Key Insights

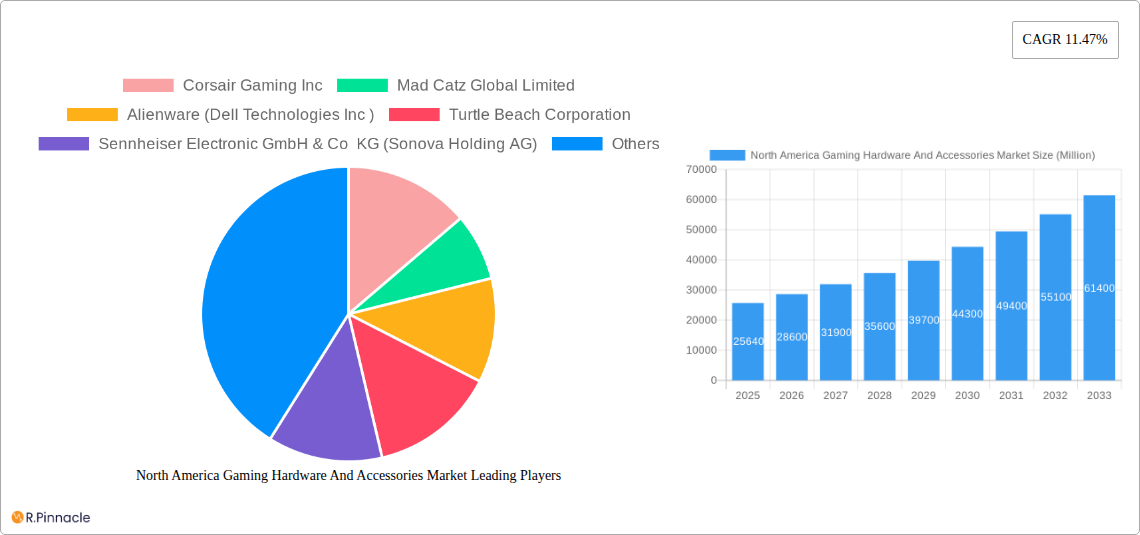

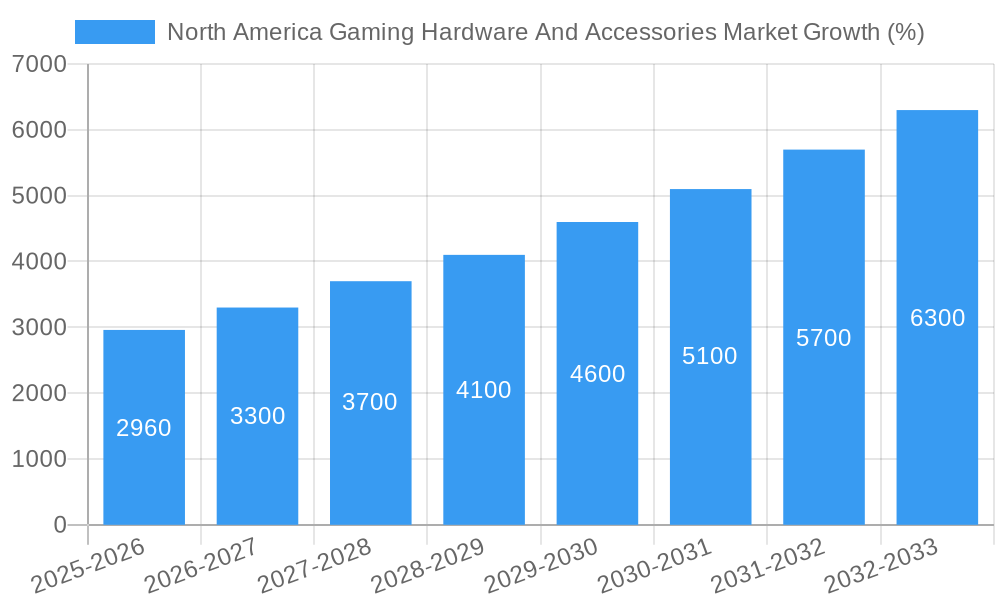

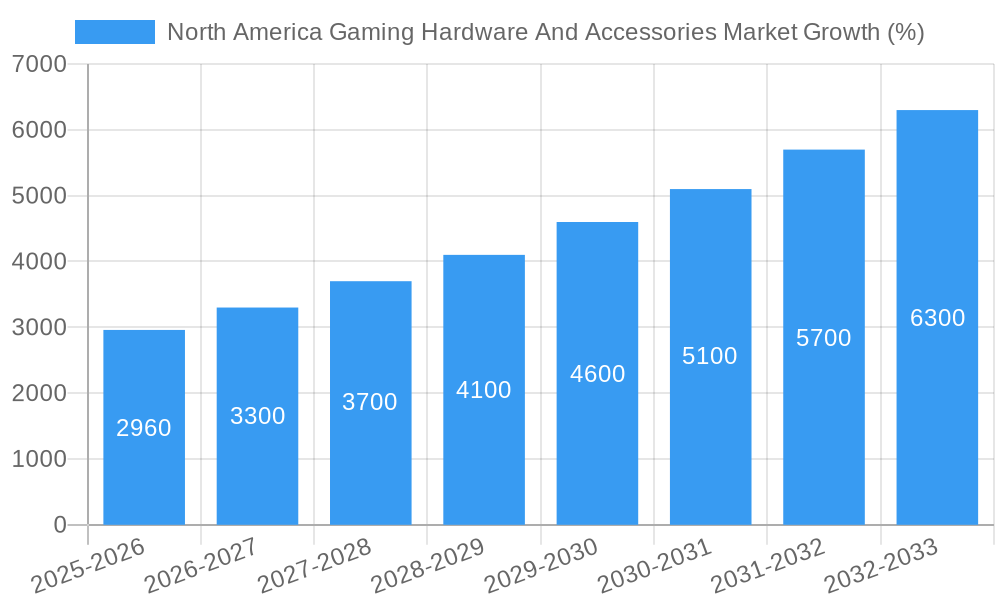

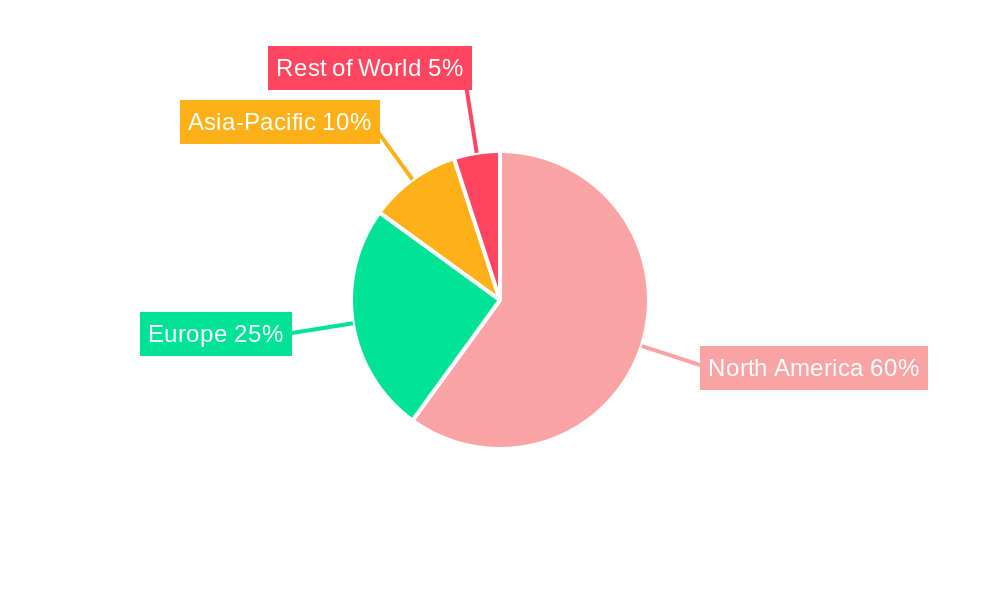

The North American gaming hardware and accessories market is experiencing robust growth, projected to reach \$25.64 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 11.47% from 2025 to 2033. This expansion is fueled by several key drivers. The rising popularity of esports and competitive gaming continues to drive demand for high-performance hardware such as gaming PCs, high-refresh-rate monitors, and advanced peripherals like gaming mice and keyboards. Furthermore, technological advancements in virtual reality (VR) and augmented reality (AR) are creating new avenues for immersive gaming experiences, boosting sales of VR headsets and related accessories. The increasing affordability of gaming hardware and the widespread availability of high-speed internet access are also contributing factors. The market is segmented by product type, including gaming PCs, consoles, headsets, keyboards, mice, controllers, VR devices, and other accessories. Regionally, the United States and Canada represent the largest markets within North America, with the US dominating due to its substantial gaming community and higher disposable income. Major players like Corsair, Razer, Logitech, and Sony are actively competing in this dynamic market, constantly innovating and releasing new products to cater to evolving consumer preferences. The increasing demand for personalized gaming experiences and the integration of advanced technologies like AI and cloud gaming will further propel market expansion throughout the forecast period.

The continued growth of the North American gaming hardware and accessories market will be influenced by several factors. Competition among manufacturers is intense, driving innovation and price reductions, making gaming hardware more accessible to a wider audience. However, potential restraints include economic downturns that might impact consumer spending on discretionary items like gaming equipment and the potential for supply chain disruptions affecting component availability. Despite these potential challenges, the long-term outlook for the North American gaming hardware and accessories market remains positive, driven by ongoing technological advancements, the growing popularity of gaming, and the expanding reach of esports. Specific segments, such as VR and AR gaming, are expected to exhibit particularly rapid growth, driven by innovative product launches and improving affordability. Companies are expected to focus on strategic partnerships, product diversification, and enhanced marketing strategies to capture market share and address changing consumer preferences throughout the forecast period.

This comprehensive report provides an in-depth analysis of the North America gaming hardware and accessories market, offering valuable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report unveils the market's current dynamics, future trends, and key players shaping its trajectory. The market is segmented by product type (Gaming PCs, Gaming Consoles, Gaming Headsets, Gaming Keyboards, Gaming Mice, Gaming Controllers/Joysticks/Gamepads, Virtual Reality Devices, Other Gaming Accessories) and by country (United States, Canada). The total market value is projected to reach xx Million by 2033.

North America Gaming Hardware And Accessories Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors influencing the North American gaming hardware and accessories market. The market exhibits a moderately concentrated structure, with key players like Corsair Gaming Inc, Alienware (Dell Technologies Inc), Turtle Beach Corporation, Sennheiser Electronic GmbH & Co KG (Sonova Holding AG), Steelseries (GN Store Nord A/S), Razer Inc, Cooler Master Co Ltd, Logitech International SA, Nvidia Corporation, HyperX (HP Inc), Nintendo Co Ltd, Anker Innovations Technology Co Ltd, Sony Group Corporation, and Mad Catz Global Limited vying for market share.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Innovation Drivers: Advancements in VR/AR technology, eSports growth, and increasing demand for high-performance peripherals are key drivers.

- Regulatory Frameworks: Regulations concerning data privacy and online safety impact market operations.

- Product Substitutes: The market faces competition from alternative entertainment options.

- End-User Demographics: The core demographic comprises millennials and Gen Z, with significant growth in female and older gamers.

- M&A Activities: The past five years have witnessed xx M&A deals, with an aggregate value of approximately xx Million. These deals have primarily focused on expanding product portfolios and technological capabilities.

North America Gaming Hardware And Accessories Market Market Dynamics & Trends

The North American gaming hardware and accessories market is experiencing robust growth, driven by several factors. The increasing popularity of esports, coupled with the rising adoption of cloud gaming services, has significantly boosted demand for high-performance gaming peripherals. Technological advancements, such as the development of haptic feedback technology and the integration of artificial intelligence in gaming hardware, are further propelling market expansion. The market exhibits a strong preference for immersive gaming experiences, with a steady rise in demand for Virtual Reality (VR) and Augmented Reality (AR) devices. Competitive dynamics are intense, with established players focusing on innovation and strategic partnerships to maintain their market share. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration reaching xx% by 2033.

Dominant Regions & Segments in North America Gaming Hardware And Accessories Market

The United States dominates the North American gaming hardware and accessories market, accounting for approximately xx% of the total market value in 2025. This dominance is attributable to several factors:

- Key Drivers in the United States:

- Strong consumer spending power

- High internet penetration and robust infrastructure

- Thriving esports culture

- Favorable regulatory environment

- Key Drivers in Canada:

- Growing adoption of high-speed internet

- Increasing disposable incomes

- Rising popularity of esports and online gaming

By product type, Gaming PCs and Gaming Consoles hold the largest market share in 2025, followed by Gaming Headsets and Gaming Keyboards. The VR devices segment is projected to witness substantial growth, driven by technological advancements and increasing consumer interest in immersive gaming experiences.

North America Gaming Hardware And Accessories Market Product Innovations

Recent innovations focus on enhancing gaming immersion, performance, and ergonomics. Manufacturers are integrating advanced features like haptic feedback, improved audio quality, customizable RGB lighting, and ergonomic designs. This emphasis on user experience aligns with evolving consumer preferences and competitive pressures. The market is also witnessing the integration of AI and machine learning to personalize gaming experiences and optimize performance.

Report Scope & Segmentation Analysis

This report segments the North American gaming hardware and accessories market based on product type and geography. The product type segmentation includes Gaming PCs, Gaming Consoles, Gaming Headsets, Gaming Keyboards, Gaming Mice, Gaming Controllers/Joysticks/Gamepads, Virtual Reality Devices, and Other Gaming Accessories. The geographic segmentation focuses on the United States and Canada. Each segment is analyzed based on its market size, growth projections, and competitive dynamics, providing granular insights for market understanding. Growth projections vary significantly across segments, with VR devices and other accessories expected to show the highest growth rates during the forecast period.

Key Drivers of North America Gaming Hardware And Accessories Market Growth

Several factors drive the growth of the North American gaming hardware and accessories market. These include: the increasing adoption of high-speed internet and mobile gaming, technological advancements (e.g., enhanced graphics capabilities, haptic feedback), the growth of the esports industry, rising disposable incomes, and supportive government policies promoting digital entertainment.

Challenges in the North America Gaming Hardware And Accessories Market Sector

Challenges include increasing production costs, supply chain disruptions, intense competition from established and emerging players, and potential regulatory changes affecting online gaming and data privacy. These factors can negatively impact market growth and profitability, impacting margins and profitability.

Emerging Opportunities in North America Gaming Hardware And Accessories Market

Emerging opportunities include the increasing popularity of cloud gaming, the growing demand for personalized gaming experiences (AI integration), the expansion of VR/AR applications in gaming, and the growth of mobile gaming. These trends create potential for innovation and new market entries.

Leading Players in the North America Gaming Hardware And Accessories Market Market

- Corsair Gaming Inc

- Mad Catz Global Limited

- Alienware (Dell Technologies Inc)

- Turtle Beach Corporation

- Sennheiser Electronic GmbH & Co KG (Sonova Holding AG)

- Steelseries (GN Store Nord A/S)

- Redragon (Eastern Times Technology Co Ltd)

- Nintendo Co Ltd

- Anker Innovations Technology Co Ltd

- Sony Group Corporation

- Razer Inc

- Cooler Master Co Ltd

- Logitech International SA

- Nvidia Corporation

- HyperX (HP Inc)

Key Developments in North America Gaming Hardware And Accessories Market Industry

- April 2024: Razer launched the Razer Kishi Ultra, a USB-C gaming controller compatible with Android, iPhone 15 series, and iPad Mini.

- April 2024: SteelSeries launched a white version of its Arctis Nova Pro headphones.

Future Outlook for North America Gaming Hardware And Accessories Market Market

The North American gaming hardware and accessories market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and the expanding esports industry. Strategic partnerships, innovative product development, and expansion into new markets will be crucial for success in this dynamic sector. The market is expected to see continued adoption of VR/AR and cloud gaming technologies, further enhancing the gaming experience and driving market expansion.

North America Gaming Hardware And Accessories Market Segmentation

-

1. Product Type

- 1.1. Gaming PCs

- 1.2. Gaming Consoles

- 1.3. Gaming Headsets

- 1.4. Gaming Keyboards

- 1.5. Gaming Mice

- 1.6. Gaming Controllers/Joysticks/Gamepads

- 1.7. Virtual Reality Devices

- 1.8. Other Gaming Accessories

-

2. Region

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. End User

- 3.1. Casual Gamers

- 3.2. Professional Gamers

- 3.3. Esports Athletes

North America Gaming Hardware And Accessories Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Gaming Hardware And Accessories Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment; New Console and Computer GPU Unit Launch to Present an Increase in the Demand for Accessories

- 3.3. Market Restrains

- 3.3.1. Fluctuation in the Production of Silicon Chips is Leading to a Shortage in the Demand for Gaming Accessories

- 3.4. Market Trends

- 3.4.1. Gaming PCs to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Gaming Hardware And Accessories Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Gaming PCs

- 5.1.2. Gaming Consoles

- 5.1.3. Gaming Headsets

- 5.1.4. Gaming Keyboards

- 5.1.5. Gaming Mice

- 5.1.6. Gaming Controllers/Joysticks/Gamepads

- 5.1.7. Virtual Reality Devices

- 5.1.8. Other Gaming Accessories

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Casual Gamers

- 5.3.2. Professional Gamers

- 5.3.3. Esports Athletes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Gaming Hardware And Accessories Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Gaming Hardware And Accessories Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Gaming Hardware And Accessories Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Gaming Hardware And Accessories Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Corsair Gaming Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mad Catz Global Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Alienware (Dell Technologies Inc )

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Turtle Beach Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sennheiser Electronic GmbH & Co KG (Sonova Holding AG)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Steelseries (GN Store Nord A/S)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Redragon (Eastern Times Technology Co Ltd)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nintendo Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Anker Innovations Technology Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sony Group Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Razer Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Cooler Master Co Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Logitech International SA

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Nvidia Corporation7 2 Market Positioning Analysi

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 HyperX (HP Inc )

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Corsair Gaming Inc

List of Figures

- Figure 1: North America Gaming Hardware And Accessories Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Gaming Hardware And Accessories Market Share (%) by Company 2024

List of Tables

- Table 1: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States North America Gaming Hardware And Accessories Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Gaming Hardware And Accessories Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Gaming Hardware And Accessories Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Gaming Hardware And Accessories Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Gaming Hardware And Accessories Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Gaming Hardware And Accessories Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Gaming Hardware And Accessories Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Gaming Hardware And Accessories Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 23: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Region 2019 & 2032

- Table 24: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 25: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by End User 2019 & 2032

- Table 26: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 27: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: United States North America Gaming Hardware And Accessories Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States North America Gaming Hardware And Accessories Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Canada North America Gaming Hardware And Accessories Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada North America Gaming Hardware And Accessories Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Mexico North America Gaming Hardware And Accessories Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico North America Gaming Hardware And Accessories Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gaming Hardware And Accessories Market?

The projected CAGR is approximately 11.47%.

2. Which companies are prominent players in the North America Gaming Hardware And Accessories Market?

Key companies in the market include Corsair Gaming Inc, Mad Catz Global Limited, Alienware (Dell Technologies Inc ), Turtle Beach Corporation, Sennheiser Electronic GmbH & Co KG (Sonova Holding AG), Steelseries (GN Store Nord A/S), Redragon (Eastern Times Technology Co Ltd), Nintendo Co Ltd, Anker Innovations Technology Co Ltd, Sony Group Corporation, Razer Inc, Cooler Master Co Ltd, Logitech International SA, Nvidia Corporation7 2 Market Positioning Analysi, HyperX (HP Inc ).

3. What are the main segments of the North America Gaming Hardware And Accessories Market?

The market segments include Product Type, Region, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment; New Console and Computer GPU Unit Launch to Present an Increase in the Demand for Accessories.

6. What are the notable trends driving market growth?

Gaming PCs to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Fluctuation in the Production of Silicon Chips is Leading to a Shortage in the Demand for Gaming Accessories.

8. Can you provide examples of recent developments in the market?

April 2024 - Razer, a global lifestyle brand for gamers, released the Razer Kishi Ultra, an addition to the mobile gaming world. The Kishi Ultra, a USB C gaming controller compatible with Android, iPhone 15 series, and iPad Mini, marks a paradigm shift in mobile gaming by providing gamers console-grade control with immersive haptics. Built with attention to detail, the Kishi Ultra is a full-size console-class controller featuring high-quality ergonomics, haptics, and Razer Chroma RGB to provide a true console gaming experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gaming Hardware And Accessories Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gaming Hardware And Accessories Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gaming Hardware And Accessories Market?

To stay informed about further developments, trends, and reports in the North America Gaming Hardware And Accessories Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence