Key Insights

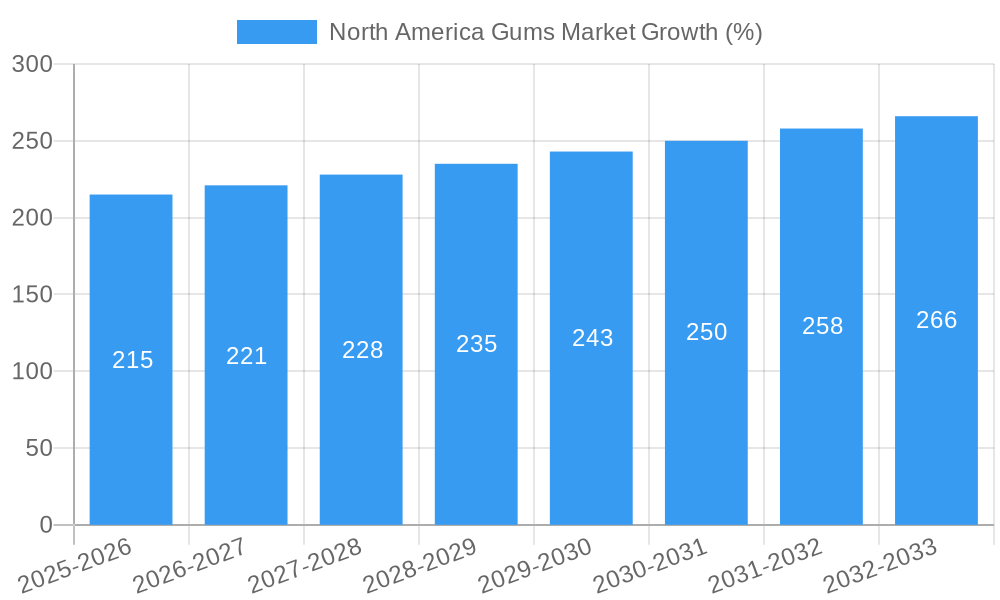

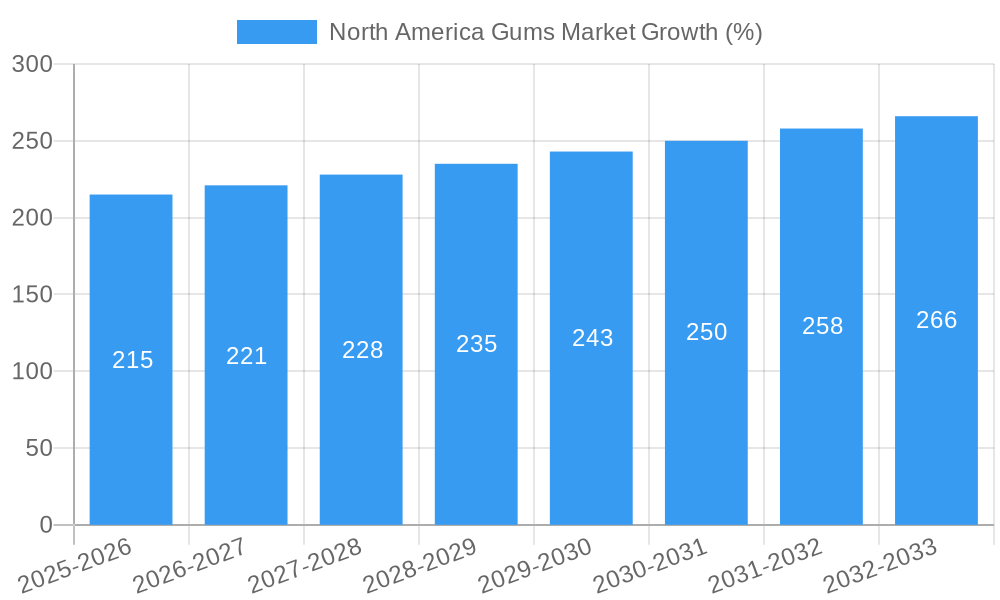

The North American gums market, valued at approximately $X billion in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 4.30% from 2025 to 2033. This growth is driven by several key factors. Firstly, the increasing popularity of sugar-free and functional gums, catering to health-conscious consumers, is a significant driver. Secondly, innovative product launches featuring novel flavors, textures, and functional benefits continue to attract consumers and stimulate market expansion. The convenience store channel dominates distribution, followed by supermarkets and hypermarkets, and the burgeoning online retail segment shows promising growth potential. Furthermore, robust marketing campaigns focusing on the social aspects of gum chewing, such as stress relief and oral hygiene benefits, significantly influence consumer purchasing decisions. Regional variations exist within North America; the United States holds the largest market share, followed by Canada and Mexico, with the Rest of North America segment showing moderate growth. Leading players such as Mondelēz International, Mars Incorporated, and Perfetti Van Melle leverage their established brands and extensive distribution networks to maintain a strong market presence, while smaller, niche players focus on innovation and specific consumer segments.

However, certain market restraints exist. Fluctuations in raw material prices, particularly sugar and other key ingredients, can impact profitability. Additionally, increasing consumer awareness of the potential negative health implications associated with excessive sugar consumption could restrain growth in certain segments. To mitigate these challenges, manufacturers are focusing on diversification through product innovation, expanding into new distribution channels, and employing targeted marketing strategies to maintain market competitiveness. The ongoing competition among established players and the emergence of new entrants with innovative products suggest a dynamic and evolving market landscape in the years to come. The market segmentation by confectionery variant (bubble gum, chewing gum, sugar-free chewing gum) reflects the diverse consumer preferences and the manufacturers' strategies to cater to these preferences.

North America Gums Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America gums market, covering the period 2019-2033. It offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to understand market dynamics, growth opportunities, and competitive landscapes. The report leverages extensive data analysis and expert insights to deliver actionable intelligence. Base year is 2025 and the forecast period is 2025-2033.

North America Gums Market Structure & Innovation Trends

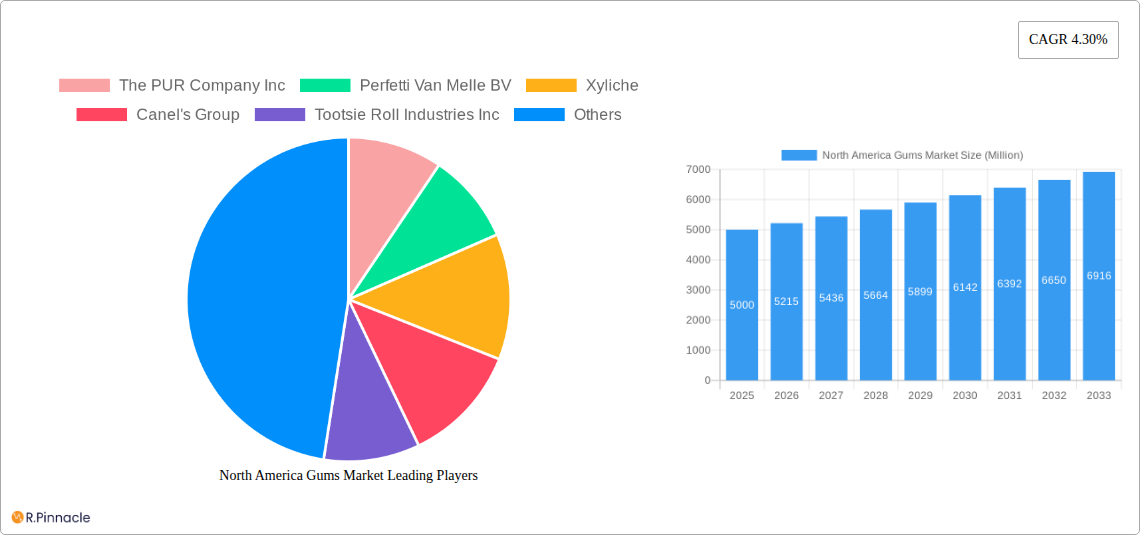

This section analyzes the North America gums market's structure, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The market is moderately consolidated, with key players such as Mondelez International, Mars Incorporated, and Perfetti Van Melle holding significant market share – estimated at xx% combined in 2025. Smaller players like The PUR Company Inc and Simply Gum Inc focus on niche segments, often emphasizing natural or organic ingredients.

- Innovation Drivers: Growing demand for sugar-free and functional gums drives innovation. The introduction of gums with added vitamins or functional benefits is a significant trend.

- Regulatory Framework: Regulations concerning sugar content and labeling impact product formulations and marketing strategies.

- Product Substitutes: Other confectionery items and mints compete with gums.

- End-User Demographics: The core consumer base includes young adults and adults.

- M&A Activities: The market has seen moderate M&A activity in the historical period (2019-2024), with deal values totaling approximately xx Million. Further consolidation is anticipated during the forecast period.

North America Gums Market Market Dynamics & Trends

This section explores market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The North American gums market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by increasing consumer preference for convenient and on-the-go snack options.

The market penetration of sugar-free gums is also expected to rise significantly. Technological disruptions, such as innovative packaging and flavor development, contribute to market expansion. Competitive dynamics are shaped by product differentiation, branding strategies, and distribution networks. Major players are investing heavily in marketing and advertising to maintain their market share and expand into new segments. The influence of health and wellness trends is also a key factor, creating demand for functional gums.

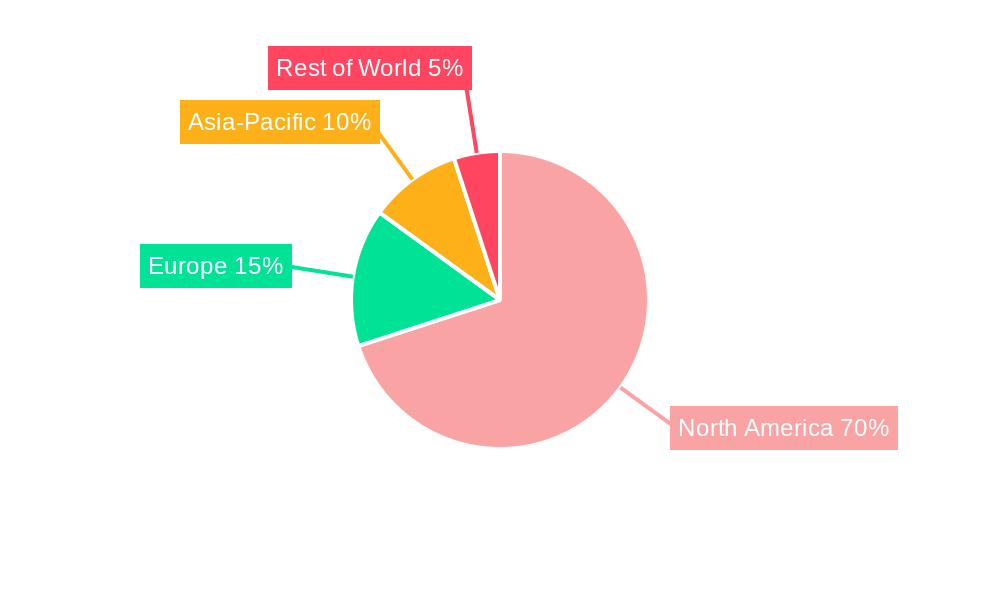

Dominant Regions & Segments in North America Gums Market

The United States constitutes the largest market share within North America, followed by Canada and Mexico. The Rest of North America segment contributes a smaller portion to the overall market value. Within distribution channels, supermarkets/hypermarkets hold the dominant position, driven by their extensive reach and consumer accessibility.

- Key Drivers of US Dominance: Large consumer base, robust retail infrastructure, and established distribution networks contribute to its leading position.

- Canada's Market Dynamics: Higher per capita consumption and favorable economic conditions support its market growth.

- Mexico's Market Potential: Growing disposable incomes and changing consumer preferences represent promising growth opportunities.

- Segment-Specific Drivers:

- Supermarkets/Hypermarkets: High volume sales, established distribution networks, and consumer loyalty.

- Convenience Stores: Impulsive buying and high foot traffic.

- Online Retail: Growing e-commerce penetration boosts online sales, especially for niche brands and specialty gums.

- Chewing Gum: Remains the largest confectionery variant segment.

- Sugar-free Chewing Gum: Increasing health consciousness fuels its rapid growth.

North America Gums Market Product Innovations

Recent product developments highlight the focus on functional benefits, improved flavor profiles, and novel packaging solutions. The addition of vitamins and other health-promoting ingredients is a key trend, along with the introduction of innovative flavors and textures. Sugar-free options continue to gain popularity, driven by consumer health awareness. Competition is intense, with companies seeking to differentiate their products through unique product attributes and effective marketing campaigns. Technological advancements in flavor creation and packaging design create competitive advantages.

Report Scope & Segmentation Analysis

This report segments the North America gums market by distribution channel (Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others), country (Canada, Mexico, United States, Rest of North America), and confectionery variant (Bubble Gum, Chewing Gum, Sugar-free Chewing Gum). Each segment includes detailed growth projections, market size estimations for 2025 and beyond, and analysis of competitive dynamics. Growth is projected to be highest in the sugar-free chewing gum segment and within online retail channels.

Key Drivers of North America Gums Market Growth

Growth in the North America gums market is driven by several factors: rising disposable incomes, increasing consumer preference for convenient snack options, the growing popularity of sugar-free and functional gums, and successful marketing campaigns by key players. Innovation in flavor and formulation also plays a significant role.

Challenges in the North America Gums Market Sector

Challenges include intense competition, changing consumer preferences (e.g., towards healthier options), fluctuating raw material prices, and evolving regulatory requirements. These factors can impact profitability and market share for individual players. The increase in health consciousness may also lead to a decrease in sales of traditional, high-sugar gums.

Emerging Opportunities in North America Gums Market

Emerging opportunities lie in the growing demand for functional gums (with added vitamins or health benefits), the expansion of e-commerce channels, and the development of novel flavors and textures. Focus on sustainable and ethically sourced ingredients can also create new opportunities in the market. Also, targeting niche consumer groups can lead to revenue generation.

Leading Players in the North America Gums Market Market

- The PUR Company Inc

- Perfetti Van Melle BV

- Xyliche

- Canel's Group

- Tootsie Roll Industries Inc

- Ferrero International SA

- The Bazooka Companies Inc

- GumRunners LLC

- Simply Gum Inc

- Mars Incorporated

- Ford Gum & Machine Company Inc

- Mondelēz International Inc

- The Hershey Company

- Mazee LLC

Key Developments in North America Gums Market Industry

- September 2022: Mondelez International's Trident launched Trident Sour Patch Kids Gum, a sugar-free option, collaborating with Chloe Bailey for promotion.

- December 2022: Perfetti Van Melle introduced vitamin-enhanced Mentos and Smint gum editions.

- May 2023: Jolly Rancher Gummies updated packaging with street art-inspired designs.

Future Outlook for North America Gums Market Market

The North America gums market is poised for continued growth, driven by innovation in product offerings, expanding distribution channels, and evolving consumer preferences. Companies focusing on health-conscious, functional products and leveraging effective marketing strategies are expected to gain a competitive advantage. Opportunities exist in both traditional and online retail channels, with growth potential across various segments.

North America Gums Market Segmentation

-

1. Confectionery Variant

- 1.1. Bubble Gum

-

1.2. Chewing Gum

-

1.2.1. By Sugar Content

- 1.2.1.1. Sugar Chewing Gum

- 1.2.1.2. Sugar-free Chewing Gum

-

1.2.1. By Sugar Content

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

North America Gums Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Gums Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Cocoa Butter Equivalents Among Food Manufacturers; Rising Application in Food Industry

- 3.3. Market Restrains

- 3.3.1. Health Concerns Pertaining to the Excessive Consumption of Fats and Oils

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Gums Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Bubble Gum

- 5.1.2. Chewing Gum

- 5.1.2.1. By Sugar Content

- 5.1.2.1.1. Sugar Chewing Gum

- 5.1.2.1.2. Sugar-free Chewing Gum

- 5.1.2.1. By Sugar Content

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. United States North America Gums Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Gums Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Gums Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Gums Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 The PUR Company Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Perfetti Van Melle BV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Xyliche

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Canel's Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tootsie Roll Industries Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ferrero International SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The Bazooka Companies Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 GumRunners LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Simply Gum Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mars Incorporated

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Ford Gum & Machine Company Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Mondelēz International Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 The Hershey Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Mazee LLC

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 The PUR Company Inc

List of Figures

- Figure 1: North America Gums Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Gums Market Share (%) by Company 2024

List of Tables

- Table 1: North America Gums Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Gums Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 3: North America Gums Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: North America Gums Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Gums Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Gums Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Gums Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Gums Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Gums Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Gums Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 11: North America Gums Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: North America Gums Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Gums Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Gums Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Gums Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gums Market?

The projected CAGR is approximately 4.30%.

2. Which companies are prominent players in the North America Gums Market?

Key companies in the market include The PUR Company Inc, Perfetti Van Melle BV, Xyliche, Canel's Group, Tootsie Roll Industries Inc, Ferrero International SA, The Bazooka Companies Inc, GumRunners LLC, Simply Gum Inc, Mars Incorporated, Ford Gum & Machine Company Inc, Mondelēz International Inc, The Hershey Company, Mazee LLC.

3. What are the main segments of the North America Gums Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Cocoa Butter Equivalents Among Food Manufacturers; Rising Application in Food Industry.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Health Concerns Pertaining to the Excessive Consumption of Fats and Oils.

8. Can you provide examples of recent developments in the market?

May 2023: Jolly Rancher Gummies innovated its packaging, which was developed by local artists for bold new street art-inspired packaging.December 2022: Perfetti Van Melle launched its new Mentos and Smint gum editions with vitamins and health benefits to help boost the appeal of both brands in a new market. The new Mentos range contains vitamins such as B6, C, and B12 and features a liquid center that provides “long-lasting freshness.” It is available in a variety of citrus flavors.September 2022: Trident, a chewing gum brand offered by Mondelez International, collaborated with Chloe Bailey, a rhythm and blues singer, to release a song promoting its launch of Trident Sour Patch Kids Gum, which is sugar-free chewing gum for kids.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gums Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gums Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gums Market?

To stay informed about further developments, trends, and reports in the North America Gums Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence