Key Insights

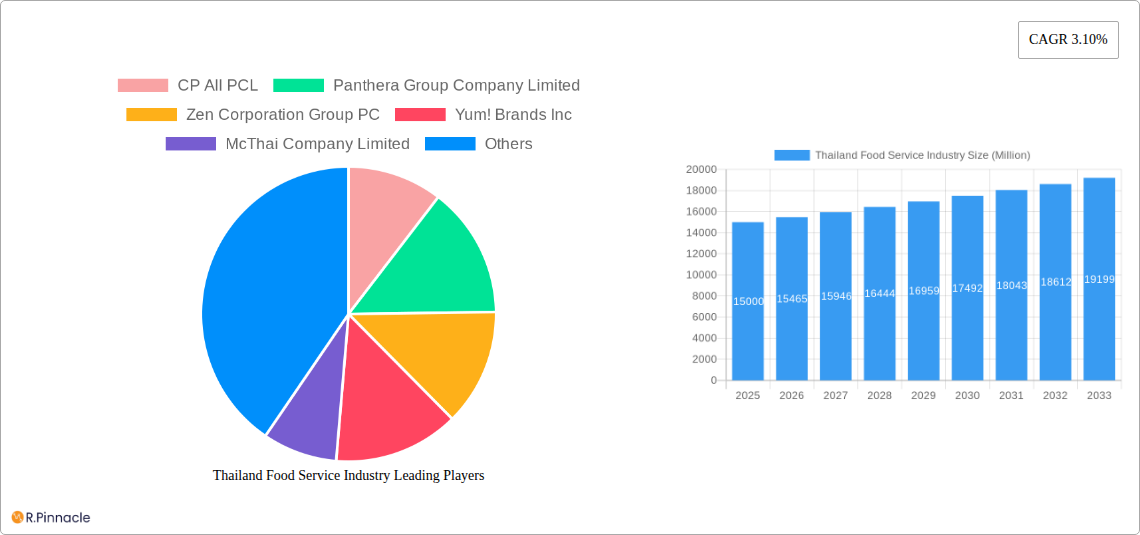

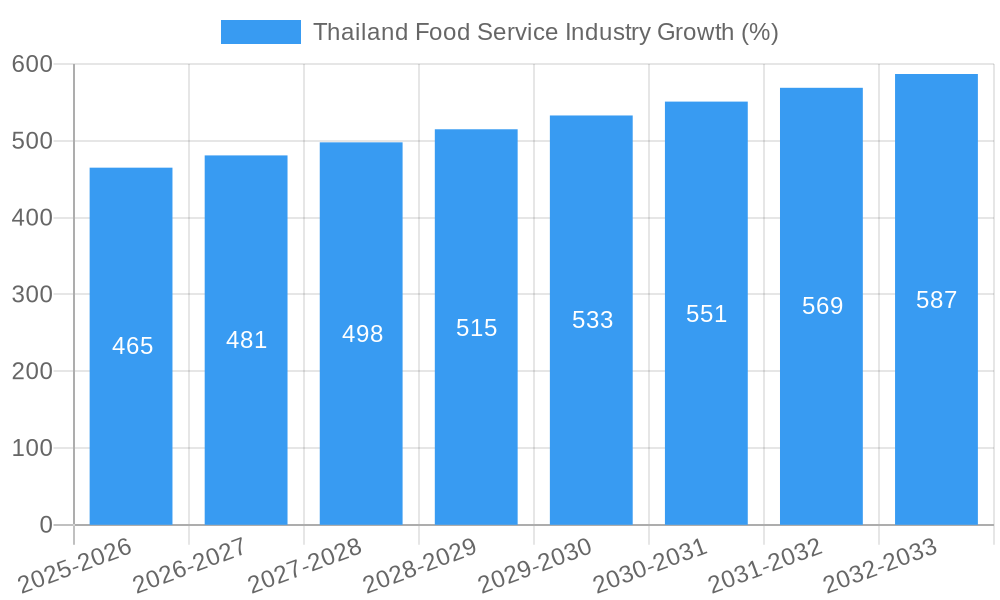

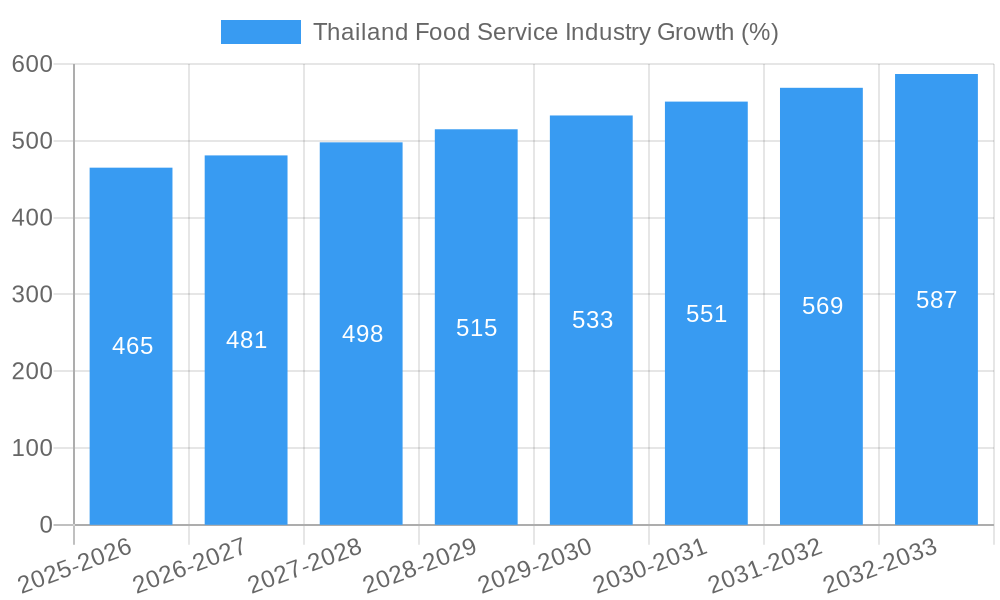

The Thailand food service industry, encompassing cafes, bars, quick-service restaurants (QSRs), and other culinary establishments, presents a dynamic market landscape. Driven by rising disposable incomes, a burgeoning tourism sector, and evolving consumer preferences towards diverse dining experiences, the industry exhibits a steady growth trajectory. The 3.10% CAGR (Compound Annual Growth Rate) indicates consistent expansion, projected to continue through 2033. Key segments contributing to this growth include chained outlets, leveraging brand recognition and operational efficiency, and the diverse "Other QSR Cuisines" segment reflecting the increasing popularity of international and fusion food options. The flourishing tourism sector strongly influences the "Leisure" and "Lodging" location segments, while standalone restaurants and retail locations maintain consistent demand. Competitive pressures stem from the presence of established international players like Yum! Brands Inc. alongside significant domestic companies like CP All PCL and MK Restaurant Group Public Company Limited. These domestic players possess deep market understanding and strong local brand recognition, providing a substantial challenge to international entrants. The industry also faces challenges related to fluctuating raw material costs and maintaining operational efficiency amidst increasing labor costs. Growth opportunities lie in expanding to underserved regions, leveraging digital marketing and delivery platforms to enhance customer reach, and focusing on innovation and customization to cater to increasingly sophisticated consumer palates. The diverse range of segments within the market provides opportunities for specialized players to target niche consumer segments and develop focused business models.

The significant presence of large corporations, alongside numerous smaller independent outlets, indicates a market with both established players and room for smaller businesses to thrive. The market’s success hinges on adapting to changing consumer preferences, incorporating technological advancements for improved operational efficiency and customer engagement, and responding effectively to fluctuations in raw material pricing and labor costs. Future success will likely be determined by the ability to navigate these challenges and effectively capitalize on the growth opportunities presented by Thailand's vibrant and evolving food culture. Expansion into new geographic locations and the strategic adoption of digital technologies will also be key factors driving growth within the industry.

Thailand Food Service Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Thailand food service industry, offering invaluable insights for industry professionals, investors, and strategic planners. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamic landscape, highlighting key trends, challenges, and opportunities. The report leverages extensive data analysis to project a market valued at xx Million by 2033, providing actionable intelligence for informed decision-making.

Thailand Food Service Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of Thailand's food service industry, focusing on market concentration, innovation drivers, regulatory frameworks, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of large multinational corporations and smaller, independent players. Key players like CP All PCL and Minor International PCL hold significant market share, while emerging players continue to disrupt the market with innovative concepts and business models.

- Market Concentration: The top 5 players account for an estimated xx% of the market share in 2025. This concentration is expected to slightly increase by 2033 to xx%, driven by consolidation and expansion of larger chains.

- Innovation Drivers: Growing consumer demand for diverse cuisines, health-conscious options, and convenient food delivery services are major drivers of innovation. Technological advancements in food preparation, ordering, and delivery are further fueling this trend.

- Regulatory Framework: The government's regulations on food safety, hygiene, and licensing impact market operations. Changes in these regulations can create both opportunities and challenges for businesses.

- Product Substitutes: The rise of meal kit delivery services and home-cooked meals present competitive pressures for traditional food service businesses.

- End-User Demographics: The increasing young population and growing middle class with higher disposable incomes significantly contribute to the market's expansion.

- M&A Activities: Significant M&A activity was observed during the historical period (2019-2024), with deal values totaling approximately xx Million. This trend is expected to continue, albeit at a slower pace, during the forecast period. Examples include the acquisition of [Company A] by [Company B] for xx Million in [Year].

Thailand Food Service Industry Market Dynamics & Trends

This section delves into the market dynamics and trends shaping the Thailand food service industry. It explores the factors influencing market growth, technological disruptions, evolving consumer preferences, and the competitive landscape.

The Thai food service industry is experiencing robust growth, propelled by factors such as rising disposable incomes, increasing urbanization, and a burgeoning tourism sector. The market’s Compound Annual Growth Rate (CAGR) is estimated to be xx% during the forecast period (2025-2033). Technological advancements, such as online ordering platforms and mobile payment systems, are significantly impacting market dynamics. Consumer preferences are shifting towards healthier options, diverse cuisines, and convenient delivery services. The competitive landscape is dynamic, with both established players and new entrants vying for market share. Market penetration of online food delivery services is anticipated to reach xx% by 2033. These trends are reshaping business strategies and driving innovation across the sector.

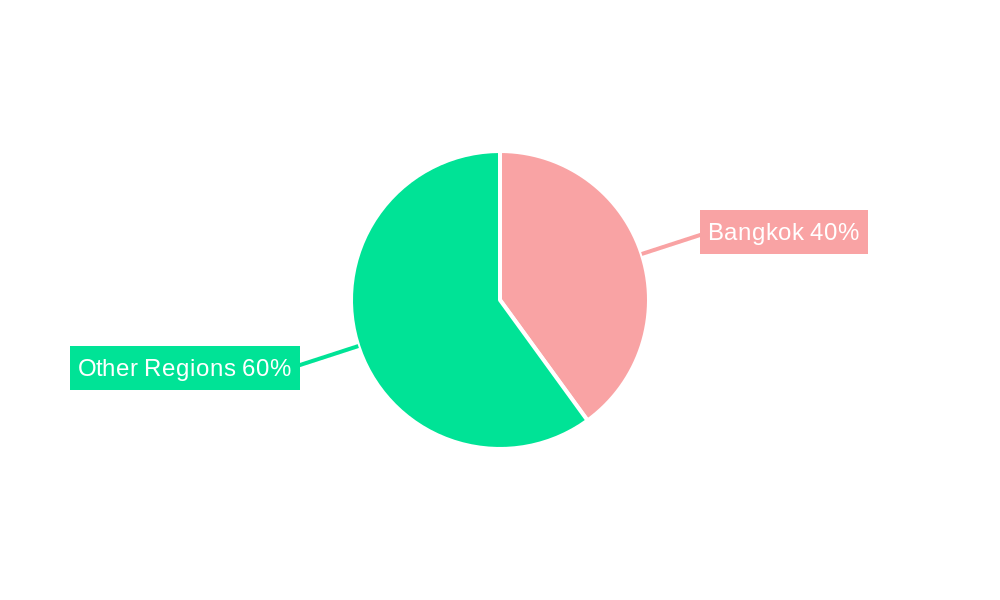

Dominant Regions & Segments in Thailand Food Service Industry

This section identifies the leading regions and segments within the Thailand food service industry, analyzing their market share and growth drivers.

Dominant Segments:

- Foodservice Type: The QSR (Quick Service Restaurant) segment, particularly Other QSR Cuisines, dominates the market due to its affordability and convenience. Cafes & Bars also show significant growth driven by increasing demand for social and leisure activities.

- Outlet: Chained Outlets hold a larger market share compared to independent outlets, benefiting from economies of scale and brand recognition. However, independent outlets maintain a presence, catering to niche markets and local preferences.

- Location: Retail locations account for a considerable share due to high foot traffic and accessibility. Growth in the travel and leisure segments is tied to tourism numbers. Standalone and lodging locations also contribute significantly.

Key Drivers:

- Economic Policies: Government initiatives promoting tourism and investment in the food service sector positively impact market growth.

- Infrastructure Development: Improved transportation networks and rising urban populations facilitate the expansion of food service outlets.

The Bangkok Metropolitan Region (BMR) remains the dominant region, owing to its high population density, strong economic activity, and vibrant tourism sector. However, other regions are witnessing increasing growth as infrastructure improves and disposable incomes rise.

Thailand Food Service Industry Product Innovations

The food service industry in Thailand is witnessing continuous product innovation, driven by evolving consumer demands and technological advancements. This includes the introduction of healthier menu options, diverse cuisines, and convenient meal solutions. Technological innovations are enabling personalized experiences, automated ordering systems, and improved efficiency in food preparation and delivery. These innovations are enhancing customer satisfaction and improving operational efficiency, leading to a competitive advantage for businesses adopting them.

Report Scope & Segmentation Analysis

This report comprehensively segments the Thailand food service industry across several parameters:

Foodservice Type: Cafes & Bars, Other QSR Cuisines. The QSR segment is projected to experience significant growth, driven by increasing demand for fast and affordable meals. Cafes & Bars are also projected for substantial growth due to changing consumer preferences for social experiences.

Outlet: Chained Outlets and Independent Outlets. Chained outlets are expected to maintain a larger market share due to brand recognition and economies of scale. Independent outlets, however, will continue to thrive by focusing on unique offerings and local preferences.

Location: Leisure, Lodging, Retail, Standalone, and Travel. Retail locations will continue to dominate due to their high visibility and accessibility. However, the Travel segment's growth will closely follow the rise in tourism.

Each segment presents unique growth projections and competitive dynamics reflecting market opportunities and potential threats.

Key Drivers of Thailand Food Service Industry Growth

Several factors fuel the growth of Thailand's food service industry. The rising disposable income of the growing middle class significantly boosts spending on dining experiences. A thriving tourism sector brings a continuous influx of international visitors, creating high demand. Technological advancements, such as online ordering platforms and food delivery apps, enhance accessibility and convenience. Government support through favorable policies and infrastructure development further contributes to the sector's expansion.

Challenges in the Thailand Food Service Industry Sector

The Thailand food service industry faces several challenges. Fluctuating raw material prices impact profitability, while labor shortages increase operational costs. Maintaining high food safety standards amidst increasing competition is crucial. Competition from new entrants and established players demands constant innovation and adaptability. The increasing popularity of meal delivery services presents a threat to traditional sit-down restaurants. These challenges require businesses to adopt efficient strategies and manage costs effectively.

Emerging Opportunities in Thailand Food Service Industry

The industry presents significant opportunities. The growing demand for healthy and organic options creates a market for specialized restaurants. Technological advancements in food processing and delivery methods improve service efficiency. The rise of ghost kitchens and cloud kitchens allows businesses to reduce overhead costs and expand their reach. Catering to the increasing demand for unique and personalized dining experiences allows for the creation of new and highly successful foodservice models.

Leading Players in the Thailand Food Service Industry Market

- CP All PCL

- Panthera Group Company Limited

- Zen Corporation Group PC

- Yum! Brands Inc

- McThai Company Limited

- Thai Beverage PCL

- MK Restaurant Group Public Company Limited

- Global Franchise Architects Company Limited

- Central Plaza Hotel Public Company Limited

- Food Capitals Public Company Limited

- Minor International PCL

- Maxim's Caterers Limited

- PTT Public Company Limited

Key Developments in Thailand Food Service Industry Industry

- April 2022: Thai Beverage PCL launched "Oishi Biztoro," a hybrid Japanese restaurant offering fast food and full-service dining, expanding its market reach and diversifying its offerings.

- July 2021: A&W Thailand's partnership with 7-Eleven to launch waffle products signifies a strategic move towards retail channel expansion and diversification.

- April 2021: MK Restaurant Group's opening of its first MK Gold restaurant in Chiang Mai indicates a premium market segment expansion strategy.

Future Outlook for Thailand Food Service Industry Market

The Thailand food service industry shows significant growth potential. Continued economic growth, increasing urbanization, and a burgeoning tourism sector will fuel demand. The adoption of technology, innovative business models, and diversification of offerings will shape the industry's future. Focusing on healthy options and adapting to changing consumer preferences are crucial for success. The market is expected to experience consistent growth, presenting numerous opportunities for businesses to expand and thrive.

Thailand Food Service Industry Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Thailand Food Service Industry Segmentation By Geography

- 1. Thailand

Thailand Food Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness and Extensive Promotions for Differentiated Food Ingredients; Favorable Regulatory Framework

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Flavonoids

- 3.4. Market Trends

- 3.4.1. The rise in veganism and vegetarianism in the country led to the expansion of plant-based menu options

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CP All PCL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Panthera Group Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zen Corporation Group PC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yum! Brands Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 McThai Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thai Beverage PCL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MK Restaurant Group Public Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Global Franchise Architects Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Central Plaza Hotel Public Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Food Capitals Public Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Minor International PCL

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Maxim's Caterers Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 PTT Public Company Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 CP All PCL

List of Figures

- Figure 1: Thailand Food Service Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Food Service Industry Share (%) by Company 2024

List of Tables

- Table 1: Thailand Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Thailand Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Thailand Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Thailand Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Thailand Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Thailand Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 8: Thailand Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 9: Thailand Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 10: Thailand Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Food Service Industry?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the Thailand Food Service Industry?

Key companies in the market include CP All PCL, Panthera Group Company Limited, Zen Corporation Group PC, Yum! Brands Inc, McThai Company Limited, Thai Beverage PCL, MK Restaurant Group Public Company Limited, Global Franchise Architects Company Limited, Central Plaza Hotel Public Company Limited, Food Capitals Public Company Limited, Minor International PCL, Maxim's Caterers Limited, PTT Public Company Limited.

3. What are the main segments of the Thailand Food Service Industry?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Awareness and Extensive Promotions for Differentiated Food Ingredients; Favorable Regulatory Framework.

6. What are the notable trends driving market growth?

The rise in veganism and vegetarianism in the country led to the expansion of plant-based menu options.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Flavonoids.

8. Can you provide examples of recent developments in the market?

April 2022: Thai Beverage PCL launched a new brand, "Oishi Biztoro," which was developed as a 'hybrid' Japanese restaurant serving fast food and full service. The restaurant offers various popular and familiar Japanese dishes, divided into three main groups: "Ramen and Soba" Noodle Menu Group, "Donburi" Rice Menu Group, and Snacks Menu Group.July 2021: A&W Thailand partnered with 7-Eleven to launch three waffle products: Fish & Cheese Waffle, Grilled Teriyaki Chicken Waffle, and Spicy Chicken Waffle. This partnership is in response to the fast-food chain's shift toward packaged foods sold through the retail channel.April 2021: MK Restaurant Group opened its first MK Gold restaurant in Chiang Mai. It offers a premium dining experience with a wide range of menus.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Food Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Food Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Food Service Industry?

To stay informed about further developments, trends, and reports in the Thailand Food Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence