Key Insights

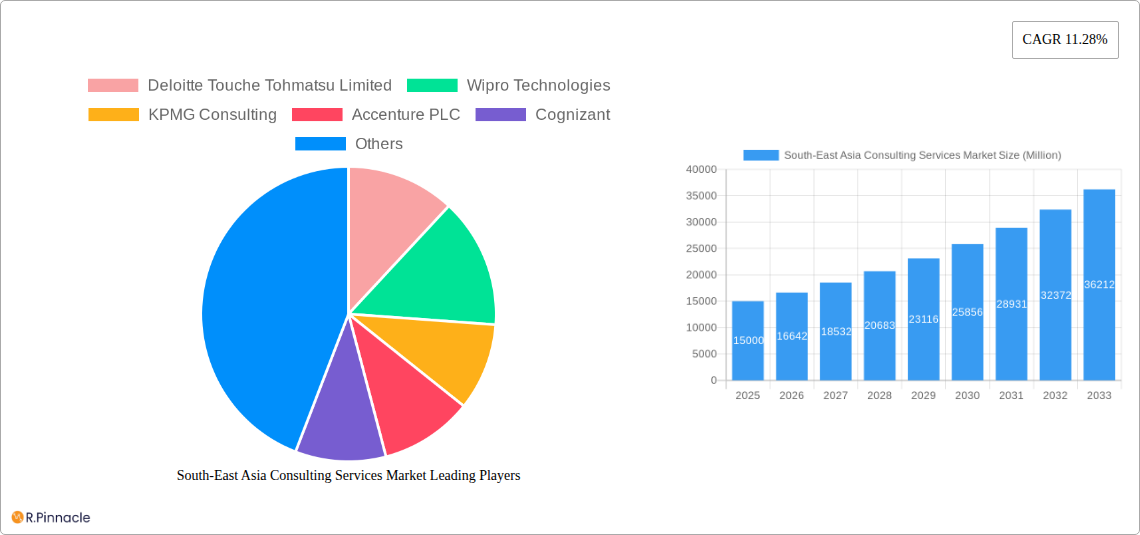

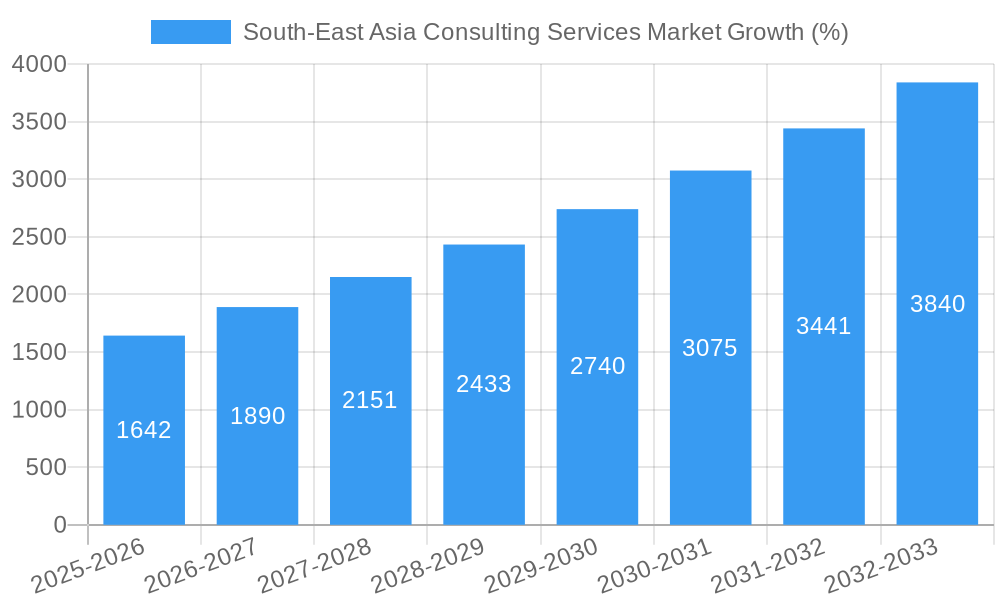

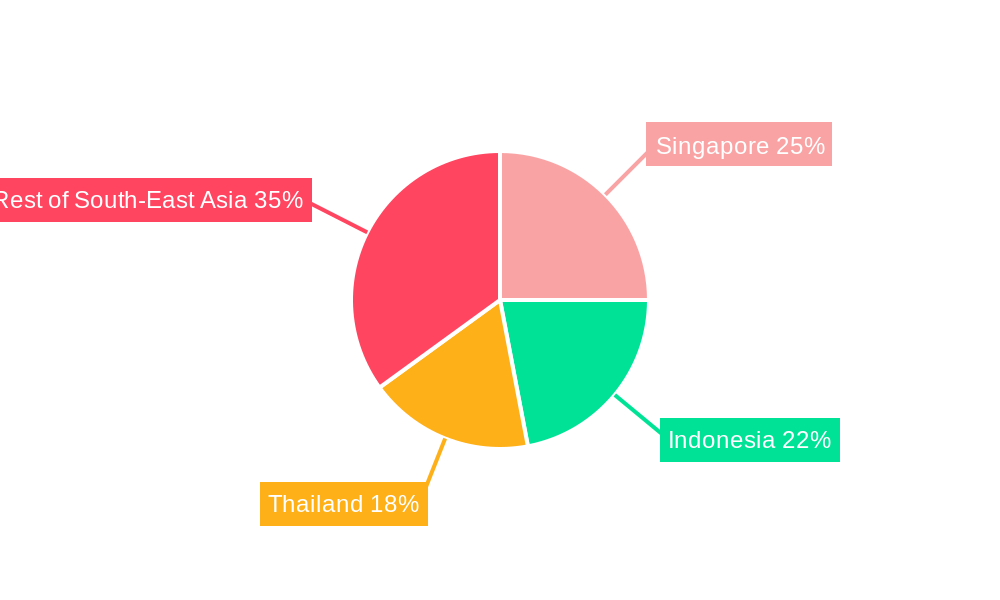

The South-East Asia consulting services market is experiencing robust growth, driven by increasing government investments in infrastructure, the expansion of digital technologies across various sectors, and a growing need for strategic guidance amidst economic fluctuations. The market's 11.28% CAGR signifies substantial expansion, with a projected market size exceeding several billion dollars by 2033 (precise figures require further data, but an estimate based on the provided CAGR and a reasonable 2025 base value can be extrapolated). Key segments driving this growth include IT & digital consulting, fueled by the region's rapid digital transformation, and financial consulting, responding to the evolving needs of a dynamic financial landscape. The financial services, life sciences and healthcare, and IT and telecommunication end-user industries are major contributors, exhibiting strong demand for specialized expertise in areas like regulatory compliance, operational efficiency, and digital strategy. Growth varies across the region, with Singapore and Indonesia likely leading due to their advanced economies and large market sizes. Thailand and the Rest of South-East Asia contribute significantly, albeit with potentially lower growth rates compared to the leading nations. While data limitations prevent precise quantification, challenges such as skills shortages and competition from international consulting firms represent potential restraints to future market growth. However, the increasing adoption of innovative technologies and the rising focus on sustainability across industries are expected to further fuel market expansion in the coming years.

The competitive landscape is intense, featuring a mix of global giants like Deloitte, Accenture, and PwC, alongside regional players and specialized boutiques. These firms offer a diverse range of services, tailoring their expertise to the specific needs of various industries and clients. Successful players are adapting to the evolving demands of the market by investing in technological capabilities, developing specialized expertise in emerging sectors (like fintech and sustainable energy), and prioritizing talent acquisition and retention to maintain a competitive edge. The market’s dynamism necessitates a focus on agility, innovation, and a deep understanding of the diverse cultural and regulatory environments within South-East Asia to effectively cater to local client needs and capture market share.

South-East Asia Consulting Services Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South-East Asia consulting services market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The base year for this analysis is 2025. The report segments the market by service type, end-user industry, and region, providing granular data and growth projections. Key players like Deloitte, Accenture, and McKinsey & Company are analyzed for their market share and strategic moves. The total market size in 2025 is estimated at xx Million.

South-East Asia Consulting Services Market Structure & Innovation Trends

The South-East Asia consulting services market exhibits a moderately concentrated structure, with a few global giants and several regional players vying for market share. Market leader xx holds approximately xx% of the market (2025), followed by xx with xx%. Innovation is driven by increasing digitalization, the need for business process optimization, and the growing adoption of advanced technologies such as AI and cloud computing. Regulatory frameworks, while generally supportive of foreign investment, vary across countries. The market also sees competition from in-house consulting teams within large organizations and technology providers offering specialized solutions. M&A activity is significant, with deal values exceeding xx Million in the past five years. Notable examples include Accenture's acquisition of Entropia in June 2022.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share in 2025.

- Innovation Drivers: Digital transformation, AI adoption, cloud computing, business process optimization.

- Regulatory Frameworks: Vary across Southeast Asian nations; generally supportive of foreign investment but with nuances.

- M&A Activity: Significant, with total deal values exceeding xx Million (2019-2024).

- End-User Demographics: Growing middle class, increasing urbanization, and a rise in tech-savvy businesses are driving demand.

South-East Asia Consulting Services Market Dynamics & Trends

The South-East Asia consulting services market is experiencing robust growth, driven by several key factors. The region's rapidly expanding economies, coupled with increasing government spending on infrastructure and digitalization initiatives, are significant contributors. Technological disruptions, such as the widespread adoption of cloud computing, artificial intelligence, and big data analytics, are transforming business operations, fueling demand for consulting services. Changing consumer preferences, particularly amongst younger generations, are pushing businesses to adopt more agile and data-driven strategies. The competitive landscape is highly dynamic, with both global and regional players vying for market share through strategic acquisitions, technological advancements, and service diversification. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Regions & Segments in South-East Asia Consulting Services Market

Singapore holds the dominant position within the South-East Asia consulting services market, driven by its advanced economy, sophisticated infrastructure, and presence of multinational corporations. Indonesia and Thailand also demonstrate strong growth potential, fueled by expanding economies and government initiatives.

- By Service Type: IT & Digital Consulting shows the highest growth, driven by the region's rapid digital transformation.

- By End-user Industry: The Financial Services sector is a major contributor, closely followed by IT and Telecommunication.

- By Region: Singapore leads, followed by Indonesia and Thailand. The “Rest of South-East Asia” segment is also showing promising growth.

Key Drivers:

- Singapore: Strong economic fundamentals, advanced infrastructure, high concentration of MNCs.

- Indonesia: Large and growing economy, significant government investments in infrastructure.

- Thailand: Developing digital economy, increasing foreign investment.

South-East Asia Consulting Services Market Product Innovations

Recent product innovations focus on integrating advanced analytics, AI-powered solutions, and cloud-based platforms into consulting services. This enables clients to gain deeper insights, optimize operations, and accelerate digital transformation. These innovations provide competitive advantages by delivering more effective, efficient, and data-driven solutions. The market fit is strong, aligning with the growing demand for digital transformation services across various industries.

Report Scope & Segmentation Analysis

This report segments the South-East Asia consulting services market by service type (HR Consulting, Financial Consulting, IT & Digital Consulting, Strategy and Operations), end-user industry (Financial Services, Life Sciences and Healthcare, IT and Telecommunication, Government, Energy, Other End-user Industries), and region (Singapore, Indonesia, Thailand, Rest of South-East Asia). Each segment's growth projections, market size estimates, and competitive dynamics are analyzed in detail. The market size is projected to reach xx Million by 2033.

Key Drivers of South-East Asia Consulting Services Market Growth

The South-East Asia consulting services market is driven by several factors, including the region's rapid economic growth, increasing government investments in infrastructure and digitalization, rising demand for digital transformation services, and the growing adoption of advanced technologies such as AI and cloud computing. Furthermore, the increasing complexity of business operations and the need for specialized expertise are driving demand for professional consulting services.

Challenges in the South-East Asia Consulting Services Market Sector

Challenges include intense competition from both established players and new entrants, regulatory hurdles in some markets, skills shortages in certain specialized areas, and navigating diverse cultural and business environments across the region. Supply chain disruptions also impact the industry’s ability to provide timely and consistent services. These factors collectively impose constraints on the market's growth trajectory.

Emerging Opportunities in South-East Asia Consulting Services Market

Emerging opportunities lie in the growing demand for sustainable business practices, the rise of fintech and the expansion of the digital economy. Furthermore, there is increasing need for cybersecurity consulting and data analytics services. These provide significant potential for growth and innovation within the market.

Leading Players in the South-East Asia Consulting Services Market Market

- Deloitte Touche Tohmatsu Limited

- Wipro Technologies

- KPMG Consulting

- Accenture PLC

- Cognizant

- Boston Consulting Group

- Ernst & Young Global Limited

- Mercer Consulting

- A T Kearney Inc

- PricewaterhouseCoopers LLP

- Tata Consultancy Services

- McKinsey & Company

Key Developments in South-East Asia Consulting Services Market Industry

- June 2022: Accenture acquired Entropia, expanding its presence in Southeast Asia's experience-led transformation services market.

- March 2023: IBM Consulting launched a new Innovation Hub in the Philippines to cater to growing client demand for digital transformation and other services.

Future Outlook for South-East Asia Consulting Services Market Market

The South-East Asia consulting services market is poised for sustained growth, driven by continued economic expansion, technological advancements, and increasing demand for specialized expertise. Strategic investments in digital transformation, sustainability initiatives, and expanding into new markets will be key to success for companies in this dynamic sector. The market is expected to reach xx Million by 2033, offering significant opportunities for both established and emerging players.

South-East Asia Consulting Services Market Segmentation

-

1. Service Type

- 1.1. HR Consulting

- 1.2. Financial Consulting

- 1.3. IT and Digital Consulting

- 1.4. Strategy and Operations

-

2. End-user Industry

- 2.1. Financial Services

- 2.2. Life Sciences and Healthcare

- 2.3. IT and Telecommunication

- 2.4. Government

- 2.5. Energy and Utilities

- 2.6. Other End-user Industries

South-East Asia Consulting Services Market Segmentation By Geography

-

1. South East Asia

- 1.1. Indonesia

- 1.2. Malaysia

- 1.3. Singapore

- 1.4. Thailand

- 1.5. Vietnam

- 1.6. Philippines

- 1.7. Myanmar

- 1.8. Cambodia

- 1.9. Laos

South-East Asia Consulting Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-User Domain

- 3.3. Market Restrains

- 3.3.1. Shift in the Consulting Marketplace

- 3.4. Market Trends

- 3.4.1. Financial Advisory to Witness the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. HR Consulting

- 5.1.2. Financial Consulting

- 5.1.3. IT and Digital Consulting

- 5.1.4. Strategy and Operations

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Financial Services

- 5.2.2. Life Sciences and Healthcare

- 5.2.3. IT and Telecommunication

- 5.2.4. Government

- 5.2.5. Energy and Utilities

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South East Asia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. China South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 8. India South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Deloitte Touche Tohmatsu Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Wipro Technologies

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 KPMG Consulting

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Accenture PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cognizant

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Boston Consulting Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ernst & Young Global Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Mercer Consulting

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 A T Kearney Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 PricewaterhouseCoopers LLP

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Tata Consultancy Services

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 McKinsey & Company

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Deloitte Touche Tohmatsu Limited

List of Figures

- Figure 1: South-East Asia Consulting Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South-East Asia Consulting Services Market Share (%) by Company 2024

List of Tables

- Table 1: South-East Asia Consulting Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South-East Asia Consulting Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: South-East Asia Consulting Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: South-East Asia Consulting Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South-East Asia Consulting Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South-East Asia Consulting Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: South-East Asia Consulting Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: South-East Asia Consulting Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Indonesia South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Malaysia South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Singapore South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Thailand South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Vietnam South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Philippines South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Myanmar South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Cambodia South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Laos South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South-East Asia Consulting Services Market?

The projected CAGR is approximately 11.28%.

2. Which companies are prominent players in the South-East Asia Consulting Services Market?

Key companies in the market include Deloitte Touche Tohmatsu Limited, Wipro Technologies, KPMG Consulting, Accenture PLC, Cognizant, Boston Consulting Group, Ernst & Young Global Limited, Mercer Consulting, A T Kearney Inc, PricewaterhouseCoopers LLP, Tata Consultancy Services, McKinsey & Company.

3. What are the main segments of the South-East Asia Consulting Services Market?

The market segments include Service Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-User Domain.

6. What are the notable trends driving market growth?

Financial Advisory to Witness the Highest Growth Rate.

7. Are there any restraints impacting market growth?

Shift in the Consulting Marketplace.

8. Can you provide examples of recent developments in the market?

March 2023: IBM Consulting doubled down on its dedication to South East Asia with the introduction of a new Innovation Hub in the Philippines. The primary aim of the Innovation Hub in Cebu City was to cater to the growing demand for IBM Consulting's clients in Japan on topics involving business processes, digital transformation, application management, hybrid cloud, supply chain, artificial intelligence, finance, and procurement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South-East Asia Consulting Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South-East Asia Consulting Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South-East Asia Consulting Services Market?

To stay informed about further developments, trends, and reports in the South-East Asia Consulting Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence