Key Insights

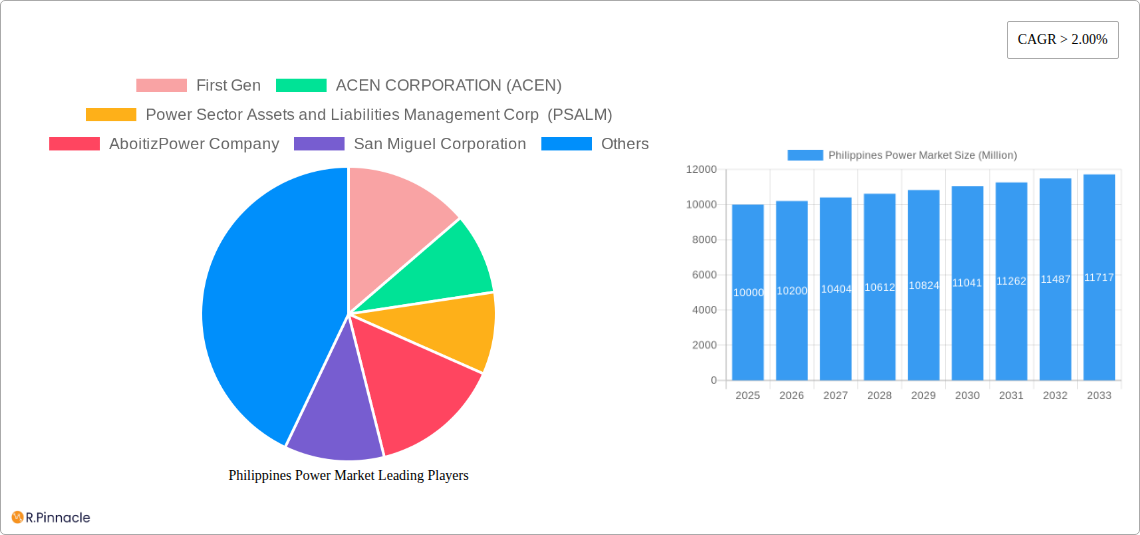

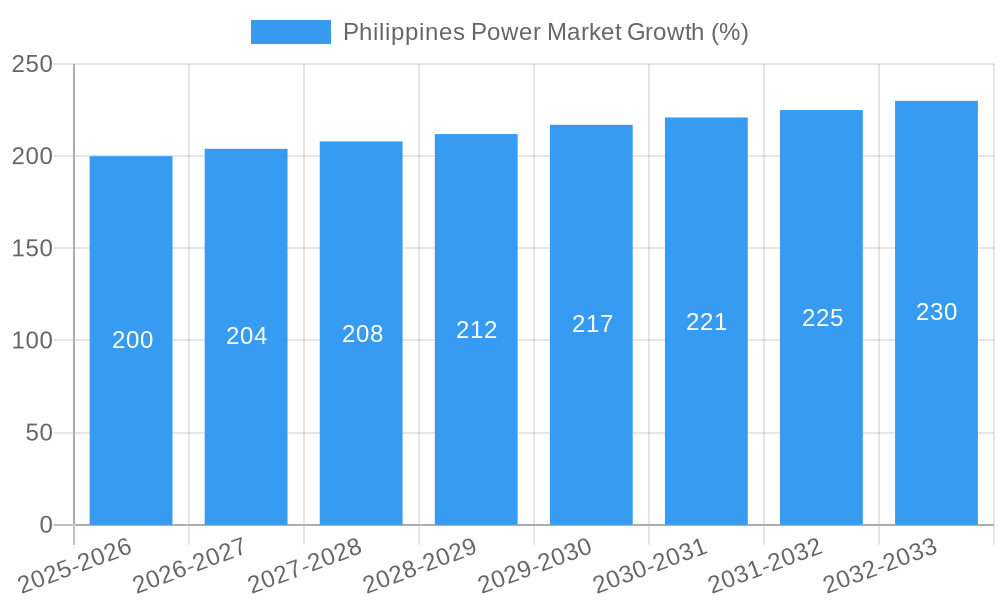

The Philippines power market, valued at approximately $X million in 2025 (assuming a logical market size based on regional comparisons and the provided CAGR), is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) exceeding 2.00% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing energy demand driven by a growing population and expanding economy necessitates significant investments in power generation and distribution infrastructure. Furthermore, the government's strong push towards renewable energy sources, such as solar, wind, and hydro, is accelerating the transition away from traditional thermal power plants, contributing substantially to market growth. This transition is also influenced by global trends towards sustainability and decreasing renewable energy costs. However, challenges remain, including the need for improved grid infrastructure to effectively integrate intermittent renewable energy sources and the potential for regulatory hurdles and financing constraints to impede project development. The market segmentation highlights the significance of renewable energy sources, which are likely to gain significant market share over the forecast period, alongside continued investment in thermal and hydro power. Key players like First Gen, ACEN, PSALM, AboitizPower, San Miguel Corporation, Shell, and Dianter Renewable Energy are actively shaping the market landscape through strategic investments and project development.

The competitive landscape is characterized by both established players and emerging renewable energy companies vying for market share. The forecast period will witness significant investments in new power generation projects, particularly in renewable energy, driven by government policies and growing environmental concerns. The country's geographical location and climate conditions offer opportunities for various renewable energy sources. However, the market will also need to address challenges related to land acquisition, permitting processes, and community engagement for renewable energy projects. Effective policy implementation, alongside strategic collaborations between the government, private sector, and international partners, will be crucial in ensuring a sustainable and reliable energy supply for the Philippines throughout the forecast period. The consistent growth in the market suggests a strong potential for investors and businesses in the energy sector.

Philippines Power Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Philippines power market, covering historical performance (2019-2024), current market dynamics (2025), and future projections (2025-2033). It offers actionable insights for industry professionals, investors, and policymakers navigating this rapidly evolving sector. The report leverages extensive data analysis and expert insights to identify key trends, challenges, and opportunities within the Philippines' power landscape. With a focus on renewable energy growth, market consolidation, and technological advancements, this report is an essential resource for understanding the future of power in the Philippines.

Philippines Power Market Market Structure & Innovation Trends

This section analyzes the structure of the Philippines power market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The study period is 2019-2033, with 2025 as the base and estimated year.

Market Concentration: The Philippines power market exhibits moderate concentration, with key players like First Gen, ACEN CORPORATION (ACEN), AboitizPower Company, and San Miguel Corporation holding significant market share. Precise market share data for 2025 is estimated at xx%, xx%, xx%, and xx%, respectively. Smaller players such as DIANTER Renewable Energy Resources Philippines and new entrants contribute to increased competition.

Innovation Drivers: The push for renewable energy sources, driven by government policies and the increasing demand for sustainable power, is a major innovation driver. Technological advancements in solar, wind, and geothermal energy are also playing a crucial role.

Regulatory Framework: The regulatory environment influences market dynamics through licensing, grid access, and feed-in tariffs. Recent reforms, such as the Green Energy Auction Program (GEAP), are fostering renewable energy investments.

Product Substitutes: While electricity is essential, energy efficiency measures and the adoption of alternative energy sources (e.g., rooftop solar) represent potential substitutes.

End-User Demographics: The report segments end-users by residential, commercial, and industrial sectors, analyzing their varying electricity consumption patterns and preferences.

M&A Activities: The power sector has witnessed significant M&A activity, with deal values in the range of xx Million in recent years. Strategic acquisitions have shaped market consolidation and expansion into renewable energy segments.

Philippines Power Market Market Dynamics & Trends

This section explores the market dynamics and trends shaping the Philippines power market. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected at xx%. This growth is driven by several factors including:

Increasing Electricity Demand: Driven by economic growth, rising population, and industrialization.

Government Support for Renewable Energy: Policies like the GEAP are attracting significant investment in renewable energy projects.

Technological Advancements: Cost reductions in renewable energy technologies, such as solar and wind, are enhancing their competitiveness.

Power Sector Modernization: Initiatives to upgrade the electricity grid and improve transmission infrastructure are boosting efficiency.

Shifting Consumer Preferences: Growing awareness of environmental sustainability is driving demand for cleaner energy options.

Competitive Dynamics: Increased competition among power producers, both traditional and renewable, will drive innovation and efficiency improvements. The market penetration of renewable energy is estimated to reach xx% by 2033.

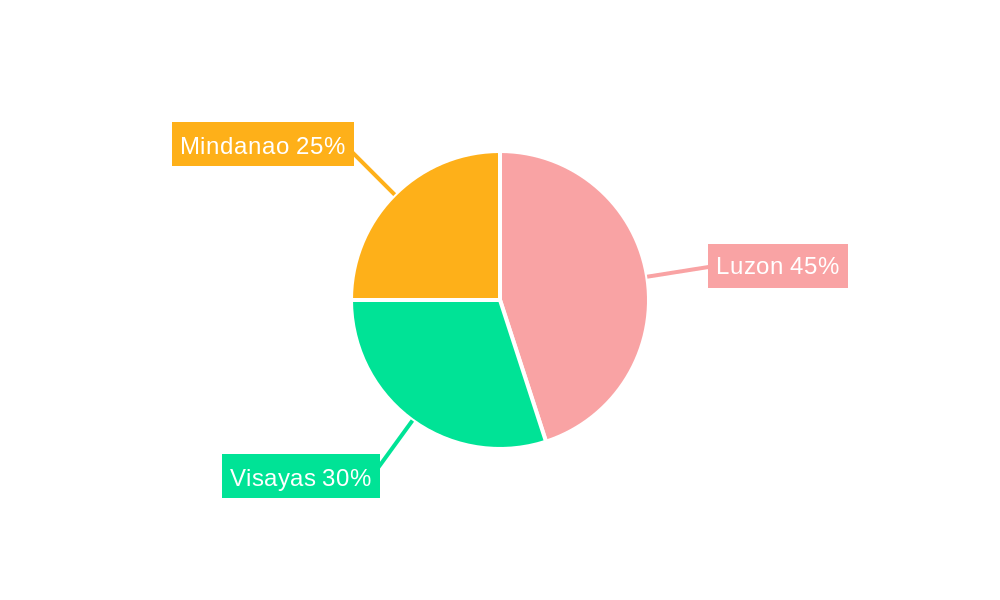

Dominant Regions & Segments in Philippines Power Market

This section analyzes the dominant regions and segments within the Philippines power market. While precise regional data requires further specification, generally Luzon is expected to be the dominant region due to its higher population density and industrial activity. The renewable energy segment is projected to experience significant growth, driven by several factors:

Key Drivers for Renewable Energy Dominance:

- Favorable government policies and incentives.

- Abundant renewable energy resources (solar, wind, geothermal).

- Decreasing costs of renewable energy technologies.

- Growing awareness of climate change and sustainability.

Dominance Analysis: The Renewable segment is poised for significant growth, surpassing the Thermal segment in the forecast period. The hydro segment maintains a consistent presence, while 'Other Generation Sources' will occupy a smaller, albeit growing, niche. Factors like grid integration challenges and resource availability will shape the relative growth rates of each segment.

Philippines Power Market Product Innovations

The Philippines power market is witnessing significant product innovations, primarily in renewable energy technologies. Advancements in solar PV efficiency, wind turbine designs, and energy storage systems are enhancing the reliability and cost-effectiveness of renewable energy solutions. These innovations are improving market fit by providing more reliable and affordable clean energy options.

Report Scope & Segmentation Analysis

This report segments the Philippines power market by generation source: Thermal, Hydro, Renewable, and Other Generation Sources.

Thermal: This segment includes coal, oil, and natural gas power plants, projected to experience a decline in market share due to environmental concerns and government policies promoting renewable energy. The market size for Thermal is estimated at xx Million in 2025.

Hydro: This segment relies on hydroelectric power plants. Market growth will be relatively stable, constrained by the availability of suitable sites. The 2025 market size is estimated at xx Million.

Renewable: This rapidly growing segment encompasses solar, wind, geothermal, and biomass power. The 2025 market size is estimated at xx Million and is projected to see the highest growth rate among the segments.

Other Generation Sources: This segment includes waste-to-energy and other emerging technologies. It will experience moderate growth driven by innovation and government support. The 2025 market size is projected at xx Million.

Key Drivers of Philippines Power Market Growth

Key growth drivers for the Philippines power market include increasing electricity demand fueled by economic growth and population increase, government support for renewable energy through initiatives such as the GEAP, and technological advancements reducing the cost of renewable energy technologies. These factors, along with the modernization of the power grid, are crucial for accelerating market expansion.

Challenges in the Philippines Power Market Sector

Challenges include the need for significant investments in grid infrastructure to accommodate increasing renewable energy integration, supply chain constraints impacting project timelines and costs, and the ongoing need to balance energy security with environmental sustainability goals. These constraints could potentially delay the transition to cleaner energy sources.

Emerging Opportunities in Philippines Power Market

Emerging opportunities include expanding the adoption of distributed generation, such as rooftop solar, exploring new renewable energy technologies like offshore wind, and developing smart grid solutions to improve efficiency and grid management. The focus on energy storage solutions will also be a key growth opportunity.

Leading Players in the Philippines Power Market Market

- First Gen

- ACEN CORPORATION (ACEN)

- Power Sector Assets and Liabilities Management Corp (PSALM)

- AboitizPower Company

- San Miguel Corporation

- Shell PLC

- DIANTER Renewable Energy Resources Philippines

Key Developments in Philippines Power Market Industry

June 2022: The Philippines Department of Energy awarded 19 contracts for renewable energy projects with a capacity of 1.57 GW under the first round of the 2 GW Green Energy Auction Program (GEAP). This significantly boosts renewable energy capacity and market competitiveness.

2022: Shell PLC announced plans for a joint venture with Nickel Asia Corp (NAC) to develop 3 GW of renewable energy projects in the Philippines. This large-scale investment underscores the growing interest in the country's renewable energy sector and has implications for future market share. Further, Shell plans to develop 1 GW of renewable energy projects by 2028, reinforcing long-term commitment.

Future Outlook for Philippines Power Market Market

The future of the Philippines power market is bright, driven by robust economic growth, increasing electrification, and a strong government commitment to renewable energy. Strategic investments in renewable energy infrastructure and grid modernization will be critical for realizing the sector's full potential. The market is expected to experience sustained growth, with renewable energy playing an increasingly dominant role.

Philippines Power Market Segmentation

-

1. Generation Source

- 1.1. Thermal

- 1.2. Hydro

- 1.3. Renewable

- 1.4. Other Generation Sources

Philippines Power Market Segmentation By Geography

- 1. Philippines

Philippines Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Mobile Devices4.; Rising Adaption of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; Availability of Technical Challenges

- 3.4. Market Trends

- 3.4.1. Renewable Energy Growth in the nation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Generation Source

- 5.1.1. Thermal

- 5.1.2. Hydro

- 5.1.3. Renewable

- 5.1.4. Other Generation Sources

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Generation Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 First Gen

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ACEN CORPORATION (ACEN)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Power Sector Assets and Liabilities Management Corp (PSALM)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AboitizPower Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 San Miguel Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shell PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DIANTER Renewable Energy Resources Philippines

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 First Gen

List of Figures

- Figure 1: Philippines Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Philippines Power Market Share (%) by Company 2024

List of Tables

- Table 1: Philippines Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Philippines Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Philippines Power Market Revenue Million Forecast, by Generation Source 2019 & 2032

- Table 4: Philippines Power Market Volume Gigawatt Forecast, by Generation Source 2019 & 2032

- Table 5: Philippines Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Philippines Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 7: Philippines Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Philippines Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 9: Philippines Power Market Revenue Million Forecast, by Generation Source 2019 & 2032

- Table 10: Philippines Power Market Volume Gigawatt Forecast, by Generation Source 2019 & 2032

- Table 11: Philippines Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Philippines Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Power Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Philippines Power Market?

Key companies in the market include First Gen, ACEN CORPORATION (ACEN), Power Sector Assets and Liabilities Management Corp (PSALM), AboitizPower Company, San Miguel Corporation, Shell PLC, DIANTER Renewable Energy Resources Philippines.

3. What are the main segments of the Philippines Power Market?

The market segments include Generation Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Mobile Devices4.; Rising Adaption of Electric Vehicles.

6. What are the notable trends driving market growth?

Renewable Energy Growth in the nation.

7. Are there any restraints impacting market growth?

4.; Availability of Technical Challenges.

8. Can you provide examples of recent developments in the market?

In 2022, Shell PLC plans for a joint venture with Nickel Asia Corp (NAC) to develop 3 GW of renewable energy projects in the Philippines and to develop 1 GW of renewable energy projects by 2028.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Power Market?

To stay informed about further developments, trends, and reports in the Philippines Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence