Key Insights

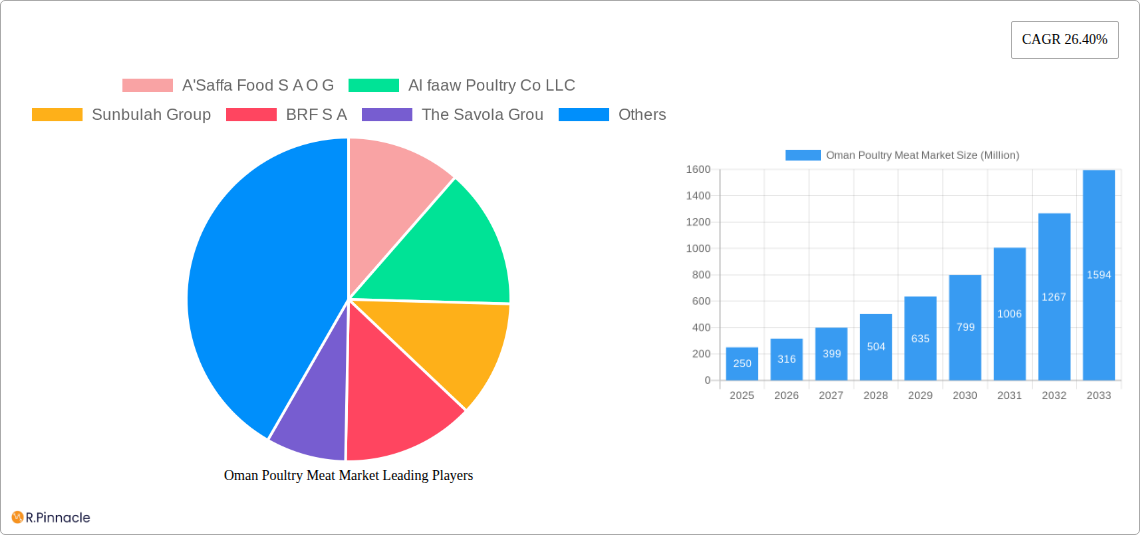

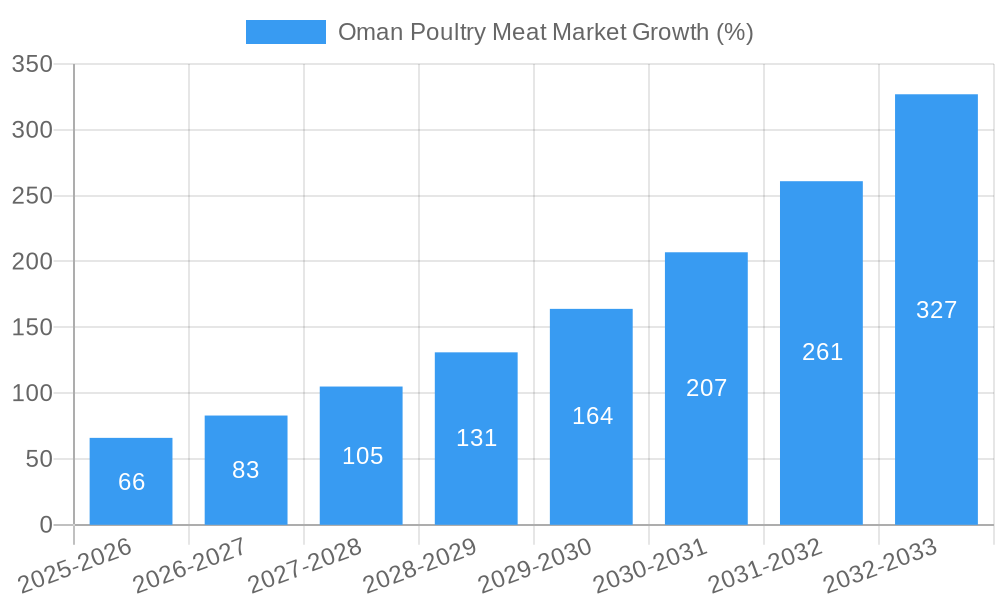

The Oman poultry meat market exhibits robust growth potential, fueled by a rising population, increasing disposable incomes, and a growing preference for protein-rich diets. The market's Compound Annual Growth Rate (CAGR) of 26.40% from 2019 to 2024 indicates significant expansion. This growth is driven by factors such as the increasing urbanization leading to higher demand for convenient and affordable protein sources, the rising popularity of fast food and processed food containing poultry, and government initiatives promoting domestic poultry production. The market is segmented by distribution channels (off-trade and on-trade), form (canned, fresh/chilled, frozen, processed), and key players such as A'Saffa Food S A O G, Al faaw Poultry Co LLC, and Sunbulah Group, all contributing to the market's dynamism. The preference for fresh and chilled poultry over canned or frozen options is a notable trend, shaping product development and distribution strategies. Challenges include fluctuations in feed prices, potential disease outbreaks, and competition from imported poultry products. However, these challenges are likely to be mitigated by investments in advanced farming techniques and stringent quality control measures.

Looking ahead to 2033, the Oman poultry meat market is projected to maintain its upward trajectory. The continued expansion of the food service industry, coupled with rising consumer awareness of the health benefits of poultry, will further stimulate demand. Strategic partnerships between local producers and international players are likely to increase the market's efficiency and competitiveness. Furthermore, innovations in poultry processing and packaging, such as extended shelf-life technologies, will support greater market penetration. The market segmentation will likely evolve, with increasing demand for value-added products and specialized poultry cuts. Overall, despite potential economic fluctuations, the strong fundamentals of the Oman poultry meat market support a positive outlook for continued growth in the forecast period.

This comprehensive report provides an in-depth analysis of the Oman poultry meat market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a robust understanding of market trends, dynamics, and future projections. The report meticulously analyzes market size, segmentation, competitive landscape, and growth drivers, incorporating data from the historical period (2019-2024) and leveraging projected figures where necessary.

Oman Poultry Meat Market Market Structure & Innovation Trends

This section examines the structure of the Oman poultry meat market, analyzing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and merger & acquisition (M&A) activities. The market is characterized by a moderate level of concentration, with key players such as A'Saffa Food S A O G, Al faaw Poultry Co LLC, and Sunbulah Group holding significant market share. Estimates suggest A'Saffa Food S A O G holds approximately xx% market share, while Al faaw Poultry Co LLC and Sunbulah Group hold xx% and xx% respectively. The remaining market share is distributed amongst smaller players and regional producers.

Innovation is driven primarily by consumer demand for healthier and more convenient poultry products, leading to increased investment in processing techniques and product diversification. Regulatory frameworks, while generally supportive of market growth, are subject to periodic revisions. Product substitutes, such as red meat and plant-based alternatives, represent a moderate competitive threat, yet consumer preference for poultry remains high. The end-user demographic is diverse, encompassing households, food service establishments, and industrial users. Recent M&A activity has been relatively limited, with deal values totaling an estimated xx Million in the past five years. Further analysis shows a significant focus on vertical integration within the industry.

Oman Poultry Meat Market Market Dynamics & Trends

The Oman poultry meat market exhibits a robust growth trajectory, driven by several key factors. Rising disposable incomes, population growth, and urbanization are fueling increased demand for protein-rich foods. Furthermore, changing consumer preferences towards convenient and ready-to-eat meals are positively impacting market growth. Technological advancements in poultry farming and processing are enhancing efficiency and product quality, while also influencing cost reduction. The market is witnessing a shift towards healthier and value-added poultry products, impacting consumer purchasing choices significantly. Competitive dynamics remain intense, with companies competing on price, quality, and branding. Market penetration of processed poultry products shows promising growth, with a CAGR of xx% predicted during the forecast period. The overall market CAGR is projected at xx% during 2025–2033.

Dominant Regions & Segments in Oman Poultry Meat Market

The Oman poultry meat market demonstrates varied growth across regions and segments. The key findings show a dominance of the Off-Trade distribution channel, accounting for approximately xx% of market share compared to the On-Trade sector with xx%. This is primarily driven by the prevalence of supermarkets and hypermarkets, coupled with rising e-commerce adoption. The Fresh/Chilled segment leads in market share among different forms of poultry, with xx%, followed by Frozen at xx%, Processed at xx% and Canned at xx%.

Key Drivers for Off-Trade Dominance:

- Extensive retail infrastructure.

- Growing consumer preference for convenient shopping.

- Increasing e-commerce penetration.

Key Drivers for Fresh/Chilled Segment Dominance:

- Consumer preference for freshness and quality.

- Shorter shelf-life, driving frequent purchases.

- Wider availability in retail outlets.

Oman Poultry Meat Market Product Innovations

Recent years have witnessed significant innovations in the Oman poultry meat market. Companies are focusing on value-added products like marinated and ready-to-cook poultry, catering to the increasing demand for convenience. The use of advanced processing technologies has resulted in improved product quality, extended shelf life, and reduced waste. This focus on innovation aims at enhancing product differentiation and satisfying evolving consumer preferences for healthier and more convenient options.

Report Scope & Segmentation Analysis

This report comprehensively segments the Oman poultry meat market by distribution channel (Off-Trade and On-Trade) and product form (Canned, Fresh/Chilled, Frozen, and Processed). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. The Off-Trade segment is projected to witness significant growth, driven by expansion of retail channels and evolving shopping habits. The Fresh/Chilled segment holds the largest market share, while the Frozen segment is poised for significant growth due to improved storage and distribution capabilities. The processed segment exhibits healthy growth projections due to consumer interest in convenient and ready-to-eat options. The canned segment also shows steady growth with the increasing demand for shelf-stable products.

Key Drivers of Oman Poultry Meat Market Growth

Several factors are propelling the growth of the Oman poultry meat market. These include a rising population, increasing disposable incomes leading to higher protein consumption, government initiatives supporting the poultry industry, and technological advancements in poultry farming and processing. The growth of the food service sector and the increasing adoption of convenient, ready-to-eat meals also contributes to the market's expansion.

Challenges in the Oman Poultry Meat Market Sector

The Oman poultry meat market faces challenges such as fluctuations in feed prices, potential outbreaks of avian influenza impacting production, and increased competition from imported poultry products. Furthermore, maintaining consistent product quality and adhering to stringent food safety regulations presents ongoing operational challenges. These factors impact profitability and sustainable growth within the sector.

Emerging Opportunities in Oman Poultry Meat Market

The Oman poultry meat market presents opportunities for growth in value-added products, organic poultry, and halal-certified poultry. Expanding into new export markets and investing in sustainable farming practices will unlock further growth potentials. Technological advancements such as automation and precision farming techniques offer scope for enhancing production efficiency and product quality.

Leading Players in the Oman Poultry Meat Market Market

- A'Saffa Food S A O G

- Al faaw Poultry Co LLC

- Sunbulah Group

- BRF S A

- The Savola Group

- IFFCO Group

- JBS SA

- Al Zain Farms LLC

Key Developments in Oman Poultry Meat Market Industry

- January 2021: IFFCO Group announced plans to establish 3 Fuji Foods (its recently acquired Indian company) as a major manufacturing base. This aims to serve diverse markets and consolidate its portfolio through new opportunities.

- January 2021: Sunbulah Group launched a range of organic and gluten-free products, catering to increasing consumer demand for healthier options.

Future Outlook for Oman Poultry Meat Market Market

The Oman poultry meat market is projected to witness sustained growth over the forecast period. Increased investments in technology, government support for the industry, and evolving consumer preferences are key factors that will drive market expansion. The focus on value-added products and sustainable practices will shape future market dynamics. Strategic partnerships and acquisitions will continue to play a significant role in shaping the competitive landscape.

Oman Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Oman Poultry Meat Market Segmentation By Geography

- 1. Oman

Oman Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Advancements in payment and delivery technologies propelling retail stores' sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Form

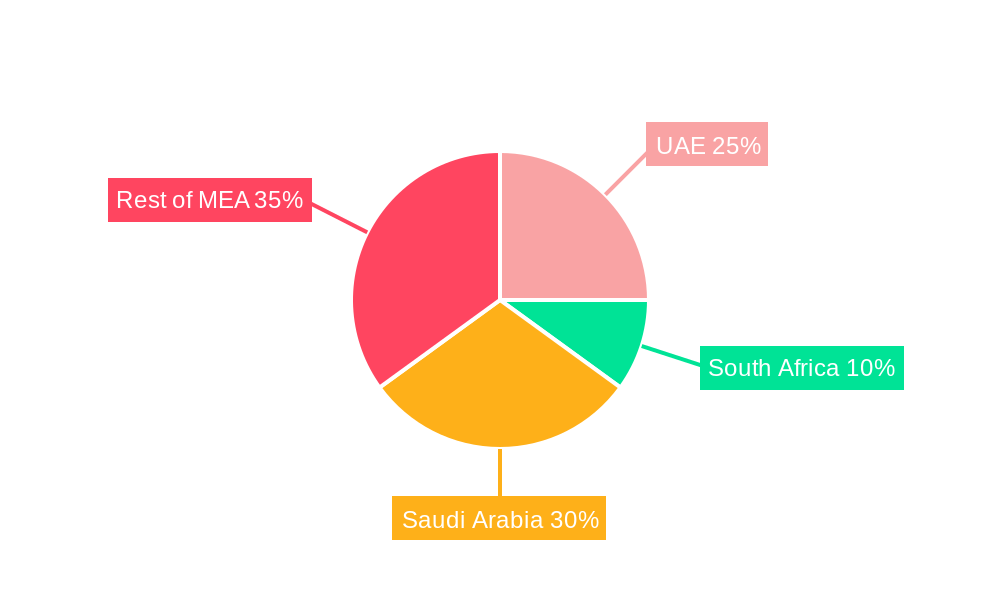

- 6. UAE Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 A'Saffa Food S A O G

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Al faaw Poultry Co LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sunbulah Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BRF S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Savola Grou

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IFFCO Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JBS SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Al Zain Farms LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 A'Saffa Food S A O G

List of Figures

- Figure 1: Oman Poultry Meat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Poultry Meat Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Oman Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Oman Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Oman Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE Oman Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa Oman Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Oman Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA Oman Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Oman Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 11: Oman Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Oman Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Poultry Meat Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Oman Poultry Meat Market?

Key companies in the market include A'Saffa Food S A O G, Al faaw Poultry Co LLC, Sunbulah Group, BRF S A, The Savola Grou, IFFCO Group, JBS SA, Al Zain Farms LLC.

3. What are the main segments of the Oman Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Advancements in payment and delivery technologies propelling retail stores' sales.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

January 2021: IFFCO Group has planned to turn 3 Fuji Foods, its recently acquired company in India, into a major manufacturing base to serve customers across various markets and to consolidate its portfolio by exploring new opportunities.January 2021: Sunbulah Group announced the launch of a range of organic and gluten-free products and SKUs to meet the increasing demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Poultry Meat Market?

To stay informed about further developments, trends, and reports in the Oman Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence