Key Insights

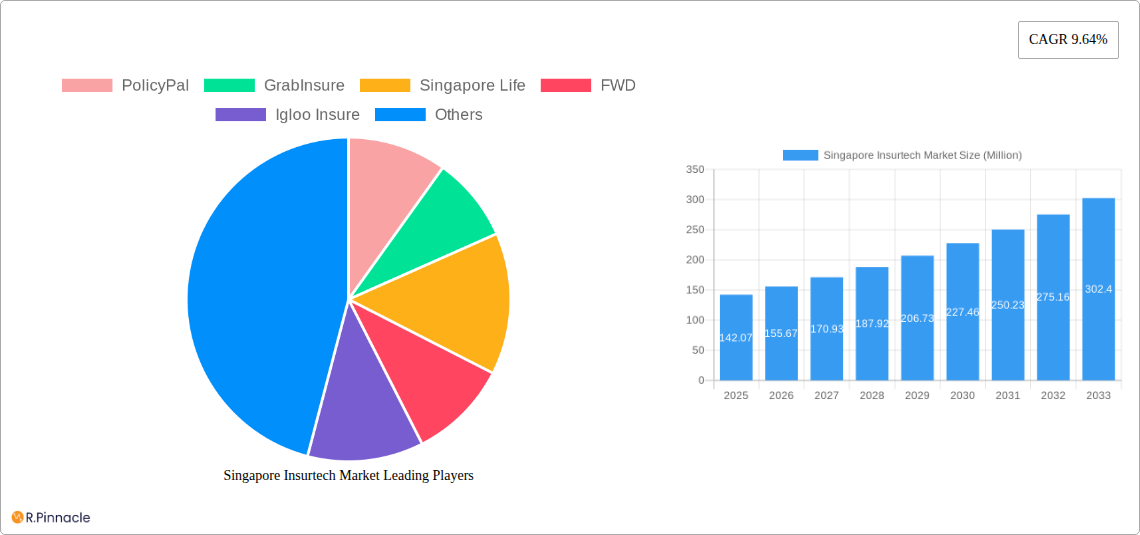

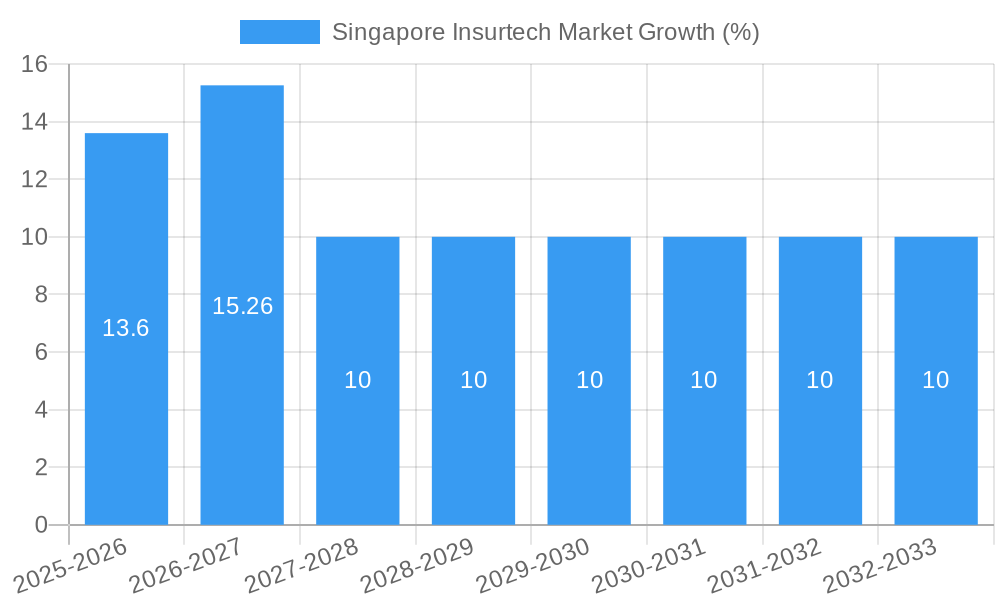

The Singapore Insurtech market, valued at $142.07 million in 2025, is projected to experience robust growth, driven by increasing smartphone penetration, rising digital literacy, and a government supportive of fintech innovation. This burgeoning sector is characterized by a high CAGR of 9.64%, indicating significant expansion opportunities over the forecast period (2025-2033). Key drivers include the growing demand for convenient and personalized insurance solutions, coupled with the increasing adoption of mobile-first insurance platforms. Consumers are increasingly seeking seamless online purchasing experiences, faster claims processing, and tailored insurance products that cater to their specific needs. This trend is further amplified by the increasing integration of Insurtech solutions with other financial technology services, creating a more holistic and interconnected financial ecosystem. The market is segmented by product type (e.g., life insurance, health insurance, general insurance), distribution channel (e.g., online platforms, mobile apps, partnerships), and target customer demographics (e.g., millennials, high-net-worth individuals). Companies like PolicyPal, GrabInsure, and Singapore Life are leading the charge in this dynamic market, showcasing innovative products and services. However, challenges remain, including regulatory hurdles, data privacy concerns, and the need to build consumer trust in digital insurance solutions. Addressing these challenges will be critical for sustained growth and market expansion.

The competitive landscape is highly dynamic, with both established insurers and new entrants vying for market share. The successful players will be those that can effectively leverage technology to improve customer experience, streamline operations, and offer competitive pricing. Looking forward, we anticipate continued innovation in areas such as artificial intelligence (AI)-powered risk assessment, blockchain-based claims processing, and personalized insurance products offered through embedded finance solutions. The historical period (2019-2024) has served as a foundation for this growth, establishing a strong base for future expansion. While specific regional data is unavailable, the market's growth projections suggest a significant expansion across different segments and customer bases. The future of Singapore’s Insurtech market promises a more efficient, transparent, and customer-centric insurance industry.

Singapore Insurtech Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Singapore Insurtech market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report leverages rigorous data analysis to illuminate current market dynamics and predict future trends. Discover key growth drivers, emerging opportunities, and significant challenges shaping this dynamic sector.

Singapore Insurtech Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Singapore Insurtech market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of established players and innovative startups, with a growing emphasis on digitalization and customer-centric solutions.

Market Concentration: The market displays a moderately concentrated structure, with a few key players holding significant market share (estimated at xx Million in 2025), while numerous smaller players compete in niche segments. Market share data for 2025 will be provided in the full report.

Innovation Drivers: Key drivers include increasing smartphone penetration, rising demand for personalized insurance products, supportive government regulations, and the adoption of advanced technologies like AI and blockchain.

Regulatory Framework: The Monetary Authority of Singapore (MAS) plays a crucial role in shaping the regulatory landscape, encouraging innovation while maintaining financial stability.

Product Substitutes: The rise of alternative financial technologies and direct-to-consumer models presents competitive pressures.

End-User Demographics: The target demographic is expanding to encompass a wider range of age groups and income levels.

M&A Activities: Significant M&A activity has been observed in recent years, with deal values reaching xx Million in 2024 (estimated). The full report will provide a detailed analysis of significant transactions and their impact on market dynamics.

Singapore Insurtech Market Dynamics & Trends

This section delves into the key factors driving market growth, exploring technological advancements, consumer behavior, and competitive dynamics within the Singapore Insurtech market.

The Singapore Insurtech market is experiencing robust growth, propelled by several key factors. Increasing digital adoption among consumers, coupled with the government's support for fintech innovation, is creating a fertile ground for growth. Furthermore, the demand for tailored insurance products and efficient claims processes is fueling the adoption of Insurtech solutions. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, driven by the increasing penetration of digital insurance products, estimated at xx% in 2025. The competitive landscape is dynamic, with established insurers and agile Insurtech startups vying for market share. Technological disruptions, such as AI-powered underwriting and blockchain-based claims processing, are transforming the industry. Consumer preferences are shifting toward personalized, transparent, and convenient insurance solutions.

Dominant Regions & Segments in Singapore Insurtech Market

The Singapore Insurtech market is concentrated primarily within Singapore itself, benefiting from the country's robust digital infrastructure and supportive regulatory environment.

- Key Drivers of Dominance:

- Strong Digital Infrastructure: Singapore possesses advanced digital infrastructure, making it an ideal environment for Insurtech operations.

- Government Support: The government actively promotes fintech innovation, creating a conducive ecosystem for Insurtech companies to thrive.

- High Internet Penetration: High internet and smartphone penetration rates among the population contribute to widespread adoption of digital insurance solutions.

The market is further segmented by product type (life insurance, general insurance, health insurance, etc.), distribution channels (online platforms, mobile apps, agents), and customer demographics. Detailed analysis of these segments, including growth projections and competitive dynamics, will be presented in the full report.

Singapore Insurtech Market Product Innovations

The Singapore Insurtech market is witnessing rapid product innovation, with a focus on creating user-friendly, personalized, and efficient insurance solutions. This includes the development of AI-powered chatbots for customer support, mobile-first insurance platforms, and data-driven risk assessment models. These innovations cater to the growing demand for customized insurance options and faster claim processes, significantly enhancing customer experience and market competitiveness. The adoption of blockchain technology for secure and transparent transactions is also gaining traction.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the Singapore Insurtech market. Key segments include: by product type (life, general, health), by distribution channel (online, mobile app, agents), by customer demographics (age, income), and by business model (B2C, B2B). Each segment's growth projection, market size (in Millions), and competitive landscape will be detailed in the full report. Further granularity will be provided regarding specific niches within these broader segments.

Key Drivers of Singapore Insurtech Market Growth

Several factors contribute to the significant growth of the Singapore Insurtech market. Government initiatives promoting fintech innovation, coupled with the increasing adoption of digital technologies and a rising demand for personalized insurance solutions, are key drivers. The growing prevalence of smartphones and high internet penetration rates further facilitate the adoption of Insurtech solutions, driving market expansion. Moreover, the development of innovative products and services tailored to specific customer needs continues to fuel market growth.

Challenges in the Singapore Insurtech Market Sector

Despite the market's promising outlook, several challenges hinder its growth. Cybersecurity concerns and data privacy regulations present significant obstacles. Competition from established insurance players and the need for robust regulatory frameworks to manage risks are also key considerations. Moreover, ensuring the seamless integration of Insurtech solutions with existing infrastructure remains a challenge. These challenges, along with their quantifiable impact on market growth, will be further elaborated in the full report.

Emerging Opportunities in Singapore Insurtech Market

The Singapore Insurtech market presents numerous opportunities. Expansion into untapped customer segments, such as the underserved population, presents significant potential. The integration of emerging technologies, such as IoT and AI, offers avenues for developing innovative insurance products and enhancing customer experiences. Partnerships between Insurtech firms and traditional insurers can leverage the strengths of both, leading to innovative solutions and expanding market reach.

Leading Players in the Singapore Insurtech Market Market

- PolicyPal

- GrabInsure

- Singapore Life

- FWD

- Igloo Insure

- GoBear

- Budget Direct Insurance

- Ergo Insurance

- Sompo Insurance Singapore

- List Not Exhaustive

Key Developments in Singapore Insurtech Market Industry

- December 2023: Surer launched Go-Helper Insurance, a customizable migrant domestic worker insurance solution in partnership with Etiqa Insurance. This development significantly expands insurance access to a previously underserved market segment.

- March 2023: Surer partnered with Zurich Insurance to offer access to Zurich's digital insurance solutions. This collaboration enhances efficiency and product offerings for Surer's users.

Future Outlook for Singapore Insurtech Market Market

The future of the Singapore Insurtech market is bright. Continued government support, technological advancements, and evolving consumer preferences will drive further growth. The market is poised for expansion, with significant opportunities for innovation and market penetration. Strategic partnerships and the development of innovative products will play crucial roles in shaping the future landscape. The market is expected to continue its strong growth trajectory, driven by the adoption of emerging technologies and an increasing focus on customer-centric solutions.

Singapore Insurtech Market Segmentation

-

1. Business Model

- 1.1. Carrier

- 1.2. Enabler

- 1.3. Distributor

-

2. Insurance Type

- 2.1. Life Insurance

- 2.2. Non-Life Insurance

Singapore Insurtech Market Segmentation By Geography

- 1. Singapore

Singapore Insurtech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Investment in Insurtech Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Insurtech Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 5.1.1. Carrier

- 5.1.2. Enabler

- 5.1.3. Distributor

- 5.2. Market Analysis, Insights and Forecast - by Insurance Type

- 5.2.1. Life Insurance

- 5.2.2. Non-Life Insurance

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 PolicyPal

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GrabInsure

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Singapore Life

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FWD

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Igloo Insure

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GoBear

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Budget Direct Insurance

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ergo Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sompo Insurance Singapore**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 PolicyPal

List of Figures

- Figure 1: Singapore Insurtech Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Singapore Insurtech Market Share (%) by Company 2024

List of Tables

- Table 1: Singapore Insurtech Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Singapore Insurtech Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Singapore Insurtech Market Revenue Million Forecast, by Business Model 2019 & 2032

- Table 4: Singapore Insurtech Market Volume Million Forecast, by Business Model 2019 & 2032

- Table 5: Singapore Insurtech Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 6: Singapore Insurtech Market Volume Million Forecast, by Insurance Type 2019 & 2032

- Table 7: Singapore Insurtech Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Singapore Insurtech Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Singapore Insurtech Market Revenue Million Forecast, by Business Model 2019 & 2032

- Table 10: Singapore Insurtech Market Volume Million Forecast, by Business Model 2019 & 2032

- Table 11: Singapore Insurtech Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 12: Singapore Insurtech Market Volume Million Forecast, by Insurance Type 2019 & 2032

- Table 13: Singapore Insurtech Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Singapore Insurtech Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Insurtech Market?

The projected CAGR is approximately 9.64%.

2. Which companies are prominent players in the Singapore Insurtech Market?

Key companies in the market include PolicyPal, GrabInsure, Singapore Life, FWD, Igloo Insure, GoBear, Budget Direct Insurance, Ergo Insurance, Sompo Insurance Singapore**List Not Exhaustive.

3. What are the main segments of the Singapore Insurtech Market?

The market segments include Business Model, Insurance Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 142.07 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Investment in Insurtech Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In December 2023, Surer launched the debut of Go-Helper Insurance, a completely customisable migrant domestic worker (MDW) insurance solution developed in partnership with Etiqa Insurance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Insurtech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Insurtech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Insurtech Market?

To stay informed about further developments, trends, and reports in the Singapore Insurtech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence