Key Insights

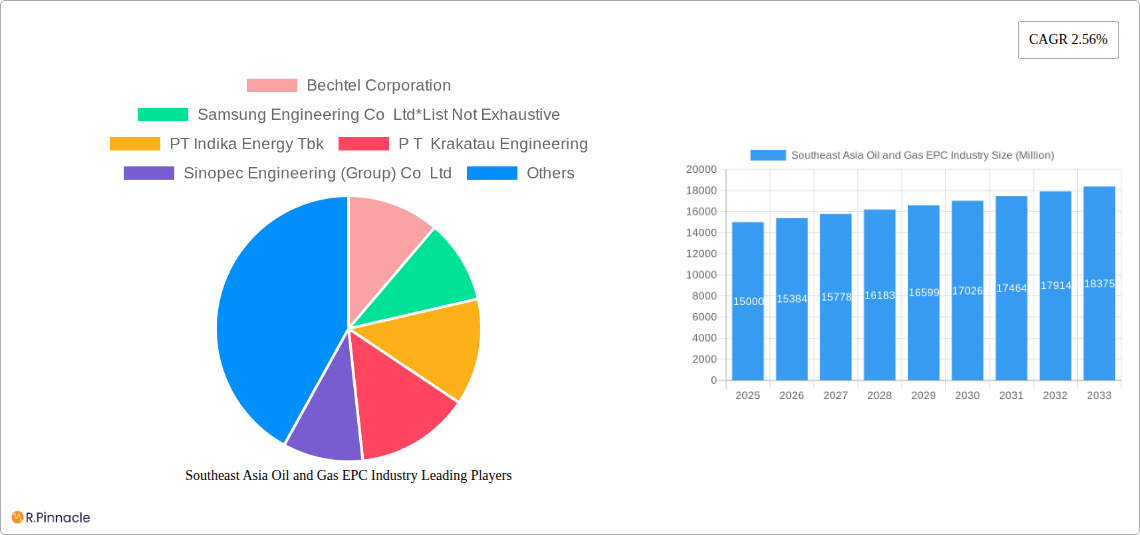

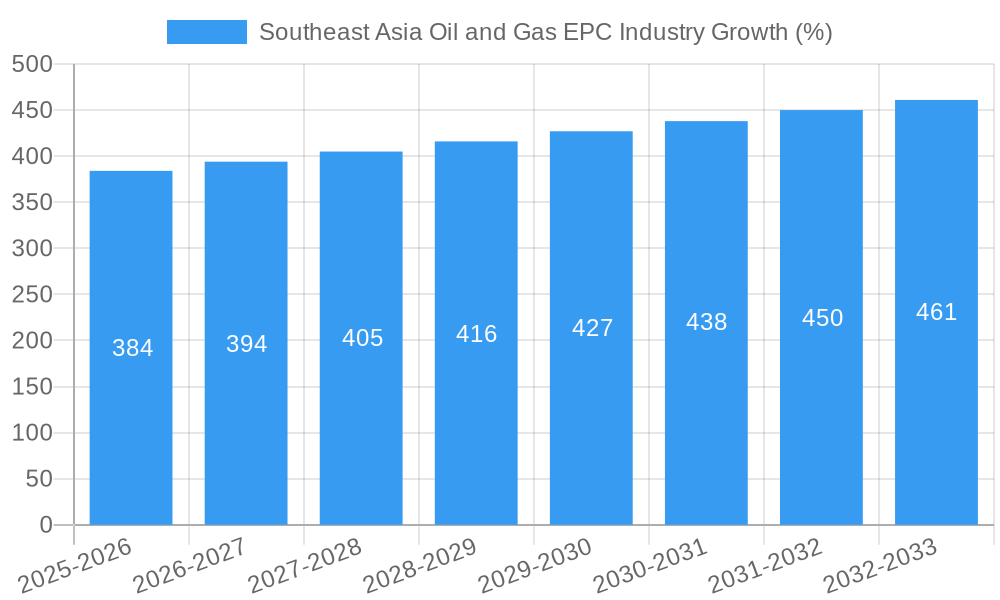

The Southeast Asia Oil and Gas Engineering, Procurement, and Construction (EPC) industry, currently experiencing a Compound Annual Growth Rate (CAGR) of 2.56%, presents a robust market opportunity. Driven by increasing energy demands across rapidly developing economies like China, India, and Indonesia, coupled with ongoing infrastructure development projects and significant investments in upstream and downstream activities, the market is projected to experience steady growth. Major players like Bechtel, Samsung Engineering, and Sinopec Engineering are actively participating, leveraging their expertise to capitalize on the region's extensive oil and gas reserves and expanding energy needs. While geopolitical uncertainties and fluctuating oil prices pose potential challenges, the long-term outlook remains positive due to the sustained commitment to energy security and diversification across Southeast Asia. The upstream sector, focusing on exploration and production, is expected to maintain a significant share of the market, supported by government initiatives to enhance domestic oil and gas production. However, the downstream sector, encompassing refining, processing, and distribution, is also projected to witness substantial growth as industrialization accelerates and energy consumption increases across the region. Competition among EPC companies is intense, emphasizing efficiency, cost-effectiveness, and technological innovation as crucial success factors.

Growth will be further fueled by government investments in renewable energy, alongside continued reliance on fossil fuels. This dynamic creates a unique opportunity for EPC companies to diversify their portfolios and become involved in projects ranging from conventional oil and gas infrastructure to renewable energy projects, potentially leading to increased market diversification and even higher growth rates than the current CAGR of 2.56% over the coming decade. This necessitates strategic partnerships and technological adaptation, allowing EPC companies to address the evolving landscape and maintain competitiveness. The market segmentation, while dominated by Upstream activities now, is likely to see increasing proportional growth in Midstream and Downstream segments due to the expansion of refining capacity and petrochemical projects in the region, attracting further investments and fueling industry development.

Southeast Asia Oil & Gas EPC Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Southeast Asia Oil & Gas Engineering, Procurement, and Construction (EPC) industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, key players, and future growth prospects. The report projects a xx Million market value in 2025, forecasting a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033.

Southeast Asia Oil and Gas EPC Industry Market Structure & Innovation Trends

The Southeast Asia Oil & Gas EPC market exhibits a moderately concentrated structure, with several multinational corporations and regional players vying for market share. Key players like Bechtel Corporation, Samsung Engineering Co Ltd, PT Indika Energy Tbk, P T Krakatau Engineering, Sinopec Engineering (Group) Co Ltd, PT Barata Indonesia (Persero), PT Meindo Elang Indah, Petrofac Limited, PT Rekayasa Industri, Saipem SpA, Fluor Corporation, John Wood Group PLC, PT JGC Indonesia, and TechnipFMC PLC dominate the landscape, although the exact market share of each company varies across upstream, midstream, and downstream segments.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the industry is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Stringent environmental regulations, the need for enhanced operational efficiency, and the push towards digitalization are driving innovation in EPC technologies.

- Regulatory Frameworks: Varying regulatory landscapes across Southeast Asian nations influence project timelines and investment decisions.

- Product Substitutes: Renewables and alternative energy sources pose a long-term challenge to the dominance of fossil fuels, impacting future EPC demand.

- End-User Demographics: The demand for oil and gas is heavily influenced by population growth, industrialization, and economic activity across the region.

- M&A Activities: Recent M&A activity in the region has involved deals valued at approximately xx Million in the past 5 years, largely focused on consolidating market share and gaining access to specific expertise.

Southeast Asia Oil and Gas EPC Industry Market Dynamics & Trends

The Southeast Asia Oil & Gas EPC market is experiencing dynamic shifts driven by several factors. Sustained economic growth in many Southeast Asian nations is fueling energy demand, leading to increased investment in upstream exploration and production projects. Technological advancements, such as improved drilling techniques and digitalization of project management, are enhancing operational efficiency and reducing costs. However, fluctuating oil and gas prices create uncertainty and influence investment decisions. The growing emphasis on environmental sustainability is driving a shift towards cleaner energy sources and more environmentally friendly EPC practices. Furthermore, intense competition among EPC players necessitates continuous innovation and optimization of project delivery models. The market is also witnessing a rise in the adoption of modular construction and fabrication to reduce project execution time and costs. These factors collectively contribute to the market's overall growth trajectory, although the pace of expansion can be affected by global economic conditions and geopolitical events. The market penetration of advanced technologies like AI and machine learning in project management is currently estimated at xx%.

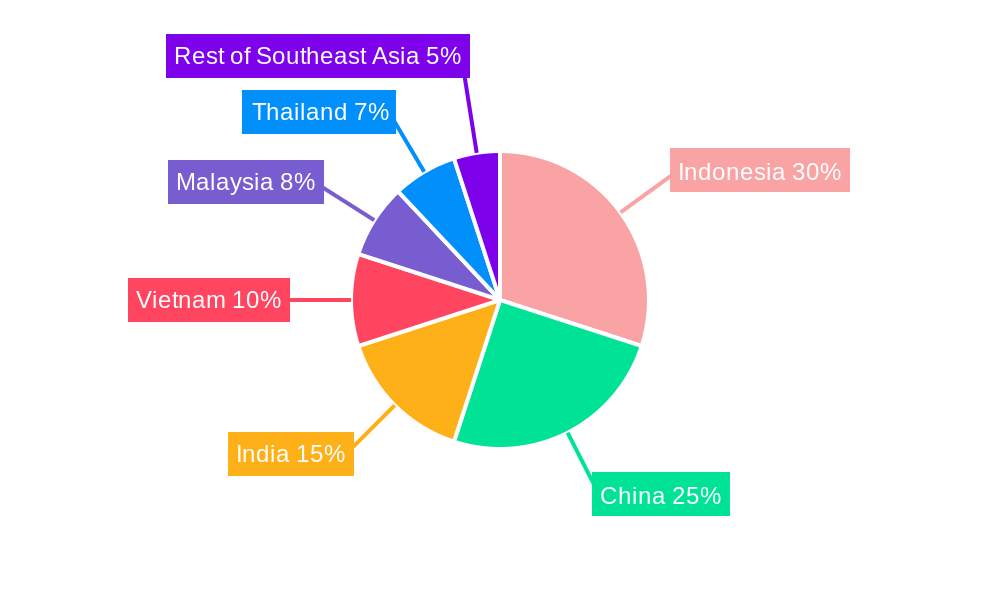

Dominant Regions & Segments in Southeast Asia Oil and Gas EPC Industry

The Southeast Asia Oil & Gas EPC market displays regional variations in growth. Indonesia, Malaysia, and Vietnam emerge as leading nations within the region due to their significant oil and gas reserves, robust economic growth, and favorable government policies. Within the sector segmentation, the Upstream segment consistently holds the largest market share, largely due to substantial investments in exploration and production activities. This dominance is further reinforced by the expansion of oil and gas fields and the increasing demand for energy in the region.

- Key Drivers in Dominant Regions:

- Indonesia: Abundant reserves, government initiatives supporting energy infrastructure development.

- Malaysia: Established oil and gas industry, strong investor confidence.

- Vietnam: Growing energy demand, increasing investments in offshore oil and gas exploration.

- Upstream Dominance: High investments in exploration and production, expansion of existing fields, and substantial reserves drive the dominance of the upstream segment.

Southeast Asia Oil and Gas EPC Industry Product Innovations

Recent product innovations within the Southeast Asia Oil & Gas EPC sector focus on enhancing efficiency, safety, and environmental sustainability. This includes the adoption of advanced technologies such as digital twins for project planning and management, the use of modular fabrication techniques for faster construction, and the development of environmentally friendly materials and construction methods. These innovations enable EPC companies to deliver projects more effectively, optimize costs, and meet evolving environmental regulations. Furthermore, the increased adoption of remote monitoring and control systems enhances the efficiency and reduces the risk associated with offshore operations.

Report Scope & Segmentation Analysis

This report segments the Southeast Asia Oil & Gas EPC market into three key sectors: Upstream, Midstream, and Downstream.

Upstream: The Upstream segment encompasses exploration, drilling, and production activities. This segment is projected to witness significant growth due to ongoing exploration efforts and investments in new projects. Competition in this segment is intense, with major international and regional EPC players vying for contracts. Market size is estimated at xx Million in 2025.

Midstream: This segment covers the transportation and storage of oil and gas. This segment is experiencing growth driven by investments in pipelines, storage facilities, and liquefied natural gas (LNG) infrastructure. Market size in 2025 is estimated at xx Million.

Downstream: The Downstream sector comprises refining, petrochemicals, and marketing of oil and gas products. Market growth is influenced by evolving fuel standards and increasing petrochemical demand. The market size is projected to be xx Million in 2025.

Key Drivers of Southeast Asia Oil and Gas EPC Industry Growth

Several factors drive the growth of the Southeast Asia Oil & Gas EPC industry. The rising energy demand fueled by economic expansion and population growth creates a strong impetus for investment in new oil and gas infrastructure. Government policies supporting energy security and infrastructure development further encourage growth. Technological advancements, including automation and digitalization, enhance efficiency and reduce costs, contributing to the industry's attractiveness. Finally, the exploration of new oil and gas reserves adds another dimension to the growth trajectory.

Challenges in the Southeast Asia Oil and Gas EPC Industry Sector

The Southeast Asia Oil & Gas EPC industry faces various challenges. Fluctuating oil and gas prices create uncertainty, impacting investment decisions and project profitability. Geopolitical risks and regulatory complexities add further layers of difficulty. Supply chain disruptions, especially during the pandemic, highlighted the vulnerability of the industry. Intense competition among EPC firms and the increasing need to adopt sustainable practices pose further hurdles.

Emerging Opportunities in Southeast Asia Oil and Gas EPC Industry

Several opportunities are emerging for the Southeast Asia Oil & Gas EPC industry. The shift towards cleaner energy sources, such as natural gas and renewable energy, opens up new avenues for EPC firms. The growing adoption of digital technologies presents opportunities for companies to improve efficiency and project delivery. The development of new oil and gas fields and the expansion of existing infrastructure provide further growth prospects. Finally, regional cooperation in energy projects can unlock new opportunities for collaborations and partnerships.

Leading Players in the Southeast Asia Oil and Gas EPC Industry Market

- Bechtel Corporation

- Samsung Engineering Co Ltd

- PT Indika Energy Tbk

- P T Krakatau Engineering

- Sinopec Engineering (Group) Co Ltd

- PT Barata Indonesia (Persero)

- PT Meindo Elang Indah

- Petrofac Limited

- PT Rekayasa Industri

- Saipem SpA

- Fluor Corporation

- John Wood Group PLC

- PT JGC Indonesia

- TechnipFMC PLC

Key Developments in Southeast Asia Oil and Gas EPC Industry

- August 2021: Hyundai Engineering Co. secured a USD 256 Million contract to revamp IRPC Pcl's refinery in Thailand, boosting cleaner fuel production.

- 2020: The Indonesia Deepwater Development project, involving Chevron, Pertamina, Eni Indonesia, and Sinopec, commenced, encompassing extensive pipeline and subsea infrastructure development.

Future Outlook for Southeast Asia Oil and Gas EPC Industry Market

The Southeast Asia Oil & Gas EPC market holds substantial potential for future growth, driven by persistent energy demand and ongoing investments in infrastructure development. The strategic adoption of digital technologies and sustainable practices will be critical for industry players to remain competitive. The exploration of new energy resources and regional collaborations will further shape the market's trajectory. However, the industry must navigate fluctuating oil and gas prices and geopolitical uncertainties to fully realize its potential.

Southeast Asia Oil and Gas EPC Industry Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

-

2. Geography

- 2.1. Indonesia

- 2.2. Malaysia

- 2.3. Thailand

- 2.4. Rest of Southeast Asia

Southeast Asia Oil and Gas EPC Industry Segmentation By Geography

- 1. Indonesia

- 2. Malaysia

- 3. Thailand

- 4. Rest of Southeast Asia

Southeast Asia Oil and Gas EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. The Downstream Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Indonesia

- 5.2.2. Malaysia

- 5.2.3. Thailand

- 5.2.4. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.3.2. Malaysia

- 5.3.3. Thailand

- 5.3.4. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Indonesia Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Indonesia

- 6.2.2. Malaysia

- 6.2.3. Thailand

- 6.2.4. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Malaysia Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Indonesia

- 7.2.2. Malaysia

- 7.2.3. Thailand

- 7.2.4. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Thailand Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Indonesia

- 8.2.2. Malaysia

- 8.2.3. Thailand

- 8.2.4. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Rest of Southeast Asia Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Indonesia

- 9.2.2. Malaysia

- 9.2.3. Thailand

- 9.2.4. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. China Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 11. Japan Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 12. India Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 15. Australia Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Bechtel Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Samsung Engineering Co Ltd*List Not Exhaustive

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 PT Indika Energy Tbk

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 P T Krakatau Engineering

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Sinopec Engineering (Group) Co Ltd

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 PT Barata Indonesia (Persero)

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 PT Meindo Elang Indah

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Petrofac Limited

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 PT Rekayasa Industri

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Saipem SpA

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Fluor Corporation

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 John Wood Group PLC

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 PT JGC Indonesia

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 TechnipFMC PLC

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.1 Bechtel Corporation

List of Figures

- Figure 1: Southeast Asia Oil and Gas EPC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Southeast Asia Oil and Gas EPC Industry Share (%) by Company 2024

List of Tables

- Table 1: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 14: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 17: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 20: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 23: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Oil and Gas EPC Industry?

The projected CAGR is approximately 2.56%.

2. Which companies are prominent players in the Southeast Asia Oil and Gas EPC Industry?

Key companies in the market include Bechtel Corporation, Samsung Engineering Co Ltd*List Not Exhaustive, PT Indika Energy Tbk, P T Krakatau Engineering, Sinopec Engineering (Group) Co Ltd, PT Barata Indonesia (Persero), PT Meindo Elang Indah, Petrofac Limited, PT Rekayasa Industri, Saipem SpA, Fluor Corporation, John Wood Group PLC, PT JGC Indonesia, TechnipFMC PLC.

3. What are the main segments of the Southeast Asia Oil and Gas EPC Industry?

The market segments include Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

The Downstream Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

In August 2021, Hyundai Engineering Co. won a USD 256 million order from Thailand's third-largest refiner, IRPC Pcl, to revamp its refinery with a total capacity of 215,000 barrels per day in Rayong. Hyundai Engineering Co. has to upgrade its refinery, allowing the Thai integrated petrochemical company to produce cleaner diesel of Euro V standard. The construction started in August 2021, and the refinery is expected to come into operation by 2024 with new facilities such as a Diesel Hydrotreating Unit (DHT) and upgraded existing plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Oil and Gas EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Oil and Gas EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Oil and Gas EPC Industry?

To stay informed about further developments, trends, and reports in the Southeast Asia Oil and Gas EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence