Key Insights

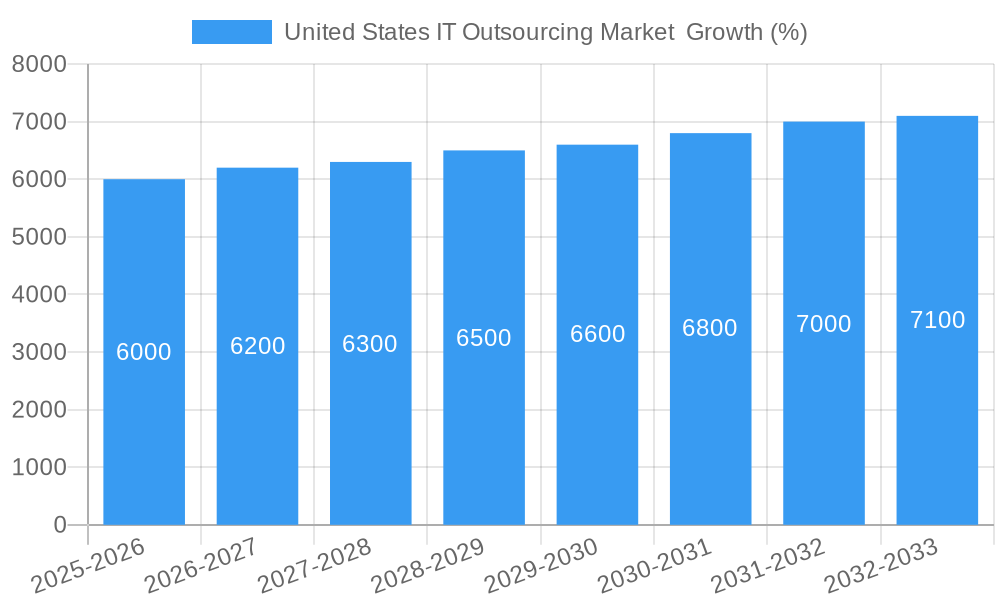

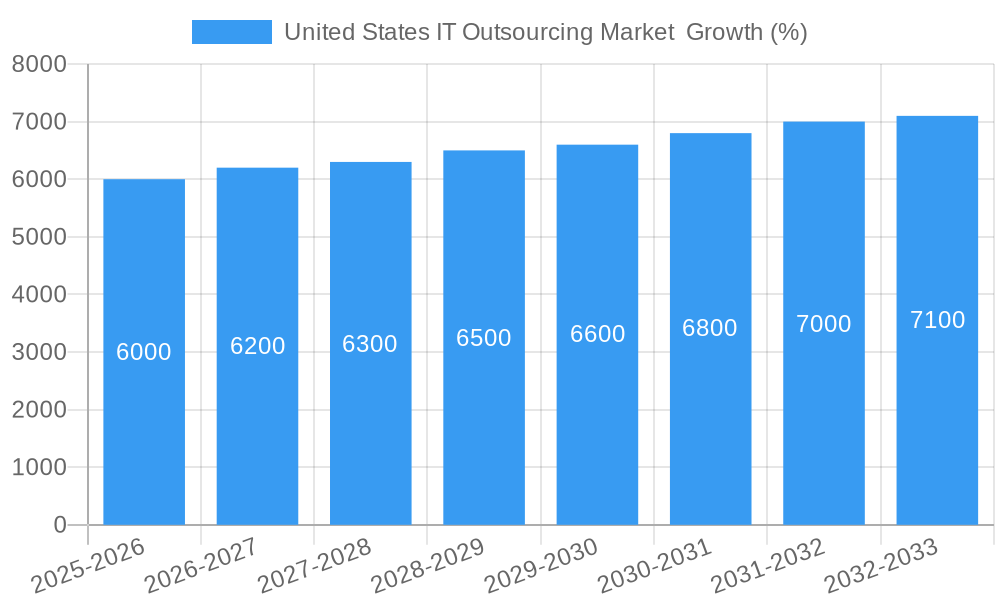

The United States IT outsourcing market, a significant segment of the global IT services landscape, is experiencing steady growth, driven by several key factors. The increasing adoption of cloud computing, the need for enhanced cybersecurity measures, and the rising demand for digital transformation initiatives across various industries are major catalysts. Businesses are increasingly outsourcing IT functions like application development and maintenance, infrastructure management, and data analytics to specialized providers to reduce operational costs, improve efficiency, and focus on core competencies. The large enterprise segment is a key driver, with substantial investments in IT outsourcing to support their complex operations and technological advancements. However, factors such as data security concerns and potential vendor lock-in are acting as restraints, requiring careful vendor selection and robust contract negotiations. The market is segmented by service type (application outsourcing, infrastructure outsourcing, and other services), organization size (SMEs and large enterprises), and industry (with significant contributions from banking, finance, IT & telecom, healthcare, and government). While precise market sizing for the US is unavailable from the provided data, based on the global CAGR of 2.87%, and considering the US's significant share of the global IT market, a conservative estimate for the 2025 US IT outsourcing market size would be in the range of $200-250 billion. The forecast period (2025-2033) indicates continued growth, likely exceeding $300 billion by 2033, driven by continued technological innovation and increasing digitalization across various sectors.

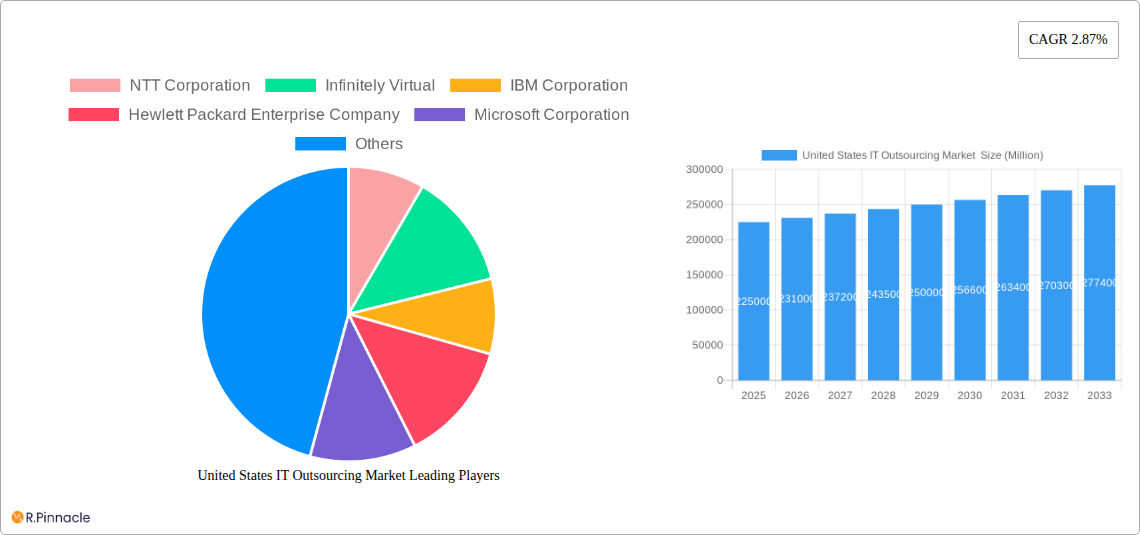

The competitive landscape is highly fragmented, with both large multinational corporations (like IBM, Microsoft, and NTT) and smaller specialized firms vying for market share. Successful players are likely to be those that demonstrate a strong focus on security, offer tailored solutions to meet specific client needs, and adapt quickly to evolving technological advancements. The geographical distribution within the US is expected to be skewed towards major technology hubs, such as California, Texas, and New York, although growth is likely across diverse regions. Future trends include the increasing adoption of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) within outsourcing contracts, further fueling market expansion. The focus will continue to be on value-added services and strategic partnerships, moving beyond purely transactional relationships to create long-term value for clients.

United States IT Outsourcing Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the United States IT Outsourcing market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils the market's structure, dynamics, and future outlook, equipping you with actionable intelligence to navigate this dynamic landscape. The market is projected to reach xx Million by 2033, exhibiting a significant CAGR of xx% during the forecast period (2025-2033).

United States IT Outsourcing Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the US IT outsourcing market. The market exhibits a moderately concentrated structure, with key players like NTT Corporation, IBM Corporation, Hewlett Packard Enterprise Company, Microsoft Corporation, DXC Technology Company, CDW Corporation, and Infinitely Virtual holding significant market share. However, numerous smaller players also contribute to the market's dynamism. Market share data for 2024 suggests that the top 5 players collectively hold approximately xx% of the market, with the remaining share distributed amongst numerous smaller firms.

Innovation is driven by advancements in cloud computing, AI, and 5G technologies, fostering the development of sophisticated outsourcing services. Regulatory frameworks, including data privacy regulations (e.g., CCPA, GDPR implications) and cybersecurity standards, significantly influence market practices. The market witnesses considerable M&A activity, with deal values exceeding xx Million in the last five years. These mergers often involve smaller firms being acquired by larger players to expand their service portfolios and geographic reach. For example, the acquisition of [Company A] by [Company B] in [Year] resulted in a [quantifiable impact, e.g., 15% increase in market share for Company B]. The increasing demand for digital transformation across various sectors fuels this consolidation. Product substitutes, such as in-house IT development, exert competitive pressure, impacting market growth. The end-user demographic comprises both SMEs and large enterprises across diverse industries.

United States IT Outsourcing Market Market Dynamics & Trends

The US IT outsourcing market is experiencing robust growth, driven primarily by the increasing adoption of cloud-based solutions, the rising demand for digital transformation initiatives across industries, and the persistent need for cost optimization. Technological advancements in AI, machine learning, and automation are transforming service offerings, leading to higher efficiency and improved service quality. Consumer preferences are shifting towards flexible, scalable, and secure outsourcing solutions, impacting vendor choices. The market exhibits intense competitive dynamics, with established players and emerging firms vying for market share through service innovation, strategic partnerships, and aggressive pricing strategies. This leads to continuous improvement in service offerings and cost reduction for clients. The market penetration of cloud-based IT outsourcing services continues to increase, projected to reach xx% by 2033. This growth is fueled by benefits such as scalability, cost-effectiveness and enhanced agility. The market is forecast to grow at a CAGR of xx% from 2025 to 2033, driven by technological advancements and the expanding demand for digital transformation services across various sectors.

Dominant Regions & Segments in United States IT Outsourcing Market

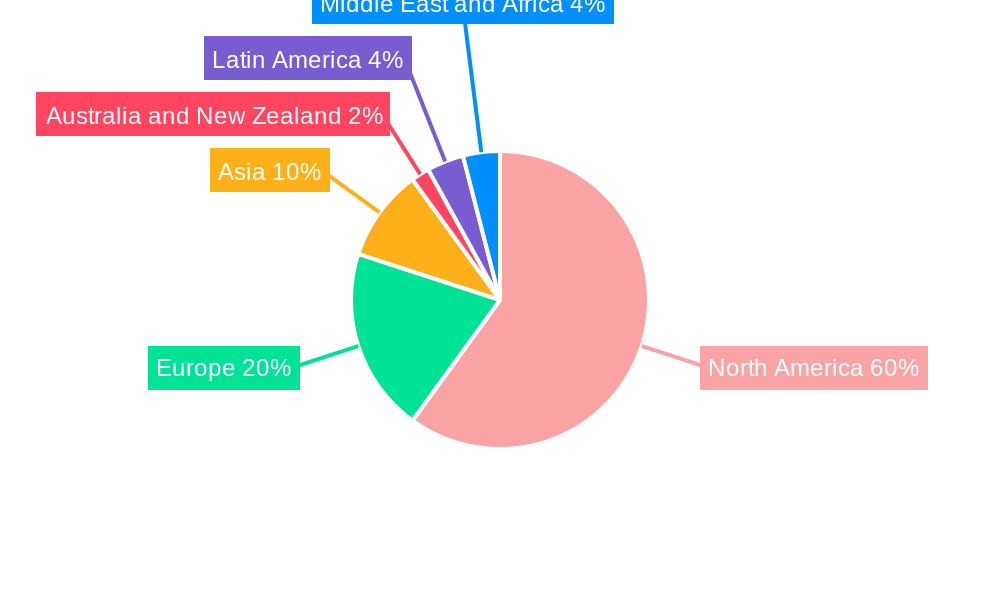

The US IT outsourcing market is geographically diverse, with significant activity across various regions. However, major metropolitan areas like New York, California, Texas, and Illinois represent dominant hubs for IT outsourcing due to high concentrations of technology companies, skilled labor, and robust infrastructure.

- By Service Type: Infrastructure outsourcing currently dominates the market, accounting for approximately xx% of the total revenue in 2024, followed by application outsourcing and other services. The growth of cloud computing and 5G networks is driving increased demand for infrastructure outsourcing.

- By Organization Size: Large enterprises represent a substantial portion of the market, with SMEs showing significant growth potential driven by increasing affordability and accessibility of cloud services.

- By Industry: The Banking, Financial Services, and Insurance (BFSI), IT and Telecom, and Healthcare sectors are key market drivers. BFSI's stringent regulatory requirements and the need for robust security measures contribute significantly to outsourcing demand, while the healthcare sector's adoption of telehealth and electronic health records fuels further expansion. The Government and Public Sector segment exhibits consistent growth, driven by the digitalization initiatives and the need for efficient and secure IT infrastructure. Retail and e-commerce sectors, and the Energy, Utilities, and Mining industry are experiencing significant growth in their reliance on IT outsourcing.

The dominance of these segments is attributed to several key drivers: robust IT infrastructure, favorable government policies promoting digitalization, a skilled workforce, and increasing digital adoption across these industries. Economic policies impacting technological investments play a crucial role in the market's dynamics.

United States IT Outsourcing Market Product Innovations

The US IT outsourcing market showcases continuous product innovation, driven by the rapid evolution of technologies such as AI, machine learning, blockchain, and the Internet of Things (IoT). Providers are incorporating these advancements into their service offerings, providing clients with enhanced security, automation, and data analytics capabilities. These innovations enhance efficiency, reduce operational costs, and deliver superior customer experiences. The market is witnessing the emergence of specialized IT outsourcing solutions tailored to specific industry needs, providing further competitive differentiation. This constant drive towards innovation ensures the market's continued growth and expansion.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the US IT outsourcing market across various segments:

- By Service Type: Application Outsourcing (market size xx Million in 2024, projected to reach xx Million by 2033), Infrastructure Outsourcing (market size xx Million in 2024, projected to reach xx Million by 2033), Other Services (market size xx Million in 2024, projected to reach xx Million by 2033).

- By Organization Size: SMEs (market size xx Million in 2024, projected to reach xx Million by 2033), Large Enterprises (market size xx Million in 2024, projected to reach xx Million by 2033).

- By Industry: Banking, Financial Services, and Insurance; IT and Telecom; Manufacturing; Healthcare; Government and Public Sector; Retail and E-commerce; Energy, Utilities, and Mining; Others (each segment's market size and projections are detailed within the full report).

Each segment exhibits unique growth dynamics and competitive landscapes, detailed comprehensively within the full report.

Key Drivers of United States IT Outsourcing Market Growth

The growth of the US IT outsourcing market is propelled by several key factors:

- Technological advancements: The continuous evolution of cloud computing, AI, and big data analytics fuels demand for advanced IT outsourcing services.

- Cost optimization: Outsourcing allows companies to reduce operational expenses by leveraging external expertise and resources.

- Increased focus on digital transformation: Businesses across industries are increasingly investing in digital transformation initiatives, driving demand for IT outsourcing solutions.

- Demand for skilled IT professionals: A shortage of skilled IT professionals in the US further drives demand for outsourcing.

- Government initiatives supporting digitalization: Government policies promoting the adoption of new technologies contribute to market expansion.

These factors collectively accelerate the market's growth trajectory.

Challenges in the United States IT Outsourcing Market Sector

The US IT outsourcing market faces several challenges:

- Data security and privacy concerns: Ensuring the security and privacy of sensitive data outsourced to third-party providers remains a significant challenge.

- Regulatory compliance: Navigating complex regulatory landscapes and compliance requirements can be burdensome for both providers and clients.

- Geopolitical factors: International relations and trade policies can influence the outsourcing landscape.

- Supply chain disruptions: Global events can affect the availability of skilled resources and technology infrastructure.

- Competition: Intense competition from both domestic and international providers requires continuous innovation and cost optimization.

Emerging Opportunities in United States IT Outsourcing Market

The US IT outsourcing market presents several promising opportunities:

- Growth of specialized IT outsourcing: Demand for specialized solutions catering to specific industry needs presents significant growth potential.

- Expansion into emerging technologies: The integration of AI, machine learning, and other advanced technologies in outsourcing offers substantial opportunities.

- Focus on sustainability and ethical sourcing: Providing sustainable and ethical IT solutions is attracting growing customer interest.

- Increased adoption of managed services: The demand for comprehensive, end-to-end managed IT services presents a lucrative avenue for growth.

- Expansion to underserved markets: Reaching out to small and medium-sized enterprises (SMEs) that haven't fully embraced outsourcing offers significant untapped potential.

Leading Players in the United States IT Outsourcing Market Market

- NTT Corporation

- Infinitely Virtual

- IBM Corporation

- Hewlett Packard Enterprise Company

- Microsoft Corporation

- DXC Technology Company

- CDW Corporation

- List Not Exhaustive

Key Developments in United States IT Outsourcing Market Industry

- July 2023: Leidos partners with Microsoft to accelerate AI transformation for public sector clients, highlighting the growing importance of AI-based IT outsourcing services.

- June 2023: Nokia and DXC Technology's partnership expands DXC Signal Private LTE and 5G, boosting DXC's IT infrastructure outsourcing capabilities and driving market growth through enhanced business automation and digital transformation solutions.

Future Outlook for United States IT Outsourcing Market Market

The US IT outsourcing market is poised for continued growth, driven by the accelerating pace of technological innovation, increasing demand for digital transformation, and the ongoing need for cost optimization across various industries. The market's future will likely be shaped by the expansion of cloud-based services, the increased adoption of AI and machine learning, and the growing importance of cybersecurity. Strategic partnerships and M&A activities will continue to reshape the competitive landscape, creating both opportunities and challenges for players in this dynamic market. The increasing focus on sustainability and ethical sourcing will also influence market trends and attract customers seeking environmentally responsible solutions.

United States IT Outsourcing Market Segmentation

-

1. Service Type

- 1.1. Application Outsourcing

- 1.2. Infrastructure Outsourcing

- 1.3. Other Services

-

2. Organization Size

- 2.1. SMEs

- 2.2. Large Enterprises

-

3. Industry

- 3.1. Banking, Financial Services, and Insurance

- 3.2. IT and Telecom

- 3.3. Manufacturing

- 3.4. Healthcare

- 3.5. Government and Public Sector

- 3.6. Retail and E-commerce

- 3.7. Energy, Utilities, and Mining

- 3.8. Others

United States IT Outsourcing Market Segmentation By Geography

- 1. United States

United States IT Outsourcing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations; Organizations are Increasingly Focusing on IT as a Means to Gain Differentiation by Relying on Outsourced Vendors; Ongoing Migration toward the Cloud and Adoption of Virtualized Infrastructure

- 3.3. Market Restrains

- 3.3.1. Initial High Cost of Adoption; Lack of Skilled Professionals in the Oil and Gas Industry

- 3.4. Market Trends

- 3.4.1. Ongoing Migration Toward Cloud and the Adoption of Virtualized Infrastructure to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Application Outsourcing

- 5.1.2. Infrastructure Outsourcing

- 5.1.3. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SMEs

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry

- 5.3.1. Banking, Financial Services, and Insurance

- 5.3.2. IT and Telecom

- 5.3.3. Manufacturing

- 5.3.4. Healthcare

- 5.3.5. Government and Public Sector

- 5.3.6. Retail and E-commerce

- 5.3.7. Energy, Utilities, and Mining

- 5.3.8. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 NTT Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Infinitely Virtual

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hewlett Packard Enterprise Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Microsoft Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 DXC Technology Company

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 CDW Corporation*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 NTT Corporation

List of Figures

- Figure 1: United States IT Outsourcing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States IT Outsourcing Market Share (%) by Company 2024

List of Tables

- Table 1: United States IT Outsourcing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States IT Outsourcing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: United States IT Outsourcing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 4: United States IT Outsourcing Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 5: United States IT Outsourcing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States IT Outsourcing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 19: United States IT Outsourcing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 20: United States IT Outsourcing Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 21: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States IT Outsourcing Market ?

The projected CAGR is approximately 2.87%.

2. Which companies are prominent players in the United States IT Outsourcing Market ?

Key companies in the market include NTT Corporation, Infinitely Virtual, IBM Corporation, Hewlett Packard Enterprise Company, Microsoft Corporation, DXC Technology Company, CDW Corporation*List Not Exhaustive.

3. What are the main segments of the United States IT Outsourcing Market ?

The market segments include Service Type, Organization Size, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations; Organizations are Increasingly Focusing on IT as a Means to Gain Differentiation by Relying on Outsourced Vendors; Ongoing Migration toward the Cloud and Adoption of Virtualized Infrastructure.

6. What are the notable trends driving market growth?

Ongoing Migration Toward Cloud and the Adoption of Virtualized Infrastructure to Drive the Market.

7. Are there any restraints impacting market growth?

Initial High Cost of Adoption; Lack of Skilled Professionals in the Oil and Gas Industry.

8. Can you provide examples of recent developments in the market?

July 2023 - Leidos, an American science and technology player, announced that it entered into a strategic collaboration agreement with Microsoft to leverage the company's unique strengths in the market to accelerate artificial intelligence (AI) transformation for new and existing customers in the public sector, showing the growth of company's AI-based IT outsourcing services in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States IT Outsourcing Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States IT Outsourcing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States IT Outsourcing Market ?

To stay informed about further developments, trends, and reports in the United States IT Outsourcing Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence