Key Insights

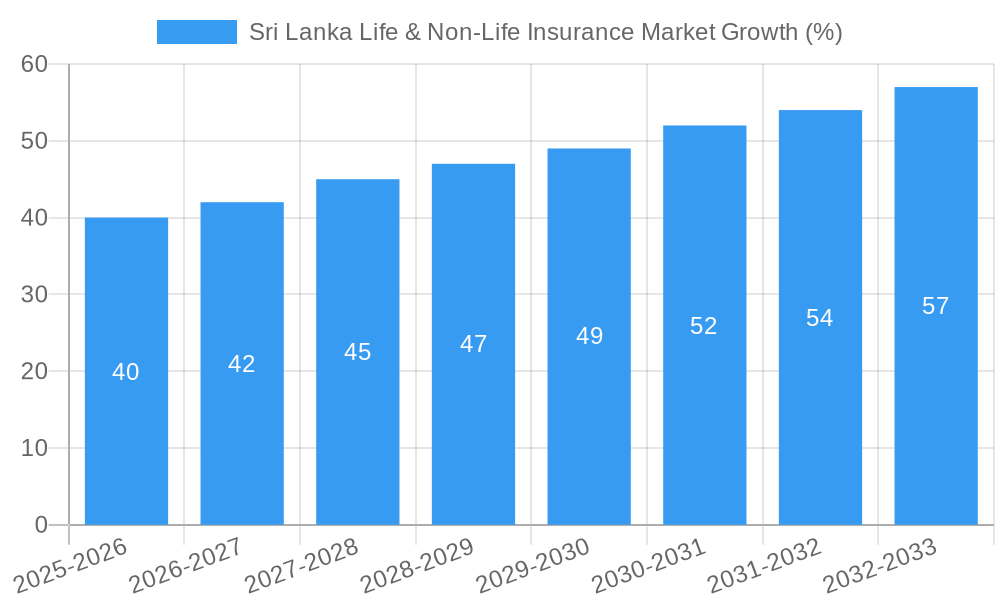

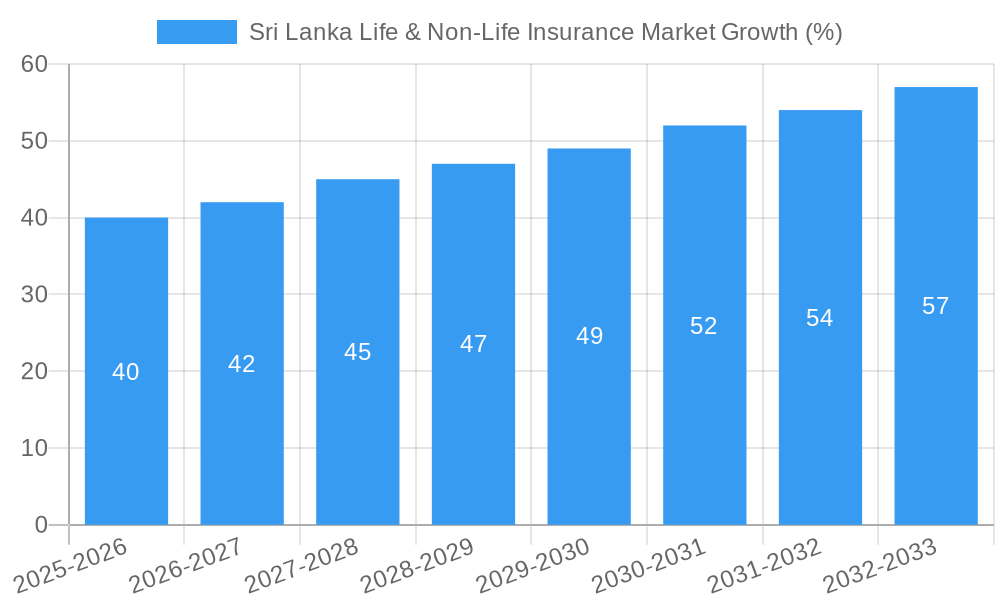

The Sri Lanka life and non-life insurance market, valued at $870 million in 2025, is projected to experience robust growth, driven by increasing health consciousness, rising disposable incomes, and government initiatives promoting financial inclusion. The market's Compound Annual Growth Rate (CAGR) of 4.53% from 2025 to 2033 indicates a steady expansion, with significant potential for further development. The life insurance segment, encompassing both individual and group policies, is expected to dominate the market share, fueled by a growing awareness of long-term financial security needs. Non-life insurance, including motor, property, and health insurance, will also contribute substantially, propelled by increasing vehicle ownership and a greater understanding of the importance of risk mitigation. Distribution channels are diverse, with a mix of direct sales, agency networks, bank partnerships, and other intermediaries playing crucial roles in market penetration. Key players like Ceylinco Insurance, AIA Insurance, and Sri Lanka Insurance are vying for market dominance through product innovation, digitalization, and expanding their distribution networks. While regulatory changes and economic volatility pose potential restraints, the overall outlook remains optimistic, suggesting considerable opportunities for growth and investment in this dynamic market.

The forecast period (2025-2033) anticipates consistent growth, primarily driven by factors such as increasing urbanization, improving literacy rates, and a growing middle class with enhanced purchasing power. Expansion into underserved rural areas, coupled with the introduction of innovative insurance products tailored to specific demographic needs, will further fuel market expansion. The competitive landscape is likely to intensify with both domestic and international players seeking to capture market share. Strategic partnerships, mergers and acquisitions, and technological advancements, including the adoption of InsurTech solutions, will shape the industry's future. A continued focus on enhancing customer experience, improving claim settlement processes, and fostering trust are crucial for long-term success within the Sri Lankan insurance sector.

Sri Lanka Life & Non-Life Insurance Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Sri Lanka life and non-life insurance market, offering valuable insights for industry professionals, investors, and strategic planners. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a detailed overview of market dynamics, trends, and future growth potential. The analysis includes granular segmentation by type (Life and Non-Life), distribution channel (Direct, Agency, Banks, Other), and key players including Ceylinco Insurance, Arpiko, AssetLine, Janashakthi Insurance, Allianz Insurance, Sri Lanka Insurance, Continental Insurance Lanka, AIA Insurance, Union Assurance, and MSBL Insurance (list not exhaustive).

Sri Lanka Life & Non-Life Insurance Market Structure & Innovation Trends

This section analyzes the Sri Lankan insurance market's competitive landscape, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activity. We delve into market share dynamics for key players, exploring the impact of M&A deals (with estimated values where available) on market structure and competition. The analysis covers the period from 2019 to 2024, incorporating observations on regulatory changes and their effects on innovation and product development. We will also identify key demographic trends influencing insurance demand. For example, the aging population might drive growth in specific life insurance segments, while increasing urbanization may impact the non-life insurance market. The estimated value of M&A deals in the period 2019-2024 is estimated at xx Million. The market share of the top 5 players in 2024 is estimated at xx%.

Sri Lanka Life & Non-Life Insurance Market Market Dynamics & Trends

This section explores the key factors driving market growth, technological disruptions, evolving consumer preferences, and competitive dynamics within the Sri Lankan life and non-life insurance sector. We will analyze the compound annual growth rate (CAGR) for both life and non-life insurance segments during the historical and forecast periods. Market penetration rates for different insurance products will be examined, along with an in-depth discussion of factors such as increasing consumer awareness, changing lifestyles, and the impact of government policies. Technological disruptions, such as the rise of Insurtech and digital distribution channels, will be analyzed in detail. Furthermore, the report will assess the competitive intensity within the market, including pricing strategies and product differentiation tactics employed by key players. The estimated CAGR for the life insurance market from 2025 to 2033 is projected at xx%, while the non-life insurance market is projected at xx%. Market penetration for life insurance in 2024 is estimated to be xx%, and for non-life insurance at xx%.

Dominant Regions & Segments in Sri Lanka Life & Non-Life Insurance Market

This section identifies the leading regions and segments within the Sri Lankan life and non-life insurance market. Detailed dominance analysis will be provided for each segment (Life Insurance, Non-Life Insurance, Direct, Agency, Banks, and Other Distribution Channels). Key drivers of dominance will be outlined using bullet points and include factors such as:

- Economic Policies: Government initiatives impacting insurance penetration and investment.

- Infrastructure Development: Impact of infrastructure on distribution networks and accessibility.

- Demographic Trends: Age, income distribution, and urbanization patterns influencing insurance demand.

- Competitive Landscape: Market share and strategies of dominant players in each segment.

We will analyze the relative performance of different regions within the country, identifying factors contributing to regional variations in insurance penetration and market growth. The Western Province is expected to remain the dominant region, driven by higher income levels and increased urbanization.

Sri Lanka Life & Non-Life Insurance Market Product Innovations

This section summarizes recent product developments, their applications, and competitive advantages. We will highlight technological trends driving product innovation, analyzing the market fit of new offerings and their impact on consumer behavior. Key aspects covered will include the introduction of innovative insurance products tailored to specific market segments and the adoption of technology to enhance customer experience and operational efficiency. The increasing use of digital platforms for insurance sales and service is a key trend to be highlighted.

Report Scope & Segmentation Analysis

This report comprehensively segments the Sri Lanka life and non-life insurance market by:

- By Type: Life Insurance (Growth projections, market size, competitive dynamics)

- Group: Non-Life Insurance (Growth projections, market size, competitive dynamics)

- By Distribution Channel: Direct (Growth projections, market size, competitive dynamics), Agency (Growth projections, market size, competitive dynamics), Banks (Growth projections, market size, competitive dynamics), Other Distribution Channels (Growth projections, market size, competitive dynamics).

Each segment's analysis will include growth projections, market size estimations, and an assessment of the competitive dynamics at play.

Key Drivers of Sri Lanka Life & Non-Life Insurance Market Growth

The growth of the Sri Lanka life and non-life insurance market is propelled by several key factors:

- Rising disposable incomes: Increased purchasing power fuels demand for insurance products.

- Government regulations and initiatives: Supportive policies promote market expansion.

- Technological advancements: Insurtech solutions enhance efficiency and accessibility.

- Growing awareness of risk management: Increased understanding of insurance benefits.

Challenges in the Sri Lanka Life & Non-Life Insurance Market Sector

The Sri Lanka insurance market faces several challenges:

- Economic volatility: Macroeconomic instability impacts consumer spending and insurance uptake.

- Regulatory complexities: Bureaucratic hurdles hinder market growth and efficiency.

- Competition from informal insurance providers: Unregulated players pose a threat to formal insurers.

- Limited financial literacy: Lack of awareness about insurance benefits restricts market penetration. The estimated impact of these challenges on market growth in 2024 is estimated to be a reduction of xx Million.

Emerging Opportunities in Sri Lanka Life & Non-Life Insurance Market

The Sri Lankan insurance market presents several emerging opportunities:

- Growth of the microinsurance sector: Expanding access to insurance for low-income populations.

- Adoption of digital technologies: Leveraging Insurtech for product innovation and improved customer service.

- Focus on niche segments: Targeting specific demographic groups with tailored insurance solutions.

- Expansion into underserved regions: Reaching untapped markets within Sri Lanka.

Leading Players in the Sri Lanka Life & Non-Life Insurance Market Market

- Ceylinco Insurance

- Arpiko

- AssetLine

- Janashakthi Insurance

- Allianz Insurance

- Sri Lanka Insurance

- Continental Insurance Lanka

- AIA Insurance

- Union Assurance

- MSBL Insurance

Key Developments in Sri Lanka Life & Non-Life Insurance Market Industry

- March 2023: Sri Lanka Insurance partnered with SLIM Agrisaviya to launch the CABE program, fostering agricultural entrepreneurship and potentially expanding the agricultural insurance market.

- January 2022: Ceylinco General Insurance introduced ‘Drive Thru Claims,’ improving claim settlement speed and customer convenience, enhancing its competitive position.

Future Outlook for Sri Lanka Life & Non-Life Insurance Market Market

The Sri Lanka life and non-life insurance market is poised for robust growth, driven by factors such as rising incomes, supportive government policies, and technological advancements. Opportunities exist in expanding insurance penetration, particularly in underserved segments, and leveraging digital technologies to enhance efficiency and customer experience. The market is expected to witness increased competition, with players focusing on innovation and product differentiation to attract and retain customers. The long-term outlook remains positive, indicating significant potential for market expansion and investment in the coming years.

Sri Lanka Life & Non-Life Insurance Market Segmentation

-

1. Type

-

1.1. Life Insurances

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurances

- 1.2.1. Motor

- 1.2.2. Home

- 1.2.3. Other Non-Life Insurance

-

1.1. Life Insurances

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Sri Lanka Life & Non-Life Insurance Market Segmentation By Geography

- 1. Sri Lanka

Sri Lanka Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Rising Digital Personalization in Life and Non-Life Insurance at Sri Lanka

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sri Lanka Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Life Insurances

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurances

- 5.1.2.1. Motor

- 5.1.2.2. Home

- 5.1.2.3. Other Non-Life Insurance

- 5.1.1. Life Insurances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sri Lanka

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Sri Lanka Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Sri Lanka Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8. India Sri Lanka Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Sri Lanka Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Sri Lanka Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Sri Lanka Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Sri Lanka Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Ceylinco Insurance

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Arpiko

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 AssetLine

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Janashakthi Insurance

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Allianz Insurance

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Sri Lanka Insurance

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Continental Insurance Lanka**List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 AIA Insurance

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Union Assurance

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 MSBL Insurance

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Ceylinco Insurance

List of Figures

- Figure 1: Sri Lanka Life & Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sri Lanka Life & Non-Life Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Sri Lanka Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Sri Lanka Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Sri Lanka Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Sri Lanka Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Sri Lanka Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Sri Lanka Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Sri Lanka Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sri Lanka Life & Non-Life Insurance Market?

The projected CAGR is approximately 4.53%.

2. Which companies are prominent players in the Sri Lanka Life & Non-Life Insurance Market?

Key companies in the market include Ceylinco Insurance, Arpiko, AssetLine, Janashakthi Insurance, Allianz Insurance, Sri Lanka Insurance, Continental Insurance Lanka**List Not Exhaustive, AIA Insurance, Union Assurance, MSBL Insurance.

3. What are the main segments of the Sri Lanka Life & Non-Life Insurance Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Rising Digital Personalization in Life and Non-Life Insurance at Sri Lanka.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

March 2023: Sri Lanka Insurance partnered with SLIM Agrisaviya to nurture the agriculture sector. The Certificate in Agri-Business and Entrepreneurship (CABE) program is a first-of-its-kind qualification available in Sri Lanka to transform farmers into “Agriprenuers.”

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sri Lanka Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sri Lanka Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sri Lanka Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Sri Lanka Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence