Key Insights

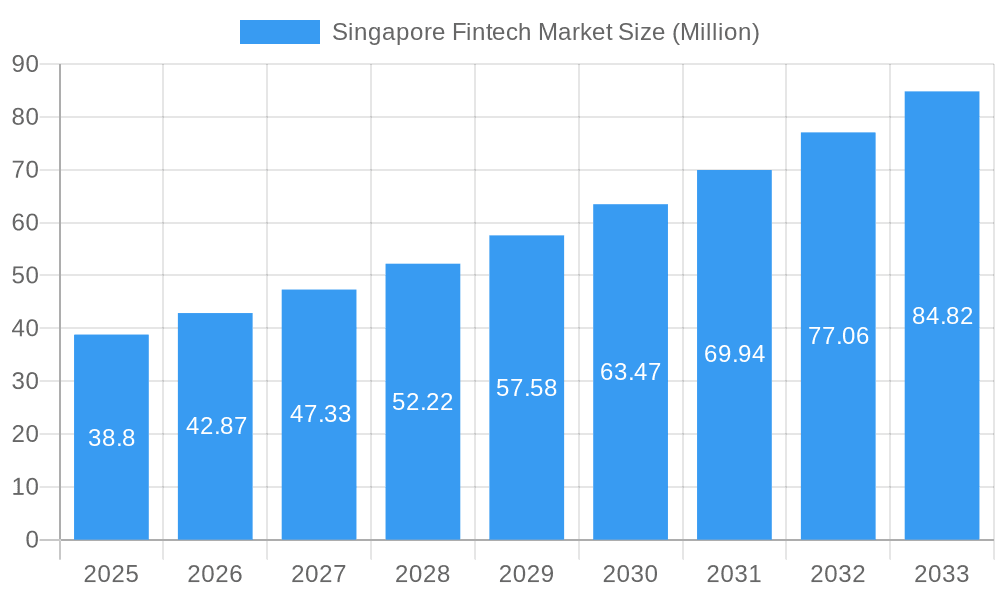

The Singapore Fintech market, valued at $38.80 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.24% from 2025 to 2033. This significant expansion is fueled by several key drivers. The government's proactive support for innovation through initiatives like the Smart Nation initiative and the Monetary Authority of Singapore's (MAS) regulatory sandbox foster a conducive environment for fintech companies to flourish. Furthermore, Singapore's strategic location, robust infrastructure, and highly skilled workforce attract significant foreign investment and talent, bolstering the sector's growth. Increasing digital adoption amongst consumers and businesses, coupled with a rising demand for convenient and efficient financial services, are also contributing factors. The market's segmentation likely includes areas like payments, lending, wealth management, and insurtech, each experiencing varying growth rates based on specific technological advancements and consumer preferences. Competition is fierce, with established players like Funding Societies and newer entrants vying for market share, leading to continuous innovation and product diversification.

Singapore Fintech Market Market Size (In Million)

The competitive landscape is dynamic, with a range of companies – from established players like Funding Societies and Singlife to rapidly growing startups such as MatchMove Pay and Aspire – contributing to the market's dynamism. The forecast period (2025-2033) will likely witness further consolidation and strategic partnerships as companies strive to gain a competitive edge. Potential restraints could include regulatory hurdles, cybersecurity concerns, and the need for widespread financial literacy to ensure successful adoption of new fintech solutions. However, the strong government support and the inherent advantages of Singapore's economic environment suggest a positive outlook for sustained growth in the Singapore Fintech market throughout the forecast period. Further research into specific market segments and competitive analyses would provide a more granular understanding of this expanding sector.

Singapore Fintech Market Company Market Share

Singapore Fintech Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Singapore Fintech market, covering its structure, dynamics, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers valuable insights for industry professionals, investors, and policymakers. The forecast period extends from 2025 to 2033, while the historical period analyzed is 2019-2024. Expect detailed analysis of market size (in Millions), CAGR, and market penetration, providing actionable intelligence for strategic decision-making.

Singapore Fintech Market Structure & Innovation Trends

This section analyzes the competitive landscape of Singapore's Fintech sector, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. We delve into market share distribution among key players, examining the impact of mergers and acquisitions on market dynamics. The analysis includes quantifiable data on M&A deal values (in Millions) where available, offering a clear picture of the market's evolving structure.

- Market Concentration: The Singapore Fintech market exhibits a moderately concentrated structure, with a few dominant players and a large number of smaller, niche players. The top 5 players account for approximately xx% of the market share in 2025.

- Innovation Drivers: Government support for innovation, a robust talent pool, and a strong regulatory framework are key drivers of innovation in the Singapore Fintech market.

- Regulatory Frameworks: The Monetary Authority of Singapore (MAS) plays a crucial role in shaping the regulatory landscape, fostering innovation while ensuring financial stability.

- Product Substitutes: Traditional financial services act as substitutes for certain Fintech products, but the increasing adoption of digital solutions is driving market growth.

- End-User Demographics: The market is characterized by a tech-savvy population with high smartphone penetration and digital literacy, fueling the adoption of Fintech solutions.

- M&A Activities: The Singapore Fintech market has witnessed significant M&A activity in recent years, with deal values totaling xx Million in 2024. Key deals have involved [mention specific deals and their estimated values if available].

Singapore Fintech Market Market Dynamics & Trends

This section explores the key dynamics shaping the Singapore Fintech market, including market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. We provide a comprehensive analysis of market growth, using metrics such as CAGR and market penetration rates to illustrate market evolution over the forecast period. The analysis will cover factors like the impact of digital transformation, evolving consumer behavior, and the competitive strategies employed by major players. Expected CAGR for the forecast period (2025-2033) is xx%. Market penetration is estimated at xx% in 2025.

Dominant Regions & Segments in Singapore Fintech Market

This section identifies the leading regions and segments within the Singapore Fintech market. The analysis will focus on the key drivers of dominance, including economic policies, infrastructure, and consumer behavior.

Key Drivers:

- Government Support: The Singaporean government's proactive policies promoting Fintech innovation have created a favorable environment for growth.

- Robust Infrastructure: Singapore's advanced digital infrastructure and high internet penetration support the widespread adoption of Fintech solutions.

- Strong Talent Pool: The availability of skilled professionals in technology and finance contributes significantly to the sector’s development.

Dominance Analysis: [Detailed paragraph analyzing the dominance of specific regions or segments, e.g., payments, lending, wealth management, and their respective market shares. Include a detailed explanation of why these segments are leading.].

Singapore Fintech Market Product Innovations

This section summarizes recent product developments in the Singapore Fintech market, highlighting key technological trends and their market fit. The analysis focuses on the competitive advantages offered by these innovations and their potential impact on the market landscape. [Paragraph outlining key product innovations, such as advancements in mobile payments, AI-driven financial advice, and blockchain-based solutions. Examples could include the innovations of companies like MatchMove Pay in embedded finance].

Report Scope & Segmentation Analysis

This report segments the Singapore Fintech market based on [mention specific segmentation criteria, e.g., product type, service type, target customer, and deployment mode]. Each segment's growth projections, market size (in Millions), and competitive dynamics will be analyzed. [Paragraphs dedicated to each segment, detailing its current size, projected growth, and key players. Include specific growth projections for each segment in Millions].

Key Drivers of Singapore Fintech Market Growth

This section outlines the key factors driving the growth of the Singapore Fintech market.

- Technological Advancements: The rapid development of technologies such as AI, blockchain, and cloud computing is fueling innovation and enhancing the efficiency of Fintech solutions.

- Government Initiatives: The Singaporean government's supportive policies and regulatory frameworks are creating a favorable environment for Fintech growth.

- Rising Smartphone Penetration and Digital Literacy: The high adoption rate of smartphones and increasing digital literacy among the population contribute to the expanding market for Fintech services.

- Growing Demand for Financial Inclusion: Fintech solutions are playing a crucial role in enhancing financial inclusion by providing access to financial services for underserved populations.

Challenges in the Singapore Fintech Market Sector

This section addresses the challenges faced by the Singapore Fintech market.

- Regulatory Hurdles: Navigating the regulatory landscape and complying with evolving regulations can be challenging for Fintech companies. [Quantify the impact of regulatory hurdles, for example, using data on the time and cost involved in obtaining licenses].

- Cybersecurity Threats: The increasing reliance on digital platforms makes Fintech companies vulnerable to cybersecurity threats, impacting customer trust and operational efficiency.

- Competition: Intense competition from both established financial institutions and new Fintech entrants poses a challenge to market players. [Quantify the impact of competition, for example, using data on market share changes].

Emerging Opportunities in Singapore Fintech Market

This section highlights the emerging opportunities in the Singapore Fintech market.

- Open Banking: The implementation of open banking initiatives presents opportunities for Fintech companies to develop innovative financial products and services.

- Regtech and Suptech: The growing demand for regulatory compliance solutions creates opportunities for Regtech and Suptech companies.

- Sustainable Finance: The increasing focus on sustainability presents opportunities for Fintech companies to develop solutions that support environmental, social, and governance (ESG) goals.

Leading Players in the Singapore Fintech Market Market

- Funding Societies

- Skuad

- MatchMove Pay

- Silent eight

- TrakInvest

- Vauld

- MoneySmart

- Advance AI

- Singlife

- Aspire

- Hatcher Plus Pte Ltd

- Bambu

Key Developments in Singapore Fintech Market Industry

- September 2023: BitDATA Exchange partnered with MatchMove to introduce a next-generation solution for managing digital assets.

- July 2023: MatchMove and Stripe collaborated to provide seamless payments on the Shopmatic platform.

- November 2022: The UK and Singapore agreed on a new MoU to boost fintech trade and cooperation.

Future Outlook for Singapore Fintech Market Market

The Singapore Fintech market is poised for significant growth in the coming years, driven by continued technological innovation, supportive government policies, and increasing demand for digital financial services. The market is expected to witness the emergence of new business models and disruptive technologies, presenting attractive opportunities for both established players and new entrants. Strategic partnerships and collaborations will be crucial for success in this dynamic and competitive landscape. Continued focus on regulatory compliance and cybersecurity will also be essential for maintaining trust and ensuring the sustainable growth of the industry.

Singapore Fintech Market Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending & Lending Investments

- 1.4. Online Insurance & Insurance Marketplaces

- 1.5. Other Service Propositions

-

2. End-User

- 2.1. Banking

- 2.2. E-Commerce

- 2.3. Income Tax Returns

- 2.4. Insurance

- 2.5. Securities

Singapore Fintech Market Segmentation By Geography

- 1. Singapore

Singapore Fintech Market Regional Market Share

Geographic Coverage of Singapore Fintech Market

Singapore Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Blockchain Driving Singapore Fintech Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending & Lending Investments

- 5.1.4. Online Insurance & Insurance Marketplaces

- 5.1.5. Other Service Propositions

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Banking

- 5.2.2. E-Commerce

- 5.2.3. Income Tax Returns

- 5.2.4. Insurance

- 5.2.5. Securities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Funding Societies

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Skuad

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MatchMove Pay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Silent eight

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TrakInvest

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vauld

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MoneySmart

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Advance AI

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Singlife

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aspire

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hatcher Plus Pte Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bambu**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Funding Societies

List of Figures

- Figure 1: Singapore Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 2: Singapore Fintech Market Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 3: Singapore Fintech Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Singapore Fintech Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 5: Singapore Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Singapore Fintech Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Singapore Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 8: Singapore Fintech Market Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 9: Singapore Fintech Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Singapore Fintech Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 11: Singapore Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Singapore Fintech Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Fintech Market?

The projected CAGR is approximately 10.24%.

2. Which companies are prominent players in the Singapore Fintech Market?

Key companies in the market include Funding Societies, Skuad, MatchMove Pay, Silent eight, TrakInvest, Vauld, MoneySmart, Advance AI, Singlife, Aspire, Hatcher Plus Pte Ltd, Bambu**List Not Exhaustive.

3. What are the main segments of the Singapore Fintech Market?

The market segments include Service Proposition, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.80 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Blockchain Driving Singapore Fintech Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In September 2023, BitDATA Exchange partnered with MatchMove, a leading embedded finance enabler, to introduce a next-generation solution that transforms the way businesses manage their digital assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Fintech Market?

To stay informed about further developments, trends, and reports in the Singapore Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence