Key Insights

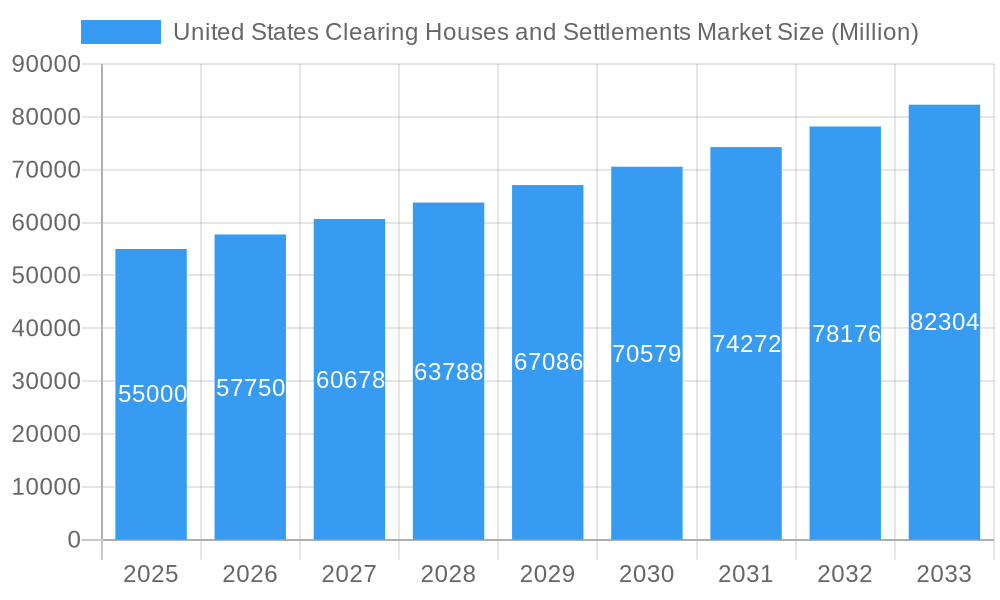

The United States clearing and settlement market demonstrates strong expansion, driven by escalating trading volumes, the proliferation of electronic trading platforms, and the increasing sophistication of financial instruments. With a projected Compound Annual Growth Rate (CAGR) exceeding 5%, the market is poised for sustained growth. While precise figures for 2024 are subject to ongoing analysis, current estimates suggest a market size of approximately $6.75 billion. This growth is primarily attributed to the increasing demand for secure and efficient clearing and settlement solutions, especially amid heightened regulatory oversight and the expansion of derivatives markets. Future growth will likely be propelled by technological innovations like blockchain and distributed ledger technology, which aim to optimize processes and reduce operational costs. Key challenges include cybersecurity threats, evolving regulatory landscapes, and potential market volatility. Major US market participants, including the New York Stock Exchange and NASDAQ, are continually enhancing their infrastructure and services to address evolving industry requirements and maintain competitive positioning.

United States Clearing Houses and Settlements Market Market Size (In Billion)

Market segmentation is expected to be diverse, covering various asset classes, clearinghouse types, and service offerings. Significant investments are anticipated in infrastructure modernization, technological advancements, and robust cybersecurity measures throughout the forecast period. These investments underscore the critical role of secure and efficient clearing and settlement systems in preserving market stability and fostering investor trust. Strategic planning within this sector necessitates a detailed understanding of regional market dynamics across the United States. Further research can illuminate specific growth patterns within distinct regions and asset classes.

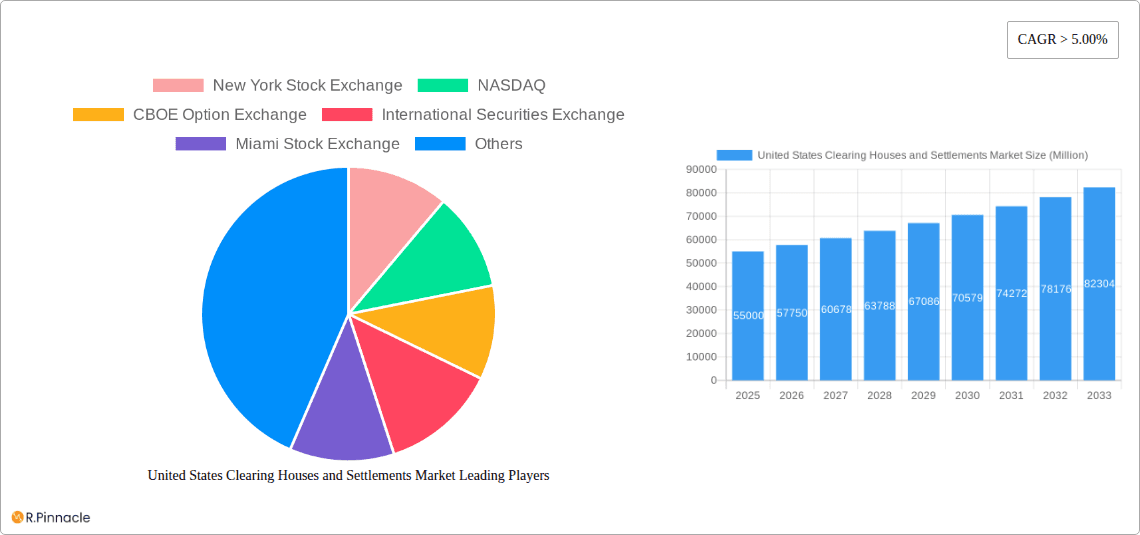

United States Clearing Houses and Settlements Market Company Market Share

United States Clearing Houses and Settlements Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Clearing Houses and Settlements Market, offering valuable insights for industry professionals, investors, and strategists. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. We analyze market dynamics, key players, emerging trends, and future growth potential, providing actionable data to navigate this crucial sector of the financial markets. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

United States Clearing Houses and Settlements Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment impacting the US clearing houses and settlements market. We examine market concentration, assessing the market share held by key players such as the New York Stock Exchange, NASDAQ, CBOE Option Exchange, International Securities Exchange, Miami Stock Exchange, National Stock Exchange, and Philadelphia Stock Exchange (list not exhaustive). The report also investigates mergers and acquisitions (M&A) activity within the sector, quantifying deal values in Millions and analyzing their impact on market consolidation. Innovation drivers, such as advancements in technology (e.g., blockchain, AI) and regulatory changes, are examined, along with the impact of substitute products and evolving end-user demographics. We analyze the regulatory frameworks shaping market behavior and their influence on innovation and competition. The total M&A deal value in the sector during the historical period (2019-2024) is estimated at xx Million.

United States Clearing Houses and Settlements Market Market Dynamics & Trends

This section delves into the factors driving market growth, including increasing trading volumes, the expanding adoption of electronic trading platforms, and the rising demand for efficient and secure clearing and settlement services. We also analyze technological disruptions, such as the implementation of blockchain technology and the rise of RegTech solutions aimed at enhancing efficiency and regulatory compliance. Consumer preferences for faster and more cost-effective clearing and settlement processes are explored. The report also examines competitive dynamics within the market, analyzing the strategies employed by leading players to gain market share. The market's growth trajectory is presented via CAGR and market penetration rates for key segments.

Dominant Regions & Segments in United States Clearing Houses and Settlements Market

This section identifies the leading regions and segments within the US clearing houses and settlements market. Detailed dominance analysis is provided, supported by bullet points outlining key drivers for each dominant area:

- Key Drivers for Dominant Region/Segment:

- Robust economic activity and growth.

- Favorable regulatory environment.

- Well-developed infrastructure.

- High concentration of financial institutions.

- Technological advancements.

United States Clearing Houses and Settlements Market Product Innovations

Recent product innovations focus on enhanced speed, security, and efficiency in clearing and settlement processes. Technological advancements like AI and machine learning are being integrated to improve risk management and operational efficiency. New products are designed to meet evolving regulatory requirements and cater to the needs of a diverse range of market participants, including institutional investors and high-frequency traders. These innovations are aimed at improving market liquidity and reducing operational costs.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the US clearing houses and settlements market to provide granular insights into its diverse components. The segmentation is based on critical parameters including, but not limited to: By Type of Instrument (e.g., Equities, Fixed Income, Derivatives, FX, Commodities), By Clearing House Type (e.g., Central Counterparties (CCPs), Bilateral Clearing), By Client Type (e.g., Investment Banks, Hedge Funds, Asset Managers, Retail Brokers), and By Technology Employed (e.g., Traditional Clearing Systems, DLT-based Solutions). For each identified segment, the report details projected growth rates, current market size (expressed in Millions of USD), and analyses the specific competitive dynamics at play. Detailed paragraphs elaborating on the unique characteristics, growth drivers, challenges, and key players within each segment are provided to offer a holistic understanding of the market landscape.

Key Drivers of United States Clearing Houses and Settlements Market Growth

The growth of the US clearing houses and settlements market is driven by several factors: the increasing volume of financial transactions, technological advancements that improve efficiency and reduce costs, and stricter regulatory oversight aimed at enhancing market stability and reducing systemic risk. The growing adoption of electronic trading and the increasing demand for faster and more secure clearing and settlement services also contribute to market growth.

Challenges in the United States Clearing Houses and Settlements Market Sector

The US clearing houses and settlements market faces challenges such as increasing regulatory scrutiny, cybersecurity threats, and the need for continuous technological upgrades to maintain competitiveness. These challenges can lead to increased operational costs and compliance burdens, potentially impacting profitability. The competitive landscape also presents challenges, with existing and emerging players vying for market share. The exact quantifiable impact of these challenges is difficult to precisely estimate, but significant investment is required to overcome them.

Emerging Opportunities in United States Clearing Houses and Settlements Market

The United States Clearing Houses and Settlements Market is ripe with emerging opportunities, driven by ongoing innovation and evolving market needs. The increasing exploration and adoption of blockchain technology present a significant avenue for enhanced transparency, security, and efficiency in clearing and settlement processes. This disruptive technology has the potential to reduce settlement times and associated costs, fostering greater market liquidity. The burgeoning growth of financial technology (fintech) solutions is another key area of opportunity, with innovative platforms offering specialized services that cater to niche market demands and improve overall operational agility. Expansion into new and emerging asset classes, such as digital assets and cryptocurrencies, presents a substantial growth frontier for clearing houses equipped to handle the unique challenges associated with these markets. Furthermore, the increasing demand for integrated, end-to-end post-trade solutions that encompass clearing, settlement, and collateral management offers significant potential for companies that can deliver comprehensive and seamless services. By embracing these emerging trends and adapting to evolving regulatory frameworks, market participants can unlock new revenue streams and solidify their competitive positions.

Key Developments in United States Clearing Houses and Settlements Market Industry

- December 2023: Miami International Holdings, Inc. launched MIAX Sapphire, a novel exchange designed to enhance options trading capacity by integrating both electronic and physical trading floors, thereby expanding market access and trading flexibility.

- December 2023: In a strategic move to bolster systemic stability, Wall Street regulators have mandated increased clearing house usage for trades within the vast $26 trillion US Treasury market. This regulatory shift is aimed at mitigating counterparty risk and fortifying the resilience of this critical financial market.

- Ongoing: Significant investment and development in Distributed Ledger Technology (DLT) by major clearing houses and technology providers to explore and pilot blockchain-based solutions for faster, more transparent, and secure settlement processes.

- Recent: Growing emphasis on enhancing cybersecurity measures and data privacy protocols across the clearing and settlement ecosystem in response to increasing cyber threats and stringent regulatory requirements.

Future Outlook for United States Clearing Houses and Settlements Market Market

The future trajectory of the United States Clearing Houses and Settlements Market is exceptionally promising, poised for continued expansion and transformation. The ongoing surge in global trading volumes, coupled with the persistent requirement for secure, efficient, and resilient market infrastructure, will serve as foundational growth drivers. The integration of advanced technologies, including Artificial Intelligence (AI) for risk management and fraud detection, and the continued maturation of blockchain and DLT applications, will be pivotal in shaping the future landscape. These innovations are expected to unlock unprecedented levels of efficiency, reduce operational costs, and enhance risk mitigation capabilities. Furthermore, strategic collaborations, mergers, and acquisitions will continue to play a significant role in consolidating the market, fostering innovation, and expanding the service offerings of key players. The market is expected to witness greater specialization in services, catering to the evolving needs of a diverse range of financial instruments and client segments, ultimately driving greater market depth and accessibility.

United States Clearing Houses and Settlements Market Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Instruments

- 2.1. Debt

- 2.2. Equity

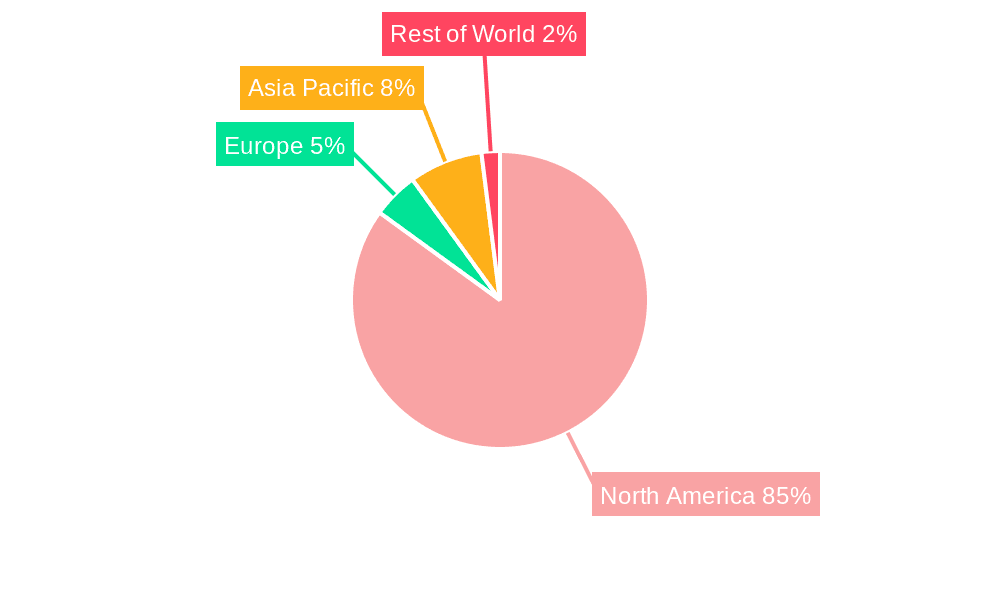

United States Clearing Houses and Settlements Market Segmentation By Geography

- 1. United States

United States Clearing Houses and Settlements Market Regional Market Share

Geographic Coverage of United States Clearing Houses and Settlements Market

United States Clearing Houses and Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digital Assets and Digitalization is Expected to Boost the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Instruments

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 New York Stock Exchange

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NASDAQ

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CBOE Option Exchange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 International Securities Exchange

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Miami Stock Exchange

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Stock Exchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Philadelphia Stock Exchange*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 New York Stock Exchange

List of Figures

- Figure 1: United States Clearing Houses and Settlements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Clearing Houses and Settlements Market Share (%) by Company 2025

List of Tables

- Table 1: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 2: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 3: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 5: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 6: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Clearing Houses and Settlements Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the United States Clearing Houses and Settlements Market?

Key companies in the market include New York Stock Exchange, NASDAQ, CBOE Option Exchange, International Securities Exchange, Miami Stock Exchange, National Stock Exchange, Philadelphia Stock Exchange*List Not Exhaustive.

3. What are the main segments of the United States Clearing Houses and Settlements Market?

The market segments include Type of Market, Financial Instruments.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.75 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digital Assets and Digitalization is Expected to Boost the Growth of the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In December 2023, Miami International Holdings, Inc. has introduced new MIAX Sapphire, physical trading floor located in Miami's Wynwood district. The new MIAX Sapphire exchange, which will run both an electronic exchange and a physical trading floor, will be MIAX's fourth national securities exchange for U.S. multi-listed options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Clearing Houses and Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Clearing Houses and Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Clearing Houses and Settlements Market?

To stay informed about further developments, trends, and reports in the United States Clearing Houses and Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence