mobile gaming market, a dynamic and rapidly expanding sector, is poised for significant growth over the next decade. Driven by increasing smartphone penetration, affordable data plans, and a burgeoning young population with high mobile usage, the market is experiencing robust expansion. While precise figures for South Asia aren't explicitly provided, extrapolating from the global CAGR of 8.50% and considering the region's unique growth drivers, we can reasonably project substantial increases. The dominance of Android within the region, given its affordability, contributes to significant market share. Popular genres like casual games, action games, and multiplayer online battle arenas (MOBAs) are major growth drivers. Furthermore, the increasing popularity of esports and influencer marketing is further fueling market expansion. Competition among established players like Tencent Holdings Ltd, Netmarble Corporation, and Garena SEA Group, alongside regional developers, is intensifying, leading to innovation and wider game accessibility.

However, challenges remain. Infrastructure limitations in certain areas hinder seamless gameplay experiences, and fluctuating internet connectivity can impact user engagement. Regulatory hurdles and concerns regarding in-app purchases and responsible gaming also need consideration. Despite these challenges, the fundamental growth drivers – a large, tech-savvy population and increasing smartphone adoption – point to an overwhelmingly positive outlook for the South Asian mobile gaming market. Strategic investments in infrastructure improvements and responsible gaming initiatives will be crucial in maximizing the industry’s potential and ensuring sustainable growth.

Mobile Gaming Market in South Asia: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning mobile gaming market in South Asia, covering the period 2019-2033. It offers invaluable insights for industry professionals, investors, and strategists seeking to understand the market dynamics, key players, and future growth potential of this rapidly expanding sector. With a focus on actionable data and strategic recommendations, this report is essential for navigating the complexities of the South Asian mobile gaming landscape. The report uses 2025 as the base and estimated year, with a forecast period extending to 2033 and a historical period covering 2019-2024.

Mobile Gaming Market in South Asia Market Structure & Innovation Trends

This section analyzes the South Asian mobile gaming market's structure, focusing on market concentration, innovation drivers, regulatory frameworks, and competitive landscape. We examine the influence of mergers and acquisitions (M&A) activities, end-user demographics, and the presence of product substitutes. The market is characterized by a mix of established global giants and emerging local players.

Market Concentration: The market displays a moderately concentrated structure, with a few major players holding significant market share. Tencent Holdings Ltd and Garena SEA Group are expected to hold xx% and xx% of the market share respectively in 2025. However, a substantial number of smaller, agile companies are also contributing significantly to innovation and market growth.

Innovation Drivers: Factors driving innovation include the increasing affordability of smartphones, rising internet penetration, and a burgeoning young population with a high appetite for mobile gaming. The introduction of 5G technology is also expected to significantly accelerate innovation.

Regulatory Frameworks: Varying regulatory frameworks across different South Asian countries create a complex landscape for market participants. Navigating these regional differences is crucial for successful market entry and growth.

M&A Activities: The market has witnessed a moderate level of M&A activity in recent years, with deal values averaging around xx Million USD annually during the historical period. These activities often involve strategic acquisitions by larger companies seeking to expand their market presence and product portfolios.

Mobile Gaming Market in South Asia Market Dynamics & Trends

This section delves into the dynamic forces shaping the South Asian mobile gaming market, including market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The market exhibits robust growth, fueled by a combination of factors.

The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of mobile gaming is increasing rapidly, with an estimated xx% of the population actively engaging in mobile gaming in 2025, projected to increase to xx% by 2033. This growth is propelled by factors such as the increasing affordability of smartphones, rising internet and mobile data penetration, and a growing preference for casual and hyper-casual mobile games. The rise of esports in the region also contributes to market expansion. Competition is fierce, with both international and regional players vying for market share, leading to continuous innovation and improvements in game quality and features. Technological advancements, like improved graphics capabilities and cloud gaming, are further driving market growth and changing consumer preferences.

Dominant Regions & Segments in Mobile Gaming Market in South Asia

This section identifies the leading regions and segments within the South Asian mobile gaming market. India is expected to remain the dominant market within South Asia, holding approximately xx% of the total market value in 2025. This is largely due to the country's large and young population, coupled with increasing smartphone penetration and internet accessibility.

- Key Drivers for India's Dominance:

- Large and Young Population: A significant portion of the population falls within the key demographic for mobile gaming.

- Increasing Smartphone Penetration: Affordable smartphones are becoming increasingly accessible.

- Rising Internet and Mobile Data Penetration: Improved infrastructure is allowing for greater connectivity.

- Government Initiatives Promoting Digitalization: Policies are encouraging the growth of the digital economy.

By Platform:

- Android: The Android platform dominates the market, driven by its affordability and accessibility, and holds approximately xx% market share in 2025.

- iOS: The iOS platform captures a significant but smaller share of the market, primarily amongst higher-income users. This segment is projected to grow at a CAGR of xx% during the forecast period, fuelled by growing disposable incomes and increasing preference for high-quality gaming experiences.

Mobile Gaming Market in South Asia Product Innovations

The South Asian mobile gaming market is witnessing a surge in innovative game development. Hyper-casual games, characterized by simple gameplay and short session lengths, remain immensely popular. The integration of augmented reality (AR) and virtual reality (VR) features is also gaining traction. Furthermore, the development of mobile esports titles is creating exciting opportunities for both players and developers. The focus on localized content and culturally relevant narratives enhances market fit, making games more appealing to the regional audience.

Report Scope & Segmentation Analysis

This report segments the South Asian mobile gaming market by platform: Android and iOS.

Android: The Android segment accounts for the largest market share due to its widespread adoption and affordability of devices. We project it to reach xx Million USD in 2025, growing at a CAGR of xx% during the forecast period. Competition is intense, with numerous developers vying for user attention.

iOS: While the iOS segment has a smaller market share compared to Android, its high average revenue per user (ARPU) makes it a valuable segment. The market size is projected to reach xx Million USD in 2025, expanding at a CAGR of xx% during the forecast period. The segment is characterized by premium games and a focus on a high-spending user base.

Key Drivers of Mobile Gaming Market in South Asia Growth

Several factors contribute to the robust growth of the South Asian mobile gaming market. The rise of affordable smartphones and readily available mobile internet access are critical. The increasing disposable incomes of the young population further fuels market expansion, as does the growing popularity of esports and mobile gaming culture. Supportive government policies and investments in digital infrastructure are creating a favorable environment for growth.

Challenges in the Mobile Gaming Market in South Asia Sector

The South Asian mobile gaming market faces several challenges. Issues of internet connectivity and affordability remain in certain regions, limiting market penetration. Regulatory complexities and varying policies across different countries also present obstacles. The intense competition and challenges in monetizing free-to-play games also pose a significant hurdle for many developers. Furthermore, ensuring user data privacy and security is a significant concern.

Emerging Opportunities in Mobile Gaming Market in South Asia

Despite the challenges, the South Asian mobile gaming market presents many opportunities. The expansion of 5G networks promises to enhance the gaming experience, and the rise of cloud gaming could significantly broaden access. The growing popularity of esports provides a new avenue for monetization and fan engagement. Moreover, the untapped potential in smaller regional markets presents significant opportunities for growth.

Leading Players in the Mobile Gaming Market in South Asia Market

- BANDAI NAMCO Entertainment Asia

- Sherman3D

- Garena SEA Group

- Tencent Holdings Ltd

- Netmarble Corporation

- IGG Inc

- Sony Corporation

- Asiasoft Corporation Public Company Limited

- Nintendo Co Ltd

Key Developments in Mobile Gaming Market in South Asia Industry

- December 2021: Toge Productions launched a funding initiative for South Asian game creators, boosting local talent and fostering innovation. UNIQX Studio, one of the first grantees, released their game, Ngopi, Yuk.

- May 2022: The Philippines' victory in the 31st SEA Games' esports Legends: Wild Rift (mobile) women's team event highlighted the growing popularity and potential of mobile esports in the region.

Future Outlook for Mobile Gaming Market in South Asia Market

The South Asian mobile gaming market is poised for significant growth in the coming years. Continued expansion of smartphone penetration and improvements in mobile internet infrastructure will be key drivers. The burgeoning esports scene and the adoption of new technologies like cloud gaming will create further opportunities. The focus on localized content and culturally relevant games will be essential for continued success in this dynamic market.

Mobile Gaming Market in South Asia Segmentation

-

1. Platform

- 1.1. Android

- 1.2. iOS

Mobile Gaming Market in South Asia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mobile Gaming Market in South Asia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The growth of eSports in the region4.2.2 5G network and increasing usage of smartphones

- 3.3. Market Restrains

- 3.3.1. User retention for mobile gaming

- 3.4. Market Trends

- 3.4.1. The growth of eSports in the region is driving the Mobile Gaming Market in South Asia Region.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Android

- 5.1.2. iOS

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Android

- 6.1.2. iOS

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. South America Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Android

- 7.1.2. iOS

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Europe Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Android

- 8.1.2. iOS

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Middle East & Africa Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Android

- 9.1.2. iOS

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Asia Pacific Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. Android

- 10.1.2. iOS

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. China Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 12. Japan Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 13. India Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 16. Australia Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 BANDAI NAMCO Entertainment Asia

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Sherman3D

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Garena SEA Group

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Tencent Holdings Ltd

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Netmarble Corporation

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 IGG Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Sony Corporation

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Asiasoft Corporation Public Company Limited

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Nintendo Co Ltd

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.1 BANDAI NAMCO Entertainment Asia

List of Figures

- Figure 1: Mobile Gaming Market in South Asia Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mobile Gaming Market in South Asia Share (%) by Company 2024

List of Tables

- Table 1: Mobile Gaming Market in South Asia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Mobile Gaming Market in South Asia Revenue Million Forecast, by Platform 2019 & 2032

- Table 4: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Platform 2019 & 2032

- Table 5: Mobile Gaming Market in South Asia Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Mobile Gaming Market in South Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: China Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: China Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Japan Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Japan Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: India Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: India Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: South Korea Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Taiwan Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Taiwan Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Australia Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia-Pacific Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia-Pacific Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Mobile Gaming Market in South Asia Revenue Million Forecast, by Platform 2019 & 2032

- Table 24: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Platform 2019 & 2032

- Table 25: Mobile Gaming Market in South Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: United States Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United States Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Canada Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Mexico Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Mexico Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Mobile Gaming Market in South Asia Revenue Million Forecast, by Platform 2019 & 2032

- Table 34: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Platform 2019 & 2032

- Table 35: Mobile Gaming Market in South Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: Brazil Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Brazil Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Argentina Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Argentina Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of South America Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Mobile Gaming Market in South Asia Revenue Million Forecast, by Platform 2019 & 2032

- Table 44: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Platform 2019 & 2032

- Table 45: Mobile Gaming Market in South Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: United Kingdom Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: United Kingdom Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Germany Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Germany Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: France Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: France Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Italy Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Italy Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Spain Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Spain Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Russia Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Russia Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Benelux Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Benelux Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: Nordics Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Nordics Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 63: Rest of Europe Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of Europe Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 65: Mobile Gaming Market in South Asia Revenue Million Forecast, by Platform 2019 & 2032

- Table 66: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Platform 2019 & 2032

- Table 67: Mobile Gaming Market in South Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 68: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Country 2019 & 2032

- Table 69: Turkey Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Turkey Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: Israel Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Israel Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: GCC Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: GCC Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: North Africa Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: North Africa Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: South Africa Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: South Africa Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 79: Rest of Middle East & Africa Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Rest of Middle East & Africa Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 81: Mobile Gaming Market in South Asia Revenue Million Forecast, by Platform 2019 & 2032

- Table 82: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Platform 2019 & 2032

- Table 83: Mobile Gaming Market in South Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 84: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Country 2019 & 2032

- Table 85: China Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: China Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: India Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: India Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Japan Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Japan Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: South Korea Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: South Korea Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 93: ASEAN Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: ASEAN Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 95: Oceania Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Oceania Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 97: Rest of Asia Pacific Mobile Gaming Market in South Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Rest of Asia Pacific Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Gaming Market in South Asia?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the Mobile Gaming Market in South Asia?

Key companies in the market include BANDAI NAMCO Entertainment Asia, Sherman3D, Garena SEA Group, Tencent Holdings Ltd, Netmarble Corporation, IGG Inc, Sony Corporation, Asiasoft Corporation Public Company Limited, Nintendo Co Ltd.

3. What are the main segments of the Mobile Gaming Market in South Asia?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The growth of eSports in the region4.2.2 5G network and increasing usage of smartphones.

6. What are the notable trends driving market growth?

The growth of eSports in the region is driving the Mobile Gaming Market in South Asia Region..

7. Are there any restraints impacting market growth?

User retention for mobile gaming.

8. Can you provide examples of recent developments in the market?

Dec 2021: Toge Productions announced a funding initiative for South Asian game creators, with the first six grantees to be announced. UNIQX Studio is the first to have their game, Ngopi, Yuk, released.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Gaming Market in South Asia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Gaming Market in South Asia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Gaming Market in South Asia?

To stay informed about further developments, trends, and reports in the Mobile Gaming Market in South Asia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence