Key Insights

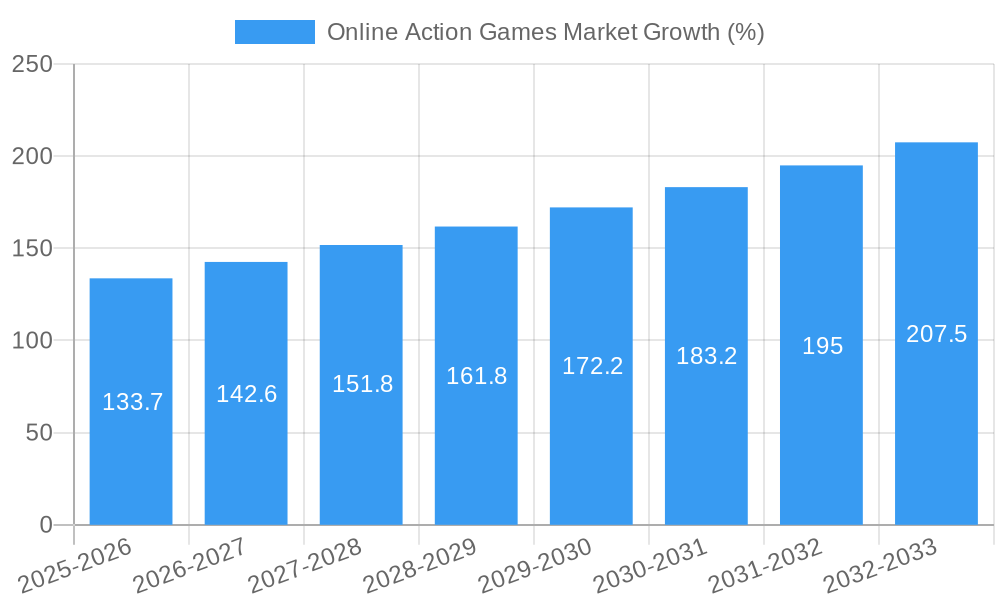

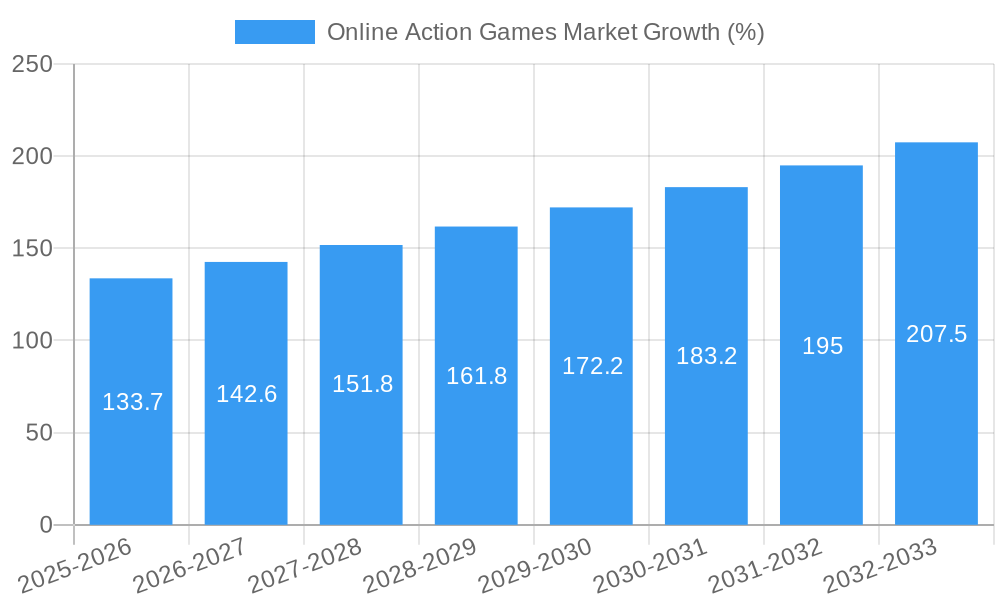

The online action game market is experiencing robust growth, fueled by several key factors. The market's substantial size, estimated at [Insert a reasonable market size in millions based on the provided CAGR of 8.94% and a 2025 value – e.g., $1500 million] in 2025, reflects the enduring popularity of this genre across diverse platforms. The increasing penetration of high-speed internet and affordable smartphones globally significantly contributes to market expansion, particularly within the mobile gaming segment. Moreover, the continuous evolution of game mechanics, graphics, and online multiplayer features enhances player engagement and retention, thereby driving market expansion. The prevalence of free-to-play models, while often monetized through in-app purchases, broadens the player base, contributing significantly to the overall revenue. However, market saturation in some regions and increasing competition among developers necessitate innovative gameplay and monetization strategies to sustain growth.

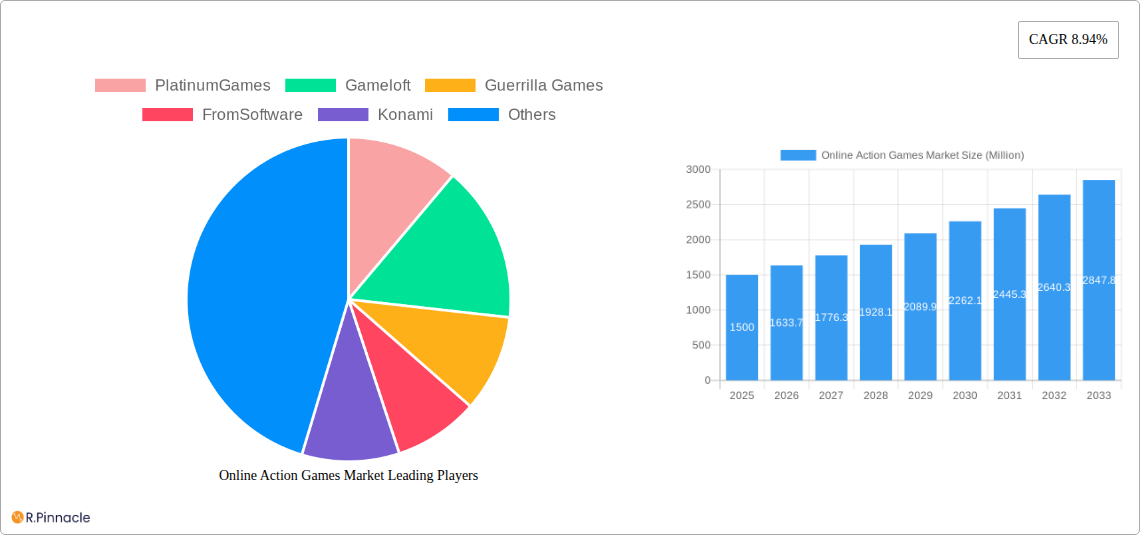

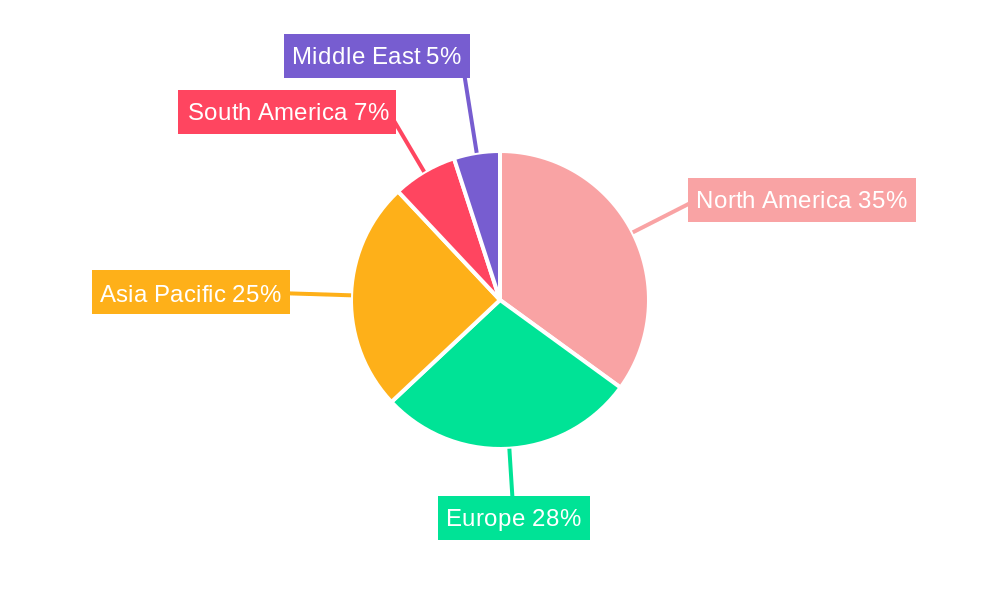

Growth is projected to continue throughout the forecast period (2025-2033), with the CAGR of 8.94% suggesting a significant increase in market value by 2033. The diverse range of platforms (PCs, consoles, mobile) and operating systems (iOS, Android, Windows) ensures broad accessibility for players. Key players like Tencent, Sony Interactive Entertainment, and EA DICE, known for their high-quality action titles, are driving innovation and competition. Regional differences exist, with North America and Asia Pacific expected to remain dominant markets due to high internet penetration and established gaming cultures. However, emerging markets in South America and the Middle East offer considerable untapped potential for future growth, given increasing smartphone adoption and internet connectivity. The continued popularity of esports further contributes to market expansion by creating new revenue streams through tournaments and viewership.

Online Action Games Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Online Action Games market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the estimated year 2025. The report leverages extensive data analysis to forecast market trends and growth opportunities, ultimately helping you navigate the dynamic landscape of the online action gaming sector. The market is valued at $xx Million in 2025 and is projected to reach $xx Million by 2033.

Online Action Games Market Structure & Innovation Trends

This section analyzes the competitive landscape, highlighting market concentration, innovation drivers, and regulatory influences shaping the online action games market. We examine the impact of mergers and acquisitions (M&A) activities, detailing deal values and their consequences on market share. The analysis encompasses end-user demographics and the role of product substitutes.

- Market Concentration: The market is characterized by a mix of large established players and emerging independent developers. Top players hold a significant market share, estimated at xx% in 2025.

- Innovation Drivers: Technological advancements in graphics, AI, and game design are key drivers, pushing the boundaries of gameplay and immersion.

- Regulatory Frameworks: Age ratings, data privacy regulations, and content restrictions significantly influence market dynamics.

- Product Substitutes: Other forms of entertainment, such as eSports and other online games, represent key competitive alternatives.

- End-User Demographics: The primary demographic includes young adults and millennials, with growing participation from older age groups.

- M&A Activities: Significant M&A activity has been observed in recent years, with deal values exceeding $xx Million in the past five years. These acquisitions have shaped the market landscape by consolidating resources and expanding market reach. For example, the acquisition of [Company X] by [Company Y] in [Year] resulted in a [quantifiable impact, e.g., 10% increase in market share for Company Y].

Online Action Games Market Dynamics & Trends

This section delves into the key factors driving market growth, including technological advancements, evolving consumer preferences, and competitive dynamics. We analyze the Compound Annual Growth Rate (CAGR) and market penetration to offer a complete understanding of the market trajectory.

The market is experiencing robust growth driven by the increasing accessibility of high-speed internet, the proliferation of mobile gaming, and advancements in game engine technology. The rising popularity of esports and live streaming further fuels this growth. Consumer preferences are shifting towards more immersive and social gaming experiences, pushing developers to create games with robust multiplayer functionalities and cross-platform compatibility. The market penetration of online action games is estimated to be xx% in 2025, projected to increase to xx% by 2033. The CAGR during this period is projected to be xx%. Competitive dynamics are intense, with established players investing heavily in R&D and new game releases while smaller studios focus on niche markets and innovative game mechanics.

Dominant Regions & Segments in Online Action Games Market

This section identifies leading regions, countries, and market segments based on revenue model (Free Gaming Services, Paid Gaming Services), platform (PCs, Consoles, Mobile Phones), and operating system (iOS, Android, Windows, Other).

By Revenue Model:

- Free Gaming Services: This segment dominates the market due to its accessibility and wider reach, particularly on mobile platforms. Key drivers include free-to-play models, in-app purchases, and advertising revenue.

- Paid Gaming Services: This segment comprises premium games with one-time purchase models or subscription-based services. High-quality graphics and gameplay contribute to higher average revenue per user.

By Platform:

- Mobile Phones: This segment shows the strongest growth, driven by increasing smartphone penetration and the convenience of mobile gaming.

- PCs: This segment maintains a significant market share due to high-quality graphics and gameplay potential.

- Consoles: This segment benefits from dedicated gaming hardware and loyal player bases.

By Operating System:

- iOS and Android: These operating systems dominate due to their widespread adoption and access to large app stores.

- Windows: Remains important for PC gaming.

- Other Operating Systems: This segment is relatively smaller.

Dominance Analysis: North America and Asia are leading regions, driven by high internet penetration, strong gaming cultures, and substantial consumer spending. Key drivers in these regions include robust infrastructure, favorable economic policies, and a large pool of skilled game developers.

Online Action Games Market Product Innovations

Recent product innovations focus on enhanced graphics, improved artificial intelligence (AI) for more realistic opponents, and the integration of virtual reality (VR) and augmented reality (AR) technologies for more immersive gameplay experiences. These innovations cater to the evolving demands of gamers who seek increasingly realistic and interactive gaming experiences. The success of these innovations hinges on their seamless integration into existing gameplay mechanics and their accessibility across different platforms.

Report Scope & Segmentation Analysis

This report segments the Online Action Games Market by Revenue Model (Free Gaming Services and Paid Gaming Services), Platform (PCs, Consoles, and Mobile Phones), and Operating System (iOS, Android, Windows, and Other Operating Systems). Each segment's growth projection, market size, and competitive dynamics are analyzed in detail.

- By Revenue Model: The Free Gaming Services segment is projected to have a higher CAGR due to its accessibility and wider reach, while the Paid Gaming Services segment maintains higher average revenue per user.

- By Platform: Mobile Phones are expected to witness the fastest growth, driven by increasing smartphone penetration and convenience. PCs and Consoles will continue to hold significant market share.

- By Operating System: iOS and Android will remain the dominant operating systems due to their vast user base, while Windows retains relevance for PC gaming.

Key Drivers of Online Action Games Market Growth

The Online Action Games market is driven by several key factors. Technological advancements, including improved graphics rendering, AI, and VR/AR integration, enhance gaming experiences, attracting a wider audience. The rising popularity of esports and live streaming adds another layer of engagement and viewership. Further economic factors such as increased disposable income and the growing adoption of high-speed internet contribute to market expansion.

Challenges in the Online Action Games Market Sector

The Online Action Games market faces challenges including intense competition, increasing development costs, and the potential for regulatory changes impacting monetization strategies and content. Supply chain disruptions can affect game development and distribution. Furthermore, maintaining a balance between innovation and monetization is crucial for long-term success.

Emerging Opportunities in Online Action Games Market

Emerging opportunities lie in the expansion of cloud gaming services, the growing adoption of cross-platform play, and the integration of blockchain technology for enhanced user experience and security. Furthermore, the exploration of new game genres and the development of games specifically tailored for emerging markets hold significant potential.

Leading Players in the Online Action Games Market Market

- PlatinumGames

- Gameloft

- Guerrilla Games

- FromSoftware

- Konami

- SIE Santa Monica Studio

- Nintendo EPD

- Rocksteady Studios

- Tencent

- Rockstar North

- Sony Interactive Entertainment

- EA DICE

- Bethesda Game Studios

- Capcom

- Ubisoft

- id Software

Key Developments in Online Action Games Market Industry

- July 2022: Ubisoft unveils Tom Clancy's The Division® Resurgence, a free-to-play mobile game for iOS and Android, expanding the franchise's reach and potentially attracting new players to the action RPG genre. This launch signifies the continued importance of the mobile gaming market and the adaptation of successful franchises for diverse platforms.

Future Outlook for Online Action Games Market Market

The future of the Online Action Games market is bright, fueled by continuous technological advancements, the expansion of esports, and the growing popularity of cloud gaming. Strategic partnerships and acquisitions will further shape the industry landscape. The market is poised for sustained growth, driven by innovations in gameplay mechanics, graphics, and accessibility across various platforms.

Online Action Games Market Segmentation

-

1. Revenue Model

- 1.1. Free Gaming Services

- 1.2. Paid Gaming Services

-

2. Platform

- 2.1. PCs

- 2.2. Consoles

- 2.3. Mobile Phones

-

3. Operating System

- 3.1. iOS

- 3.2. Android

- 3.3. Windows

- 3.4. Other Operating Systems

Online Action Games Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

-

5. Middle East

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of the Middle East

Online Action Games Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Adoption of Smartphones; Increased Utilization of Gaming Simulation for Training and Analysis Across a Variety of Fields; Growing Demand for VR Headsets

- 3.3. Market Restrains

- 3.3.1. Need for Expensive Graphic Cards

- 3.4. Market Trends

- 3.4.1. Surge in the usage of MMORPG Games

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Action Games Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Revenue Model

- 5.1.1. Free Gaming Services

- 5.1.2. Paid Gaming Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. PCs

- 5.2.2. Consoles

- 5.2.3. Mobile Phones

- 5.3. Market Analysis, Insights and Forecast - by Operating System

- 5.3.1. iOS

- 5.3.2. Android

- 5.3.3. Windows

- 5.3.4. Other Operating Systems

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Revenue Model

- 6. North America Online Action Games Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Revenue Model

- 6.1.1. Free Gaming Services

- 6.1.2. Paid Gaming Services

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. PCs

- 6.2.2. Consoles

- 6.2.3. Mobile Phones

- 6.3. Market Analysis, Insights and Forecast - by Operating System

- 6.3.1. iOS

- 6.3.2. Android

- 6.3.3. Windows

- 6.3.4. Other Operating Systems

- 6.1. Market Analysis, Insights and Forecast - by Revenue Model

- 7. Europe Online Action Games Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Revenue Model

- 7.1.1. Free Gaming Services

- 7.1.2. Paid Gaming Services

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. PCs

- 7.2.2. Consoles

- 7.2.3. Mobile Phones

- 7.3. Market Analysis, Insights and Forecast - by Operating System

- 7.3.1. iOS

- 7.3.2. Android

- 7.3.3. Windows

- 7.3.4. Other Operating Systems

- 7.1. Market Analysis, Insights and Forecast - by Revenue Model

- 8. Asia Pacific Online Action Games Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Revenue Model

- 8.1.1. Free Gaming Services

- 8.1.2. Paid Gaming Services

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. PCs

- 8.2.2. Consoles

- 8.2.3. Mobile Phones

- 8.3. Market Analysis, Insights and Forecast - by Operating System

- 8.3.1. iOS

- 8.3.2. Android

- 8.3.3. Windows

- 8.3.4. Other Operating Systems

- 8.1. Market Analysis, Insights and Forecast - by Revenue Model

- 9. South America Online Action Games Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Revenue Model

- 9.1.1. Free Gaming Services

- 9.1.2. Paid Gaming Services

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. PCs

- 9.2.2. Consoles

- 9.2.3. Mobile Phones

- 9.3. Market Analysis, Insights and Forecast - by Operating System

- 9.3.1. iOS

- 9.3.2. Android

- 9.3.3. Windows

- 9.3.4. Other Operating Systems

- 9.1. Market Analysis, Insights and Forecast - by Revenue Model

- 10. Middle East Online Action Games Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Revenue Model

- 10.1.1. Free Gaming Services

- 10.1.2. Paid Gaming Services

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. PCs

- 10.2.2. Consoles

- 10.2.3. Mobile Phones

- 10.3. Market Analysis, Insights and Forecast - by Operating System

- 10.3.1. iOS

- 10.3.2. Android

- 10.3.3. Windows

- 10.3.4. Other Operating Systems

- 10.1. Market Analysis, Insights and Forecast - by Revenue Model

- 11. North America Online Action Games Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Online Action Games Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Online Action Games Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. South America Online Action Games Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 15. Middle East Online Action Games Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of the Middle East

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 PlatinumGames

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Gameloft

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Guerrilla Games

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 FromSoftware

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Konami

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 SIE Santa Monica Studio

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Nintendo EPD

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Rocksteady Studios

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Tencent

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Rockstar North

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Sony Interactive Entertainment

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 EA DICE*List Not Exhaustive

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Bethesda Game Studios

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Capcom

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Ubisoft

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 id Software

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.1 PlatinumGames

List of Figures

- Figure 1: Global Online Action Games Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Online Action Games Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Online Action Games Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Online Action Games Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Online Action Games Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Online Action Games Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Online Action Games Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Online Action Games Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Online Action Games Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Online Action Games Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Online Action Games Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Online Action Games Market Revenue (Million), by Revenue Model 2024 & 2032

- Figure 13: North America Online Action Games Market Revenue Share (%), by Revenue Model 2024 & 2032

- Figure 14: North America Online Action Games Market Revenue (Million), by Platform 2024 & 2032

- Figure 15: North America Online Action Games Market Revenue Share (%), by Platform 2024 & 2032

- Figure 16: North America Online Action Games Market Revenue (Million), by Operating System 2024 & 2032

- Figure 17: North America Online Action Games Market Revenue Share (%), by Operating System 2024 & 2032

- Figure 18: North America Online Action Games Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Online Action Games Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Online Action Games Market Revenue (Million), by Revenue Model 2024 & 2032

- Figure 21: Europe Online Action Games Market Revenue Share (%), by Revenue Model 2024 & 2032

- Figure 22: Europe Online Action Games Market Revenue (Million), by Platform 2024 & 2032

- Figure 23: Europe Online Action Games Market Revenue Share (%), by Platform 2024 & 2032

- Figure 24: Europe Online Action Games Market Revenue (Million), by Operating System 2024 & 2032

- Figure 25: Europe Online Action Games Market Revenue Share (%), by Operating System 2024 & 2032

- Figure 26: Europe Online Action Games Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Online Action Games Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Online Action Games Market Revenue (Million), by Revenue Model 2024 & 2032

- Figure 29: Asia Pacific Online Action Games Market Revenue Share (%), by Revenue Model 2024 & 2032

- Figure 30: Asia Pacific Online Action Games Market Revenue (Million), by Platform 2024 & 2032

- Figure 31: Asia Pacific Online Action Games Market Revenue Share (%), by Platform 2024 & 2032

- Figure 32: Asia Pacific Online Action Games Market Revenue (Million), by Operating System 2024 & 2032

- Figure 33: Asia Pacific Online Action Games Market Revenue Share (%), by Operating System 2024 & 2032

- Figure 34: Asia Pacific Online Action Games Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Online Action Games Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Online Action Games Market Revenue (Million), by Revenue Model 2024 & 2032

- Figure 37: South America Online Action Games Market Revenue Share (%), by Revenue Model 2024 & 2032

- Figure 38: South America Online Action Games Market Revenue (Million), by Platform 2024 & 2032

- Figure 39: South America Online Action Games Market Revenue Share (%), by Platform 2024 & 2032

- Figure 40: South America Online Action Games Market Revenue (Million), by Operating System 2024 & 2032

- Figure 41: South America Online Action Games Market Revenue Share (%), by Operating System 2024 & 2032

- Figure 42: South America Online Action Games Market Revenue (Million), by Country 2024 & 2032

- Figure 43: South America Online Action Games Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East Online Action Games Market Revenue (Million), by Revenue Model 2024 & 2032

- Figure 45: Middle East Online Action Games Market Revenue Share (%), by Revenue Model 2024 & 2032

- Figure 46: Middle East Online Action Games Market Revenue (Million), by Platform 2024 & 2032

- Figure 47: Middle East Online Action Games Market Revenue Share (%), by Platform 2024 & 2032

- Figure 48: Middle East Online Action Games Market Revenue (Million), by Operating System 2024 & 2032

- Figure 49: Middle East Online Action Games Market Revenue Share (%), by Operating System 2024 & 2032

- Figure 50: Middle East Online Action Games Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East Online Action Games Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Online Action Games Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Online Action Games Market Revenue Million Forecast, by Revenue Model 2019 & 2032

- Table 3: Global Online Action Games Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 4: Global Online Action Games Market Revenue Million Forecast, by Operating System 2019 & 2032

- Table 5: Global Online Action Games Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Online Action Games Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Online Action Games Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Russia Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Online Action Games Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: India Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: China Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Online Action Games Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Brazil Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Argentina Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Online Action Games Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United Arab Emirates Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Saudi Arabia Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of the Middle East Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Online Action Games Market Revenue Million Forecast, by Revenue Model 2019 & 2032

- Table 31: Global Online Action Games Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 32: Global Online Action Games Market Revenue Million Forecast, by Operating System 2019 & 2032

- Table 33: Global Online Action Games Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of North America Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Online Action Games Market Revenue Million Forecast, by Revenue Model 2019 & 2032

- Table 39: Global Online Action Games Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 40: Global Online Action Games Market Revenue Million Forecast, by Operating System 2019 & 2032

- Table 41: Global Online Action Games Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Germany Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: United Kingdom Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Russia Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Spain Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Europe Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Online Action Games Market Revenue Million Forecast, by Revenue Model 2019 & 2032

- Table 49: Global Online Action Games Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 50: Global Online Action Games Market Revenue Million Forecast, by Operating System 2019 & 2032

- Table 51: Global Online Action Games Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: India Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: China Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Online Action Games Market Revenue Million Forecast, by Revenue Model 2019 & 2032

- Table 57: Global Online Action Games Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 58: Global Online Action Games Market Revenue Million Forecast, by Operating System 2019 & 2032

- Table 59: Global Online Action Games Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Brazil Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Argentina Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Global Online Action Games Market Revenue Million Forecast, by Revenue Model 2019 & 2032

- Table 63: Global Online Action Games Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 64: Global Online Action Games Market Revenue Million Forecast, by Operating System 2019 & 2032

- Table 65: Global Online Action Games Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: United Arab Emirates Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Saudi Arabia Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of the Middle East Online Action Games Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Action Games Market?

The projected CAGR is approximately 8.94%.

2. Which companies are prominent players in the Online Action Games Market?

Key companies in the market include PlatinumGames, Gameloft, Guerrilla Games, FromSoftware, Konami, SIE Santa Monica Studio, Nintendo EPD, Rocksteady Studios, Tencent, Rockstar North, Sony Interactive Entertainment, EA DICE*List Not Exhaustive, Bethesda Game Studios, Capcom, Ubisoft, id Software.

3. What are the main segments of the Online Action Games Market?

The market segments include Revenue Model, Platform, Operating System.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Adoption of Smartphones; Increased Utilization of Gaming Simulation for Training and Analysis Across a Variety of Fields; Growing Demand for VR Headsets.

6. What are the notable trends driving market growth?

Surge in the usage of MMORPG Games.

7. Are there any restraints impacting market growth?

Need for Expensive Graphic Cards.

8. Can you provide examples of recent developments in the market?

In July 2022 - Tom Clancy's The Division® Resurgence, a new free-to-play third-person shooter RPG mobile game from Tom Clancy's The Division franchise, was unveiled by Ubisoft. The Division Resurgence by Tom Clancy is a masterpiece with a fresh plot, a new storyline, and difficult opponent groups. The game is accessible for iOS and Android devices in the App Store® and Google PlayTM.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Action Games Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Action Games Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Action Games Market?

To stay informed about further developments, trends, and reports in the Online Action Games Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence