Key Insights

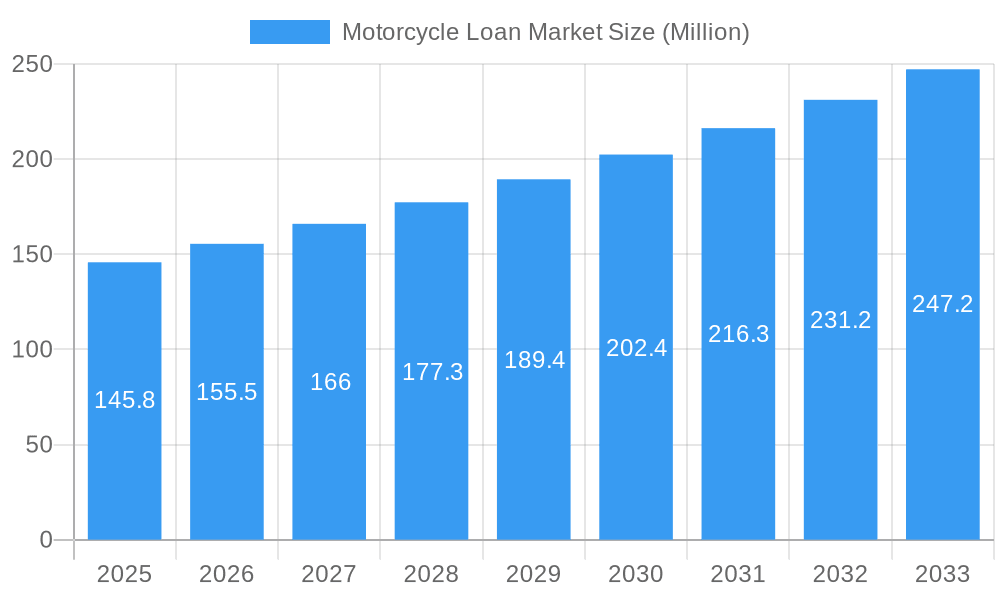

The global motorcycle loan market, valued at $145.80 million in 2025, is projected to experience robust growth, driven by rising motorcycle sales, particularly in developing economies with expanding middle classes. Increasing affordability through diverse financing options offered by banks, NBFCs, OEMs, and fintech companies fuels this expansion. The market is segmented by vehicle type (two-wheelers dominating), provider type, loan amount sanctioned (with a likely concentration in the 25-50% and 51-75% brackets reflecting common lending practices), and loan tenure (with 3-5 years likely being the most popular). Geographical expansion, particularly in Asia-Pacific regions like India and Southeast Asia, contributes significantly to market growth. However, factors such as economic downturns impacting consumer spending and stringent lending regulations could act as potential restraints. The competitive landscape includes established players like Daimler Financial Services, Capital One, and JPMorgan Chase, alongside burgeoning fintech lenders, indicating a dynamic and evolving market structure. The increasing penetration of digital lending platforms and personalized financial solutions further enhances market attractiveness.

Motorcycle Loan Market Market Size (In Million)

The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) of 6.61%, indicating substantial market expansion. This growth is underpinned by continuous technological advancements in the motorcycle industry, leading to the development of more fuel-efficient and technologically advanced models, thereby boosting demand. Furthermore, government initiatives promoting sustainable transportation and infrastructure development in several regions further contribute to the positive outlook for motorcycle loans. Nevertheless, fluctuations in interest rates and evolving consumer preferences pose challenges to sustained growth. A diversified product portfolio and strategic partnerships are crucial for lenders to navigate this dynamic market and capitalize on emerging opportunities.

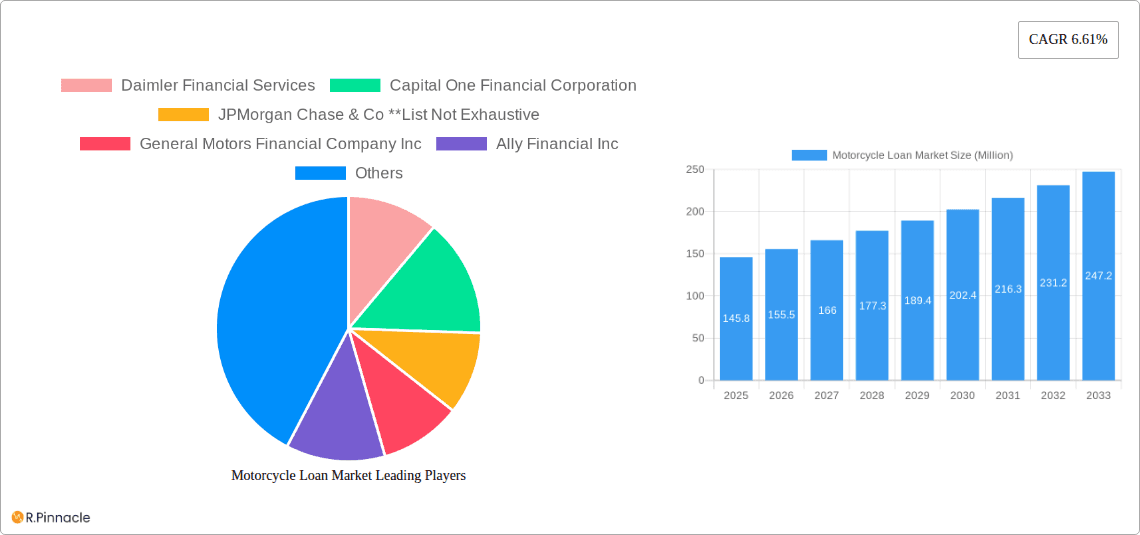

Motorcycle Loan Market Company Market Share

Motorcycle Loan Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Motorcycle Loan Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. We analyze market trends, segment performance, key players, and future growth prospects, providing actionable intelligence for navigating this dynamic sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Motorcycle Loan Market Market Structure & Innovation Trends

The global motorcycle loan market displays a moderately concentrated structure, with key players like Daimler Financial Services, Capital One Financial Corporation, and JPMorgan Chase & Co. holding significant market share. However, the market also features numerous regional and niche players, leading to considerable competition. Market concentration is further influenced by the growing presence of Fintech companies offering innovative lending solutions.

- Market Share: Daimler Financial Services holds an estimated xx% market share, followed by Capital One Financial Corporation at xx% and JPMorgan Chase & Co. at xx%. Other significant players include General Motors Financial Company Inc, Ally Financial Inc, Bank of America Corporation, Ford Motor Credit Company, GM Financial Inc, Mitsubishi HC Capital UK PLC, and Toyota Financial Services. These figures are estimates based on available data and may vary.

- Innovation Drivers: Technological advancements, such as digital lending platforms and AI-powered credit scoring, are driving innovation. The increasing adoption of mobile banking and online applications further facilitates market expansion.

- Regulatory Frameworks: Varying regulations across different geographies impact market growth and lending practices. Compliance costs and regulatory changes influence the operational efficiency of lending institutions.

- Mergers & Acquisitions: The recent acquisition of Mandala Multifinance by Mitsubishi UFJ Financial Group for USD 465 Million highlights the significant M&A activity in the sector. These activities reshape market dynamics, influencing competition and market share distribution. Total M&A deal value in the sector in 2024 is estimated at xx Million.

- Product Substitutes: Other forms of financing, such as personal loans or leasing arrangements, could be considered substitutes, depending on consumer needs and preferences.

Motorcycle Loan Market Market Dynamics & Trends

The motorcycle loan market is driven by factors such as rising disposable incomes, increasing demand for personal mobility, and favorable financing options. Technological disruption, particularly in the form of Fintech solutions, is reshaping the lending landscape. Consumer preferences are shifting towards online platforms and digital lending solutions, offering convenience and speed. The competitive landscape is marked by intense rivalry amongst established financial institutions and emerging Fintech players.

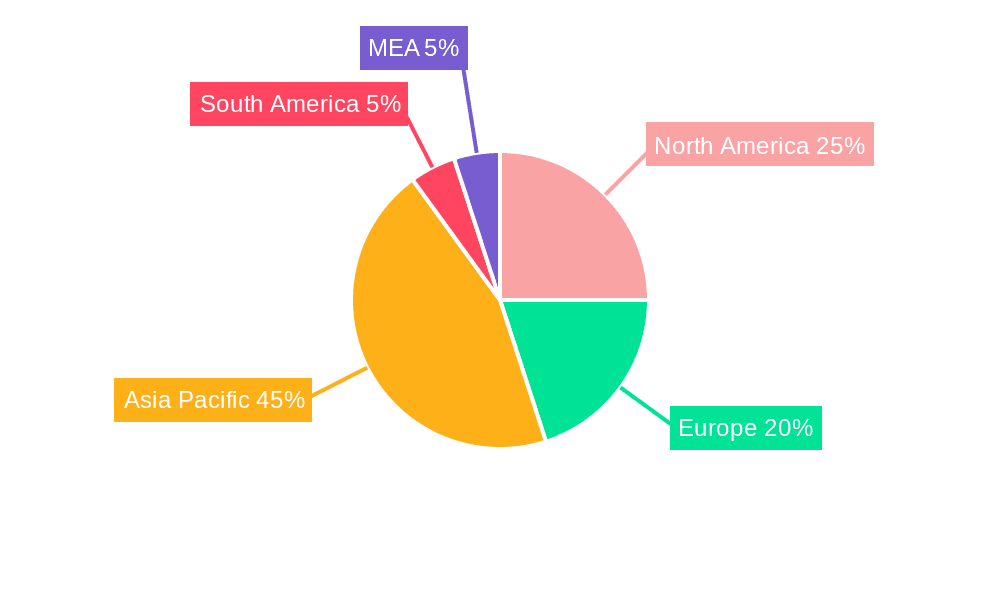

Dominant Regions & Segments in Motorcycle Loan Market

The two-wheeler segment dominates the motorcycle loan market, owing to high demand and affordability. Asia-Pacific, particularly India and Southeast Asia, represent the most dominant region due to a large motorcycle-owning population and growing middle class.

- By Vehicle Type: Two-wheeler loans constitute the largest segment, accounting for approximately xx% of the total market, followed by passenger cars (xx%) and commercial vehicles (xx%).

- By Provider Type: Banks and NBFCs are the primary providers, but the share of OEMs and Fintech companies is gradually increasing.

- By Percentage of Amount Sanctioned: The 25-50% segment holds the largest share due to risk management practices by lenders.

- By Tenure: Loans with tenure of 3-5 years constitute the largest segment, reflecting preferred repayment schedules.

- Key Drivers (Regional):

- Asia-Pacific: Rapid economic growth, increasing urbanization, and rising disposable incomes.

- North America: Stable economic conditions, and growing popularity of motorcycles as recreational vehicles.

- Europe: Increasing demand for commuter motorcycles and evolving financing schemes.

Motorcycle Loan Market Product Innovations

Recent product innovations include digital loan application platforms, personalized financing options based on credit scores and risk profiles, and integrated insurance products. These innovations enhance customer experience and streamline the loan process. Technological trends like AI and machine learning are being utilized to improve risk assessment and fraud detection. Market fit is determined by the increasing demand for digital services and personalized financial solutions.

Report Scope & Segmentation Analysis

This report comprehensively segments the motorcycle loan market based on vehicle type (two-wheeler, passenger car, commercial vehicle), provider type (banks, NBFCs, OEMs, other providers), percentage of amount sanctioned (less than 25%, 25-50%, 51-75%, more than 75%), and loan tenure (less than 3 years, 3-5 years, more than 5 years). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. For example, the two-wheeler segment is projected to grow at a CAGR of xx% during the forecast period, driven by increasing demand and affordability.

Key Drivers of Motorcycle Loan Market Growth

The motorcycle loan market is fueled by factors like rising disposable incomes, increasing urbanization, and the growing popularity of motorcycles as a mode of transportation and leisure. Government initiatives promoting affordable transportation and favorable financing policies further stimulate market growth. Technological advancements in lending platforms and credit scoring also contribute significantly.

Challenges in the Motorcycle Loan Market Sector

The sector faces challenges such as stringent regulatory requirements, increasing competition from Fintech lenders, and managing non-performing loans. Economic downturns and fluctuating interest rates pose risks to market stability. Supply chain disruptions can affect the availability of motorcycles and consequently impact loan demand.

Emerging Opportunities in Motorcycle Loan Market

Emerging markets in developing economies, coupled with the expansion of digital lending platforms, present significant opportunities for growth. The increasing adoption of innovative technologies like blockchain and AI offers further potential. Furthermore, the rise of electric motorcycles opens new avenues for specialized financing options.

Leading Players in the Motorcycle Loan Market Market

- Daimler Financial Services

- Capital One Financial Corporation

- JPMorgan Chase & Co

- General Motors Financial Company Inc

- Ally Financial Inc

- Bank of America Corporation

- Ford Motor Credit Company

- GM Financial Inc

- Mitsubishi HC Capital UK PLC

- Toyota Financial Services

Key Developments in Motorcycle Loan Market Industry

- June 2023: Mitsubishi UFJ Financial Group's acquisition of Mandala Multifinance for USD 465 million signifies significant consolidation in the Indonesian market.

- May 2023: The partnership between Suzuki Motorcycle India and Bajaj Finance expands financing options for Suzuki customers, boosting sales and market penetration.

Future Outlook for Motorcycle Loan Market Market

The motorcycle loan market is poised for continued growth, driven by increasing demand in emerging economies, technological advancements, and evolving consumer preferences. Strategic partnerships, expansion into new markets, and diversification of product offerings will be crucial for sustained success in this competitive sector. The market is expected to experience healthy growth in the coming years, supported by favorable economic conditions and technological advancements.

Motorcycle Loan Market Segmentation

-

1. Vehicle Type

- 1.1. Two-Wheeler

- 1.2. Passenger Car

- 1.3. Commercial Vehicle

-

2. Provider Type

- 2.1. Banks

- 2.2. NBFCs (Non-Banking Financial Services)

- 2.3. OEM (Original Equipment Manufacturer)

- 2.4. Other Provider Types (Fintech Companies)

-

3. Percentage of Amount Sanctioned

- 3.1. Less than 25%

- 3.2. 25-50%

- 3.3. 51-75%

- 3.4. More than 75%

-

4. Tenure

- 4.1. Less than 3 Years

- 4.2. 3-5 Years

- 4.3. More than 5 Years

Motorcycle Loan Market Segmentation By Geography

-

1. North America

- 1.1. USA

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Vietnam

- 3.5. Austrilia

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. Egypt

- 4.3. UAE

- 4.4. Rest of Middle East and Africa

-

5. South America

- 5.1. Argentina

- 5.2. Colombia

- 5.3. Rest of South America

Motorcycle Loan Market Regional Market Share

Geographic Coverage of Motorcycle Loan Market

Motorcycle Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Increasing Sales of Motorcycles will Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Two-Wheeler

- 5.1.2. Passenger Car

- 5.1.3. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. Banks

- 5.2.2. NBFCs (Non-Banking Financial Services)

- 5.2.3. OEM (Original Equipment Manufacturer)

- 5.2.4. Other Provider Types (Fintech Companies)

- 5.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 5.3.1. Less than 25%

- 5.3.2. 25-50%

- 5.3.3. 51-75%

- 5.3.4. More than 75%

- 5.4. Market Analysis, Insights and Forecast - by Tenure

- 5.4.1. Less than 3 Years

- 5.4.2. 3-5 Years

- 5.4.3. More than 5 Years

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Two-Wheeler

- 6.1.2. Passenger Car

- 6.1.3. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Provider Type

- 6.2.1. Banks

- 6.2.2. NBFCs (Non-Banking Financial Services)

- 6.2.3. OEM (Original Equipment Manufacturer)

- 6.2.4. Other Provider Types (Fintech Companies)

- 6.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 6.3.1. Less than 25%

- 6.3.2. 25-50%

- 6.3.3. 51-75%

- 6.3.4. More than 75%

- 6.4. Market Analysis, Insights and Forecast - by Tenure

- 6.4.1. Less than 3 Years

- 6.4.2. 3-5 Years

- 6.4.3. More than 5 Years

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Two-Wheeler

- 7.1.2. Passenger Car

- 7.1.3. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Provider Type

- 7.2.1. Banks

- 7.2.2. NBFCs (Non-Banking Financial Services)

- 7.2.3. OEM (Original Equipment Manufacturer)

- 7.2.4. Other Provider Types (Fintech Companies)

- 7.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 7.3.1. Less than 25%

- 7.3.2. 25-50%

- 7.3.3. 51-75%

- 7.3.4. More than 75%

- 7.4. Market Analysis, Insights and Forecast - by Tenure

- 7.4.1. Less than 3 Years

- 7.4.2. 3-5 Years

- 7.4.3. More than 5 Years

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Two-Wheeler

- 8.1.2. Passenger Car

- 8.1.3. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Provider Type

- 8.2.1. Banks

- 8.2.2. NBFCs (Non-Banking Financial Services)

- 8.2.3. OEM (Original Equipment Manufacturer)

- 8.2.4. Other Provider Types (Fintech Companies)

- 8.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 8.3.1. Less than 25%

- 8.3.2. 25-50%

- 8.3.3. 51-75%

- 8.3.4. More than 75%

- 8.4. Market Analysis, Insights and Forecast - by Tenure

- 8.4.1. Less than 3 Years

- 8.4.2. 3-5 Years

- 8.4.3. More than 5 Years

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East and Africa Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Two-Wheeler

- 9.1.2. Passenger Car

- 9.1.3. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Provider Type

- 9.2.1. Banks

- 9.2.2. NBFCs (Non-Banking Financial Services)

- 9.2.3. OEM (Original Equipment Manufacturer)

- 9.2.4. Other Provider Types (Fintech Companies)

- 9.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 9.3.1. Less than 25%

- 9.3.2. 25-50%

- 9.3.3. 51-75%

- 9.3.4. More than 75%

- 9.4. Market Analysis, Insights and Forecast - by Tenure

- 9.4.1. Less than 3 Years

- 9.4.2. 3-5 Years

- 9.4.3. More than 5 Years

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. South America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Two-Wheeler

- 10.1.2. Passenger Car

- 10.1.3. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Provider Type

- 10.2.1. Banks

- 10.2.2. NBFCs (Non-Banking Financial Services)

- 10.2.3. OEM (Original Equipment Manufacturer)

- 10.2.4. Other Provider Types (Fintech Companies)

- 10.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 10.3.1. Less than 25%

- 10.3.2. 25-50%

- 10.3.3. 51-75%

- 10.3.4. More than 75%

- 10.4. Market Analysis, Insights and Forecast - by Tenure

- 10.4.1. Less than 3 Years

- 10.4.2. 3-5 Years

- 10.4.3. More than 5 Years

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Daimler Financial Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Capital One Financial Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JPMorgan Chase & Co **List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Motors Financial Company Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ally Financial Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bank of American Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ford Motor Credit Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GM Financial Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsubishi HC Capital UK PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Toyota Financial Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Daimler Financial Services

List of Figures

- Figure 1: Global Motorcycle Loan Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 5: North America Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 6: North America Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 7: North America Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 8: North America Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 9: North America Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 10: North America Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: Europe Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 15: Europe Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 16: Europe Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 17: Europe Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 18: Europe Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 19: Europe Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 20: Europe Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 25: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 26: Asia Pacific Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 27: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 28: Asia Pacific Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 29: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 30: Asia Pacific Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 33: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 34: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 35: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 36: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 37: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 38: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 39: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 40: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 43: South America Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 44: South America Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 45: South America Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 46: South America Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 47: South America Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 48: South America Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 49: South America Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 50: South America Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 51: South America Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 3: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 4: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 5: Global Motorcycle Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 8: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 9: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 10: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: USA Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 16: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 17: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 18: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: UK Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 27: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 28: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 29: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: India Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: China Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Japan Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Austrilia Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 37: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 38: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 39: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 40: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Egypt Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: UAE Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 46: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 47: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 48: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 49: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Argentina Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Colombia Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of South America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motorcycle Loan Market?

The projected CAGR is approximately 6.61%.

2. Which companies are prominent players in the Motorcycle Loan Market?

Key companies in the market include Daimler Financial Services, Capital One Financial Corporation, JPMorgan Chase & Co **List Not Exhaustive, General Motors Financial Company Inc, Ally Financial Inc, Bank of American Corporation, Ford Motor Credit Company, GM Financial Inc, Mitsubishi HC Capital UK PLC, Toyota Financial Services.

3. What are the main segments of the Motorcycle Loan Market?

The market segments include Vehicle Type, Provider Type, Percentage of Amount Sanctioned, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 145.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Increasing Sales of Motorcycles will Drive the Market.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

June 2023: Mitsubishi UFJ Financial Group acquired listed Indonesian motorcycle loan company Mandala Multifinance for 7 trillion IDT ( USD 465 million). The Japanese financial giant will hold 70.6% through its subsidiary MUFG Bank and 10% through Adira Dinamika Multi Finance, a subsidiary of Bank Danamon. MUFG will conduct a mandatory tender offer for the remaining 19.4% stake of Mandala Multifinance after the completion of the acquisition, which is expected by early next year. The purchase is subject to regulatory approvals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motorcycle Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motorcycle Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motorcycle Loan Market?

To stay informed about further developments, trends, and reports in the Motorcycle Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence