Key Insights

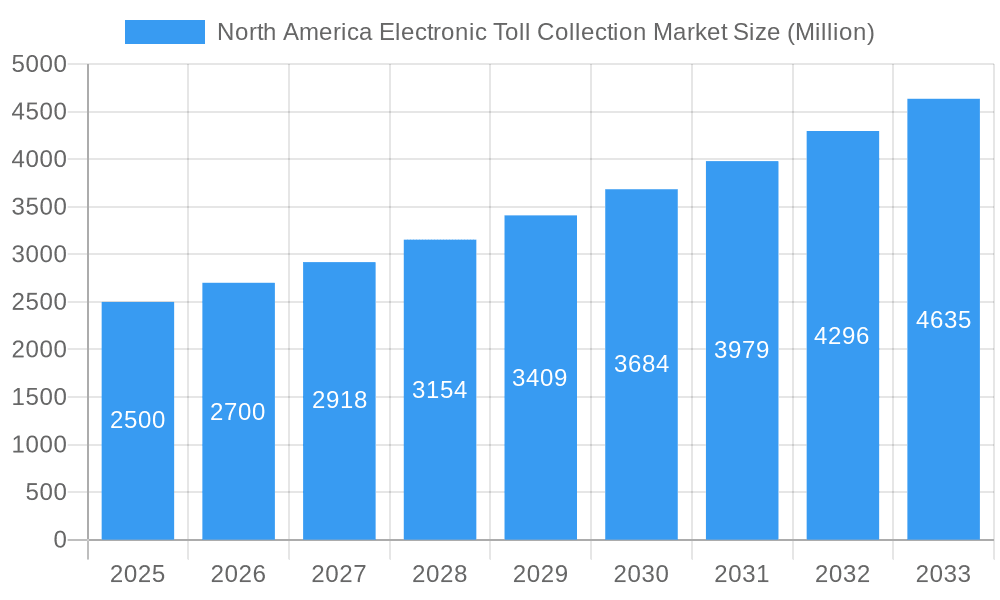

The North American Electronic Toll Collection (ETC) market is experiencing substantial expansion, propelled by escalating traffic congestion in key urban centers and a growing preference for cashless payment solutions. The market's Compound Annual Growth Rate (CAGR) is projected at 3.2%, indicating sustained growth through 2033. Key growth catalysts include government investments in efficient transportation infrastructure, the widespread adoption of advanced technologies such as Radio-frequency Identification (RFID) and Dedicated Short-range Communication (DSRC) for streamlined toll processing, and an increasing number of vehicles equipped with ETC systems. The market size for 2025 is estimated to be $3.11 billion. Market segmentation highlights robust growth across various applications, particularly bridges, roads, and tunnels. The advantages of ETC systems, including reduced toll plaza congestion, improved traffic flow, and enhanced revenue collection for transportation authorities, are primary growth drivers.

North America Electronic Toll Collection Market Market Size (In Billion)

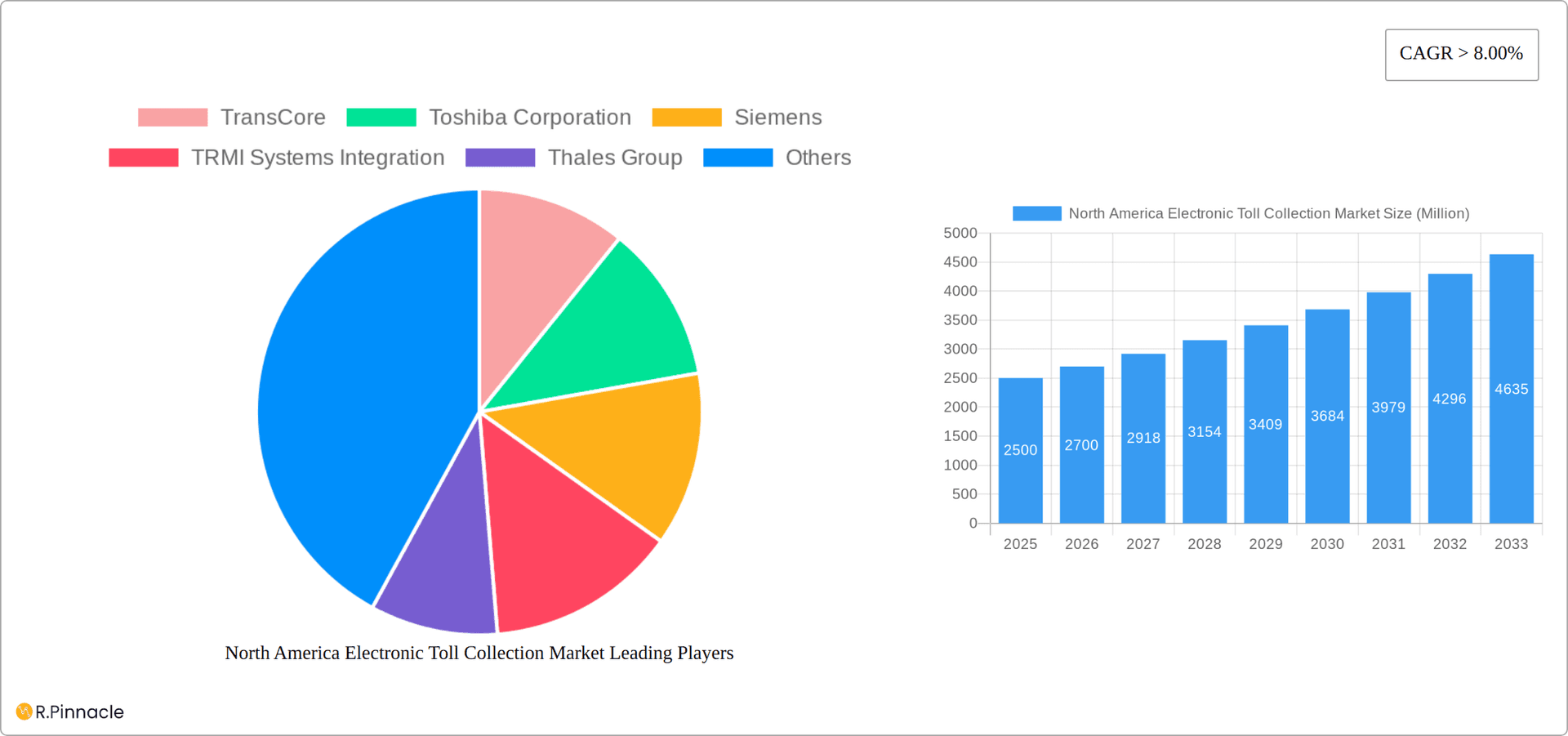

Significant growth is anticipated in RFID and DSRC technology segments, owing to their proven reliability and scalability. The "Other Types" transponder segment, encompassing emerging technologies, is also expected to contribute significantly to future market expansion. Leading market players, including TransCore, Toshiba Corporation, and Siemens, are actively innovating and expanding their service offerings to meet evolving customer demands. This dynamic competitive environment fosters innovation and drives market growth. While the United States currently holds the largest market share, Canada and Mexico represent significant growth opportunities. The rest of North America is projected to exhibit moderate growth, driven by ongoing infrastructure development and the adoption of advanced ETC solutions. The market's trajectory is contingent upon continuous technological advancements, supportive government policies, and expanding infrastructure projects.

North America Electronic Toll Collection Market Company Market Share

North America Electronic Toll Collection Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Electronic Toll Collection Market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, growth drivers, competitive landscape, and future opportunities within this rapidly evolving sector. The market is segmented by Type (Transponder, Other Types), Technology (Radio-frequency Identification (RFID), Dedicated Short-range Communication (DSRC), Other Technologies), and Application Type (Bridges, Roads, Tunnels). Key players such as TransCore, Toshiba Corporation, Siemens, TRMI Systems Integration, Thales Group, Kapsch Group, and Magnetic AutoContro are analyzed in detail.

North America Electronic Toll Collection Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The market is moderately consolidated, with key players holding significant market share, though the exact figures are proprietary to the full report.

Innovation drivers include the increasing adoption of advanced technologies like RFID and DSRC, alongside the continuous need for improved efficiency and security in toll collection systems. Regulatory frameworks vary across North American jurisdictions, impacting the market's development. The emergence of alternative payment methods represents a significant product substitute. M&A activities, highlighted by deals such as the USD 400 Million contract awarded in May 2021 to three firms by New York’s MTA, shape the market's structure and competitive dynamics. The total value of M&A deals within the studied period is estimated at xx Million USD.

North America Electronic Toll Collection Market Dynamics & Trends

This section delves into the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The market is experiencing significant growth, driven by increasing traffic volume, government initiatives to improve infrastructure, and the need for efficient and automated toll collection systems. The projected CAGR for the forecast period (2025-2033) is estimated to be xx%. Technological disruptions, such as the integration of AI and IoT, are transforming the industry. Consumer preferences are shifting towards seamless and user-friendly electronic toll payment methods. Market penetration of electronic toll collection systems is expected to reach xx% by 2033. Competitive dynamics are shaped by technological advancements, pricing strategies, and the pursuit of new contracts.

Dominant Regions & Segments in North America Electronic Toll Collection Market

This section identifies the leading regions and segments within the North America Electronic Toll Collection Market. While specific regional dominance data is proprietary, the analysis reveals key factors driving segment growth.

- Leading Region: (Data proprietary to full report) Key drivers include robust infrastructure development and high traffic volume.

- Leading Segment (Type): Transponder systems are expected to maintain a significant market share owing to their established usage. (Data proprietary to full report). Key Drivers: High reliability, ease of use.

- Leading Segment (Technology): RFID technology currently holds dominance due to its wide adoption. (Data proprietary to full report). Key Drivers: Maturity of the technology, cost-effectiveness.

- Leading Segment (Application Type): The Roads segment is likely to dominate due to its extensive network compared to Bridges and Tunnels. (Data proprietary to full report). Key Drivers: High traffic density on road networks, extensive geographic coverage.

Detailed analysis of regional and segment dominance is included in the full report.

North America Electronic Toll Collection Market Product Innovations

Recent product innovations focus on enhancing interoperability between different systems, improving user experience, and integrating advanced technologies such as AI and machine learning for fraud detection and system optimization. This leads to a more efficient and reliable toll collection process. The market is witnessing a shift towards multi-lane free-flow tolling systems that reduce congestion and enhance user convenience.

Report Scope & Segmentation Analysis

This report segments the North America Electronic Toll Collection market by Type (Transponder, Other Types), Technology (RFID, DSRC, Other Technologies), and Application Type (Bridges, Roads, Tunnels). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail within the full report.

- Type: The Transponder segment is expected to grow at a xx% CAGR driven by existing infrastructure and ease of use. The "Other Types" segment includes alternative payment technologies and is projected for xx% CAGR.

- Technology: RFID continues to be dominant, projected to grow at xx% CAGR. DSRC shows potential growth (xx% CAGR) driven by increasing demands for higher speeds and security.

- Application Type: The Roads segment exhibits the largest market share and the highest growth potential due to expansive road networks and higher traffic volume. Bridges and Tunnels segments show steady growth driven by dedicated infrastructure projects.

Key Drivers of North America Electronic Toll Collection Market Growth

Several factors contribute to the market's growth. Increased traffic congestion in major urban areas necessitates efficient toll collection systems. Government initiatives promoting infrastructure development, such as road expansions and upgrades, directly fuel demand. Technological advancements, particularly in RFID and DSRC technologies, improve efficiency and accuracy. The pursuit of reduced operational costs and improved security by toll authorities further drive market growth.

Challenges in the North America Electronic Toll Collection Market Sector

The North American electronic toll collection (ETC) market faces significant hurdles. High initial capital expenditure for system implementation and ongoing maintenance remains a major barrier to entry and expansion for smaller players. Furthermore, ensuring interoperability between diverse ETC systems across state and provincial lines presents a persistent challenge, hindering seamless user experiences and potentially leading to driver frustration and lost revenue. Supply chain vulnerabilities, exacerbated by recent global events, continue to impact project timelines and costs. The critical need for robust cybersecurity measures to protect sensitive user data and system integrity demands substantial investment and ongoing vigilance against evolving threats. Finally, the intensely competitive landscape, populated by both established giants and innovative newcomers, necessitates continuous technological advancement and strategic adaptation to maintain market share and profitability.

Emerging Opportunities in North America Electronic Toll Collection Market

Despite the challenges, the North American ETC market presents compelling opportunities for growth and innovation. The integration of artificial intelligence (AI) and machine learning (ML) offers the potential to significantly enhance system efficiency, accuracy, and security, improving fraud detection and optimizing traffic management. The widespread adoption of multi-lane free-flow (MLFF) tolling systems is streamlining traffic flow, reducing congestion, and improving the overall driver experience. Expansion into underserved geographic areas, particularly in rural regions and developing urban areas, presents a significant untapped market. The increasing preference for contactless payment methods, driven by both convenience and health concerns, provides a powerful impetus for the adoption of advanced ETC technologies. Moreover, the growing emphasis on sustainable transportation solutions aligns perfectly with the potential for ETC systems to integrate with broader initiatives aimed at reducing carbon emissions and promoting environmentally friendly transportation choices.

Leading Players in the North America Electronic Toll Collection Market Market

- TransCore

- Toshiba Corporation

- Siemens

- TRMI Systems Integration

- Thales Group

- Kapsch Group

- Magnetic AutoControl

Key Developments in North America Electronic Toll Collection Market Industry

- December 2021: Quarterhill Inc. subsidiary, ETC, awarded a USD 72.8 Million contract for electronic toll collection integration and maintenance services by CTRMA in Austin, Texas.

- June 2021: Kapsch TrafficCom awarded a contract by Plenary Infrastructure Group to develop a new toll collection system for Louisiana Highway LA-1.

- May 2021: New York's MTA awarded almost USD 400 Million in contracts for toll system operations to Conduent, Faneuil Inc., and Transcore LP.

Future Outlook for North America Electronic Toll Collection Market Market

The North America Electronic Toll Collection Market is poised for substantial growth, driven by ongoing infrastructure development, technological advancements, and the increasing adoption of electronic payment methods. The market’s future potential hinges on the seamless integration of advanced technologies, robust cybersecurity measures, and the creation of user-friendly and efficient toll collection systems that meet the evolving needs of drivers and transportation authorities. Strategic partnerships and investments in research and development will play a crucial role in shaping the market's future trajectory.

North America Electronic Toll Collection Market Segmentation

-

1. Type

- 1.1. Transponder

- 1.2. Other Types

-

2. Technology

- 2.1. Radio-frequency Identification (RFID)

- 2.2. Dedicated Short-range Communication (DSRC)

- 2.3. Other Technologies

-

3. Application Type

- 3.1. Bridges

- 3.2. Roads

- 3.3. Tunnels

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Rest of North America

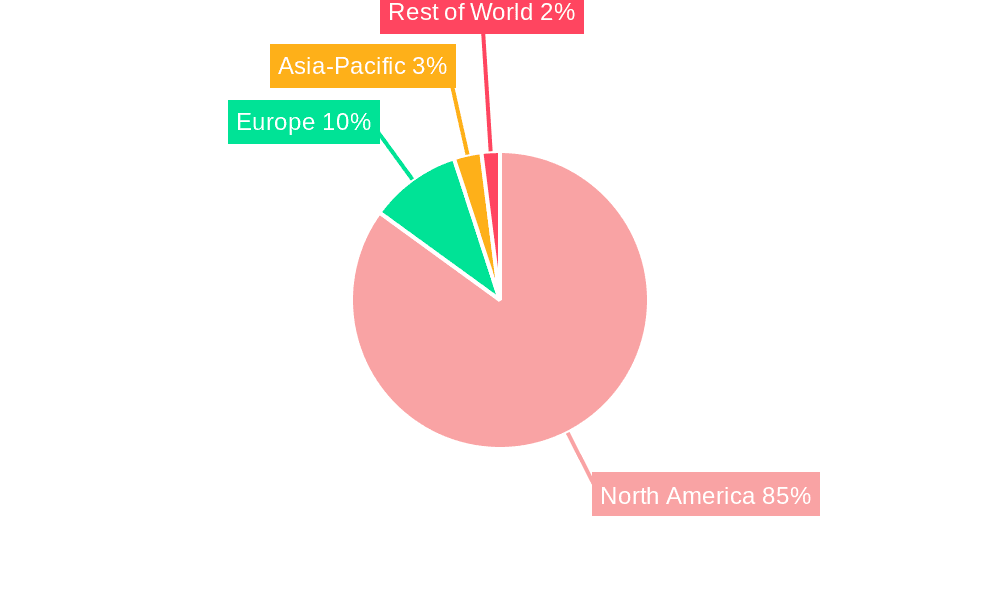

North America Electronic Toll Collection Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Electronic Toll Collection Market Regional Market Share

Geographic Coverage of North America Electronic Toll Collection Market

North America Electronic Toll Collection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Economy And Infrastructural Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Electric Commercial Vehicle May Hamper the Growth

- 3.4. Market Trends

- 3.4.1. Technological Advancement of Electronic Toll Collection Systems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Electronic Toll Collection Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Transponder

- 5.1.2. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Radio-frequency Identification (RFID)

- 5.2.2. Dedicated Short-range Communication (DSRC)

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Bridges

- 5.3.2. Roads

- 5.3.3. Tunnels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Electronic Toll Collection Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Transponder

- 6.1.2. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Radio-frequency Identification (RFID)

- 6.2.2. Dedicated Short-range Communication (DSRC)

- 6.2.3. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by Application Type

- 6.3.1. Bridges

- 6.3.2. Roads

- 6.3.3. Tunnels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Electronic Toll Collection Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Transponder

- 7.1.2. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Radio-frequency Identification (RFID)

- 7.2.2. Dedicated Short-range Communication (DSRC)

- 7.2.3. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by Application Type

- 7.3.1. Bridges

- 7.3.2. Roads

- 7.3.3. Tunnels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America Electronic Toll Collection Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Transponder

- 8.1.2. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Radio-frequency Identification (RFID)

- 8.2.2. Dedicated Short-range Communication (DSRC)

- 8.2.3. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by Application Type

- 8.3.1. Bridges

- 8.3.2. Roads

- 8.3.3. Tunnels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 TransCore

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Toshiba Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Siemens

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 TRMI Systems Integration

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Thales Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Kapsch Group

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Magnetic AutoContro

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 TransCore

List of Figures

- Figure 1: North America Electronic Toll Collection Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Electronic Toll Collection Market Share (%) by Company 2025

List of Tables

- Table 1: North America Electronic Toll Collection Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Electronic Toll Collection Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: North America Electronic Toll Collection Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 4: North America Electronic Toll Collection Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Electronic Toll Collection Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Electronic Toll Collection Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: North America Electronic Toll Collection Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: North America Electronic Toll Collection Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 9: North America Electronic Toll Collection Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Electronic Toll Collection Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America Electronic Toll Collection Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: North America Electronic Toll Collection Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 13: North America Electronic Toll Collection Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 14: North America Electronic Toll Collection Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Electronic Toll Collection Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Electronic Toll Collection Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: North America Electronic Toll Collection Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 18: North America Electronic Toll Collection Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 19: North America Electronic Toll Collection Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Electronic Toll Collection Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Electronic Toll Collection Market?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the North America Electronic Toll Collection Market?

Key companies in the market include TransCore, Toshiba Corporation, Siemens, TRMI Systems Integration, Thales Group, Kapsch Group, Magnetic AutoContro.

3. What are the main segments of the North America Electronic Toll Collection Market?

The market segments include Type, Technology, Application Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.11 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Economy And Infrastructural Growth.

6. What are the notable trends driving market growth?

Technological Advancement of Electronic Toll Collection Systems.

7. Are there any restraints impacting market growth?

High Cost of Electric Commercial Vehicle May Hamper the Growth.

8. Can you provide examples of recent developments in the market?

In December 2021, Quarterhill Inc announced that its wholly-owned subsidiary, Electronic Transaction Consultants, LLC ("ETC"), had received an award notice from the Central Texas Regional Mobility Authority ("CTRMA") in Austin, Texas, to provide electronic toll collection integration and maintenance services. The contract's initial term is six (6) years, with two (2) two-year extension options. The contract's initial six-year term is worth USD 72,791,680, and it's subject to standard terms and conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Electronic Toll Collection Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Electronic Toll Collection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Electronic Toll Collection Market?

To stay informed about further developments, trends, and reports in the North America Electronic Toll Collection Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence