Key Insights

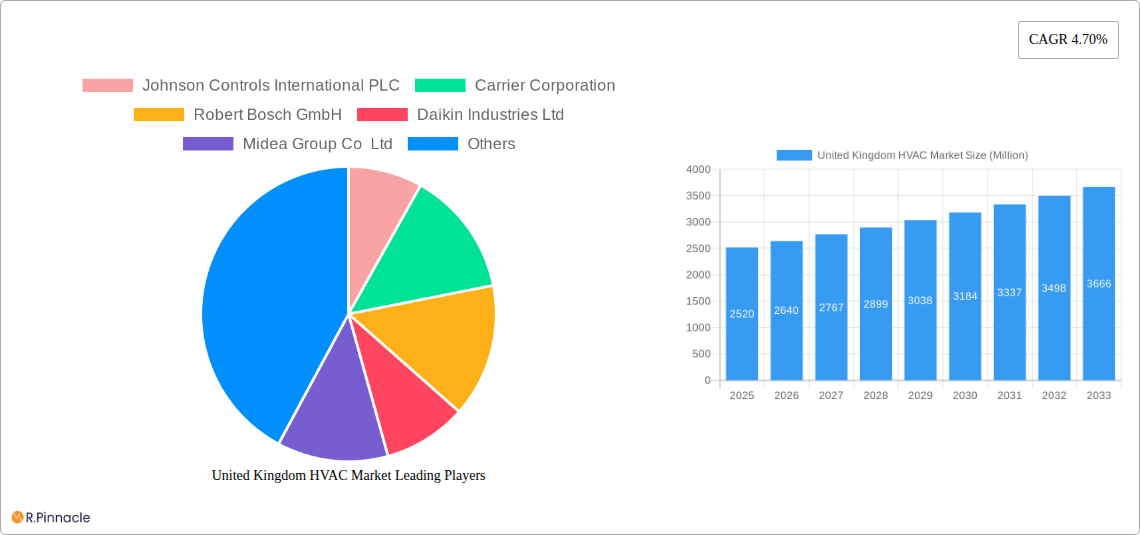

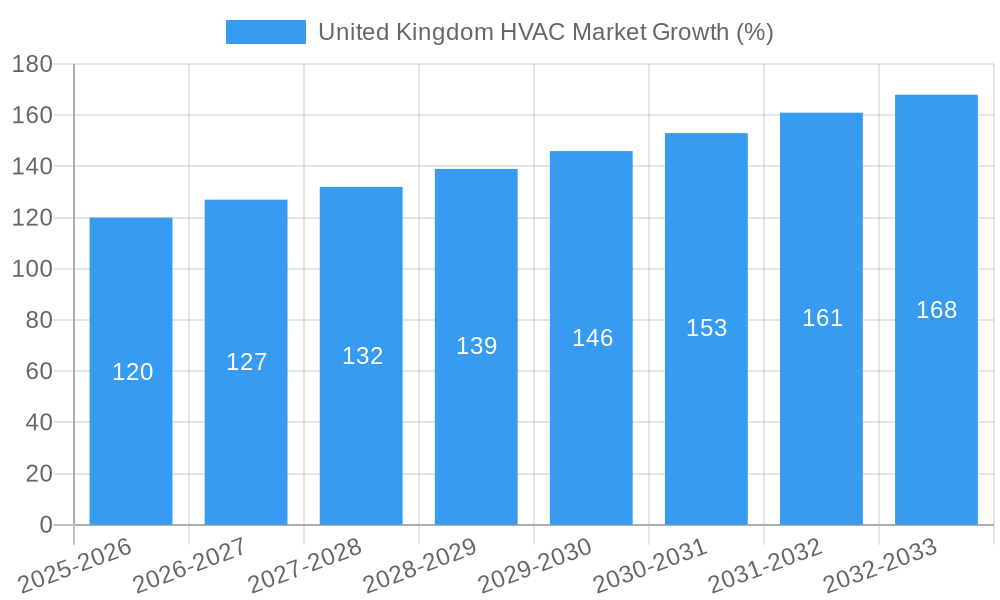

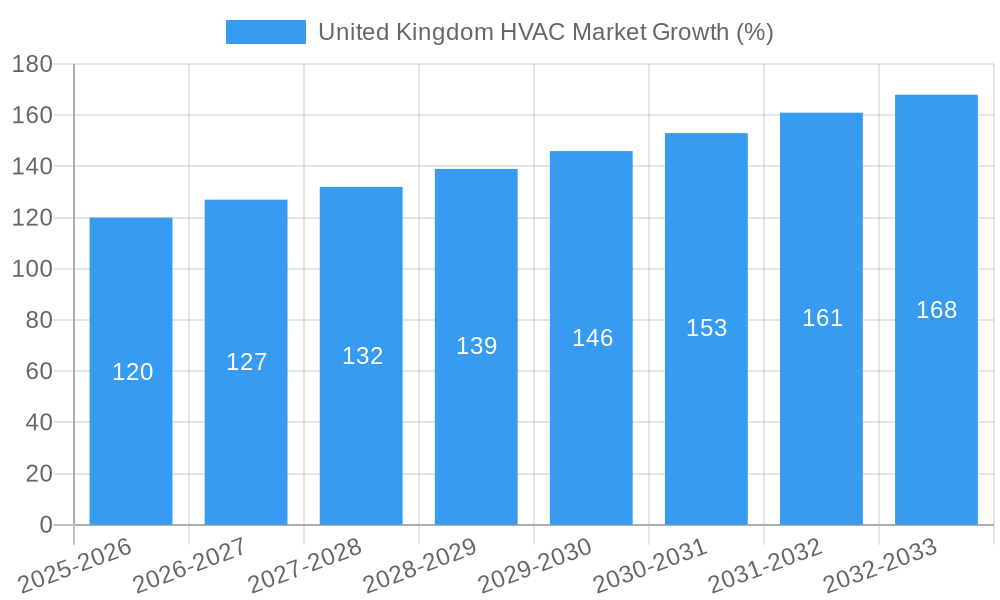

The United Kingdom HVAC market, valued at approximately £2.52 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for energy-efficient solutions, stringent government regulations aimed at reducing carbon emissions, and a growing focus on improving indoor air quality are significant contributors to this expansion. The market's growth is further fueled by rising construction activities, particularly in the commercial and residential sectors, necessitating advanced HVAC systems. Furthermore, technological advancements, such as the adoption of smart HVAC technologies and the integration of renewable energy sources, are enhancing system efficiency and appeal, leading to increased market penetration. This trend is expected to continue throughout the forecast period (2025-2033), with a compound annual growth rate (CAGR) of 4.70%.

However, the market faces certain challenges. Fluctuations in raw material prices, particularly for metals and refrigerants, can impact manufacturing costs and profitability. Supply chain disruptions, a global phenomenon, can also lead to project delays and impact overall market growth. Despite these potential restraints, the long-term outlook remains positive, driven by sustained demand for environmentally conscious and energy-efficient HVAC systems. Major players like Johnson Controls, Carrier, Bosch, Daikin, and Midea are actively shaping the market through innovation and strategic partnerships, driving market consolidation and competition. The focus on smart home technologies and building automation will likely propel the market towards increased sophistication and integration in the coming years. The UK's commitment to sustainable practices and energy-efficiency initiatives provides a supportive regulatory environment that encourages the market's growth and adoption of greener technologies.

United Kingdom HVAC Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the United Kingdom HVAC market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period. Market size is expressed in Millions throughout the report.

United Kingdom HVAC Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the UK HVAC market. We delve into market concentration, assessing the market share held by key players such as Johnson Controls International PLC, Carrier Corporation, Robert Bosch GmbH, Daikin Industries Ltd, Midea Group Co Ltd, System Air AB, LG Electronics Inc, BDR Thermea Group, Mitsubishi Electric Hydronics & IT Cooling Systems SpA, and Danfoss Inc. The report also examines M&A activities, including deal values and their impact on market dynamics. The analysis includes:

- Market Concentration: A detailed breakdown of market share held by major players, revealing the level of competition and dominance within specific segments. For example, Johnson Controls may hold xx% market share in the residential segment, while Daikin may lead in the commercial sector with xx%.

- Innovation Drivers: Examination of factors driving innovation, such as government regulations promoting energy efficiency, advancements in heat pump technology, and increasing demand for smart HVAC systems.

- Regulatory Frameworks: Analysis of relevant UK regulations, including building codes and energy efficiency standards, and their influence on market growth and technological adoption.

- Product Substitutes: Exploration of alternative technologies and their potential impact on the market, such as geothermal heating and district heating systems.

- End-User Demographics: Analysis of the end-user segments (residential, commercial, industrial) and their specific needs and preferences within the HVAC market.

- M&A Activities: Review of recent mergers and acquisitions in the UK HVAC sector, including deal values and their strategic implications for market consolidation. We estimate a total M&A deal value of approximately £xx Million in the period 2019-2024.

United Kingdom HVAC Market Market Dynamics & Trends

This section explores the key market dynamics influencing growth, including technological advancements, consumer preferences, and competitive pressures. We analyze the Compound Annual Growth Rate (CAGR) and market penetration rates for various segments, providing a clear picture of market evolution. Specific drivers and trends explored include:

- Market growth drivers are expected to include increasing demand for energy-efficient solutions, government incentives for renewable energy technologies, and rising concerns about climate change.

- Technological disruptions, such as the adoption of smart thermostats, IoT integration, and the increasing popularity of heat pumps, are also discussed.

- The analysis also focuses on evolving consumer preferences, including demand for improved indoor air quality and personalized comfort settings.

- Competitive dynamics are examined, focusing on strategies employed by major players, including product differentiation, pricing strategies, and expansion into new markets. The market is projected to reach xx Million by 2033, indicating a robust CAGR of xx%.

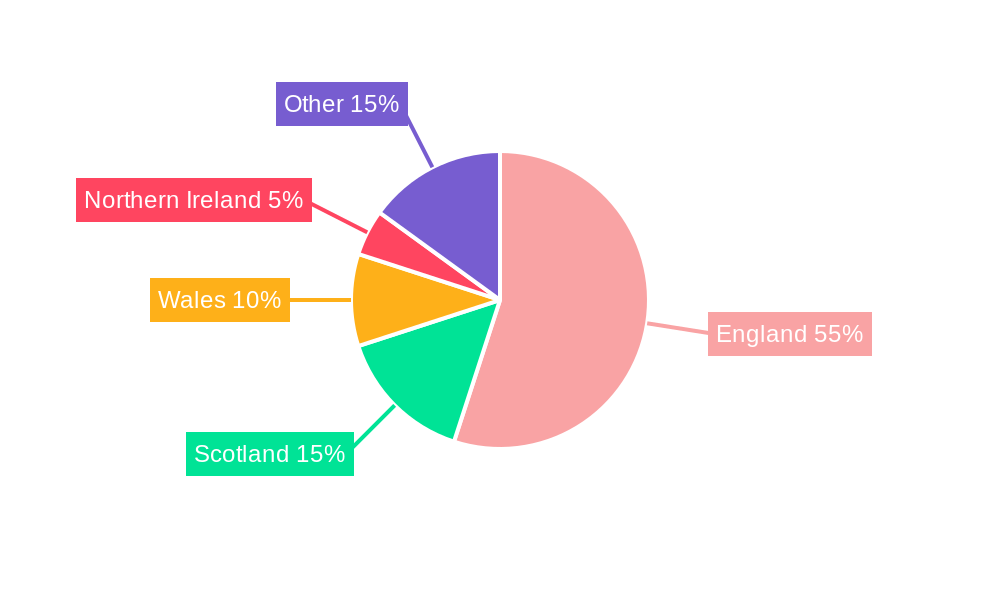

Dominant Regions & Segments in United Kingdom HVAC Market

This section identifies the leading regions and segments within the UK HVAC market. We analyze the factors driving dominance in these areas, providing a nuanced understanding of market geography and segment specific dynamics. Key drivers analyzed could include:

Leading Region/Segment: London and the South East are expected to dominate the market due to factors like high population density, commercial activity and higher disposable incomes. The commercial segment is predicted to show higher growth compared to the residential segment due to factors such as increasing focus on building energy efficiency.

Key Drivers: Bullet points highlighting specific factors driving regional and segmental dominance. For London, these could include robust construction activity, stringent building regulations, and high demand for modern, energy-efficient HVAC systems. For the commercial segment, these factors may be corporate sustainability initiatives, government regulations, and the need to optimize energy costs.

Strong economic activity and infrastructure development.

Government initiatives supporting energy efficiency upgrades.

High concentration of commercial buildings requiring HVAC solutions.

United Kingdom HVAC Market Product Innovations

This section summarizes recent product innovations, focusing on technological trends and their impact on market competitiveness. Examples include the increasing adoption of heat pump technology, smart HVAC systems, and integrated building management systems. The emphasis is on how these innovations improve energy efficiency, enhance control and comfort, and cater to evolving consumer demands. Advancements in air purification and filtration systems also contribute to the market’s innovation drive.

Report Scope & Segmentation Analysis

This section outlines the scope of the report and details the market segmentation used throughout the analysis. The market is segmented by:

- End-user: Residential, Commercial, Industrial. Each segment will have its own growth projections, market size estimates, and competitive landscape analysis. The commercial segment is expected to witness significant growth driven by ongoing construction and refurbishment projects and the stringent regulatory framework in place.

- Product type: Heat pumps, air conditioners, furnaces, ventilation systems. Each product type will have its own analysis. The growth of heat pumps is expected to outpace other product types due to growing awareness of environmental sustainability and government incentives.

- Technology: Smart HVAC systems, traditional HVAC systems. This segmentation will examine differences in pricing, adoption rates, and the competitive dynamics of different technologies.

Key Drivers of United Kingdom HVAC Market Growth

Several factors contribute to the growth of the UK HVAC market. These include:

- Stringent building regulations and energy efficiency standards promoting energy-efficient HVAC systems.

- Increasing awareness of environmental sustainability and the adoption of greener technologies, such as heat pumps.

- Government incentives and subsidies aimed at encouraging the adoption of renewable energy sources and efficient HVAC technologies.

- Growing demand for improved indoor air quality and personalized comfort, driving adoption of smart and advanced HVAC systems.

Challenges in the United Kingdom HVAC Market Sector

The UK HVAC market faces certain challenges:

- Supply chain disruptions and material cost fluctuations impacting manufacturing and project timelines. The impact could be quantified in terms of project delays and increased costs.

- Competition from established and emerging players creates pressure on pricing and profitability. We project a xx% decrease in average profit margins for key players by 2033 due to increased competition.

- Skilled labor shortages for installation and maintenance can hinder market growth. This challenge may cause delays in project completion and increased installation costs.

Emerging Opportunities in United Kingdom HVAC Market

The UK HVAC market offers several emerging opportunities:

- Growing demand for smart and connected HVAC systems creating opportunities for technological advancements and integration.

- Expanding adoption of renewable energy sources and integration with heat pumps providing opportunities for sustainable solutions.

- Focus on improving indoor air quality, particularly in the wake of the COVID-19 pandemic, opening doors for advanced filtration systems.

Leading Players in the United Kingdom HVAC Market Market

- Johnson Controls International PLC

- Carrier Corporation

- Robert Bosch GmbH

- Daikin Industries Ltd

- Midea Group Co Ltd

- System Air AB

- LG Electronics Inc

- BDR Thermea Group

- Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- Danfoss Inc

Key Developments in United Kingdom HVAC Market Industry

- April 2024: Johnson Controls launched the York YH5 15.2 SEER2 2-Stage heat pumps for residential use, offering improved energy efficiency (SEER2 of 16 and HSPF2 of 8).

- January 2024: Bosch Home Comfort Group introduced a new air-to-air heat pump designed for cold climate heating, expanding the market for heat pumps in regions with severe winters.

Future Outlook for United Kingdom HVAC Market Market

The UK HVAC market is poised for continued growth, driven by government policies promoting energy efficiency, increasing demand for sustainable solutions, and advancements in technology. Opportunities exist for companies to capitalize on the growth of heat pumps, smart HVAC systems, and improved indoor air quality solutions. The market is predicted to experience robust growth, with a focus on energy efficiency and sustainable solutions shaping the future of the industry.

United Kingdom HVAC Market Segmentation

-

1. Type of Component

-

1.1. HVAC Equipment

- 1.1.1. Heating Equipment

- 1.1.2. Air Conditioning/Ventilation Equipment

- 1.2. HVAC Services

-

1.1. HVAC Equipment

-

2. End-user Industry

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

United Kingdom HVAC Market Segmentation By Geography

- 1. United Kingdom

United Kingdom HVAC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand For Energy Efficient Devices; Increased Construction And Retrofit Activity To Aid Demand

- 3.3. Market Restrains

- 3.3.1. Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand For Energy Efficient Devices; Increased Construction And Retrofit Activity To Aid Demand

- 3.4. Market Trends

- 3.4.1. The Residential Sector is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom HVAC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 5.1.1. HVAC Equipment

- 5.1.1.1. Heating Equipment

- 5.1.1.2. Air Conditioning/Ventilation Equipment

- 5.1.2. HVAC Services

- 5.1.1. HVAC Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Johnson Controls International PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carrier Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Robert Bosch GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Daikin Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Midea Group Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 System Air AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LG Electronics Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BDR Thermea Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Danfoss Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: United Kingdom HVAC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom HVAC Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom HVAC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom HVAC Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United Kingdom HVAC Market Revenue Million Forecast, by Type of Component 2019 & 2032

- Table 4: United Kingdom HVAC Market Volume Billion Forecast, by Type of Component 2019 & 2032

- Table 5: United Kingdom HVAC Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: United Kingdom HVAC Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: United Kingdom HVAC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United Kingdom HVAC Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: United Kingdom HVAC Market Revenue Million Forecast, by Type of Component 2019 & 2032

- Table 10: United Kingdom HVAC Market Volume Billion Forecast, by Type of Component 2019 & 2032

- Table 11: United Kingdom HVAC Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: United Kingdom HVAC Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: United Kingdom HVAC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom HVAC Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom HVAC Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the United Kingdom HVAC Market?

Key companies in the market include Johnson Controls International PLC, Carrier Corporation, Robert Bosch GmbH, Daikin Industries Ltd, Midea Group Co Ltd, System Air AB, LG Electronics Inc, BDR Thermea Group, Mitsubishi Electric Hydronics & IT Cooling Systems SpA, Danfoss Inc.

3. What are the main segments of the United Kingdom HVAC Market?

The market segments include Type of Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand For Energy Efficient Devices; Increased Construction And Retrofit Activity To Aid Demand.

6. What are the notable trends driving market growth?

The Residential Sector is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand For Energy Efficient Devices; Increased Construction And Retrofit Activity To Aid Demand.

8. Can you provide examples of recent developments in the market?

April 2024: Johnson Controls introduced a new line of heat pumps designed for use in residential settings. The York YH5 15.2 SEER2 2-Stage heat pumps aim to deliver year-round comfort and energy efficiency. These systems boast a seasonal energy efficiency ratio (SEER2) of 16 and a heating seasonal performance factor (HSPF2) of 8. The YH5 heat pump includes options for accessing the compressor from the top or side and a control box that swings out for easy access.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom HVAC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom HVAC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom HVAC Market?

To stay informed about further developments, trends, and reports in the United Kingdom HVAC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence