Key Insights

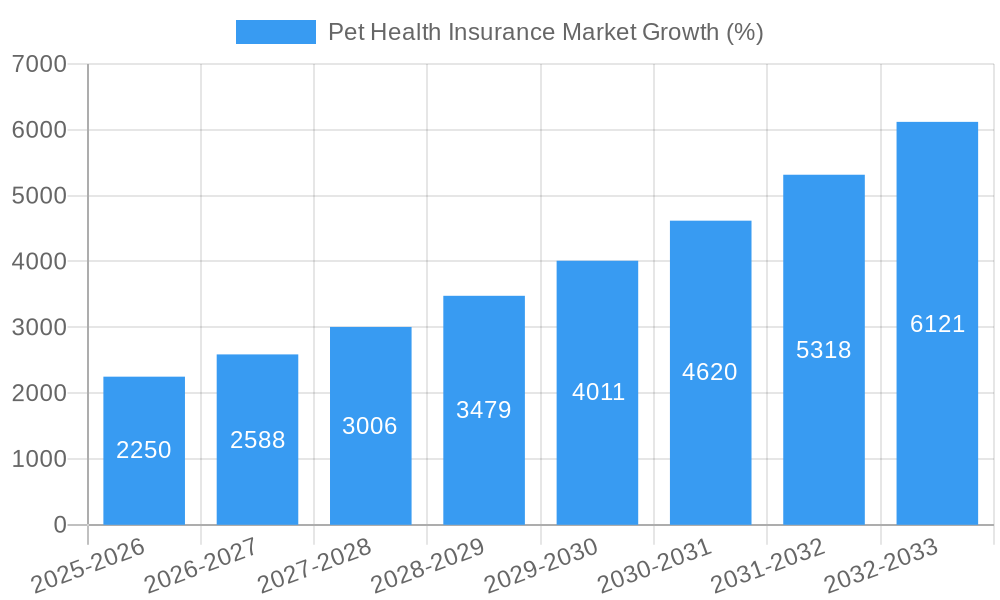

The pet health insurance market is experiencing robust growth, driven by increasing pet ownership, rising veterinary costs, and a growing awareness of pet health among owners. The study period of 2019-2033 reveals a significant expansion, with a substantial market size in 2025 serving as a strong base for future projections. While precise figures for market size are unavailable, considering the average CAGR (Compound Annual Growth Rate) observed in the pet insurance sector—generally between 15-25%—and the base year of 2025, we can infer a considerable market value. This growth is fueled by several key factors, including the humanization of pets, leading to increased spending on their well-being; the availability of more comprehensive and affordable insurance plans; and the expanding online distribution channels that improve accessibility. The rising prevalence of chronic conditions in pets, requiring extensive and costly treatment, also contributes to the demand for pet insurance.

Looking ahead to 2033, the market is poised for continued expansion, propelled by evolving consumer preferences and technological advancements. The introduction of innovative insurance products, such as preventative care coverage and telemedicine integration, will likely further stimulate market growth. Geographic variations in market penetration are also expected, with developed nations exhibiting higher adoption rates compared to emerging economies. However, the latter are expected to show significant growth potential in the coming years, driven by rising disposable incomes and increasing awareness of pet health insurance benefits. The market will likely see increased competition among insurers, leading to innovations in product offerings and pricing strategies to attract and retain customers.

Pet Health Insurance Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Pet Health Insurance Market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities. The report leverages extensive data analysis to project a robust forecast for the market's growth trajectory. Download now to gain a competitive edge!

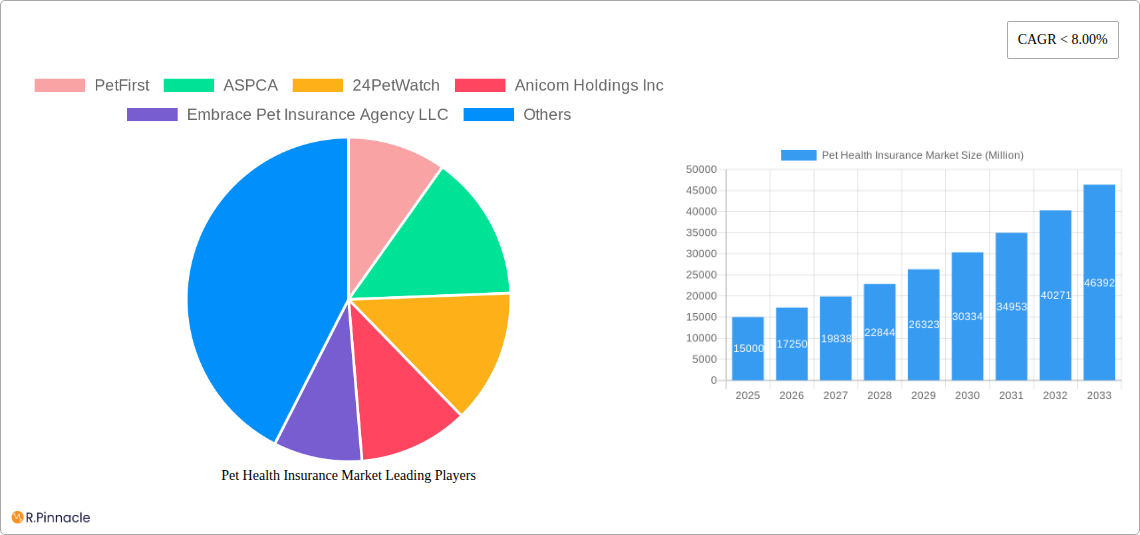

Pet Health Insurance Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the Pet Health Insurance Market. The market is characterized by a moderate level of concentration, with key players like PetFirst, ASPCA, 24PetWatch, Anicom Holdings Inc, Embrace Pet Insurance Agency LLC, Figo Pet Insurance LLC, HartVille, Healthy Paws Pet Insurance LLC, Hollard, and Oneplan holding significant market share (exact figures are detailed within the report). The combined market share of the top five players is estimated at xx%.

- Market Concentration: Moderate, with a few dominant players and several smaller niche players.

- Innovation Drivers: Technological advancements in telehealth, data analytics, and personalized pet care are driving innovation.

- Regulatory Frameworks: Varying regulations across different geographies influence market dynamics.

- Product Substitutes: Limited direct substitutes, but alternative pet care financing options exist.

- End-User Demographics: Growing pet ownership and increasing pet humanization are key demographic drivers.

- M&A Activities: The report details several significant M&A activities in the historical period (2019-2024), including deals totaling an estimated value of xx Million USD. Further details on deal specifics and their impact on market consolidation are provided in the full report.

Pet Health Insurance Market Dynamics & Trends

This section delves into the market's growth trajectory, highlighting key trends and dynamics. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration remains relatively low in some regions, suggesting significant untapped potential.

Factors driving market growth include: increasing pet ownership rates, rising pet healthcare costs, growing awareness of pet insurance benefits, and advancements in veterinary technology. However, competitive pressures and consumer price sensitivity remain key challenges.

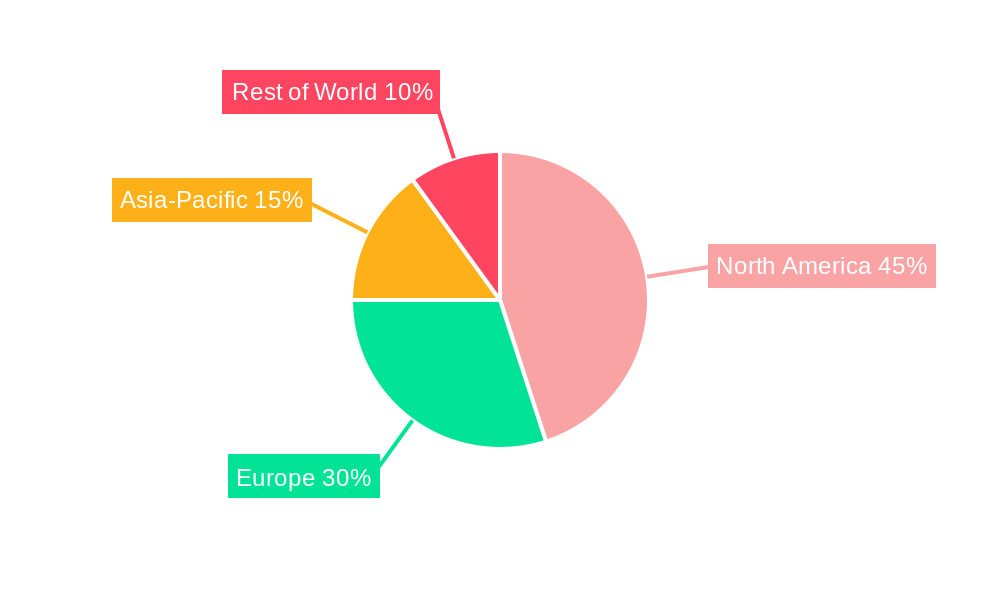

Dominant Regions & Segments in Pet Health Insurance Market

The North American market currently holds the dominant position in the global Pet Health Insurance Market, driven by factors such as high pet ownership rates, robust healthcare infrastructure, and favorable regulatory environments. Several other regions are experiencing rapid growth, fueled by increasing pet humanization and rising disposable incomes.

- North America: High pet ownership rates, advanced veterinary care, and strong consumer awareness of pet insurance.

- Europe: Increasing pet ownership and rising awareness of pet insurance benefits.

- Asia-Pacific: Rapid growth in pet ownership, particularly in developing economies.

- Other Regions: Significant growth potential fueled by rising disposable incomes and increased pet adoption rates.

A detailed segment-wise analysis, including market size and growth projections, is presented in the complete report.

Pet Health Insurance Market Product Innovations

Recent product innovations focus on enhancing coverage options, integrating telehealth services, and leveraging data analytics for personalized risk assessment. We are witnessing the emergence of bundled services that combine pet insurance with wellness programs, increasing customer value and loyalty. This trend reflects both consumer demand and a proactive response from insurance providers to enhance their offerings.

Report Scope & Segmentation Analysis

This report segments the Pet Health Insurance Market by various factors, including pet type (dogs, cats, others), coverage type (accident-only, accident & illness, wellness), distribution channel (direct, brokers, online), and region. Each segment’s market size, growth rate, and competitive dynamics are analyzed in detail within the report. Growth projections for each segment are detailed within the report’s forecast section.

Key Drivers of Pet Health Insurance Market Growth

Several key factors contribute to the market's growth. Rising pet healthcare costs are a major driver, along with increasing pet ownership, growing consumer awareness of pet insurance benefits, and the expansion of telehealth services. Favorable regulatory environments in certain regions also stimulate market expansion.

Challenges in the Pet Health Insurance Market Sector

The market faces challenges such as high acquisition costs, stringent regulatory compliance requirements, and intense competition among established players and new entrants. The impact of these factors on profitability and market share is quantified within the full report.

Emerging Opportunities in Pet Health Insurance Market

Significant opportunities exist in untapped markets, particularly in developing economies with growing pet ownership rates. The integration of technology, such as AI-powered risk assessment tools and personalized wellness programs, presents significant opportunities. Expanding into niche markets, such as exotic pet insurance, also offers lucrative growth prospects.

Leading Players in the Pet Health Insurance Market Market

- PetFirst

- ASPCA

- 24PetWatch

- Anicom Holdings Inc

- Embrace Pet Insurance Agency LLC

- Figo Pet Insurance LLC

- HartVille

- Healthy Paws Pet Insurance LLC

- Hollard

- Oneplan

Key Developments in Pet Health Insurance Market Industry

- 2021: MetLife expands pet insurance benefits to include virtual vet visits, rollover benefits, family plans, and grief counseling. This significantly enhances the value proposition of pet insurance for employees.

- 2021: Wagmo raises 12.5 Million USD to offer pet insurance and a comprehensive wellness program, disrupting the traditional model by offering wellness services independently or bundled with insurance.

Future Outlook for Pet Health Insurance Market Market

The Pet Health Insurance Market is poised for robust growth, driven by several key factors. Continued growth in pet ownership, increasing pet healthcare costs, advancements in technology, and the rising adoption of pet insurance among pet owners will all contribute to sustained market expansion. Strategic partnerships, product innovation, and expansion into new markets will present key opportunities for players seeking to capture a greater share of this expanding market.

Pet Health Insurance Market Segmentation

-

1. Policy

- 1.1. Illness and Accidents

- 1.2. Chronic Conditions

- 1.3. Others

-

2. Provider

- 2.1. Public

- 2.2. Private

Pet Health Insurance Market Segmentation By Geography

- 1. North America

- 2. Latin America

- 3. Europe

- 4. Asia Pacific

- 5. Middle East and Africa

Pet Health Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Pet Adoption; Rising Awareness Regarding Pet Insurance

- 3.3. Market Restrains

- 3.3.1. Increasing Number of Pet Adoption; Rising Awareness Regarding Pet Insurance

- 3.4. Market Trends

- 3.4.1. Increasing Pet Healthcare Act as a Driver for Pet Insurance Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Policy

- 5.1.1. Illness and Accidents

- 5.1.2. Chronic Conditions

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Provider

- 5.2.1. Public

- 5.2.2. Private

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Latin America

- 5.3.3. Europe

- 5.3.4. Asia Pacific

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Policy

- 6. North America Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Policy

- 6.1.1. Illness and Accidents

- 6.1.2. Chronic Conditions

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Provider

- 6.2.1. Public

- 6.2.2. Private

- 6.1. Market Analysis, Insights and Forecast - by Policy

- 7. Latin America Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Policy

- 7.1.1. Illness and Accidents

- 7.1.2. Chronic Conditions

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Provider

- 7.2.1. Public

- 7.2.2. Private

- 7.1. Market Analysis, Insights and Forecast - by Policy

- 8. Europe Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Policy

- 8.1.1. Illness and Accidents

- 8.1.2. Chronic Conditions

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Provider

- 8.2.1. Public

- 8.2.2. Private

- 8.1. Market Analysis, Insights and Forecast - by Policy

- 9. Asia Pacific Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Policy

- 9.1.1. Illness and Accidents

- 9.1.2. Chronic Conditions

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Provider

- 9.2.1. Public

- 9.2.2. Private

- 9.1. Market Analysis, Insights and Forecast - by Policy

- 10. Middle East and Africa Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Policy

- 10.1.1. Illness and Accidents

- 10.1.2. Chronic Conditions

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Provider

- 10.2.1. Public

- 10.2.2. Private

- 10.1. Market Analysis, Insights and Forecast - by Policy

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 PetFirst

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ASPCA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 24PetWatch

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Anicom Holdings Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Embrace Pet Insurance Agency LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Figo Pet Insurance LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HartVille

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Healthy Paws Pet Insurance LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hollard

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oneplan

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 PetFirst

List of Figures

- Figure 1: Global Pet Health Insurance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 3: North America Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 4: North America Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 5: North America Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 6: North America Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 9: Latin America Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 10: Latin America Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 11: Latin America Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 12: Latin America Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Latin America Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 15: Europe Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 16: Europe Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 17: Europe Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 18: Europe Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 21: Asia Pacific Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 22: Asia Pacific Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 23: Asia Pacific Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 24: Asia Pacific Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East and Africa Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 27: Middle East and Africa Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 28: Middle East and Africa Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 29: Middle East and Africa Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 30: Middle East and Africa Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pet Health Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 3: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 4: Global Pet Health Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 6: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 7: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 9: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 10: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 12: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 13: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 15: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 16: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 18: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 19: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Health Insurance Market?

The projected CAGR is approximately < 8.00%.

2. Which companies are prominent players in the Pet Health Insurance Market?

Key companies in the market include PetFirst, ASPCA, 24PetWatch, Anicom Holdings Inc, Embrace Pet Insurance Agency LLC, Figo Pet Insurance LLC, HartVille, Healthy Paws Pet Insurance LLC, Hollard, Oneplan.

3. What are the main segments of the Pet Health Insurance Market?

The market segments include Policy, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Pet Adoption; Rising Awareness Regarding Pet Insurance.

6. What are the notable trends driving market growth?

Increasing Pet Healthcare Act as a Driver for Pet Insurance Market Growth.

7. Are there any restraints impacting market growth?

Increasing Number of Pet Adoption; Rising Awareness Regarding Pet Insurance.

8. Can you provide examples of recent developments in the market?

In 2021, MetLife expands pet insurance benefits to include virtual vet visits. Through MetLife's new pet insurance benefit, employers will be able to provide employee pet parents with access to veterinary telehealth services, roll over benefits, family plans for coverage of more than one pet and grief counseling. Additionally, employees switching from one insurance provider to MetLife will not be denied if their dog or cat has a preexisting condition, an exclusive perk of the employee benefit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pet Health Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pet Health Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pet Health Insurance Market?

To stay informed about further developments, trends, and reports in the Pet Health Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence